OneCapital Review 1

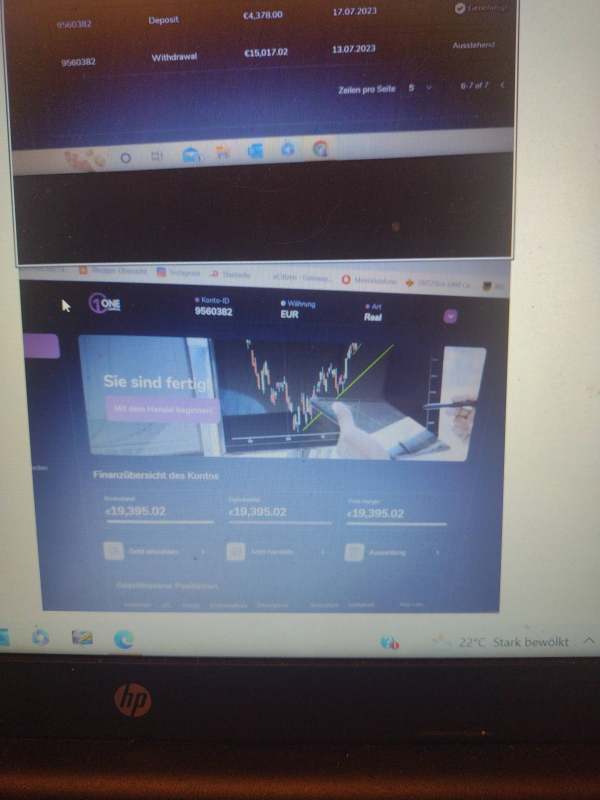

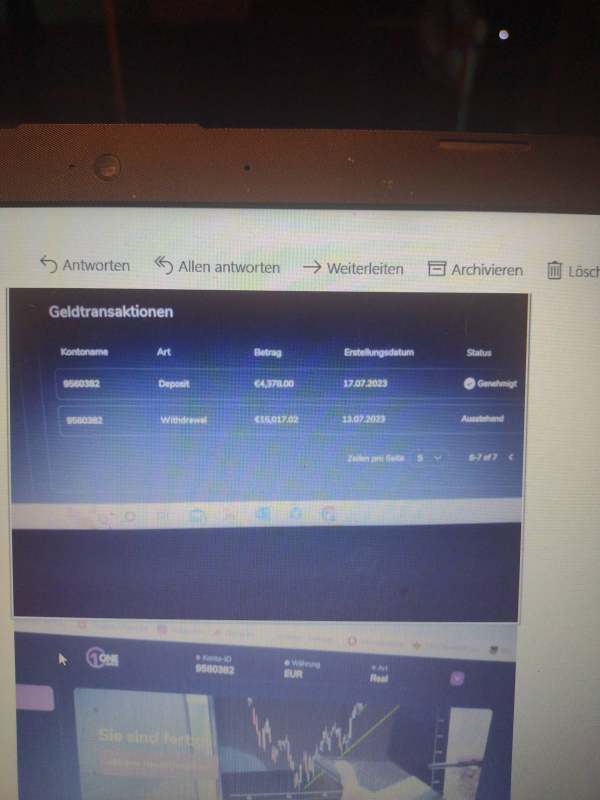

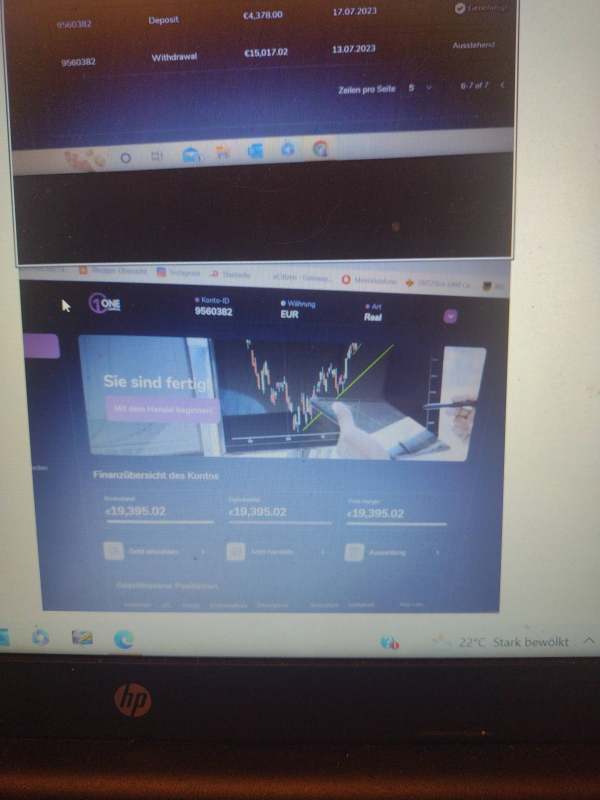

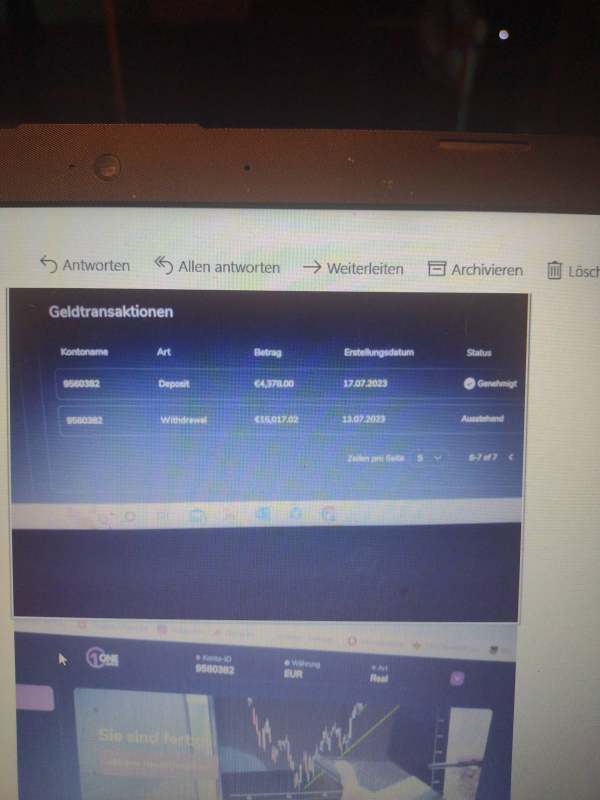

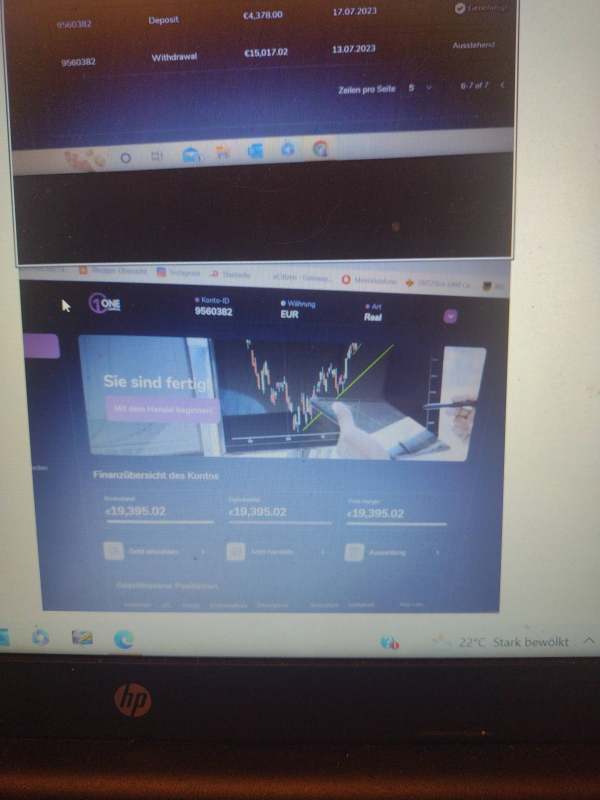

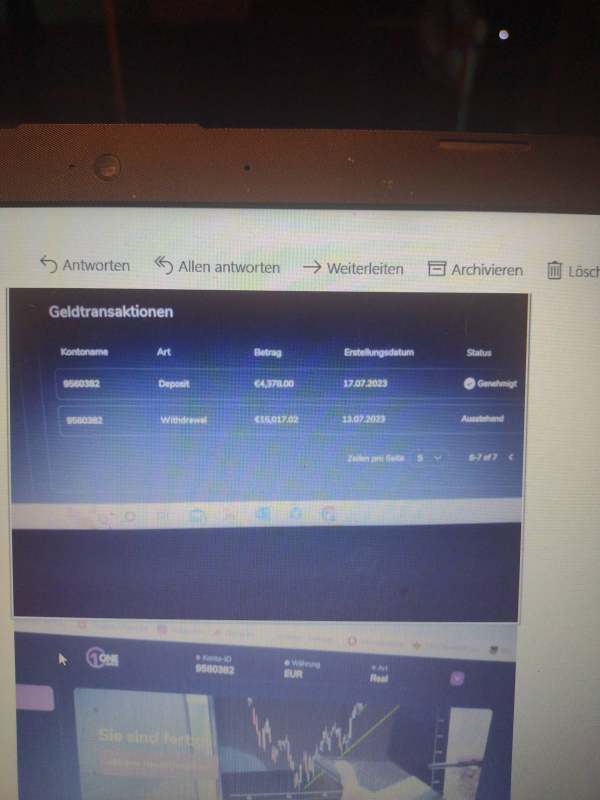

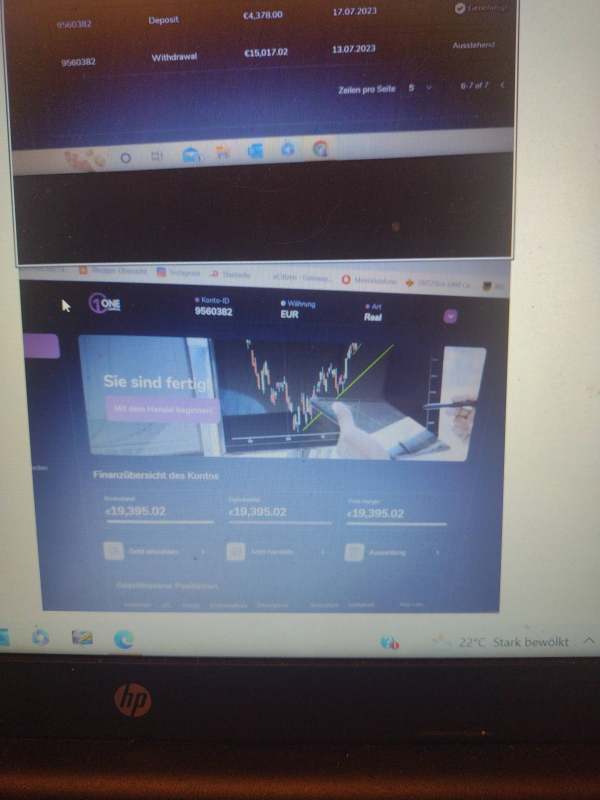

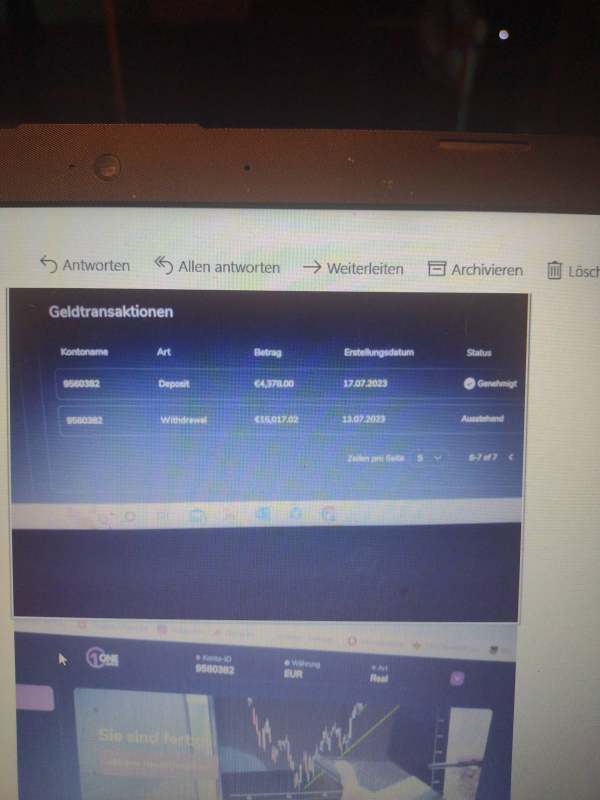

Since July 13, 2023, the payout to my account 9560382 for 15,017.02 euros has been listed as outstanding. There are no contact support addresses and the dashboard is at a standstill.

OneCapital Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Since July 13, 2023, the payout to my account 9560382 for 15,017.02 euros has been listed as outstanding. There are no contact support addresses and the dashboard is at a standstill.

This Onecapital review shows a concerning picture of an unregulated forex broker that poses significant risks to traders. Based on available market information and user feedback, Onecapital operates without proper regulatory oversight, which immediately raises red flags for potential investors. The platform has received mixed user reviews, with some traders providing surprisingly positive ratings while others express serious concerns about the broker's legitimacy and trustworthiness.

The broker appears to target traders seeking high-risk investment opportunities, but this comes at the expense of security and regulatory protection. Unlike established brokers that operate under strict financial regulations, Onecapital's lack of proper licensing creates an environment where trader funds and rights are not adequately protected. While some users have reported satisfactory experiences, the overall trust level remains extremely low due to the absence of regulatory safeguards that are considered essential in modern forex trading.

This review is based on available market information and user feedback as of 2025. It's crucial to understand that regulatory standards vary significantly across different countries and regions. While Onecapital may lack proper regulation in major financial jurisdictions, the legal status of such operations can differ depending on local laws and enforcement practices.

Our evaluation methodology combines user testimonials, available platform information, and industry standards to provide a comprehensive assessment. However, given the limited transparency from the broker itself, some aspects of this review rely on third-party observations and user experiences rather than official company disclosures.

| Criteria | Score | Rating |

|---|---|---|

| Account Conditions | 3/10 | Poor |

| Tools and Resources | 2/10 | Very Poor |

| Customer Service | 4/10 | Below Average |

| Trading Experience | 3/10 | Poor |

| Trust and Safety | 1/10 | Extremely Poor |

| User Experience | 4/10 | Below Average |

Onecapital presents itself as a forex trading platform, though specific details about its founding date and corporate background remain unclear in available documentation. The broker's business model appears to focus on forex trading services, though the exact range of financial instruments and trading conditions are not transparently disclosed. This lack of transparency is particularly concerning given the importance of clear terms and conditions in forex trading.

The platform operates without oversight from recognized financial regulatory authorities, which distinguishes it significantly from established brokers who maintain licenses with bodies such as the FCA, CySEC, or ASIC. This regulatory gap means that traders using Onecapital do not benefit from the investor protection schemes, compensation funds, and dispute resolution mechanisms that regulated brokers must provide. The absence of regulatory supervision also means there are no external audits of the broker's financial practices or client fund segregation policies.

Regulatory Status: Onecapital operates without regulation from any recognized financial authority, creating significant risks for traders who choose to use their services.

Deposit and Withdrawal Methods: Specific information about payment methods and processing procedures has not been disclosed in available documentation.

Minimum Deposit Requirements: The broker has not clearly specified minimum deposit amounts in publicly available information.

Bonus and Promotions: Details about promotional offers or bonus programs are not mentioned in available materials.

Trading Assets: While the platform appears to offer forex trading, the complete range of available currency pairs and other financial instruments remains unspecified.

Cost Structure: Information about spreads, commissions, overnight fees, and other trading costs has not been transparently disclosed, making it difficult for traders to assess the true cost of trading.

Leverage Options: Specific leverage ratios offered by the broker are not clearly stated in available documentation.

Platform Options: The trading platform technology and available software options have not been detailed in accessible materials.

This Onecapital review highlights the concerning lack of transparency across multiple crucial areas that traders need to evaluate before choosing a broker.

The account conditions offered by Onecapital receive a poor rating due to the significant lack of transparency regarding account types, features, and requirements. Unlike regulated brokers who must clearly disclose their account structures, Onecapital has not provided detailed information about different account tiers, minimum deposit requirements, or specific features available to traders.

The absence of clear information about account opening procedures creates uncertainty for potential clients. Regulated brokers typically offer multiple account types designed for different trader profiles, from beginners to professionals, each with specific features and requirements. Without this information being readily available, traders cannot make informed decisions about whether Onecapital's offerings match their trading needs and experience levels.

Furthermore, there is no mention of important account features such as Islamic accounts for Muslim traders, demo accounts for practice, or managed account options. The lack of detailed terms and conditions regarding account usage, maintenance fees, or inactivity charges adds to the uncertainty. This Onecapital review emphasizes that the opacity surrounding basic account information is a significant concern for potential users.

Onecapital receives an extremely poor rating for tools and resources, primarily due to the complete absence of information about trading tools, analytical resources, and educational materials. Professional forex trading requires access to comprehensive market analysis, charting tools, economic calendars, and research reports, none of which are clearly documented as being available through this broker.

The lack of information about trading tools suggests that the platform may not offer the sophisticated analytical capabilities that serious traders require. Modern forex trading platforms typically provide advanced charting packages, technical indicators, automated trading capabilities, and integration with third-party analysis tools. Without these resources, traders would be significantly disadvantaged in making informed trading decisions.

Educational resources are another critical area where information is completely lacking. Reputable brokers invest heavily in trader education through webinars, tutorials, market analysis, and trading guides. The absence of any mention of educational support suggests that Onecapital may not prioritize trader development and success, which is concerning for both novice and experienced traders seeking to improve their skills.

Customer service receives a below-average rating based on limited user feedback and the absence of clear information about support channels and availability. While some user reviews mention interactions with customer service, the overall picture suggests inconsistent service quality and limited support options compared to regulated brokers.

Professional forex brokers typically offer multiple contact methods including live chat, phone support, email assistance, and comprehensive FAQ sections. They also provide multilingual support to serve international clients effectively. The lack of detailed information about Onecapital's customer service capabilities raises questions about their commitment to client support and problem resolution.

Response times and service quality appear to be inconsistent based on available user feedback. Some traders have reported satisfactory interactions, while others express frustration with communication and support quality. The absence of 24/7 support, which is standard among reputable forex brokers due to the round-the-clock nature of forex markets, may leave traders without assistance during critical trading periods.

The trading experience with Onecapital receives a poor rating due to insufficient information about platform stability, execution quality, and overall trading environment. User feedback does not provide detailed insights into crucial aspects such as order execution speed, slippage rates, or platform reliability during high-volatility periods.

Platform functionality and user interface design are critical factors that significantly impact trading success, yet specific details about Onecapital's trading platform are not readily available. Professional traders require stable, fast, and feature-rich platforms that can handle complex trading strategies and provide real-time market data without interruption.

The absence of information about mobile trading capabilities is particularly concerning in today's trading environment where mobile functionality is essential. Most serious traders need access to their accounts and the ability to execute trades from mobile devices, especially during market-moving events. Without clear information about mobile platform availability and functionality, traders cannot assess whether the broker meets their accessibility requirements.

This Onecapital review indicates that the lack of transparency about trading conditions makes it difficult for traders to evaluate whether the platform can meet their performance expectations.

Trust and safety receive the lowest possible rating due to Onecapital's complete lack of regulatory oversight and the absence of standard investor protection measures. The broker operates without licenses from recognized financial regulatory authorities, which means traders have no access to compensation schemes, dispute resolution services, or regulatory oversight that would protect their interests.

Regulated brokers are required to segregate client funds from company operating funds, maintain adequate capital reserves, and submit to regular audits. These safeguards ensure that client money is protected even if the broker encounters financial difficulties. Onecapital's unregulated status means these protections are not in place, creating significant risks for trader deposits.

The lack of transparency about company ownership, financial statements, and operational procedures further undermines trust. Reputable brokers typically provide detailed information about their corporate structure, regulatory compliance, and risk management procedures. The absence of this information makes it impossible for traders to assess the broker's financial stability and long-term viability.

Industry reputation and third-party verification are also lacking, with no evidence of positive endorsements from recognized financial industry organizations or independent rating agencies. This combination of factors creates an extremely high-risk environment for traders considering this broker.

User experience receives a below-average rating based on mixed feedback from traders and the absence of detailed information about platform usability and customer journey optimization. While some users have provided positive ratings, the overall satisfaction level appears inconsistent, with significant concerns about various aspects of the trading experience.

The registration and account verification process lacks clear documentation, making it difficult for potential users to understand what steps are required to begin trading. Professional brokers typically provide streamlined onboarding processes with clear timelines and requirements for account opening and verification.

User interface design and platform navigation are crucial for trading efficiency, yet specific details about Onecapital's platform design and user experience optimization are not available. Modern trading platforms should offer intuitive interfaces, customizable layouts, and efficient order management systems that enhance rather than hinder trading performance.

The absence of user feedback about deposit and withdrawal experiences is concerning, as smooth fund management is essential for trader satisfaction. Common user complaints and the broker's responsiveness to feedback are not well documented, making it difficult to assess how effectively the company addresses user concerns and implements improvements based on client input.

This comprehensive Onecapital review reveals significant concerns about the broker's suitability for most traders. The complete absence of regulatory oversight, combined with limited transparency about essential trading conditions, creates an extremely high-risk environment that is unsuitable for risk-averse investors.

While some users have reported positive experiences, the overall evaluation indicates that Onecapital lacks the fundamental safeguards and professional standards expected from a reputable forex broker. The platform may only be appropriate for traders who fully understand and accept the substantial risks associated with using an unregulated broker, though even experienced traders would likely find better options among properly licensed alternatives.

The main advantages appear to be limited to some positive user feedback, while the disadvantages include lack of regulation, limited transparency, and absence of investor protections that are standard in the industry.

FX Broker Capital Trading Markets Review