Is Equiity safe?

Pros

Cons

Is Equiity A Scam?

Introduction

Equiity is a relatively new player in the crowded forex and CFD trading market, positioned as a modern and user-friendly platform catering to both novice and experienced traders. Established in 2022 and based in Mauritius, Equiity claims to offer a diverse range of trading instruments, including forex, commodities, cryptocurrencies, and indices. However, with the proliferation of online trading platforms, it is crucial for traders to exercise caution and thoroughly assess the credibility of their chosen brokers. This article aims to provide an objective evaluation of Equiity, examining its regulatory status, company background, trading conditions, customer fund safety, client experiences, platform performance, and overall risk profile. The findings are based on a comprehensive analysis of various online sources and reviews, ensuring a well-rounded perspective.

Regulation and Legitimacy

Regulation is a cornerstone in determining a broker's legitimacy and trustworthiness. Equiity operates under the oversight of the Mauritius Financial Services Commission (FSC), which is responsible for regulating financial services in Mauritius. While the FSC is not regarded as one of the most stringent regulators globally, it does impose certain compliance requirements to protect investors. Below is a summary of Equiity's regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Mauritius FSC | GB 21027168 | Mauritius | Verified |

The FSC mandates that brokers maintain transparent practices, segregate client funds, and adhere to anti-money laundering regulations. Despite the less rigorous nature of the FSC compared to other regulatory bodies, such as the UK's FCA or the US's CFTC, Equiity's adherence to its regulations suggests a level of legitimacy. However, the quality of regulation is essential, as it directly impacts the level of protection afforded to traders. Historically, Equiity has not been reported to engage in fraudulent activities, which adds to its credibility. Nonetheless, traders should remain vigilant and conduct due diligence, as regulatory compliance does not entirely eliminate risks associated with trading.

Company Background Investigation

Equiity is owned and operated by MRL Investments (MU) Ltd, a registered financial services provider in Mauritius. The company was established to provide a modern trading experience, leveraging technology to enhance user accessibility and operational efficiency. The management team behind Equiity comprises professionals with diverse backgrounds in finance and technology, contributing to the broker's strategic development and operational integrity.

The company's transparency is reflected in its commitment to providing clear information about its services and fees. Equiity's website offers insights into its offerings, including various account types and trading instruments, which helps build trust with potential clients. However, the broker's relatively young age in the industry raises questions about its long-term stability and reliability. Newer brokers may not have the same track record as established firms, which can be a concern for risk-averse traders.

Trading Conditions Analysis

Equiity's trading conditions are a crucial aspect for potential clients to consider. The broker offers a competitive fee structure, claiming no hidden costs or commissions on trades. However, scrutiny of its pricing reveals that spreads may be higher than industry averages, particularly for entry-level accounts. Below is a comparison of Equiity's core trading costs with industry averages:

| Fee Type | Equiity | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.5 - 28 pips | 1.0 - 2.0 pips |

| Commission Model | 0% | 0 - 0.5% |

| Overnight Interest Range | Varies | Varies |

The spread for major currency pairs on the silver account starts at 28 pips, which is considerably higher than the industry average. This could impact profitability for traders, particularly those who engage in high-frequency trading. Additionally, Equiity charges overnight fees, which can vary based on market conditions and account type. Traders should be aware of these costs, as they can accumulate and affect overall trading performance.

Customer Funds Safety

The safety of customer funds is paramount in the forex trading industry. Equiity implements several measures to ensure the security of client deposits. Client funds are held in segregated accounts, which means that the broker cannot use these funds for its operational expenses. This practice is crucial in safeguarding traders' investments in the event of financial difficulties faced by the broker.

Furthermore, Equiity offers negative balance protection, ensuring that clients cannot lose more than their initial deposit. This feature is particularly beneficial for new traders who may be at a higher risk of incurring losses. Additionally, Equiity is a member of the Investor Compensation Fund, which provides an extra layer of protection for eligible investors in case the broker becomes insolvent. However, it is essential to note that there have been no reported incidents of fund mismanagement or security breaches associated with Equiity, which is a positive sign for potential clients.

Customer Experience and Complaints

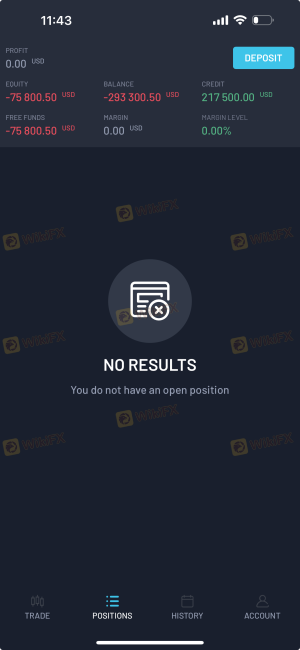

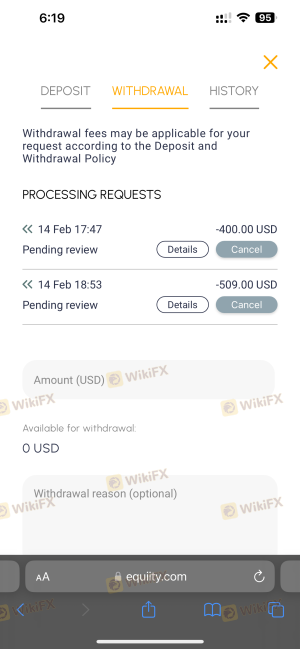

Customer feedback is a critical factor in assessing a broker's reliability. Reviews for Equiity are mixed, with some users praising the platform for its user-friendly interface and responsive customer service. However, common complaints include issues related to account verification delays and difficulty in accessing funds. Below is a summary of the primary complaint types and their severity assessments:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Account Verification Delays | High | Slow response |

| Withdrawal Issues | Medium | Generally responsive |

| High Spreads | Medium | Acknowledged but unchanged |

For instance, some traders have reported frustration with the account verification process, which can take longer than expected. In one case, a user expressed dissatisfaction after waiting several days to have their account verified, which delayed their trading activities. On the other hand, when issues arise, Equiity's customer support is generally responsive, assisting clients through various channels, including live chat and email.

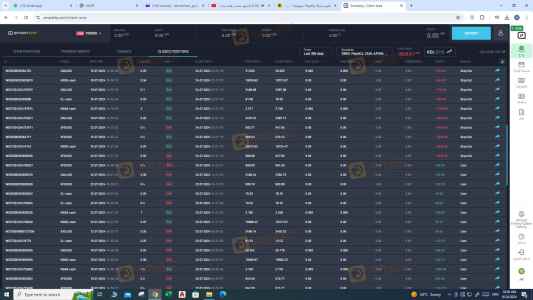

Platform and Trade Execution

Equiity's trading platform is designed to be user-friendly and accessible across devices, providing traders with a seamless experience. The platform features advanced charting tools and real-time market data, which are essential for informed trading decisions. However, the absence of popular trading platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5) may deter some experienced traders who prefer these established systems.

In terms of trade execution, Equiity claims to offer fast execution speeds, averaging around 0.06 seconds for gold accounts. However, the market maker model employed by Equiity raises concerns about potential conflicts of interest, as the broker takes the opposite side of client trades. This model can lead to increased slippage and rejected orders during volatile market conditions, which may negatively impact trading outcomes.

Risk Assessment

When evaluating the overall risk associated with trading on Equiity, several factors must be considered. Below is a risk assessment summary:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Regulated by FSC, but less stringent than others. |

| Financial Risk | High | Higher spreads may affect profitability. |

| Operational Risk | Medium | Potential delays in withdrawals and account verification. |

| Market Risk | High | Trading CFDs involves significant risks due to leverage. |

To mitigate these risks, traders should ensure they fully understand the broker's trading conditions and implement sound risk management strategies. This includes setting appropriate stop-loss orders and only trading with funds they can afford to lose.

Conclusion and Recommendations

In conclusion, Equiity does not appear to be a scam, as it operates under the regulatory oversight of the Mauritius FSC and implements several measures to protect client funds. However, traders should be aware of the higher-than-average spreads and potential delays in account verification and withdrawals.

For novice traders seeking a user-friendly platform with a range of trading instruments, Equiity may be a suitable choice. However, more experienced traders might want to consider alternatives that offer lower spreads and more advanced trading platforms. Reliable alternatives include brokers regulated by stricter authorities, such as the FCA or ASIC, which can provide a higher level of investor protection and transparency.

Overall, while Equiity presents itself as a legitimate broker, it is crucial for traders to conduct their due diligence and carefully consider their trading needs before opening an account.

Is Equiity a scam, or is it legit?

The latest exposure and evaluation content of Equiity brokers.

Equiity Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Equiity latest industry rating score is 1.36, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.36 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.