LEX Markets 2025 Review: Everything You Need to Know

Executive Summary

LEX Markets stands out as a specialized commercial real estate investing platform. It makes property investments easier through fractional ownership. This lex review reveals a platform designed to break down traditional barriers in commercial real estate investing, offering entry points as low as $100 compared to conventional real estate investments requiring tens of thousands of dollars. The platform works as a middleman between investors and real estate firms seeking to sell stakes in individual commercial properties.

LEX Markets enables trading in individual pieces of commercial real estate properties with securities sales arranged in increments as small as $100. This new approach targets beginner investors and those with limited capital who traditionally couldn't access commercial real estate markets. The platform makes money by charging property owners listing fees while providing investors with opportunities to buy and trade property stakes. However, specific regulatory information and detailed operational procedures remain limited in available documentation.

Important Notice

This review is based on available information from multiple sources. Readers should note that regulatory details and specific operational procedures may vary by jurisdiction. LEX Markets appears to focus primarily on commercial real estate investments, which differ significantly from traditional forex or securities trading platforms. Potential investors should verify current regulatory status, fees, and platform features directly with LEX Markets before making investment decisions. The commercial real estate investment landscape continues evolving rapidly.

Rating Overview

Broker Overview

LEX Markets represents a new generation of investment platforms specifically targeting commercial real estate opportunities. The platform's core business model centers on fractional real estate investing. This allows multiple investors to purchase stakes in individual commercial properties. Unlike traditional real estate investment trusts or direct property ownership, LEX Markets facilitates direct investment in specific commercial properties through a digital marketplace approach.

The platform serves as a crucial middleman connecting property owners seeking capital with investors looking for real estate exposure. Property owners pay listing fees to showcase their investment opportunities on the platform, while investors can browse, analyze, and purchase fractional ownership stakes. This model addresses longstanding accessibility issues in commercial real estate investing, where high minimum investments and complex processes traditionally excluded smaller investors.

LEX Markets enables trading functionality beyond initial purchases. This allows investors to buy and sell their property stakes on the platform's secondary market. This liquidity feature distinguishes it from traditional real estate investments, which typically require lengthy holding periods and complex exit processes. The platform's focus on commercial properties rather than residential real estate also positions it uniquely in the fractional ownership space, targeting potentially higher-yield investment opportunities.

Regulatory Status: Specific regulatory information for LEX Markets is not detailed in available sources. This raises important considerations for potential investors regarding oversight and investor protection measures.

Deposit and Withdrawal Methods: Available documentation does not specify the exact payment methods, processing times, or withdrawal procedures supported by the platform.

Minimum Deposit Requirements: LEX Markets offers entry points starting at $100 according to some sources, while others indicate $250 minimum investments. This makes it accessible compared to traditional commercial real estate investments.

Bonuses and Promotions: No specific promotional offers or bonus programs are mentioned in available information about LEX Markets.

Tradeable Assets: The platform exclusively focuses on commercial real estate properties. It offers fractional ownership stakes in individual properties rather than diversified real estate portfolios.

Fee Structure: While property owners pay listing fees, the complete fee structure for investors, including transaction costs, management fees, and potential exit fees, is not comprehensively detailed in available sources.

Leverage Options: Traditional leverage mechanisms are not mentioned in available LEX Markets documentation. Real estate fractional ownership typically operates on cash investment basis.

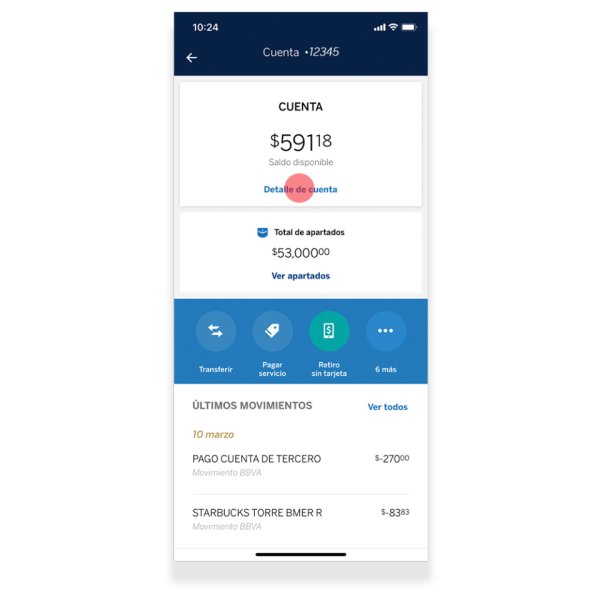

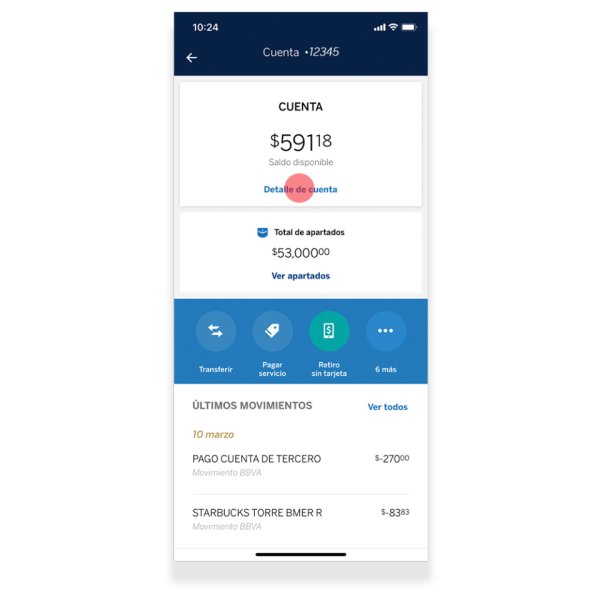

Platform Options: Specific trading platform details, mobile applications, or web-based interface features are not extensively covered in available materials.

Geographic Restrictions: Available sources do not specify geographic limitations or international availability of LEX Markets services.

Customer Support Languages: Language support options for customer service are not specified in available documentation.

This comprehensive lex review continues with detailed analysis of each rating category. It provides investors with thorough insights into the platform's capabilities and limitations.

Account Conditions Analysis

LEX Markets' account structure reflects its specialized focus on commercial real estate investing rather than traditional trading accounts. The platform's most notable feature is its low barrier to entry, with minimum investments starting at $100 to $250 depending on specific property offerings. This accessibility represents a significant departure from traditional commercial real estate investing. Traditional minimum investments often range from $5,000 to $25,000 or higher.

The account opening process appears streamlined for real estate investing. However, specific verification requirements, documentation needs, and approval timeframes are not detailed in available sources. Unlike forex or stock trading platforms that offer multiple account tiers with varying features, LEX Markets appears to operate on a more uniform access model where all investors can participate in available property offerings subject to minimum investment requirements.

Account funding mechanisms and withdrawal procedures remain unclear from available documentation. This could impact user experience and liquidity management. The platform's focus on fractional real estate ownership means account holders receive stakes in specific properties rather than traditional trading balances, fundamentally changing how investors interact with their holdings.

The absence of detailed information about account management features, portfolio tracking tools, or performance reporting capabilities in this lex review highlights potential areas. Prospective investors should seek clarification directly from the platform before committing funds.

LEX Markets' tool suite appears tailored specifically for real estate investment analysis rather than traditional trading tools. The platform likely provides property-specific information including financial performance data, location details, tenant information, and projected returns for each available investment opportunity. However, comprehensive details about analytical tools, market research resources, or investment calculators are not extensively documented in available sources.

Educational resources for commercial real estate investing, market analysis reports, or investment guidance materials are not specifically mentioned in available information. This gap could be significant for beginner investors who need foundational knowledge about commercial real estate investing, property valuation methods, and market dynamics.

The platform's research capabilities, due diligence support, and property vetting processes remain unclear from available documentation. Commercial real estate investing typically requires extensive property analysis, market research, and financial modeling. However, specific tools supporting these activities are not detailed in current sources.

Technology infrastructure supporting the platform, including mobile accessibility, real-time updates, and portfolio management features, also lacks detailed coverage in available materials. The absence of comprehensive tool descriptions suggests potential investors should thoroughly evaluate platform capabilities before committing to investments.

Customer Service and Support Analysis

Customer service information for LEX Markets is notably limited in available documentation. This presents concerns for potential investors who require reliable support for their real estate investments. Available sources do not specify customer service channels, availability hours, response time expectations, or support quality metrics.

The complexity of commercial real estate investing typically requires knowledgeable customer support capable of addressing property-specific questions, investment procedures, and account management issues. However, details about support team expertise, escalation procedures, or specialized assistance for real estate investment queries are not available in current documentation.

Communication channels such as phone support, email assistance, live chat availability, or help desk systems are not specified in available sources. This information gap is particularly concerning for an investment platform where investors may need timely assistance with significant financial decisions.

Multilingual support capabilities, international customer assistance, and time zone coverage also remain unspecified. The lack of comprehensive customer service information in this review suggests potential investors should prioritize evaluating support quality and availability before platform engagement.

Trading Experience Analysis

The trading experience on LEX Markets differs fundamentally from traditional financial markets due to its focus on real estate fractional ownership. Instead of rapid-fire trading of stocks or currencies, the platform facilitates longer-term real estate investments with secondary market trading capabilities for liquidity.

Platform stability and performance metrics are not detailed in available sources. Real estate investing platforms typically experience different technical requirements compared to high-frequency trading systems. Order execution for real estate stakes likely involves different processes and timeframes compared to traditional securities trading.

The user interface design, navigation efficiency, and investment process workflow are not comprehensively described in available documentation. Commercial real estate investing requires clear presentation of complex property information, financial data, and legal documentation. This makes interface design crucial for user experience.

Mobile platform availability and functionality remain unclear from available sources. Modern investors increasingly expect mobile access for portfolio monitoring and investment management. The secondary market trading functionality, which allows investors to sell their property stakes, represents a key differentiator but lacks detailed operational descriptions.

This lex review notes that the overall trading experience evaluation is limited by insufficient technical and operational details in available documentation. This emphasizes the need for direct platform evaluation by prospective investors.

Trust and Reliability Analysis

Trust and reliability represent significant concerns in this LEX Markets evaluation due to limited regulatory information and transparency details in available sources. The absence of specific regulatory oversight details, licensing information, or compliance frameworks raises important questions about investor protection and platform accountability.

Fund security measures, segregation of client assets, and protection protocols are not detailed in available documentation. Commercial real estate investing involves substantial sums and extended holding periods. This makes robust security measures and clear asset protection policies essential for investor confidence.

Company transparency regarding ownership, management team, operational history, and financial stability is not comprehensively covered in available sources. Established track records, industry certifications, and third-party audits would typically support platform credibility but are not specified in current documentation.

Regulatory compliance, dispute resolution mechanisms, and investor protection measures remain unclear from available information. The platform's handling of potential conflicts, property performance issues, or liquidity challenges also lacks detailed coverage. This represents significant considerations for potential investors.

The limited transparency and regulatory information significantly impact the trust assessment in this review. This highlights the critical importance of thorough due diligence before platform engagement.

User Experience Analysis

User experience evaluation for LEX Markets is constrained by limited detailed information about platform interface, functionality, and user feedback in available sources. The platform's focus on commercial real estate investing suggests a different user experience paradigm compared to traditional trading platforms. It emphasizes property research, investment analysis, and portfolio monitoring over rapid trading activities.

The investment process workflow, from property discovery through purchase completion, is not comprehensively detailed in available documentation. Commercial real estate investing typically involves extensive due diligence, document review, and decision-making processes that require intuitive platform design and clear information presentation.

Portfolio management features, performance tracking capabilities, and reporting tools are not specifically described in available sources. Investors typically require comprehensive dashboards showing property performance, income distributions, and overall portfolio metrics for effective investment management.

Registration and verification processes, account setup procedures, and initial user onboarding are not detailed in current documentation. The complexity of real estate investing often requires thorough user education and guided setup processes to ensure investor understanding and compliance.

User satisfaction indicators, common user complaints, or platform improvement initiatives are not available in current sources. This limits comprehensive user experience assessment. The platform's target audience of beginner real estate investors would particularly benefit from user-friendly design and comprehensive support resources.

Conclusion

This comprehensive lex review reveals LEX Markets as an innovative platform democratizing commercial real estate investing through fractional ownership opportunities. The platform's primary strength lies in its low minimum investment requirements of $100-$250. This makes commercial real estate accessible to smaller investors traditionally excluded from this market segment.

However, significant information gaps regarding regulatory oversight, detailed operational procedures, customer support quality, and platform features limit comprehensive evaluation. The absence of specific regulatory details, fee structures, and user experience information represents notable concerns for potential investors seeking transparency and reliability.

LEX Markets appears most suitable for beginner investors interested in commercial real estate exposure with limited capital requirements. The platform's secondary market trading functionality provides liquidity advantages over traditional real estate investments. However, operational details require further clarification.

Prospective investors should prioritize direct platform evaluation, regulatory verification, and comprehensive fee disclosure before committing funds. While the fractional real estate concept shows promise, the limited available information emphasizes the importance of thorough due diligence and direct communication with LEX Markets representatives to address the gaps identified in this review.