Is MGS Finance safe?

Pros

Cons

Is MGS Finance A Scam?

Introduction

MGS Finance is an online trading platform that claims to offer a range of financial services, including forex, cryptocurrencies, stocks, and commodities. Operating from Sydney, Australia, it positions itself as a gateway to global financial markets, promising competitive trading conditions and a user-friendly experience. However, the increasing number of allegations surrounding its legitimacy raises concerns among potential traders. Given the high stakes involved in forex trading, it is imperative for traders to conduct thorough evaluations of any broker before committing their funds. This article aims to provide a comprehensive analysis of MGS Finance, focusing on its regulatory status, company background, trading conditions, client safety, and user experiences. The findings are based on a review of various online sources, user testimonials, and industry reports.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in assessing its legitimacy. MGS Finance claims to operate under the auspices of the Australian Securities and Investments Commission (ASIC). However, several investigations indicate that it lacks proper licensing and does not adhere to regulatory standards. The absence of a regulatory framework raises significant red flags for potential investors, as unregulated brokers often lack transparency and accountability.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | N/A | Australia | Unregulated |

The lack of a valid license means that MGS Finance is not subject to the rigorous oversight that regulated brokers must comply with. This includes requirements for capital reserves, transparency in operations, and investor protection measures. Additionally, the New Zealand Financial Markets Authority (FMA) has issued warnings against MGS Finance, stating that it is not registered or licensed to offer services to New Zealand residents. This further solidifies the notion that MGS Finance operates outside the bounds of established regulatory frameworks, which is a significant concern for potential traders looking for a safe trading environment.

Company Background Investigation

MGS Finance, also referred to as Medium Global Strategy, presents itself as a reputable brokerage firm. However, a closer examination reveals a lack of transparency regarding its ownership structure and operational history. The companys domain was registered only in December 2023, which contradicts its claims of having over 20 years of experience in the financial markets. Furthermore, the registered address of MGS Finance matches that of a legitimate ASIC-licensed company, MGS Financial Pty Limited, which does not appear to have any affiliation with MGS Finance.

The management team‘s background is also vague, with little information available about their qualifications or prior experience in the financial sector. The absence of a credible firm profile and detailed disclosures raises questions about the company's integrity and intentions. Transparency is a key characteristic of reputable brokers, and MGS Finance’s failure to provide essential information about its operations is a significant warning sign for prospective investors.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is essential. MGS Finance claims to offer competitive spreads and a variety of trading instruments. However, the lack of detailed information regarding fees and commissions raises concerns about potential hidden costs.

| Fee Type | MGS Finance | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

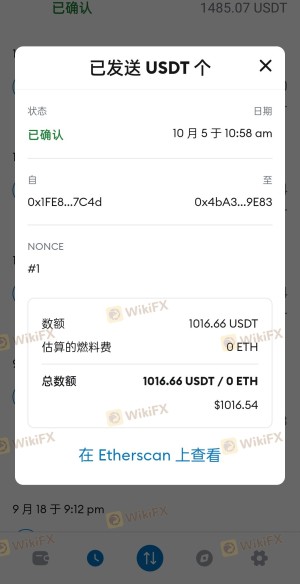

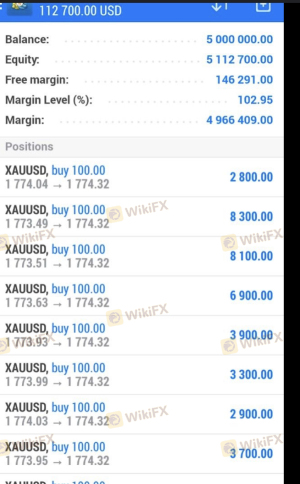

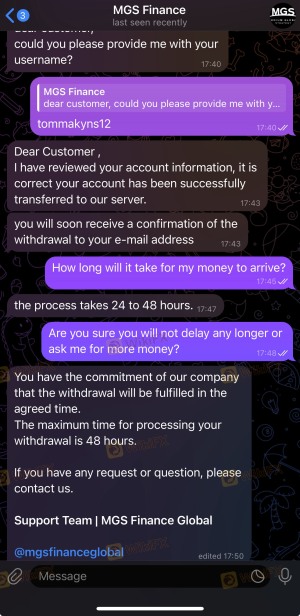

Reports from users indicate that MGS Finance may impose unusual fees, particularly when it comes to withdrawals. Traders have reported experiencing significant delays and complications when attempting to withdraw their funds, often being asked to pay additional fees or meet unrealistic conditions. Such practices are commonly associated with fraudulent brokers, who often create obstacles to discourage withdrawals and retain client funds. This lack of clarity in trading costs is a red flag that should not be overlooked by potential investors.

Client Fund Security

The security of client funds is paramount in the trading industry. MGS Finance claims to implement several measures to protect client funds, but the absence of regulatory oversight raises questions about the effectiveness of these measures. It is crucial for brokers to maintain segregated accounts to ensure that client funds are protected in the event of financial difficulties.

Additionally, the absence of negative balance protection is concerning, as it exposes traders to the risk of losing more than their initial investment. Historical records of any financial disputes or fund mismanagement involving MGS Finance have not been publicly disclosed, further complicating the assessment of client fund safety. Without robust investor protection mechanisms in place, potential clients may be putting their capital at significant risk by trading with MGS Finance.

Customer Experience and Complaints

Customer feedback provides valuable insights into a broker's operations and reliability. Reviews of MGS Finance are overwhelmingly negative, with numerous complaints regarding unresponsive customer service, withdrawal issues, and alleged manipulative practices. Many users have reported difficulties in withdrawing their funds, experiencing unexplained delays and being subjected to additional fees that were not disclosed upfront.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Customer Service Problems | Medium | Ineffective |

| Misleading Information | High | Ignored Complaints |

Several case studies highlight the struggles faced by clients attempting to retrieve their funds. For instance, one user reported waiting over four months for a withdrawal, only to be met with excuses and further requests for payment. Such experiences suggest a pattern of behavior that is common among fraudulent brokers, where the primary goal appears to be the retention of client funds rather than facilitating a smooth trading experience.

Platform and Trade Execution

The performance of the trading platform is another critical aspect of a brokers evaluation. MGS Finance claims to offer a user-friendly trading platform, but user reviews indicate issues with stability and execution quality. Traders have reported instances of slippage and rejected orders, which can significantly impact trading outcomes.

The platform's reliability is crucial for traders who depend on timely execution to capitalize on market movements. Any signs of manipulation or technical failures can lead to significant financial losses, further eroding trust in the broker. The overall user experience on the platform appears to be less than satisfactory, with many traders expressing frustration over the platforms performance.

Risk Assessment

Engaging with MGS Finance poses several risks for potential traders. The lack of regulation, combined with negative user feedback and questionable trading practices, creates a high-risk environment for investors.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated operations expose clients to fraud. |

| Financial Risk | High | Potential for loss of funds due to withdrawal issues. |

| Operational Risk | Medium | Platform instability can lead to execution failures. |

To mitigate these risks, potential investors should conduct thorough research, consider starting with minimal investments, and consult with financial advisors. It is crucial to remain vigilant and skeptical of brokers that lack transparency and regulatory oversight.

Conclusion and Recommendations

In conclusion, the evidence suggests that MGS Finance exhibits several characteristics typical of a scam broker. The lack of regulation, negative user feedback, and questionable trading practices raise significant concerns about its legitimacy. Traders are strongly advised to exercise caution and consider alternative, more reputable brokers that offer robust regulatory protections and transparent operations.

For those seeking reliable trading options, brokers such as IG, OANDA, or Forex.com, which are well-regulated and have established reputations in the industry, may serve as safer alternatives. Always prioritize due diligence and ensure that any broker you choose operates within a regulatory framework that protects your investments.

Is MGS Finance a scam, or is it legit?

The latest exposure and evaluation content of MGS Finance brokers.

MGS Finance Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MGS Finance latest industry rating score is 1.36, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.36 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.