Fx Liquidity 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Fx Liquidity review examines one of the emerging players in the forex brokerage space. Based on available market analysis and user feedback, Fx Liquidity has been classified as "safe" by WikiBit, with user evaluations on Trustpilot showing a moderate 4-star rating from 177 reviews. This indicates a generally positive user experience with some areas for improvement.

The broker's key strengths lie in providing diverse asset classes for trading. These include forex currency pairs, commodities, oil, gold, silver, and CFDs. Users have reported fast trade execution capabilities and relatively small price fluctuations during trading sessions. The platform appears to be designed for traders seeking diversified investment opportunities within the forex and related financial markets.

Fx Liquidity positions itself as suitable for forex traders who prioritize portfolio diversification. The broker seeks to provide access to multiple asset classes beyond traditional currency pairs. The broker's focus on execution speed and price stability makes it potentially attractive for both short-term and medium-term trading strategies.

Important Notice

This review is based on publicly available information, user feedback, and market analysis. Specific regulatory information and cross-regional entity differences were not detailed in available sources. Traders should conduct their own due diligence regarding regulatory compliance in their jurisdiction before opening accounts.

The evaluation methodology relies on user experiences, third-party safety assessments, and observable market practices. This approach focuses on practical information rather than direct regulatory documentation. All information presented reflects the current understanding based on available data sources.

Rating Framework

Broker Overview

Fx Liquidity operates as a financial services provider specializing in forex and related financial product trading services. While specific establishment details and company background information were not available in source materials, the broker has positioned itself within the competitive forex market by focusing on multi-asset trading capabilities and execution quality.

The broker's primary business model centers around providing traders access to various financial markets through their trading platform. This includes facilitating transactions across multiple asset classes and maintaining liquidity provision to ensure smooth trading operations for their client base.

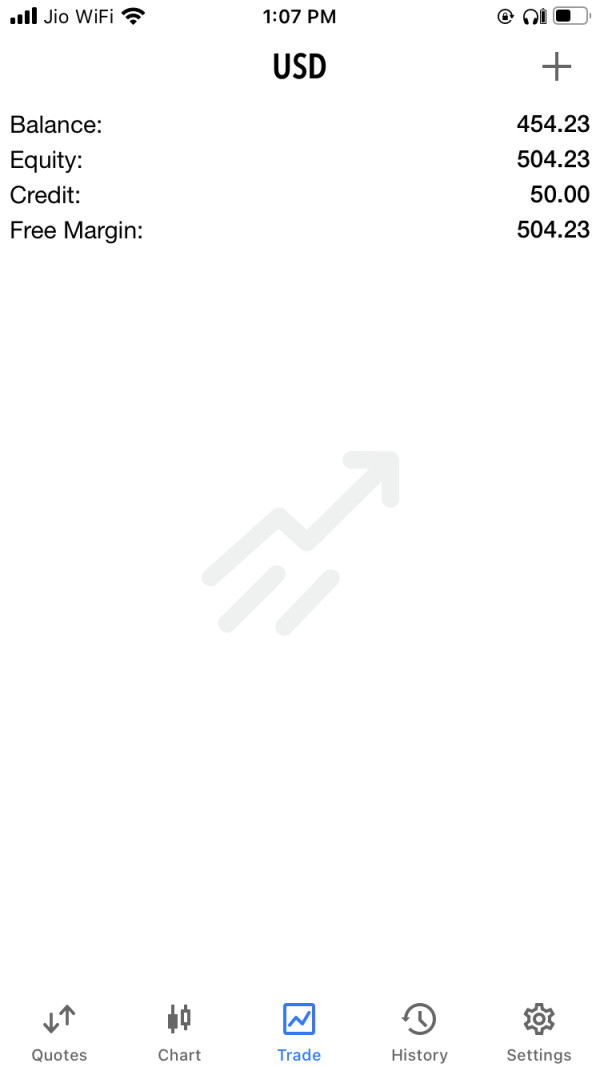

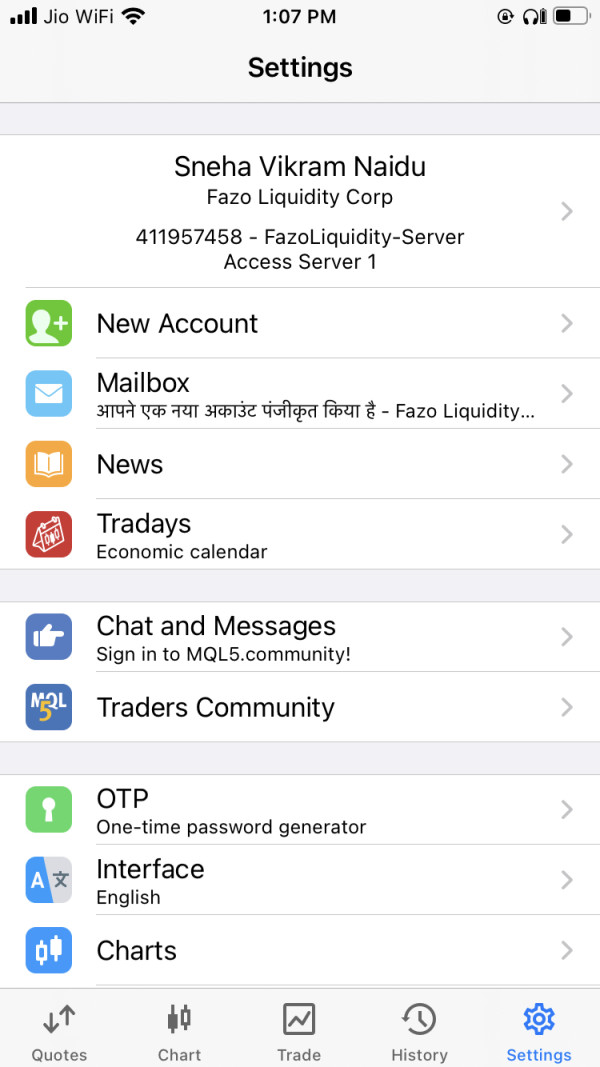

Regarding trading infrastructure, Fx Liquidity review data indicates the broker offers access to forex currency pairs, commodities trading, oil markets, precious metals including gold and silver, and CFD instruments. However, specific details about trading platform types, whether utilizing MetaTrader 4/5 or proprietary solutions, were not specified in available documentation. Similarly, information about primary regulatory oversight and licensing jurisdictions was not detailed in accessible sources.

Regulatory Status: Specific regulatory jurisdiction and licensing information was not detailed in available source materials. Traders should verify regulatory compliance independently.

Deposit and Withdrawal Methods: Available source materials did not specify the range of funding options, processing times, or associated fees for deposit and withdrawal transactions.

Minimum Deposit Requirements: Specific minimum deposit thresholds for different account types were not mentioned in accessible documentation.

Promotions and Bonuses: Current promotional offerings, welcome bonuses, or loyalty programs were not detailed in the Fx Liquidity review materials examined.

Tradeable Assets: The broker provides access to forex currency pairs, commodities markets, oil trading, precious metals including gold and silver, and CFD instruments across various underlying assets.

Cost Structure: Detailed information regarding spreads, commission structures, overnight fees, and other trading costs was not specified in available sources.

Leverage Options: Maximum leverage ratios and margin requirements were not detailed in accessible documentation.

Platform Selection: Specific trading platform options and their features were not comprehensively covered in source materials.

Geographic Restrictions: Information about restricted jurisdictions or regional limitations was not available in reviewed sources.

Customer Support Languages: Available customer service languages were not specified in accessible documentation.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of account conditions for Fx Liquidity faces limitations due to insufficient detailed information in available sources. Typically, forex brokers offer multiple account tiers designed for different trader profiles, ranging from beginner-friendly micro accounts to professional-grade institutional accounts. However, specific account types, their distinctive features, and associated benefits were not detailed in the materials reviewed.

Minimum deposit requirements play a crucial role in accessibility for new traders. However, exact amounts for different account levels were not specified in available documentation. Similarly, the account opening process, required documentation, verification procedures, and timeframes were not outlined in accessible sources.

Special account features such as Islamic swap-free accounts, managed accounts, or copy trading capabilities were not mentioned in the Fx Liquidity review materials. Without comprehensive account condition details, prospective traders would need to contact the broker directly to understand their options and requirements.

Fx Liquidity demonstrates strength in asset diversity, offering traders access to multiple market segments including forex currency pairs, commodities, oil markets, precious metals, and CFD instruments. This comprehensive asset selection allows traders to diversify their portfolios and capitalize on opportunities across different market sectors, which represents a significant advantage for those seeking varied trading opportunities.

The availability of precious metals trading, particularly gold and silver, provides traders with traditional safe-haven assets. These assets can serve as portfolio hedges during market volatility. Commodities and oil trading further expand the range of available strategies, allowing traders to benefit from global economic trends and supply-demand dynamics.

However, specific details about research and analysis resources, educational materials, market commentary, or analytical tools were not detailed in available sources. Similarly, information about automated trading support, expert advisors, or algorithmic trading capabilities was not specified in the review materials examined.

Customer Service and Support Analysis

Customer service evaluation for Fx Liquidity is constrained by limited information availability in source materials. Effective customer support typically encompasses multiple communication channels including live chat, email, telephone support, and potentially social media assistance. However, specific available channels and their operational hours were not detailed in accessible documentation.

Response time metrics, which are crucial for trader satisfaction especially during market hours, were not specified in available sources. Similarly, service quality assessments, problem resolution effectiveness, and customer satisfaction ratings beyond the general Trustpilot score were not detailed in review materials.

Multilingual support capabilities, which are essential for international brokers, were not mentioned in available documentation. The geographic coverage of customer service and timezone-specific support availability also lacked detailed information in accessible sources.

Trading Experience Analysis

Trading experience assessment for Fx Liquidity is limited by insufficient detailed information in available sources. Platform stability and execution speed are critical factors that directly impact trader success, but specific performance metrics, uptime statistics, or execution quality data were not provided in accessible documentation.

Order execution quality, including fill rates, slippage statistics, and rejection rates, represents crucial information for evaluating broker performance. However, these technical performance indicators were not detailed in available review materials. Similarly, platform functionality assessments, including charting capabilities, order types, and analytical tools, were not comprehensively covered.

Mobile trading experience, which has become increasingly important for modern traders, was not specifically addressed in source materials. The quality of mobile applications, their feature completeness compared to desktop platforms, and user interface design were not evaluated in accessible documentation.

User feedback regarding Fx Liquidity review experiences, while showing a 4-star Trustpilot rating, lacks specific details about trading environment satisfaction. Platform performance and execution quality information were not available in accessible sources.

Trust and Safety Analysis

Trust and safety evaluation for Fx Liquidity shows mixed results based on available information. The WikiBit assessment rating the broker as "Safe" provides some confidence in the platform's security measures and operational practices. Additionally, the Trustpilot rating of 4 stars from 177 user reviews suggests generally positive user experiences with the broker's services.

However, specific regulatory authorization details, including licensing jurisdictions, regulatory registration numbers, and compliance frameworks, were not detailed in available sources. This lack of transparent regulatory information represents a significant gap for traders seeking comprehensive due diligence information.

Fund security measures, including segregated account policies, deposit insurance, and client money protection protocols, were not specified in accessible documentation. Similarly, company transparency regarding ownership structure, financial reporting, and operational procedures was not detailed in review materials.

Third-party verification through WikiBit and user feedback via Trustpilot provides some external validation. However, comprehensive regulatory verification and detailed safety measure documentation would strengthen the trust assessment significantly.

User Experience Analysis

User experience evaluation for Fx Liquidity faces constraints due to limited detailed feedback in available sources. The Trustpilot 4-star rating from 177 reviews suggests moderate user satisfaction, but specific aspects of user experience, including interface design quality, navigation ease, and overall platform usability, were not detailed in accessible documentation.

Registration and account verification processes, which significantly impact initial user experience, were not described in available sources. Similarly, funding experience, including deposit processing efficiency, withdrawal procedures, and associated user satisfaction levels, lacked detailed coverage in review materials.

Common user complaints or frequently reported issues were not specified in accessible documentation. This limits the ability to identify potential problem areas or areas for improvement. User demographic analysis and typical trader profiles were also not detailed in available sources.

The overall user journey from registration through active trading was not comprehensively evaluated in source materials. This makes it difficult to assess the complete user experience offering from Fx Liquidity review perspective.

Conclusion

Based on available information, Fx Liquidity presents a mixed profile with notable strengths in asset diversity and basic safety credentials. However, significant information gaps limit comprehensive evaluation. The broker's "Safe" rating from WikiBit and 4-star Trustpilot evaluation suggest fundamental operational competency, while the range of tradeable assets including forex, commodities, and precious metals indicates solid market access capabilities.

The platform appears most suitable for traders prioritizing asset diversification and seeking access to multiple market segments beyond traditional forex pairs. However, the lack of detailed information regarding regulatory oversight, account conditions, and specific trading terms represents a considerable limitation for thorough broker assessment.

Prospective traders should conduct additional due diligence, particularly regarding regulatory compliance in their jurisdiction, before committing funds. The absence of comprehensive operational details suggests the need for direct broker contact to clarify important trading conditions and service parameters.