Executive Summary

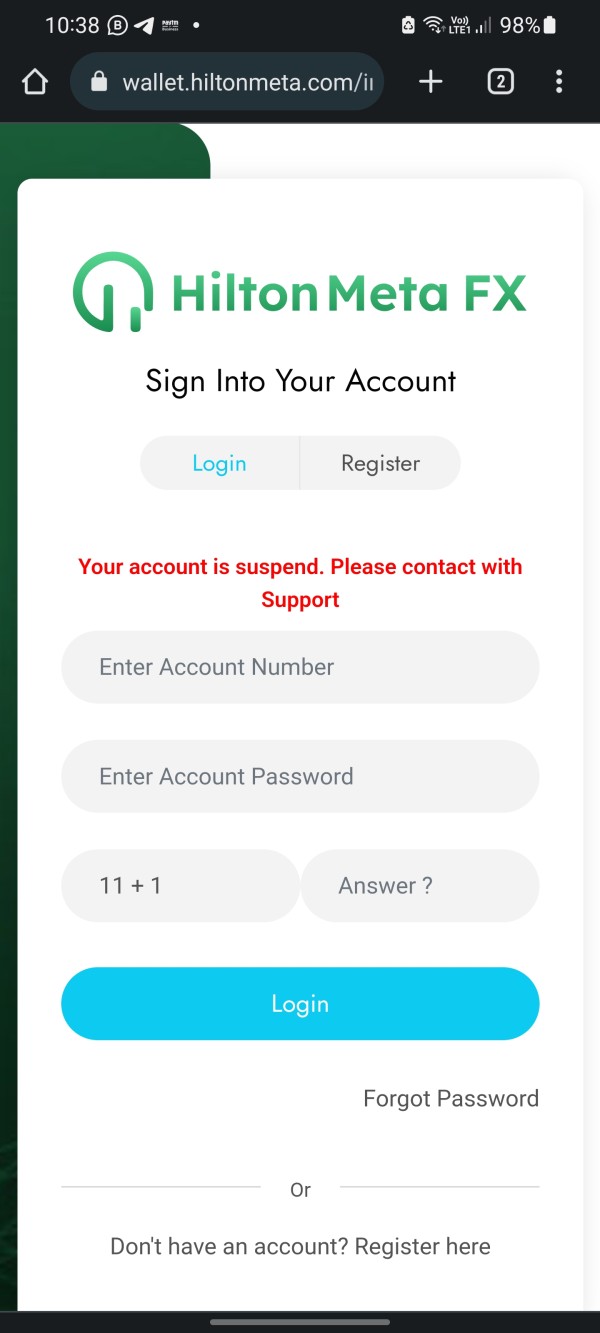

This comprehensive hiltonmetafx review reveals concerning findings about this forex broker. Potential traders should carefully consider these issues before making any decisions. Hiltonmetafx has been flagged as an unregulated broker with consistently poor user ratings, averaging a score of 2 out of 10, and faces multiple scam allegations from former clients.

Despite offering an extensive range of over 2,100 trading instruments with leverage up to 200:1, the broker's lack of regulatory oversight and negative user feedback raise significant red flags. The platform primarily targets high-risk traders interested in forex and cryptocurrency trading. Our analysis suggests extreme caution is warranted.

According to available reports, Hiltonmetafx operates from the Philippines but lacks proper regulatory authorization from recognized financial authorities. While the minimum deposit requirement of $250 may appear attractive to novice traders, the absence of regulatory protection creates serious concerns. Numerous user complaints about withdrawal issues and poor customer service make this broker unsuitable for most retail investors.

Our investigation found consistent patterns of user dissatisfaction across multiple review platforms. Particular concerns exist about fund safety and customer support responsiveness.

Important Notice

Regional Entity Differences: Hiltonmetafx operates as an unregulated entity. Trading experiences may vary significantly across different countries, particularly regarding fund security and legal recourse. Users in various jurisdictions should be aware that the lack of regulatory oversight means limited protection for their investments and potential difficulties in dispute resolution.

Review Methodology: This hiltonmetafx review is based on publicly available information, user feedback from multiple sources, and industry reports. Our assessment does not include actual trading results or first-hand platform testing. We prioritize user safety by not recommending engagement with unregulated brokers.

Rating Framework

Broker Overview

Hiltonmetafx presents itself as a multi-asset trading platform. Specific details about its establishment date remain unclear in available documentation. The company claims to operate from the Philippines, but comprehensive corporate background information is notably absent from public records.

This lack of transparency is particularly concerning given the broker's positioning in the competitive forex market. The absence of clear founding information and corporate history raises immediate questions about the company's legitimacy and long-term stability. The broker's business model appears to focus on high-leverage trading across multiple asset classes, including forex pairs, cryptocurrencies, commodities, and indices.

Critical information about their specific trading platform technology, execution model, and operational infrastructure remains undisclosed. According to available information, Hiltonmetafx operates without oversight from any recognized financial regulatory authority. This unregulated status fundamentally undermines trader protection and market integrity.

This means clients have no recourse through official channels if disputes arise, making it a high-risk proposition for any serious trader.

Regulatory Status: Hiltonmetafx has been explicitly flagged as an unregulated broker. The platform operates without authorization from any recognized financial regulatory body. This absence of regulatory oversight represents a critical risk factor for potential clients.

Minimum Deposit: The platform requires a minimum deposit of $250 to begin trading. This amount is relatively standard for retail forex brokers but concerning given the lack of regulatory protection.

Available Assets: The broker claims to offer over 2,100 trading instruments across multiple asset classes. These include forex currency pairs, cryptocurrencies, commodities, and stock indices, though specific details about these offerings remain vague.

Leverage Ratios: Maximum leverage is advertised up to 200:1. This presents significant risk potential, especially for inexperienced traders dealing with an unregulated entity.

Cost Structure: Specific information about spreads, commissions, and other trading costs is not clearly disclosed in available materials. This represents a transparency concern.

Trading Platform: Details about the specific trading platform or software used by Hiltonmetafx are not mentioned in available documentation.

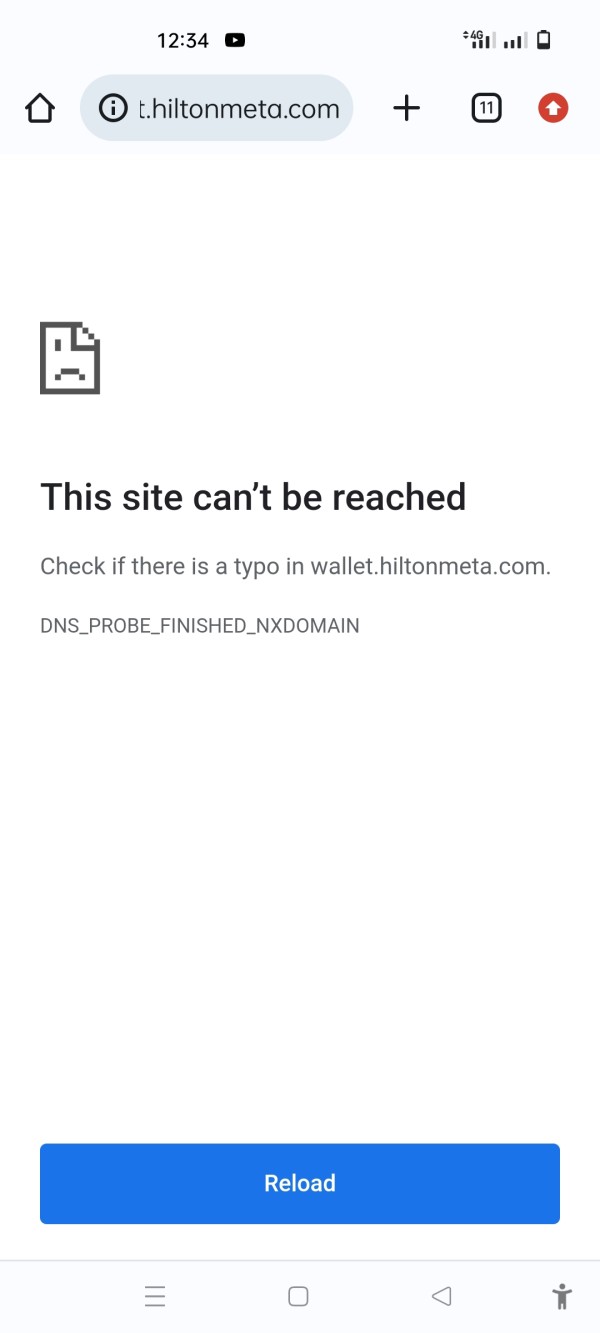

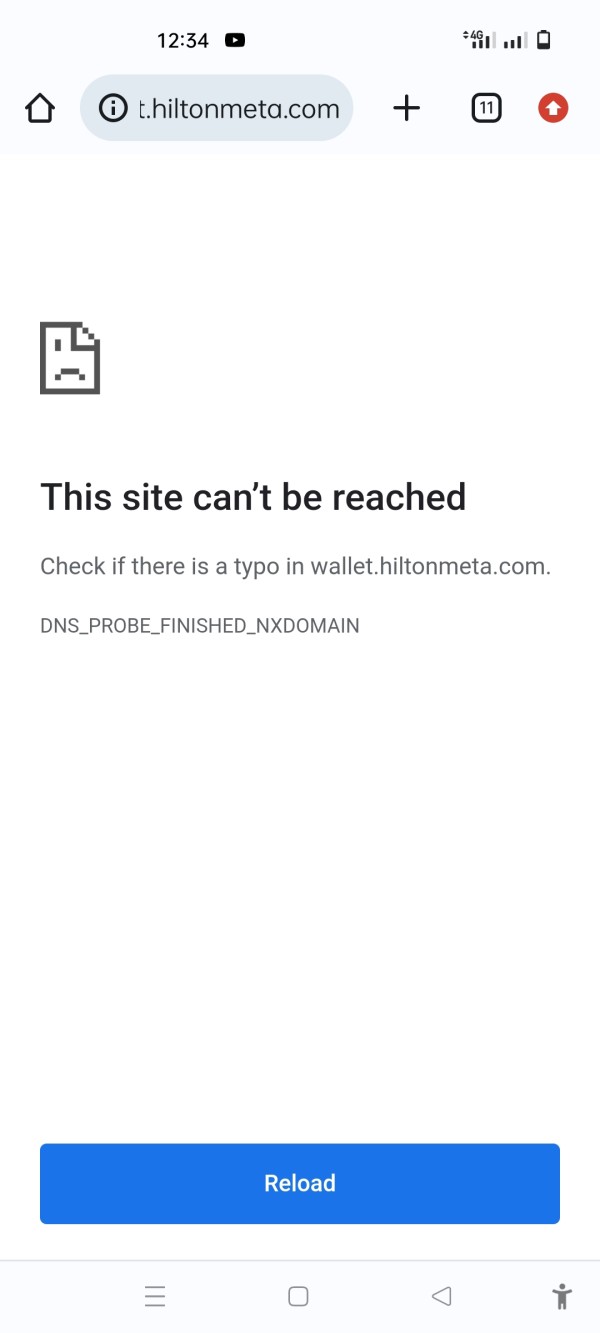

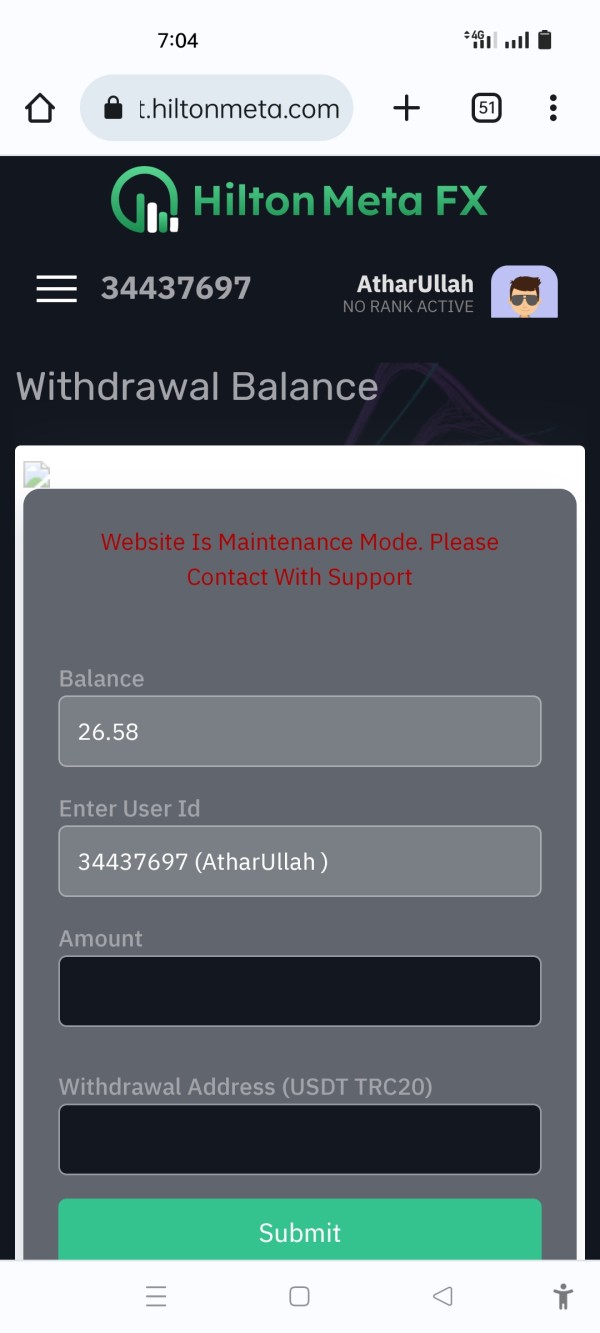

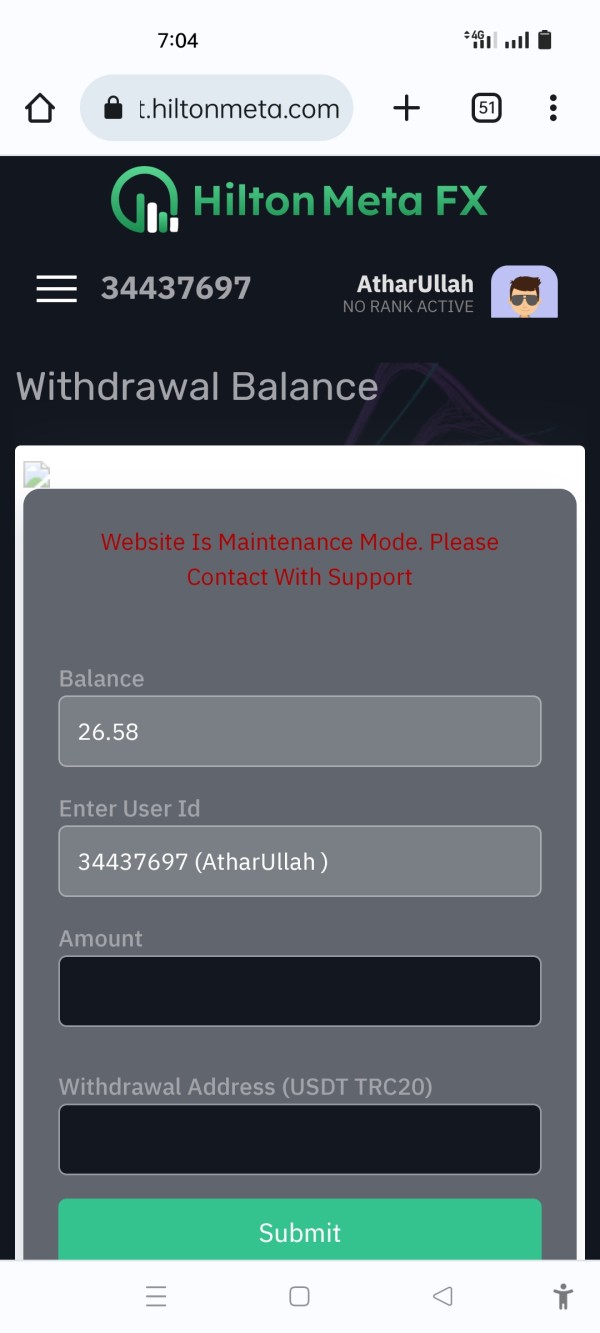

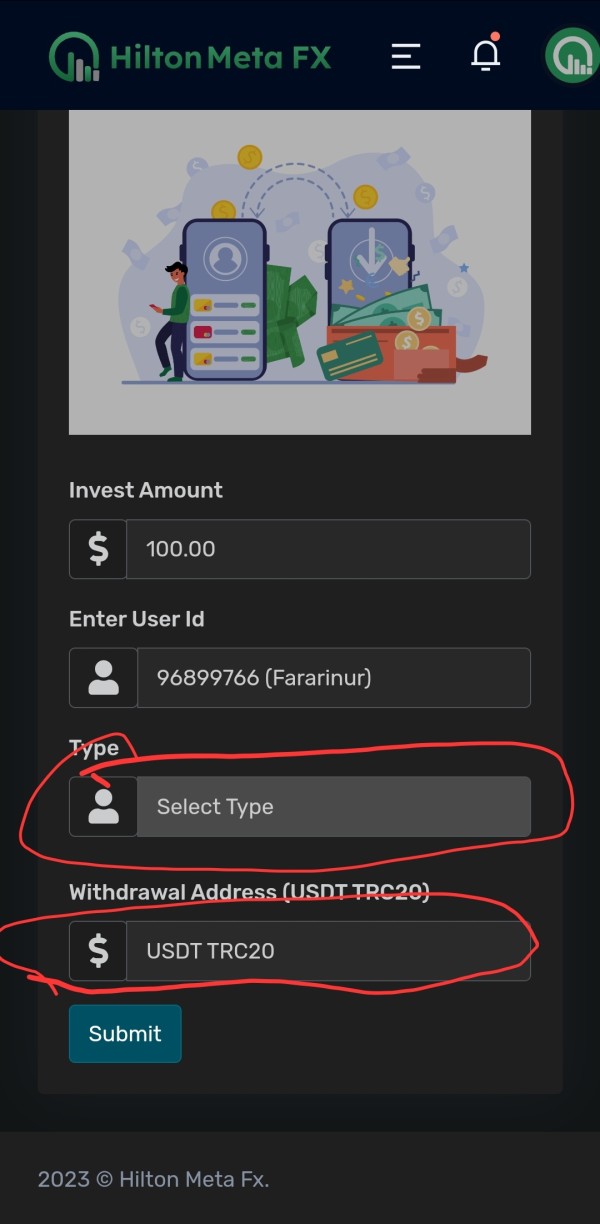

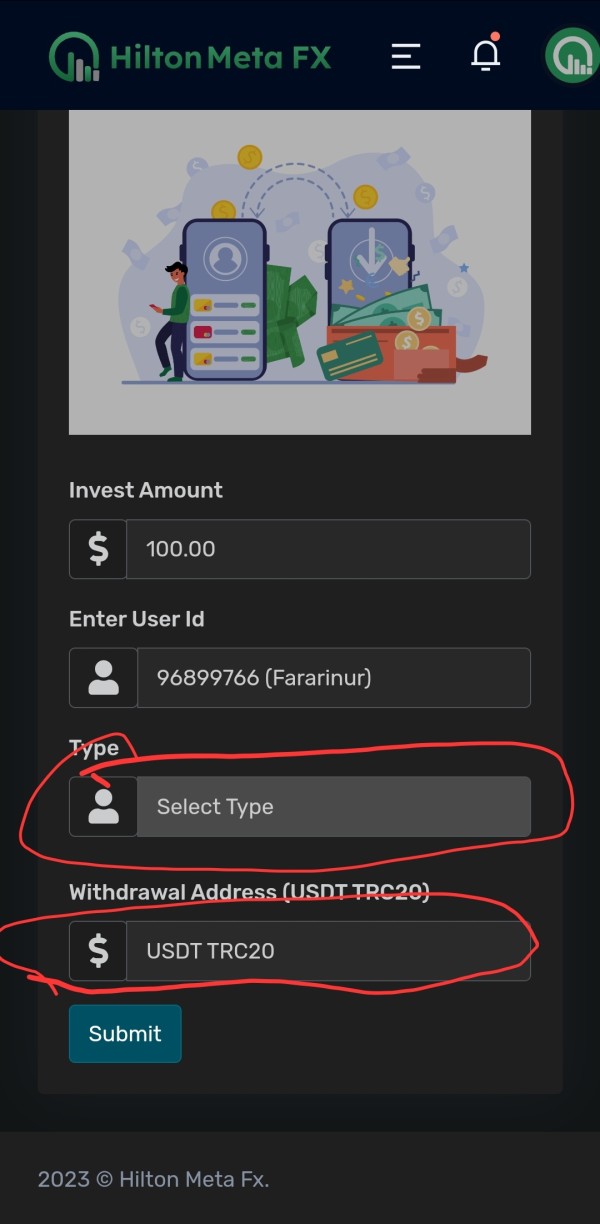

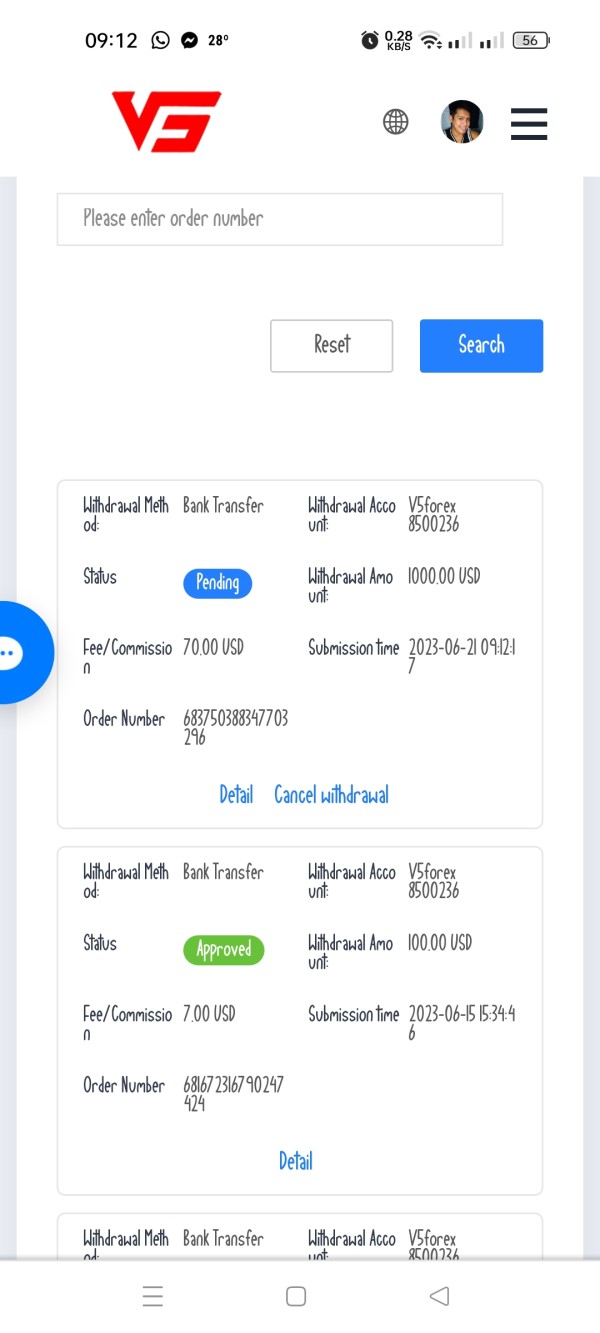

Payment Methods: Information about deposit and withdrawal methods has not been clearly specified in accessible materials.

Geographic Restrictions: Specific regional limitations or availability restrictions are not detailed in available sources.

Customer Support Languages: Available customer service languages and communication channels are not specified in current documentation.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

The account conditions offered by Hiltonmetafx present a mixed picture that ultimately favors caution over opportunity. While the $250 minimum deposit requirement appears reasonable compared to industry standards, this seemingly attractive entry point is overshadowed by the complete absence of account type diversity.

Most reputable brokers offer multiple account tiers with varying features, benefits, and requirements to accommodate different trader profiles and experience levels. The lack of detailed information about account opening procedures, verification requirements, and specific account features raises significant concerns about operational transparency. Additionally, there is no mention of specialized account options such as Islamic accounts for Muslim traders, professional accounts for experienced traders, or managed accounts for passive investors.

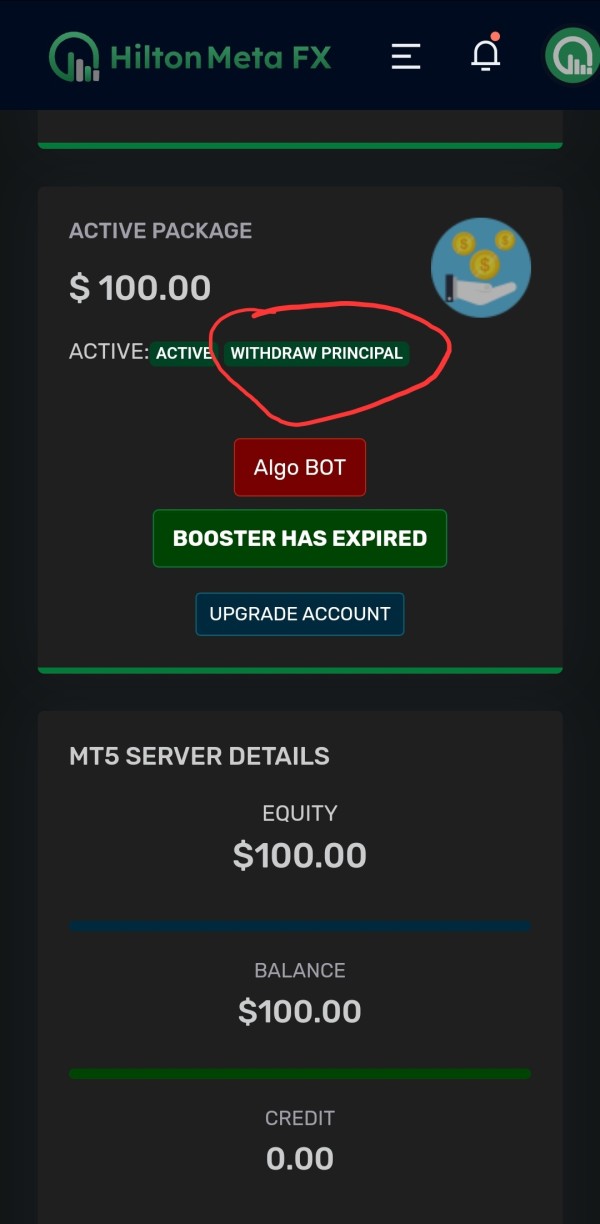

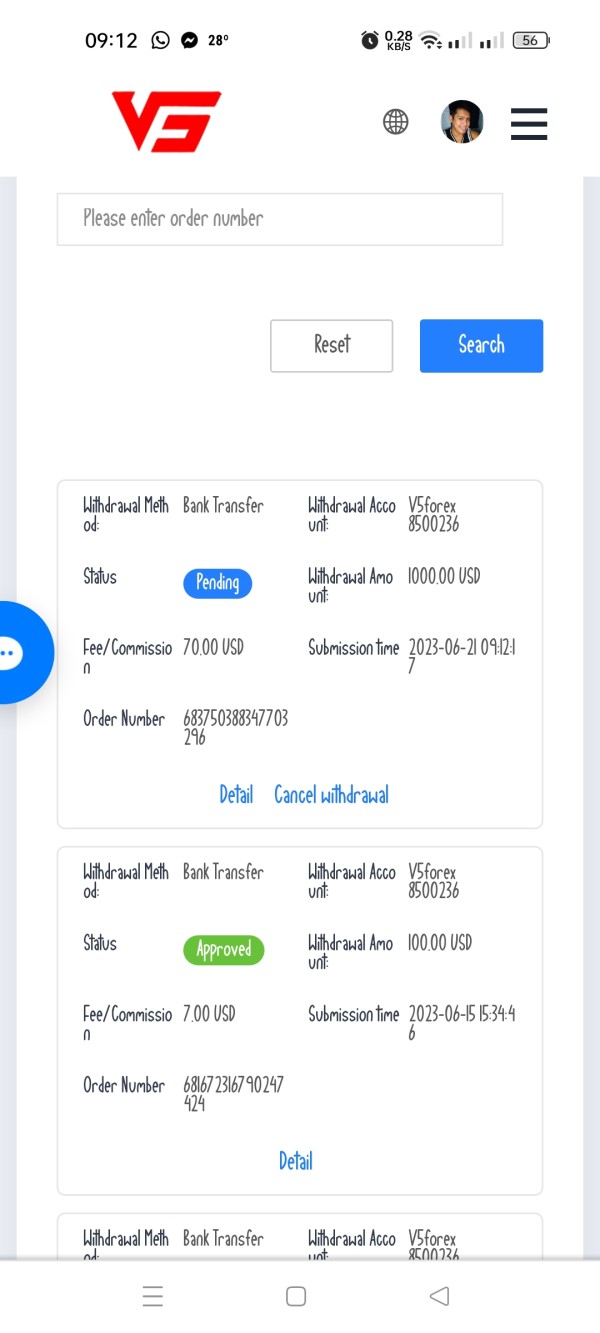

This limited flexibility suggests either an underdeveloped service offering or deliberate opacity in their account structure. User feedback regarding account conditions has been consistently negative, with particular emphasis on difficulties experienced during the account funding and withdrawal processes.

The absence of clear terms and conditions regarding account maintenance, inactivity fees, or closure procedures further compounds these concerns. This hiltonmetafx review must emphasize that the simplistic account structure, while potentially appealing to beginners, lacks the sophistication and protection mechanisms expected from legitimate forex brokers in today's market.

Hiltonmetafx's tools and resources offering presents a paradox of quantity over quality. This characterizes much of their service proposition. While the broker claims to provide access to over 2,100 trading instruments across multiple asset classes, the actual quality and accessibility of these instruments remain questionable due to the lack of detailed specifications and trading conditions for each category.

The absence of information about analytical tools, market research capabilities, or educational resources represents a significant gap in their service offering. Modern forex trading requires sophisticated charting tools, technical analysis capabilities, economic calendars, and market commentary to make informed decisions.

The lack of detail about these essential trading resources suggests either their non-existence or a deliberate attempt to obscure limited capabilities. Furthermore, there is no mention of automated trading support, API access for algorithmic traders, or integration with popular third-party analysis tools. The absence of educational materials, webinars, or market analysis content indicates a focus on transaction volume rather than trader development and success.

User feedback consistently points to inadequate tool availability and poor resource quality, which significantly impacts the overall trading experience and success potential for clients.

Customer Service and Support Analysis (Score: 3/10)

Customer service represents one of the most critically deficient areas in Hiltonmetafx's service offering. Multiple user reports and available feedback support this assessment. The lack of clearly defined customer support channels, response time commitments, or service level agreements creates an environment where traders cannot rely on timely assistance when needed.

This is particularly problematic in forex trading, where market conditions can change rapidly and immediate support may be crucial for protecting investments. User feedback consistently highlights poor response times, unhelpful support staff, and difficulty reaching qualified representatives who can address technical or account-related issues.

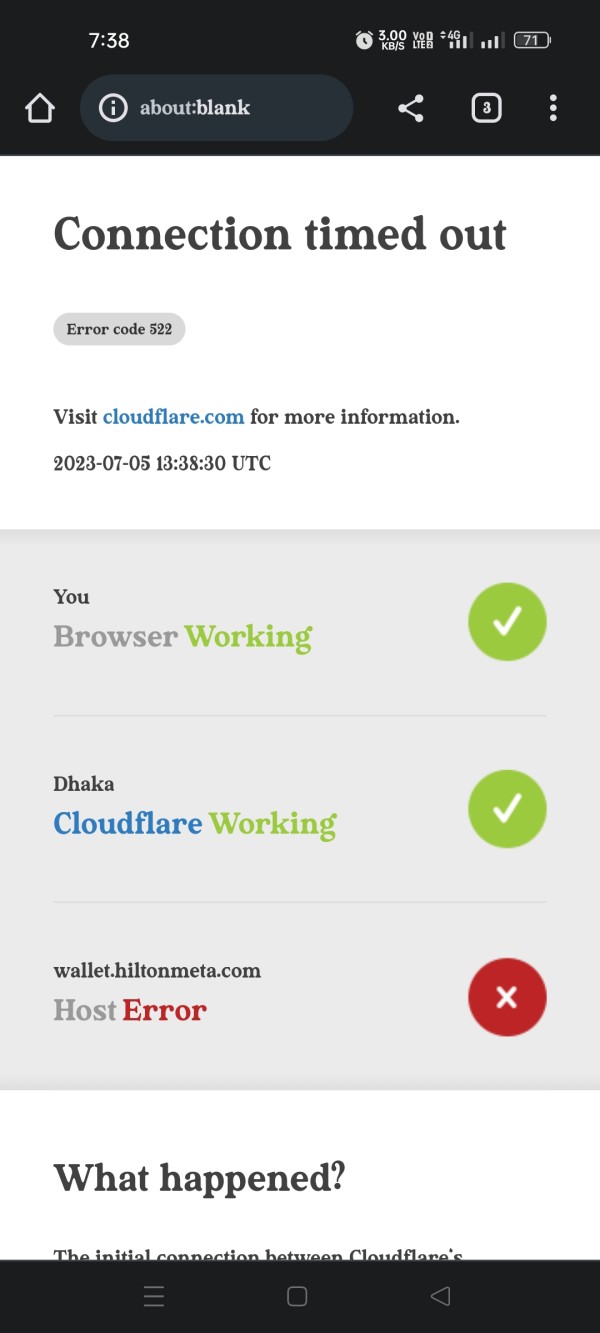

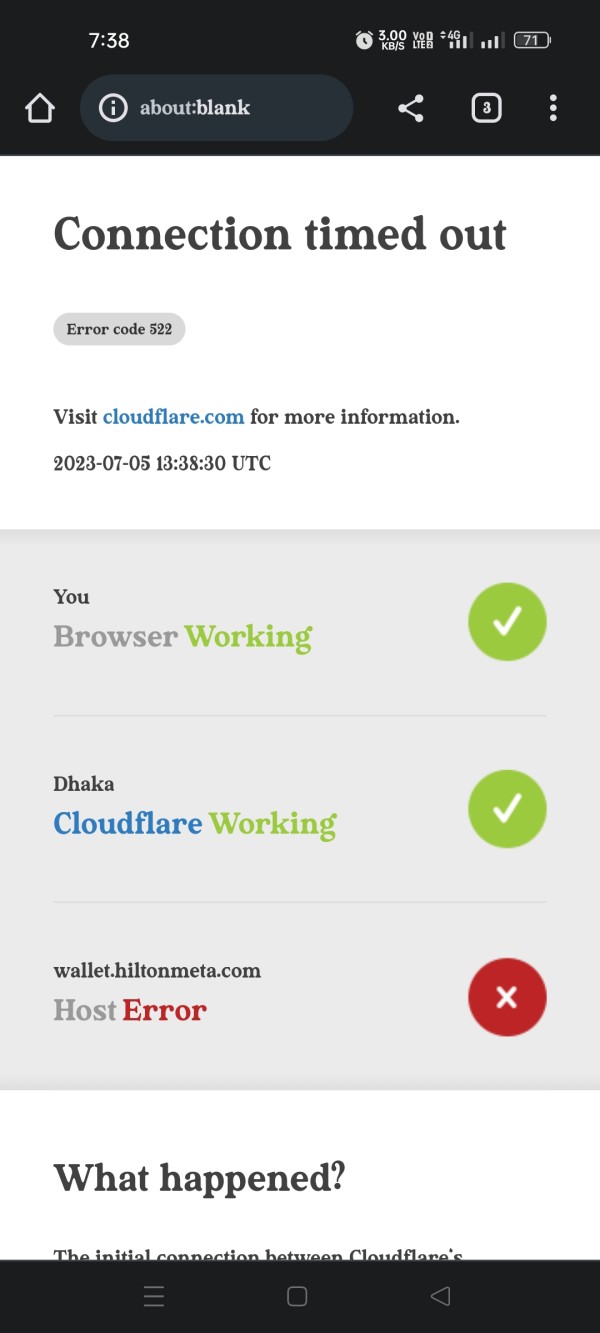

The absence of multiple communication channels such as live chat, phone support, email tickets, and social media presence suggests a minimal investment in customer service infrastructure. Additionally, there is no information about support availability hours or multilingual capabilities, which are standard expectations for international forex brokers. The most concerning aspect of customer service feedback relates to withdrawal and dispute resolution issues.

Multiple user reports indicate difficulties in obtaining responsive support when attempting to withdraw funds or resolve account problems. This pattern of poor customer service, combined with the broker's unregulated status, creates a high-risk environment where traders may find themselves without recourse when problems arise.

The lack of escalation procedures or regulatory complaint mechanisms further compounds these service deficiencies.

Trading Experience Analysis (Score: 4/10)

The trading experience with Hiltonmetafx appears to be significantly compromised by both technical limitations and operational deficiencies. These issues impact day-to-day trading activities. User feedback consistently reports subpar trading conditions, including issues with order execution, platform stability, and overall trading environment quality.

These concerns are particularly troubling given that reliable execution and platform performance are fundamental requirements for successful forex trading. The absence of detailed information about the trading platform itself raises questions about technological capabilities and infrastructure investment.

Modern forex trading requires sophisticated platforms with real-time pricing, advanced charting capabilities, multiple order types, and reliable execution speeds. The lack of transparency about these critical technical specifications suggests potential limitations that could significantly impact trading success. Mobile trading capabilities, which are essential for modern traders who need market access on the go, are not clearly addressed in available documentation.

Additionally, there is no mention of demo account availability, which is a standard feature that allows traders to test platform capabilities and trading strategies without financial risk. This hiltonmetafx review must emphasize that the combination of poor user feedback regarding trading conditions and the lack of platform transparency creates an unsuitable environment for serious forex trading activities.

Trust and Safety Analysis (Score: 2/10)

Trust and safety represent the most critical deficiencies in Hiltonmetafx's service proposition. The broker's unregulated status serves as the primary red flag for potential clients. Operating without oversight from recognized financial regulatory authorities means that client funds lack the protection mechanisms typically provided by regulated brokers, including segregated account requirements, compensation schemes, and regulatory dispute resolution procedures.

The presence of multiple scam allegations and negative user reports creates a pattern of concern that extends beyond simple service quality issues. These complaints often focus on withdrawal difficulties, unauthorized trading activities, and unresponsive customer service when problems arise.

The lack of regulatory oversight means that affected clients have limited recourse through official channels, making recovery of funds extremely difficult if problems occur. Additionally, the absence of clear information about fund segregation, insurance coverage, or financial reporting requirements demonstrates a lack of transparency that is inconsistent with legitimate broker operations. Reputable forex brokers typically provide detailed information about their regulatory status, client fund protection measures, and financial stability indicators.

The failure to provide this essential information, combined with explicit warnings about the broker's unregulated status, makes Hiltonmetafx unsuitable for any trader who values fund security and regulatory protection.

User Experience Analysis (Score: 3/10)

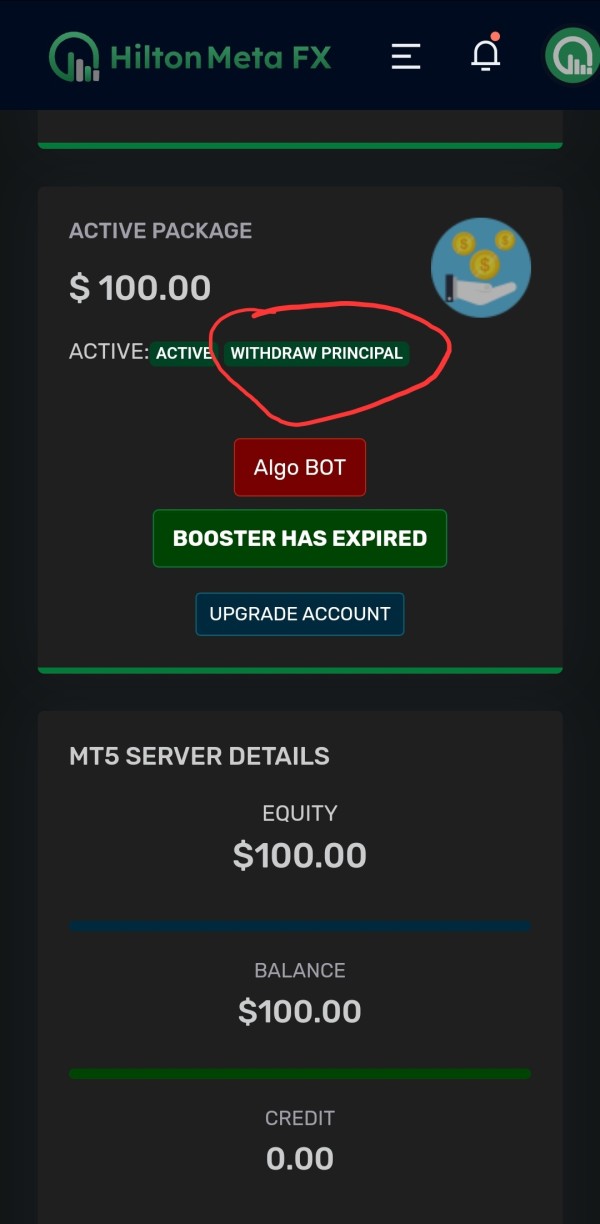

The overall user experience with Hiltonmetafx is characterized by significant dissatisfaction across multiple touchpoints. This includes everything from initial account opening through ongoing trading activities and eventual account closure attempts. User feedback consistently indicates frustration with various aspects of the service, including platform usability, customer support responsiveness, and withdrawal processes.

This pattern of negative experiences suggests systemic issues rather than isolated incidents. The lack of detailed information about user interface design, account management features, and overall platform navigation indicates either poor development investment or deliberate opacity about platform limitations.

Modern forex traders expect intuitive interfaces, comprehensive account management tools, and seamless integration between different platform components. The absence of such details, combined with negative user feedback, suggests a substandard user experience. Most concerning are the recurring complaints about fund withdrawal difficulties and account closure procedures.

Users report extended delays, excessive documentation requirements, and unresponsive support when attempting to access their funds. These issues represent fundamental failures in basic broker obligations and create an environment where traders risk losing access to their investments.

The combination of poor user satisfaction scores and specific complaints about fund access makes Hiltonmetafx unsuitable for traders who prioritize reliable account management and fund security.

Conclusion

This comprehensive hiltonmetafx review reveals a broker that presents significant risks to potential clients. Despite some superficially attractive features, these benefits are overshadowed by fundamental deficiencies. While the platform offers a wide range of trading instruments and competitive leverage ratios, these advantages cannot overcome serious problems with regulatory compliance, customer service, and operational transparency.

The broker's unregulated status represents an unacceptable risk for most retail traders. Hiltonmetafx may only be suitable for extremely high-risk traders who fully understand and accept the potential for total loss of investment without regulatory recourse.

However, even experienced traders would be better served by choosing regulated alternatives that provide proper oversight and client protection. The primary advantages of extensive product offerings and high leverage are significantly outweighed by the disadvantages of regulatory non-compliance, poor customer service, and concerning user feedback regarding fund safety and withdrawal processes. For the vast majority of forex traders, regardless of experience level, we recommend avoiding Hiltonmetafx in favor of properly regulated brokers.

These alternatives provide transparent operations, reliable customer support, and regulatory protection for client funds.