Regarding the legitimacy of INMS forex brokers, it provides ASIC and WikiBit, .

Is INMS safe?

Pros

Cons

Is INMS markets regulated?

The regulatory license is the strongest proof.

ASIC Inst Deriv Trading License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Inst Deriv Trading License (STP)

Licensed Entity:

INVESTMENT MANAGEMENT SERVICES PTY. LTD.

Effective Date:

2003-10-08Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

2020-06-30Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Inms Safe or Scam?

Introduction

Inms is an emerging player in the forex market, established in 2020 and based in Australia. It aims to cater to a diverse range of traders, offering various trading instruments and services. However, with the rapid growth of online trading platforms, the need for traders to carefully evaluate their brokers has never been more critical. The forex market is known for its volatility, and choosing an unreliable broker can lead to significant financial losses. Thus, it's essential for traders to assess the credibility and safety of brokers like Inms before committing their funds. This article investigates the safety of Inms by analyzing its regulatory status, company background, trading conditions, customer fund security, client experiences, and potential risks.

Regulation and Legitimacy

The regulatory status of a forex broker is a vital aspect to consider when evaluating its safety. A well-regulated broker adheres to strict guidelines set by financial authorities, providing a layer of protection for traders. In the case of Inms, it claims to be regulated by the Australian Securities and Investments Commission (ASIC). However, a closer examination reveals some concerning details.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 236609 | Australia | Unverified |

While ASIC is recognized as a top-tier regulator, the verification status of Inms raises red flags. The broker has been flagged by the Monetary Authority of Singapore (MAS) for potentially misleading clients into believing it is licensed. Such warnings should not be taken lightly, as they indicate a lack of transparency and possible regulatory non-compliance. The absence of clear regulatory oversight leaves traders vulnerable and questioning: Is Inms safe?

Company Background Investigation

Inms was founded in 2020, positioning itself as a modern forex broker targeting a global audience. However, the broker's relatively short history raises questions about its stability and reliability. The ownership structure of Inms is not well-documented, with limited information available about its key stakeholders or management team. Transparency in ownership is crucial for building trust, as it allows traders to understand who is behind the broker and their motivations.

The management teams background and professional experience are also crucial indicators of a broker's credibility. Unfortunately, Inms does not provide detailed information about its management, making it challenging for potential clients to gauge the expertise and qualifications of those overseeing their funds. A lack of transparency in this area can lead to skepticism among traders, further complicating the question of whether Inms is safe.

Trading Conditions Analysis

When evaluating a forex broker, understanding its trading conditions, including fees and spreads, is essential. Inms offers a range of trading instruments, but its fee structure is not entirely clear. Traders must be cautious of hidden fees that can eat into their profits.

| Fee Type | Inms | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 - 1.2 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | 2% - 5% | 1% - 3% |

The spreads offered by Inms appear to be on the higher end of the spectrum compared to industry averages. Additionally, the variable commission model can lead to unexpected costs for traders, especially if not clearly outlined in the broker's terms. This lack of clarity on fees raises concerns about whether Inms is safe, as traders could face unexpected financial burdens.

Client Fund Security

The safety of client funds is paramount when assessing a broker's credibility. Inms claims to implement various security measures to protect client funds, such as segregated accounts and investor protection schemes. However, the effectiveness of these measures is not well-documented.

Traders should inquire about the specifics of fund segregation, as it ensures that client funds are kept separate from the broker's operational funds. This practice is crucial in the event of financial difficulties faced by the broker. Additionally, the presence of negative balance protection is essential to safeguard traders from losing more than their invested capital.

Despite these assurances, there have been no publicly reported incidents of fund mismanagement or security breaches involving Inms. However, the lack of detailed information on their security measures leaves room for doubt. Therefore, potential clients must thoroughly investigate whether Inms is safe before investing.

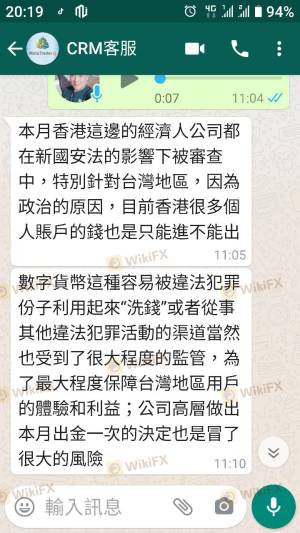

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability. Inms has received mixed reviews from clients, with some praising its user-friendly platform, while others have raised concerns about customer service and withdrawal processes.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow Response |

| Poor Customer Service | Medium | Inconsistent Support |

| Account Verification Issues | High | Lengthy Process |

Common complaints include difficulties in withdrawing funds and slow customer support responses. Such issues can significantly impact a trader's experience and raise questions about the broker's reliability. A few clients have reported prolonged withdrawal times, leading to frustration and distrust. These experiences contribute to the ongoing debate about whether Inms is safe for trading.

Platform and Trade Execution

The trading platform is a crucial element of the trading experience. Inms offers a web-based platform that is generally user-friendly, but its performance under high market volatility has been questioned. Traders need a stable and efficient platform to execute trades swiftly and accurately.

Order execution quality is another critical aspect to consider. Reports of slippage and rejected orders have surfaced, which can be detrimental to traders, especially during volatile market conditions. Any signs of platform manipulation or inconsistent execution should raise alarms for potential clients. Thus, the overall platform performance plays a significant role in determining whether Inms is safe.

Risk Assessment

Using Inms as a forex broker entails certain risks that traders should be aware of. The combination of regulatory concerns, unclear fee structures, and mixed customer feedback creates a complex risk environment.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Uncertain regulatory status |

| Fee Transparency | Medium | Potential hidden fees |

| Customer Support Reliability | Medium | Inconsistent response times |

| Platform Performance | Medium | Issues with execution and slippage |

To mitigate these risks, traders should conduct thorough research, start with a demo account, and only invest amounts they can afford to lose. Understanding the broker's policies and practices is essential for risk management.

Conclusion and Recommendations

After evaluating the various aspects of Inms, it is evident that potential clients should approach this broker with caution. The regulatory uncertainties, mixed customer feedback, and unclear fee structures raise significant concerns about its safety and reliability. While there are no direct signs of fraud, the lack of transparency and regulatory clarity suggests that traders should be vigilant.

For traders seeking a more secure and reliable trading environment, it is advisable to consider brokers regulated by top-tier authorities with proven track records. Options such as brokers regulated by the FCA or ASIC with transparent fee structures and robust customer support may provide a safer trading experience. Ultimately, assessing whether Inms is safe requires careful consideration of the risks involved and a thorough understanding of the broker's practices.

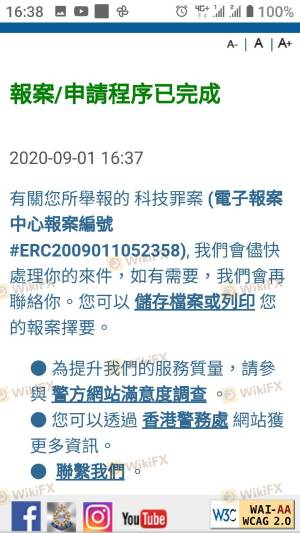

Is INMS a scam, or is it legit?

The latest exposure and evaluation content of INMS brokers.

INMS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

INMS latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.