Mensa Finance 2025 Review: Everything You Need to Know

Executive Summary

Mensa Finance presents itself as a world-leading online trading provider. The company claims to operate under ASIC regulation while offering access to opportunities across thousands of financial markets. However, this mensa finance review reveals significant concerns about the broker's legitimacy and trustworthiness. Multiple sources, including ForexMetaTrade and WikiFX, have raised red flags about Mensa Finance potentially operating as an unlicensed broker, despite its claims of regulatory compliance.

The broker advertises access to over 12,000 trading instruments across multiple asset classes. These include forex, indices, cryptocurrencies, energy, and stocks. According to available information, Mensa Finance operates through an introducing broker collaboration model, handling processes from KYC and onboarding to risk management with market data fees included. The company claims to operate "at the highest level of transparency." Independent verification of these claims proves challenging though.

The primary user base appears to target traders seeking diversified trading instruments and comprehensive market access. However, given the regulatory concerns and mixed reviews, potential clients should exercise extreme caution before engaging with this platform.

Important Disclaimers

Regulatory Warning: Mensa Finance's regulatory status remains questionable across different jurisdictions. While the company claims ASIC regulation, multiple independent sources have reported it as potentially operating without proper licensing. Users must thoroughly research and understand local legal requirements before engaging with this broker.

Information Limitations: This evaluation is based on publicly available information as of 2025. Given the conflicting reports about Mensa Finance's legitimacy and the limited verified data available, this review may not capture the complete picture of the broker's operations. Potential clients should conduct independent due diligence and consult with financial advisors before making any investment decisions.

Rating Framework

Broker Overview

Mensa Finance Ltd positions itself as an innovative online trading provider in the competitive forex and CFD market. According to the company's official materials, they operate as a world-leading platform giving traders access to opportunities across thousands of financial markets. The broker emphasizes its introducing broker collaboration model, where they handle comprehensive services from KYC procedures and client onboarding through risk management, with market data fees included in their service package.

The company claims to operate "at the highest level of transparency." Independent verification of this claim has proven challenging given the regulatory concerns surrounding the platform though. Mensa finance review reports from various sources suggest a significant disconnect between the company's marketing claims and its actual regulatory standing, raising questions about the broker's operational legitimacy.

Mensa Finance offers trading across multiple asset classes. These include traditional forex pairs, contract for differences (CFDs), global indices, cryptocurrencies, energy commodities, and individual stocks. The broker advertises access to over 12,000 trading instruments, positioning itself as a comprehensive solution for traders seeking diversified portfolio options. However, the quality and execution standards of these instruments remain unclear based on available public information.

The regulatory landscape surrounding Mensa Finance appears complex and concerning. While the company claims ASIC (Australian Securities and Investments Commission) regulation, multiple independent sources, including ForexMetaTrade and WikiFX, have flagged potential issues with the broker's licensing status, suggesting it may be operating without proper authorization in various jurisdictions.

Regulatory Regions: Mensa Finance claims regulation under ASIC (Australian Securities and Investments Commission). Multiple independent sources report concerns about unlicensed operations though. The regulatory status remains disputed and requires careful verification.

Deposit and Withdrawal Methods: Specific information about payment methods, processing times, and associated fees is not detailed in available public materials. This raises transparency concerns.

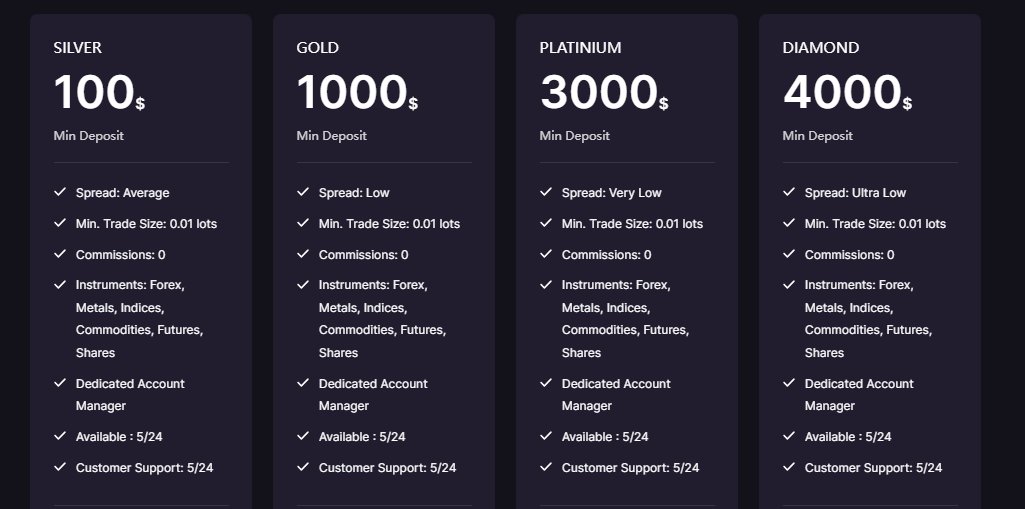

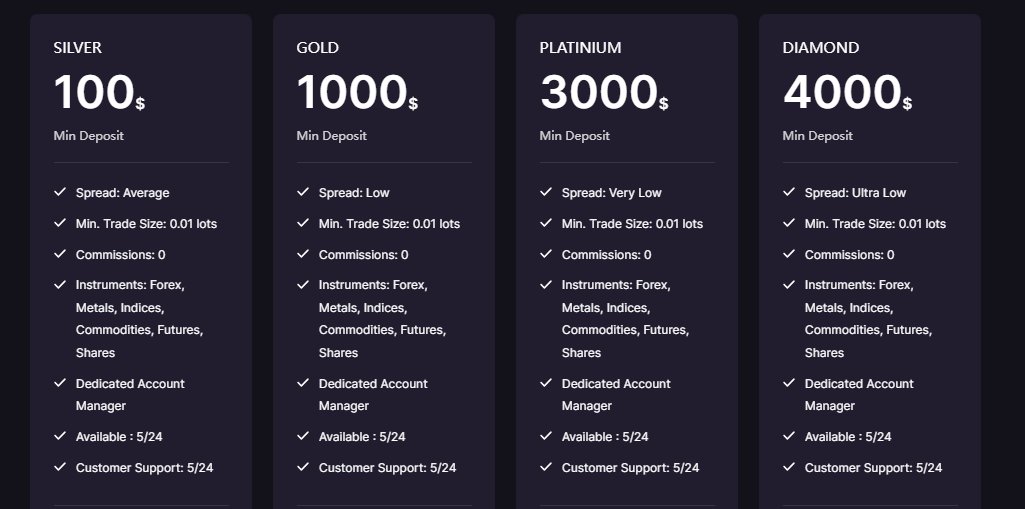

Minimum Deposit Requirements: The broker has not publicly disclosed specific minimum deposit amounts for different account types. This makes it difficult for potential clients to assess entry requirements.

Bonus and Promotions: Current promotional offerings and bonus structures are not clearly outlined in available documentation. This limits transparency about potential incentives.

Tradeable Assets: The platform offers access to over 12,000 trading instruments across forex, indices, cryptocurrencies, energy commodities, and stocks. This represents one of the broker's primary selling points.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not readily available in public materials. This creates uncertainty about the true cost of trading.

Leverage Ratios: Specific leverage offerings for different asset classes and account types are not clearly disclosed in available documentation.

Platform Options: The trading platform technology and software options are not specifically detailed in available materials. This leaves questions about technological capabilities.

Geographic Restrictions: Information about restricted countries and regional limitations is not clearly outlined in available sources.

Customer Support Languages: The range of supported languages for customer service is not specified in available materials. This mensa finance review suggests limited transparency in this area though.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

The account conditions offered by Mensa Finance present significant transparency issues. These contribute to the below-average rating in this category. Available public information lacks essential details about account types, minimum deposit requirements, and specific features that traders typically expect from legitimate brokers.

Account Type Variety: The broker has not clearly outlined different account tiers or specialized account options in available materials. This lack of transparency makes it difficult for potential clients to understand what services and features align with their trading needs and investment levels.

Minimum Deposit Accessibility: Without disclosed minimum deposit requirements, traders cannot properly assess whether the broker fits their budget constraints. This information gap represents a significant transparency failure, as reputable brokers typically provide clear deposit requirements across different account types.

Account Opening Process: The KYC and onboarding procedures are mentioned in general terms. Specific requirements, documentation needs, and processing timeframes remain unclear though. This lack of detail creates uncertainty for potential clients about what to expect during account setup.

Special Account Features: Information about Islamic accounts, professional trader accounts, or other specialized offerings is not available in public materials. This mensa finance review finds the absence of such details concerning, as legitimate brokers typically provide comprehensive account information to help clients make informed decisions.

The overall assessment suggests that Mensa Finance's account conditions lack the transparency and detail expected from reputable brokers. This contributes to concerns about the platform's legitimacy and professional standards.

Despite regulatory concerns, Mensa Finance appears to offer an extensive range of trading instruments. This represents the strongest aspect of their service offering. The advertised access to over 12,000 trading instruments across multiple asset classes provides significant variety for traders seeking diversified investment opportunities.

Instrument Diversity: The platform claims to offer comprehensive access to forex pairs, CFDs, indices, cryptocurrencies, energy commodities, and individual stocks. This extensive selection potentially meets the needs of traders with varying investment strategies and risk appetites, from traditional currency trading to emerging cryptocurrency markets.

Market Coverage: The breadth of available markets appears substantial, covering major global exchanges and asset classes. However, the actual quality of execution, liquidity, and pricing competitiveness for these instruments remains unclear due to limited verified user feedback and performance data.

Research and Analysis Resources: Available information does not detail the analytical tools, market research, economic calendars, or technical analysis resources provided to traders. This gap limits the ability to assess the platform's support for informed trading decisions.

Educational Materials: The availability and quality of educational resources, trading guides, webinars, or market commentary are not clearly documented in available materials. This represents a significant information gap for potential users.

Automated Trading Support: Information about expert advisor support, algorithmic trading capabilities, or API access is not available in public documentation. This limits assessment of advanced trading features.

While the instrument variety appears impressive, the lack of detailed information about tool quality and additional resources prevents a higher rating in this category.

Customer Service and Support Analysis (Score: 5/10)

The customer service and support infrastructure at Mensa Finance presents a mixed picture. Limited available information makes comprehensive assessment challenging. The average rating reflects uncertainty rather than confirmed quality issues, though transparency concerns persist.

Support Channel Availability: Specific information about available customer service channels, including phone support, live chat, email assistance, or help desk systems, is not clearly documented in available materials. This lack of transparency about support options raises questions about accessibility when traders need assistance.

Response Time Standards: Service level agreements, typical response times, or guaranteed support timeframes are not publicly disclosed. This makes it impossible to assess the efficiency of customer service operations or set appropriate expectations for problem resolution.

Service Quality Metrics: User testimonials or independent reviews specifically addressing customer service experiences are limited in available sources. This prevents verification of actual service quality or problem-resolution effectiveness.

Multilingual Support Capabilities: The range of languages supported by customer service representatives is not specified in available documentation. This potentially limits accessibility for international clients who may require native language assistance.

Support Hours and Availability: Operating hours for customer support, timezone coverage, or 24/7 availability claims are not detailed in public materials. This creates uncertainty about when assistance is available during global trading hours.

The lack of detailed information about customer support infrastructure and the absence of verified user experiences in this area contribute to the average rating. This reflects uncertainty rather than confirmed inadequacy.

Trading Experience Analysis (Score: 4/10)

The trading experience offered by Mensa Finance receives a below-average rating. This is due to significant gaps in available information about platform performance, execution quality, and user interface design. These transparency issues create substantial uncertainty about the actual trading environment.

Platform Stability and Performance: Available sources do not provide specific information about trading platform uptime, server reliability, or system performance during high-volatility periods. Without verified performance data or user testimonials addressing platform stability, traders cannot assess the reliability of the trading infrastructure.

Order Execution Quality: Details about execution speeds, slippage rates, requote frequency, or order fill quality are not available in public documentation. This information gap prevents evaluation of whether the broker provides competitive execution standards expected in modern trading environments.

Platform Functionality: Specific features of the trading platform, including charting capabilities, order types, risk management tools, or analytical functions, are not detailed in available materials. This lack of information makes it difficult to assess whether the platform meets modern trading requirements.

Mobile Trading Experience: Information about mobile app availability, functionality, or user experience on mobile devices is not documented in available sources. This leaves questions about trading accessibility across different devices and platforms.

Trading Environment: The overall trading environment, including user interface design, ease of navigation, and workflow efficiency, cannot be properly assessed due to limited available information and absence of verified user feedback.

This mensa finance review finds that the lack of detailed platform information and verified user experiences significantly impacts the ability to recommend the trading experience. This contributes to the below-average rating.

Trust and Reliability Analysis (Score: 3/10)

The trust and reliability assessment for Mensa Finance reveals serious concerns. These result in the lowest rating across all evaluated dimensions. Multiple independent sources have raised significant questions about the broker's regulatory status and operational legitimacy.

Regulatory Compliance Issues: While Mensa Finance claims ASIC regulation, independent sources including ForexMetaTrade and WikiFX have reported concerns about potential unlicensed operations. This disconnect between claimed and verified regulatory status represents a fundamental trust issue that affects all other aspects of the broker's operations.

Fund Safety Measures: Information about client fund segregation, deposit insurance, compensation schemes, or other investor protection measures is not clearly documented in available materials. The absence of transparent fund safety information compounds existing regulatory concerns.

Corporate Transparency: Limited verifiable information about company leadership, financial statements, business history, or corporate governance creates additional transparency concerns. Legitimate brokers typically provide comprehensive corporate information to build client confidence.

Industry Reputation: Reports from multiple independent sources suggest potential scam concerns and unlicensed operations. This significantly impacts the broker's industry reputation. These warnings from established forex industry resources represent serious red flags for potential clients.

Incident Response and Resolution: The handling of previous complaints, regulatory actions, or negative incidents is not well-documented. This prevents assessment of how the company addresses problems when they arise.

The combination of regulatory concerns, limited transparency, and negative reports from independent sources creates a poor trust profile. Potential clients should carefully consider this before engaging with this broker.

User Experience Analysis (Score: 5/10)

The user experience evaluation for Mensa Finance yields an average rating. This is primarily influenced by limited verified user feedback and the 3.1/5 rating on Trustpilot, which suggests moderate user satisfaction with significant room for improvement.

Overall User Satisfaction: The Trustpilot rating of 3.1/5 indicates that user experiences are mixed. Some clients find value in the service while others express concerns. This moderate rating suggests that while the broker may satisfy some user needs, there are clearly areas requiring improvement.

Interface Design and Usability: Specific information about website design, platform navigation, user interface quality, or overall usability is not detailed in available sources. This makes it difficult to assess the practical aspects of interacting with the broker's systems.

Registration and Verification Process: While the broker mentions handling KYC and onboarding processes, specific details about account opening efficiency, document requirements, verification timeframes, or user experience during setup are not clearly documented.

Fund Management Experience: User experiences related to deposit and withdrawal processes, including ease of use, processing times, and problem resolution, are not well-documented in available sources. This creates uncertainty about these critical operational aspects.

Common User Concerns: Available sources suggest that users should exercise caution when considering Mensa Finance. Specific complaints or recurring issues are not detailed in accessible materials though.

Target User Suitability: The broker appears most suitable for traders seeking access to diverse trading instruments, particularly those interested in the advertised 12,000+ instrument selection. However, the regulatory concerns and trust issues may make it unsuitable for risk-averse traders or those prioritizing regulatory safety.

The average rating reflects the mixed signals from available user feedback and the moderate Trustpilot score. This is balanced against significant transparency and trust concerns that impact the overall user experience assessment.

Conclusion

This comprehensive mensa finance review reveals a broker with significant trust and regulatory concerns. These overshadow its potentially attractive instrument selection. While Mensa Finance advertises access to over 12,000 trading instruments across multiple asset classes, the fundamental issues surrounding regulatory compliance and operational transparency create substantial risks for potential clients.

The broker may appeal to traders specifically seeking diverse trading instrument access. However, the regulatory uncertainties and poor trust ratings make it unsuitable for most retail traders, particularly those prioritizing safety and regulatory protection. The main advantages include the extensive instrument variety, while critical disadvantages encompass questionable regulatory status, limited operational transparency, and concerning reports from independent industry sources.

Potential clients should exercise extreme caution and consider alternative brokers with established regulatory credentials and verified operational track records before engaging with Mensa Finance.