Is Hiltonmetafx safe?

Business

License

Is Hiltonmetafx Safe or Scam?

Introduction

Hiltonmetafx is a relatively new player in the forex trading market, claiming to offer a diverse range of trading products and high leverage options. As the financial landscape becomes increasingly saturated with various trading platforms, traders must exercise caution when choosing brokers. The potential risks associated with unregulated brokers can lead to significant financial losses, making it imperative for traders to conduct thorough evaluations before committing their funds. This article aims to provide an objective analysis of Hiltonmetafx, assessing its regulatory status, company background, trading conditions, and overall safety for potential investors.

Regulation and Legitimacy

The regulatory status of a trading broker is crucial in determining its legitimacy and safety. Hiltonmetafx operates without any valid regulatory oversight, which raises concerns about its credibility. The absence of regulation means there are no external authorities monitoring the broker's activities, leading to potential risks for traders. Below is a summary of the regulatory information related to Hiltonmetafx:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The lack of a regulatory framework means that investors' funds are not protected by any law, making it essential for traders to approach Hiltonmetafx with caution. Furthermore, Hiltonmetafx has been linked to a rebranded version of the notorious V5 platform, which has a history of scams and fraudulent activities. This connection further emphasizes the need for potential investors to be wary when considering this broker.

Company Background Investigation

Hiltonmetafx presents itself as a newly established trading platform based in the Philippines. However, the company's history and ownership structure raise red flags. It is reported that Hiltonmetafx is essentially a rebranding of the V5 Forex Global platform, notorious for engaging in fraudulent activities. The management team behind Hiltonmetafx remains largely anonymous, lacking transparency and clear information about their professional backgrounds. This opacity raises questions about the company's integrity and the level of trust traders can place in it.

Moreover, the information disclosed on their website primarily consists of promotional content, with little to no details provided about the company's operational history or management. This lack of transparency is concerning and contributes to the overall skepticism surrounding Hiltonmetafx's legitimacy.

Trading Conditions Analysis

The trading conditions offered by Hiltonmetafx are another critical aspect that requires scrutiny. The broker claims to provide access to over 2,100 trading products, with leverage of up to 1:200. However, the absence of a demo account and limited trading platform options are significant drawbacks for potential investors.

Here is a comparative overview of the core trading costs associated with Hiltonmetafx:

| Fee Type | Hiltonmetafx | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | High | Medium |

| Commission Model | N/A | Varies |

| Overnight Interest Range | Unclear | Varies |

The high spreads reported by users indicate that the trading costs may not be competitive compared to other regulated brokers. Additionally, the unclear commission structure raises concerns about potential hidden fees, which could further diminish traders' profits.

Client Fund Security

When evaluating the safety of a broker, the measures taken to protect client funds are paramount. Hiltonmetafx does not provide sufficient information regarding its fund security measures, such as segregated accounts, investor protection schemes, or negative balance protection. The lack of clarity in these areas poses significant risks for traders, as their investments may be vulnerable to mismanagement or loss.

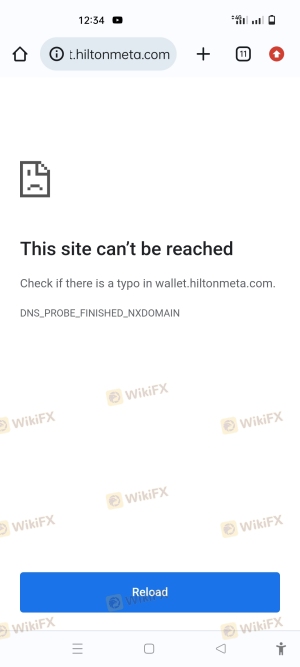

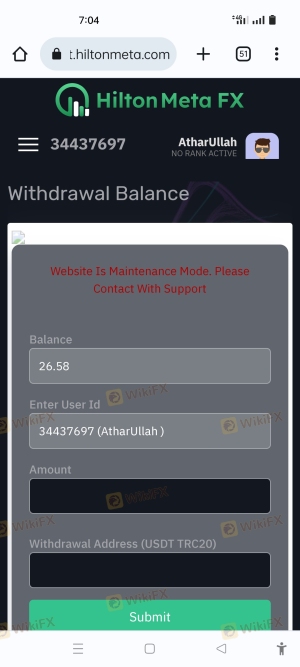

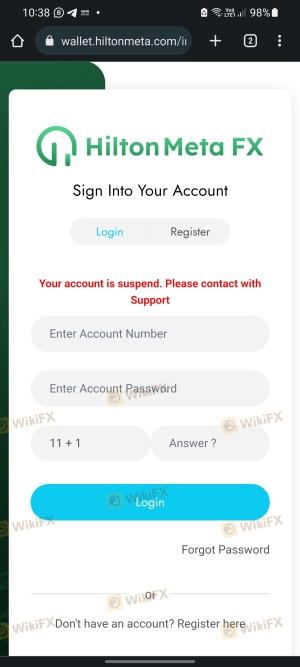

Furthermore, historical complaints regarding withdrawal issues and fund accessibility further amplify concerns about the safety of client funds with Hiltonmetafx. Traders have reported difficulties in withdrawing their funds, which could indicate underlying problems with the broker's financial practices.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. Reviews of Hiltonmetafx reveal a pattern of negative experiences, primarily related to withdrawal issues and poor customer support.

Here is a summary of the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow/Unresponsive |

| Poor Customer Support | Medium | Inconsistent |

| Lack of Transparency | High | Minimal |

For instance, users have reported being unable to withdraw their funds, with some stating that their accounts were frozen without explanation. This lack of responsiveness from the company raises serious concerns about the overall customer experience and the level of support provided to clients.

Platform and Execution

The trading platform offered by Hiltonmetafx is another critical aspect of its evaluation. The broker does not provide access to popular trading platforms like MetaTrader 4 or 5, which are widely used by traders for their robust features and reliability. Instead, Hiltonmetafx offers a basic online trading platform that may not meet the expectations of experienced traders.

The quality of order execution is also a significant concern. Reports of slippage and order rejections have emerged, indicating potential issues with the broker's execution capabilities. Such problems can severely impact trading performance and profitability, further raising questions about the broker's reliability.

Risk Assessment

Engaging with Hiltonmetafx presents various risks that traders should be aware of. Below is a summary of the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated, no oversight |

| Fund Security Risk | High | Lack of transparency in fund safety |

| Customer Service Risk | Medium | Poor response to complaints |

| Execution Risk | Medium | Reports of slippage and rejections |

To mitigate these risks, potential investors should consider conducting thorough research, only investing funds they can afford to lose, and exploring alternative brokers with established reputations and regulatory oversight.

Conclusion and Recommendations

In conclusion, the evidence suggests that Hiltonmetafx raises significant concerns regarding its legitimacy and safety. The lack of regulation, transparency, and credible management raises red flags that potential investors should not ignore. Additionally, the high trading costs, poor customer feedback, and withdrawal issues further indicate that Hiltonmetafx may not be a trustworthy broker.

For traders seeking a reliable forex broker, it is advisable to consider alternatives that are regulated by reputable authorities and have a proven track record of customer satisfaction. Brokers such as OANDA, IG, and Forex.com may provide safer trading environments with better support and transparency.

In summary, the question "Is Hiltonmetafx safe?" leans heavily towards a cautious "no." Potential investors should approach this broker with extreme caution and consider their options carefully before committing any funds.

Is Hiltonmetafx a scam, or is it legit?

The latest exposure and evaluation content of Hiltonmetafx brokers.

Hiltonmetafx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Hiltonmetafx latest industry rating score is 1.39, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.39 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.