Lunar Tiger 2025 Review: Everything You Need to Know

Executive Summary

Lunar Tiger has become a notable name in the financial markets. Its presence appears to be mainly linked with precious metals rather than traditional forex brokerage services. According to available information, the entity has gained recognition through its 2022 Australian Gold and Silver Lunar Tiger coins, which have attracted significant attention from investors seeking exposure to precious metals markets. The company appears to serve investors interested in alternative assets. It particularly focuses on those looking to diversify their portfolios with gold and silver products.

However, our Lunar Tiger review reveals significant gaps in available information regarding traditional forex trading services, regulatory oversight, and standard brokerage operations. While the precious metals offerings have generated positive market response, the lack of comprehensive trading platform details, regulatory transparency, and specific account conditions raises important considerations for potential clients. The entity seems to target high-net-worth individuals and institutional investors focused on precious metals investment rather than conventional retail forex traders.

Important Notice

Regional Entity Differences: Lunar Tiger's regulatory status and operational framework across different jurisdictions remain unclear based on available information. Potential clients should exercise caution and conduct thorough due diligence regarding compliance and regulatory oversight in their respective regions before engaging with any services.

Review Methodology: This evaluation is based on publicly available information and market data. The assessment does not consider specific regulatory backgrounds due to insufficient information regarding supervisory authorities and compliance frameworks.

Rating Framework

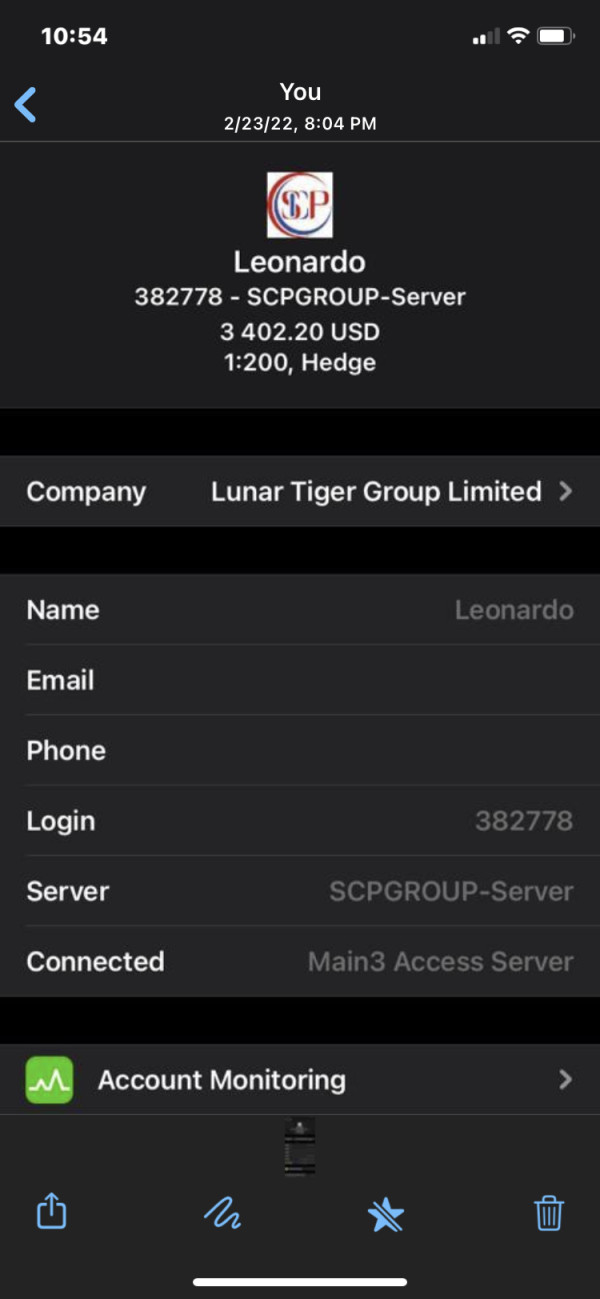

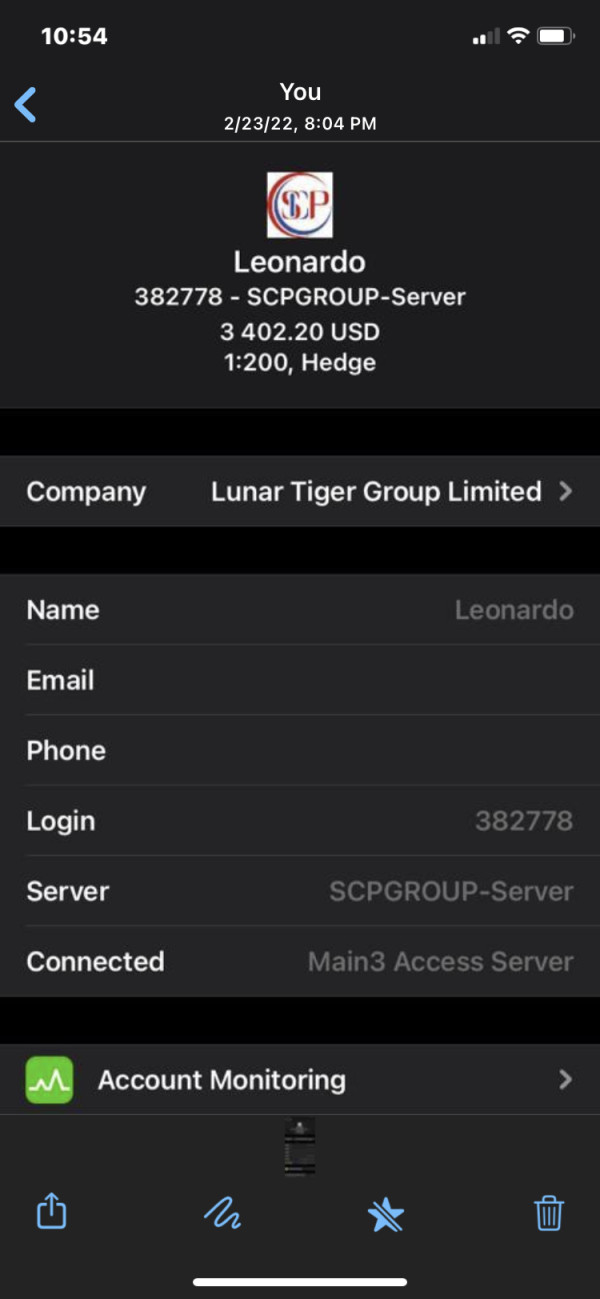

Broker Overview

Lunar Tiger appears to operate within the precious metals investment sector rather than as a conventional forex broker. The entity has gained market attention primarily through its association with the 2022 Australian Lunar Tiger gold and silver coins, which form part of the popular Australian Lunar Series III collection. These products have attracted investors seeking exposure to precious metals markets. They particularly appeal to those interested in numismatic and bullion investments.

The business model appears to focus on precious metals distribution and investment products rather than traditional currency trading services. This positioning places Lunar Tiger in a specialized market segment that caters to investors looking for alternative asset classes beyond conventional forex, stocks, and bonds. The emphasis on Australian mint products suggests a connection to established precious metals markets and potentially regulated coin distribution networks.

Based on available information, the entity's primary operations center around precious metals investment products, with particular emphasis on gold and silver coins from the Australian Lunar series. However, comprehensive details regarding trading platforms, asset diversification, and regulatory oversight remain limited in publicly available sources. This Lunar Tiger review highlights the need for greater transparency regarding operational frameworks and regulatory compliance.

Regulatory Oversight: Available information does not specify particular regulatory authorities overseeing Lunar Tiger's operations. This represents a significant concern for potential clients seeking regulated investment services.

Deposit and Withdrawal Methods: Specific information regarding funding options, processing times, and associated fees has not been disclosed in available sources.

Minimum Deposit Requirements: No clear minimum investment thresholds have been identified in the available documentation.

Promotional Offers: Current bonus structures or promotional incentives are not detailed in accessible information sources.

Tradeable Assets: Primary focus appears to be on precious metals, specifically Australian gold and silver coins. However, comprehensive asset listings are not available.

Cost Structure: Detailed information regarding spreads, commissions, overnight fees, and other trading costs remains undisclosed in available sources.

Leverage Options: No specific leverage ratios or margin requirements have been identified in the available information.

Platform Selection: Trading platform specifications and capabilities are not detailed in current information sources.

Geographic Restrictions: Specific jurisdictional limitations or service availability by region has not been clarified.

Customer Support Languages: Available language support options for customer service have not been specified.

This Lunar Tiger review emphasizes the need for more comprehensive disclosure of operational details and service specifications.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Lunar Tiger's account conditions reveals significant information gaps that impact our assessment. Available sources do not provide clear details regarding account types, minimum deposit requirements, or specific terms and conditions for different client categories. This lack of transparency makes it difficult for potential clients to understand the fundamental requirements for engaging with the platform.

Traditional forex brokers typically offer multiple account tiers with varying minimum deposits, spread structures, and additional features. However, Lunar Tiger's focus appears to be on precious metals investment products rather than conventional trading accounts. The absence of detailed account specifications, including Islamic account options, demo account availability, and account opening procedures, represents a significant limitation for this Lunar Tiger review.

Without clear information about account structures, fees, and requirements, potential clients cannot make informed decisions about whether the platform meets their investment needs and financial capabilities. This transparency gap significantly impacts the overall evaluation of account conditions.

The assessment of trading tools and resources reveals limited available information regarding Lunar Tiger's technological capabilities and analytical offerings. Conventional brokers typically provide comprehensive trading platforms, market analysis tools, economic calendars, and educational resources to support client decision-making.

However, available sources do not detail specific trading tools, charting capabilities, or analytical resources that might be available to clients. The absence of information regarding research materials, market commentary, or educational content suggests either limited offerings in these areas or insufficient disclosure of available resources.

Automated trading support, algorithmic trading capabilities, and third-party platform integration details are also not available in current information sources. This lack of clarity regarding technological infrastructure and analytical support tools significantly limits our ability to evaluate the platform's suitability for different types of investors and trading strategies.

Customer Service and Support Analysis

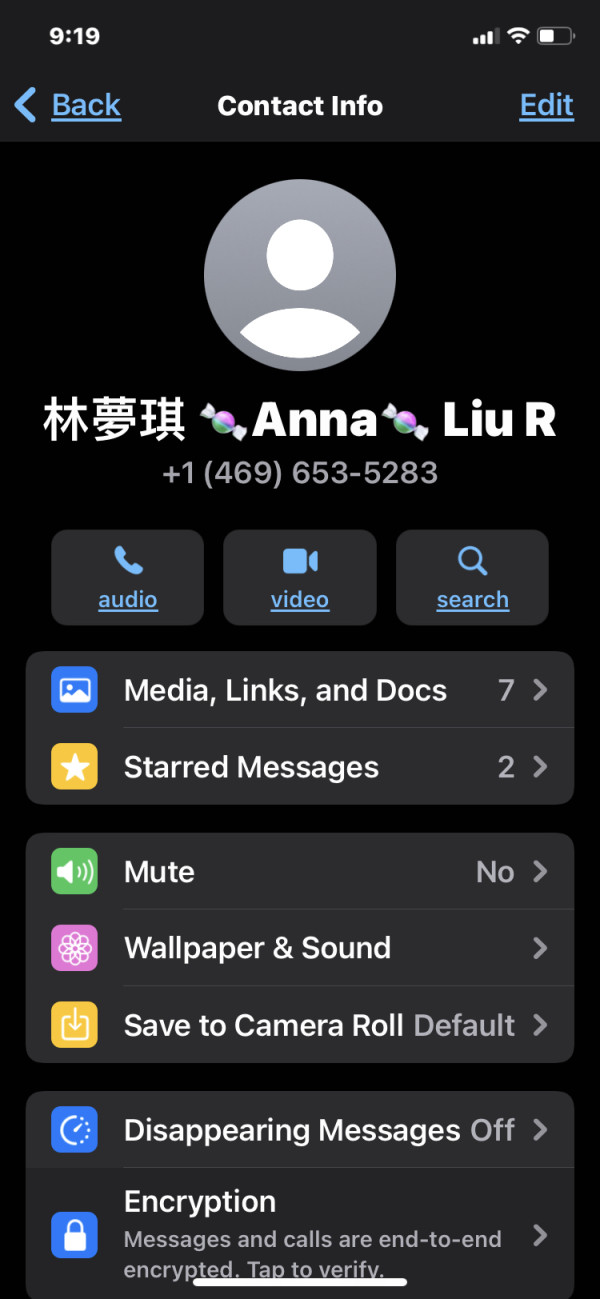

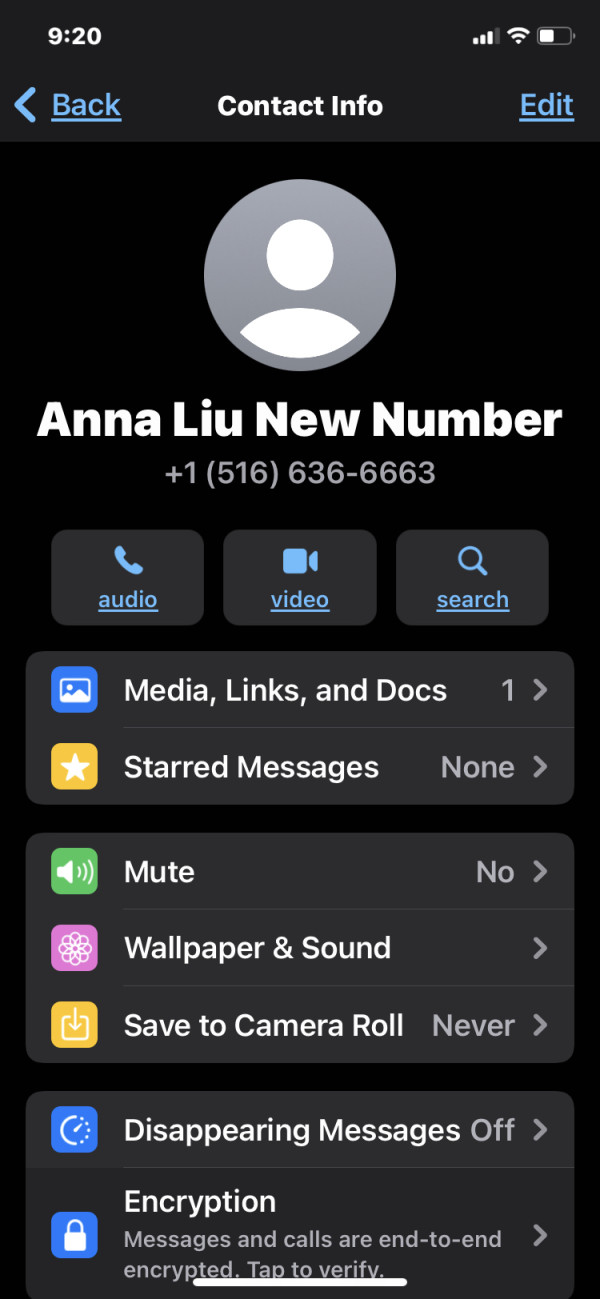

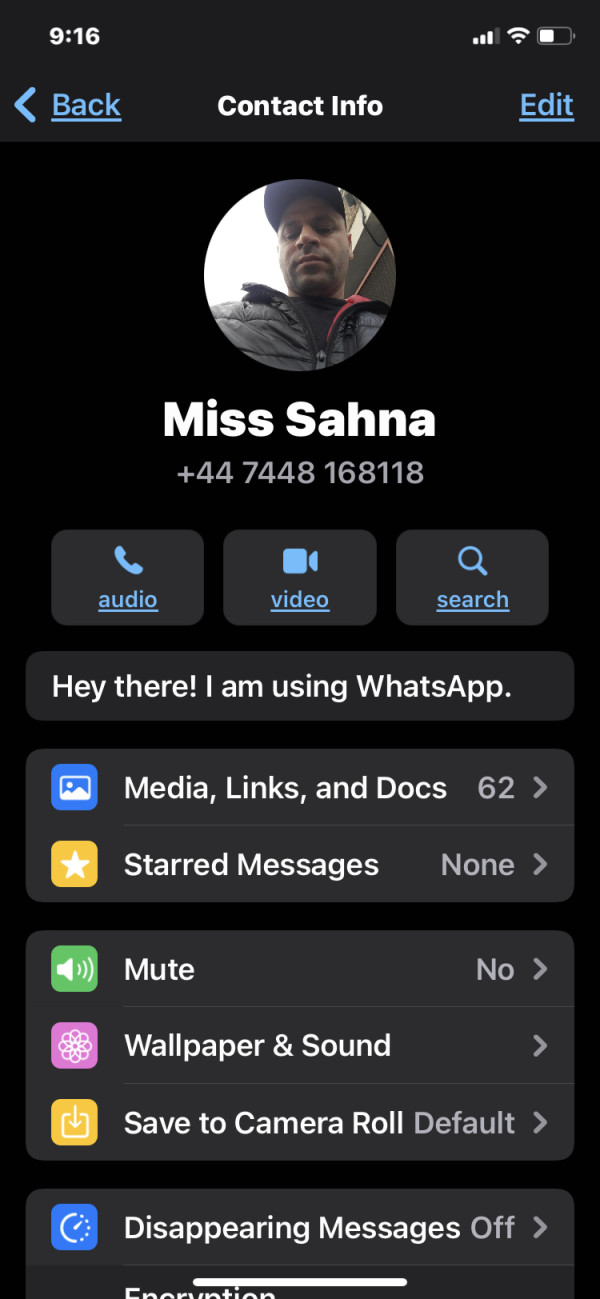

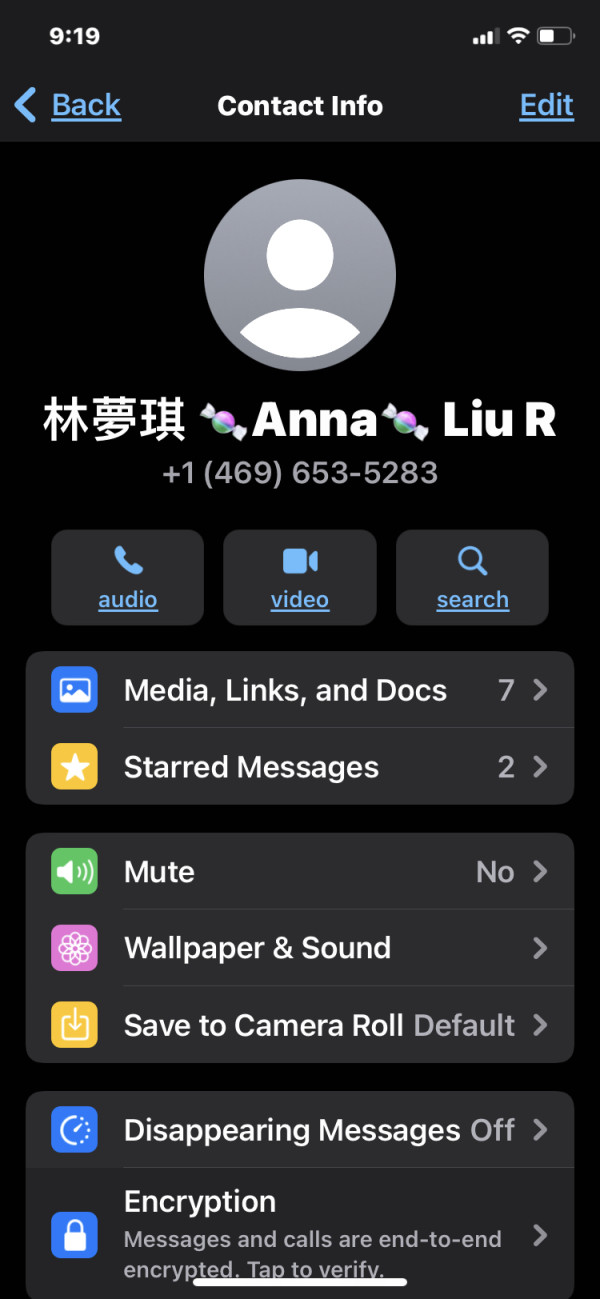

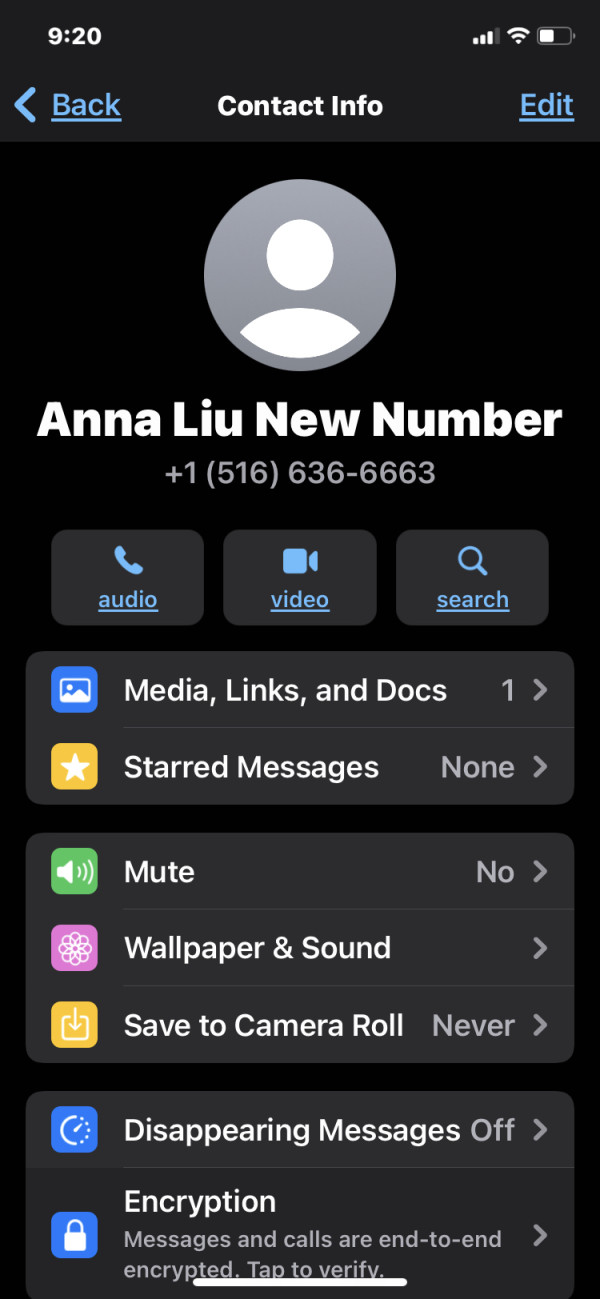

Customer service evaluation for Lunar Tiger faces significant limitations due to insufficient information about support channels, availability, and service quality. Effective customer support typically includes multiple contact methods, extended service hours, multilingual support, and rapid response times for client inquiries and technical issues.

Available information does not specify customer service channels such as live chat, telephone support, email response times, or help desk availability. The absence of details regarding support hours, weekend availability, and emergency contact procedures raises concerns about service accessibility and reliability.

Multilingual support capabilities, which are essential for international client bases, are not documented in available sources. Additionally, there are no available testimonials or feedback regarding customer service quality, problem resolution effectiveness, or overall client satisfaction with support services. This information gap significantly impacts our ability to assess the customer service dimension accurately.

Trading Experience Analysis

The trading experience evaluation for Lunar Tiger is constrained by limited information regarding platform performance, execution quality, and user interface design. Effective trading platforms typically offer stable connectivity, fast order execution, comprehensive charting tools, and intuitive navigation for both desktop and mobile environments.

Available sources do not provide specific details about platform stability, execution speeds, or slippage rates during various market conditions. The absence of information regarding mobile trading applications, platform customization options, and advanced order types limits our assessment of the overall trading environment quality.

User feedback regarding platform functionality, ease of use, and technical reliability is not available in current sources. Without concrete data on execution quality, platform features, and user satisfaction, this Lunar Tiger review cannot provide a comprehensive evaluation of the actual trading experience clients might expect.

Trust and Security Analysis

Trust and security assessment reveals significant concerns due to limited regulatory information and unclear security protocols. Reputable financial service providers typically maintain transparent regulatory compliance, client fund protection measures, and comprehensive security frameworks to protect client assets and personal information.

Available information does not specify regulatory authorities overseeing Lunar Tiger's operations, which raises important questions about compliance standards and client protection measures. The absence of details regarding segregated client accounts, deposit insurance, and fund security protocols represents a significant concern for potential clients.

Company transparency, including management information, financial statements, and operational history, is not readily available in public sources. Additionally, there is no information regarding third-party security audits, data protection measures, or incident response procedures. These transparency and security gaps significantly impact the trust and reliability assessment.

User Experience Analysis

User experience evaluation is limited by insufficient feedback and interface information available in current sources. While precious metals products appear to have generated market interest, comprehensive user satisfaction data regarding platform usability, account management processes, and overall service quality is not available.

Available information does not detail user interface design, account registration procedures, verification processes, or fund management workflows. The absence of user testimonials, satisfaction surveys, or experience reviews makes it difficult to assess actual client satisfaction levels and identify common user concerns or preferences.

Platform accessibility features, mobile optimization, and user support resources are not documented in available sources. Without comprehensive user feedback and interface specifications, this evaluation cannot provide detailed insights into the practical user experience clients might encounter.

Conclusion

This Lunar Tiger review reveals a complex entity that appears to focus primarily on precious metals investment products rather than traditional forex brokerage services. While the 2022 Australian Gold and Silver Lunar Tiger coins have generated market interest, significant information gaps regarding regulatory oversight, trading conditions, and operational transparency raise important considerations for potential clients.

The platform may be suitable for investors specifically seeking precious metals exposure, particularly those interested in Australian mint products and numismatic investments. However, the lack of comprehensive disclosure regarding account conditions, regulatory compliance, and standard brokerage operations limits its appeal for conventional forex traders seeking transparent, regulated trading environments.

Primary advantages include market recognition in precious metals sectors, while significant disadvantages include insufficient regulatory transparency, limited operational disclosure, and unclear trading conditions. Potential clients should conduct thorough due diligence and seek additional information before making investment decisions.