Honch International 2025 Review: Everything You Need to Know

Summary

Honch International operates as an offshore forex broker with questionable regulatory status. This creates potential risks for investors who want reliable trading services. According to available information from TheForexReview, this honch international review reveals a broker that lacks proper regulatory oversight, which could expose traders to significant financial vulnerabilities.

The platform offers MetaTrader 5 as its primary trading solution. It also maintains a relatively low minimum deposit requirement of $100, making it accessible to beginner traders and small-scale investors. However, the absence of clear regulatory compliance and the offshore nature of its operations raise serious concerns about fund security and operational transparency.

While the low entry barrier might attract new traders, the lack of regulatory protection means investors have limited recourse in case of disputes or operational issues. The broker's website design has been criticized as unprofessional, further undermining confidence in its credibility. This review aims to provide a comprehensive analysis of Honch International's services, highlighting both its accessible features and the significant risks associated with trading through an unregulated offshore entity.

Important Notice

Due to Honch International's status as an unregulated offshore broker, users across different jurisdictions may find themselves with insufficient legal protection and limited regulatory recourse. The broker's offshore registration means that traditional investor protection schemes available through regulated entities may not apply to client funds or trading activities.

This honch international review is based on publicly available information and user feedback compiled from various sources, as direct testing of the platform's services was not conducted. Potential clients should be aware that regulatory standards and consumer protections vary significantly between regulated and unregulated brokers. The information presented in this review reflects the current state of available data and may not capture recent changes in the broker's operations or service offerings.

Rating Framework

Broker Overview

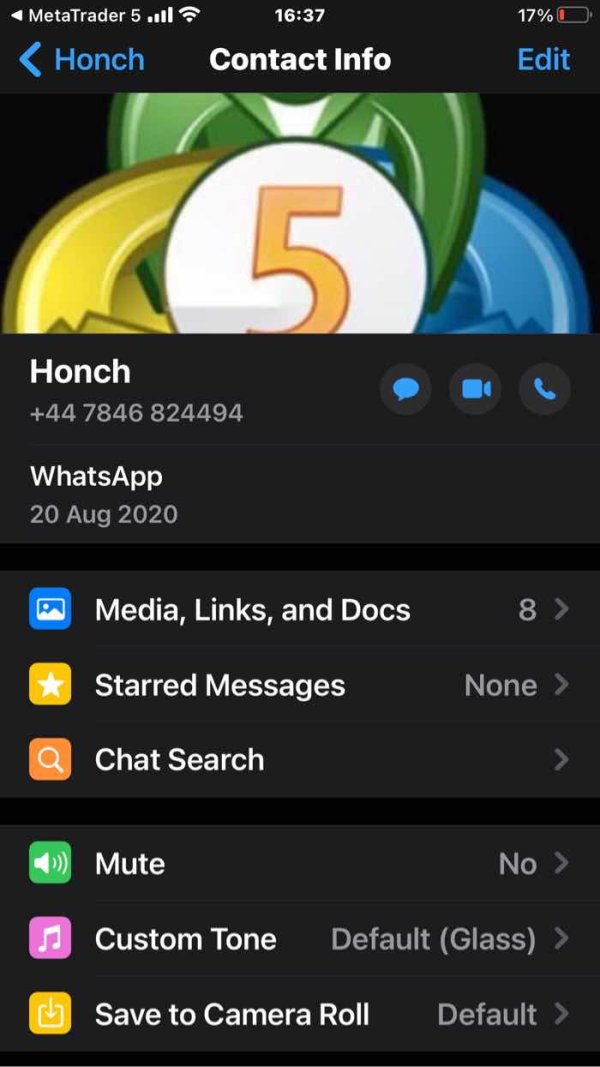

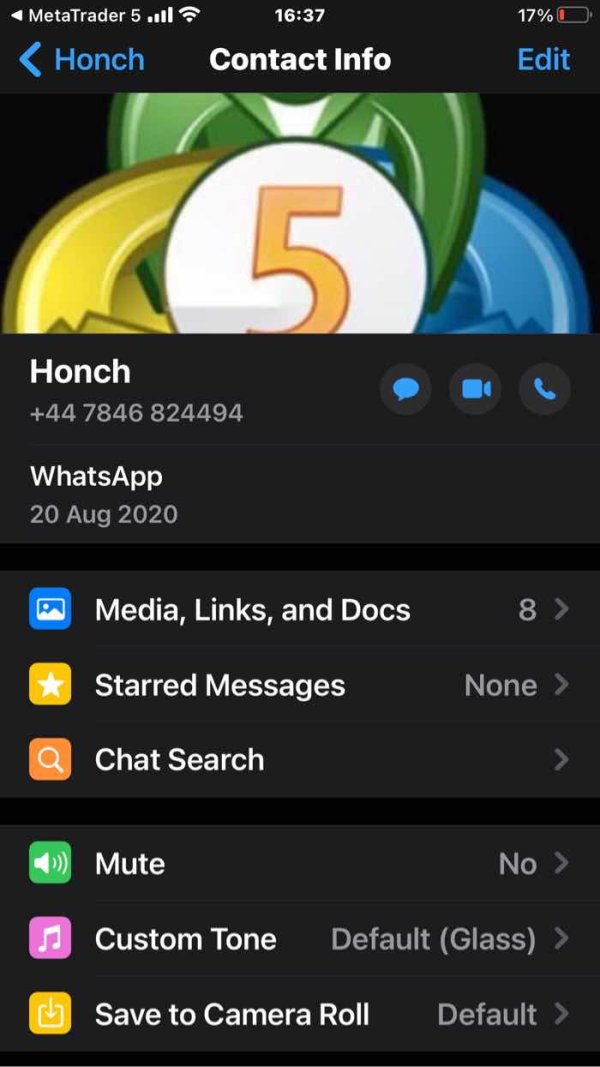

Honch International presents itself as a forex and CFD broker operating from an offshore jurisdiction. Specific details about its founding date and corporate structure remain unclear in available documentation. According to TheForexReview reports, the company attempts to serve international clients through its online trading platform, positioning itself as an accessible option for retail traders seeking exposure to global financial markets.

The broker's business model appears to focus on providing basic trading services through the popular MetaTrader 5 platform. It targets primarily inexperienced traders who may be attracted by low minimum deposit requirements. However, the lack of regulatory oversight raises questions about the sustainability and reliability of its operational framework, particularly regarding client fund segregation and business conduct standards.

The platform offers access to multiple asset classes including forex pairs, stocks, commodities, and interest rate products. This attempts to provide a diversified trading environment. However, the absence of detailed information about spreads, commissions, and execution quality makes it difficult to assess the true cost-effectiveness of trading with this broker.

This honch international review indicates that while the broker offers basic trading infrastructure, the lack of regulatory compliance and transparent business practices significantly undermines its credibility in the competitive forex market.

Regulatory Status: Available information does not indicate any specific regulatory authorization from recognized financial authorities. This positions Honch International as an unregulated offshore entity.

Deposit and Withdrawal Methods: Specific information about funding methods and withdrawal procedures is not detailed in available sources, though the minimum deposit requirement is set at $100.

Minimum Deposit Requirements: The broker maintains a relatively low barrier to entry with a minimum deposit of $100. This makes it accessible to small-scale investors and beginners.

Bonus and Promotional Offers: Current promotional offerings and bonus structures are not specified in available documentation.

Tradeable Assets: The platform provides access to forex currency pairs, stocks, commodities, and interest rate products. This offers a basic range of trading instruments.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not available in current sources.

Leverage Ratios: Maximum leverage is offered up to 1:100. This is relatively conservative compared to some offshore brokers.

Platform Options: Trading is conducted through the MetaTrader 5 platform. This provides access to standard charting tools and automated trading capabilities.

Geographic Restrictions: Specific information about restricted jurisdictions or regional limitations is not detailed in available sources.

Customer Service Languages: Available customer support languages and communication channels are not specified in current documentation.

This honch international review reveals significant information gaps that potential clients should consider when evaluating the broker's transparency and operational standards.

Detailed Rating Analysis

Account Conditions Analysis

The account structure at Honch International appears relatively straightforward. Detailed information about different account tiers and their specific features remains limited in available documentation. The broker's minimum deposit requirement of $100 positions it as accessible to retail traders with limited capital, particularly appealing to newcomers to forex trading who want to test the waters without significant financial commitment.

However, the lack of detailed information about account types, their specific benefits, and associated conditions represents a significant transparency issue. Most reputable brokers provide clear documentation about different account categories, their features, and eligibility requirements. The absence of such information makes it difficult for potential clients to understand what services they can expect at different investment levels.

The account opening process details are not clearly outlined in available sources. This could indicate either streamlined procedures or lack of proper documentation standards. While the low minimum deposit might attract beginners, the absence of comprehensive account information suggests limited customization options for more experienced traders who might require specific features or conditions.

This honch international review finds that while the basic accessibility is reasonable, the lack of detailed account information and transparent conditions significantly limits the broker's appeal to serious traders who require clear understanding of their trading environment and associated costs.

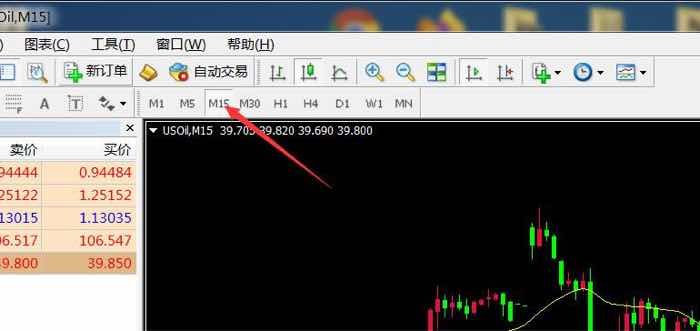

Honch International's primary technological offering centers around the MetaTrader 5 platform. This represents a solid foundation for trading activities. MT5 provides comprehensive charting capabilities, technical analysis tools, automated trading support through Expert Advisors, and multi-asset trading functionality that can accommodate various trading strategies and experience levels.

The platform's built-in features include advanced order types, multiple timeframe analysis, custom indicators, and algorithmic trading capabilities that can satisfy both manual and automated trading approaches. However, the broker's own research and analysis resources beyond the standard MT5 offerings are not detailed in available information, suggesting limited value-added services for traders seeking market insights and educational content.

Educational resources, market analysis, economic calendars, and trading guides that many regulated brokers provide as standard offerings appear to be absent or not prominently featured in Honch International's service portfolio. This limitation could significantly impact trader development, particularly for beginners who benefit from structured learning materials and ongoing market analysis. The absence of proprietary trading tools, advanced analytics, or specialized research capabilities means traders must rely primarily on MT5's standard features and seek external sources for market analysis and educational content, which may not provide the comprehensive trading environment that more sophisticated traders require.

Customer Service and Support Analysis

Information regarding Honch International's customer service infrastructure, response times, and support quality is notably absent from available documentation. This raises concerns about the broker's commitment to client service standards. The lack of clearly stated customer support channels, operating hours, and response time commitments suggests either inadequate service infrastructure or poor communication of available support options.

Professional forex brokers typically provide multiple communication channels including live chat, email support, phone assistance, and sometimes dedicated account managers for different client tiers. The absence of detailed customer service information makes it impossible to assess whether Honch International meets industry standards for client support and problem resolution. Multilingual support capabilities, which are crucial for international brokers serving diverse client bases, are not specified in available sources.

This information gap could indicate limited language support or lack of international service standards that global traders expect from their brokers. Without user feedback about actual customer service experiences, response quality, or problem resolution effectiveness, potential clients cannot make informed decisions about the broker's ability to provide adequate support when needed. This lack of transparency about customer service capabilities represents a significant weakness in the broker's overall service proposition.

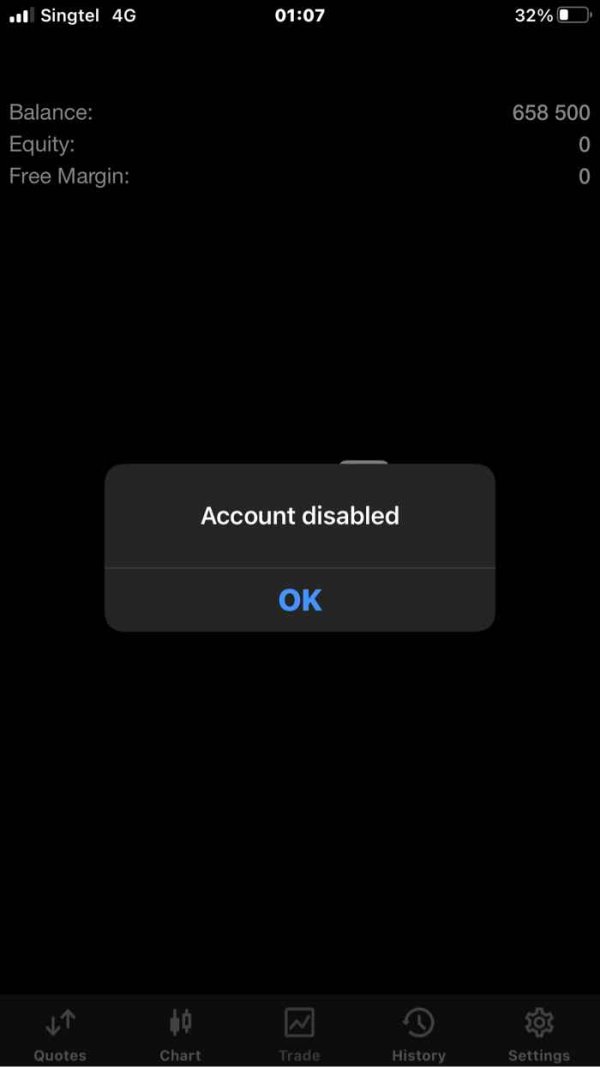

Trading Experience Analysis

The trading experience at Honch International is primarily shaped by the MetaTrader 5 platform. This provides a familiar and functional environment for forex and CFD trading. MT5's robust architecture typically ensures stable performance, though specific information about the broker's server infrastructure, execution speeds, and platform reliability is not available in current sources.

Order execution quality, which is crucial for trading success, lacks detailed documentation regarding fill rates, slippage statistics, or execution methodology. Without this information, traders cannot assess whether the broker provides fair and efficient order processing, particularly during volatile market conditions when execution quality becomes most critical. The platform's mobile trading capabilities through MT5 mobile applications should provide reasonable access to trading functions, though the broker's specific mobile trading features and optimizations are not detailed.

Market depth information, real-time pricing accuracy, and advanced order types availability through the broker's MT5 implementation remain unclear. Trading environment factors such as spread competitiveness, liquidity provision, and market access during high-impact news events are not documented, making it difficult to evaluate the overall trading conditions. The absence of detailed trading statistics and performance metrics suggests limited transparency about the actual trading experience clients can expect.

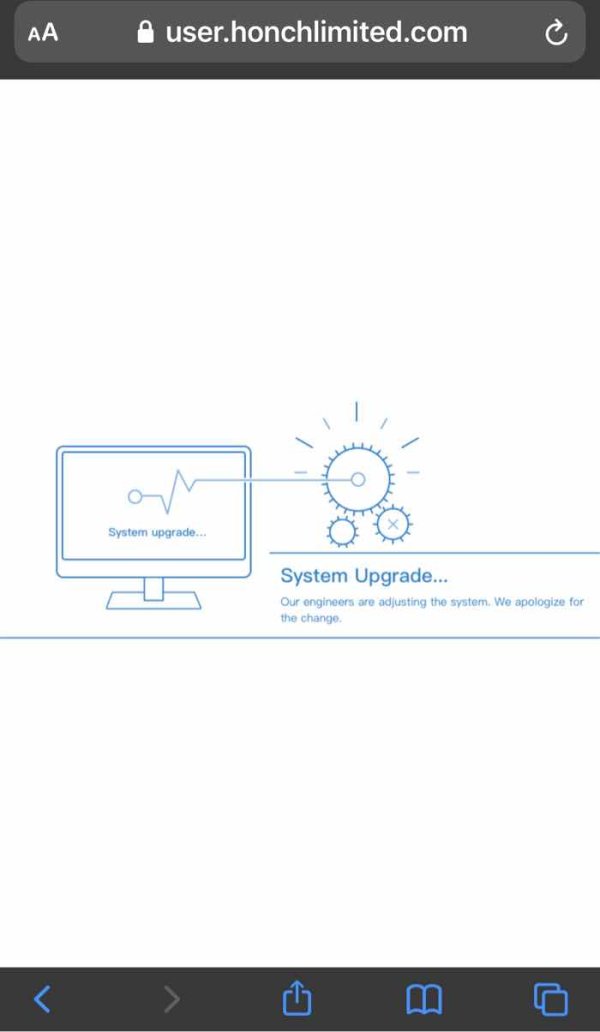

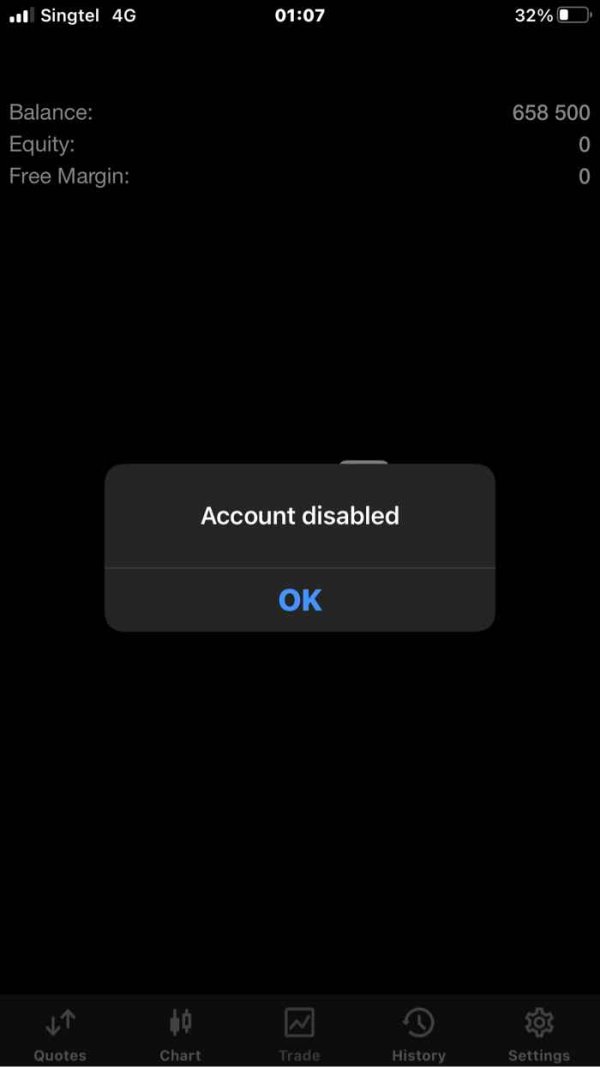

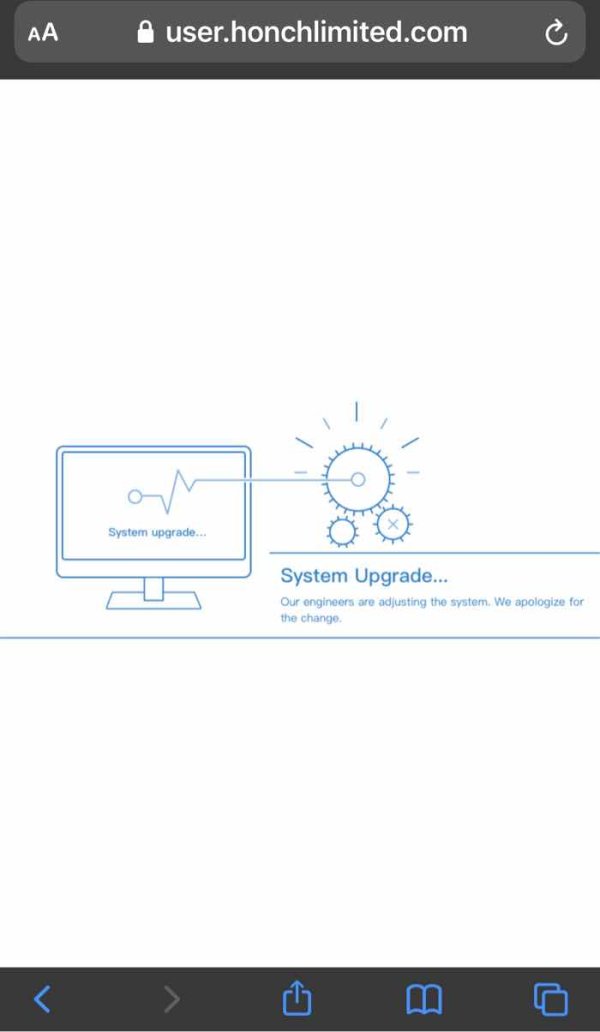

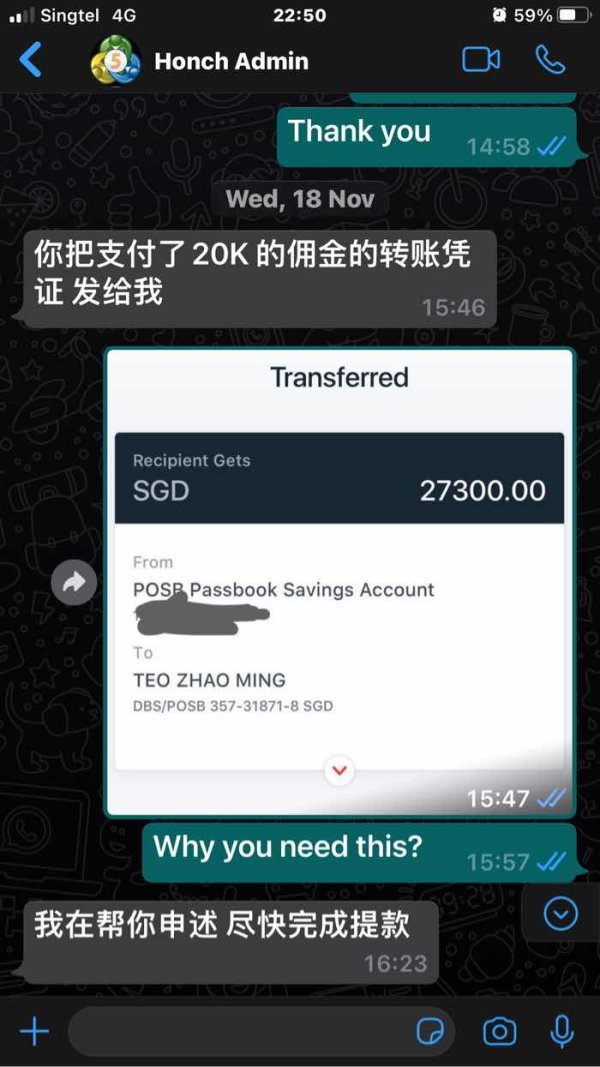

Trust and Reliability Analysis

The most significant concern regarding Honch International relates to its unregulated status. This fundamentally undermines trust and reliability for potential clients. Operating without oversight from recognized financial regulatory authorities means the broker is not subject to capital adequacy requirements, client fund segregation mandates, or operational conduct standards that protect trader interests.

Regulatory compliance provides essential investor protections including compensation schemes, dispute resolution procedures, and operational transparency requirements that unregulated brokers are not obligated to maintain. The absence of regulatory oversight means clients have limited recourse in case of operational issues, fund access problems, or business disputes. Information about the broker's corporate structure, financial backing, ownership details, and operational history is not readily available, further complicating trust assessment.

Established brokers typically provide comprehensive corporate information, regulatory documentation, and operational transparency that allows clients to verify their legitimacy and stability. The lack of third-party audits, financial reporting, or independent verification of business practices means potential clients cannot assess the broker's financial stability or operational integrity. Without regulatory supervision and transparent business practices, Honch International presents significant counterparty risk that traders should carefully consider before committing funds.

User Experience Analysis

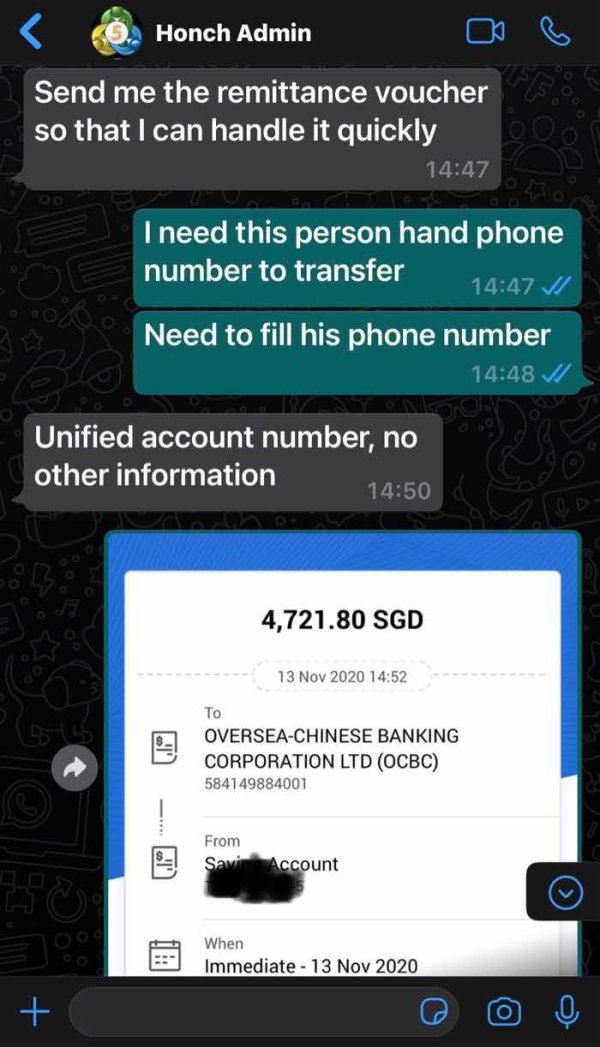

Available feedback regarding Honch International's user experience includes criticism of the broker's website design. This has been characterized as unprofessional and inadequate for a financial services provider. Poor website design often reflects broader issues with user interface development and attention to client experience details that can significantly impact overall satisfaction.

The registration and account verification processes are not detailed in available sources, though streamlined procedures could be either a benefit for quick account setup or a concern if proper due diligence and security measures are inadequate. Clear onboarding procedures with appropriate security measures are essential for both regulatory compliance and user confidence. Funding and withdrawal experiences, which are crucial aspects of user satisfaction, lack detailed documentation about processing times, available methods, fees, and potential complications.

Efficient and transparent financial transactions are fundamental to positive user experiences with online brokers. User interface design beyond the standard MT5 platform, including account management areas, reporting functions, and client portal features, are not described in available information. The absence of user testimonials or detailed experience reports makes it difficult to assess actual client satisfaction levels and common user experience issues that might affect trading activities and overall service satisfaction.

Conclusion

This comprehensive honch international review reveals a broker that, while offering some basic accessibility features such as low minimum deposits and MetaTrader 5 platform access, presents significant concerns primarily related to its unregulated status and lack of operational transparency. The broker may appeal to small-scale investors and beginner traders seeking low-cost entry into forex trading, but the absence of regulatory oversight creates substantial risks that potential clients must carefully consider.

The main advantages include the relatively low $100 minimum deposit requirement and access to the reliable MT5 trading platform. This provides essential trading functionality. However, these benefits are overshadowed by critical disadvantages including the lack of regulatory protection, limited transparency about business operations, poor website design feedback, and absence of detailed information about costs, customer service, and operational procedures.

Potential clients should approach Honch International with significant caution, understanding that unregulated offshore brokers carry inherent risks that regulated alternatives do not present. Serious traders seeking reliable, transparent, and protected trading environments would likely benefit from considering regulated alternatives that provide comprehensive investor protections and operational transparency.