Nyce 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive nyce review examines a company that presents itself across multiple business sectors. These sectors include financial services and consumer products. While Nyce Services LLC operates as a non-active freight brokerage company based in Salisbury, Maryland, the brand extends into various markets offering real estate investment platforms, community empowerment initiatives, and financial literacy education. The company provides both live and demo trading accounts with swap-free options and competitive spreads. This positions it as a single entry point for diverse financial needs.

Based on available user feedback, Nyce products demonstrate strong customer satisfaction with ratings reaching 9/10 for certain services and recommendation rates of 86% in luxury care segments. The platform caters primarily to traders seeking diversified trading conditions and educational resources. However, potential users should note the limited regulatory transparency and the company's varied business focus. This may impact the consistency of financial services delivery.

Important Notice

This evaluation is based on publicly available information and user feedback collected from various sources. Readers should be aware that regulatory requirements and legal frameworks may differ significantly across jurisdictions where Nyce operates. The company's multi-sector approach means that different business units may operate under varying regulatory standards and compliance requirements.

This review methodology relies on user testimonials, company-provided information, and publicly accessible data. Due to limited specific regulatory information available in source materials, potential clients are strongly advised to conduct independent verification of licensing and regulatory status before engaging with any financial services.

Rating Framework

Broker Overview

Nyce Services LLC represents a unique entity in the financial services landscape. It is officially registered as a freight brokerage company in Salisbury, Maryland, though currently listed as non-active in its primary registration. The company has expanded its operational scope to encompass real estate investment platforms, community empowerment programs, and financial literacy education initiatives. This diversified approach suggests an organization attempting to create a comprehensive ecosystem for financial services and community development.

The company's business model centers around providing what they describe as a single entry point for all financial needs through their NYCE platform. This integrated approach aims to simplify the user experience by consolidating various financial services under one umbrella. The platform supports multiple account types including both live trading accounts and demo accounts, with particular emphasis on accommodating diverse trading preferences through swap-free options and competitive spread structures. While specific asset classes are not extensively detailed in available materials, the platform appears to focus on forex trading and related financial instruments.

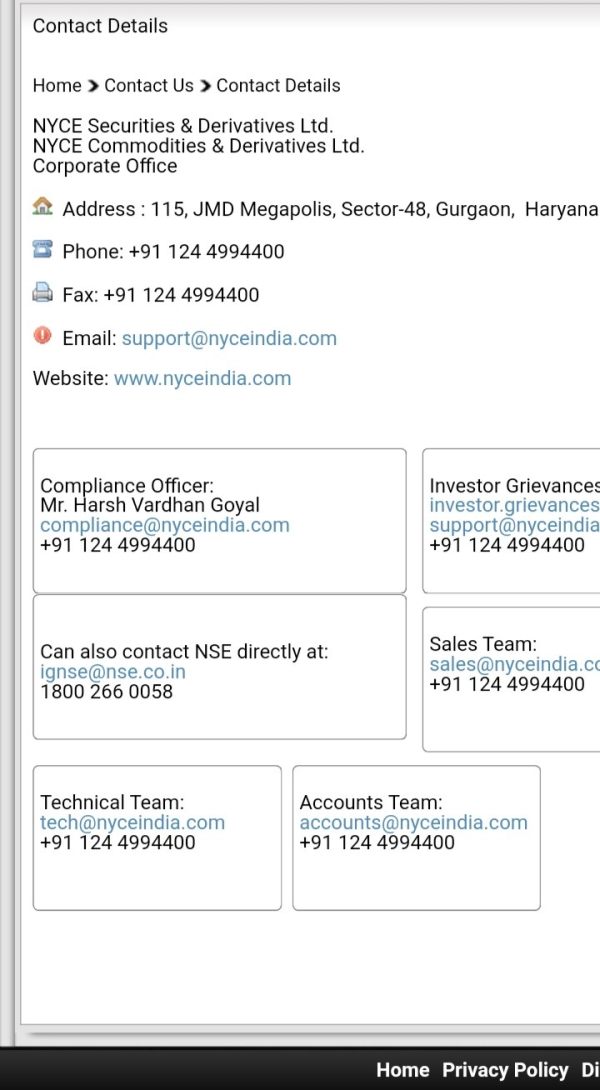

Regulatory Status: Available information does not specify clear regulatory oversight from major financial authorities. This represents a significant consideration for potential users seeking traditional broker regulation.

Deposit and Withdrawal Methods: Specific information regarding supported payment methods, processing times, and associated fees is not detailed in available source materials.

Minimum Deposit Requirements: The platform's entry-level capital requirements are not specified in accessible documentation. This suggests potential users should contact the company directly for this information.

Promotional Offers: Current bonus structures, promotional campaigns, or incentive programs are not outlined in available materials.

Trading Assets: The platform focuses on forex markets. However, the complete range of available instruments, including CFDs, commodities, or indices, requires clarification from the company.

Cost Structure: The company advertises competitive spreads as a key feature. However, specific spread ranges, commission structures, and overnight fees are not detailed in source materials.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in available documentation.

Platform Selection: NYCE is positioned as the primary trading platform, described as a single entry point for financial needs. However, technical specifications and platform features require further investigation.

Geographic Restrictions: Information regarding restricted countries or regional limitations is not provided in available materials.

Customer Support Languages: Supported languages for customer service are not specified in accessible documentation.

This nyce review highlights the need for potential users to request comprehensive information directly from the company to address these specification gaps.

Account Conditions Analysis

Nyce's account structure demonstrates flexibility by offering both live trading accounts and demo accounts. This caters to different experience levels and risk preferences. The inclusion of swap-free options particularly appeals to traders with religious considerations or those seeking to avoid overnight interest charges. This feature suggests the company recognizes diverse client needs and attempts to provide inclusive trading conditions.

The competitive spreads mentioned as a key feature indicate the company's effort to maintain cost-effective trading conditions. However, without specific spread ranges or comparison data, traders cannot fully evaluate the competitiveness of these offerings against industry standards. The demo account availability provides new traders with risk-free learning opportunities, which aligns with the company's stated focus on financial literacy education.

Account opening procedures and verification requirements are not detailed in available materials. This leaves questions about the onboarding experience. The absence of information regarding minimum deposit requirements also creates uncertainty for potential clients planning their initial investment. User feedback from the Nyce Legs product line shows impressive satisfaction ratings of 9/10, suggesting the company maintains quality standards in at least some of its service offerings.

The nyce review data indicates strong user approval in certain segments. However, the connection between consumer product satisfaction and financial services quality requires careful consideration. Traders should verify account terms, conditions, and requirements directly with the company before committing to any trading relationship.

The platform's positioning as a "single entry point for all financial needs" suggests an integrated approach to trading tools and resources. However, specific details about available analytical tools, charting capabilities, and research resources are not extensively documented. This unified platform concept could potentially streamline the trading experience by consolidating various functionalities under one interface.

Educational resources appear to be a focus area, given the company's emphasis on financial literacy education as part of its broader mission. However, the scope, quality, and accessibility of these educational materials are not detailed in available source materials. For traders seeking comprehensive learning resources, this represents an area requiring direct inquiry with the company.

Research and analysis capabilities, automated trading support, and advanced charting tools are not specifically mentioned in accessible documentation. Modern traders typically expect sophisticated analytical tools, real-time market data, and customizable interfaces, but the extent to which Nyce provides these features remains unclear from available information.

The integration of community empowerment initiatives with trading resources could provide unique value for users interested in socially conscious investing or community-focused financial education. However, the practical implementation and availability of these resources through the trading platform require clarification from the company directly.

Customer Service and Support Analysis

Customer service information represents one of the most significant gaps in available documentation about Nyce's operations. Essential details such as support channels, availability hours, response times, and service quality metrics are not provided in accessible materials. This lack of transparency regarding customer support capabilities raises concerns for potential users who prioritize reliable assistance.

The absence of information about multilingual support, technical support capabilities, and problem resolution procedures makes it difficult to assess the company's commitment to customer service excellence. Modern traders expect multiple contact methods including live chat, email support, phone assistance, and comprehensive FAQ sections, but Nyce's offerings in these areas are not documented.

Response time expectations, escalation procedures, and service level agreements are not outlined in available materials. For traders who may encounter technical issues, account problems, or require assistance with platform navigation, the uncertainty surrounding support quality represents a significant consideration in broker selection.

The company's diverse business interests across freight brokerage, real estate, and consumer products may impact the focus and specialization of customer support for trading services. Potential users should verify support capabilities, availability, and quality standards before establishing trading relationships with the platform.

Trading Experience Analysis

Platform performance metrics, including execution speed, server stability, and order processing capabilities, are not detailed in available source materials. These technical aspects are crucial for active traders who require reliable platform performance and fast execution times. The absence of specific performance data makes it challenging to evaluate Nyce's trading infrastructure quality.

Order execution quality, slippage rates, and fill rates are not documented in accessible materials. Professional traders typically require transparency regarding execution statistics to assess whether a platform meets their performance requirements. The lack of this information represents a significant gap for traders evaluating platform suitability.

Mobile trading capabilities, platform compatibility across devices, and user interface design are not described in available documentation. Modern trading requires seamless cross-platform functionality, and the absence of mobile app information or web-based platform details limits evaluation capabilities.

Trading environment features such as one-click trading, advanced order types, risk management tools, and customization options are not specified in source materials. These features significantly impact the trading experience, particularly for active traders who rely on sophisticated order management and risk control tools.

The nyce review process reveals limited specific user feedback regarding trading platform performance. This makes it difficult to assess real-world user experiences with the trading environment. Potential users should request platform demonstrations and trial access to evaluate performance firsthand.

Trust and Regulation Analysis

The regulatory status of Nyce presents significant concerns for potential users seeking traditional financial services oversight. The company's registration as a non-active freight brokerage company in Maryland does not provide the regulatory framework typically associated with financial services providers. This unusual corporate structure raises questions about appropriate licensing for offering trading services.

The absence of clear regulatory oversight from established financial authorities such as the SEC, CFTC, or other recognized regulatory bodies represents a major consideration for risk-conscious traders. Traditional broker regulation provides important protections including segregated client funds, dispute resolution mechanisms, and operational standards that may not apply to Nyce's current structure.

Fund safety measures, client money protection, and segregation policies are not detailed in available materials. These protections are fundamental concerns for traders depositing capital with any financial services provider. The lack of transparency regarding fund handling and protection measures significantly impacts trust assessment.

Company transparency regarding ownership, financial statements, operational history, and regulatory compliance is limited in accessible documentation. Professional traders typically expect detailed disclosure about broker operations, financial stability, and regulatory standing. The multi-sector business approach may complicate the assessment of financial services-specific operational quality and focus.

User Experience Analysis

Available user satisfaction data shows promising results in certain product segments. Nyce Luxury Hair Care achieved an 86% recommendation rate. While this data relates to consumer products rather than trading services, it suggests the company maintains quality standards and customer focus in at least some business areas. However, the relevance of consumer product satisfaction to financial services quality requires careful consideration.

The user experience for trading platform registration, account verification, and onboarding processes is not detailed in available materials. These initial interactions significantly impact user satisfaction and platform adoption, making the absence of this information a notable gap for potential users evaluating the service.

Interface design, platform navigation, and user experience optimization are not described in accessible documentation. Modern trading platforms require intuitive design, efficient workflow, and user-friendly interfaces to support effective trading activities. The lack of specific information about platform usability makes evaluation challenging.

Common user complaints, satisfaction surveys, and user retention data are not provided in available materials. This information typically helps potential users understand real-world experiences and identify potential issues before committing to a platform. The absence of comprehensive user feedback limits the ability to assess service quality accurately.

The company's focus on community empowerment and financial literacy education suggests a user-centric approach. However, the practical implementation of these values in the trading platform experience requires direct verification from current users or platform trials.

Conclusion

This comprehensive evaluation reveals that Nyce operates as a multi-sector entity with ambitious goals spanning financial services, community development, and education. While the company demonstrates strong user satisfaction in certain product segments and offers competitive trading conditions including swap-free accounts and competitive spreads, significant information gaps limit the ability to provide a complete assessment of their trading services.

The platform appears most suitable for traders interested in exploring alternative approaches to financial services and those who value community-focused initiatives alongside trading activities. However, the limited regulatory transparency and absence of detailed platform specifications make it essential for potential users to conduct thorough due diligence before engaging with the service.

Primary advantages include diverse account options, competitive pricing claims, and high user satisfaction in available segments. Key concerns center on regulatory clarity, customer support transparency, and the need for more detailed platform specifications. Traders prioritizing traditional regulatory oversight and comprehensive platform documentation may find the current information insufficient for confident decision-making.