Is Cap House safe?

Pros

Cons

Is Cap House Safe or a Scam?

Introduction

Cap House is a forex broker that has gained attention in the trading community, particularly among those looking for new trading opportunities. As the forex market continues to grow, it attracts various brokers, some of which may not adhere to the necessary regulations and standards. This raises the importance of conducting thorough research before engaging with any trading platform. Traders must be cautious and evaluate brokers based on their regulatory status, company background, trading conditions, and customer experiences. In this article, we will investigate whether Cap House is a safe trading option or if it raises red flags that potential investors should be aware of. Our investigation is based on a comprehensive analysis of multiple sources, including regulatory databases, customer reviews, and expert opinions.

Regulation and Legitimacy

When assessing whether Cap House is safe, one of the first aspects to consider is its regulatory status. Regulation is crucial because it ensures that brokers adhere to strict standards that protect investors. A regulated broker is typically required to maintain transparency, segregate client funds, and follow ethical trading practices.

Regulatory Information

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

Currently, Cap House is not regulated by any recognized financial authority. The absence of regulation means that there are no legal protections in place to safeguard investors' funds. The company claims to be registered in Saint Lucia; however, this registration does not imply that it is licensed or authorized to conduct forex trading. In fact, Saint Lucia does not have a regulatory framework for forex trading, which raises significant concerns about the legitimacy of Cap House. Without oversight from a reputable regulatory body, traders are exposed to higher risks, making it imperative to question whether Cap House is safe for investment.

Company Background Investigation

Understanding the background of Cap House is essential in determining its trustworthiness. The broker's history, ownership structure, and management team play a significant role in assessing its reliability.

Cap House appears to be relatively new in the forex market, with limited information available regarding its establishment and development. The lack of transparency about the company's history raises questions about its credibility. Moreover, there is no publicly available information on the qualifications or experience of the management team, which is a critical factor in evaluating a broker's capability to operate effectively.

The company's website provides minimal details about its operations, which further complicates the assessment of its transparency. A reputable broker typically offers comprehensive information about its team, history, and operational practices. In contrast, the limited disclosure from Cap House suggests that potential clients should approach with caution and consider whether Cap House is safe for their trading activities.

Trading Conditions Analysis

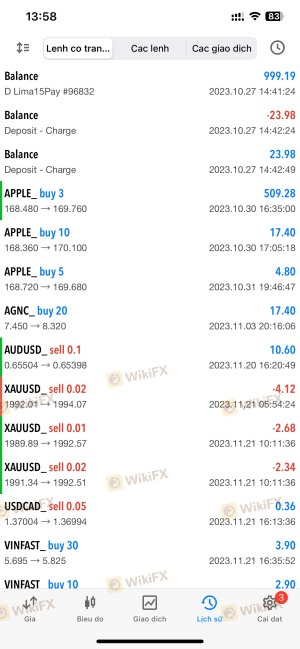

Another critical area to evaluate is the trading conditions offered by Cap House. Understanding the fee structure and trading costs is vital for traders to make informed decisions.

Cap House claims to provide various account types with competitive trading conditions. However, there are reports from users indicating issues with withdrawal processes and hidden fees, which could suggest a lack of transparency in their fee structures.

Core Trading Costs Comparison

| Fee Type | Cap House | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 pips |

| Commission Model | N/A | $5 per lot |

| Overnight Interest Range | High | Low to Medium |

Reports indicate that traders have experienced difficulties withdrawing funds, with claims of being pressured to pay additional fees before processing withdrawals. Such practices are concerning and may indicate that Cap House is not safe for investors, as they could be subjected to unexpected costs that undermine their trading profitability.

Client Fund Security

The security of client funds is paramount when assessing a broker's reliability. Traders need to understand how their funds are managed and whether there are adequate measures in place to protect their investments.

Cap House has not provided clear information regarding its fund security measures. There are no indications that client funds are kept in segregated accounts, which is a standard practice among reputable brokers to ensure that client funds are protected in the event of financial difficulties. Additionally, there is no mention of investor protection mechanisms or negative balance protection policies, which are essential for safeguarding traders against significant losses.

The absence of these fundamental safety protocols raises significant concerns about whether Cap House is safe for trading. Investors should be wary of platforms that do not prioritize the security of their funds, as this could lead to potential financial losses.

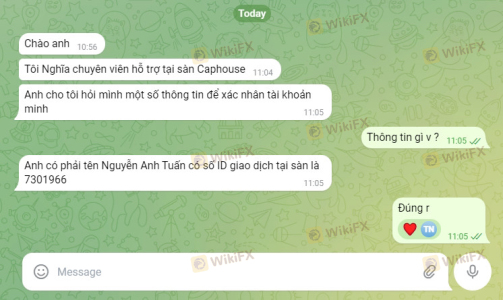

Customer Experience and Complaints

Customer feedback is an invaluable resource for evaluating a broker's reliability. Analyzing user experiences can shed light on common issues and the responsiveness of the broker to complaints.

Many reviews of Cap House highlight a pattern of complaints regarding withdrawal difficulties and poor customer service. Users have reported being unable to withdraw their funds, with some claiming that their accounts were blocked after raising concerns. This raises serious questions about the broker's commitment to customer satisfaction and transparency.

Complaint Severity Assessment

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Ineffective |

| Transparency | High | Lacking |

Several users have shared their experiences of investing significant amounts only to face obstacles when attempting to withdraw their profits. These accounts suggest that Cap House is not safe, as traders may find themselves trapped in a frustrating cycle of unresponsive customer support and unresolved issues.

Platform and Trade Execution

A broker's trading platform is a critical component of the trading experience. Evaluating the performance and reliability of the platform is essential for traders.

Cap House claims to offer an advanced trading platform; however, user feedback indicates issues with order execution and platform stability. Reports of slippage and rejected orders have surfaced, raising concerns about the integrity of the trading environment. Traders rely on seamless execution to capitalize on market opportunities, and any signs of manipulation or instability can significantly impact their trading success.

Risk Assessment

Engaging with any broker involves inherent risks, and it is crucial to assess the specific risks associated with Cap House.

Risk Rating Summary

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation |

| Financial Risk | High | Withdrawal issues |

| Operational Risk | Medium | Platform stability |

The overall risk of trading with Cap House is high, primarily due to its lack of regulation, unclear fund security measures, and numerous customer complaints. Traders should consider these risks carefully and weigh them against their investment goals.

Conclusion and Recommendations

In conclusion, the investigation into Cap House raises significant concerns about its safety and legitimacy. The absence of regulation, combined with troubling reports of withdrawal issues and customer complaints, suggests that Cap House is not safe for traders. Potential investors should approach this broker with caution and consider alternatives that offer robust regulatory oversight and a proven track record of customer satisfaction.

For those seeking a reliable trading experience, it is advisable to explore brokers that are regulated by reputable authorities, such as the FCA or ASIC. These brokers typically provide a safer trading environment, ensuring that client funds are protected and that traders have access to responsive customer support. Always conduct thorough research and consider the risks before committing to any trading platform.

Is Cap House a scam, or is it legit?

The latest exposure and evaluation content of Cap House brokers.

Cap House Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Cap House latest industry rating score is 1.36, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.36 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.