LeoPrime Review 2025: Everything You Need to Know

Executive Summary

LeoPrime presents itself as an online forex broker offering trading services to both retail and institutional clients. This leoprime review reveals a mixed picture of a broker that combines attractive trading conditions with concerning operational issues. The broker operates under regulatory oversight from the Vanuatu Financial Services Commission and the Financial Services Authority of Seychelles. This provides a basic level of regulatory compliance.

Key highlights include competitive leverage ratios up to 1:1000 and a diverse range of tradeable assets spanning forex, cryptocurrencies, indices, precious metals, and energy commodities. The platform supports both MetaTrader 4 and MetaTrader 5. These industry-standard platforms cater to traders who prefer established trading environments. With a minimum deposit requirement of just $10 USD, LeoPrime positions itself as accessible to novice traders.

However, user feedback reveals significant concerns regarding customer service responsiveness and withdrawal processing times. Multiple reports indicate slow customer support responses. Users also report difficulties in contacting support representatives when issues arise. These operational challenges impact the overall trading experience and raise questions about the broker's ability to provide reliable service during critical trading situations.

Important Notice

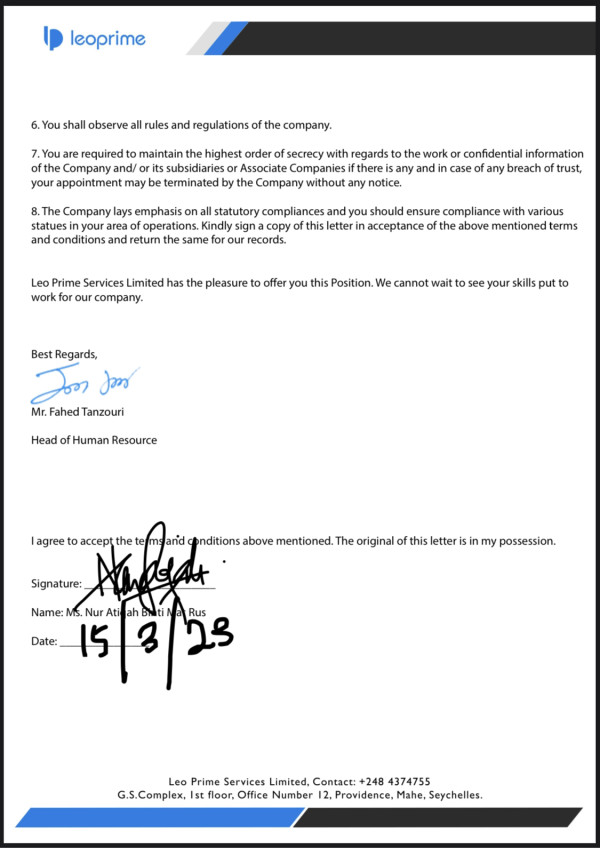

This evaluation is based on available market data, regulatory information, and user feedback collected from multiple sources. Readers should note that different regulatory entities may provide varying levels of investor protection and service standards. LeoPrime operates under VFSC and FSA regulation. The specific protections available may differ based on your jurisdiction and the regulatory framework governing your trading relationship with the broker.

Our assessment methodology incorporates direct user testimonials, regulatory filing analysis, and comparative market research to provide a comprehensive evaluation. All information presented reflects the most current data available at the time of publication. Trading conditions and broker policies may change over time.

Rating Framework

Broker Overview

LeoPrime operates as an online forex and CFD broker providing trading services across multiple asset classes. The company focuses on delivering trading solutions to both individual retail traders and institutional clients through established trading platforms. While specific founding details were not clearly specified in available documentation, the broker has established itself in the competitive online trading space. It offers high leverage ratios and comprehensive market access.

The broker's business model centers on providing market access through popular trading platforms while maintaining competitive trading conditions. LeoPrime emphasizes its commitment to serving diverse trading needs. The company achieves this through flexible account structures and comprehensive market coverage. The company positions itself as a bridge between traders and global financial markets. This facilitates access to various trading opportunities.

LeoPrime's platform infrastructure supports MetaTrader 4 and MetaTrader 5, two of the most widely recognized trading platforms in the industry. The broker offers access to multiple asset classes including foreign exchange pairs, cryptocurrency markets, stock indices, precious metals, and energy commodities. Regulatory oversight comes from the Vanuatu Financial Services Commission and the Financial Services Authority of Seychelles. This provides the broker with legal authorization to offer financial services in multiple jurisdictions.

Regulatory Status: LeoPrime operates under dual regulatory oversight from the Vanuatu Financial Services Commission and the Financial Services Authority of Seychelles. These regulatory frameworks provide basic investor protections and operational standards.

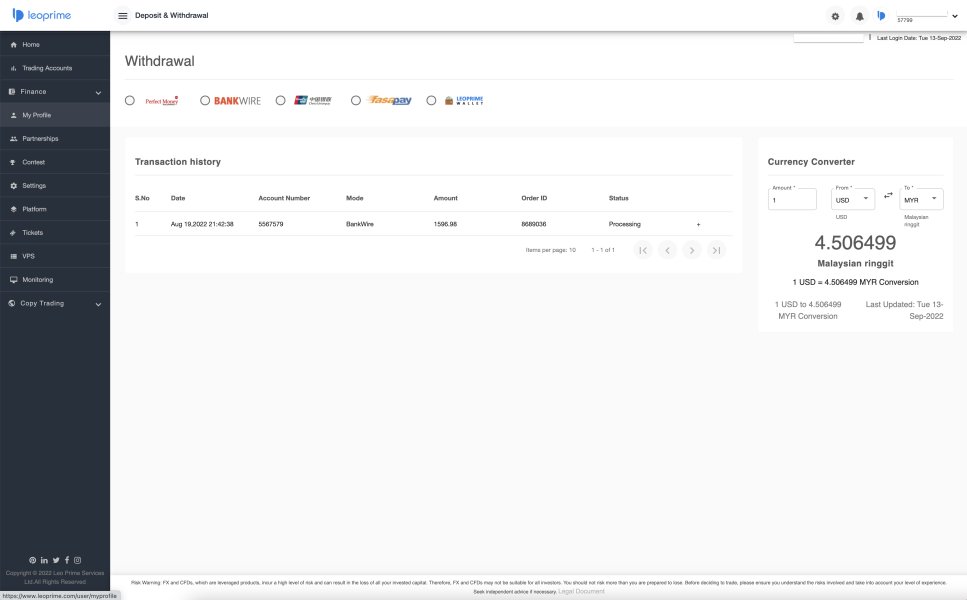

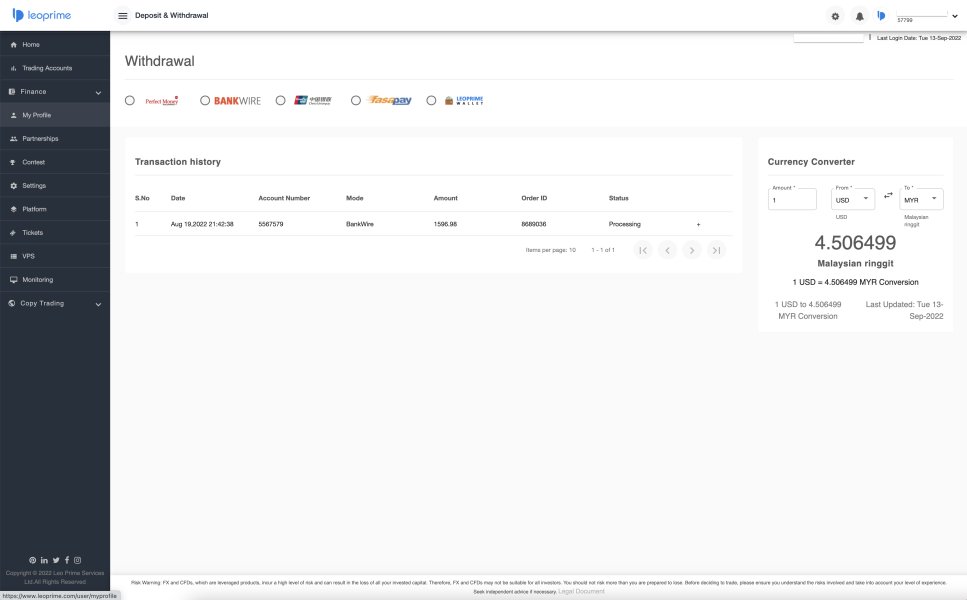

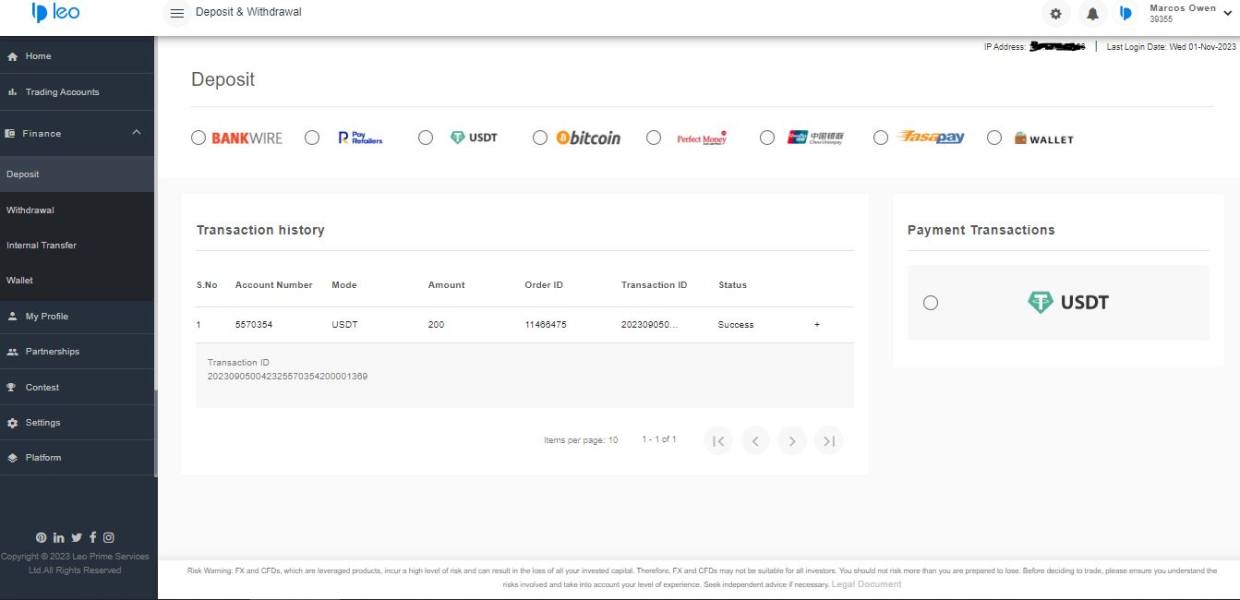

Deposit and Withdrawal Methods: Specific funding methods were not detailed in available documentation. The broker supports various payment options for client convenience.

Minimum Deposit Requirements: The broker maintains an accessible $10 USD minimum deposit requirement. This makes it particularly attractive for new traders testing the platform.

Promotional Offers: Current bonus and promotional structures were not specified in available materials.

Trading Assets: LeoPrime provides access to forex currency pairs, cryptocurrency markets, stock indices, precious metals including gold and silver, and energy commodities such as oil and gas.

Cost Structure: Detailed information regarding spreads, commissions, and other trading costs was not comprehensively outlined in available documentation.

Leverage Options: The broker offers maximum leverage ratios up to 1:1000. This provides significant capital amplification opportunities for qualified traders.

Platform Selection: Trading is facilitated through MetaTrader 4 and MetaTrader 5 platforms. These support both manual trading and automated trading strategies.

Geographic Restrictions: Specific regional limitations were not detailed in available materials.

Customer Support Languages: Multi-language support capabilities were not specified in current documentation.

This leoprime review continues with detailed analysis of each evaluation criterion. It provides comprehensive insights into the broker's performance across all key areas.

Account Conditions Analysis

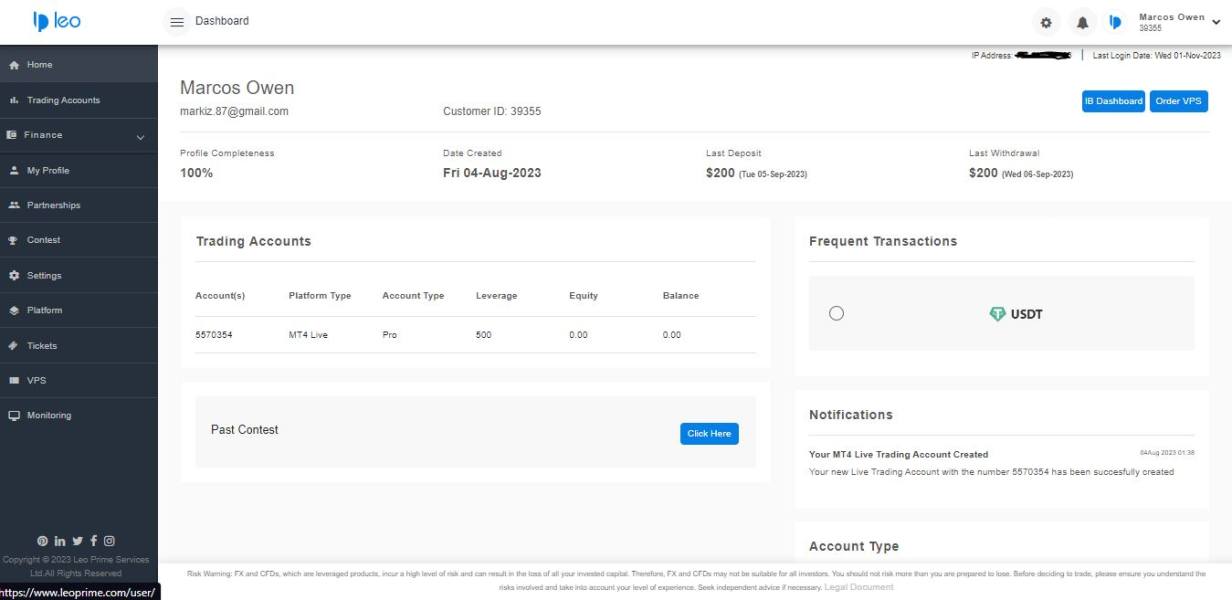

LeoPrime's account structure demonstrates a commitment to accessibility with its $10 USD minimum deposit requirement, positioning it among the more approachable brokers for new traders entering the forex market. This low barrier to entry allows traders to test the platform and services without significant financial commitment. This is particularly valuable for those uncertain about their trading approach or the broker's suitability.

However, detailed information about specific account types and their distinctive features was not comprehensively available in current documentation. This lack of transparency regarding account tier differences, special features, or graduated benefits based on deposit levels represents a significant information gap. Potential clients may find this concerning when making broker selection decisions.

The account opening process specifics were not detailed in available materials. This makes it difficult to assess the efficiency and user-friendliness of the onboarding experience. Additionally, information about specialized account options such as Islamic accounts for traders requiring Sharia-compliant trading conditions was not specified.

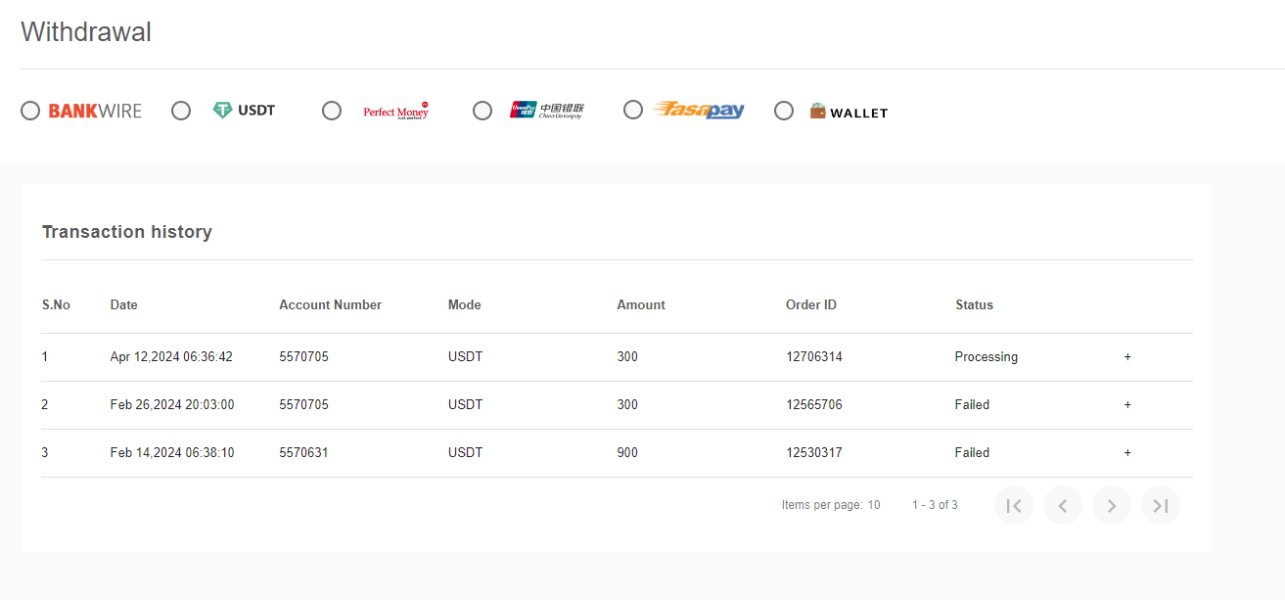

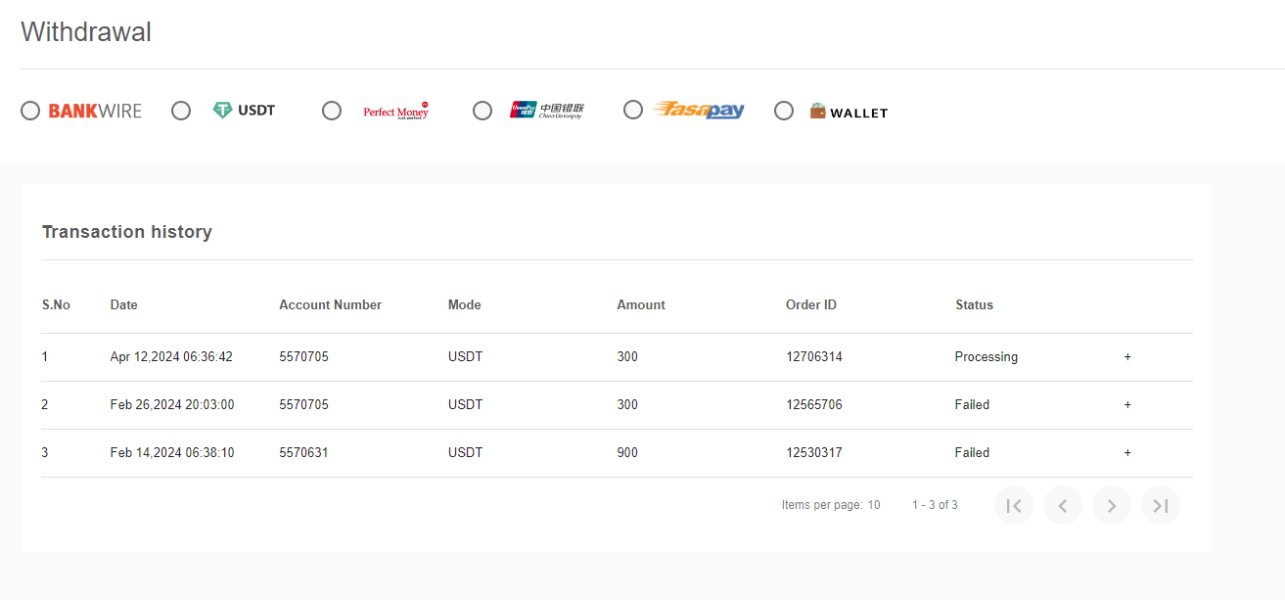

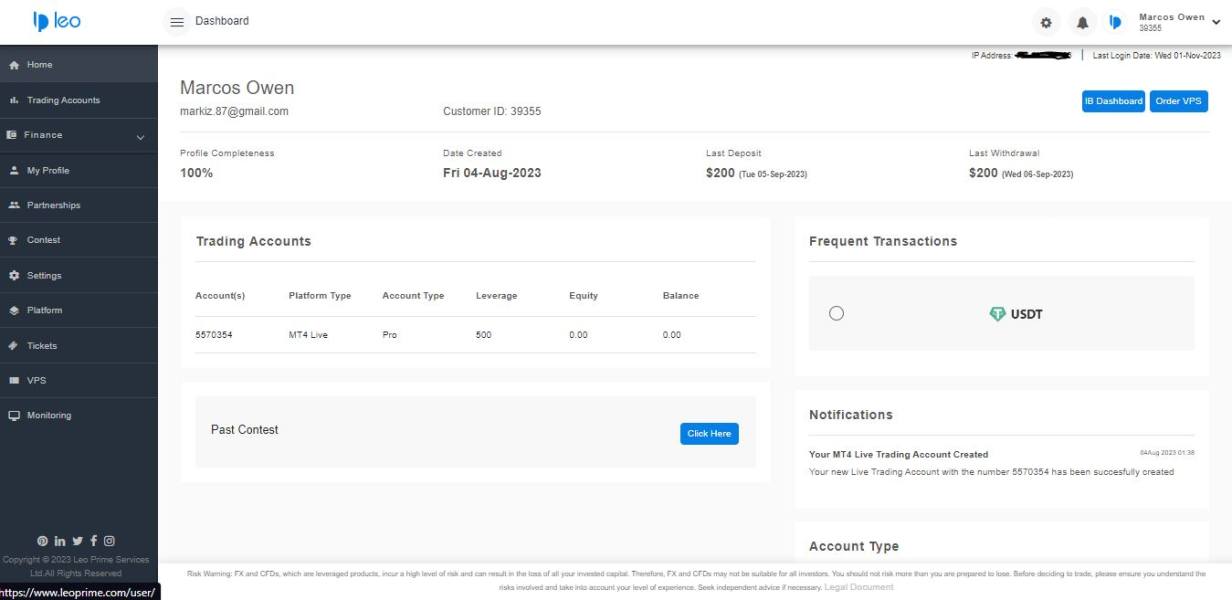

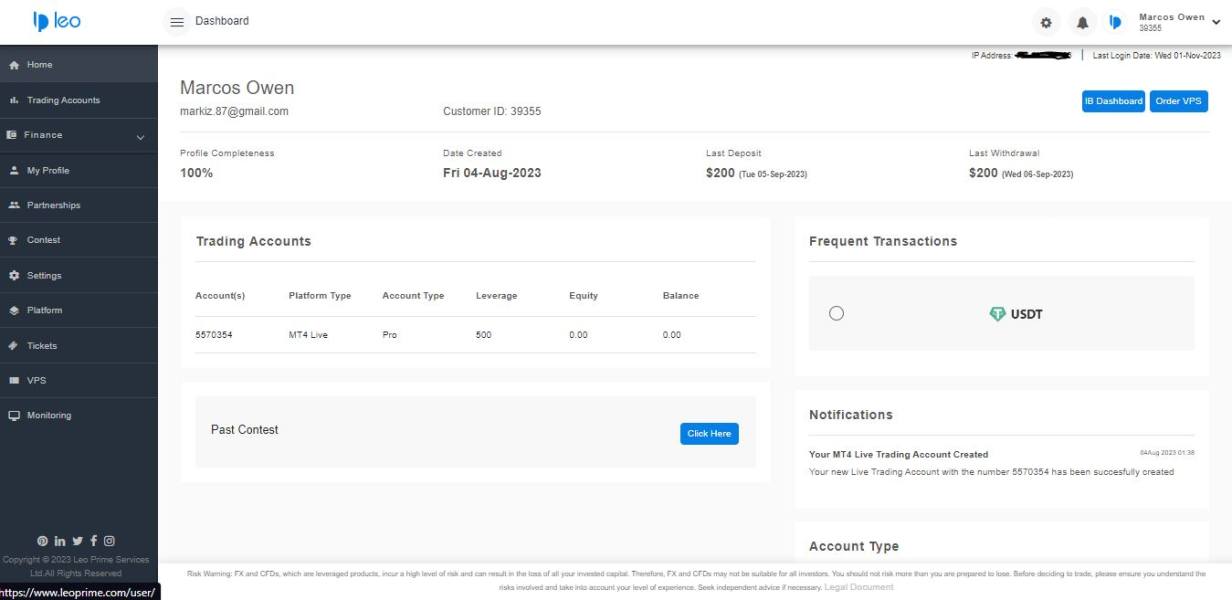

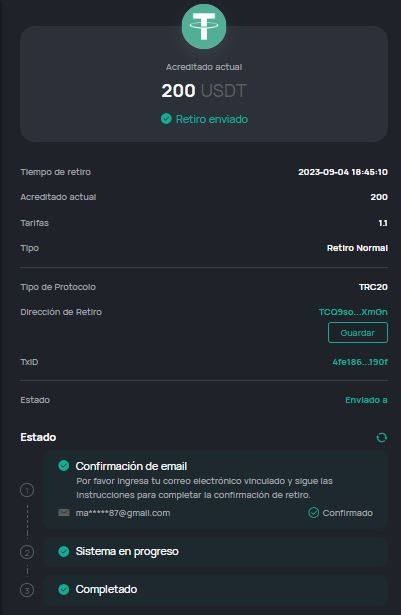

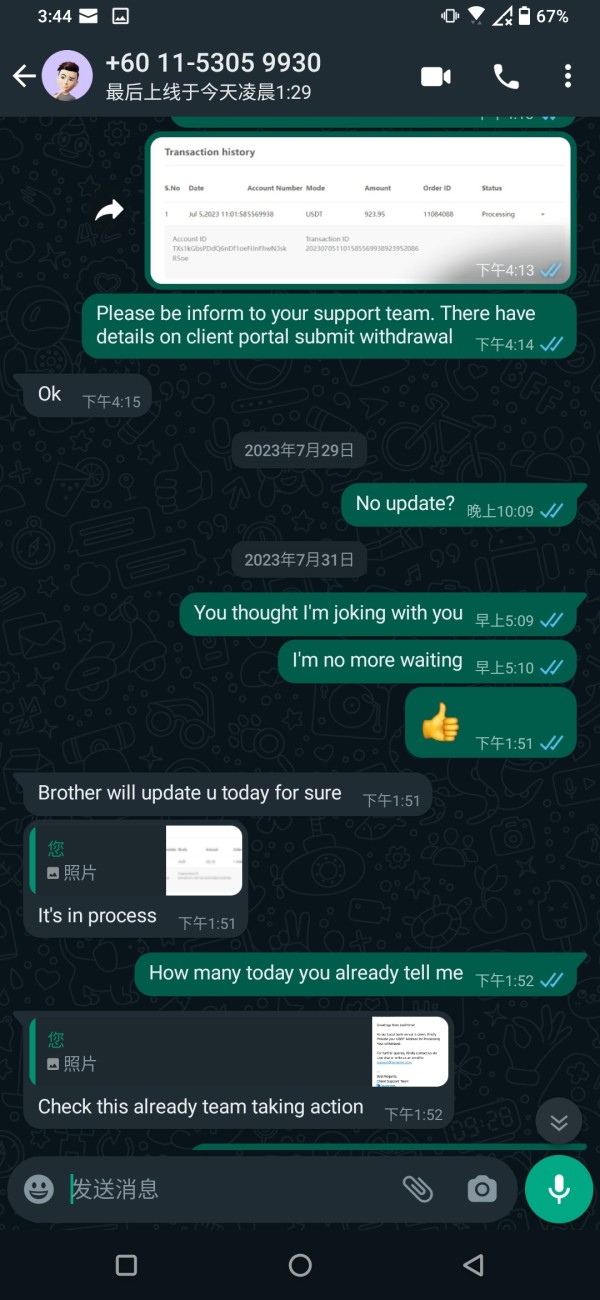

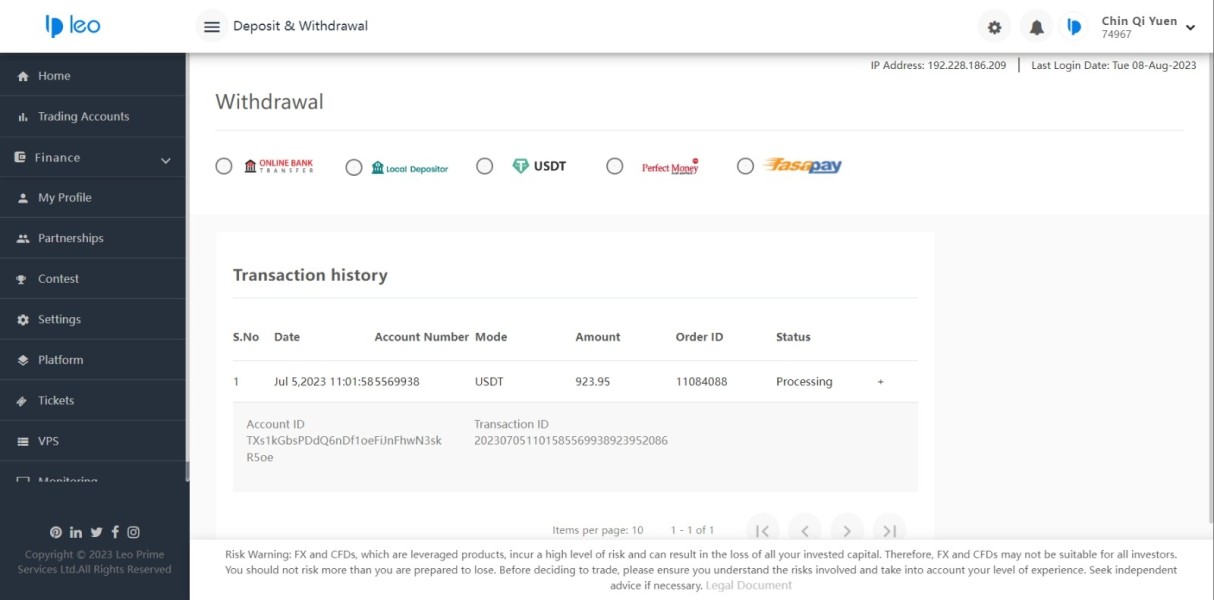

User feedback regarding account management reveals mixed experiences, with particular concerns raised about withdrawal processing times and account maintenance issues. Some traders report difficulties in accessing their funds promptly. This significantly impacts the overall account experience regardless of favorable initial deposit requirements.

The absence of detailed account feature information in this leoprime review reflects the broker's limited transparency in communicating account benefits and structures to potential clients. This may influence trader confidence in the platform's professional standards.

LeoPrime demonstrates strength in platform provision by supporting both MetaTrader 4 and MetaTrader 5, two industry-standard platforms that provide comprehensive trading functionality. These platforms offer advanced charting capabilities, technical analysis tools, and support for automated trading through Expert Advisors. This meets the needs of both manual and algorithmic traders.

The broker's asset diversity represents another significant strength, offering access to forex currency pairs, cryptocurrency markets, stock indices, precious metals, and energy commodities. This comprehensive market coverage allows traders to diversify their portfolios and pursue various trading strategies across different asset classes. Traders can accomplish this without requiring multiple broker relationships.

Support for scalping strategies and automated trading enhances the platform's appeal to active traders and those employing sophisticated trading methodologies. The MetaTrader platforms' robust functionality supports complex trading strategies. They also provide the technical infrastructure necessary for professional-level trading activities.

However, information regarding additional research and analysis resources was not detailed in available documentation. Educational materials, market analysis reports, economic calendars, and other value-added resources that many traders consider essential for informed decision-making were not comprehensively outlined.

The absence of detailed information about proprietary trading tools, research capabilities, or educational resources represents a notable gap in the broker's service offering transparency. Professional traders often require comprehensive market analysis and educational support. The lack of clear information about these resources may impact the platform's attractiveness to serious market participants.

Customer Service and Support Analysis

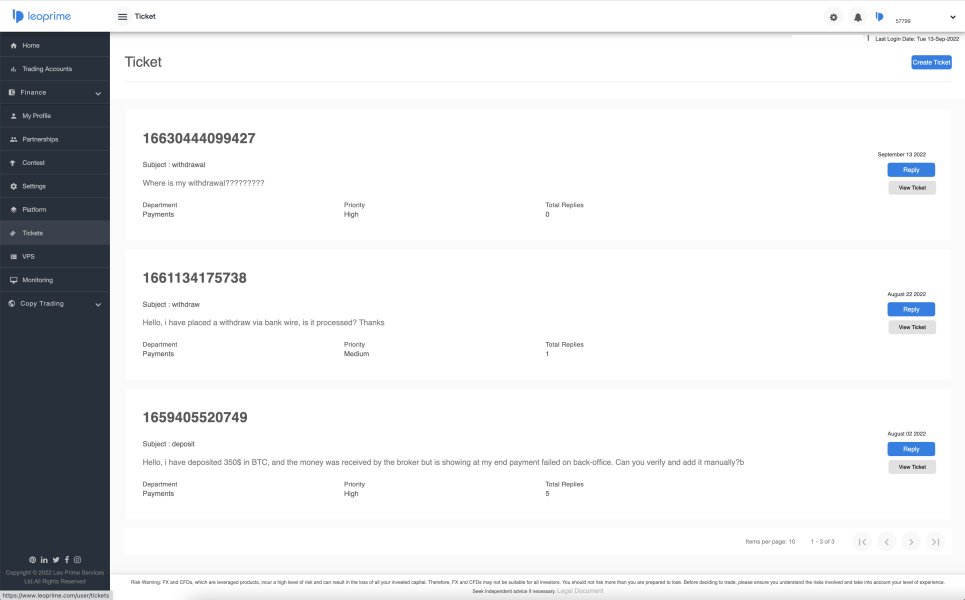

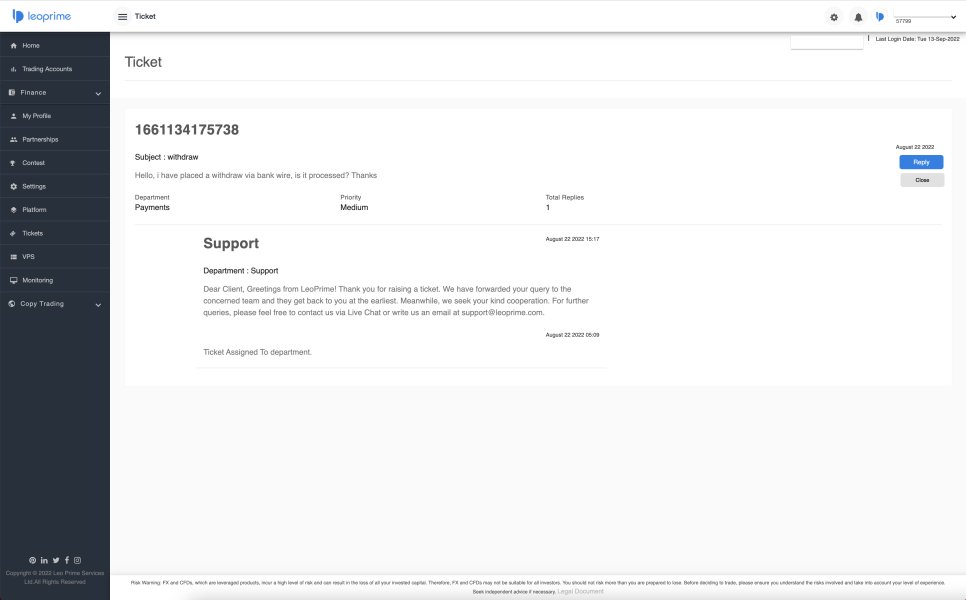

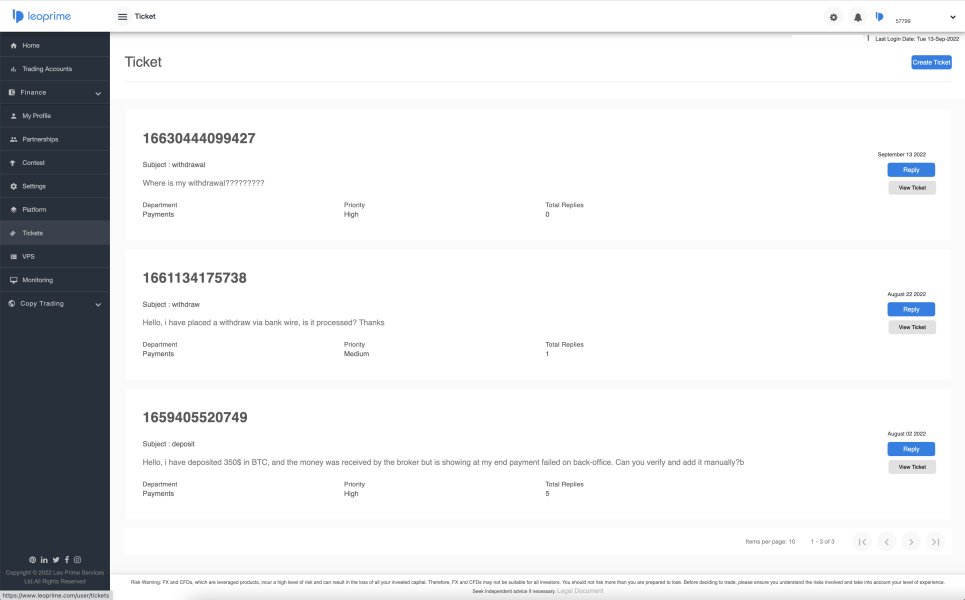

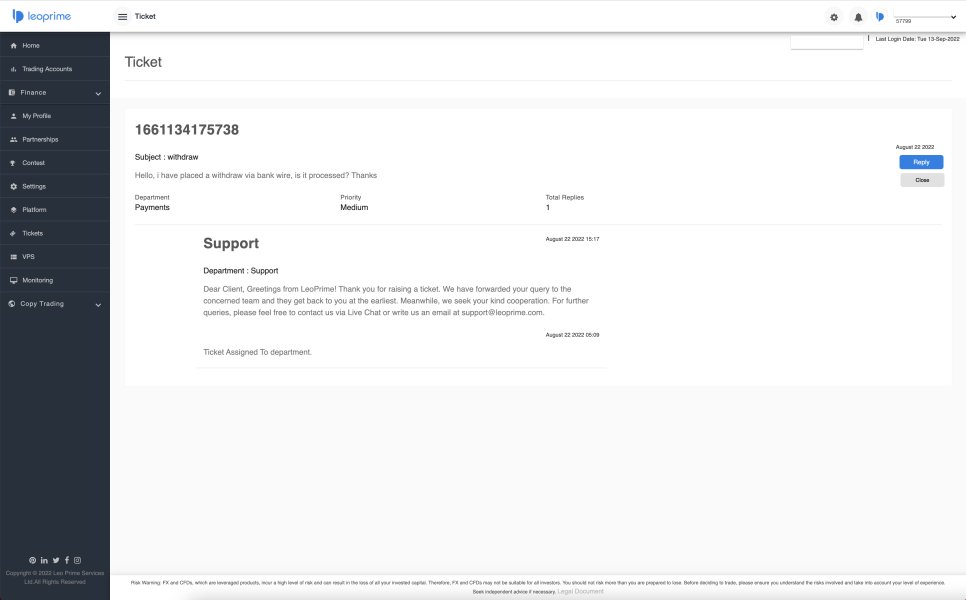

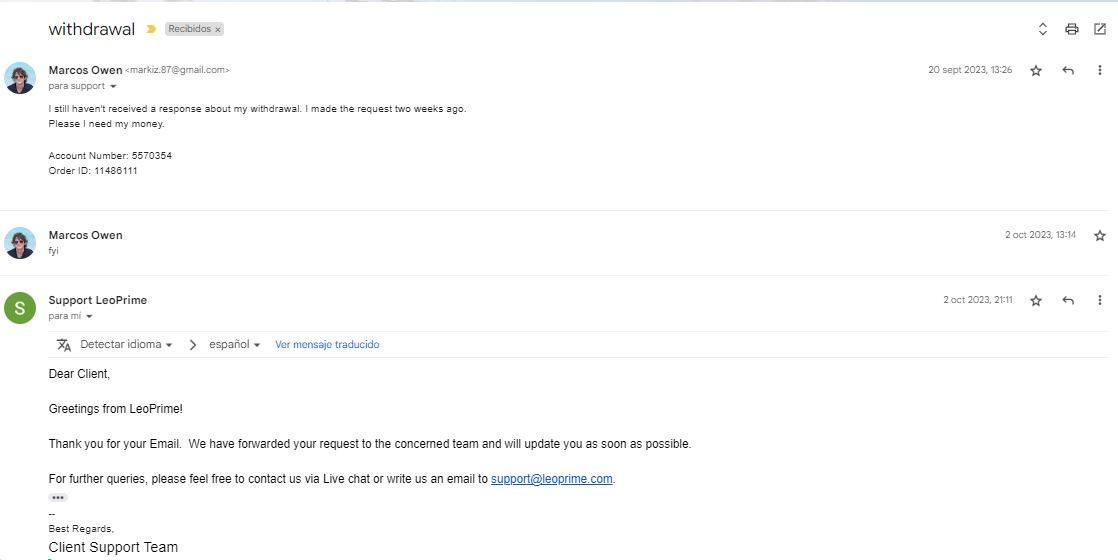

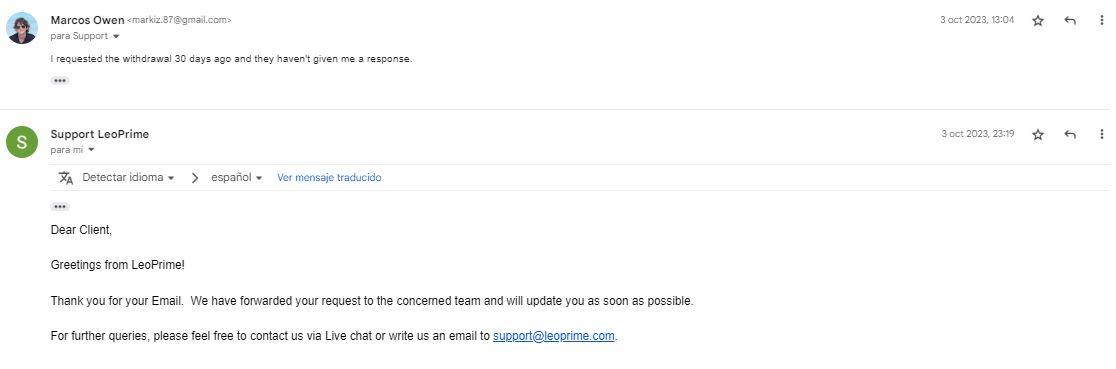

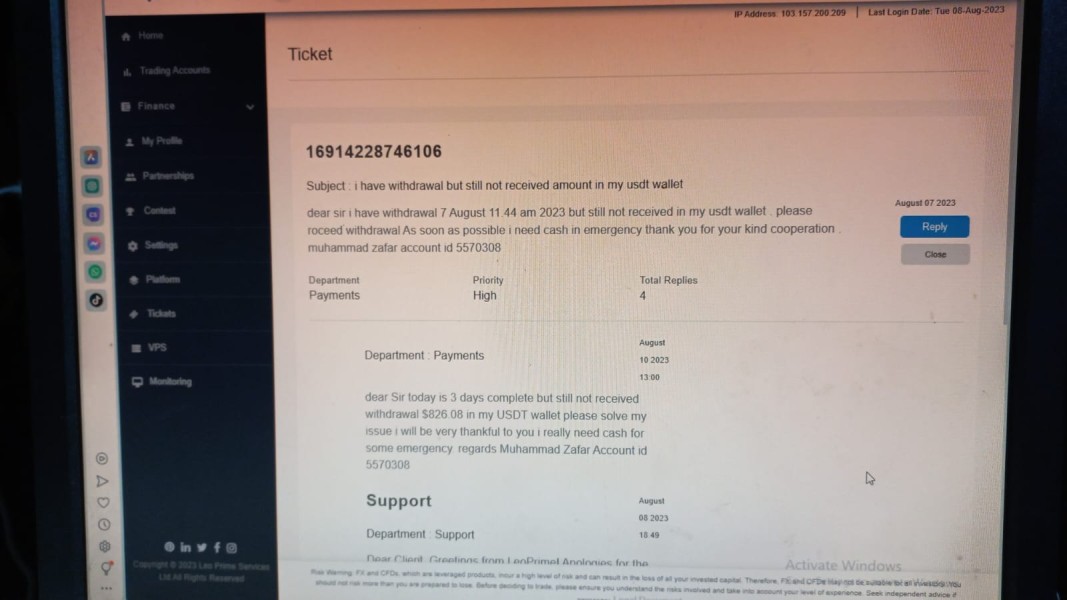

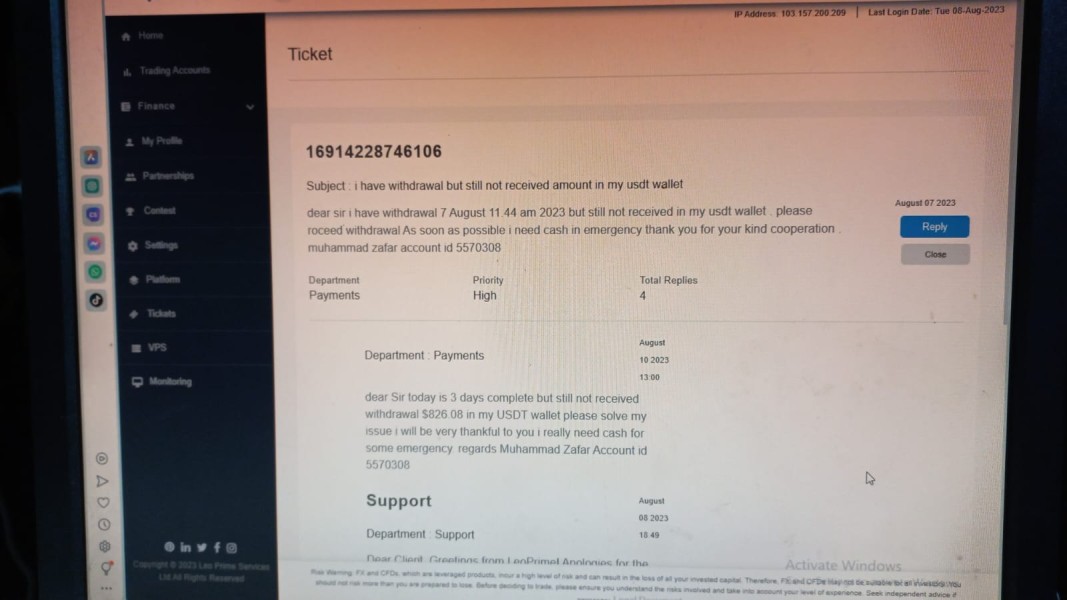

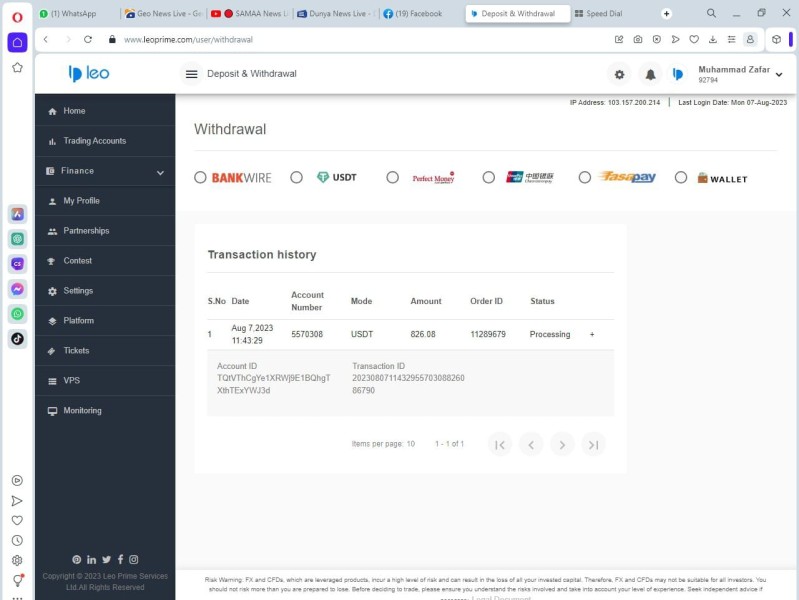

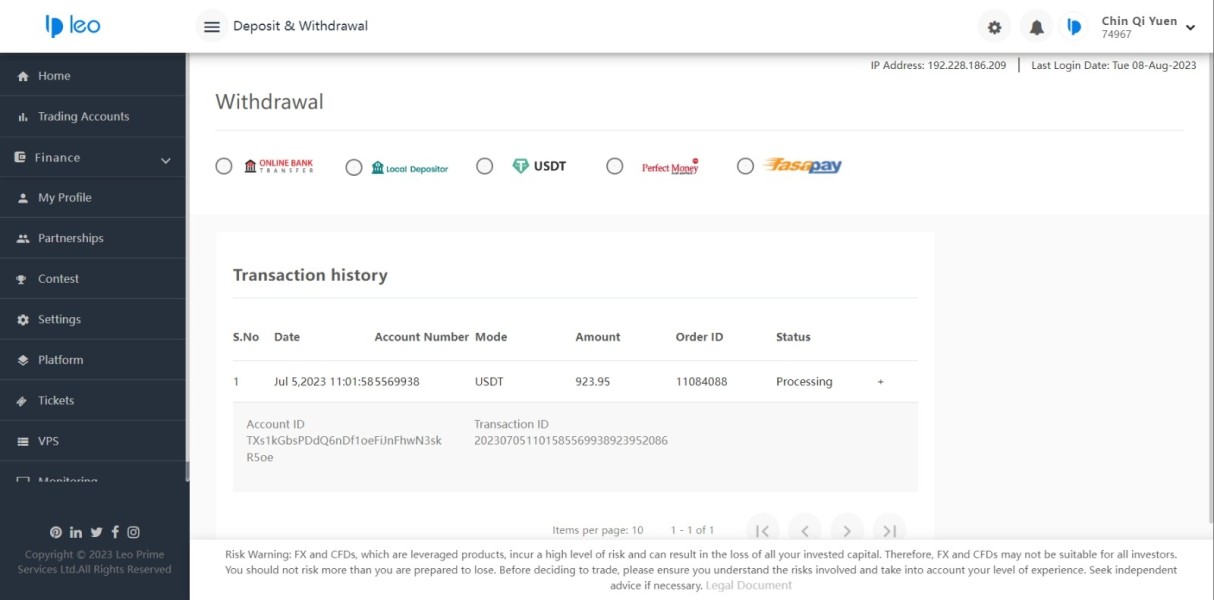

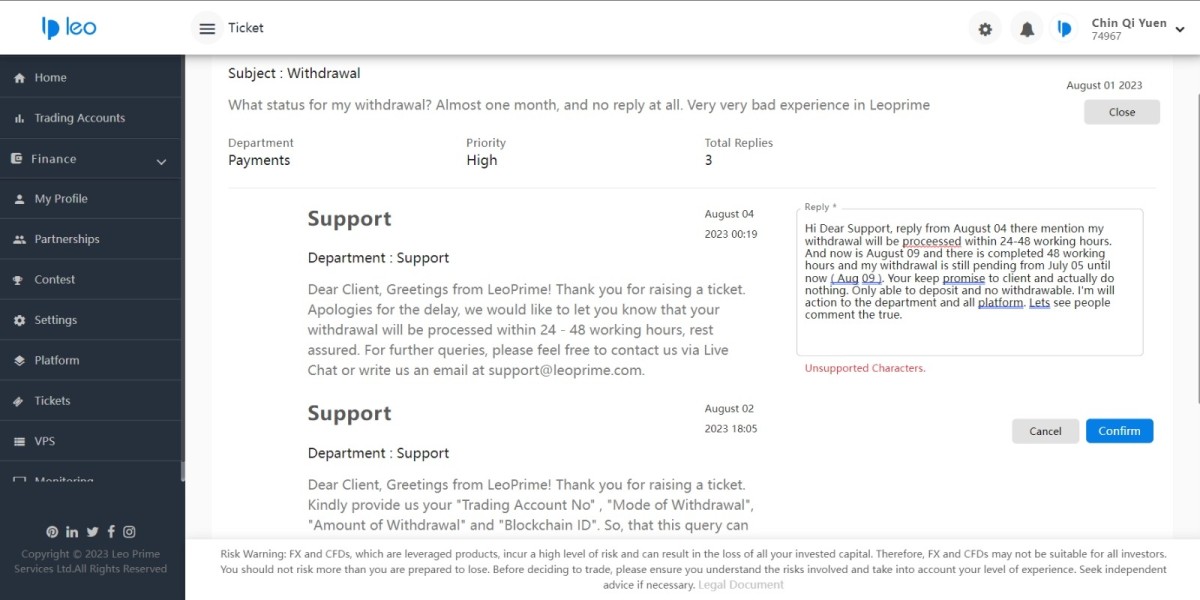

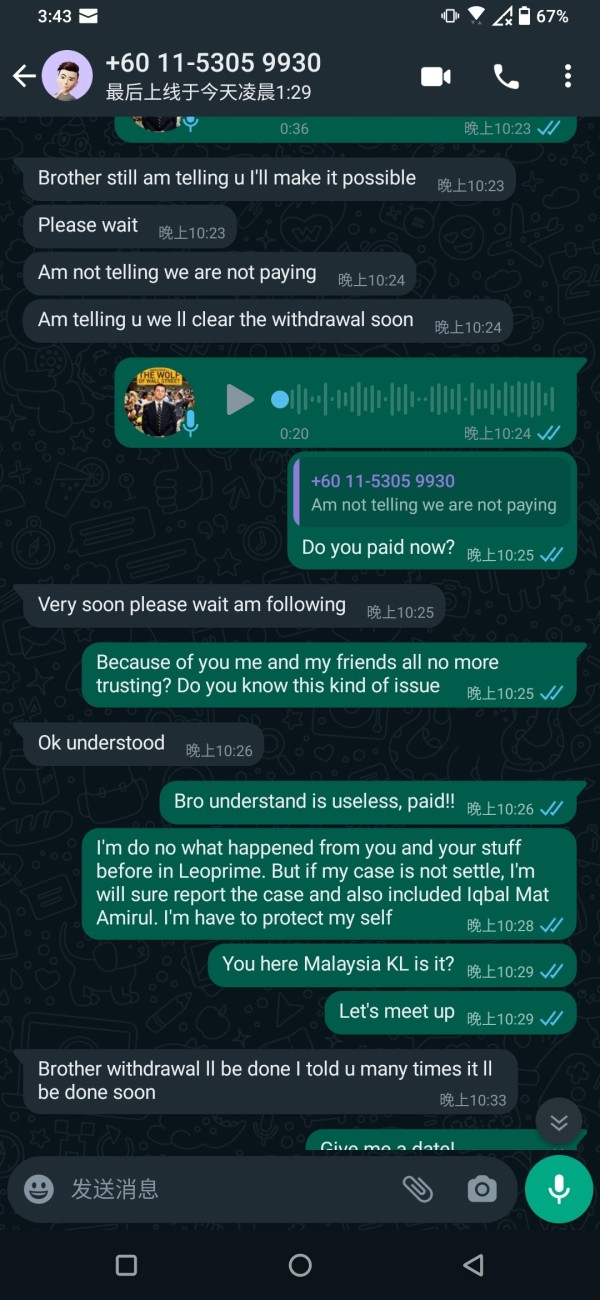

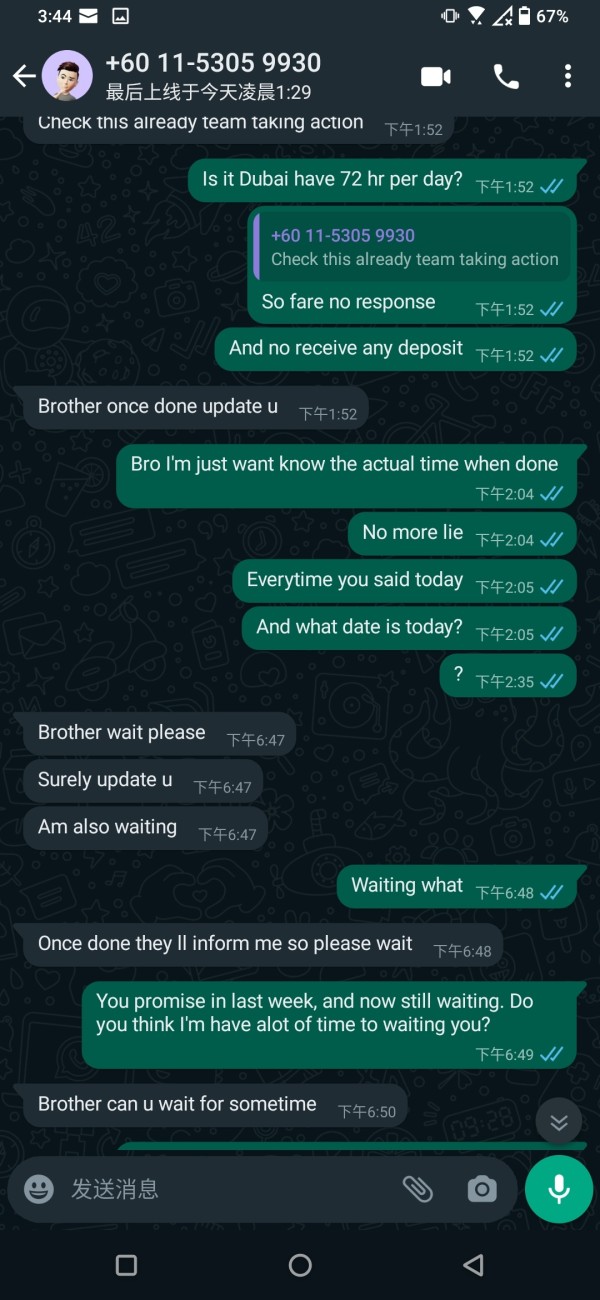

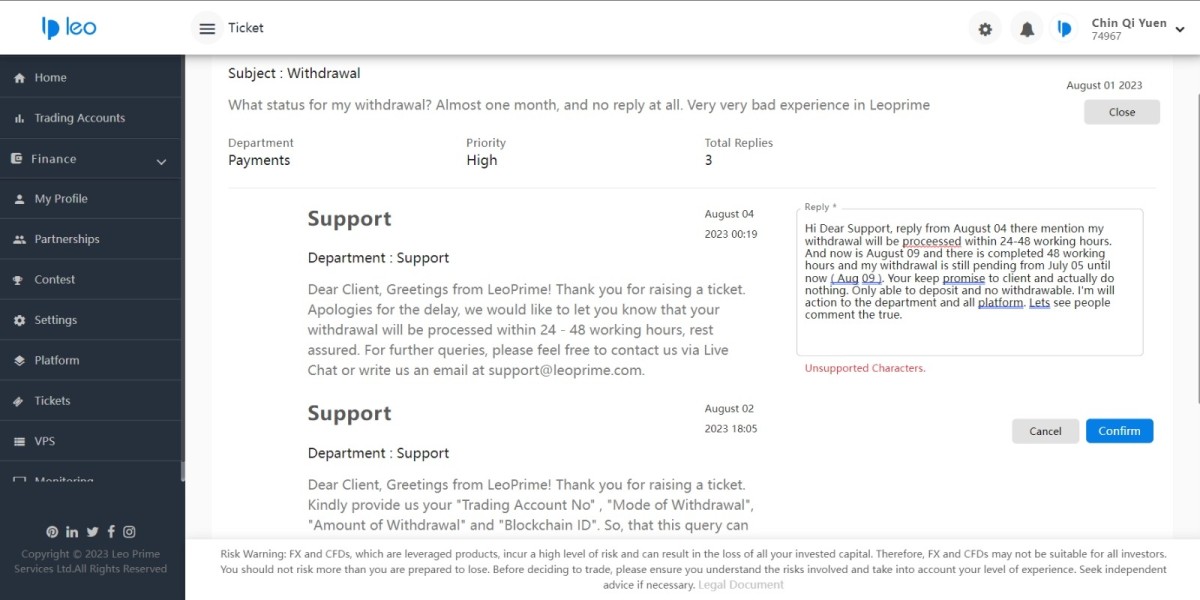

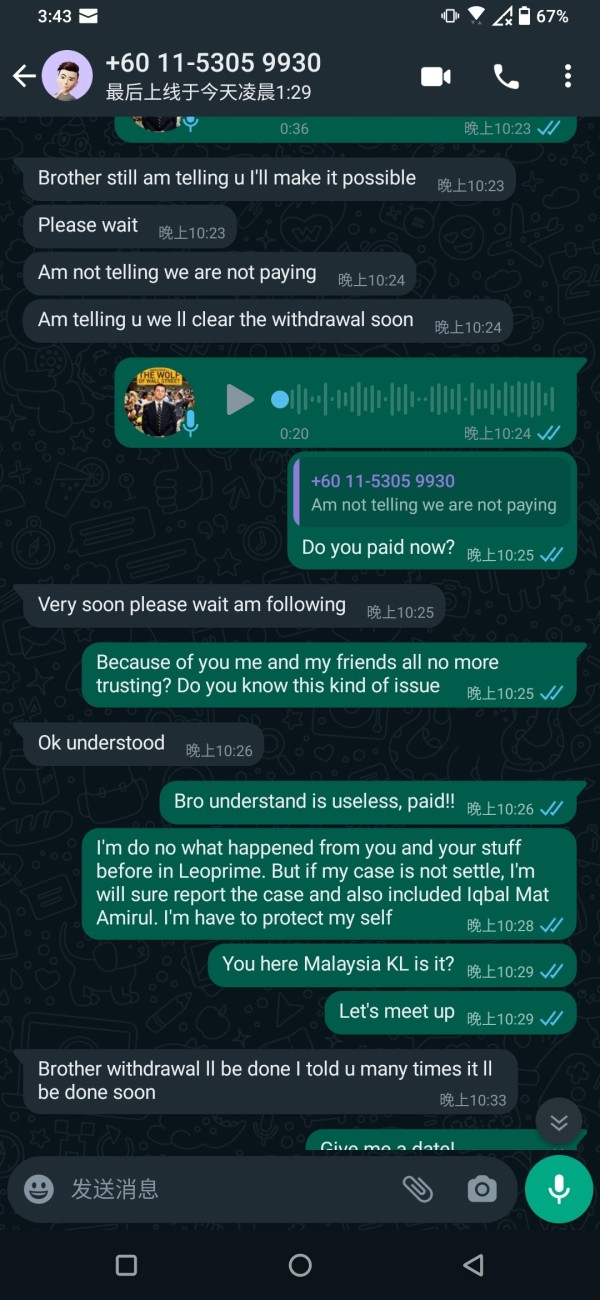

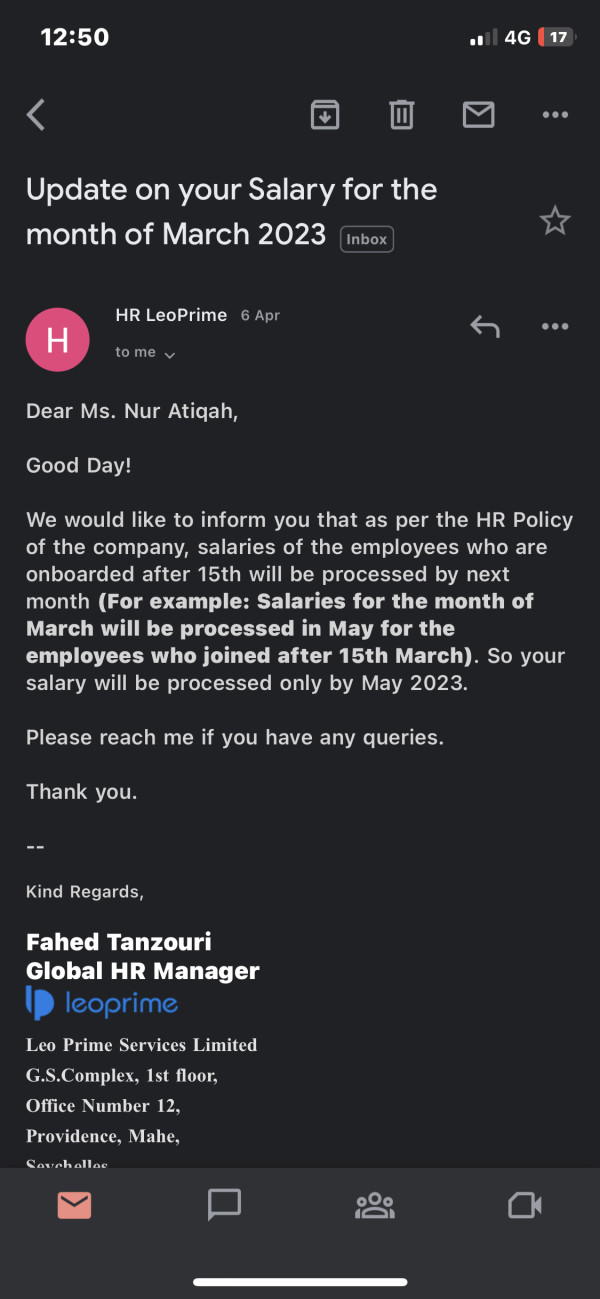

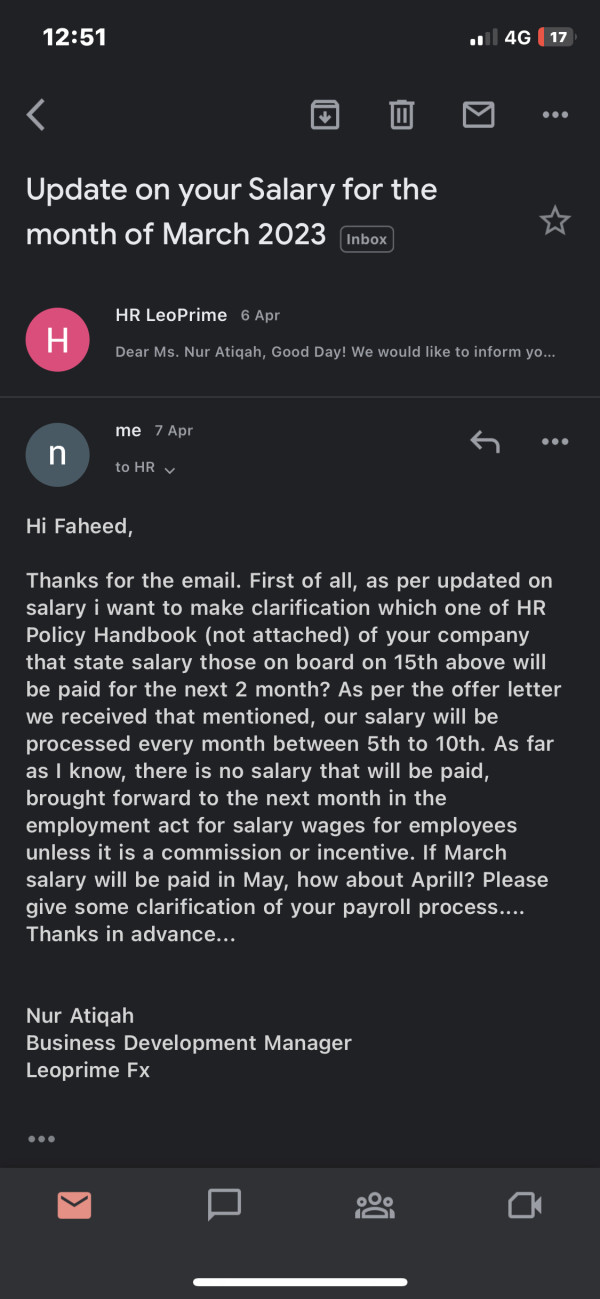

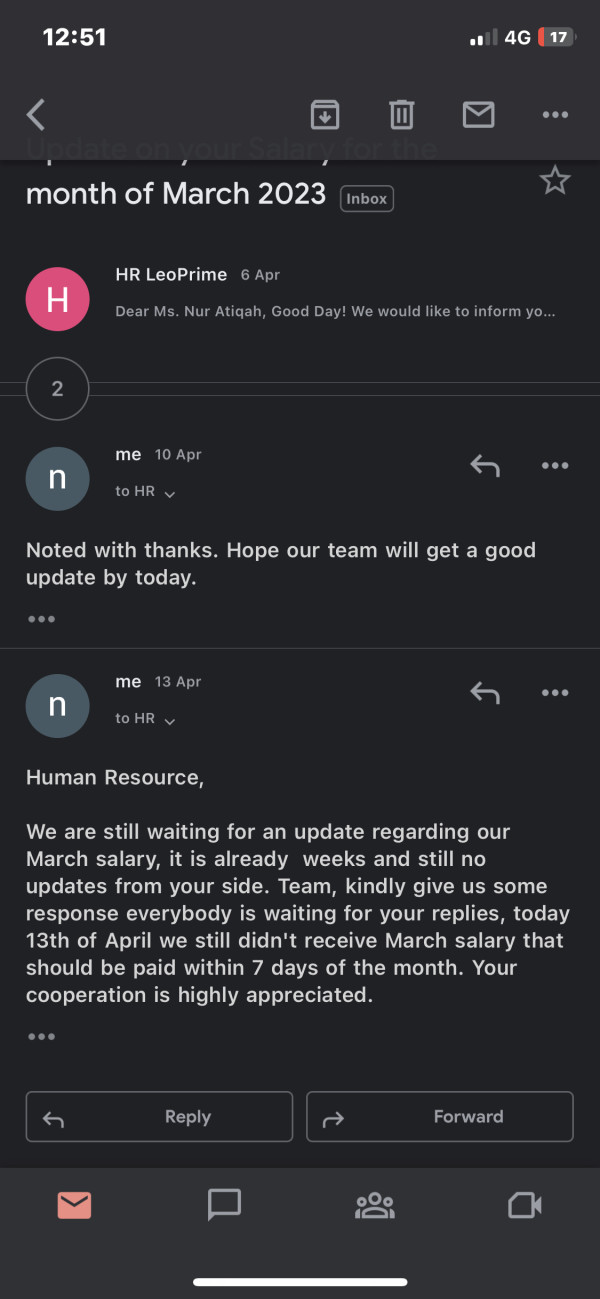

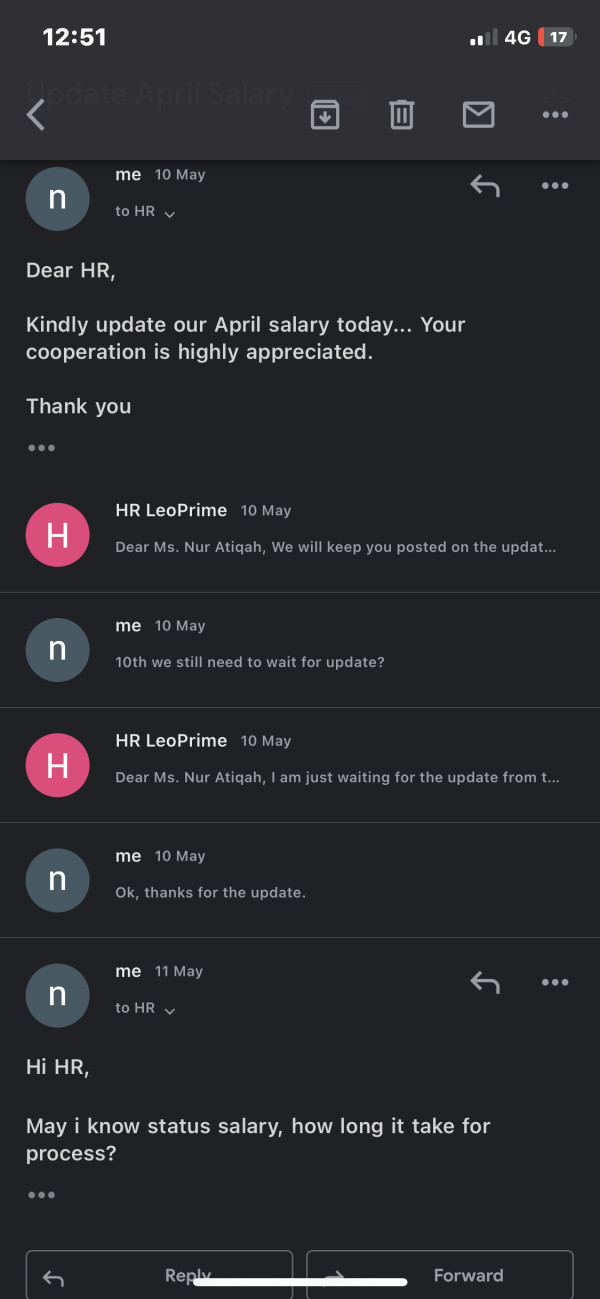

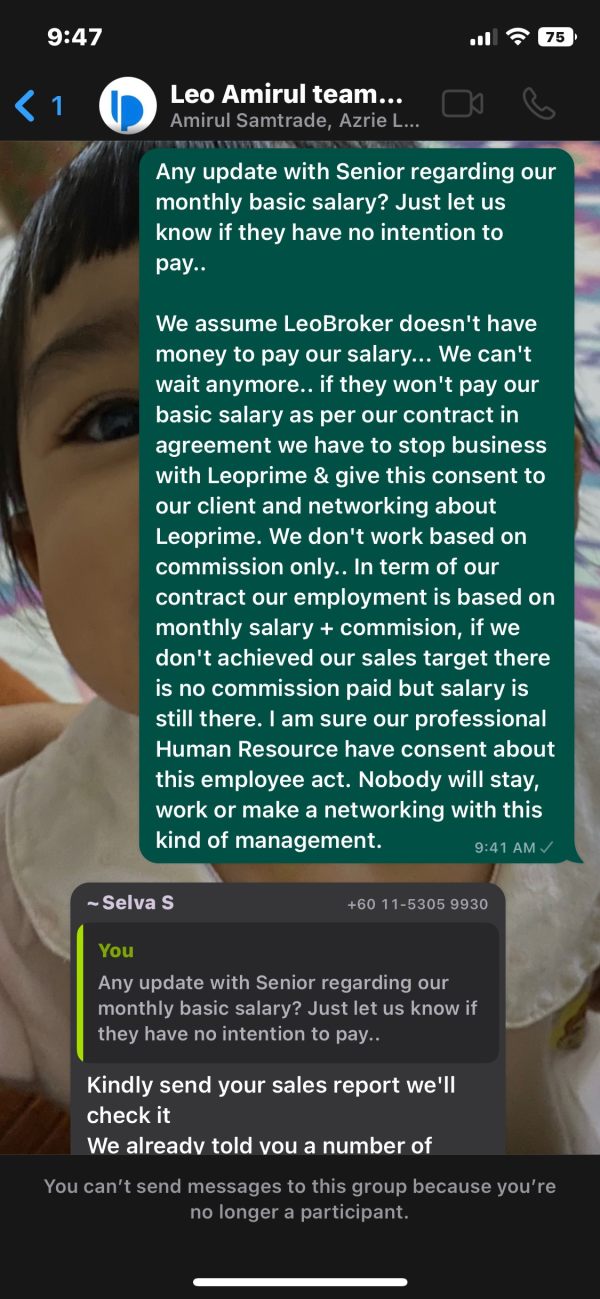

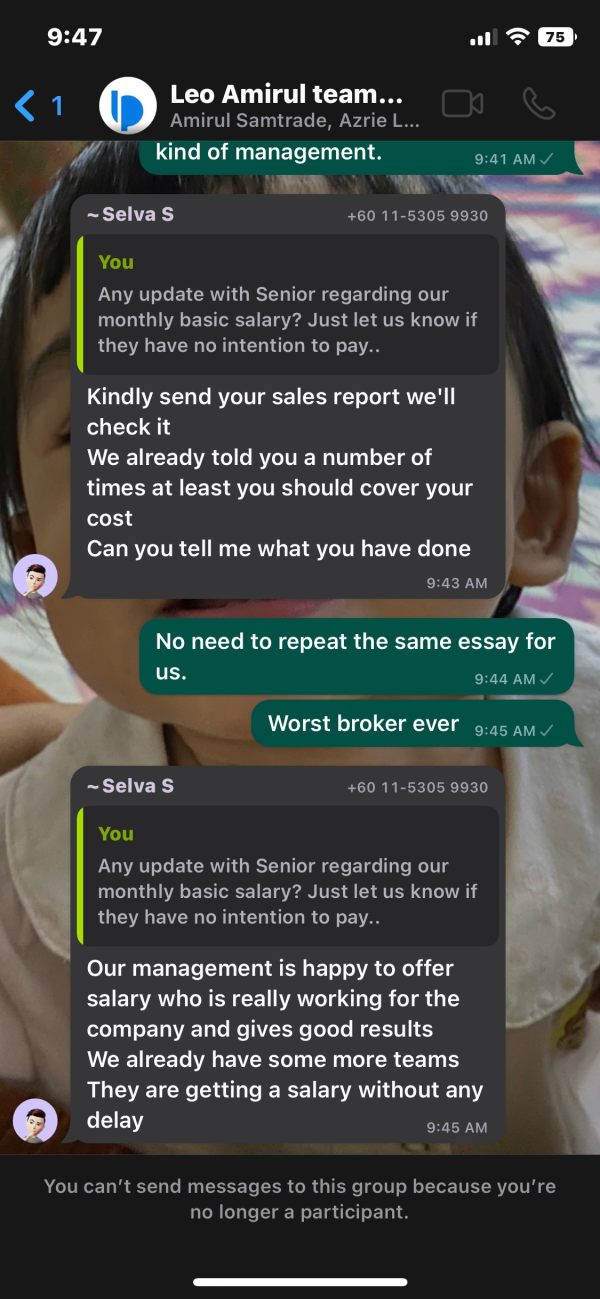

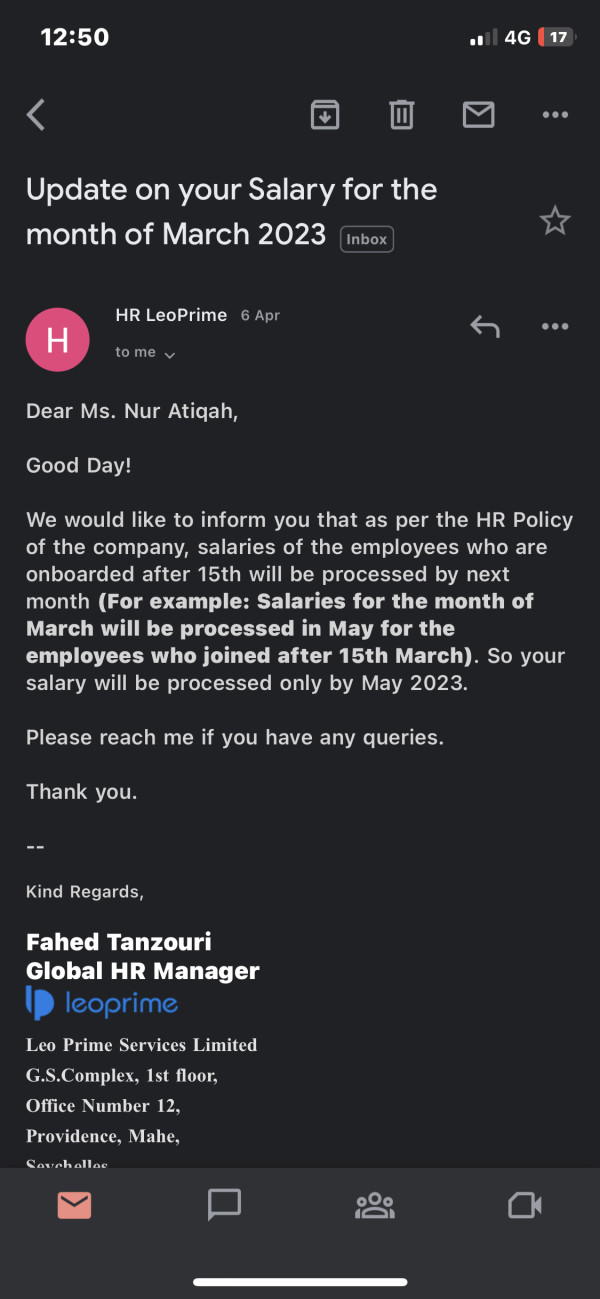

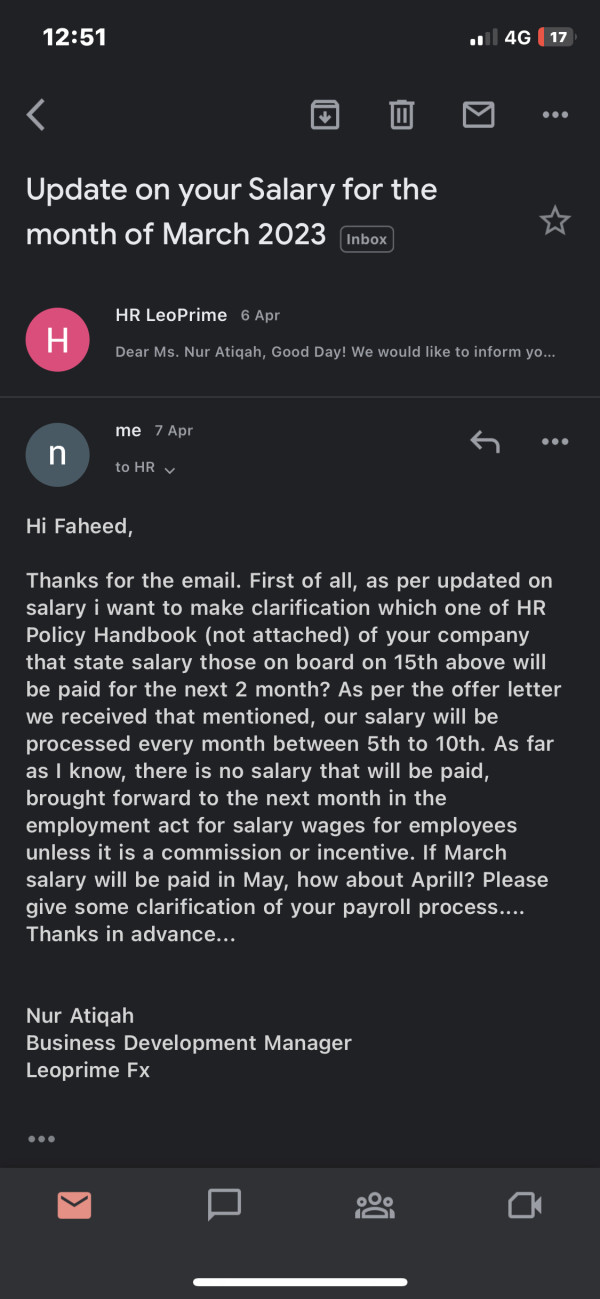

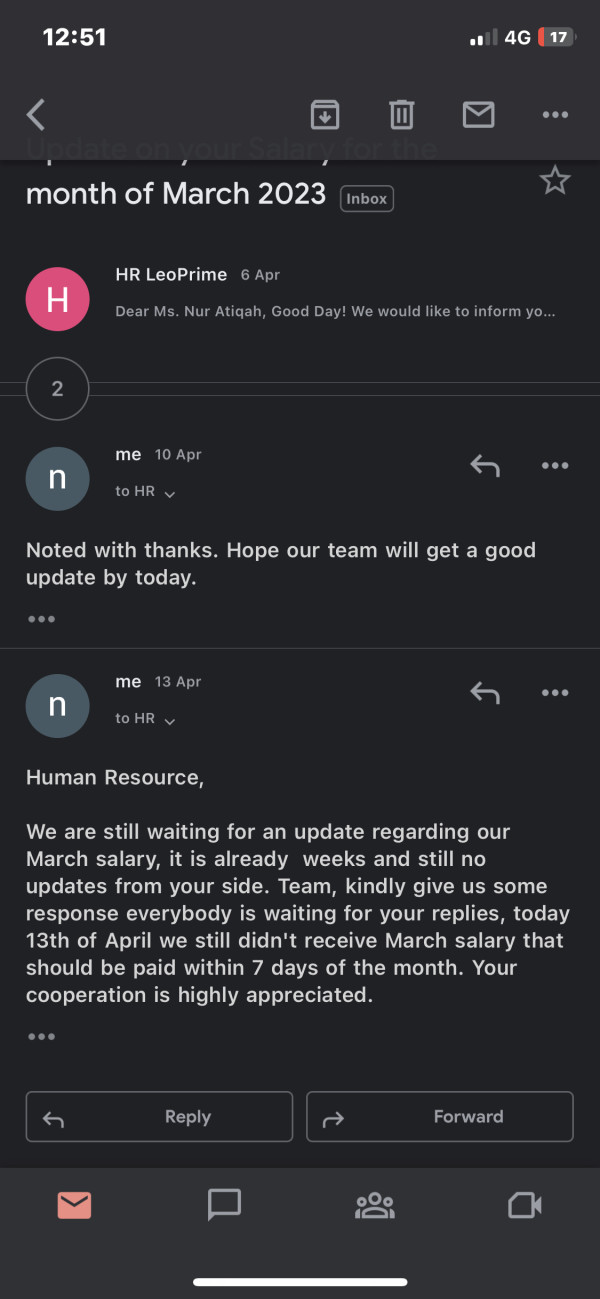

Customer service represents one of LeoPrime's most significant challenges based on available user feedback. Multiple reports indicate substantial delays in customer support response times. Some users experience difficulty reaching support representatives when urgent assistance is required. This responsiveness issue is particularly concerning in the fast-paced trading environment where timely support can be crucial for resolving trading-related problems.

The broker offers multiple communication channels including telephone, email, and online chat support. However, the effectiveness of these channels appears compromised by staffing or system limitations that prevent timely responses to client inquiries. User reports suggest that even when contact is established, the quality of problem resolution may not meet professional standards. These standards are expected in the financial services industry.

Specific instances mentioned in user feedback include prolonged waiting times for email responses and difficulties in reaching live support representatives during critical trading periods. Some users report complete inability to contact customer service when experiencing account access issues or withdrawal problems. This significantly undermines confidence in the broker's operational reliability.

The customer service challenges extend beyond simple response times to include apparent limitations in support staff expertise and problem-solving capabilities. Users report instances where support representatives were unable to provide satisfactory resolutions to technical or account-related issues. This suggests potential training or resource limitations within the support organization.

These customer service deficiencies represent a critical weakness that impacts all aspects of the trading relationship. This occurs regardless of other platform strengths or competitive trading conditions offered by the broker.

Trading Experience Analysis

The trading experience on LeoPrime's platforms presents a mixed picture based on available user feedback and platform capabilities. While the broker supports industry-standard MetaTrader 4 and MetaTrader 5 platforms, which provide robust functionality and familiar interfaces for experienced traders, user reports indicate concerning issues with trade execution and platform reliability.

Some users report experiencing trade holds and execution delays that can significantly impact trading outcomes. This is particularly true for strategies requiring precise timing or during volatile market conditions. These execution issues raise questions about the broker's liquidity arrangements and order processing systems. These are fundamental to providing a professional trading environment.

Platform stability concerns have been mentioned in user feedback, though specific technical performance data was not comprehensively available for detailed analysis. The reliability of trading platforms is crucial for maintaining consistent trading operations. Any instability can result in missed opportunities or unexpected losses.

The broker's support for automated trading and scalping strategies represents a positive aspect of the trading environment, accommodating various trading approaches and strategy types. However, the effectiveness of these features may be compromised if underlying execution and platform reliability issues persist.

Mobile trading experience details were not specified in available documentation. This represents an important gap given the increasing importance of mobile trading capabilities for modern traders who require platform access across multiple devices and locations.

Trust and Safety Analysis

LeoPrime's regulatory status provides a foundation for operational legitimacy through oversight from the Vanuatu Financial Services Commission and the Financial Services Authority of Seychelles. These regulatory relationships indicate compliance with basic operational standards and provide some level of investor protection. The specific protections may vary based on regulatory framework differences between jurisdictions.

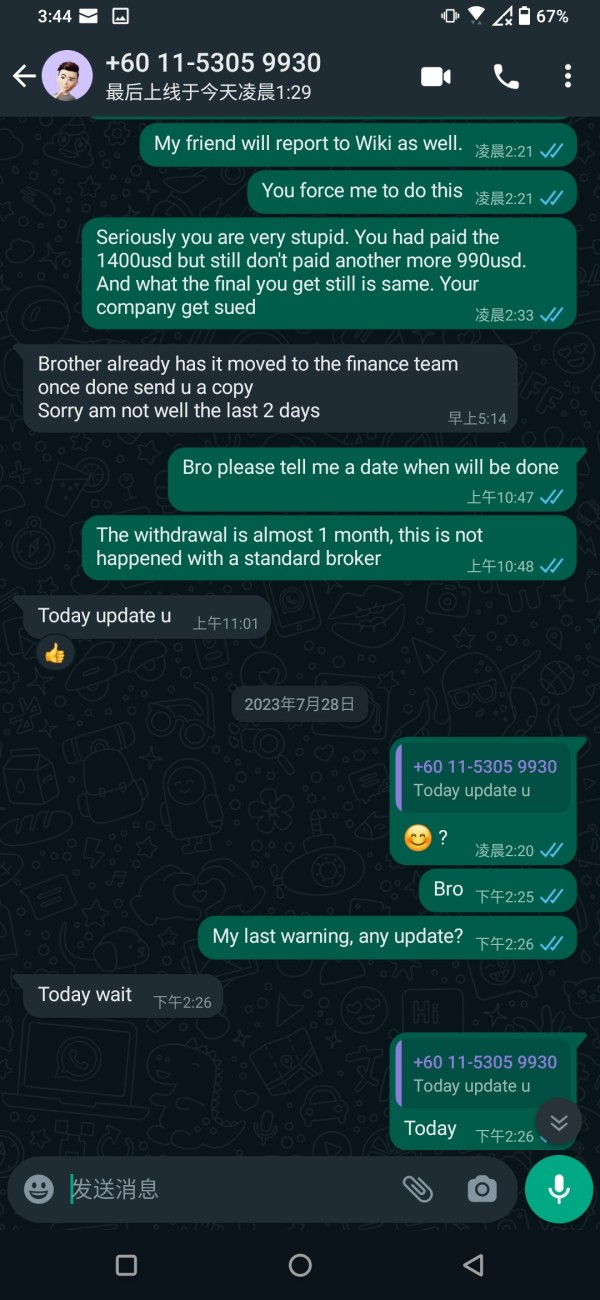

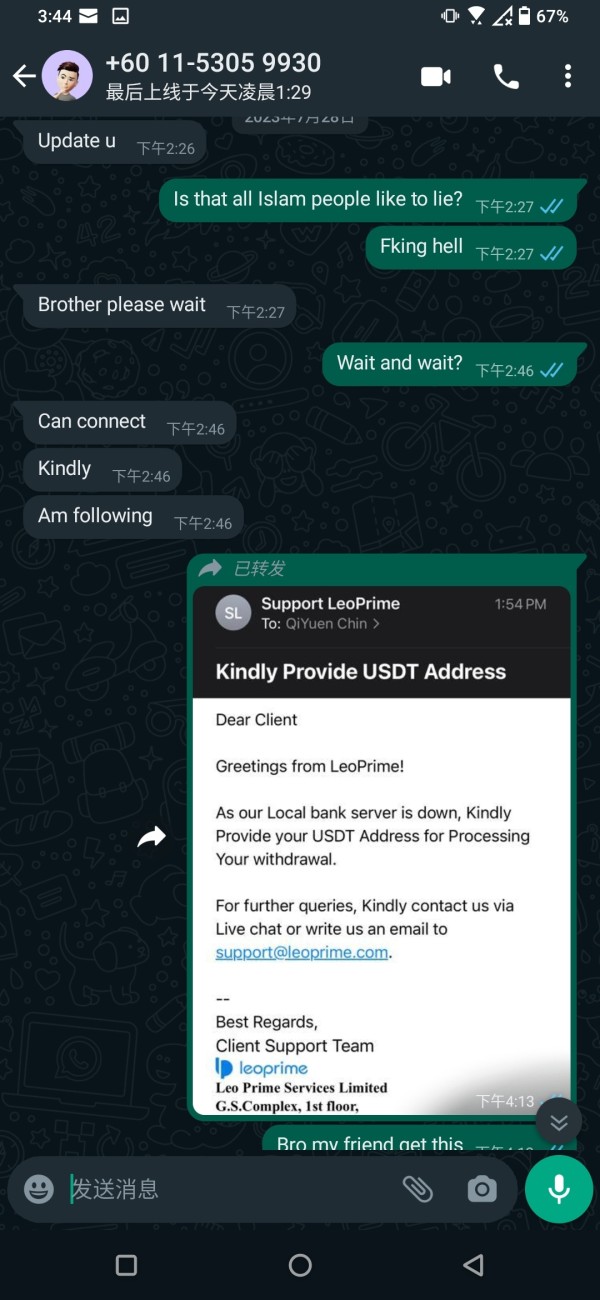

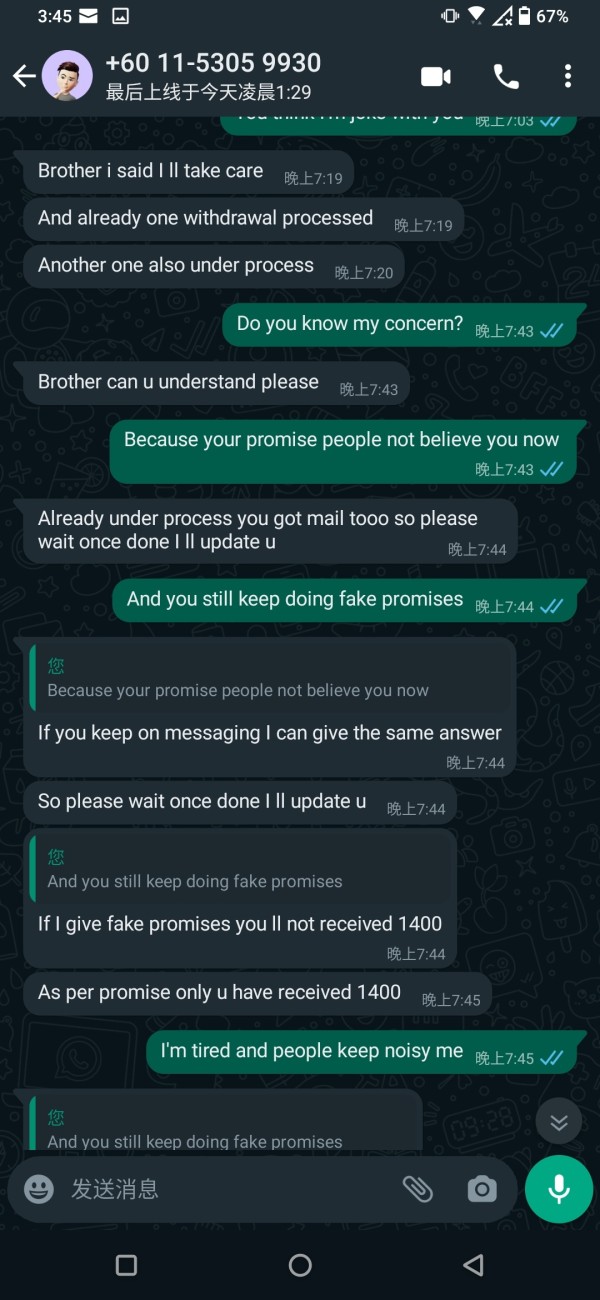

However, user feedback reveals significant concerns about the broker's handling of client issues, particularly regarding withdrawal processing and problem resolution. Reports of delayed withdrawals and inadequate customer service response to client concerns suggest potential operational deficiencies. These impact client trust regardless of regulatory compliance.

Information about specific fund safety measures, such as segregated client accounts, investor compensation schemes, or insurance coverage, was not detailed in available documentation. This transparency gap makes it difficult for potential clients to assess the actual level of protection for their invested funds. This assessment goes beyond basic regulatory oversight.

The broker's company transparency regarding ownership structure, financial backing, and operational history was not comprehensively available. This may concern traders who prioritize understanding their broker's corporate stability and background before committing significant trading capital.

Industry reputation and third-party evaluations were not extensively documented in available materials. This limits the ability to assess the broker's standing within the broader forex industry community and among professional trading organizations.

User Experience Analysis

Overall user satisfaction with LeoPrime appears neutral to negative based on available feedback, with particular concerns centered around operational reliability and customer service quality. While some traders appreciate the low minimum deposit requirement and platform accessibility, these positive aspects are often overshadowed by service delivery issues.

The user interface design and platform usability benefit from the familiar MetaTrader environment, which most forex traders recognize and can navigate effectively. However, the broker's proprietary systems and account management interfaces were not detailed in available documentation. This makes it difficult to assess the complete user experience beyond platform trading functionality.

Registration and account verification processes were not comprehensively described in available materials. This represents an important information gap for potential clients evaluating the broker's onboarding efficiency and compliance procedures.

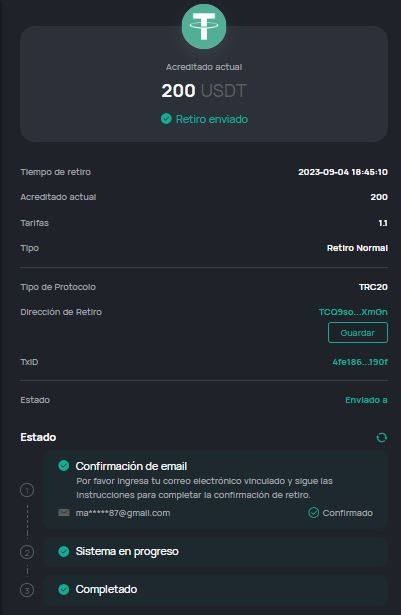

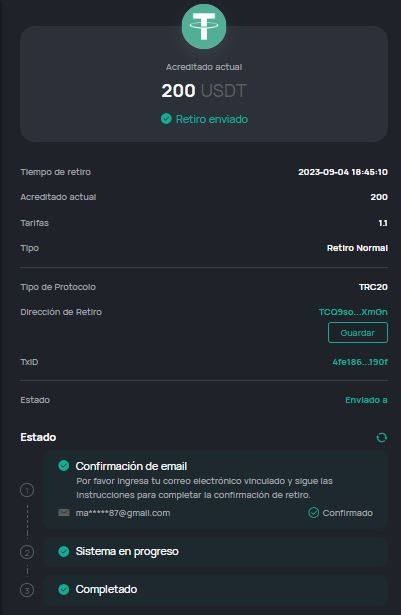

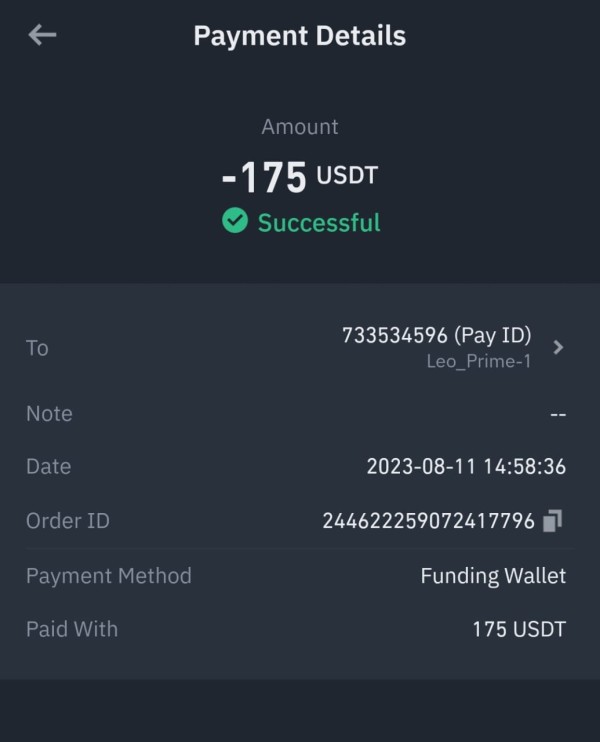

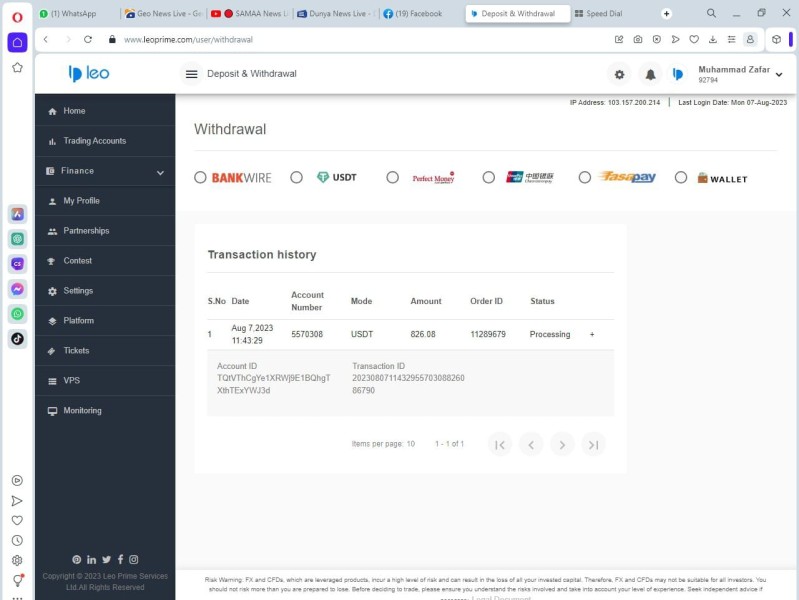

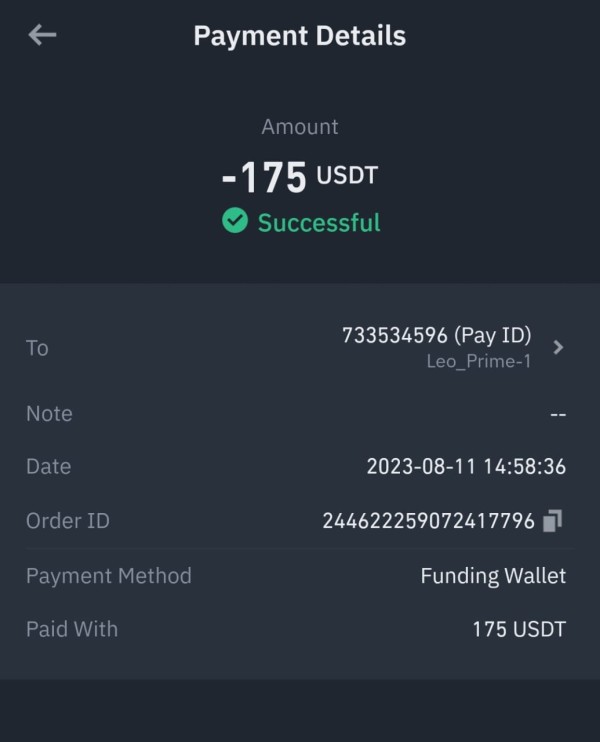

Fund operation experiences appear problematic based on user reports, with withdrawal processing issues significantly impacting overall user satisfaction. The ability to efficiently deposit and withdraw funds represents a fundamental service expectation. Difficulties in this area create substantial user experience problems.

Common user complaints focus on customer service responsiveness and withdrawal processing delays. This suggests systemic operational challenges that affect multiple aspects of the client relationship. These issues indicate that while the broker may offer competitive trading conditions, the supporting service infrastructure may not meet professional standards expected by serious traders.

Conclusion

LeoPrime presents a mixed proposition in the competitive forex broker landscape. While the broker offers attractive features such as high leverage ratios up to 1:1000, diverse trading assets, and low minimum deposit requirements, significant operational challenges undermine its overall value proposition. The combination of regulatory oversight from VFSC and FSA provides basic legitimacy. However, user feedback reveals concerning patterns of customer service deficiencies and withdrawal processing issues.

The broker appears most suitable for experienced traders who can navigate potential service challenges and prioritize trading conditions over comprehensive customer support. New traders may find the low deposit requirements attractive. However, the reported customer service limitations could prove problematic when guidance and support are most needed.

Primary advantages include competitive leverage offerings and comprehensive market access through established trading platforms. However, the documented customer service responsiveness issues and withdrawal processing concerns represent significant disadvantages. Potential clients must carefully consider these factors when evaluating LeoPrime against alternative broker options in the current market.