Kyolo Markets Limited has gained notoriety in the online trading community, primarily due to its unregulated status and the numerous red flags raised by various reviews. This review highlights concerns regarding the broker's legitimacy, trading conditions, and overall user experience, providing potential investors with critical insights.

Note: It is essential to recognize that Kyolo Markets Limited operates as an offshore entity, which significantly impacts its regulatory oversight. This review adopts a comprehensive approach to ensure fairness and accuracy in its findings.

Rating Overview

How We Rate Brokers: Our ratings are based on a thorough analysis of user experiences, expert opinions, and factual data from credible sources.

Broker Overview

Founded in 2022, Kyolo Markets Limited claims to be an Australian forex broker. However, it lacks legitimate regulatory oversight, as there are no records of its registration with the Australian Securities and Investments Commission (ASIC). The broker does not provide access to popular trading platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5), instead requiring users to share extensive personal information to access its services. Kyolo Markets Limited offers a limited range of trading instruments, primarily focusing on forex and commodities, but lacks transparency regarding its trading conditions, including spreads and leverage.

Detailed Breakdown

Regulatory Status

Kyolo Markets Limited operates without regulation, raising significant concerns about the safety of client funds. The absence of any regulatory information on its website and the lack of a credible license is alarming. According to Forex Brokerz, the broker is not listed on ASIC's register, indicating that it may be operating illegally. This unregulated status is a major red flag for potential traders.

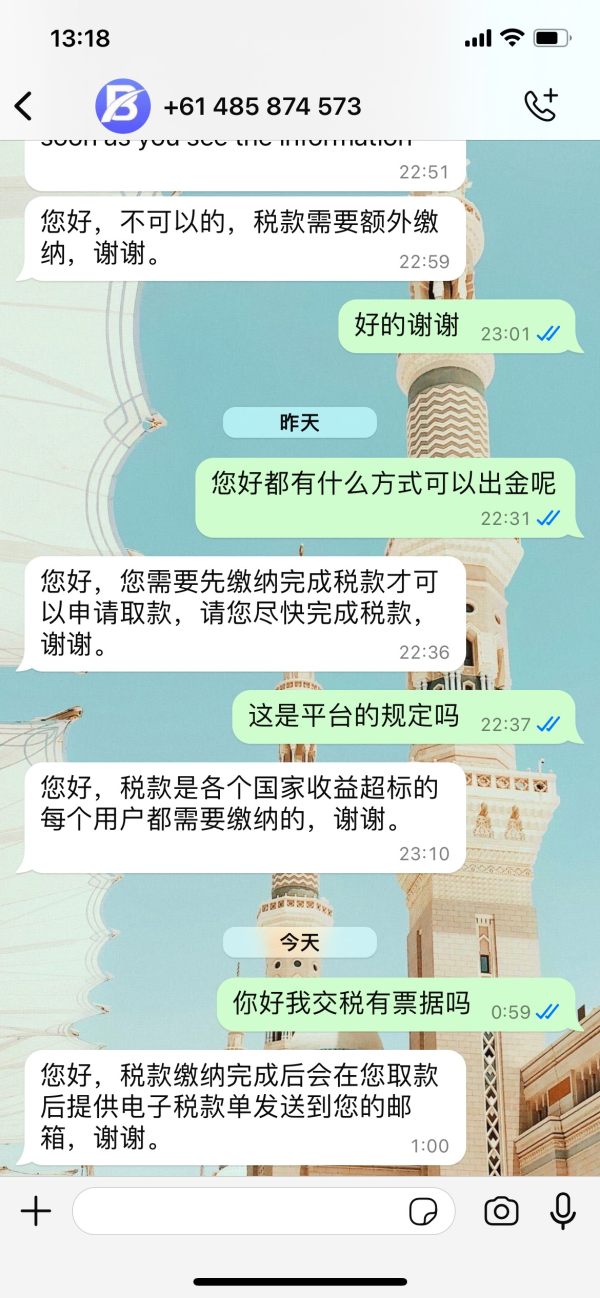

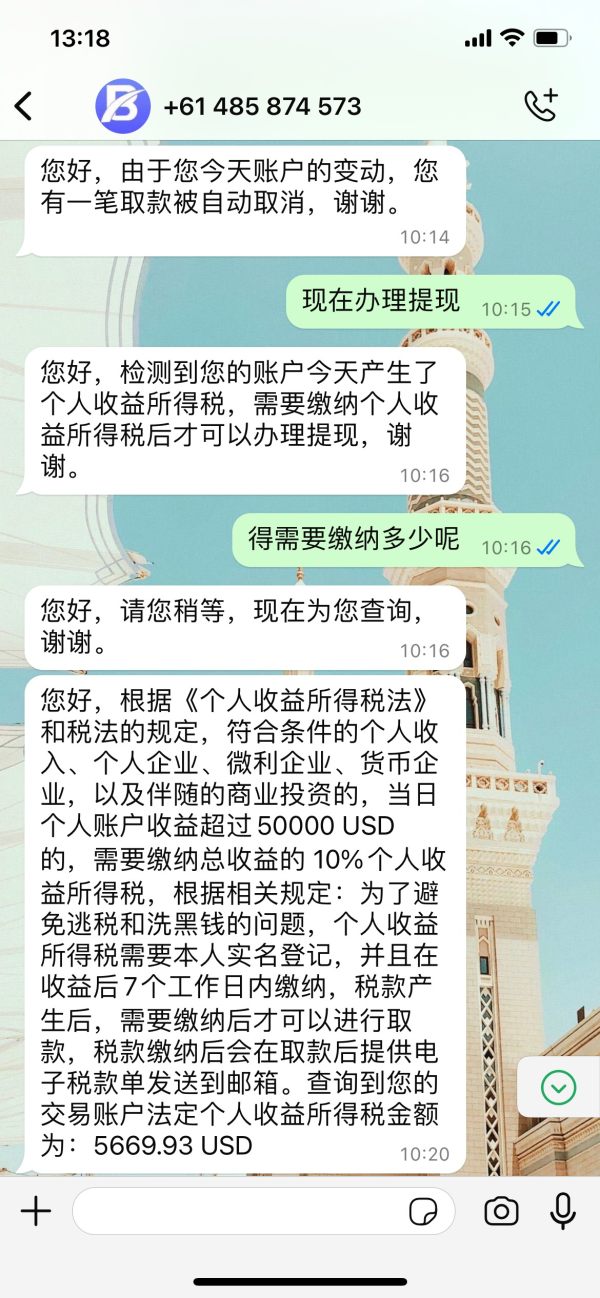

Deposit/Withdrawal Methods

Kyolo Markets Limited does not specify its deposit and withdrawal methods, which is unusual for a trading platform. Legitimate brokers typically offer a variety of secure payment options, including credit/debit cards, bank wire transfers, and e-wallet services like PayPal and Skrill. The lack of transparency regarding payment methods further underscores the broker's suspicious nature, as highlighted by WikiBit.

Minimum Deposit

The broker does not disclose its minimum deposit requirements. This lack of information is concerning, as it is common for reputable brokers to clearly outline their account types and associated costs. In contrast, other licensed brokers often have minimum deposit thresholds as low as $10, making trading accessible to a broader audience.

Kyolo Markets Limited does not offer any bonuses or promotions, which is typical for unregulated brokers. Many legitimate brokers provide incentives to attract new clients, but the absence of such offerings may indicate a lack of confidence in their services.

Trading Instruments

Kyolo Markets Limited offers a limited selection of trading instruments, primarily focusing on forex and commodities. This narrow range may not meet the needs of traders looking for diverse investment options. In comparison, regulated brokers typically provide access to a wider array of assets, including stocks, indices, and cryptocurrencies.

Costs (Spreads, Fees, Commissions)

The broker claims to offer "ultra-low" spreads but does not provide specific figures. This vague marketing tactic is concerning, as transparency regarding costs is crucial for traders. According to Bittribute, the lack of clear information about spreads and fees is a common tactic used by fraudulent brokers to mislead potential clients.

Leverage

Kyolo Markets Limited advertises leverage of up to 500:1, which is substantially higher than the limits set by regulated brokers in Australia, where leverage is capped at 30:1. This discrepancy raises questions about the broker's legitimacy and adherence to regulatory standards.

The absence of popular trading platforms like MT4 and MT5 is a significant drawback. These platforms are favored by retail traders for their advanced features and user-friendly interfaces. Instead, Kyolo Markets Limited requires users to submit personal information to access its proprietary platform, which is not standard practice for legitimate brokers.

Restricted Regions

Kyolo Markets Limited does not provide clear information regarding restricted regions, making it difficult for potential clients to determine if they can legally trade with the broker. This lack of clarity is another indicator of the broker's untrustworthiness.

Available Customer Service Languages

The broker does not specify the languages available for customer support, which can be a significant barrier for non-English speaking clients. Legitimate brokers typically offer multilingual support to cater to a diverse clientele.

Repeated Rating Overview

Detailed Breakdown

- Account Conditions: The absence of transparent information about account types and minimum deposits raises concerns about the broker's legitimacy.

- Tools and Resources: Kyolo Markets Limited lacks access to popular trading platforms and does not provide advanced trading tools.

- Customer Service and Support: The broker's lack of contact information and poor customer support options contribute to its low trust rating.

- Trading Experience: The requirement to submit extensive personal information before gaining access to the trading platform is concerning.

- Trustworthiness: The unregulated status and lack of transparency regarding trading conditions make Kyolo Markets Limited a risky choice for traders.

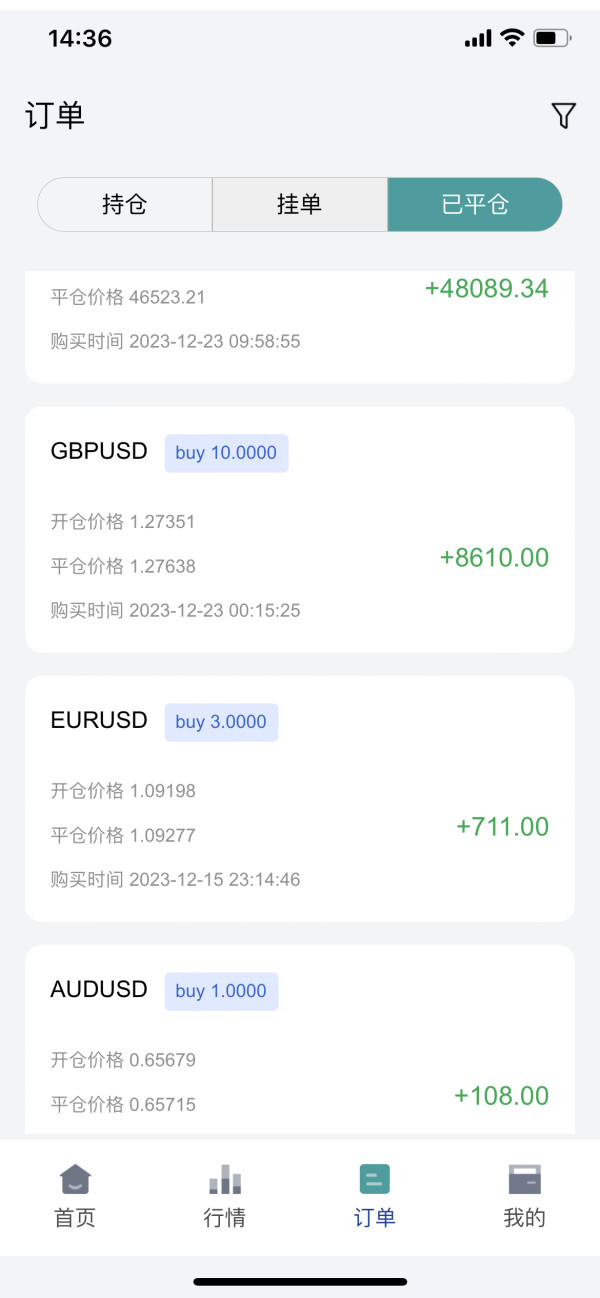

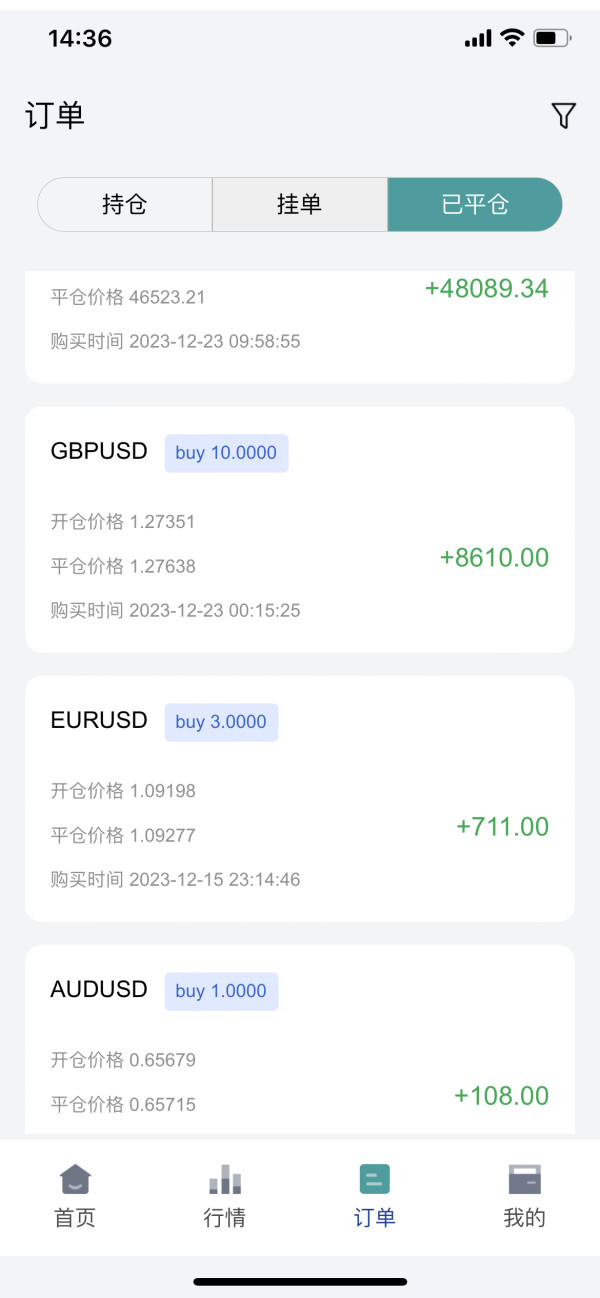

- User Experience: Overall user feedback indicates dissatisfaction with the broker's services, with many users reporting difficulties in accessing their funds.

In conclusion, the Kyolo Markets Limited review underscores significant concerns regarding the broker's legitimacy, regulatory status, and overall user experience. Prospective traders are strongly advised to exercise caution and consider choosing a regulated broker to safeguard their investments.