Regarding the legitimacy of HKBIB forex brokers, it provides HKGX and WikiBit, .

Is HKBIB safe?

Business

License

Is HKBIB markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

UnverifiedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

皇御貴金屬有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.bib79.comExpiration Time:

--Address of Licensed Institution:

九龍佐敦庇利金街8號百利金商業中心25樓2501室Phone Number of Licensed Institution:

35792688Licensed Institution Certified Documents:

Is HKBIB Safe or a Scam?

In the ever-evolving landscape of forex trading, HKBIB has emerged as a player in the market since its inception in 2022. Based in Hong Kong, HKBIB offers a variety of trading instruments, including stocks, ETFs, CFDs, bonds, futures, and options. However, the rise of online trading has also led to an increase in fraudulent activities and unregulated brokers, making it crucial for traders to carefully assess the legitimacy of their chosen platforms. This article investigates HKBIBs regulatory status, company background, trading conditions, customer experiences, and overall safety, aiming to answer the pressing question: Is HKBIB safe?

Regulation and Legitimacy

One of the most critical factors in evaluating any forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that the broker adheres to specific standards and practices designed to protect investors. Unfortunately, HKBIB operates without proper regulation, which raises significant concerns regarding its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CGSE | Type AA | Hong Kong | Suspicious Clone |

HKBIB has been flagged as a “suspicious clone” by the Chinese Gold & Silver Exchange Society (CGSE), which indicates that it may not be operating under legitimate oversight. Despite claiming to hold a Type AA license from Hong Kong authorities, the lack of verification raises doubts about its compliance with industry regulations. The absence of regulatory oversight can expose traders to significant risks, including potential fraud and mismanagement of funds. Therefore, it is imperative to approach HKBIB with caution and consider alternative platforms that offer clearer regulatory standing.

Company Background Investigation

HKBIB, formally known as HKBIB Gold, was established in 2022 and operates out of Hong Kong. The company claims to provide a diverse array of trading instruments, catering to both novice and experienced traders. However, the lack of a comprehensive company history and ownership transparency raises red flags about its credibility.

The management team at HKBIB is not widely known in the trading community, and there is limited information available regarding their professional backgrounds and experience in the financial sector. This lack of transparency can lead to skepticism among potential clients, as a reputable broker typically showcases the qualifications and expertise of its leadership team. Furthermore, the absence of detailed information about the company's operational practices and financial health only adds to the uncertainty surrounding HKBIB.

Trading Conditions Analysis

When considering whether HKBIB is safe, it is essential to analyze its trading conditions, including fees and commissions. HKBIB offers a minimum deposit requirement of HKD 10,000, which is relatively high compared to industry standards. The platform provides access to various account types, including standard and margin accounts, with leverage up to 1:100.

| Fee Type | HKBIB | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.02% | 0.1% - 0.5% |

| Commission Model | None for stocks | Varies widely |

| Overnight Interest Range | Not specified | 2% - 5% |

While HKBIB boasts competitive spreads for certain instruments, the lack of transparency regarding overnight interest rates and commission structures can be concerning. Traders should be wary of hidden fees that could significantly impact their trading profitability. It is advisable to thoroughly review the terms and conditions before committing funds to HKBIB.

Client Funds Security

The security of client funds is paramount in the forex trading industry. HKBIB claims to implement various safety measures, including segregated accounts and investor protection policies. However, the absence of regulatory oversight raises questions about the effectiveness of these measures.

The platform does not provide detailed information about its fund segregation practices or any compensation schemes in place for investors. Moreover, past reports of withdrawal issues and complaints about delayed transactions have surfaced, further complicating the assessment of HKBIB's commitment to client fund security. Traders should exercise extreme caution and consider the potential risks associated with entrusting their funds to an unregulated broker like HKBIB.

Customer Experience and Complaints

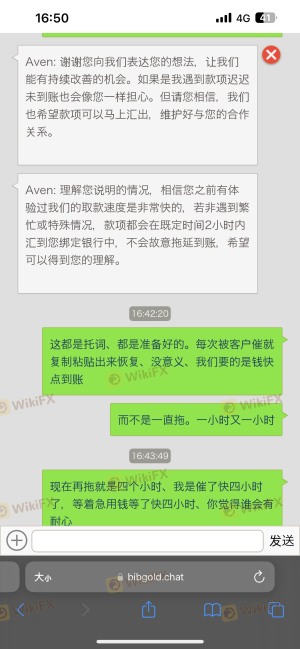

Analyzing customer feedback is crucial in determining whether HKBIB is safe. Many users have reported issues related to withdrawal delays and unresponsive customer service. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow/Unhelpful |

| Customer Support Issues | Medium | Limited Channels |

Several clients have expressed frustration over their inability to withdraw funds, citing excuses from customer service representatives that often lead to further delays. One user reported waiting for hours without resolution, raising concerns about the reliability of HKBIB's operations. Such patterns of complaints can indicate deeper systemic issues within the broker, making it essential for potential clients to be wary.

Platform and Execution

The performance of trading platforms is another critical factor to consider when assessing HKBIB's safety. The broker offers popular platforms such as MetaTrader 4 and 5, which are well-regarded for their functionality and user experience. However, reports of execution issues, including slippage and order rejections, have emerged, prompting questions about the overall reliability of HKBIBs trading environment.

Traders should be cautious of any indications of platform manipulation or inconsistencies in order execution. The lack of transparency regarding execution quality can further exacerbate concerns about the broker's integrity.

Risk Assessment

Evaluating the risks associated with trading through HKBIB is crucial for making informed decisions. The overall risk profile of HKBIB can be summarized as follows:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with clone status |

| Financial Stability | Medium | Lack of transparency in operations |

| Customer Service Risk | High | Numerous complaints about responsiveness |

Given the high-risk factors associated with HKBIB, traders are advised to exercise extreme caution. It is essential to implement robust risk management strategies, including setting strict limits on capital exposure and conducting thorough research before engaging with the broker.

Conclusion and Recommendations

In conclusion, the investigation into HKBIB raises significant concerns regarding its safety and legitimacy. The lack of regulatory oversight, coupled with a history of customer complaints and withdrawal issues, suggests that traders should approach this broker with caution. Is HKBIB safe? The evidence points toward a high level of risk, making it essential for traders to consider alternative options with clearer regulatory frameworks and proven track records.

For those seeking reliable trading platforms, it is recommended to explore brokers that are regulated by reputable authorities and offer transparent trading conditions. Options such as Interactive Brokers, Saxo Bank, or other well-regarded platforms may provide a more secure trading environment, ensuring that your investments are adequately protected. Always prioritize safety and due diligence when navigating the forex trading landscape.

Is HKBIB a scam, or is it legit?

The latest exposure and evaluation content of HKBIB brokers.

HKBIB Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HKBIB latest industry rating score is 1.44, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.44 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.