LetsTrade 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

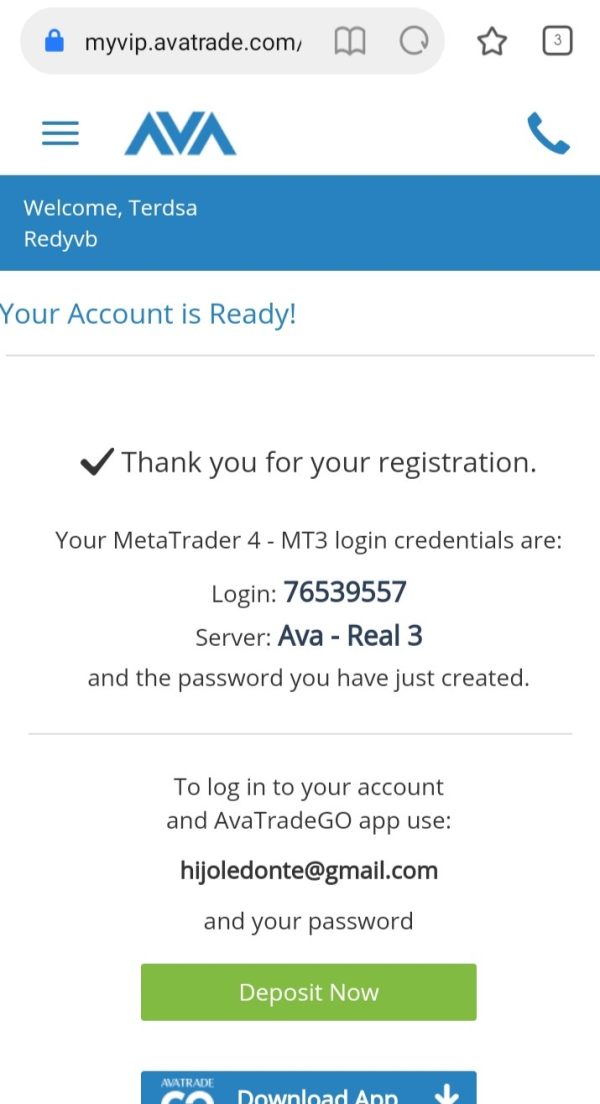

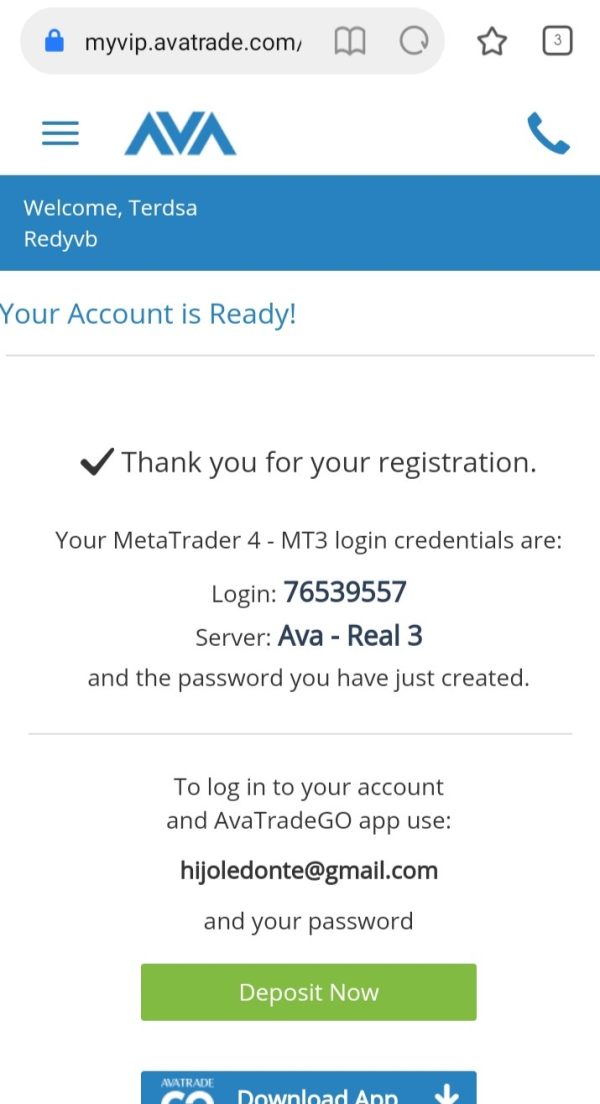

LetsTrade is a forex brokerage firm established in 2014, operating under a dual structure with a CySEC-regulated entity and an offshore counterpart. This dual presence allows LetsTrade to offer traders significant leverage options—up to 1:400 for non-EU clients—instilling a sense of opportunity for more experienced traders. Primarily targeting seasoned investors who are comfortable with the intricacies of high-leverage trading, LetsTrade caters to a niche audience with its MetaTrader 4 platform that provides robust trading tools and rapid execution speeds.

However, potential investors should exercise caution due to the structural vulnerabilities associated with its offshore operations. Concerns regarding fund safety and withdrawal reliability loom large, given the mixed reviews and warnings around user experiences with this broker. This review will delve into the various dimensions of LetsTrade—assessing its trustworthiness, trading costs, platform abilities, and overall user experience—to provide a comprehensive insight for prospective clients considering this brokerage.

⚠️ Important Risk Advisory & Verification Steps

Trading with LetsTrade involves significant risks, including the potential loss of your invested funds due to the presence of its offshore entity. The lack of stringent regulatory oversight in such jurisdictions can impact withdrawal reliability and fund safety. Prospective traders should conduct thorough due diligence before committing capital.

To self-verify the regulatory status of LetsTrade, follow these steps:

- Check the CySEC website for LetsTrade's license confirmation.

- Look for customer reviews on trusted financial websites.

- Search for any recent regulatory warnings associated with the broker.

- Verify if the brokerage is part of the investor compensation fund, which offers potential compensation for clients.

Rating Framework

Broker Overview

Company Background and Positioning

LetsTrade is a forex broker headquartered in Cyprus, legally operating under the auspices of the Cyprus Securities and Exchange Commission (CySEC). As part of the JFD Group, which includes both regulated and offshore entities, LetsTrade's dual structure presents a complex picture for potential clients. While its CySEC licensing assures some degree of regulatory oversight, the involvement of an offshore entity raises significant concerns regarding fund safety and user trust.

Core Business Overview

LetsTrade facilitates forex and CFD trading, primarily focusing on experienced traders who seek high leverage options and fast execution. Its platform of choice, MetaTrader 4, is a leading trading terminal known for its extensive charting capabilities and numerous technical analysis features, making it a popular choice among traders globally. The brokerage claims to provide negative balance protection, thereby shielding traders from the risks of debts exceeding their account balances. However, users are cautioned as trading on such terms could lead to substantial losses.

Quick-Look Details Table

| Feature | Details |

|------------------------|-------------------------------------------|

| Regulation | CySEC (JFD Group Ltd) |

| Minimum Deposit | $500 |

| Maximum Leverage | 1:400 (1:30 for EU clients) |

| Average Spread | 1.8 pips + $6 commission (EUR/USD) |

| Trading Platform | MetaTrader 4 |

In-depth Analysis of Each Dimension

Trustworthiness Analysis

The dual nature of LetsTrade's regulatory structure creates uncertainty regarding its trustworthiness. The presence of an offshore entity raises alarms about the safety of client funds, particularly since user reviews reflect mixed experiences, especially regarding withdrawals.

To ensure safety, potential clients should take the following verification steps:

- Review the CySEC registry for LetsTrade's license.

- Research user testimonials on independent forums and broker review websites.

- Contact customer support to inquire about fund segregation and the withdrawal process.

Industry feedback on LetsTrade indicates concerns about its overall reputation:

"The greatest worry regarding LetsTrade is its affiliation with an unregulated offshore entity, raising questions about the safety of client deposits and the integrity of trading practices."

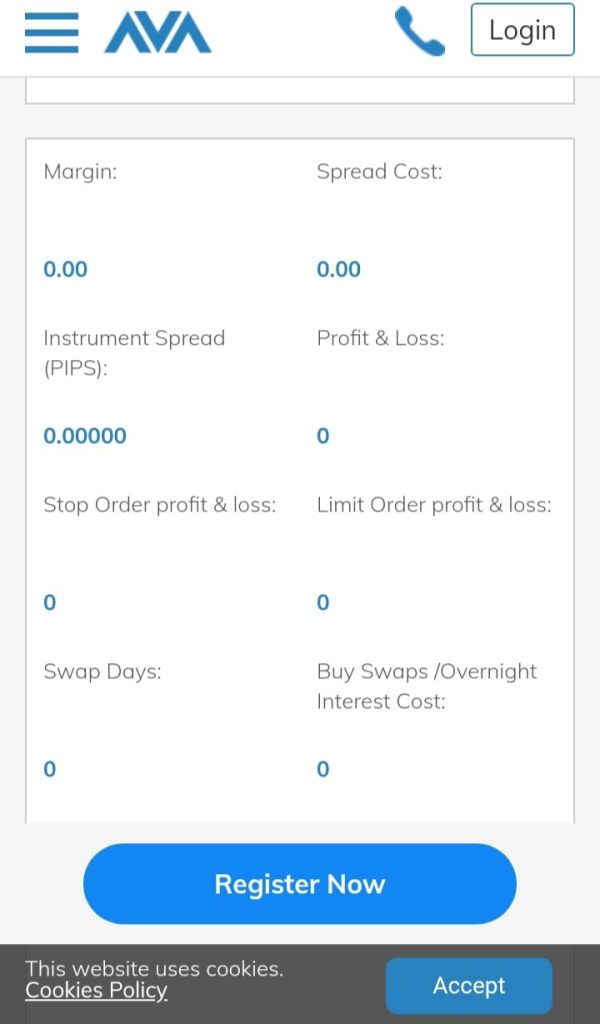

Trading Costs Analysis

Trading costs at LetsTrade present a double-edged sword scenario. While on the surface, the commission structure appears competitive, the overall cost of trading can climb due to additional fees.

The following offers insights into the commission structure:

- Advantages in Commissions: The brokerage charges a commission of $6 on the EUR/USD pair, leading to an effective spread of 1.8 pips, which is slightly above the industry average.

- The "Trap" of Non-Trading Fees: Users have noted concerns regarding hidden fees related to withdrawals and other services, making it imperative for clients to seek clarity on the fee structures to avoid unexpected costs.

In summary, although the cost structure carries merits, clients should remain vigilant and evaluate their overall trading expenses carefully before engaging with the platform.

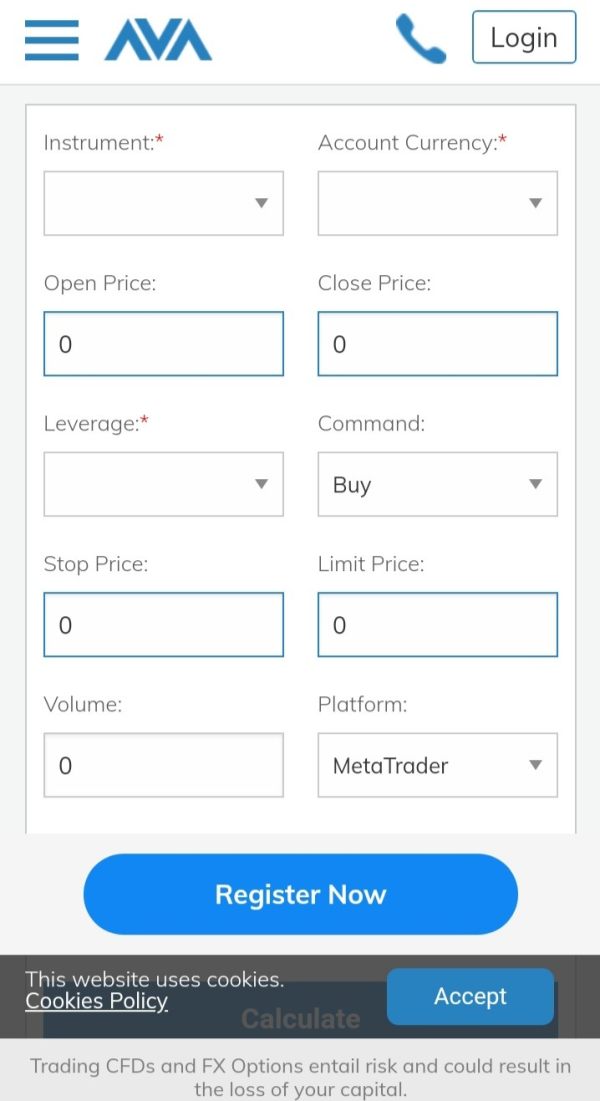

LetsTrade primarily utilizes the MetaTrader 4 platform, which is highly esteemed among traders for its versatility and user-friendliness.

- Platform Diversity: The broker provides access to MT4, known for its powerful charting and extensive tools, although it lacks other platform alternatives for varied user preferences.

- Quality of Tools and Resources: The platform facilitates advanced technical analysis with an array of indicators, while the education-related resources remain minimal, requiring users to independently seek external educational materials.

User experiences indicate a generally positive reception toward the platform's usability:

"MetaTrader 4 offered the tools I needed for a substantive trading experience, though it would be advantageous to have additional support materials directly from LetsTrade."

User Experience Analysis

User experience at LetsTrade is characterized by a mix of positive outcomes and significant challenges. While the platform's functionality generally meets expectations, feedback on customer support and the initial setup may require improvements.

- User Feedback Summary: Traders appreciate the platform's straightforwardness and execution speed, but frustrations arise over customer support responsiveness and the lack of comprehensive onboarding guidance.

Customer Support Analysis

Customer support has received varied feedback from clients. While support operates 24/5, many users have shared experiences of subpar responsiveness in handling inquiries, particularly regarding account issues.

- Quality Review: Mixed reviews suggest a need for improved efficiency and information flow, as many clients feel left without adequate assistance.

Account Conditions Analysis

The account conditions at LetsTrade present both opportunities and barriers for potential clients:

- Account Types: There exists only one standard account type with a relatively high minimum deposit requirement of $500, which may deter novice traders seeking lower entry barriers.

- Leverage Options: While high leverage (up to 1:400) attracts advanced traders, new clients should be cautious of the inherent risks that come with such high exposure.

Conclusion

In conclusion, LetsTrade provides a dual opportunity for experienced traders seeking robust trading options under the auspices of a CySEC-regulated broker. Nevertheless, significant caution is warranted due to the risks associated with its offshore counterpart, high minimum deposit requirements, and mixed reviews regarding user experiences and customer support. While its MetaTrader 4 platform offers extensive functionality, the overall service package may not suit novices or risk-averse investors. Ultimately, potential clients must weigh the enticing features against the inherent risks to determine if LetsTrade represents a worthwhile opportunity or merely a trap in their trading journey.