IGS 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive igs review reveals significant concerns about IGS Energy as a forex broker. Customer feedback paints a troubling picture of the company's trading services, showing poor performance across multiple critical areas, particularly in pricing transparency and customer service delivery. Based on available customer reviews and market information, IGS Energy demonstrates serious weaknesses that potential traders should carefully consider.

The broker offers access to over 80 currency pairs and CFDs. This provides traders with a diverse range of trading instruments, though diversity alone cannot overcome fundamental service issues. Interestingly, while customer satisfaction remains extremely low with an average rating of 1 out of 5, employee reviews present a contrasting picture with a 4.3 out of 5 rating. This suggests better internal company culture than external service delivery.

IGS Energy appears most suitable for novice traders who have minimal requirements for trading conditions. It might also work for experienced traders looking to experiment with various asset types without demanding premium service levels, though this comes with significant risks. However, the overwhelmingly negative customer feedback raises serious questions about the broker's ability to meet even basic trader expectations. Today's competitive forex market offers many better alternatives for serious traders.

Important Notice

This evaluation focuses on IGS Energy's forex trading services. Potential clients should be aware that the company operates across different jurisdictions with varying regulatory frameworks, which can significantly impact their trading experience and legal protections. While IGS Energy is registered in the United Kingdom, specific regulatory authority information and licensing details are not clearly disclosed in available materials. This lack of transparency may significantly impact trading decisions for clients in different regions.

This igs review is based on publicly available user feedback, market information, and company data. Our assessment aims to provide a comprehensive evaluation of the broker's services, helping traders make informed decisions about whether this broker meets their needs. However, traders should conduct their own due diligence before making any trading decisions. The evaluation methodology incorporates customer reviews, service analysis, and industry standard comparisons to deliver an objective assessment that reflects real user experiences.

Rating Framework

Broker Overview

IGS Energy operates as an online forex broker while maintaining its primary business focus on energy services. The company is headquartered in Dublin, Ohio, United States, though specific founding year information is not readily available in current market materials, which raises questions about the company's transparency and communication practices. The broker's business model centers on providing online forex and CFD trading services alongside its traditional energy sector operations.

The company's dual focus on energy services and forex trading creates a unique market position. However, this diversification may impact the specialized attention typically expected in professional forex brokerage services, as resources and expertise may be divided between two very different business sectors. According to available information, IGS Energy offers traders access to more than 80 currency pairs and various CFD instruments. This positions itself as a multi-asset trading platform, though the execution of this strategy appears to face significant challenges.

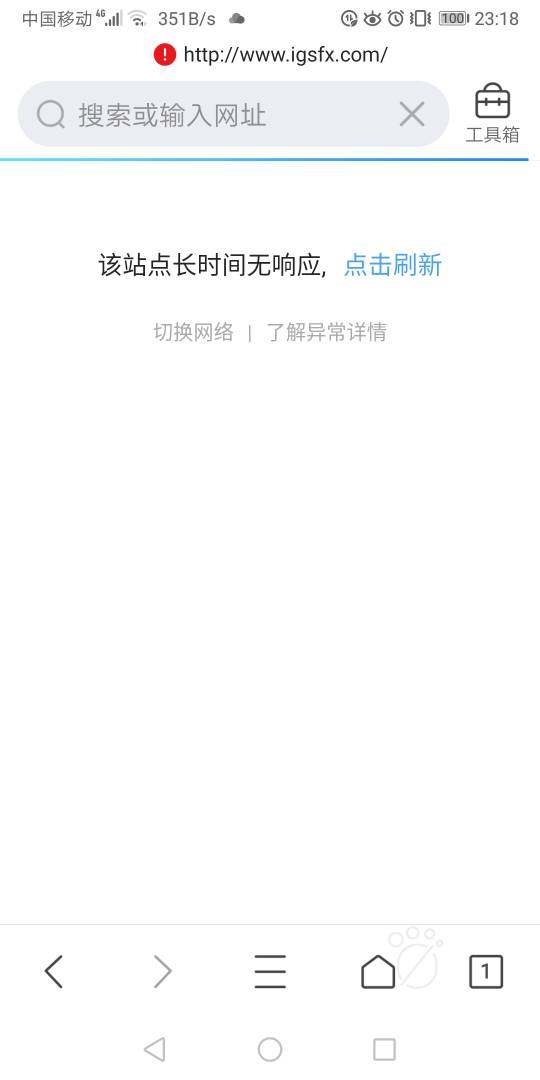

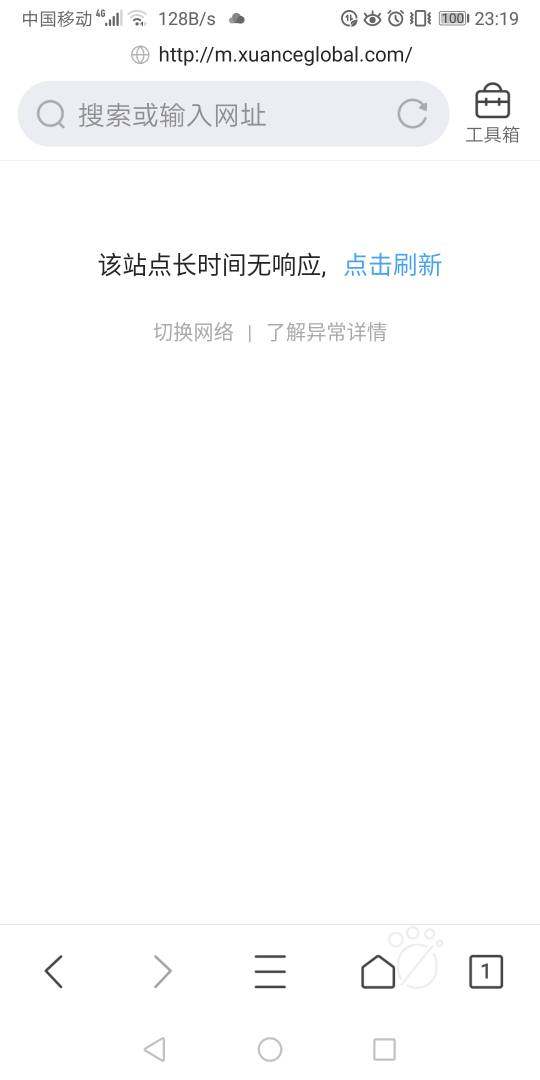

Registration details indicate the company operates under UK registration. However, specific regulatory authority oversight and licensing information remains unclear in publicly available documentation, creating uncertainty about trader protections and regulatory compliance. This igs review finds that the lack of transparent regulatory disclosure represents a significant concern for potential traders seeking regulated forex trading environments. The broker's approach to combining traditional energy services with forex trading may appeal to some traders, but the execution of this strategy appears to face challenges based on customer feedback patterns that consistently highlight service delivery problems.

Regulatory Jurisdiction: IGS Energy maintains registration in the United Kingdom. However, specific regulatory authority supervision details are not clearly disclosed in available materials, creating uncertainty about oversight and trader protections. This regulatory ambiguity may concern traders seeking transparent oversight.

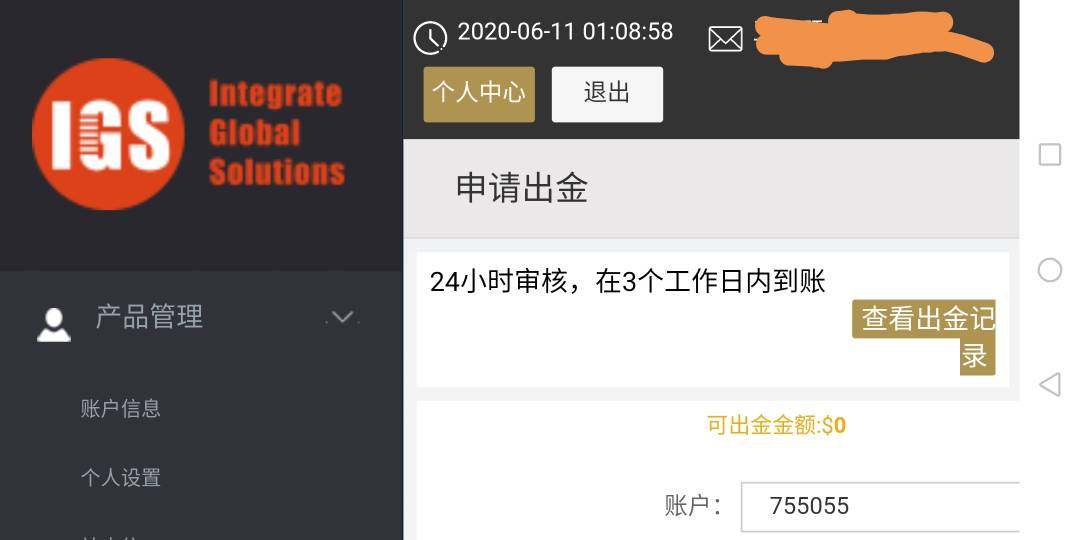

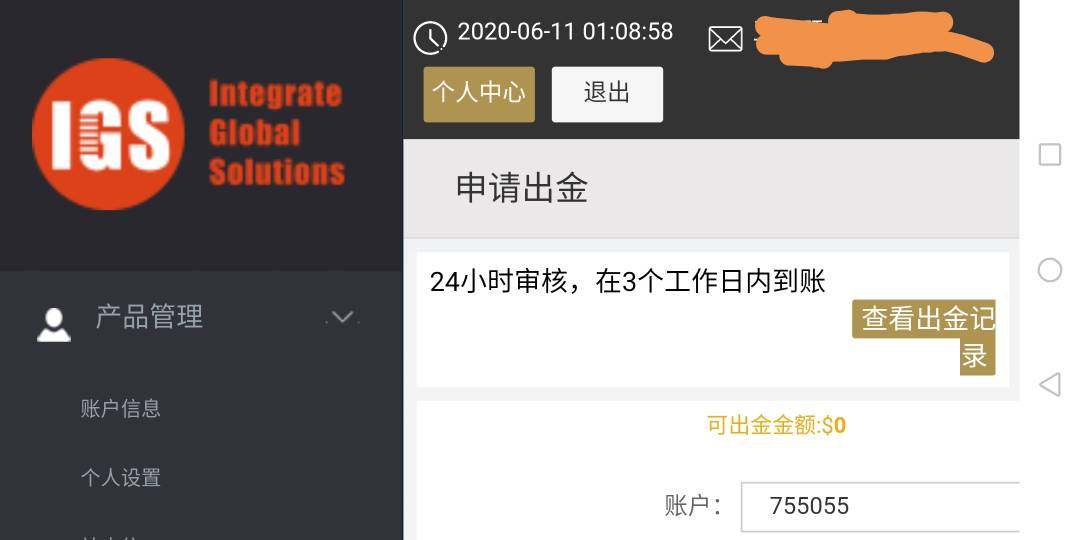

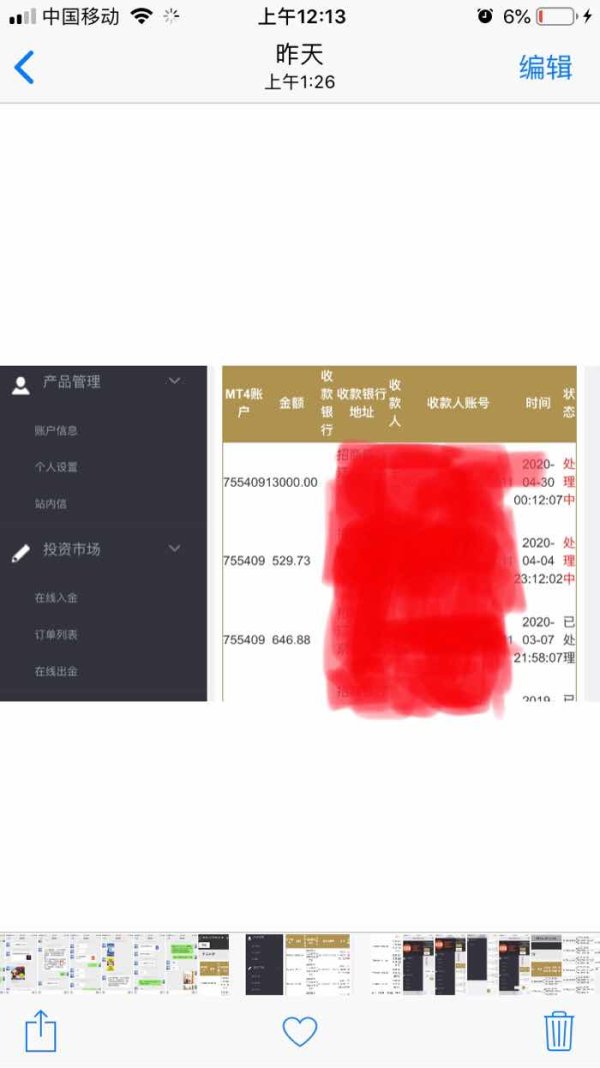

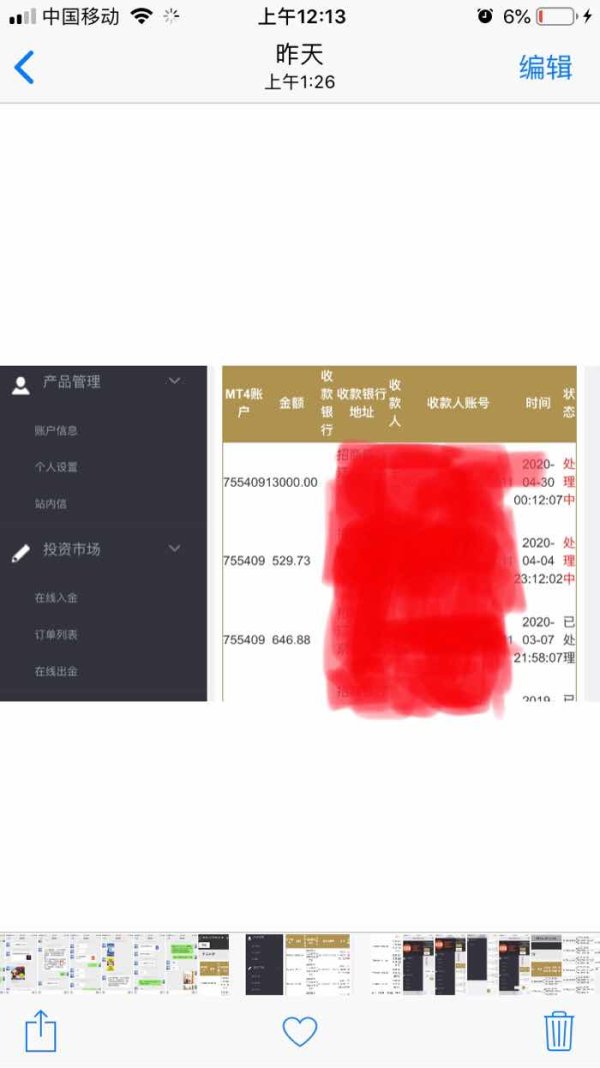

Deposit and Withdrawal Methods: Available documentation does not provide specific information regarding supported deposit and withdrawal methods. Processing times and associated fees are also not disclosed, which represents a significant transparency gap that makes it difficult for traders to plan their fund management strategies.

Minimum Deposit Requirements: Specific minimum deposit amounts are not detailed in current available information. This makes it difficult for potential traders to assess entry requirements and plan their initial investment strategies.

Bonus and Promotional Offers: No specific information regarding welcome bonuses, promotional offers, or trading incentives is available in current market materials. This lack of promotional transparency may indicate limited competitive offerings or poor marketing communication.

Tradeable Assets: The broker provides access to over 80 currency pairs and additional CFD instruments. This offers traders exposure to various financial markets beyond traditional forex pairs, providing some diversity in trading opportunities despite other service limitations.

Cost Structure: Detailed information regarding spreads, commission structures, overnight fees, and other trading costs is not clearly specified in available documentation. This creates uncertainty about true trading expenses and makes it impossible for traders to accurately calculate their potential costs and profitability.

Leverage Ratios: Specific leverage ratios offered to different account types and trader categories are not detailed in current available information. This lack of leverage transparency makes risk assessment and position sizing calculations difficult for potential traders.

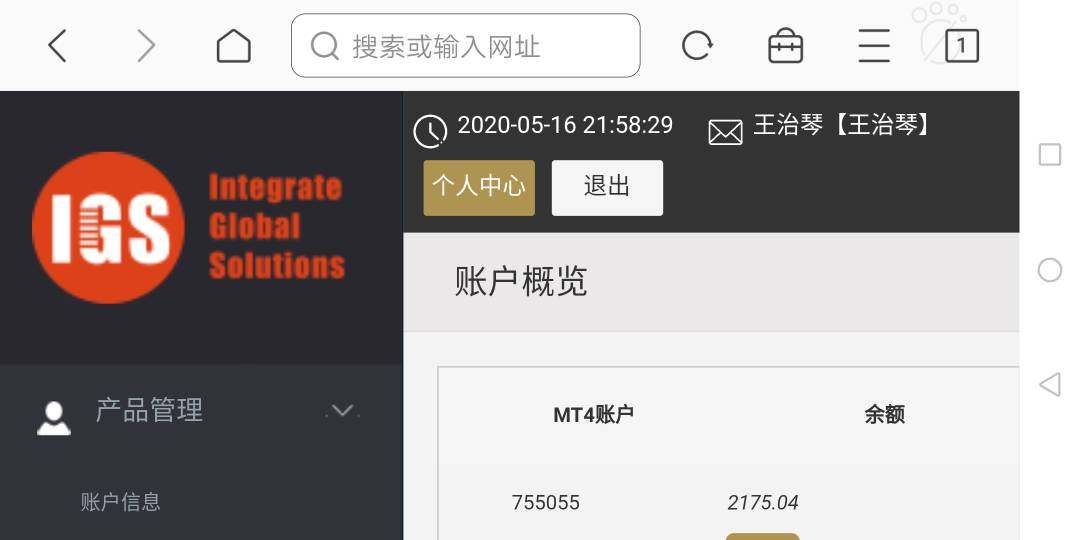

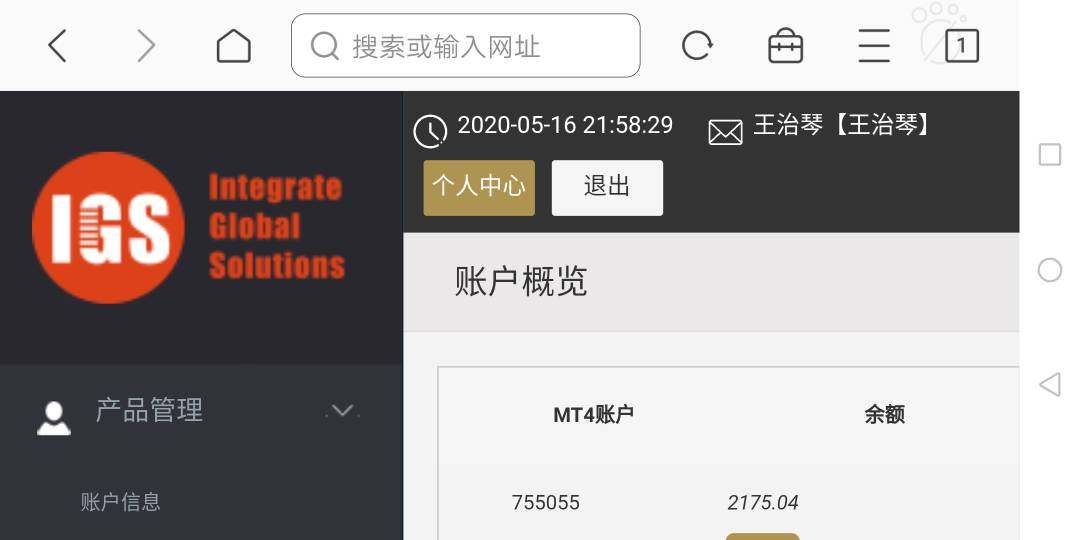

Platform Options: Information regarding supported trading platforms, whether proprietary or third-party solutions like MetaTrader, is not specified in available materials. This platform uncertainty makes it difficult for traders to assess whether the broker supports their preferred trading tools and workflows.

Geographic Restrictions: Specific information about restricted jurisdictions or geographic limitations is not provided in current documentation. This creates uncertainty for international traders about service availability in their regions.

Customer Support Languages: Available customer support languages are not specified in current materials. This language support uncertainty may impact international traders' ability to receive adequate assistance when needed.

This igs review highlights significant information gaps that potential traders should consider when evaluating the broker's suitability for their trading needs.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

The account conditions offered by IGS Energy present several concerns for potential traders. Available information lacks specific details about account types, their respective features, and associated benefits, making it nearly impossible for traders to understand what they're signing up for. This transparency deficit makes it challenging for traders to make informed decisions about which account structure best suits their trading strategy and capital requirements.

Minimum deposit requirements remain unspecified in available documentation. This prevents traders from understanding entry barriers and planning their initial investment strategies effectively. The account opening process details are similarly unclear, with no information about required documentation, verification procedures, or typical processing timeframes. Special account features such as Islamic accounts for Muslim traders are not mentioned in current materials.

Customer feedback suggests that account conditions fail to meet trader expectations. This contributes to the overall poor rating and indicates that even when traders do open accounts, they find the conditions disappointing. The lack of detailed information about account tiers, their respective benefits, and progression requirements indicates a significant gap in service transparency. When compared to industry standards where brokers typically offer multiple account types with clear specifications, IGS Energy's approach appears inadequate.

This igs review finds that the broker's account conditions require substantial improvement in transparency and competitive positioning. Modern trader expectations and industry standards demand much clearer communication and more competitive offerings than what IGS Energy currently provides.

The trading tools and resources provided by IGS Energy appear significantly limited based on available information. Current documentation fails to detail the specific analytical tools, charting capabilities, or research resources available to traders, which are essential components of any serious forex brokerage service. This absence of information suggests either limited tool availability or poor communication of existing resources.

Research and analysis resources, which are crucial for informed trading decisions, are not described in available materials. Educational resources, including webinars, tutorials, or market analysis reports, are similarly absent from current documentation, leaving traders without the support they need to improve their skills. The lack of information about automated trading support, expert advisors, or algorithmic trading capabilities further limits the broker's appeal to sophisticated traders.

User feedback indicates dissatisfaction with the tools and resources provided. This contributes to the low overall rating and suggests that whatever tools are available fail to meet trader needs and expectations. Professional traders typically require comprehensive analytical tools, real-time market data, economic calendars, and research reports to execute effective trading strategies. The apparent absence or poor communication of these resources represents a significant competitive disadvantage.

Expert opinions on the broker's analytical capabilities are not available in current market materials. This suggests limited industry recognition or engagement, which further undermines confidence in the broker's tool offerings. This tool and resource deficit significantly impacts the broker's ability to serve serious forex traders effectively.

Customer Service and Support Analysis (2/10)

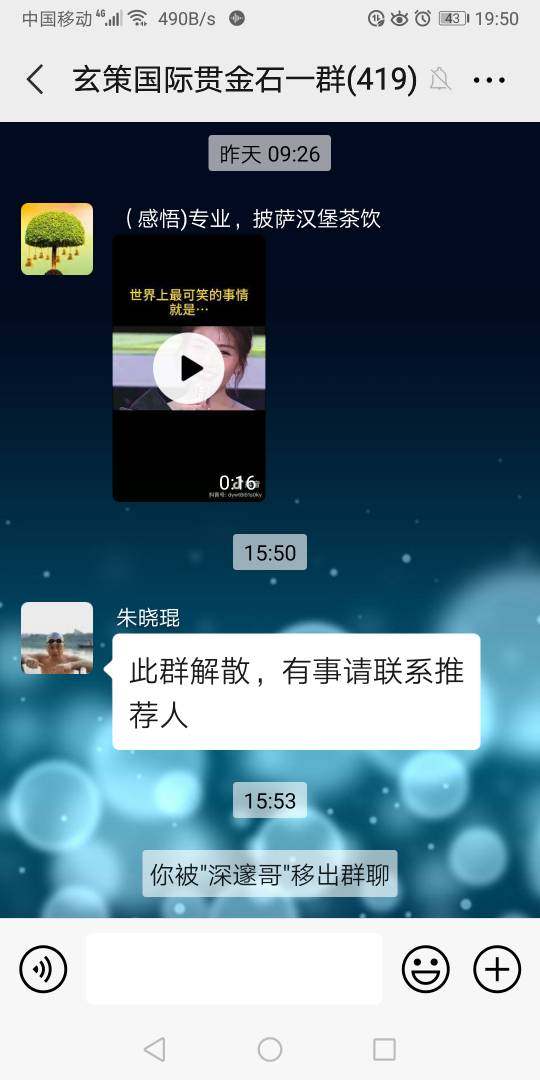

Customer service represents the most problematic area for IGS Energy. User ratings average just 1 out of 5, indicating widespread dissatisfaction with service quality, responsiveness, and problem resolution capabilities that extends across the entire customer base. This extremely poor performance indicates systemic issues that significantly impact trader experience and satisfaction.

Available customer service channels are not clearly specified in current documentation. This creates uncertainty about how traders can access support when needed, which is particularly concerning given the complexity of forex trading and the need for timely assistance. Response time performance appears poor based on user feedback, with customers expressing frustration about delayed responses to inquiries and support requests. Service quality issues extend beyond response times to include problem resolution effectiveness and staff knowledge levels.

Multilingual support availability is not detailed in current materials. This potentially limits service accessibility for international traders who may need assistance in their native languages. Customer service hours and availability across different time zones are similarly unspecified, which may impact traders in various geographic locations who need support during their active trading hours.

User feedback consistently highlights customer service inadequacies. Complaints focus on unresponsive support, inadequate problem resolution, and poor communication quality, creating a pattern of service failures that affects the entire customer experience. The absence of specific customer service improvement cases or success stories in available materials further reinforces the negative service perception. This poor customer service performance represents a critical weakness that significantly undermines the broker's overall value proposition.

Trading Experience Analysis (5/10)

The trading experience provided by IGS Energy receives a moderate rating due to limited available information about platform performance and functionality. User feedback does not provide specific details about platform stability, execution speed, or overall trading environment quality, making comprehensive assessment challenging and leaving potential traders uncertain about what to expect. This lack of detailed performance information is concerning for traders who need reliable execution and stable platforms.

Order execution quality, including slippage rates, requote frequency, and execution speed, is not detailed in available documentation. Platform functionality completeness, including advanced order types, risk management tools, and trading automation features, remains unclear from current materials, making it impossible for traders to assess whether the platform meets their technical requirements. The absence of specific performance metrics makes it difficult to assess the broker's execution standards against industry benchmarks.

Mobile trading experience details are not provided in available information. This is concerning given the importance of mobile accessibility in modern forex trading, where traders need to monitor and manage positions on the go. The lack of information about mobile app features, compatibility, and performance represents a significant information gap that affects trader convenience and flexibility.

User feedback regarding trading experience appears mixed to negative. However, specific technical performance complaints are not detailed in available materials, making it difficult to identify particular areas of concern or strength. The moderate rating reflects the uncertainty created by limited information rather than confirmed positive performance. This igs review suggests that potential traders should thoroughly test the trading environment before committing significant capital, given the lack of transparent performance information.

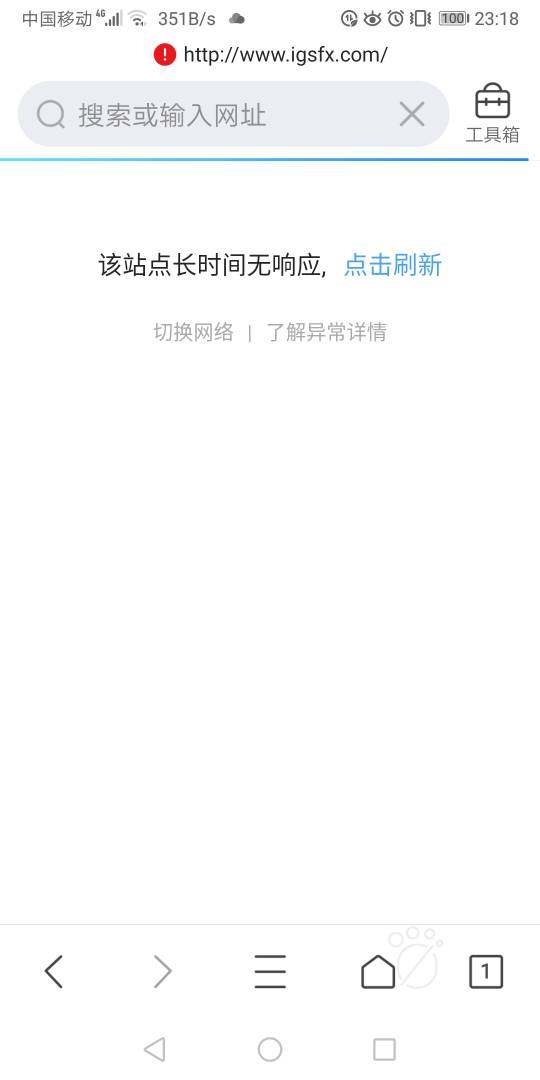

Trust and Reliability Analysis (4/10)

Trust and reliability concerns center primarily on the lack of transparent regulatory information and oversight details. While IGS Energy maintains UK registration, specific regulatory authority supervision, licensing numbers, and compliance frameworks are not clearly disclosed in available materials, creating uncertainty about the level of regulatory protection available to traders. This regulatory transparency deficit significantly impacts trader confidence and trust assessment.

Fund safety measures, including segregated account policies, deposit insurance coverage, and client fund protection protocols, are not detailed in current documentation. Company transparency regarding ownership structure, financial statements, and operational procedures appears limited based on available information, making it difficult for traders to assess the company's financial stability and operational integrity. This lack of transparency creates uncertainty about the broker's operational integrity and financial stability.

Industry reputation and recognition are not clearly established in available materials. There is limited evidence of industry awards, certifications, or professional acknowledgments that would indicate peer recognition or regulatory approval. The handling of negative events, customer complaints, or regulatory issues is not documented in current materials. This makes it difficult to assess the company's crisis management capabilities and response to problems.

Third-party evaluations and independent assessments of the broker's trustworthiness are limited in available information. The combination of regulatory transparency gaps and limited industry recognition contributes to the moderate trust and reliability rating, suggesting potential traders should exercise caution and conduct thorough due diligence before committing funds. Serious traders typically require clear regulatory oversight and transparent operational procedures, which appear lacking in this case.

User Experience Analysis (3/10)

Overall user satisfaction with IGS Energy remains significantly below industry standards. Customer ratings average 1 out of 5, indicating widespread user dissatisfaction across multiple service areas and representing a critical concern for potential traders considering the broker. This extremely poor satisfaction level indicates widespread user dissatisfaction across multiple service areas and represents a critical concern for potential traders considering the broker.

Interface design and ease of use information is not available in current materials. This makes it impossible to assess the user-friendliness of trading platforms and account management systems, which are crucial components of the overall trading experience. Registration and verification process details are similarly absent, creating uncertainty about onboarding experience and requirements that new traders will face.

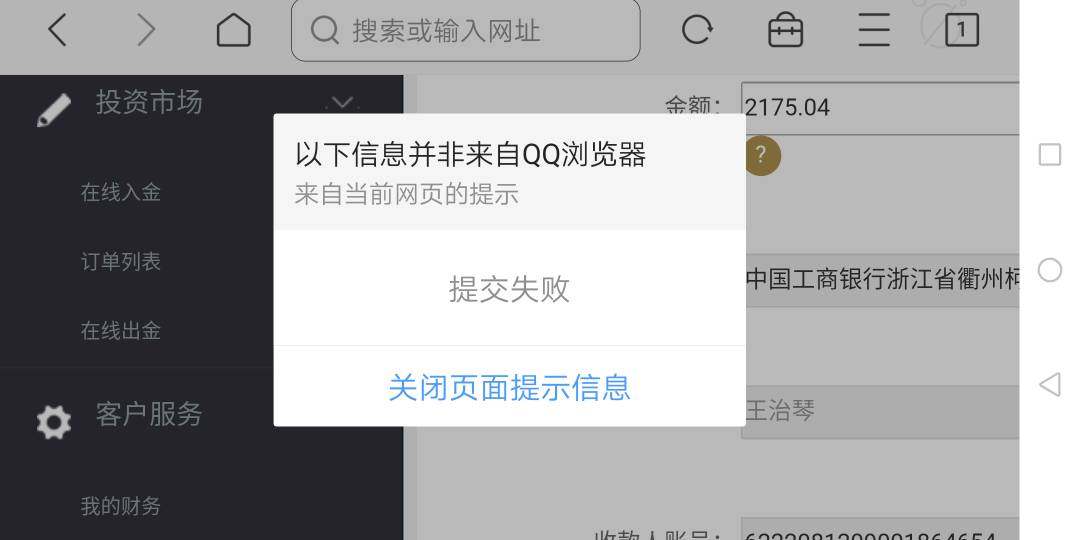

Fund operation experience, including deposit and withdrawal processes, processing times, and associated fees, lacks detailed documentation. This information gap makes it difficult for users to understand the practical aspects of account funding and profit withdrawal procedures, which are essential daily operations for active traders. User feedback suggests these processes may be problematic, though specific details are not available.

Common user complaints focus primarily on customer service inadequacies and general dissatisfaction with service delivery. The predominance of negative feedback suggests systemic issues with service quality and user experience design that affect the entire customer journey. User demographics appear to include primarily novice traders or those with limited trading condition requirements.

Improvement recommendations based on user feedback would include enhanced customer service training, improved communication protocols, and greater transparency in service delivery. The current user experience clearly requires substantial enhancement to meet competitive industry standards and trader expectations, with fundamental changes needed across multiple service areas.

Conclusion

This comprehensive igs review reveals that IGS Energy performs poorly across multiple critical areas essential for effective forex brokerage services. The broker's customer satisfaction ratings of 1 out of 5 indicate serious systemic issues that significantly impact trader experience and service quality, making it difficult to recommend this broker to most traders seeking reliable forex services. While the company offers access to over 80 currency pairs and CFDs, this asset diversity cannot compensate for fundamental service delivery problems that affect every aspect of the trading experience.

IGS Energy may be most suitable for novice traders with minimal service expectations. It might also work for experienced traders willing to accept substandard service in exchange for asset variety, though this represents a significant compromise that most professional traders would find unacceptable. However, most serious forex traders would likely find better alternatives in the competitive brokerage market.

The main advantages include diverse asset offerings and apparently positive internal company culture based on employee ratings. However, significant disadvantages include poor customer service, lack of regulatory transparency, limited trading condition information, and overwhelmingly negative user feedback that spans across all service areas. These substantial weaknesses outweigh the limited advantages, making IGS Energy a challenging recommendation for most forex traders seeking reliable, professional brokerage services that meet modern industry standards.