Forever Golden 2025 Review: Everything You Need to Know

The Forever Golden brokerage has garnered mixed reviews, with significant concerns regarding its regulatory status and user experiences. While it offers a range of trading options, including forex and CFDs, many reviews highlight issues related to customer service and withdrawal processes. Notably, the lack of robust regulatory oversight raises red flags for potential investors.

Note: It is crucial to recognize that Forever Golden operates under different entities in various jurisdictions, which may affect user experiences and regulatory protections. This review aims to provide a balanced view based on multiple sources to ensure fairness and accuracy.

Ratings Overview

We assess brokers based on user feedback, expert opinions, and factual data from various sources.

Broker Overview

Forever Golden, established in 2018, is a Malaysia-based brokerage that facilitates trading in various financial instruments, including forex, commodities, indices, and CFDs. The brokerage primarily operates on the MetaTrader 5 (MT5) platform, which is known for its advanced trading features and user-friendly interface. However, Forever Golden is regulated by the Labuan Financial Services Authority (LFSA), which has been criticized for its lenient regulatory framework compared to other top-tier regulators.

Detailed Analysis

Regulatory Status and Geographical Reach

Forever Golden is registered under the Labuan Financial Services Authority, which provides a level of oversight but is often viewed as less stringent than regulators such as the FCA or ASIC. The LFSA's regulatory standards have been questioned, with concerns about the safety of client funds and operational transparency. Traders should note that Forever Golden is not available in several major markets, including the United States and many European countries.

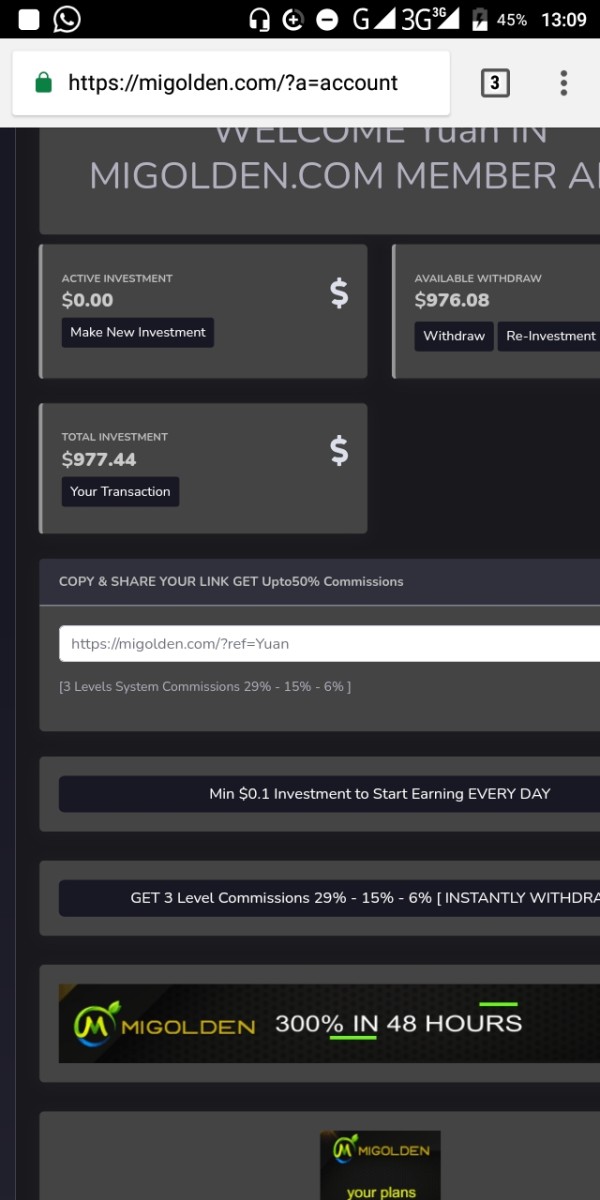

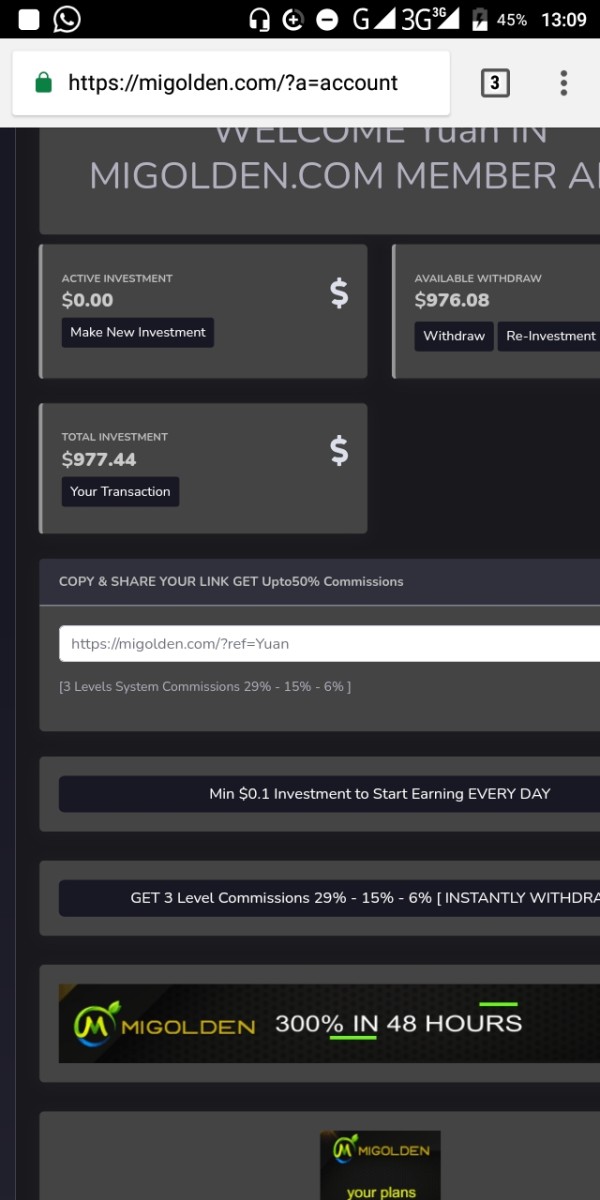

Deposit/Withdrawal Methods

Forever Golden accepts various deposit methods, including bank wire transfers, credit, and debit cards. However, users have reported issues with withdrawals, with some claiming delays and complications in accessing their funds. This has led to a negative perception of the brokerage, as timely access to funds is critical for traders. The minimum deposit requirement is set at $100, which aligns with industry standards.

Currently, Forever Golden does not offer any notable bonuses or promotional incentives. This lack of promotional offerings may be a drawback for traders seeking additional value when opening an account.

Asset Classes Available for Trading

The brokerage provides access to over 700 financial instruments, including more than 60 forex pairs, commodities like gold and silver, and various indices. However, the spreads offered by Forever Golden are reported to be relatively high, particularly for major currency pairs, which could impact overall trading profitability.

Cost Structure

Traders using Forever Golden may face high trading costs, with spreads averaging between 3 to 4 pips for major pairs. While there are no commissions on trades, overnight swap fees can accumulate, and users have reported that these fees can be significantly higher than those of competing brokers.

Leverage Options

Forever Golden offers a maximum leverage of 1:100, which can enhance trading potential but also increases the risk of significant losses. Traders should approach leverage with caution, particularly in volatile markets.

Forever Golden operates on the MT5 platform, providing a comprehensive suite of trading tools and resources. While the platform is well-regarded, the absence of a proprietary trading app may limit some users' experiences. However, the web-based and mobile versions of MT5 remain popular among traders.

Restricted Regions

Due to its regulatory status, Forever Golden is not available to residents of several countries, including the U.S., Canada, and many EU nations. This limitation can restrict potential clients from accessing the brokerage's services.

Available Customer Support Languages

Customer support at Forever Golden is available in multiple languages, including English, Arabic, and Spanish. However, users have reported slow response times and a lack of live chat support, which can be frustrating for those needing immediate assistance.

Final Ratings Overview

In conclusion, the Forever Golden review indicates that while the brokerage provides a range of trading options and utilizes a popular platform, significant concerns regarding its regulatory status, customer service, and withdrawal processes may deter potential traders. Those considering an account with Forever Golden should weigh these factors carefully and explore alternative brokers with stronger regulatory oversight and better user reviews.