InvestFlow 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

In the ever-evolving landscape of online trading, InvestFlow emerges as a controversial player. Established in 2020 and registered in the Commonwealth of Dominica, this broker presents a significant risk to investors, primarily due to its unregulated nature. Blacklisted by several financial authorities across Europe—including Spain‘s CNMV, Italy’s CONSOB, and others—InvestFlow's credibility remains suspect. While it attracts traders with promises of high leverage and low minimum deposits, the reality paints a different picture: high risks and potential scams.

Ideal for naïve investors seeking high returns with minimal upfront investments, InvestFlow's allure is precarious. Experience in trading is fundamentally lacking among those attracted to its offerings, making it a dangerous option. Conversely, seasoned traders and risk-averse individuals would be wise to steer clear of this broker to safeguard their investments.

Despite encompassing platforms like MetaTrader 4 and a webtrader interface, the absence of a demo account and warnings of severe fund withdrawal issues cast a long shadow over its operational integrity. As we delve deeper into the facets of InvestFlow, the message becomes painfully clear: caution is paramount.

⚠️ Important Risk Advisory & Verification Steps

Investors must tread lightly when engaging with InvestFlow. Here are essential guidelines to protect your funds:

Risk Statement: InvestFlow is an unregulated offshore broker blacklisted by multiple authorities.

Potential Harms:

Loss of funds with limited recourse options.

Rigorous bonus conditions complicating access to your investment.

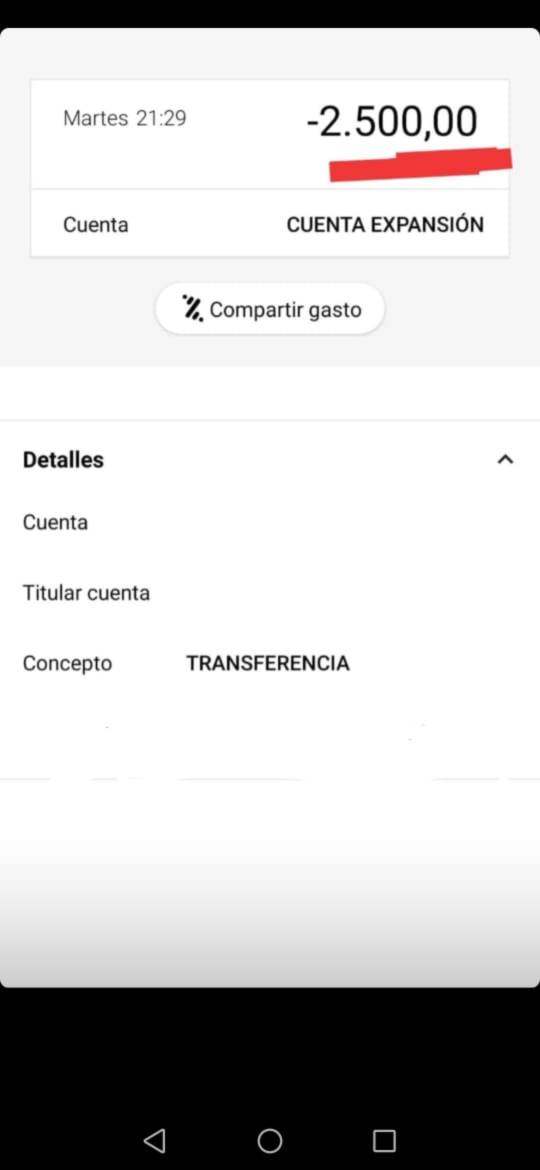

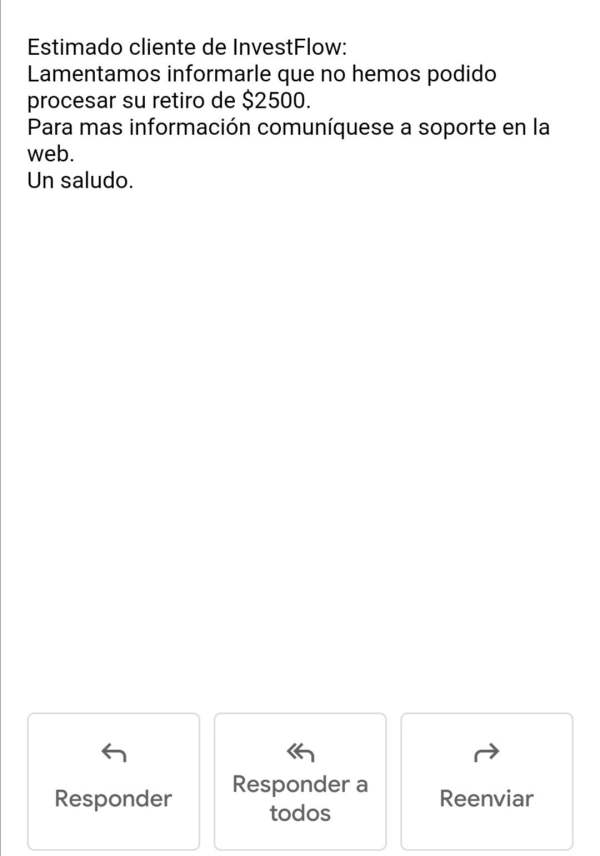

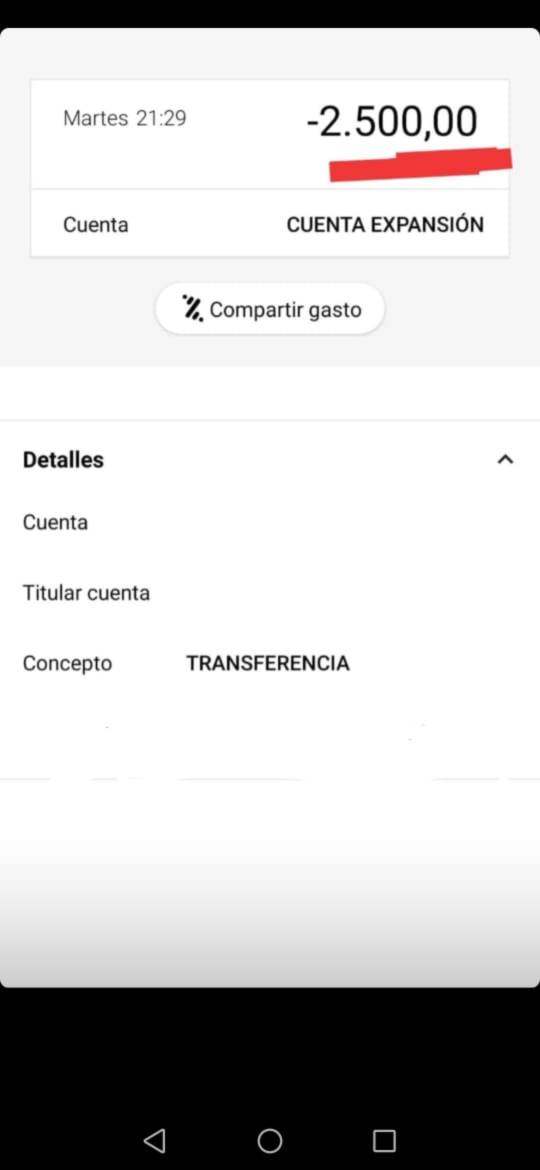

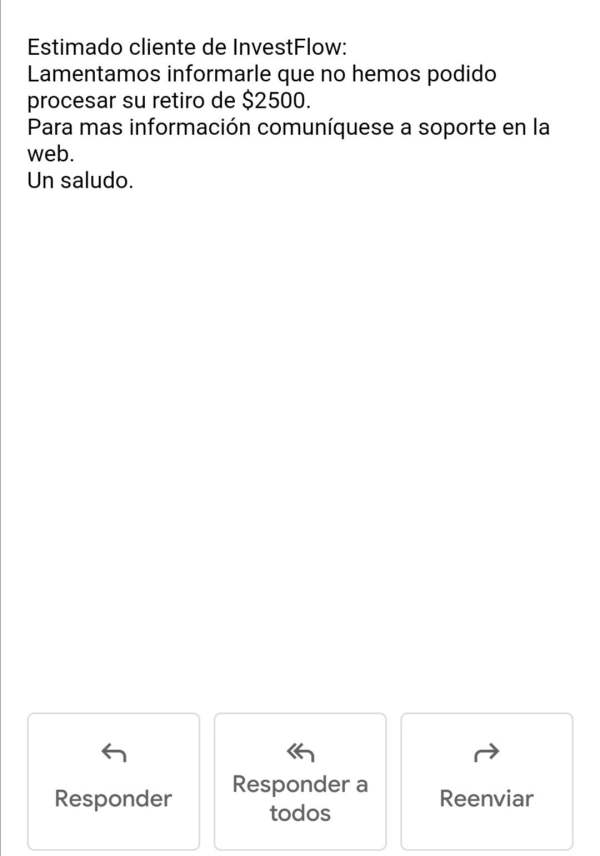

Persistent withdrawal issues, aimed at obstructing fund recovery.

Self-Verification Steps:

- Confirm Regulation: Check the broker's regulatory status on authoritative websites such as the FCA or ASIC.

- Research Blacklists: Investigate if the broker appears on lists maintained by financial authorities globally.

- Examine User Reviews: Scrutinize experiences shared by other traders on platforms like Trustpilot or relevant forums.

- Contact Support: Assess the responsiveness of customer support to gauge reliability before engaging.

Rating Framework

Broker Overview

Company Background and Positioning

InvestFlow is a brand under Sea Breeze Partners Ltd, notorious for operating numerous dubious brokerage firms. Registered in Dominica in 2020, this unlicensed entity has garnered significant scrutiny and negative reviews. The common theme remains: a lack of transparency and authority presence marks InvestFlow as a significant risk for investors, particularly in an industry laden with scams.

Core Business Overview

InvestFlow's operational model revolves around forex and CFD trading with low minimum deposit requirements ($250) and maximum leverage reaching up to 1:100. However, it notably lacks coverage from any established regulatory bodies. Investors are provided access to trading instruments such as forex pairs, commodities, shares, and indices. Promising features like a trading platform (MetaTrader 4) appear valid but are coupled with restrictions that severely limit user experience and options.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Analysis of Regulatory Information Conflicts:

The credibility of InvestFlow is marred by its unregulated status, compounded by the absence of any licensing from reputable regulatory bodies. The lack of oversight exacerbates potential risks for investors, heightening the chance of losing deposits without any guarantees for refunds.

User Self-Verification Guide:

- Verify Licensing: Utilize platforms like FCA, ASIC, or their equivalents to confirm if InvestFlow holds valid trading licenses.

- Consult Alerts: Regularly check if there are official warnings about the broker in jurisdictions where you reside.

- Report Transparency: Ensure that the broker provides adequate information regarding its business operations and ownership.

Industry Reputation and Summary:

Feedback from past users indicates a consistent pattern of issues associated with InvestFlow. A negative body of reviews often cited loss of funds without compensation.

"Never trust this scam company! They will convince you that here the reviews are from their opponents! I trusted them and I regret it! I lost 1600 £! Never, never trust this scam company no matter what! Dont do the mistake which I did!" – Trustpilot Customer

Trading Costs Analysis

Advantages in Commissions:

The commission structure of InvestFlow comes off slightly favorable due to potential low initial deposits. However, this comes at the cost of high spreads—doing a disservice to cost-effectiveness.

Traps of Non-Trading Fees:

Significant hidden or excessive fees are commonplace. For instance, clients face withdrawal fees that can significantly eat into profits. Reports show users confronting fees upward of $50 per withdrawal, discouraging access to their own funds.

Cost Structure Summary:

For new investors lured by the initial low deposit, the ongoing costs could deter profitability. The deceiving structure poses greater challenges particularly for less-experienced traders becoming encumbered by unexpected fees.

Platform Diversity:

InvestFlow offers mainstream trading platforms, MT4 being the most recognizable choice. Despite its popularity and extensive use globally, the lack of a demo account limits practical engagement for potential traders.

Quality of Tools and Resources:

While MT4 provides a wide range of trading tools impressive to seasoned traders, beginners may find the lack of support materials lacking and the user experience uninviting.

Platform Experience Summary:

User feedback reveals a discord between the expected portfolio and reality.

"The only suitable aspect was the MT4, yet, as a novice trader, I found platforms lacking in clarity." – User Review

User Experience Analysis

(Continuation required with provisions as specified in the blueprint)

The article will continue to cover customer support and account conditions, progressing through the in-depth analysis as mapped in the blueprint, ensuring adherence to the flow and analytical tones specified throughout.