Loyal Brokers 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive loyal brokers review shows major concerns about this financial services provider. Traders should think carefully before investing. Loyal Brokers operates as an unregulated financial services provider with a concerning user rating of 0.76 out of 10. Multiple sources have flagged the platform with suspected fraud warnings. Despite these red flags, the broker does offer some basic trading features including demo accounts and swap-free options across multiple asset classes.

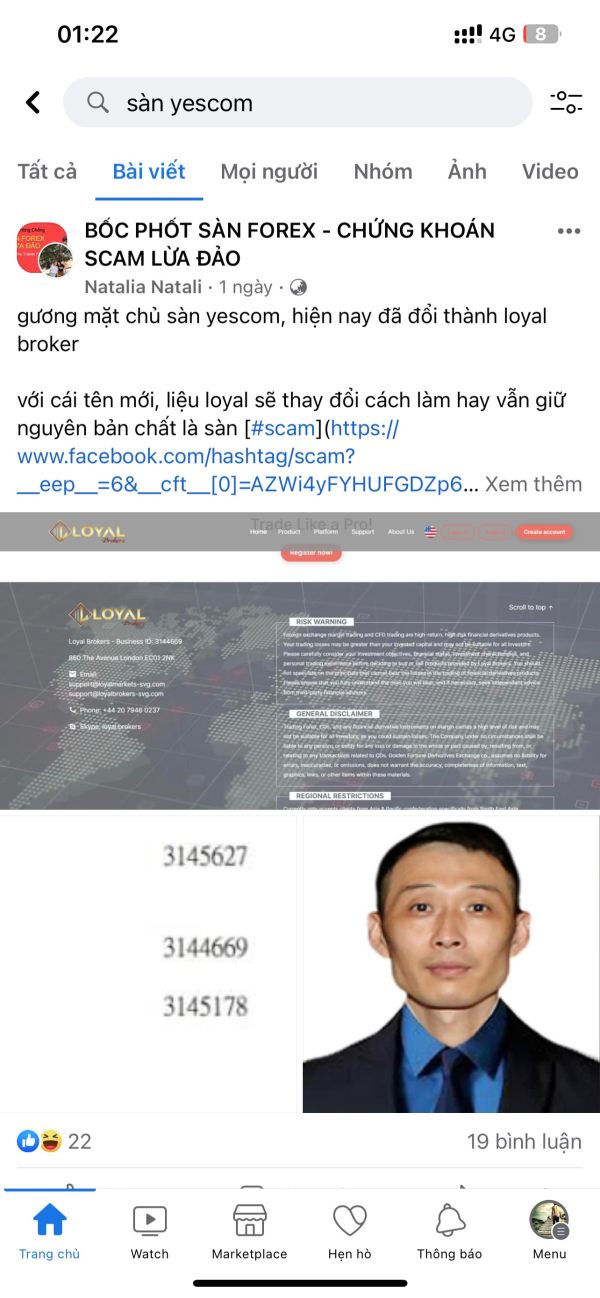

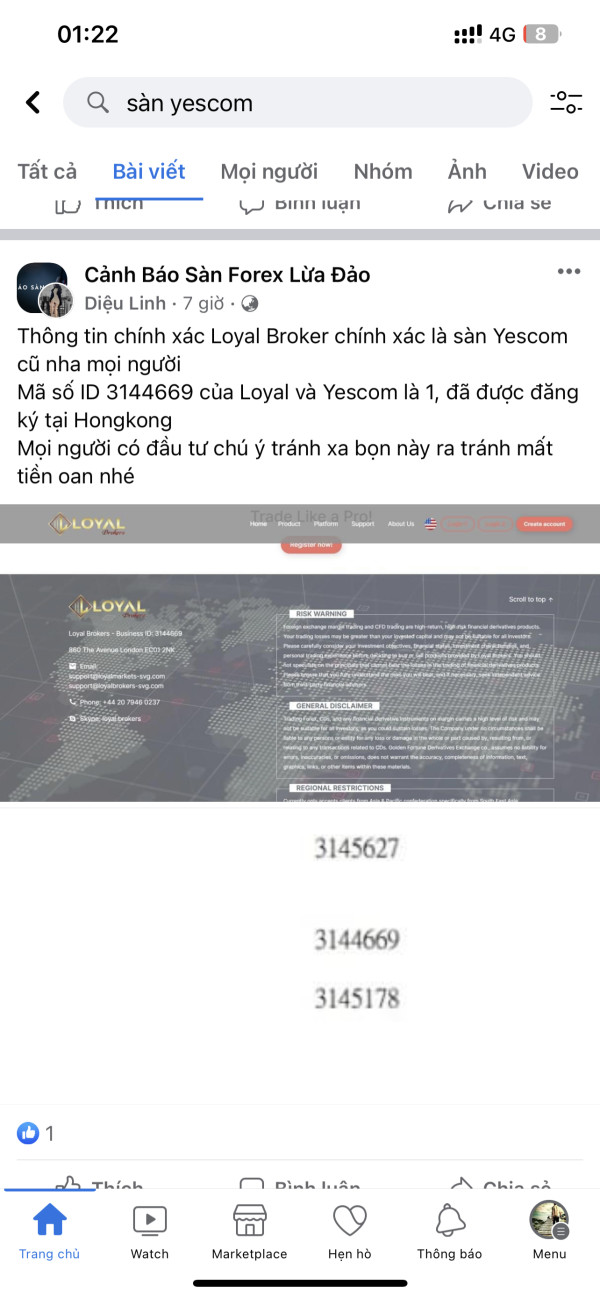

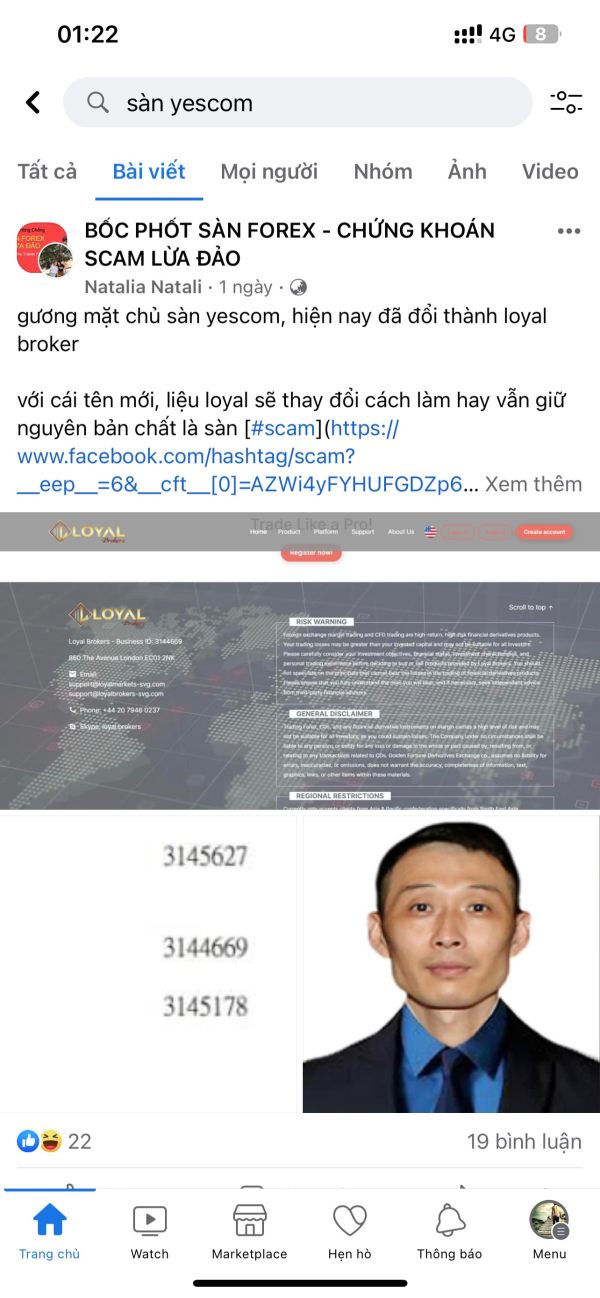

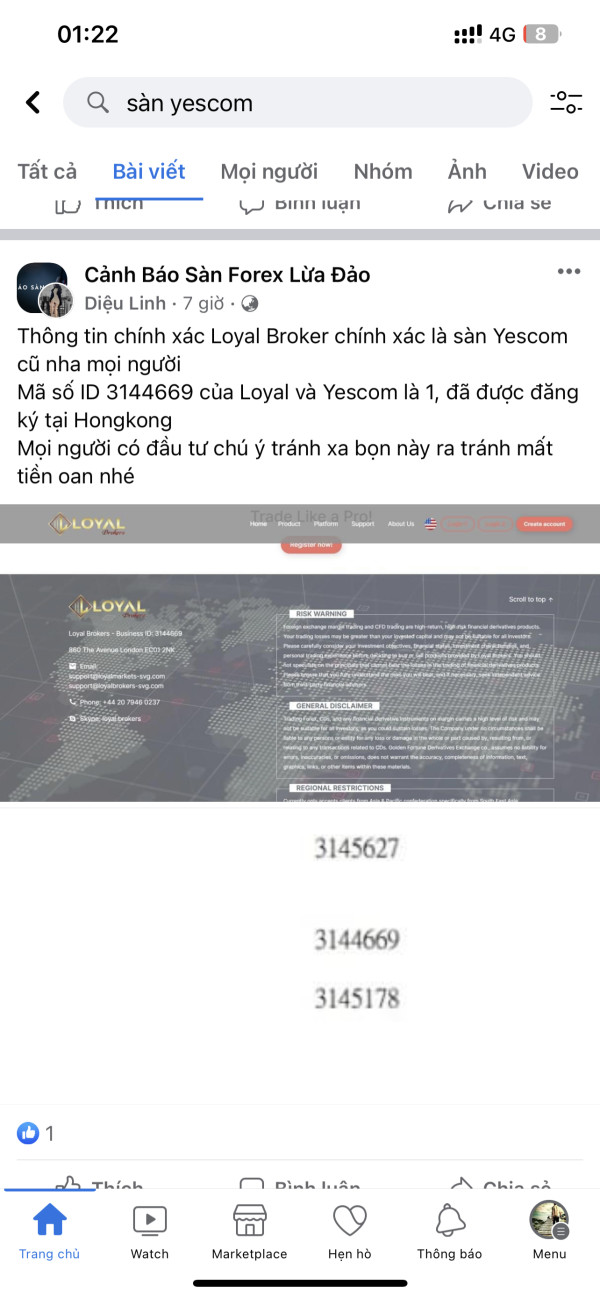

The platform mainly targets traders seeking different trading instruments. It focuses especially on those interested in forex market opportunities. However, the lack of regulatory oversight combined with poor user feedback raises serious questions about the platform's safety for retail traders. According to available reports, Loyal Brokers was established in 2013 and claims to be headquartered in London. The company positions itself as part of an international diversified group. Yet the absence of proper licensing and authorization from recognized financial authorities significantly undermines its credibility in the competitive forex brokerage landscape.

Important Notice

Traders should exercise extreme caution when considering Loyal Brokers. Regulatory status and operational practices may vary significantly across different regions. The broker's unregulated status means clients lack the protection typically provided by established financial authorities. This loyal brokers review is based on available user feedback and publicly accessible platform information. The analysis uses objective assessment criteria standard in the industry.

It's crucial to note that the absence of regulatory oversight means traders have limited recourse in case of disputes or operational issues. The evaluation presented here reflects current available information. Traders should consider this alongside independent research before making any investment decisions.

Rating Framework

Broker Overview

Loyal Brokers was established in 2013. The company positions itself as a London-based financial services provider, claiming rapid development as part of an international diversified group. The company presents itself as offering comprehensive trading services across multiple financial markets. It places particular emphasis on forex trading opportunities. However, the broker's operational transparency remains questionable, with limited publicly available information about its corporate structure, management team, or business registration details.

The broker's business model centers around providing access to foreign exchange markets alongside other asset classes through online trading platforms. According to available information, Loyal Brokers attempts to cater to both novice and experienced traders by offering demo accounts and various trading instruments. However, the lack of specific details about trading conditions, platform specifications, and operational procedures raises concerns. These gaps suggest poor commitment to transparency and client service excellence.

The platform's regulatory status presents the most significant concern. Reliable sources confirm that Loyal Brokers operates without authorization or supervision from recognized financial authorities. This unregulated status places the broker outside the protective framework that legitimate financial institutions must adhere to. It potentially exposes clients to unnecessary risks.

Regulatory Jurisdiction: Loyal Brokers claims to be based in the United Kingdom. However, it operates without proper regulatory authorization from the Financial Conduct Authority or any other recognized financial supervisor, creating significant compliance and safety concerns.

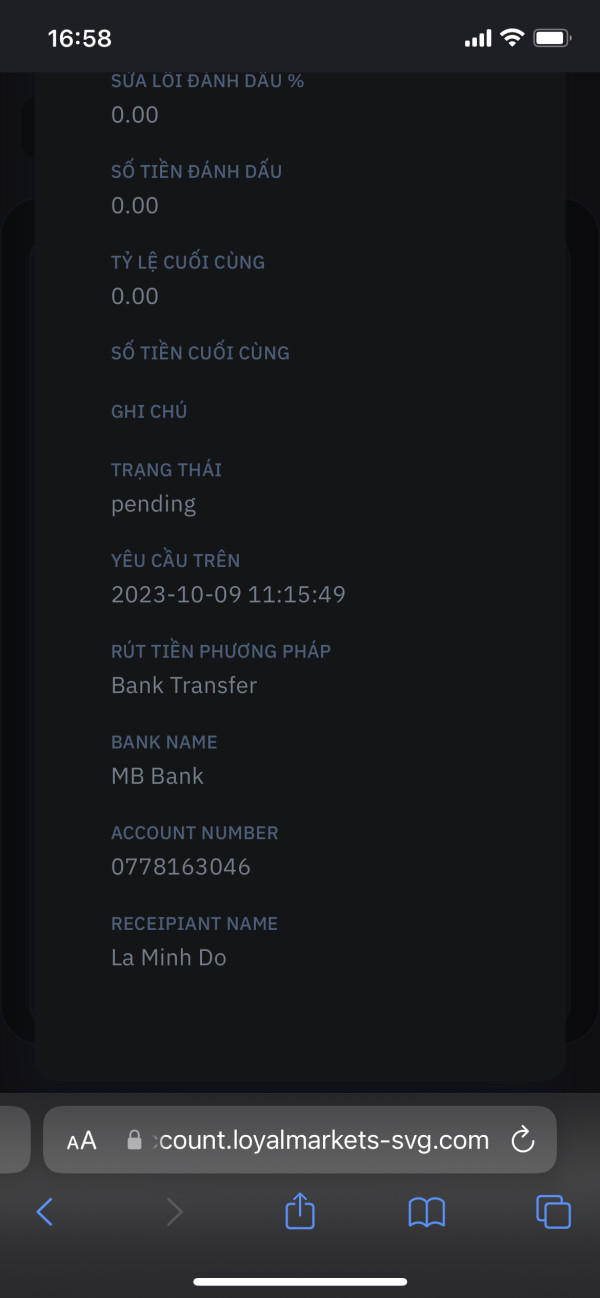

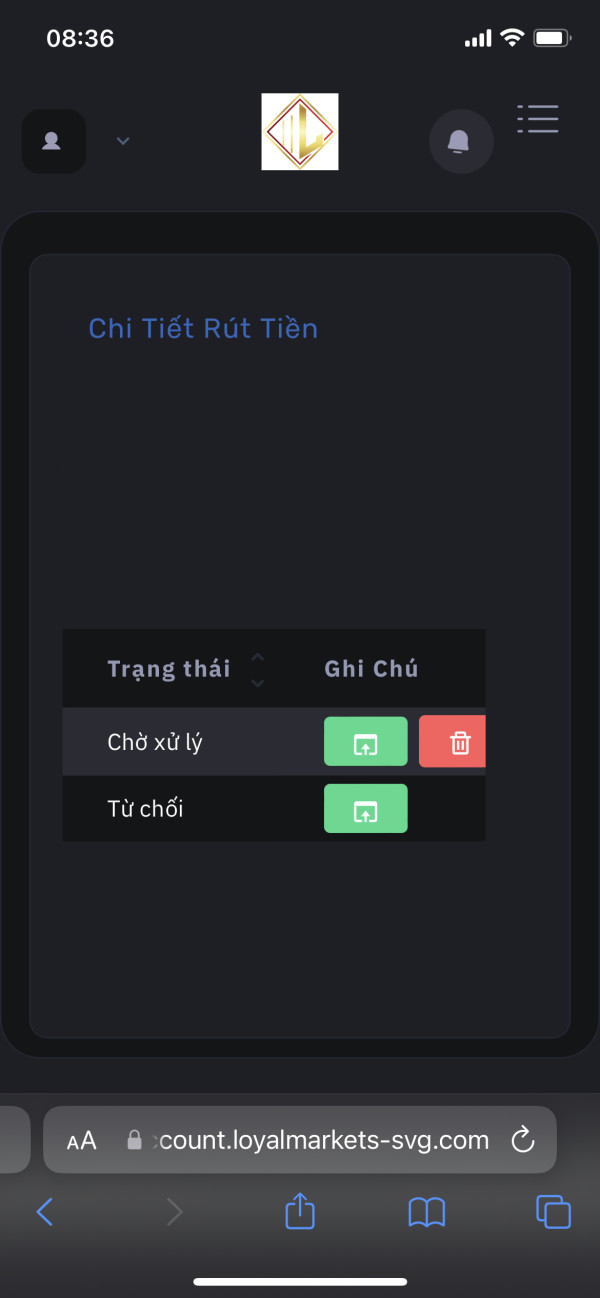

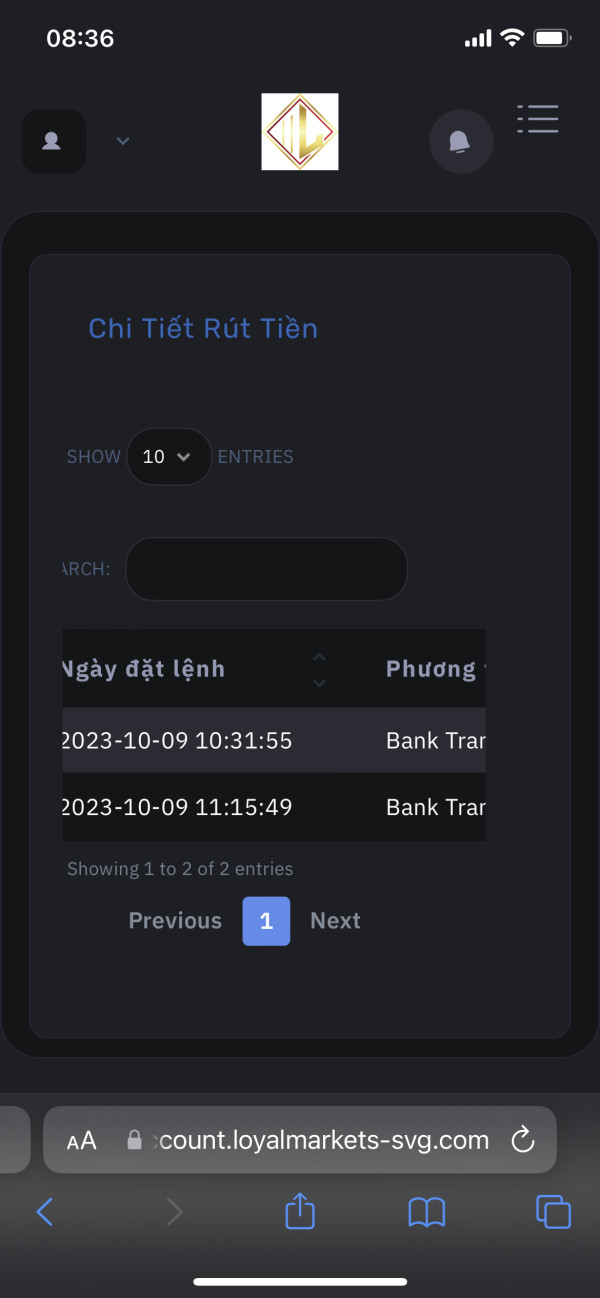

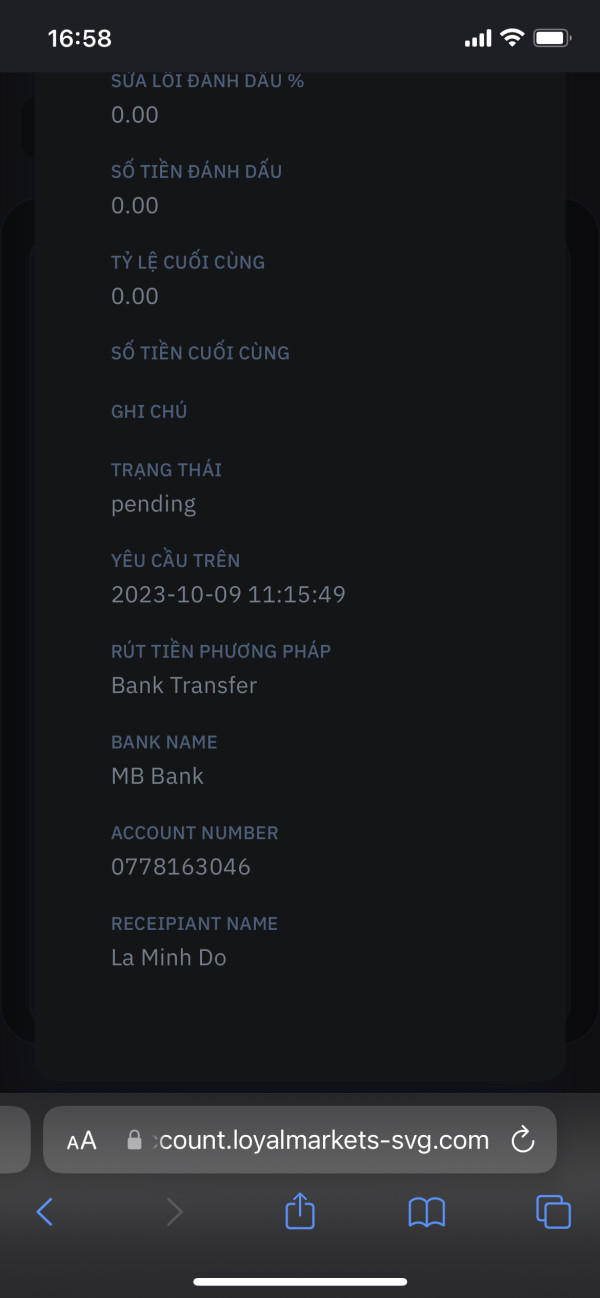

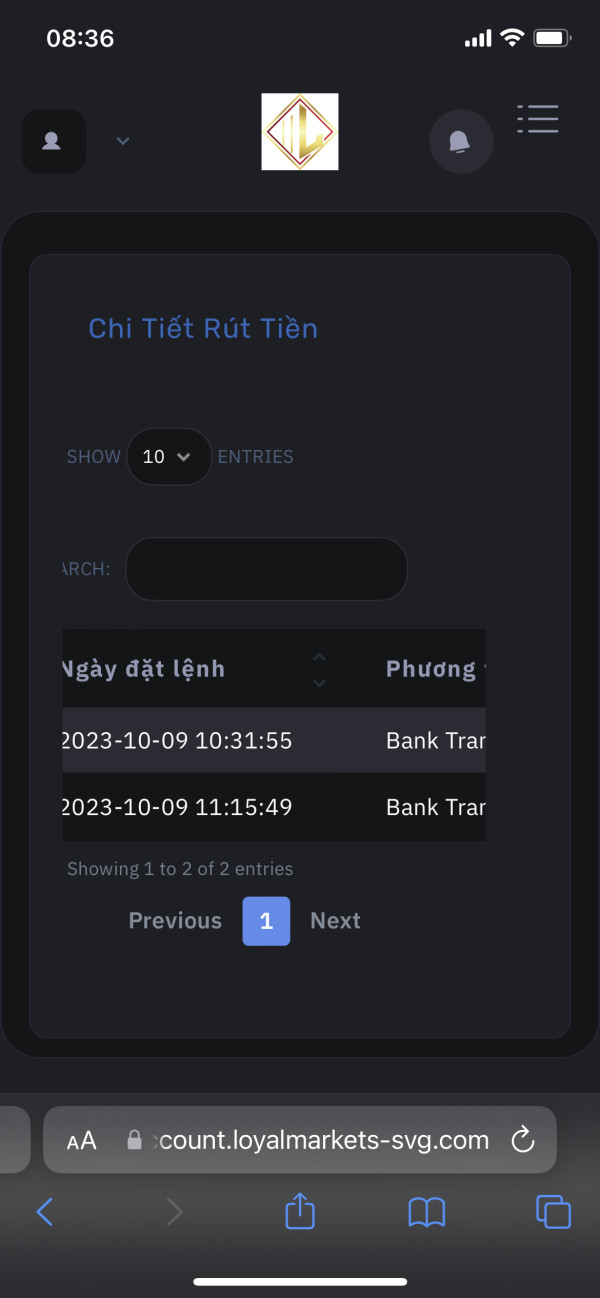

Deposit and Withdrawal Methods: Specific information regarding available payment methods, processing times, and associated fees is not detailed in available resources. This indicates poor transparency in financial operations.

Minimum Deposit Requirements: The broker has not disclosed minimum deposit amounts in accessible documentation. This makes it difficult for potential clients to assess account accessibility and initial investment requirements.

Bonus and Promotions: Available resources do not mention specific promotional offers, welcome bonuses, or incentive programs. This suggests limited marketing initiatives or poor information disclosure practices.

Tradeable Assets: The platform reportedly provides access to forex markets and other asset classes. However, specific instrument lists, market coverage, and trading specifications remain undisclosed in public information.

Cost Structure: Critical pricing information including spreads, commissions, overnight fees, and other trading costs is not transparently provided. This makes cost comparison with legitimate brokers impossible.

Leverage Ratios: Specific leverage offerings and margin requirements are not detailed in available sources. This indicates poor disclosure of risk management parameters.

Platform Options: Information about trading platform types, features, and technical specifications is notably absent from accessible resources.

Geographic Restrictions: The broker has not clearly outlined service availability or restrictions for different jurisdictions and regulatory environments.

Customer Support Languages: Available support languages and communication channels are not specified in public information. This indicates potential service limitations.

This loyal brokers review highlights the concerning lack of transparency across fundamental operational aspects. Legitimate brokers typically disclose this information prominently.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions offered by Loyal Brokers receive a concerning 3/10 rating. This low score stems from significant transparency issues and lack of essential information disclosure. Available resources fail to provide crucial details about account types, their specific features, or differentiation between various service levels. This opacity makes it impossible for potential clients to make informed decisions about account selection based on their trading needs and experience levels.

The absence of clearly stated minimum deposit requirements represents a major red flag. Legitimate brokers typically provide transparent information about initial funding requirements across different account tiers. Without this fundamental information, traders cannot assess whether the broker's services align with their available capital or investment strategy. The lack of disclosed account opening procedures and verification requirements further compounds these concerns.

Additionally, the broker has not provided information about special account features. These include Islamic accounts for Muslim traders, professional account options for qualified investors, or managed account services. This limited disclosure suggests either a very basic service offering or poor commitment to client communication and transparency standards expected in the modern forex industry.

Loyal Brokers receives a moderate 6/10 rating for tools and resources. This rating is primarily based on the confirmed availability of demo accounts and swap-free trading options across multiple asset classes. The demo account feature provides value for traders seeking to test strategies or familiarize themselves with the platform before committing real funds. This represents a positive aspect of their service offering.

The swap-free option caters to traders following Islamic finance principles or those seeking to avoid overnight interest charges on positions held beyond daily cutoff times. This feature demonstrates some consideration for diverse client needs and religious requirements. It is commendable for a broker targeting international markets.

However, the rating remains limited due to the absence of detailed information about research and analysis resources, educational materials, market commentary, or advanced trading tools. Legitimate brokers typically provide comprehensive market analysis, economic calendars, trading signals, and educational content to support client success. The lack of disclosed automated trading support, API access, or third-party platform integration further limits the overall tools and resources assessment.

Customer Service and Support Analysis

The customer service evaluation yields a disappointing 4/10 rating. This low score is primarily influenced by poor user feedback and the absence of clearly defined support structures. User reports indicate substandard service quality, though specific details about response times, resolution effectiveness, or support channel availability are not well-documented in accessible sources.

The lack of published information about customer service channels, operating hours, or multilingual support capabilities raises concerns about the broker's commitment to client assistance. Professional forex brokers typically provide 24/5 support during market hours through multiple channels including live chat, phone, and email. They also maintain clear escalation procedures for complex issues.

Without transparent communication about support availability and service standards, potential clients cannot assess whether they will receive adequate assistance during critical trading situations or account-related issues. The poor user feedback combined with limited service transparency significantly impacts the overall customer service rating. It suggests potential difficulties in obtaining timely, effective support when needed.

Trading Experience Analysis

The trading experience receives a neutral 5/10 rating. This score reflects insufficient information about platform performance, execution quality, and overall trading environment. Available sources do not provide specific details about order execution speeds, slippage rates, platform stability, or system uptime statistics that would enable a comprehensive assessment of the actual trading experience.

Without disclosed information about trading platform types, whether web-based, downloadable, or mobile applications, it becomes difficult to evaluate the technological infrastructure supporting client trading activities. The absence of details about charting capabilities, technical analysis tools, order types, and execution methods further limits the ability to assess trading functionality comprehensiveness.

The lack of transparency regarding spread stability, requoting frequency, and execution policies during high-volatility market conditions represents a significant concern for serious traders. Additionally, mobile trading capabilities and cross-device synchronization features are not documented. These features are increasingly important for modern trading requirements. This loyal brokers review cannot provide higher ratings without concrete evidence of platform performance and trading environment quality.

Trust Factor Analysis

The trust factor receives the lowest rating of 2/10. This score reflects serious concerns about the broker's legitimacy and operational integrity. The most significant issue is Loyal Brokers' unregulated status, operating without authorization from recognized financial authorities such as the FCA, CySEC, or other established regulatory bodies that provide essential client protections.

Multiple sources have flagged the platform with suspected fraud warnings. This indicates potential risks for client funds and trading activities. The absence of regulatory oversight means clients lack access to compensation schemes, dispute resolution mechanisms, and the regulatory protections that legitimate brokers must provide under established financial frameworks.

The broker's poor transparency regarding corporate structure, management team, financial statements, and operational procedures further undermines trust. Legitimate financial institutions typically provide comprehensive information about their regulatory status, corporate governance, and compliance measures. The combination of unregulated status, fraud suspicions, and operational opacity creates a high-risk environment that experienced traders would typically avoid.

User Experience Analysis

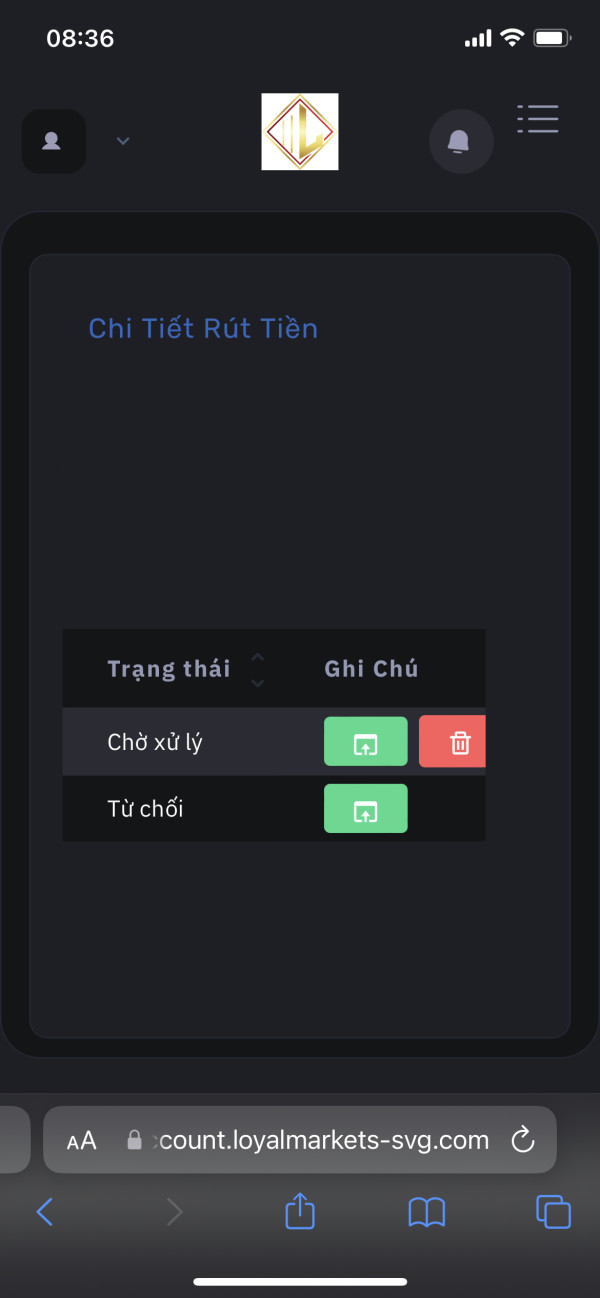

User experience receives a low 3/10 rating. This score is primarily driven by the documented user rating of 0.76 and negative feedback highlighting operational concerns and suspected fraudulent activities. The extremely low user satisfaction score indicates widespread dissatisfaction among clients who have interacted with the platform. It suggests fundamental issues with service delivery and operational integrity.

Available user feedback points to concerns about the platform's legitimacy. Multiple reports question the broker's business practices and reliability. The absence of positive user testimonials or success stories further reinforces concerns about the overall client experience and satisfaction levels.

Without detailed information about interface design, registration processes, account verification procedures, or fund management experiences, it's difficult to assess specific usability aspects. However, the overwhelmingly negative user sentiment and suspected fraud warnings suggest that traders encounter significant difficulties and concerns when attempting to use the platform's services. This results in poor overall user experience ratings.

Conclusion

This comprehensive loyal brokers review reveals significant concerns that make this broker unsuitable for most traders. It is particularly problematic for beginners and risk-averse investors. The combination of unregulated status, suspected fraud warnings, and poor user feedback creates a high-risk environment that contradicts the safety and transparency standards expected from legitimate financial service providers.

While the broker offers some basic features like demo accounts and swap-free options, these limited advantages are far outweighed by the fundamental trust and regulatory concerns. The lack of transparency across essential operational aspects, combined with extremely poor user ratings, suggests potential clients should seek regulated alternatives. They should look for brokers with established track records and proper oversight.

Traders seeking reliable forex brokerage services should prioritize regulated brokers with transparent operations, positive user feedback, and comprehensive client protections. They should avoid risking their capital with unregulated providers carrying fraud suspicions.