WiseMarket 2025 Review: Everything You Need to Know

Executive Summary

WiseMarket is a new forex broker that started getting attention in 2021. This company registered in Saint Vincent and the Grenadines, and this wisemarket review shows a platform with both good points and problems for traders who might want to use it. The broker says it helps new people start forex trading easily, and it only needs $1 to open an account, which makes it very attractive to beginners and people who want to start trading without spending much money.

The platform mainly uses MetaTrader 4, which many traders know well. It offers leverage up to 1:200, though some sources say it might go as high as 1:1000. WiseMarket got 226 user reviews with 5-star ratings on some review sites, which suggests users are generally happy. But these good reviews have some concerning reports mixed in, including claims of fraud and customer service problems that people should think about carefully.

The broker seems to focus on new traders and people who want to save money. These users like the low cost to start and the familiar trading platform. However, people should know that the rules and oversight might be limited because of where the broker registered.

Important Disclaimers

Regulatory Considerations: WiseMarket registered in Saint Vincent and the Grenadines, which might not watch over brokers as carefully as major financial centers do. This means investors might not get as much protection as they would with brokers licensed in stricter places like the UK, Australia, or European Union. People thinking about trading should carefully consider what this regulatory status means before they put money in.

Review Methodology: This review looks at user feedback, public company information, and market data that anyone can access. We want to give a fair overview of WiseMarket's services, but we know that each person's trading experience might be very different. All the information here reflects what we knew when we wrote this, and people who might use this broker should check things for themselves.

Overall Rating Framework

Broker Overview

WiseMarket started in the online forex trading world in 2021, though some sources say 2020, which shows there might be different information available to the public. The company says it's a complete online forex broker that wants to serve traders around the world in different market areas. WiseMarket's business focuses on giving people easy access to trading through established platforms while keeping entry requirements competitive, which appeals to regular traders who want cost-effective market access.

The broker works with multiple types of assets beyond traditional forex pairs, including stocks and ETFs. This suggests they want to provide different trading opportunities. This approach matches current industry trends toward complete trading platforms that serve various investment strategies and risk levels. WiseMarket says it wants to bridge the gap between professional trading tools and retail accessibility, according to available information.

WiseMarket mainly operates through the MetaTrader 4 platform, which is one of the most widely used trading interfaces in the forex industry. This platform choice gives users familiar functionality and extensive third-party support, including automated trading capabilities and custom indicator development. The broker supports trading in major forex pairs, stocks, and ETF products, though we need to verify specific details about the complete range of available instruments. The company registered in Saint Vincent and the Grenadines, which puts it in a regulatory framework that offers certain operational flexibility while potentially limiting investor protection compared to stricter jurisdictions. This wisemarket review emphasizes how important it is to understand these regulatory implications.

Detailed Service Analysis

Regulatory Jurisdiction: WiseMarket operates under Saint Vincent and the Grenadines registration, which is known for giving financial services companies operational flexibility. However, this regulatory environment might offer limited oversight compared to major financial centers, which could affect dispute resolution and investor protection.

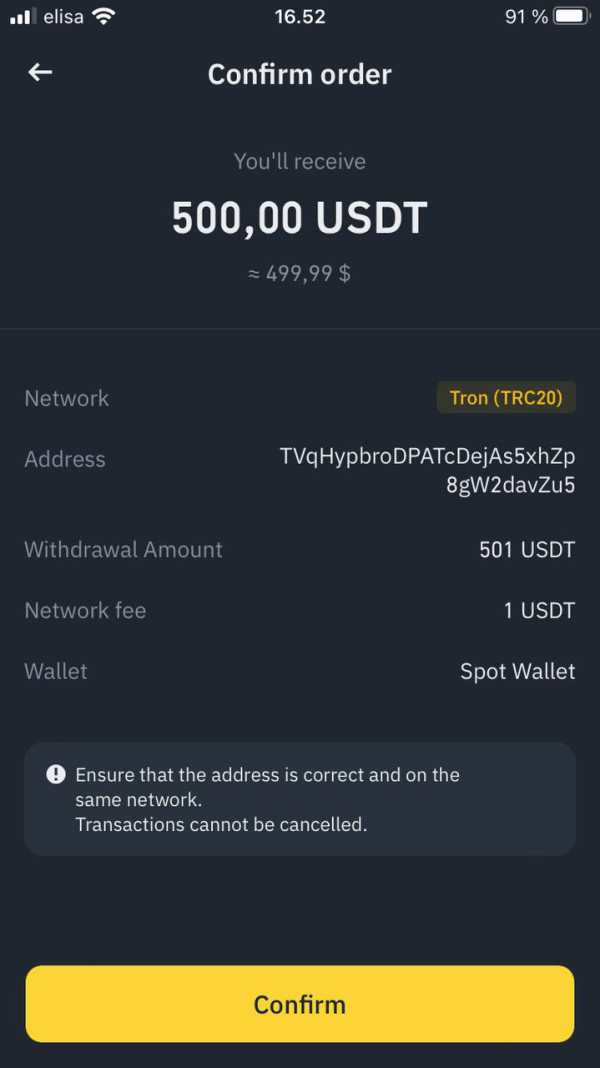

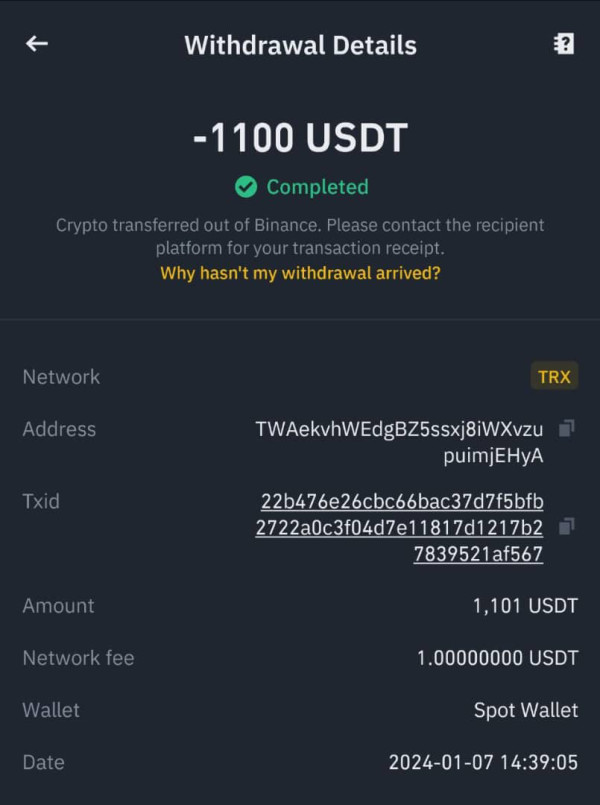

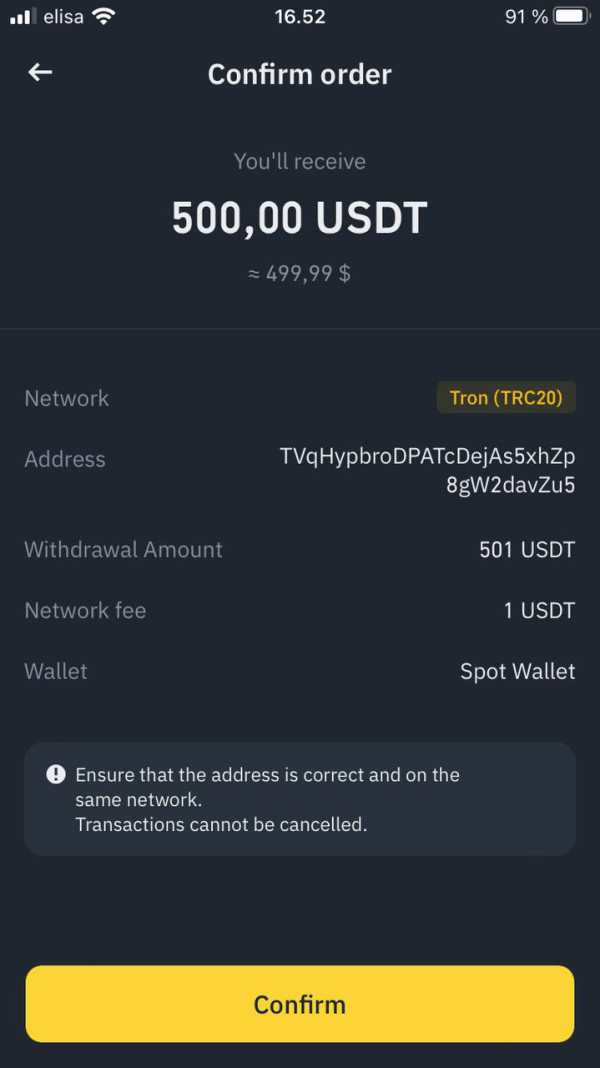

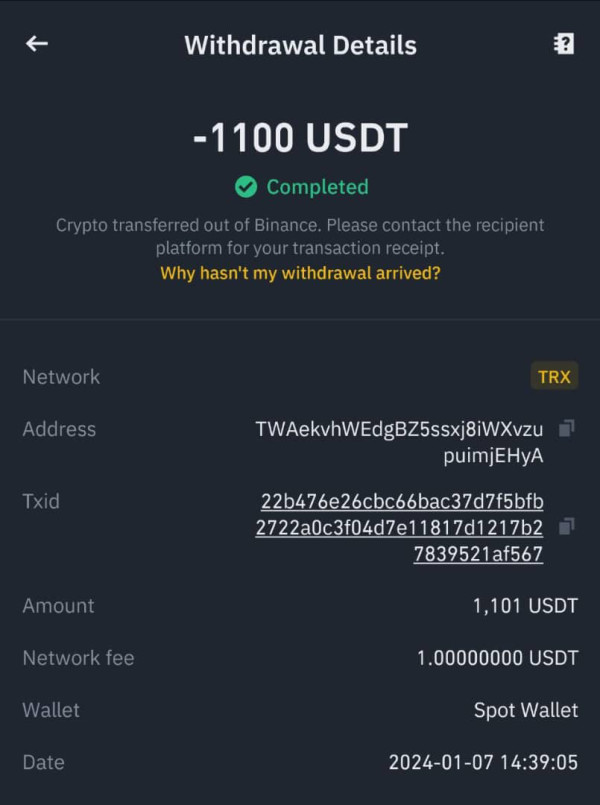

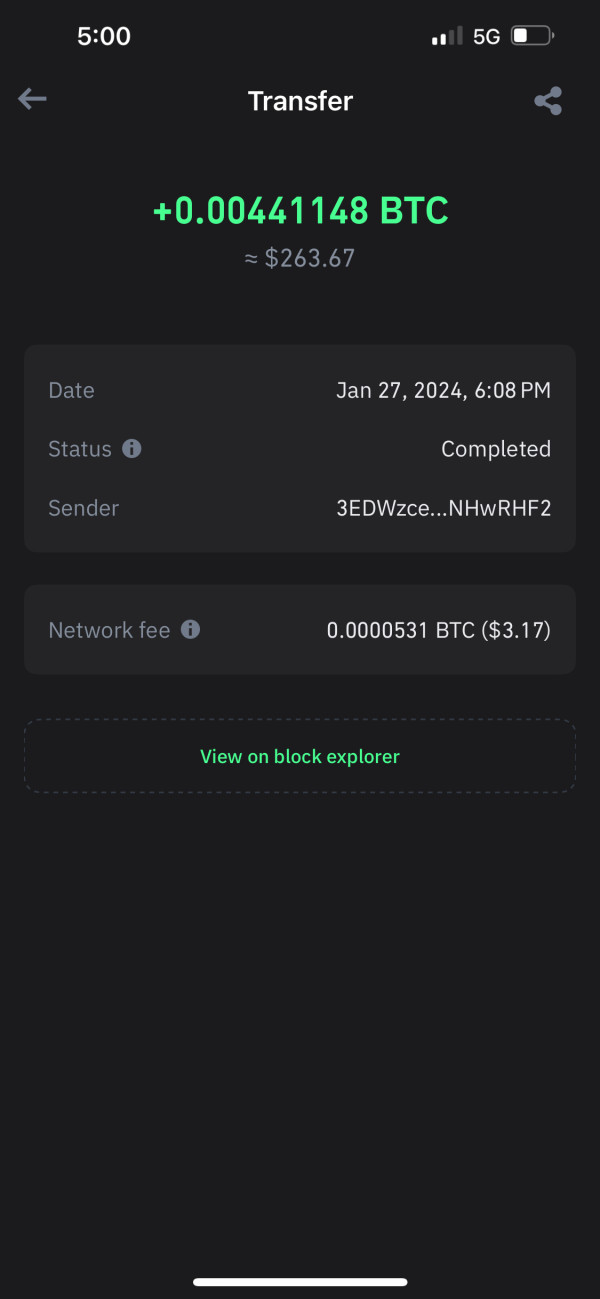

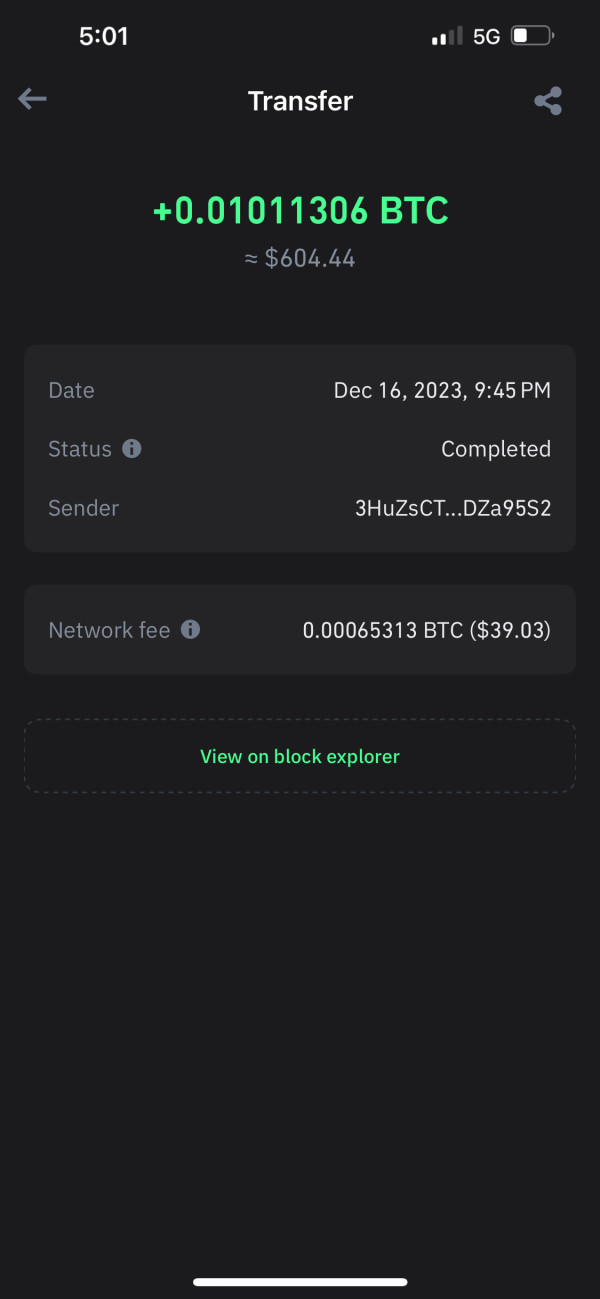

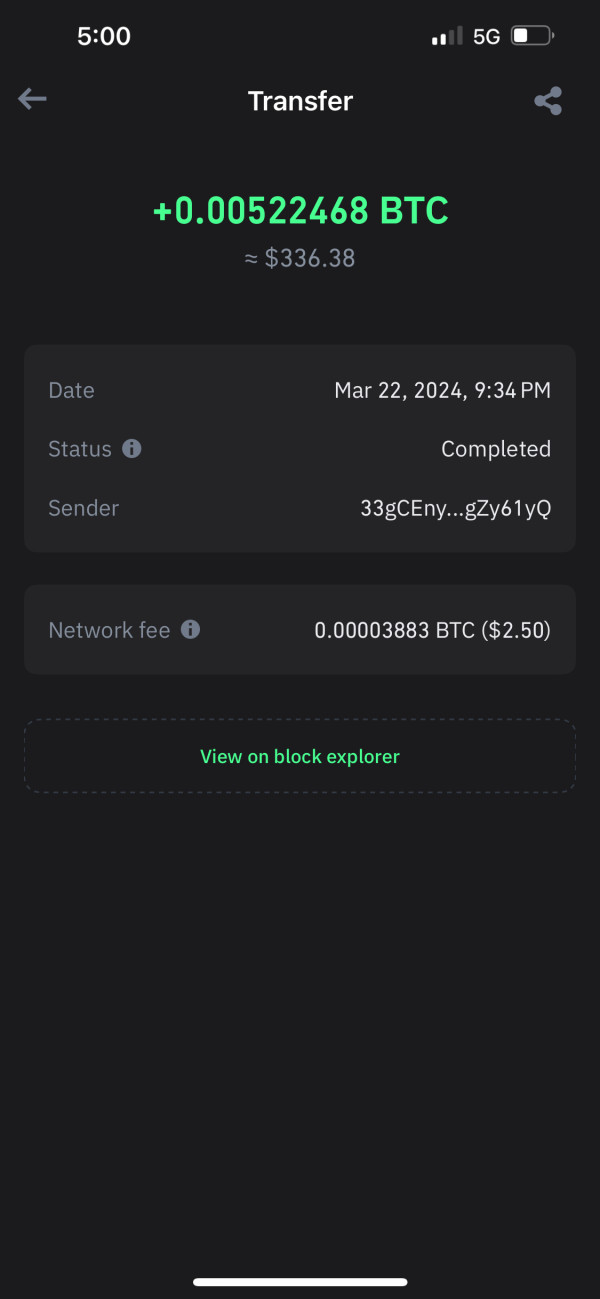

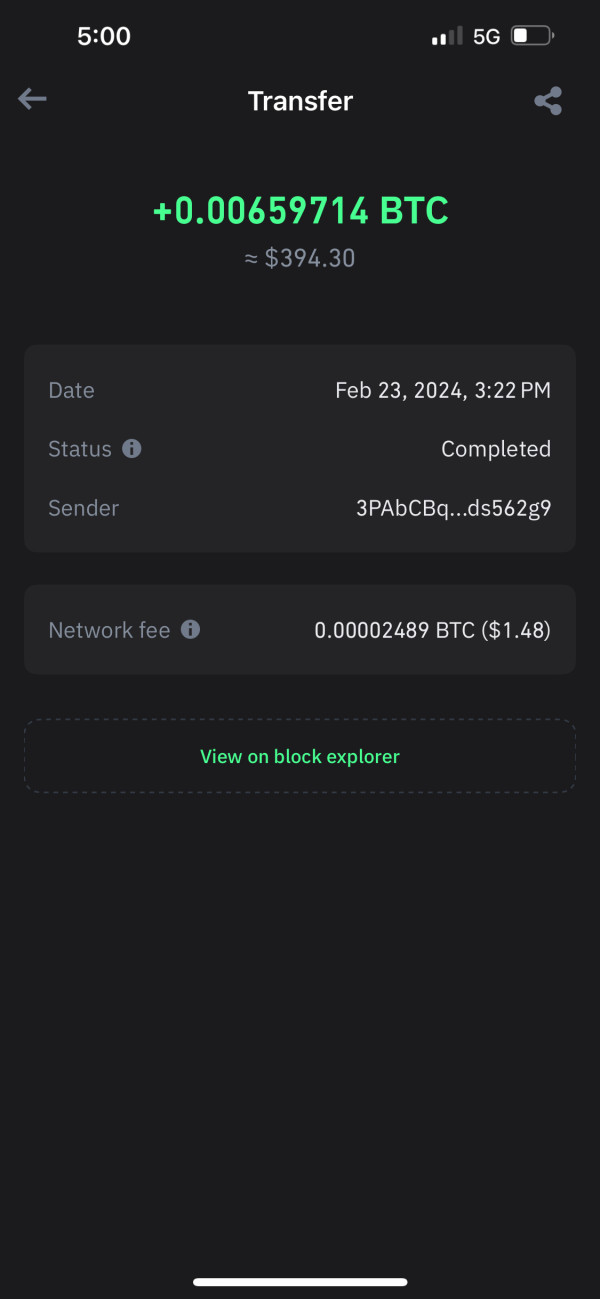

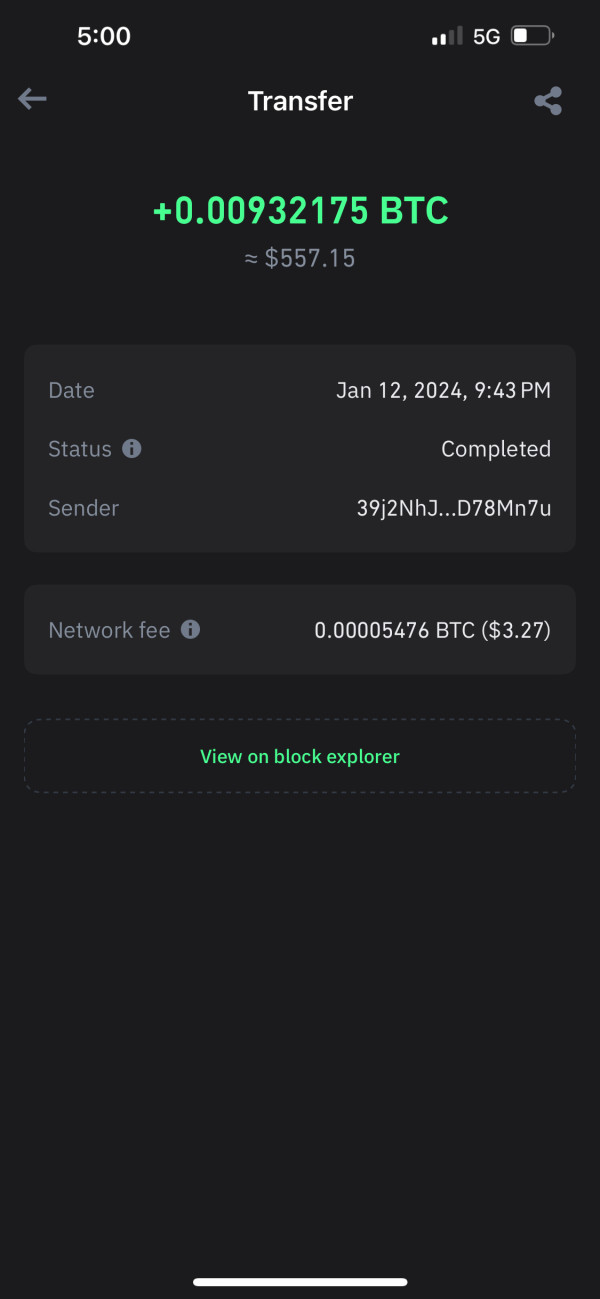

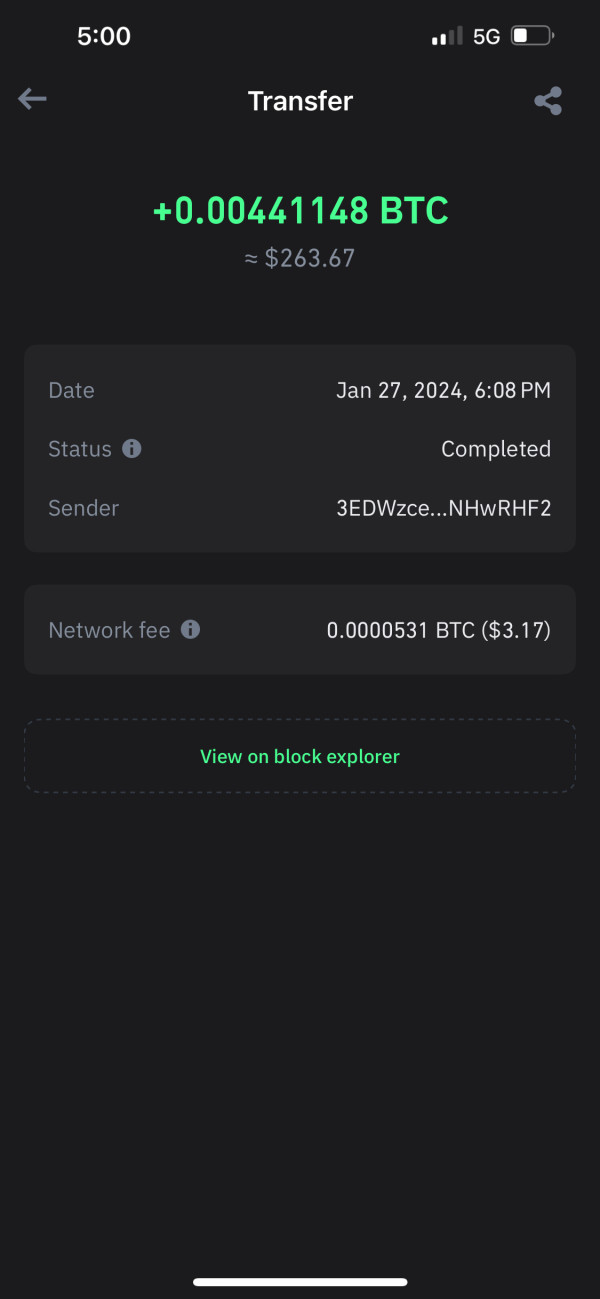

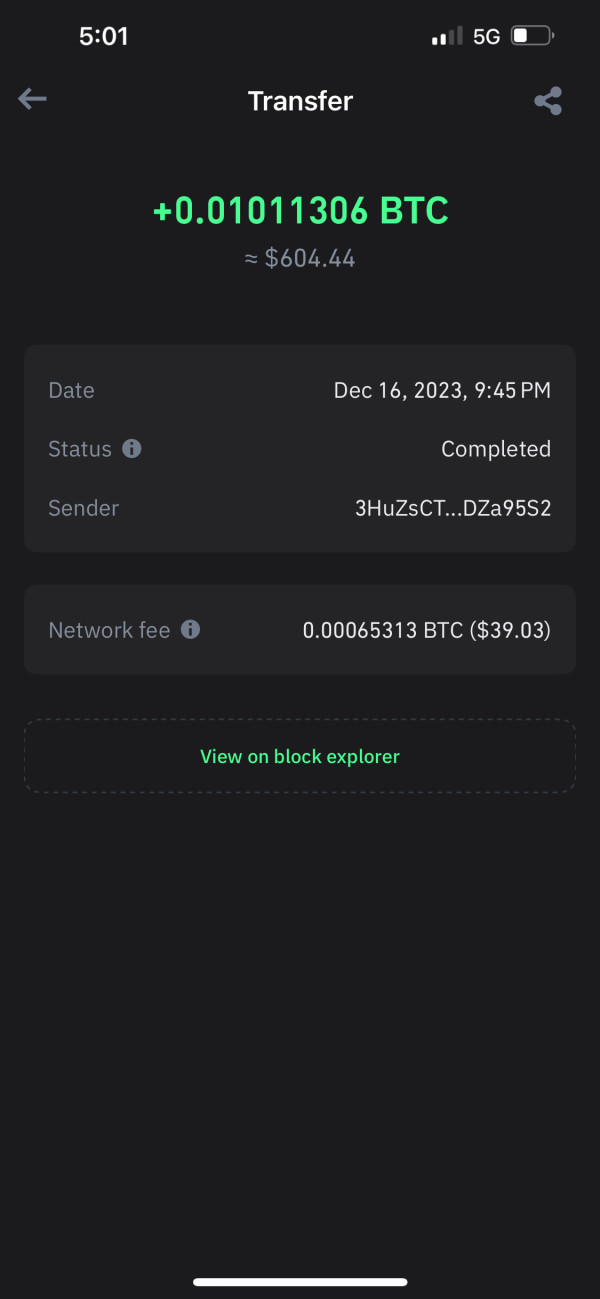

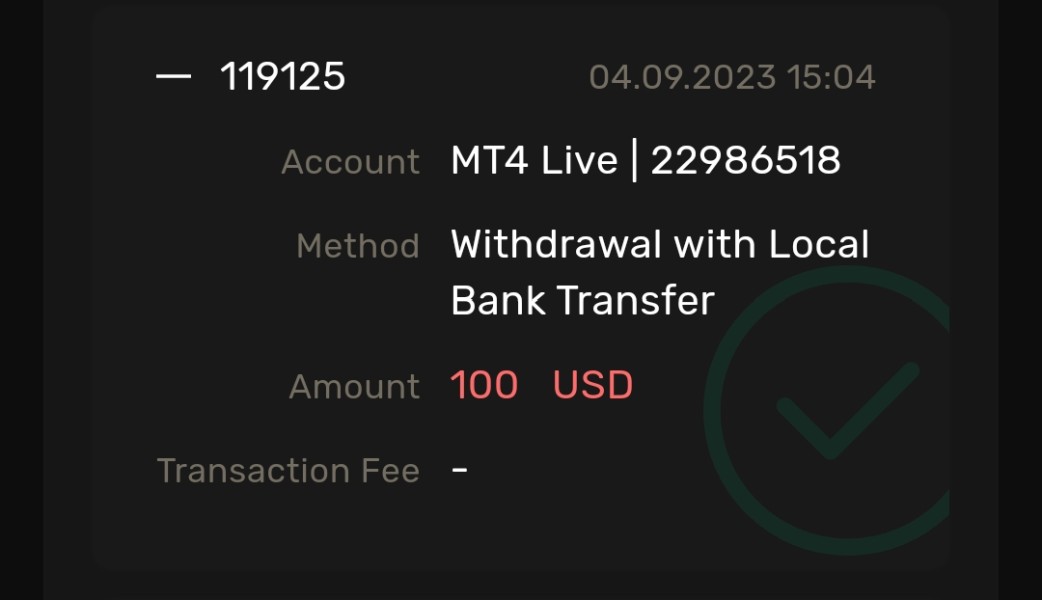

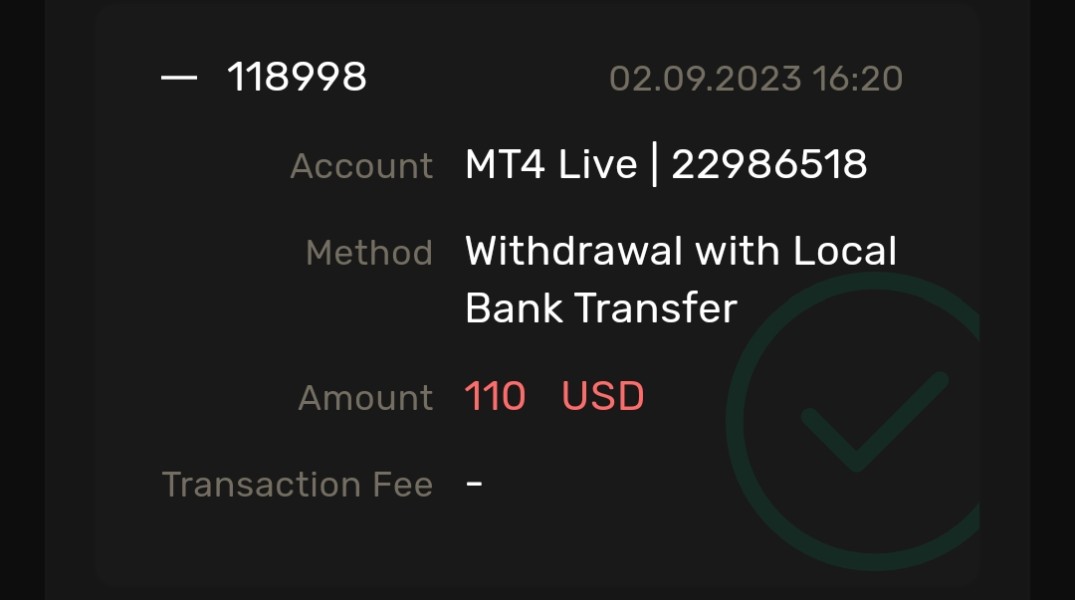

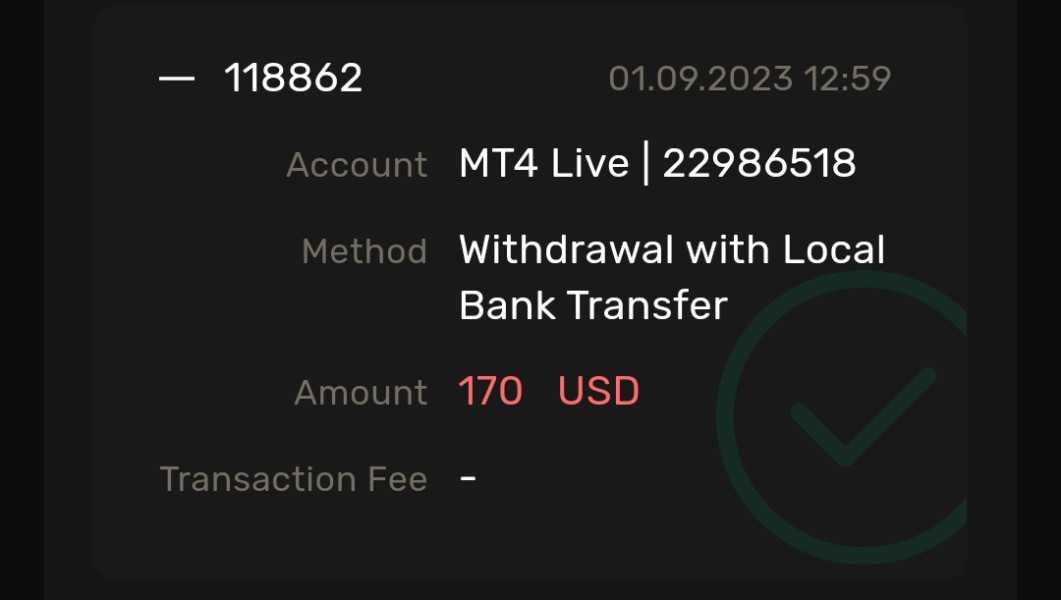

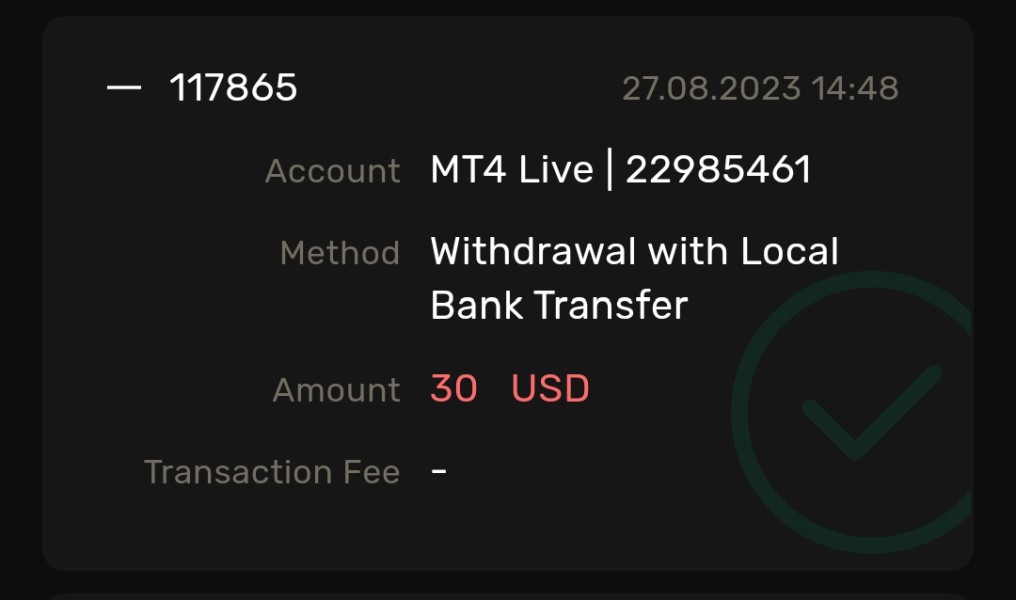

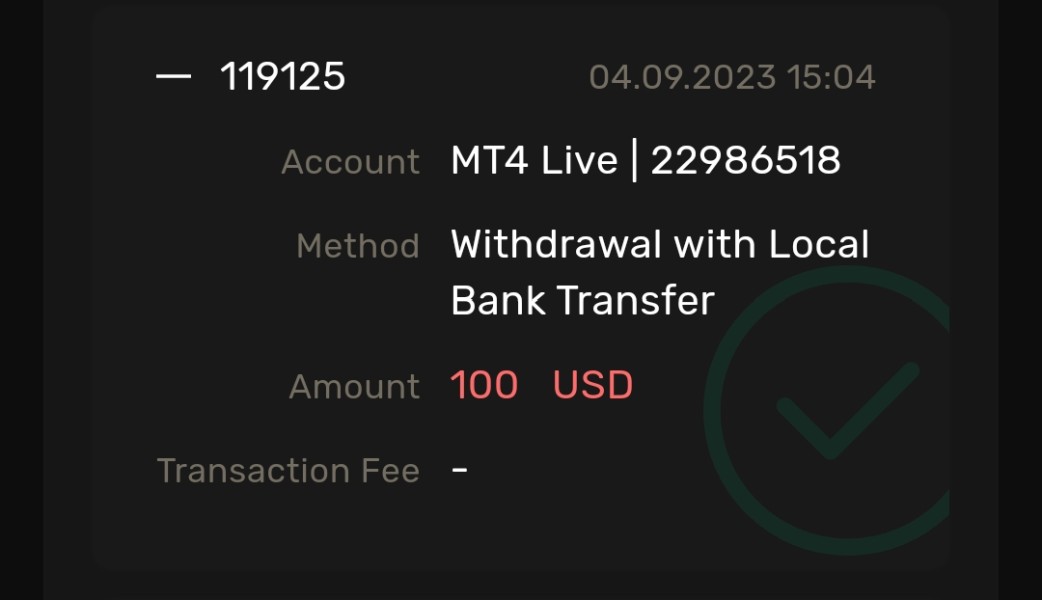

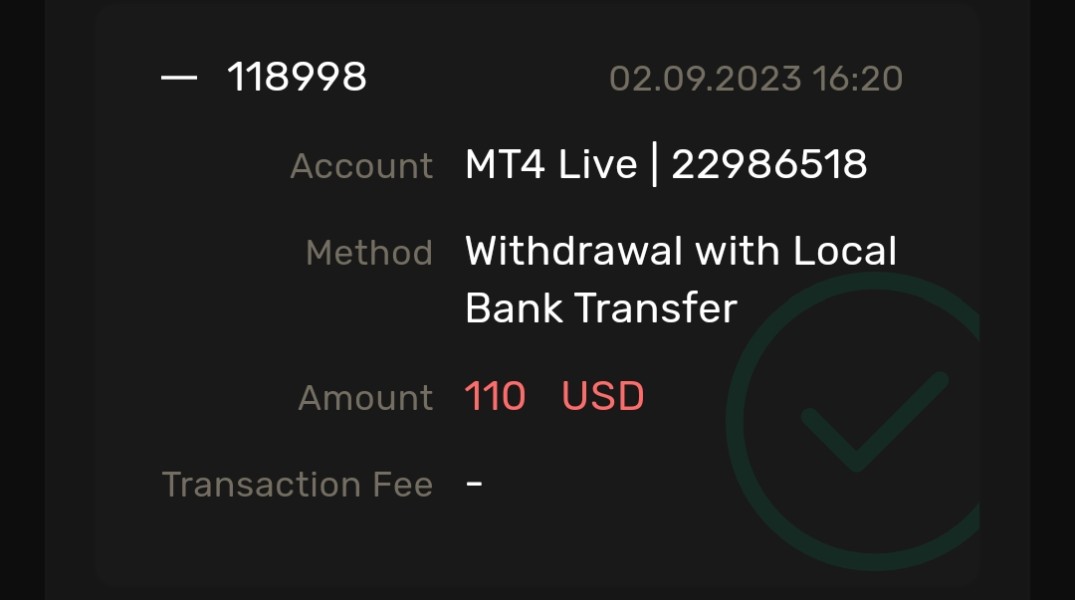

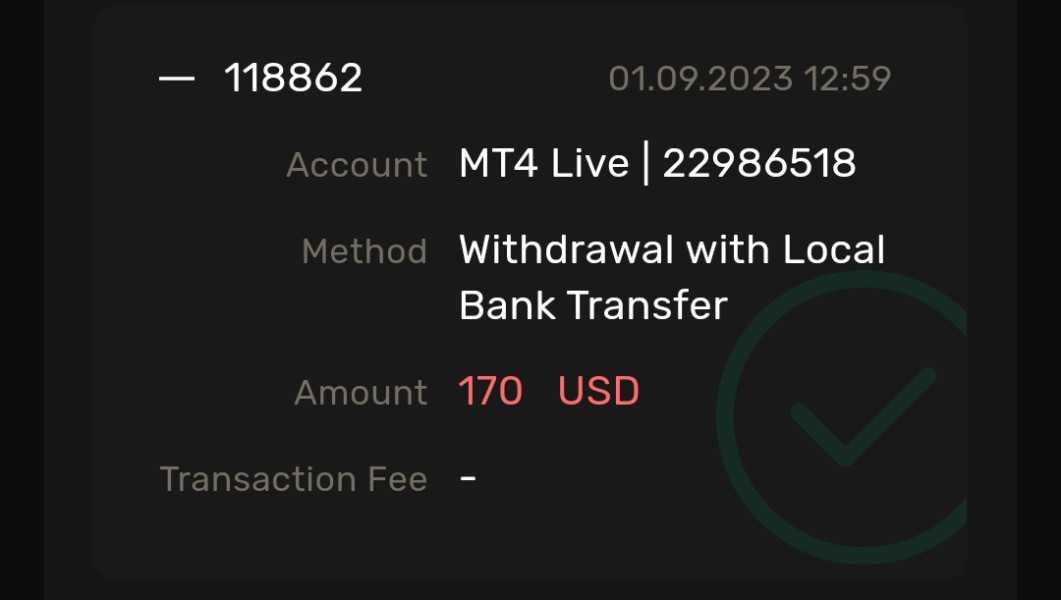

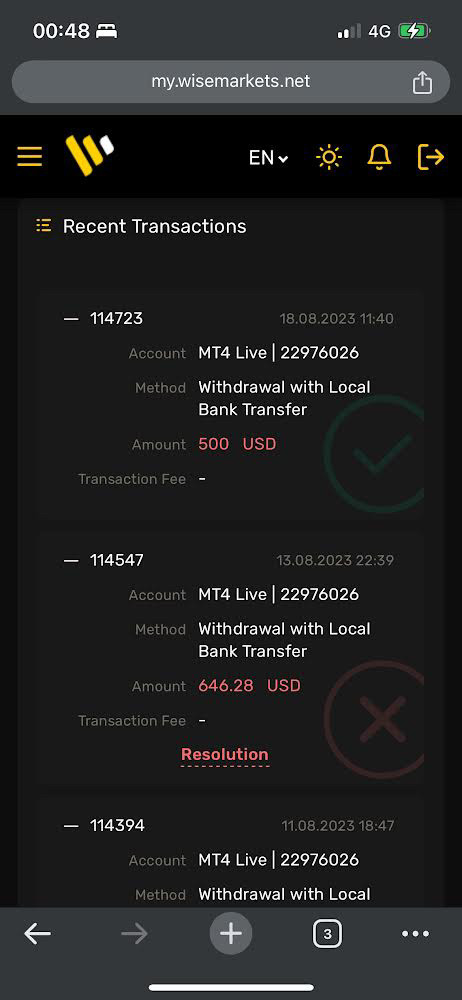

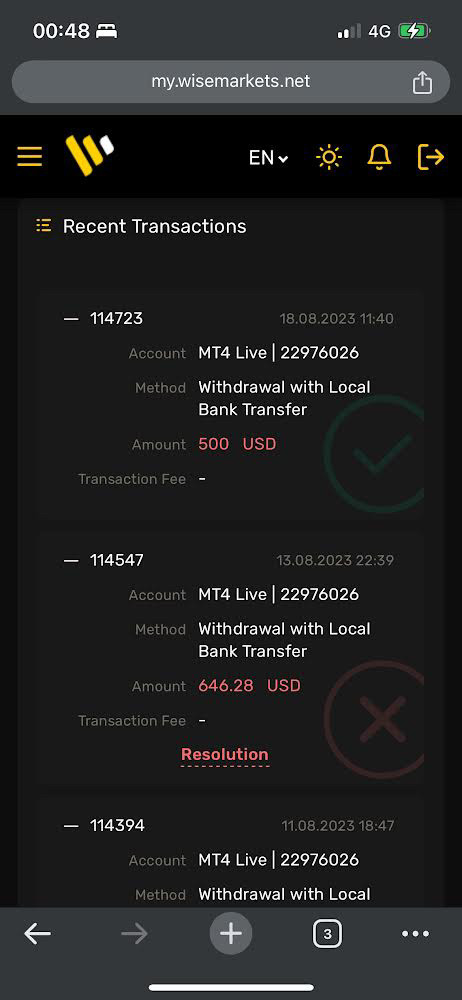

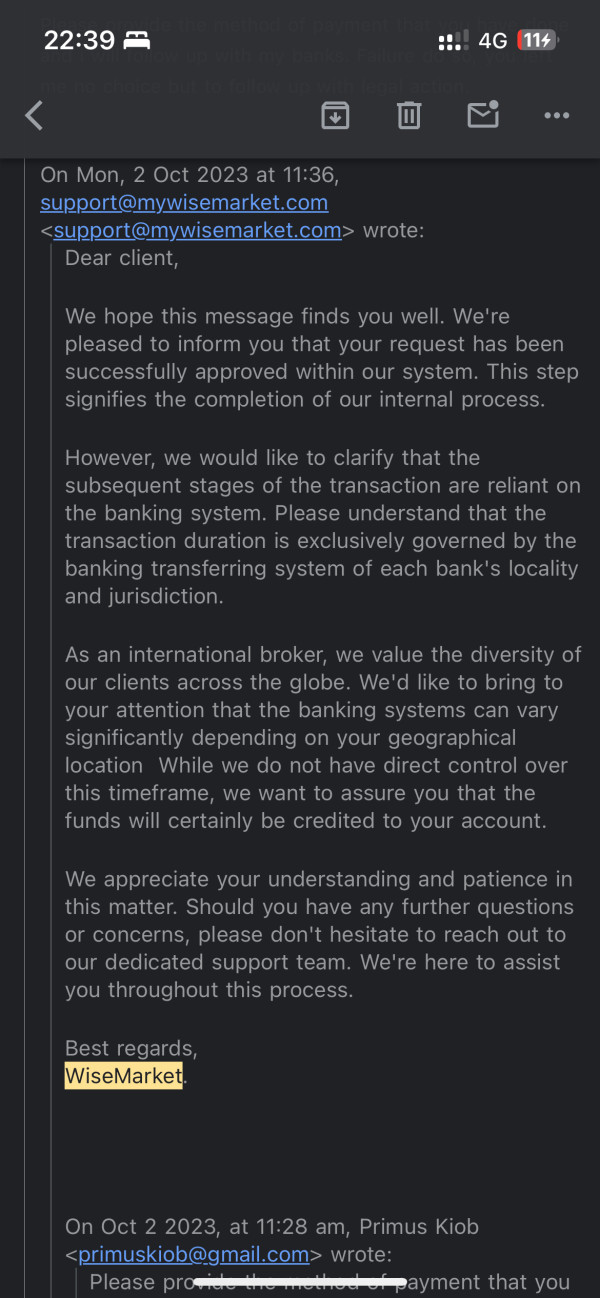

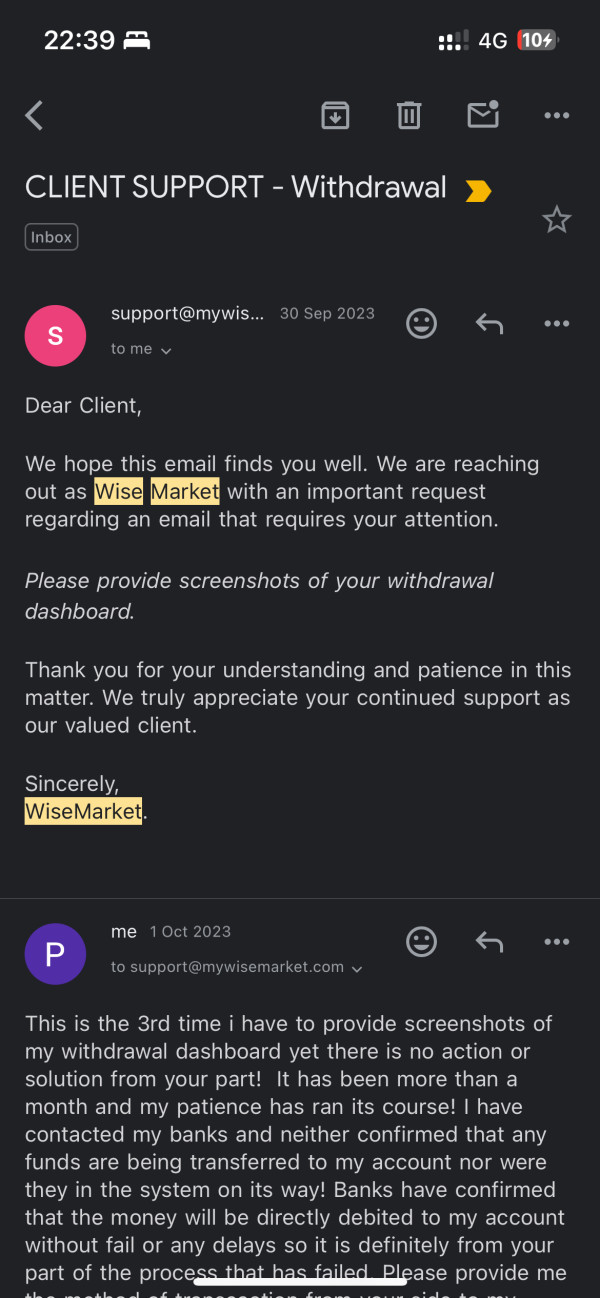

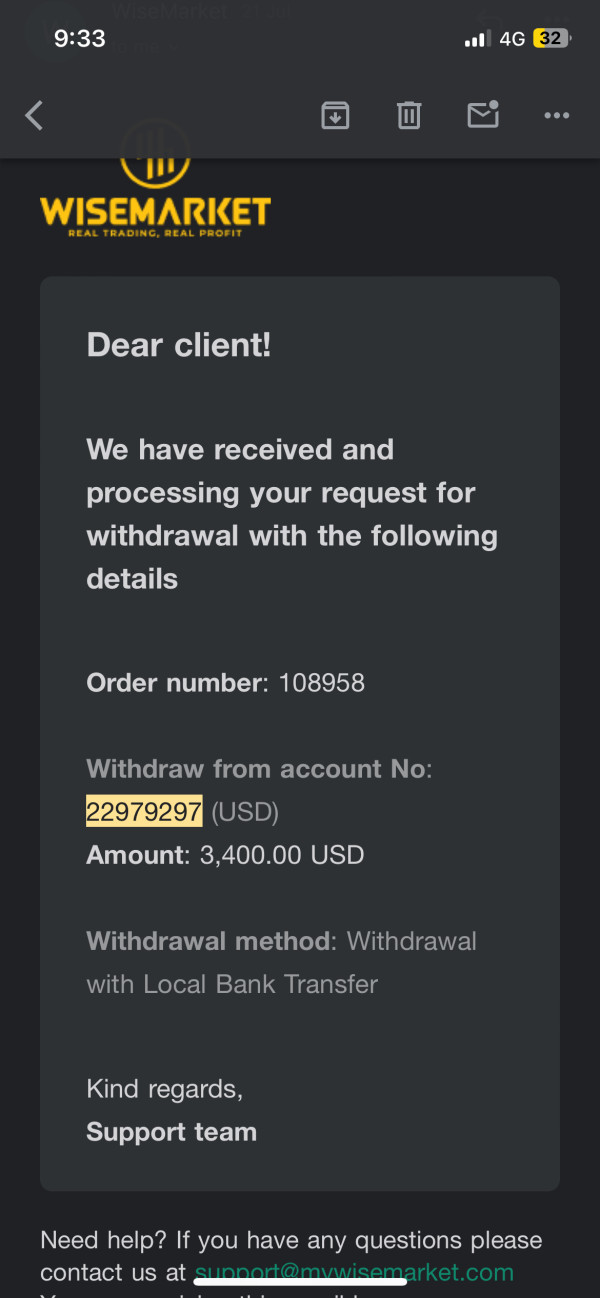

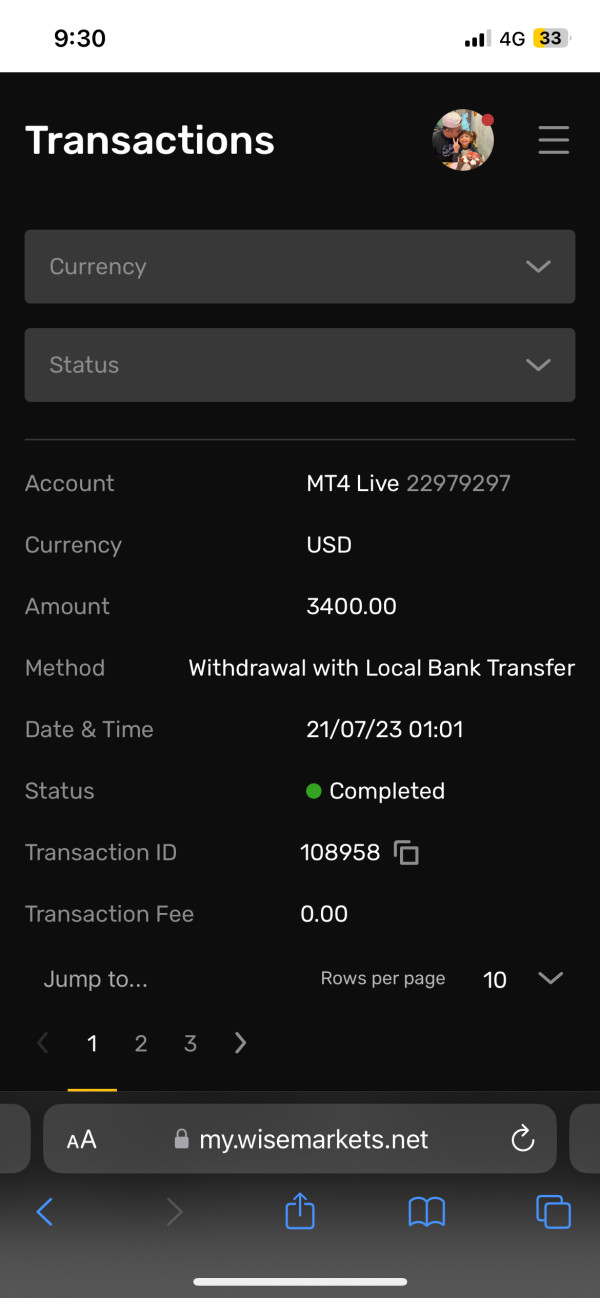

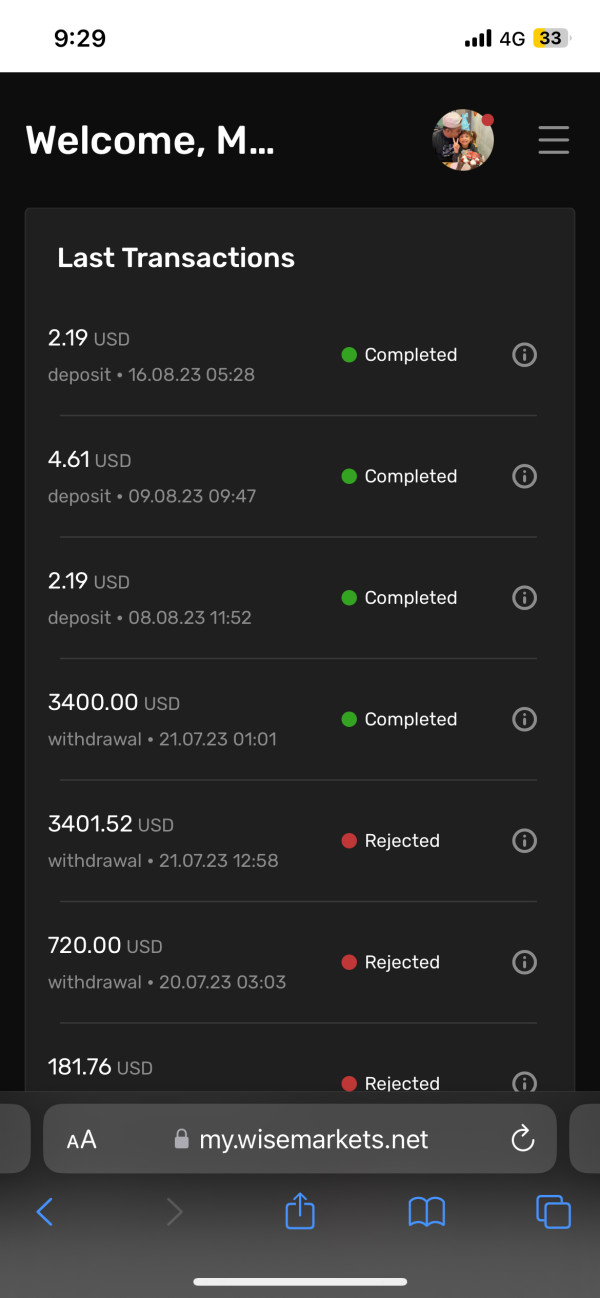

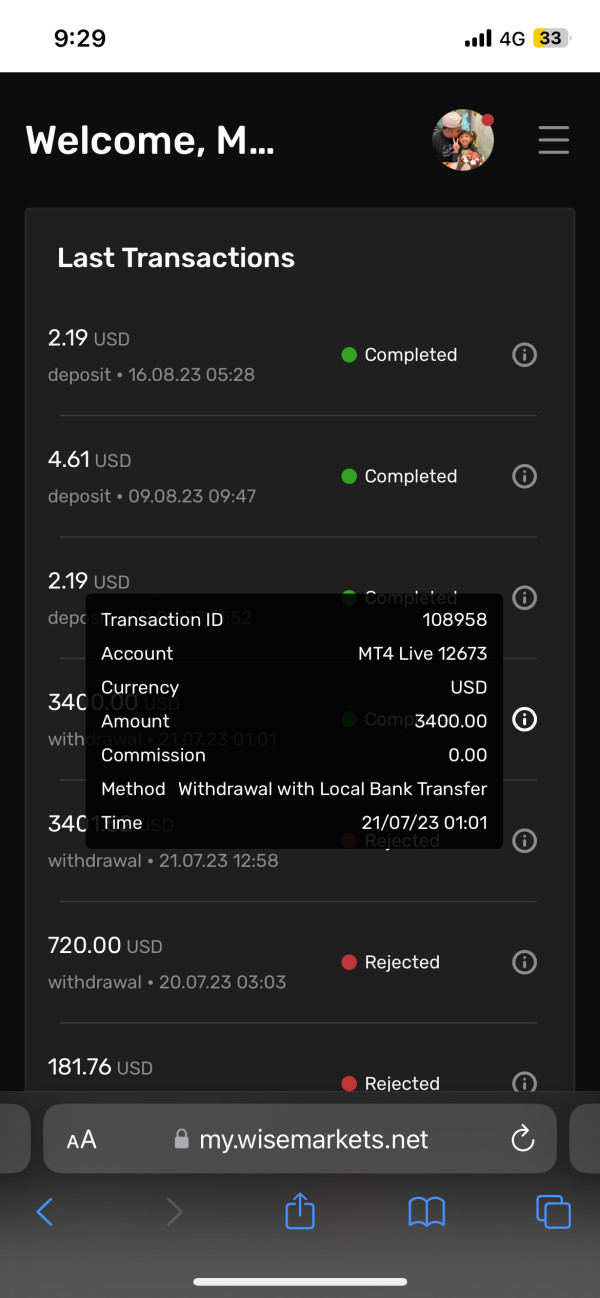

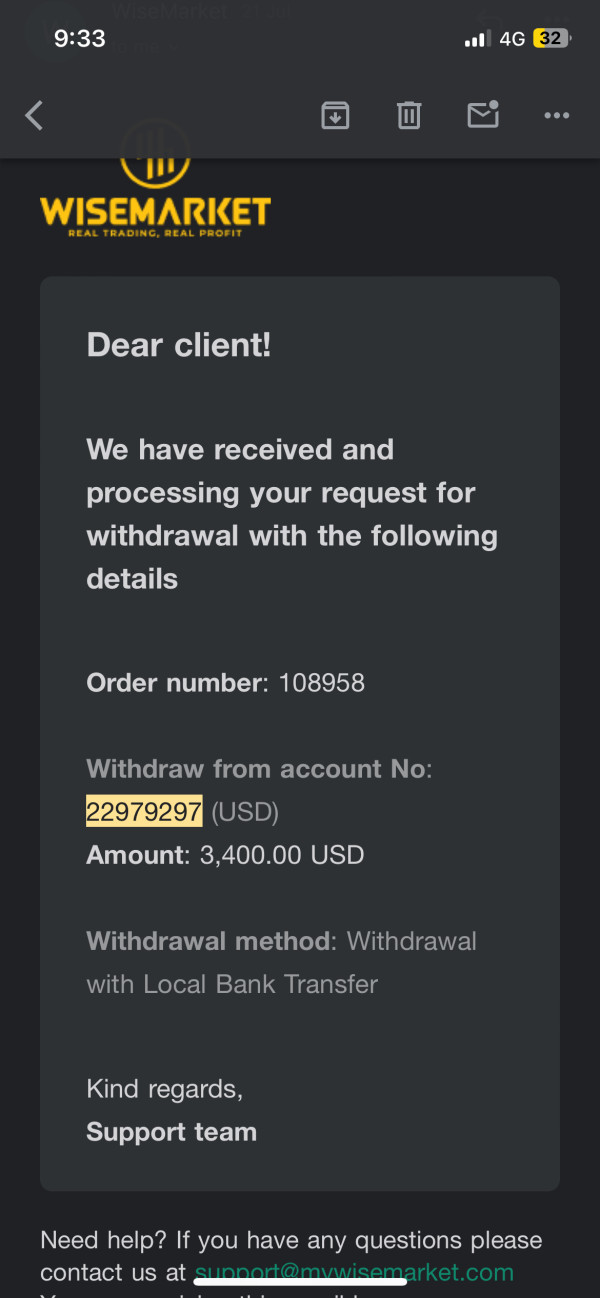

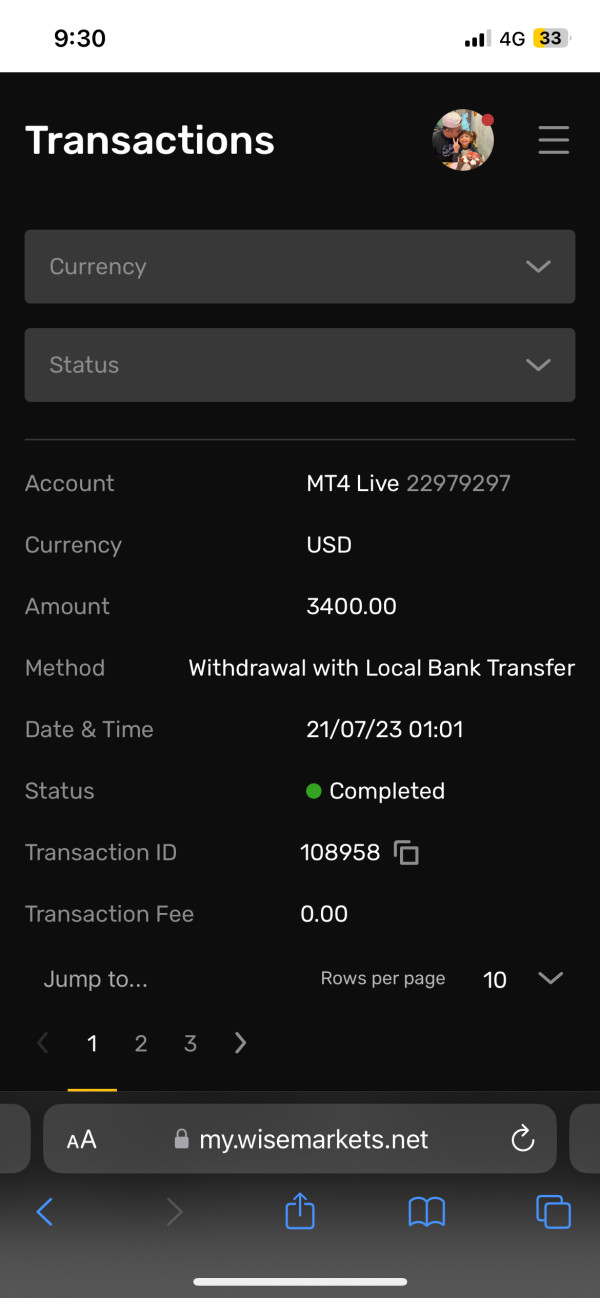

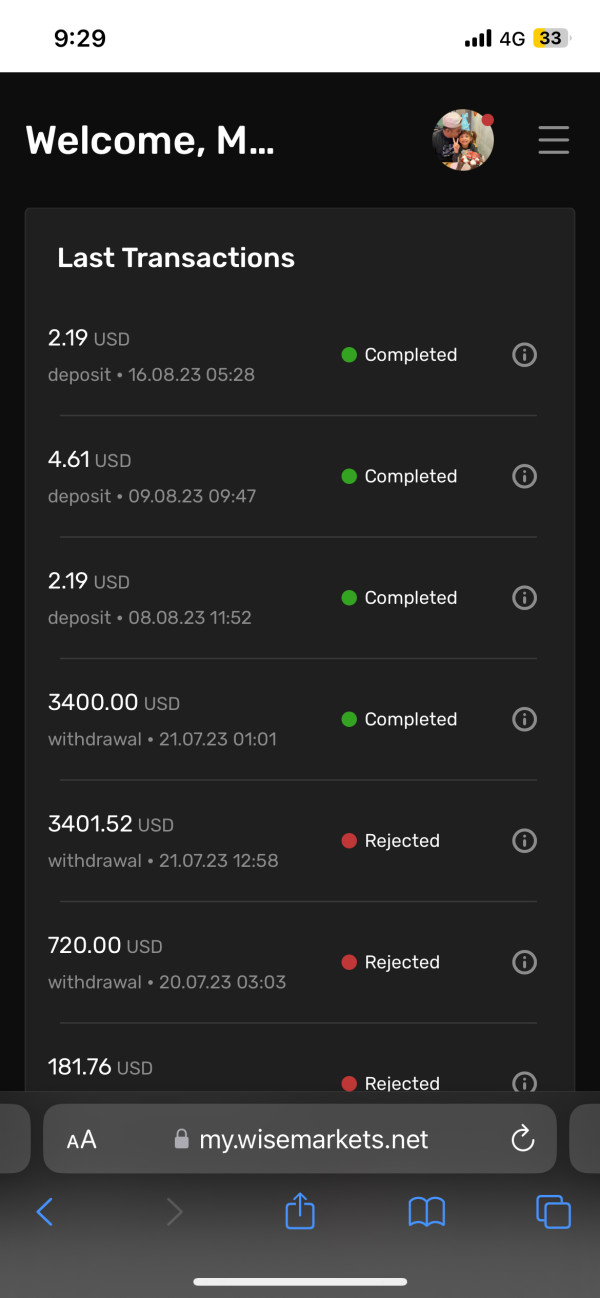

Deposit and Withdrawal Methods: Available sources don't detail specific information about payment processing methods, withdrawal procedures, and processing timeframes. People need to verify fund management procedures directly with the broker for complete understanding.

Minimum Deposit Requirements: The platform's standout feature is its $1 minimum deposit requirement. This positions it among the most accessible brokers for initial capital requirements to activate an account.

Promotional Offerings: Available documentation doesn't specify details about bonus programs, promotional campaigns, or special offers for new clients. This suggests either limited promotional activities or insufficient public disclosure of such programs.

Tradeable Assets: WiseMarket supports multiple asset categories including forex currency pairs, stock instruments, and ETF products. This provides different trading opportunities across different market sectors and investment strategies.

Cost Structure: Available sources don't thoroughly detail comprehensive information about spreads, commission structures, overnight financing costs, and additional fees. Complete cost analysis requires direct inquiry.

Leverage Options: The platform offers leverage ratios up to 1:200. Some sources indicate potential availability of higher leverage ratios reaching 1:1000, though these higher ratios need confirmation.

Platform Selection: WiseMarket provides access to the MetaTrader 4 trading platform. This offers users access to standard charting tools, technical analysis capabilities, and automated trading functionality through Expert Advisors.

Geographic Restrictions: Available documentation doesn't detail specific information about regional limitations, restricted countries, or jurisdictional trading restrictions.

Customer Support Languages: Accessible sources don't comprehensively specify available customer service language options and communication channels. Multilingual support capabilities require direct verification. This wisemarket review highlights the need for clear communication channel information.

Comprehensive Rating Analysis

Account Conditions Analysis (Score: 7/10)

WiseMarket's account structure gives big advantages to entry-level traders, mainly through its very low $1 minimum deposit requirement. This accessibility factor represents one of the most competitive entry points in the forex brokerage industry, and it effectively removes financial barriers that often prevent newcomers from exploring forex trading. The low threshold allows potential traders to get familiar with the platform and trading mechanics without substantial financial commitment.

However, available information doesn't provide detailed information about different account tiers, special features, or premium account benefits that might be available to higher-deposit clients. The absence of detailed account type information suggests either a simplified account structure or limited public disclosure of account variations. User feedback shows that the low minimum deposit has successfully attracted many beginners to the platform, though specific account opening procedures and verification requirements remain unclear.

The account conditions seem designed to focus on accessibility over premium features. This aligns with the broker's apparent focus on retail and novice traders. Compared to industry standards where minimum deposits often range from $100 to $500, WiseMarket's $1 requirement provides exceptional competitiveness. However, traders should verify whether this low deposit translates to meaningful trading capabilities or serves primarily as a marketing tool. This wisemarket review emphasizes how important it is to understand actual trading conditions beyond initial deposit requirements.

WiseMarket's tool ecosystem centers around the MetaTrader 4 platform. This provides users with access to industry-standard charting capabilities, technical analysis tools, and automated trading functionality. MT4's established reputation offers users familiar functionality and extensive community support, including access to custom indicators, Expert Advisors, and third-party trading tools developed by the broader MT4 ecosystem.

However, available sources don't detail specific information about proprietary trading tools, research resources, market analysis provision, or educational materials. This information gap makes it difficult to assess the comprehensive value proposition beyond the basic platform offering. The absence of detailed tool descriptions suggests either limited additional resources or insufficient marketing of available features.

User feedback shows general familiarity and satisfaction with the MT4 platform, which provides a solid foundation for trading activities. The platform's mobile compatibility and web-based access options typically associated with MT4 implementations would provide flexibility for traders requiring multi-device access. However, the lack of information about advanced features, premium tools, or educational resources represents a significant gap in the overall service evaluation.

Customer Service Analysis (Score: 5/10)

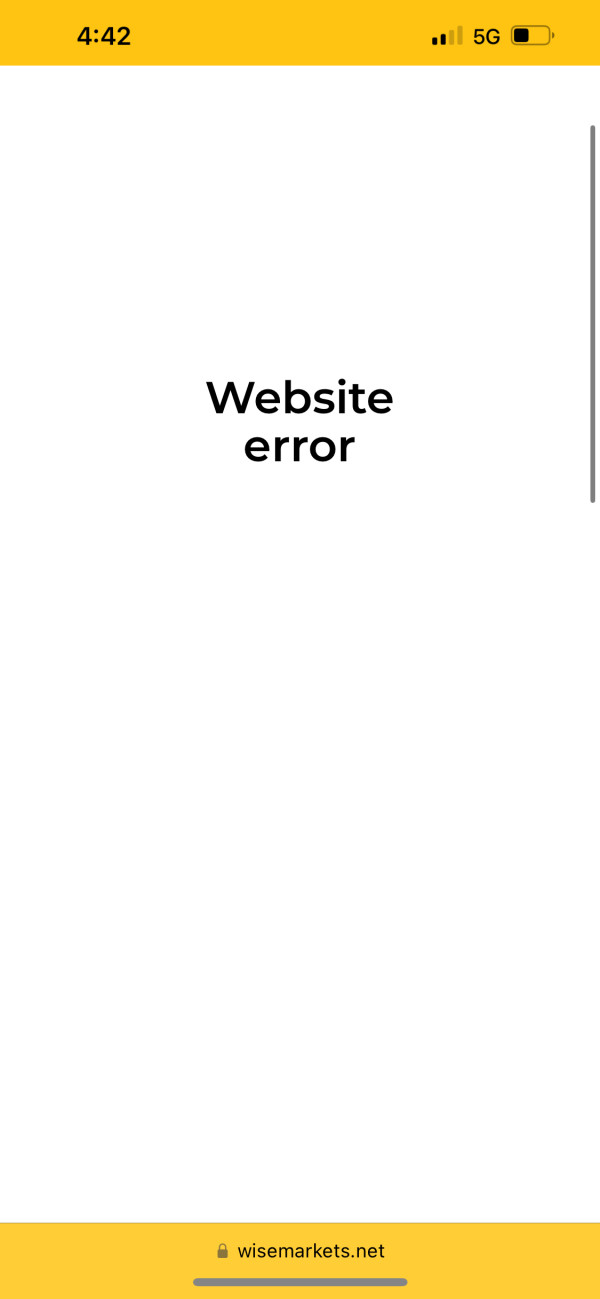

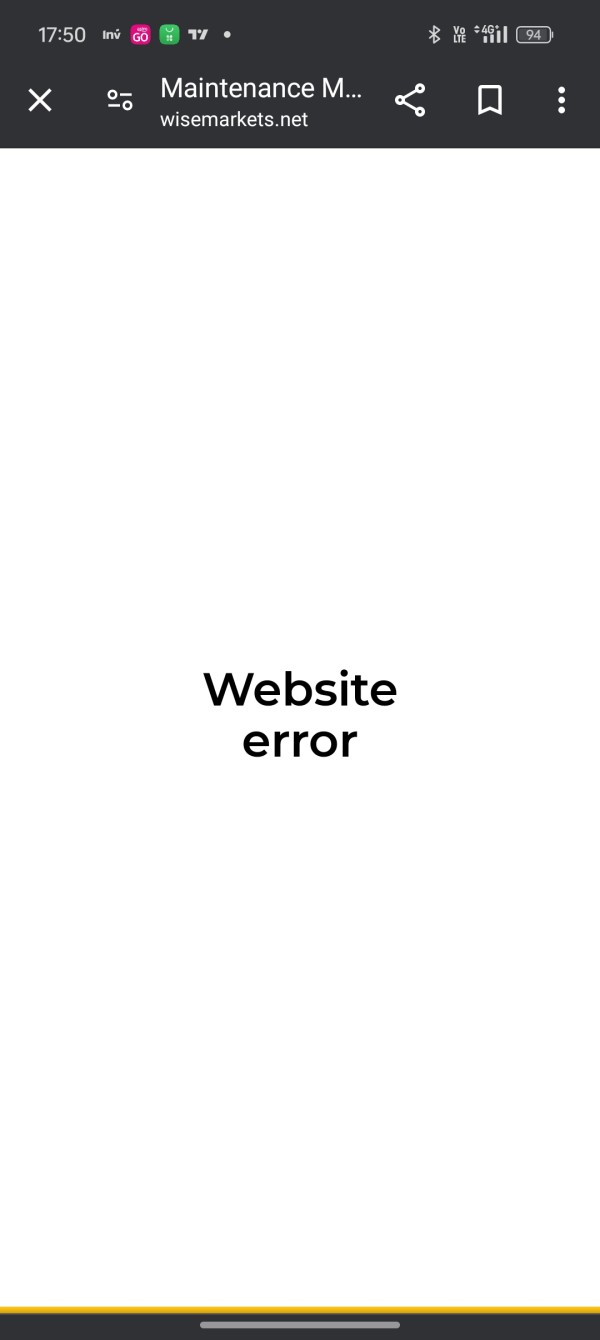

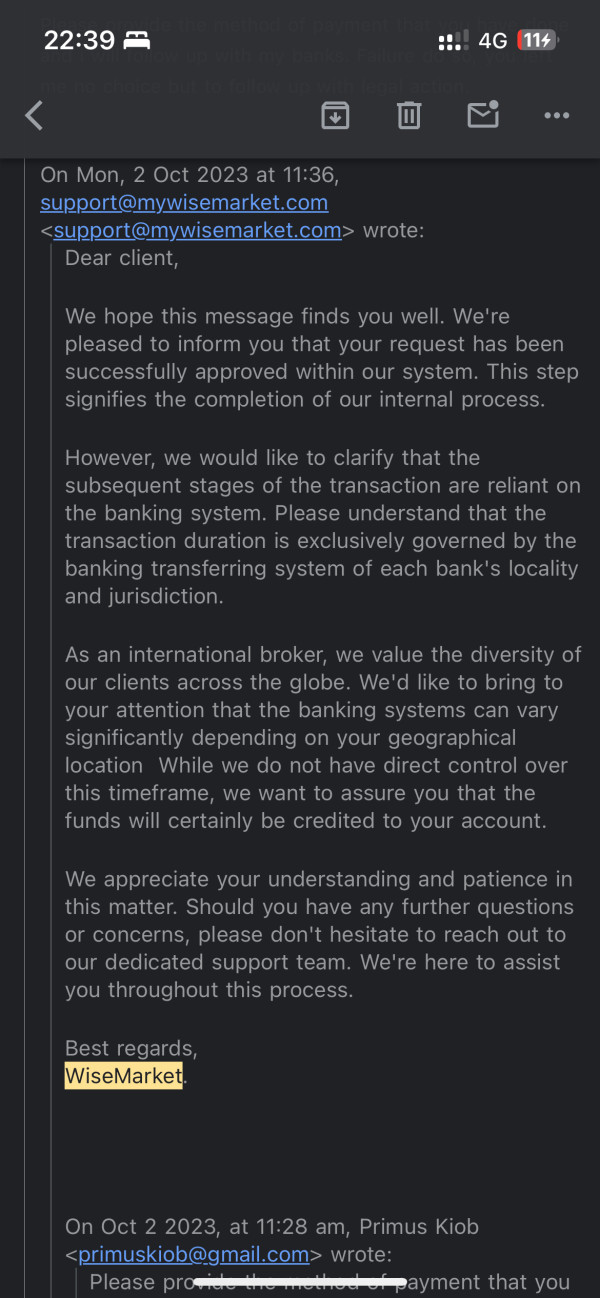

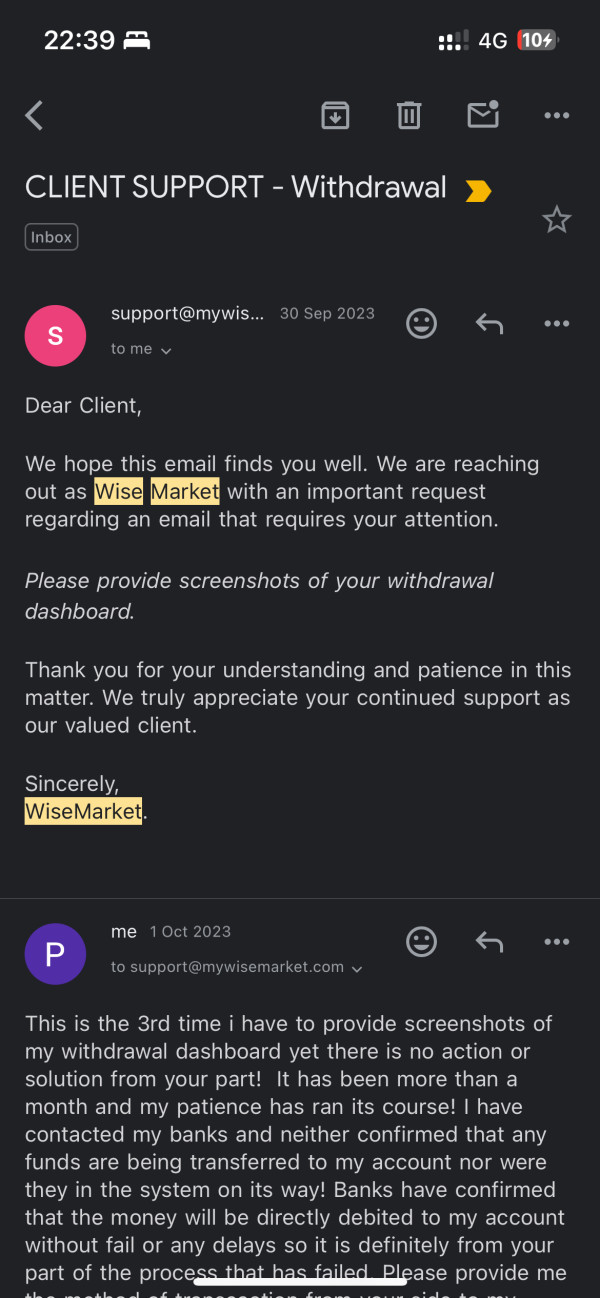

Customer service represents a significant concern area based on available user feedback and reported experiences. Multiple sources show issues with response times, problem resolution effectiveness, and overall service quality consistency. Users have reported difficulties in getting timely support and satisfactory resolution of account-related issues, which suggests potential limitations in customer service infrastructure or training.

Reports of unresolved complaints and allegations of fraudulent activities that have been submitted through various channels, including PayPal dispute mechanisms, are particularly concerning. These reports show serious concerns about the broker's approach to customer problem resolution and dispute handling. The severity of some complaints suggests potential systematic issues rather than isolated incidents.

Available information doesn't specify customer service hours, available communication channels, or response time commitments. This makes it difficult to set appropriate expectations for support interactions. The lack of transparency about customer service capabilities, combined with negative user feedback, contributes to concerns about the overall service quality and reliability of support when issues arise.

Trading Experience Analysis (Score: 6/10)

The overall trading experience seems to generate mixed feedback from users, with generally positive responses about platform stability and functionality balanced against concerns about execution quality and technical issues. Users report satisfaction with the MT4 platform's familiar interface and standard functionality, which provides a solid foundation for trading activities.

However, some user feedback shows concerns about slippage, execution delays, or other technical performance issues that can impact trading outcomes. These reports suggest potential limitations in execution infrastructure or liquidity provision that could affect trading efficiency, particularly during high-volatility market conditions.

The trading environment appears suitable for basic forex trading activities, though advanced traders may find limitations in execution sophistication or premium features. User reviews show general satisfaction with spread competitiveness and market access, though comprehensive performance data about execution statistics, average spreads, or order fill rates is not publicly available. The absence of detailed performance metrics makes objective assessment challenging. This wisemarket review notes that trading experience quality can vary significantly based on individual requirements and market conditions.

Trust and Security Analysis (Score: 4/10)

Trust and security represent the most significant concern areas for WiseMarket, with multiple factors contributing to questions about the broker's reliability and safety. The registration in Saint Vincent and the Grenadines, while legally valid, provides limited regulatory oversight compared to major financial jurisdictions, which could affect investor protection and dispute resolution mechanisms.

Documented allegations of fraudulent activities and unresolved customer complaints that have been reported through various channels are most concerning. These reports include serious accusations that, if accurate, would represent fundamental breaches of client trust and professional standards. The existence of such allegations, regardless of their ultimate validity, creates significant concerns about operational integrity and customer fund safety.

The lack of comprehensive information about client fund segregation, insurance coverage, or other protective measures further adds to trust concerns. Without clear disclosure of security protocols and protective mechanisms, potential clients cannot adequately assess the safety of their funds or the reliability of the broker's operations. Independent verification of regulatory compliance and operational standards is essential before considering this broker for trading activities.

User Experience Analysis (Score: 6/10)

User experience evaluation reveals a complex picture with both positive and negative elements that potential traders must carefully consider. The reported 226 reviews with 5-star ratings suggest general user satisfaction with basic platform functionality and service delivery. Many users seem to appreciate the low entry barrier and familiar MT4 interface, which makes platform adoption easy.

However, documented negative experiences significantly offset this positive feedback, including serious complaints about customer service, problem resolution, and allegations of fraudulent activities. The polarized nature of user feedback suggests that experiences may vary dramatically depending on individual circumstances, account types, or specific service interactions.

The MT4 platform interface generally receives positive feedback for its user-friendly design and familiar functionality. This reduces the learning curve for traders transitioning from other brokers. However, concerns about customer service responsiveness and problem resolution capabilities represent significant user experience limitations that could impact overall satisfaction, particularly when issues arise requiring support intervention.

Conclusion

WiseMarket presents a complex profile that combines attractive entry-level features with significant concerns that potential traders must carefully evaluate. The broker's primary strength lies in its exceptional accessibility, offering a $1 minimum deposit that effectively eliminates financial barriers for newcomers to forex trading. Combined with the familiar MT4 platform, this creates an appealing proposition for cost-conscious traders seeking market access.

However, substantial concerns about regulatory oversight, customer service quality, and documented fraud allegations create significant risks that overshadow the platform's accessibility advantages. The Saint Vincent and the Grenadines regulatory framework provides limited investor protection, while user complaints about service quality and unresolved disputes raise serious questions about operational reliability.

WiseMarket may be suitable for traders specifically seeking low-cost market entry who understand and accept the associated risks. However, the documented concerns about security, customer service, and regulatory oversight suggest that more established, well-regulated brokers might provide better overall value despite higher minimum deposits. Potential users should conduct thorough research and consider starting with minimal deposits while carefully monitoring their experience before committing significant funds.