Is IGS safe?

Pros

Cons

Is IGS A Scam?

Introduction

In the fast-paced world of forex trading, the choice of a broker can significantly impact a trader's success. One such broker, IGS (Integrate Global Solutions), claims to be a leading online trading platform offering a variety of financial instruments, including over 80 currency pairs and various CFDs. However, the legitimacy of IGS has come under scrutiny, raising questions about its reliability and safety. This article aims to provide a comprehensive analysis of whether IGS is a scam or a legitimate trading option. To achieve this, we will evaluate its regulatory status, company background, trading conditions, customer fund security, client experiences, platform performance, and overall risk assessment.

Regulation and Legitimacy

The regulatory framework within which a broker operates is crucial for ensuring the safety of traders' funds and maintaining market integrity. IGS claims to be regulated in several jurisdictions; however, a deeper investigation reveals a lack of credible regulatory oversight. According to the Financial Conduct Authority (FCA) in the UK, IGS has been flagged as a clone firm, operating under false pretenses to mislead investors. This raises critical concerns about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | UK | Blacklisted as clone |

The absence of legitimate regulation and the presence of warnings from recognized authorities indicate that trading with IGS poses significant risks. The importance of regulatory compliance cannot be overstated, as it provides a safeguard for traders against potential fraud and malpractice. The lack of a robust regulatory framework for IGS suggests that it may not be a safe option for traders seeking a trustworthy broker.

Company Background Investigation

IGS, or Integrate Global Solutions, presents itself as a reputable broker in the forex market. However, a closer look into its history reveals a lack of transparency regarding its ownership structure and operational history. Unlike well-established brokers with clear histories and regulatory compliance, IGSs background is murky. The company fails to provide adequate information about its management team, which is a significant red flag for potential investors.

The absence of detailed information about the company's founders and executive team raises concerns about its credibility. A reputable broker typically discloses information about its management and operational practices, which helps build trust with its clients. In contrast, IGS's lack of transparency and information disclosure may indicate an attempt to obscure its true nature.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is essential. IGS offers various trading accounts with different spreads and leverage options. However, the advertised trading conditions often do not align with actual user experiences. Reports indicate that spreads can be significantly higher than those advertised, leading to unexpected trading costs for clients.

| Fee Type | IGS | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.3 pips | 0.6 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | Varies | Varies |

The discrepancies between advertised spreads and actual trading conditions can lead to confusion and financial loss for traders. Additionally, the lack of clarity regarding fees further complicates the trading experience, making it challenging for traders to assess their potential costs accurately. This lack of transparency in trading conditions is a common trait among brokers that may not prioritize the interests of their clients.

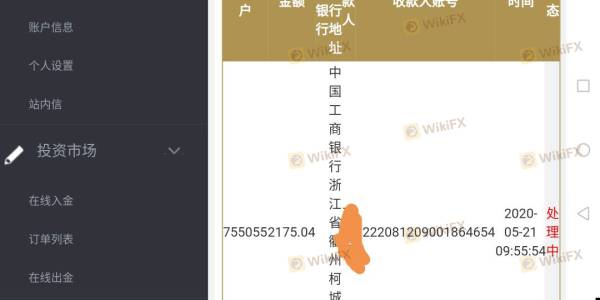

Client Fund Security

The security of client funds is a primary concern for any trader. IGS's practices regarding fund security raise significant alarms. The broker does not provide clear information about fund segregation or investor protection measures. Without proper segregation of client funds, there is an increased risk of loss in the event of the brokers insolvency or malfeasance.

Moreover, the absence of a client compensation scheme, which is typically offered by regulated brokers, further exacerbates the risk for traders. In the case of financial disputes or broker failure, traders may find themselves without recourse to recover their funds. Such practices indicate a lack of commitment to safeguarding client interests, making IGS a potentially unsafe option for traders.

Customer Experience and Complaints

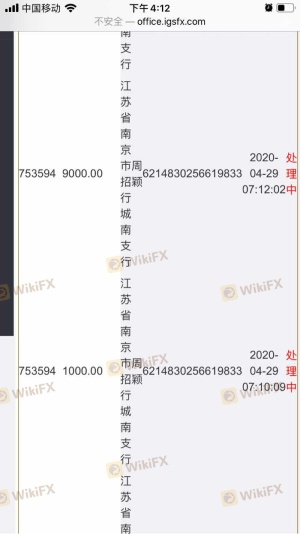

Customer feedback is a critical indicator of a broker's reliability. An analysis of user reviews for IGS reveals a troubling pattern of complaints, particularly regarding withdrawal issues and customer service experiences. Many users report difficulties in withdrawing their funds, citing delays and unresponsive customer support as significant issues.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Support Issues | Medium | Poor |

These complaints highlight the operational challenges faced by IGS and suggest a lack of effective customer support mechanisms. The inability to address client concerns promptly can lead to frustration and mistrust, further solidifying the perception that IGS may not be a reliable trading partner.

Platform and Trade Execution

The trading platform is a crucial aspect of the trading experience. IGS claims to use the industry-standard MetaTrader 4 (MT4) platform, which is generally well-regarded for its functionality. However, user experiences indicate that there may be issues with platform stability and execution quality. Reports of slippage and rejected orders raise concerns about the overall reliability of IGSs trading infrastructure.

Traders require a platform that is not only stable but also capable of executing trades quickly and efficiently. Any signs of manipulation or execution issues can severely impact trading performance and profitability. Therefore, it is essential for potential clients to consider these factors when evaluating IGS as their trading partner.

Risk Assessment

Using IGS for trading comes with inherent risks that need to be carefully considered. The lack of regulation, transparency issues, and negative customer feedback contribute to an overall high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with clone warnings. |

| Fund Security Risk | High | No clear fund segregation or protection measures. |

| Customer Support Risk | Medium | Poor responsiveness to client issues. |

To mitigate these risks, potential traders should conduct thorough due diligence and consider using brokers with established regulatory frameworks and positive user feedback. It is advisable to avoid IGS until substantial improvements in its operational practices and regulatory compliance are made.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that IGS may not be a safe broker for forex trading. The combination of regulatory red flags, lack of transparency, negative customer feedback, and questionable trading conditions paints a concerning picture. Traders should exercise caution and consider alternative options that offer better regulatory oversight and a proven track record of customer satisfaction.

For those seeking reliable forex brokers, options such as IG, OANDA, or Forex.com, which are well-regulated and have positive user reviews, may be more suitable. In light of the findings, it is clear that IGS is not safe and could potentially be a scam, warranting a cautious approach from prospective traders.

Is IGS a scam, or is it legit?

The latest exposure and evaluation content of IGS brokers.

IGS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IGS latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.