Is Loyal Brokers safe?

Business

License

Is Loyal Brokers Safe or Scam?

Introduction

Loyal Brokers is a relatively new player in the forex market, claiming to provide a wide range of trading instruments and services to both novice and experienced traders. As the financial landscape continues to evolve, the importance of due diligence cannot be overstated. Traders must exercise caution when selecting a broker, as the potential risks associated with unregulated or poorly regulated firms can lead to significant financial losses. This article aims to provide a comprehensive analysis of Loyal Brokers, focusing on its regulatory status, company background, trading conditions, customer experience, and overall safety. The evaluation will be based on various credible sources, including user reviews and expert analyses, to determine whether Loyal Brokers is safe or potentially a scam.

Regulation and Legitimacy

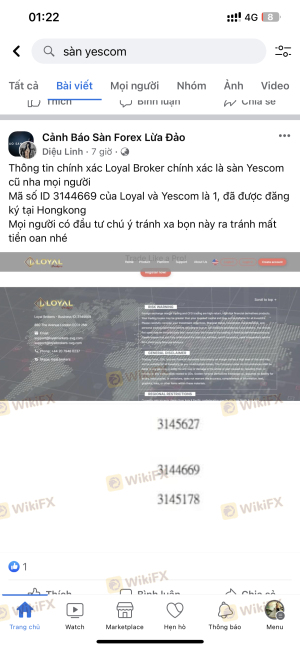

One of the most critical aspects to consider when evaluating any forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to strict operational standards and protect clients' funds. Unfortunately, Loyal Brokers operates without any valid regulatory oversight, which raises serious concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of a regulatory license means that Loyal Brokers is not subject to the stringent rules and oversight that reputable regulatory bodies enforce. This lack of regulation can lead to questionable practices, including the potential misuse of client funds. Furthermore, the broker does not appear on any official warning lists, but this does not mitigate the risks associated with trading through an unregulated entity. Traders should be particularly wary, as the absence of oversight can lead to severe consequences, especially in the event of disputes or withdrawal issues.

Company Background Investigation

Loyal Brokers was established in 2022 and operates out of Montenegro, a jurisdiction known for its lenient regulatory environment. The company claims to offer a variety of trading services, including forex, CFDs, and commodities. However, the lack of transparency regarding its ownership structure and management team is concerning.

The absence of publicly available information about the company's founders and key personnel makes it difficult to assess their qualifications and experience in the financial sector. A well-established broker typically discloses its management team's credentials, which enhances trust and credibility. In the case of Loyal Brokers, the lack of information raises red flags about its transparency and operational integrity.

Moreover, the company's website lacks detailed disclosures regarding its history, operational practices, and any affiliations with recognized financial institutions. This opacity further complicates the assessment of whether Loyal Brokers is safe for traders. Without a clear understanding of the company's background, potential clients are left in the dark regarding the reliability and trustworthiness of this broker.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is crucial. Loyal Brokers offers various trading instruments, including major currency pairs, commodities, and indices. However, the specifics regarding trading costs, such as spreads and commissions, are not transparently disclosed on their website.

| Cost Type | Loyal Brokers | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5%-2% |

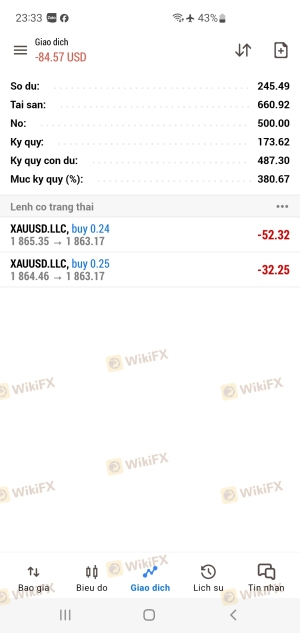

The lack of clear information on trading costs can be indicative of a broker that may impose hidden fees or unfavorable trading conditions. Traders often rely on transparent fee structures to make informed decisions, and the ambiguity surrounding Loyal Brokers' costs could lead to unexpected expenses. Furthermore, the broker's leverage offerings, which can go as high as 1:500, are concerning, especially given that higher leverage increases the risk of significant financial losses.

Client Fund Safety

The safety of client funds is a paramount concern for traders. Loyal Brokers does not provide adequate information regarding its fund protection measures. The absence of a compensation scheme or investor protection policies is particularly alarming.

Traders should always look for brokers that offer segregated accounts, ensuring that client funds are kept separate from the broker's operating capital. Furthermore, the lack of negative balance protection means that traders could potentially lose more than their initial investment, which is a significant risk factor.

Historically, unregulated brokers have been involved in various fund safety controversies, leading to financial losses for clients. While there are no specific reports of fund mismanagement at Loyal Brokers, the lack of transparency regarding their safety measures raises concerns about whether Loyal Brokers is safe for trading.

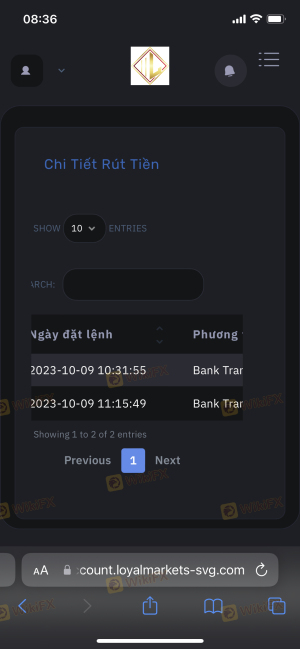

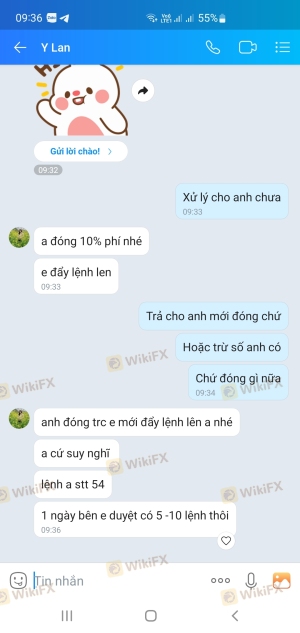

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. Reviews of Loyal Brokers reveal a mixed bag of experiences, with some users reporting difficulties in withdrawing funds and receiving inadequate customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Average |

Common complaints include delayed withdrawal requests and unresponsive customer service. These issues are particularly concerning for any trader, as timely access to funds is essential for maintaining liquidity and managing risk. For instance, one user reported being unable to withdraw their funds despite multiple requests, highlighting potential operational inefficiencies or even malicious practices.

Platform and Execution

The trading platform offered by Loyal Brokers is MetaTrader 5 (MT5), which is widely regarded for its advanced features and user-friendly interface. However, the overall performance and execution quality of the platform are critical factors to assess.

Traders have reported mixed experiences with order execution, with some noting instances of slippage and rejected orders. Such issues can significantly impact trading outcomes, especially in volatile market conditions. Moreover, the lack of transparency regarding the broker's execution policies raises questions about potential manipulation or unfair practices.

Risk Assessment

Trading with Loyal Brokers comes with inherent risks due to its unregulated status and unclear operational practices.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation, high potential for fraud. |

| Financial Risk | High | Lack of fund protection and transparency. |

| Operational Risk | Medium | Complaints regarding withdrawals and support. |

To mitigate these risks, traders should conduct thorough research before engaging with Loyal Brokers. It's advisable to start with a demo account, if available, to test the platform and assess its reliability without risking real funds.

Conclusion and Recommendations

In conclusion, the evidence suggests that Loyal Brokers is not a safe option for traders. The absence of regulation, lack of transparency, and reported issues with customer service and fund withdrawals raise significant red flags. Traders should exercise extreme caution and consider alternative options that offer robust regulatory oversight and transparent trading conditions.

For those seeking reliable forex trading experiences, it is recommended to consider brokers regulated by top-tier authorities, such as the FCA, ASIC, or NFA. These brokers typically provide a safer trading environment, better customer support, and more transparent fee structures.

Is Loyal Brokers a scam, or is it legit?

The latest exposure and evaluation content of Loyal Brokers brokers.

Loyal Brokers Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Loyal Brokers latest industry rating score is 1.39, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.39 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.