Interest Arbitrage 2025 Review: Everything You Need to Know

Executive Summary

This Interest Arbitrage review gives traders and investors a complete analysis of interest arbitrage opportunities and platforms available in 2025. Interest arbitrage is a smart investment strategy that uses interest rate differences between currencies or markets to make profits. Individual investors can now access these strategies through online platforms and advanced financial tools that were only available to big trading companies before.

The strategy works on a simple math rule where profit equals the difference between investment rate and borrowing rate times your capital. Modern platforms have made these complex financial tools available to everyone, making interest arbitrage accessible to regular traders who understand the risks and opportunities that come with it. This Interest Arbitrage review looks at the changing world of platforms and tools that help individual investors use these trading strategies to make money from interest rate differences across global markets.

Important Disclaimers

This Interest Arbitrage review uses publicly available information about interest arbitrage strategies and platforms. Readers should know that specific regulatory information, user reviews, and detailed operational aspects of individual platforms may not be fully covered in this analysis. The evaluation presented here shows the current understanding of interest arbitrage opportunities and should not be considered as financial advice.

Traders should do their own research and talk with qualified financial advisors before engaging in any arbitrage strategies.

Rating Framework

Broker Overview

Interest arbitrage as an investment strategy has changed a lot with the growth of technology and financial markets. The basic concept involves moving funds from one currency to another to take advantage of higher rates of return, as defined by industry sources.

This strategy includes both covered and uncovered interest arbitrage, with covered arbitrage using forward contracts to reduce currency risk while uncovered arbitrage accepts exchange rate exposure for potentially higher returns. The modern world of interest arbitrage has been changed by sophisticated online platforms that let individual investors participate in strategies previously reserved for big institutional players.

These platforms provide access to complex financial instruments including currency carry trades and covered interest arbitrage mechanisms. The availability of these tools has opened new opportunities for regular traders to exploit interest rate differences across global markets, though it also brings additional complexity and risk considerations.

This Interest Arbitrage review examines how technology has made these strategies more accessible while keeping the basic principles that drive profits in interest rate differential trading.

Regulatory Environment: Current available information does not specify particular regulatory frameworks governing interest arbitrage platforms, though such activities typically fall under financial services regulations in respective jurisdictions.

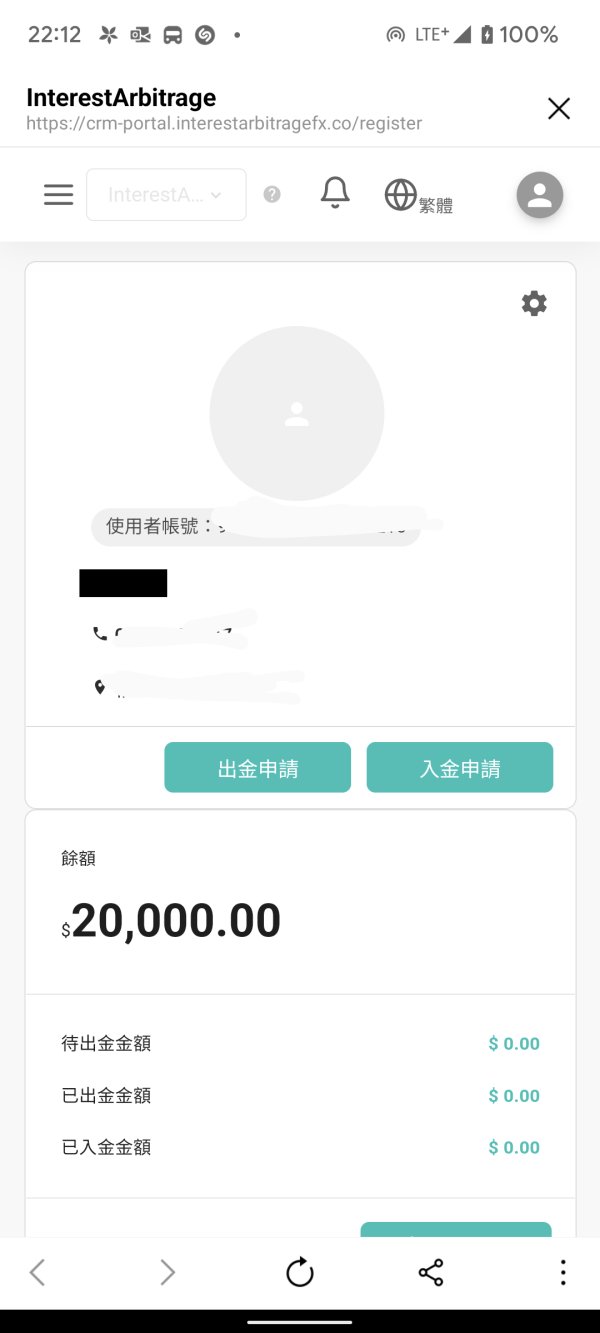

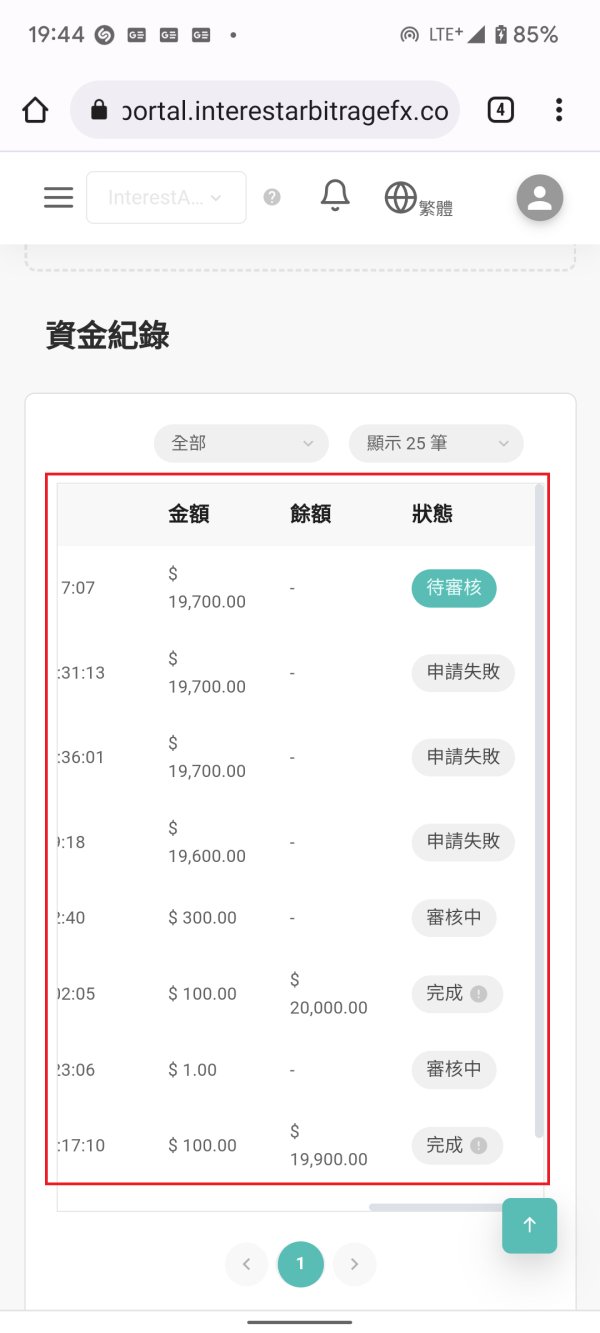

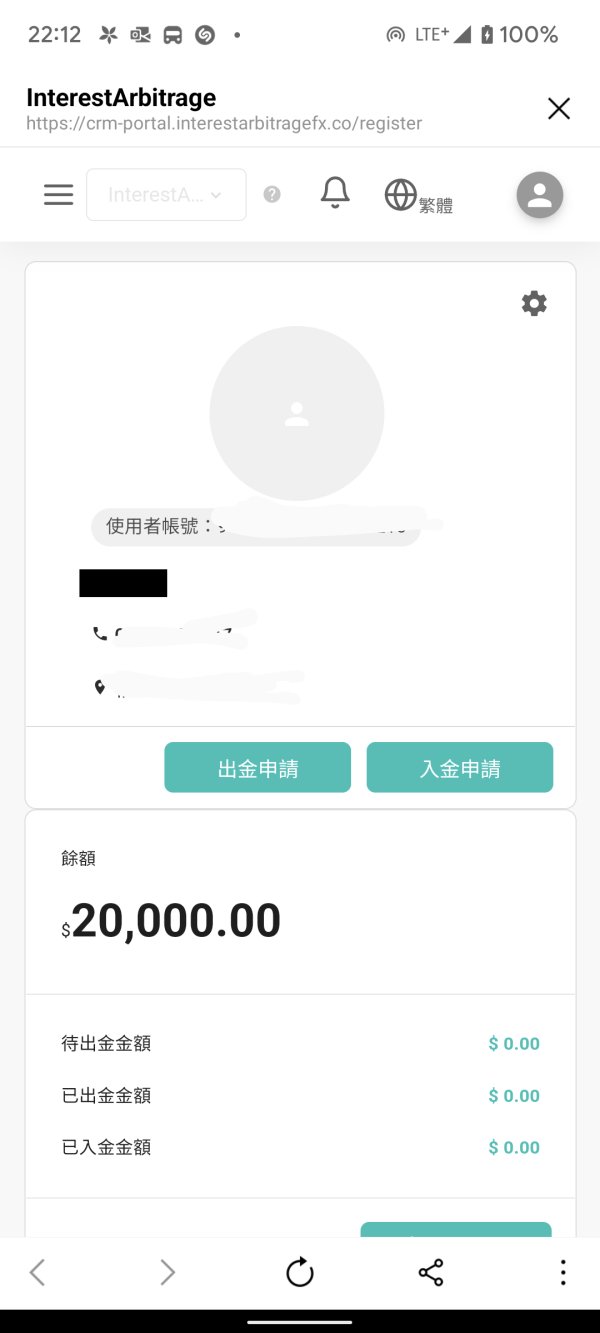

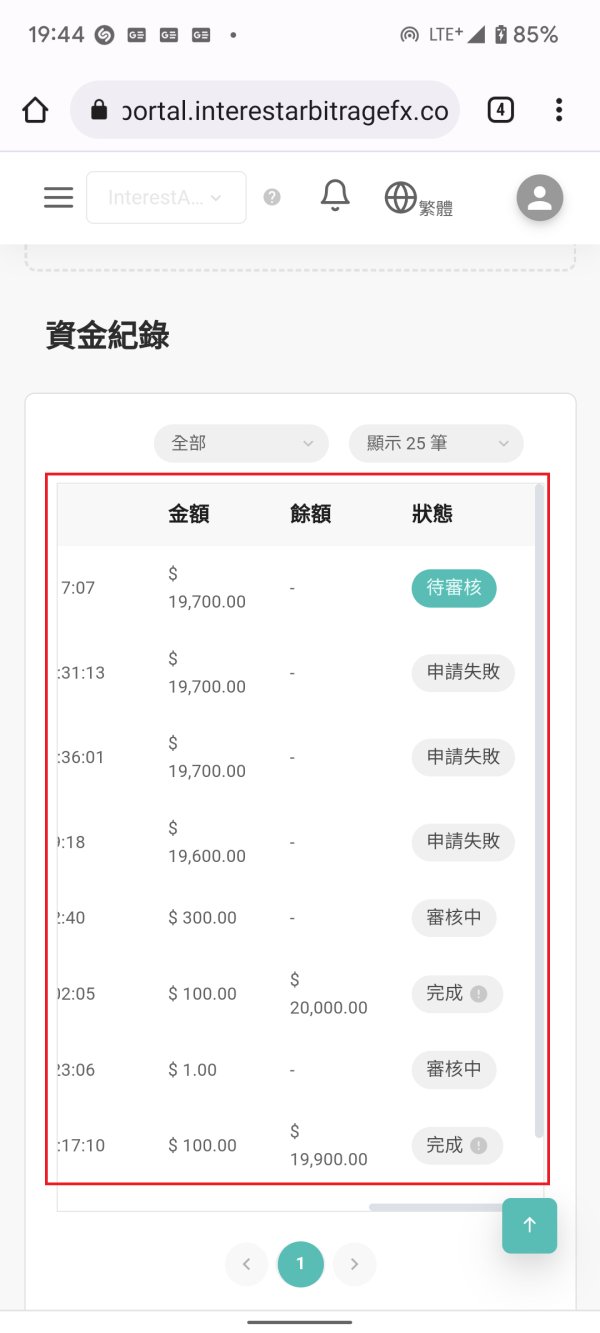

Funding Methods: Specific deposit and withdrawal options for interest arbitrage platforms are not detailed in available sources, though traditional forex and CFD platforms typically support multiple funding methods. Exact minimum deposit amounts are not specified in current information sources for interest arbitrage platforms.

Minimum Deposit Requirements: Available information does not detail specific bonus or promotional structures for interest arbitrage platforms.

Promotional Offers: Interest arbitrage strategies typically involve forex pairs, government bonds, and related financial instruments that show interest rate differences across markets.

Tradeable Assets: Specific fee information for interest arbitrage platforms is not available in current sources, though costs typically include spreads, commissions, and financing charges.

Cost Structure: Leverage specifications for interest arbitrage trading are not detailed in available information. Modern interest arbitrage strategies are made possible through online platforms offering sophisticated financial tools and real-time market access.

Leverage Options: Specific regional limitations are not detailed in current available information.

Platform Options: Language support information is not available in current sources for this Interest Arbitrage review.

Geographic Restrictions: Customer support languages remain unspecified in available documentation.

Customer Support Languages: Available platforms appear to focus on English-speaking markets based on current information.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions for interest arbitrage platforms remain largely unspecified in available information sources. Traditional interest arbitrage strategies require substantial capital bases to generate meaningful profits from interest rate differentials, suggesting that minimum deposit requirements may be higher than standard retail forex accounts.

The mathematical foundation of interest arbitrage, where profit equals the spread between investment and borrowing rates multiplied by capital, inherently favors larger account sizes. Without specific information about account types, verification processes, or special account features, it becomes challenging to evaluate the accessibility of interest arbitrage platforms for different trader segments.

Industry standards suggest that such platforms might offer tiered account structures based on capital requirements, given the sophisticated nature of arbitrage strategies. The absence of detailed account condition information in this Interest Arbitrage review highlights the need for potential users to directly contact platform providers for specific requirements and features.

Interest arbitrage platforms show strong capabilities in providing sophisticated financial tools and online platforms for individual investors. Modern platforms have successfully made complex financial instruments available to regular traders so they can participate in interest arbitrage strategies.

These tools typically include real-time interest rate monitoring, currency correlation analysis, and automated execution capabilities essential for successful arbitrage operations. The mathematical precision required for interest arbitrage, involving calculations of profit spreads and risk management, needs advanced analytical tools that current platforms appear to provide effectively.

The availability of both covered and uncovered interest arbitrage mechanisms through these platforms represents a significant advancement in retail trading capabilities. However, the complexity of these tools also requires substantial trader education and experience to utilize effectively, which may not be adequately addressed by all platform providers.

Customer Service and Support Analysis

Customer service information for interest arbitrage platforms is not available in current sources, representing a significant information gap for potential users. Given the complexity of arbitrage strategies and the sophisticated financial instruments involved, robust customer support would be essential for successful platform operation.

Effective support would need to cover both technical platform assistance and educational guidance on arbitrage strategy implementation. The absence of specific customer service details in available information sources suggests that potential users should prioritize platforms that offer comprehensive support structures, including dedicated account management for arbitrage traders.

The complexity of interest rate differential strategies and the time-sensitive nature of arbitrage opportunities would require responsive and knowledgeable customer support teams to address technical issues and trading queries effectively.

Trading Experience Analysis

The trading experience for interest arbitrage platforms cannot be fully evaluated based on available information. However, the basic nature of arbitrage trading requires platforms to provide stable, fast execution capabilities and sophisticated order management tools.

The success of interest arbitrage strategies often depends on precise timing and execution, making platform reliability and speed critical factors for trader success. Modern online platforms facilitating interest arbitrage must handle complex multi-currency transactions and provide real-time market data across different time zones and markets.

The mathematical precision required for profitable arbitrage operations demands platforms with advanced calculation capabilities and risk management tools. Without specific user experience data, this Interest Arbitrage review cannot provide detailed insights into platform performance, though the availability of sophisticated financial tools suggests a focus on advanced trading capabilities.

Trust and Reliability Analysis

Trust and reliability information for interest arbitrage platforms is not available in current sources, creating uncertainty about regulatory oversight and operational security. The sophisticated nature of arbitrage strategies and the substantial capital typically involved make regulatory compliance and operational transparency particularly important for these platforms.

Without specific regulatory information, traders cannot adequately assess the security of their investments or the legitimacy of platform operations. The absence of regulatory details and third-party evaluations in available sources represents a significant concern for potential users considering interest arbitrage platforms.

Industry best practices would suggest that legitimate arbitrage platforms should maintain clear regulatory compliance, segregated client funds, and transparent operational procedures, though such information is not available for evaluation in this review.

User Experience Analysis

User experience information for interest arbitrage platforms is limited in available sources, though the target demographic appears to be individual investors interested in sophisticated trading strategies. The complexity of interest arbitrage operations suggests that these platforms primarily serve experienced traders who understand the mathematical foundations and risk factors associated with interest rate differential strategies.

The democratization of access to complex financial instruments represents a positive development for qualified retail traders. The user profile for interest arbitrage platforms likely includes traders with substantial capital, advanced market knowledge, and risk management capabilities.

Without specific user feedback or satisfaction data, this analysis cannot provide detailed insights into actual user experiences or common challenges faced by platform users. The sophisticated nature of the tools and strategies involved suggests that user success may depend heavily on prior trading experience and market understanding.

Conclusion

This Interest Arbitrage review reveals a landscape where sophisticated arbitrage strategies have become more accessible to individual investors through online platforms and advanced financial tools. However, the significant lack of detailed information about regulatory oversight, user experiences, and specific operational aspects creates uncertainty for potential users.

While the availability of complex financial instruments for interest arbitrage represents a positive development, the absence of comprehensive platform evaluation data limits the ability to make informed recommendations. Traders interested in interest arbitrage strategies should conduct thorough research and seek platforms with clear regulatory compliance and transparent operational procedures.