SafeCap 2025 Review: Everything You Need to Know

Executive Summary

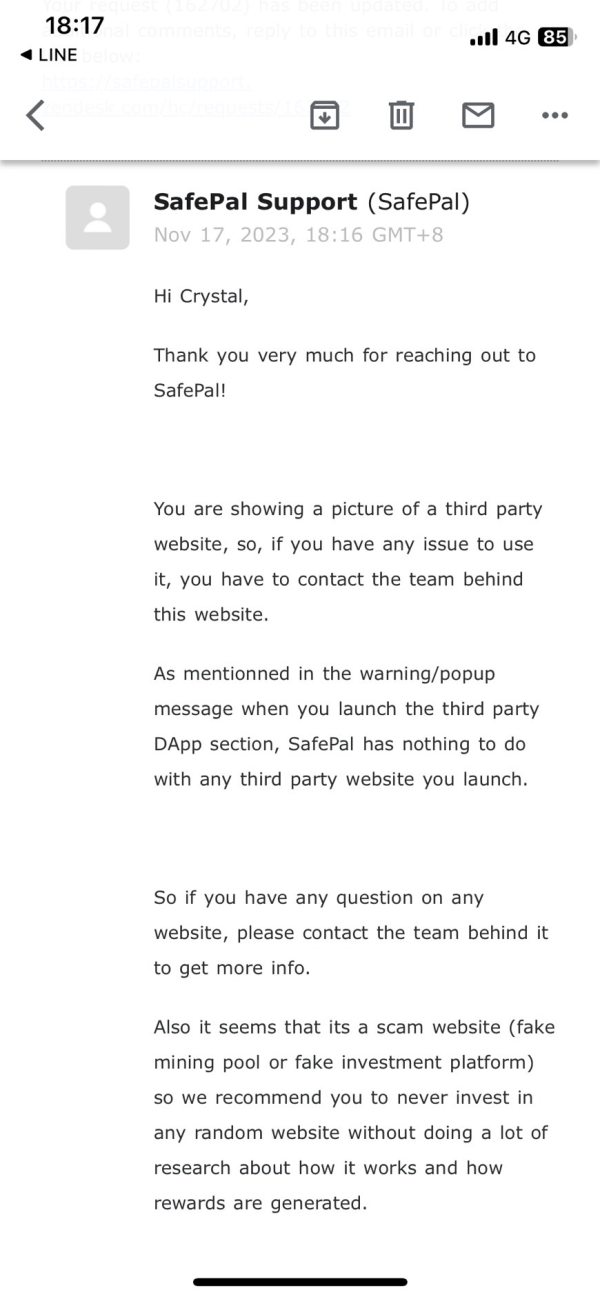

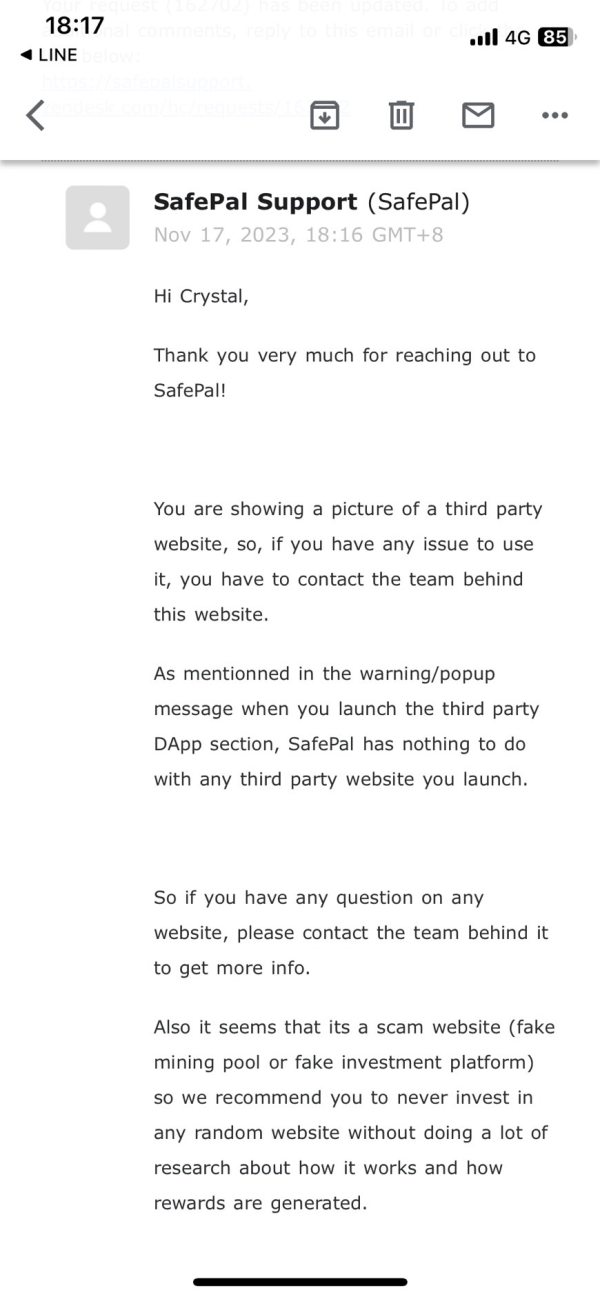

This comprehensive SafeCap review reveals major concerns about this forex broker. Potential traders must understand these issues before considering their services. SafeCap operates as an unregulated forex broker that has been flagged by the UK's Financial Conduct Authority as a clone company. This raises serious questions about its legitimacy and safety for retail traders.

SafeCap offers an intuitive Webtrader platform that has received some positive user feedback for its functionality and user-friendly interface. However, the broker faces substantial credibility issues. According to WikiBit reports, the company has received mixed reviews from users, with some positive experiences overshadowed by concerning fraud allegations and regulatory warnings. The broker claims to provide automated trading solutions with win rates exceeding 85%. These claims cannot be independently verified due to the lack of regulatory oversight.

SafeCap appears to target both novice and experienced traders through its accessible platform design. The absence of proper regulatory authorization makes it unsuitable for traders seeking secure and compliant trading environments. The FCA's warning about SafeCap being a clone company particularly undermines any confidence potential clients might have in the broker's operations.

Important Notice

This SafeCap review is based on publicly available information and user feedback collected from various sources. Readers should be aware that SafeCap's operations in the UK have been specifically warned against by the FCA. The authority has identified the company as a clone firm attempting to impersonate legitimate regulated entities. This regulatory warning indicates that SafeCap lacks proper authorization to provide financial services in the UK jurisdiction.

The evaluation presented in this review does not involve actual trading experience with SafeCap's platform. All assessments are derived from user testimonials, regulatory notices, and publicly accessible information about the broker's services and business practices. Potential traders should conduct their own due diligence and consult with financial advisors before engaging with any unregulated forex broker.

Rating Framework

Broker Overview

SafeCap operates as a forex trading platform that primarily focuses on providing online trading services through its proprietary Webtrader platform. The company's business model centers around offering forex trading opportunities to retail clients. Specific details about its establishment date and corporate headquarters remain unclear from available public information. According to various online sources, SafeCap has been operating in the forex market for some time. The lack of transparent corporate information raises questions about its operational history and business legitimacy.

The broker positions itself as a technology-driven trading platform. It emphasizes advanced trading tools and automated solutions. SafeCap claims to offer sophisticated trading systems designed to help traders navigate forex markets more effectively. However, the absence of detailed company background information contributes to the overall lack of transparency that characterizes this broker. This includes founding dates and executive team details.

SafeCap's primary offering revolves around forex trading through its Webtrader platform. The company markets this as an intuitive and comprehensive trading solution. The platform is designed to accommodate various trading styles and experience levels, from beginners to advanced traders. According to available information, SafeCap also promotes automated trading solutions that allegedly achieve high success rates. These claims lack independent verification. The broker's focus on technological innovation appears to be its main selling point, but this is overshadowed by significant regulatory and trust concerns that potential clients must carefully consider before engaging with their services.

Regulatory Status: SafeCap operates without proper regulatory authorization. The FCA specifically warns that the company is a clone firm attempting to impersonate legitimate regulated entities. This regulatory warning is particularly concerning as it indicates that SafeCap lacks the necessary licenses to provide financial services in major jurisdictions.

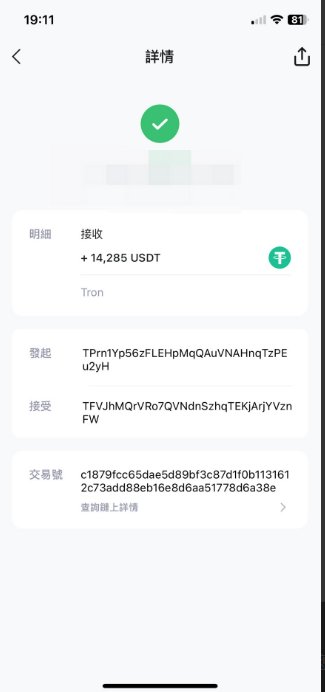

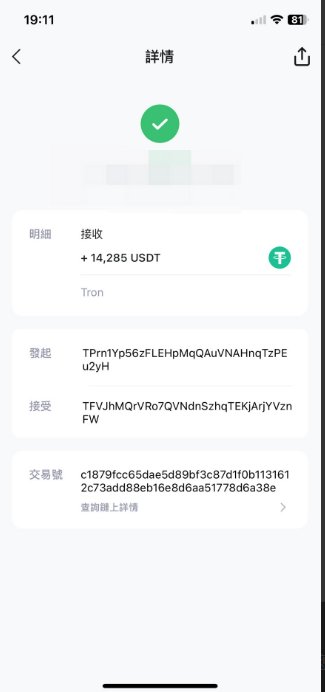

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not detailed in available public sources. This represents another transparency issue for potential clients seeking to understand how they can fund their accounts or access their funds.

Minimum Deposit Requirements: The minimum deposit amount required to open an account with SafeCap is not specified in available documentation. This makes it difficult for potential traders to assess the accessibility of the broker's services.

Bonuses and Promotions: Current promotional offers and bonus structures are not detailed in the available information. This suggests either a lack of such programs or insufficient transparency in marketing these benefits to potential clients.

Tradeable Assets: SafeCap primarily focuses on forex trading. Specific details about the range of currency pairs, CFDs, or other financial instruments available for trading are not comprehensively outlined in public sources.

Cost Structure: Critical information about spreads, commissions, overnight financing charges, and other trading costs is notably absent from available public information. This makes it impossible for traders to accurately assess the true cost of trading with SafeCap.

Leverage Ratios: Specific leverage ratios offered by SafeCap are not detailed in available sources. This is concerning given that leverage information is crucial for traders to understand their risk exposure.

Platform Options: SafeCap offers its proprietary Webtrader platform as the primary trading interface. It is described as user-friendly and suitable for various trading strategies.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

SafeCap's account conditions receive a poor rating primarily due to the lack of transparency regarding essential account features and requirements. The broker fails to provide clear information about account types, minimum deposit requirements, or specific account features. This would help potential traders make informed decisions. This SafeCap review reveals that the absence of detailed account specifications makes it extremely difficult for traders to understand what they can expect from the broker's services.

The lack of information about account opening procedures, verification requirements, and account management features further contributes to the poor rating in this category. Most legitimate brokers provide comprehensive details about their account structures. This includes various account tiers, special features for different trader segments, and clear guidance on account setup processes. SafeCap's failure to provide such fundamental information raises questions about their operational standards and commitment to transparency.

The absence of information about special account types indicates a lack of comprehensive service offerings. This includes Islamic accounts for traders requiring Sharia-compliant trading conditions. The poor account conditions rating reflects not only the missing information but also the overall concern about engaging with an unregulated broker that fails to meet basic transparency standards expected in the forex industry.

Despite the regulatory concerns surrounding SafeCap, the broker appears to offer a robust set of trading tools and resources through its Webtrader platform. User feedback suggests that the platform provides an intuitive interface with advanced trading functionalities. This caters to both novice and experienced traders. The platform's design seems to prioritize user experience, making it accessible for traders who may be new to forex trading while still offering sophisticated features for more advanced users.

SafeCap promotes its automation capabilities, claiming win rates exceeding 85% over a five-year period. While these claims cannot be independently verified due to the lack of regulatory oversight, the focus on automated trading solutions suggests that the broker has invested in developing technological tools. These could potentially benefit traders. The platform allegedly offers proprietary order flow software and ultra-fast execution speeds under 500 microseconds, which would be competitive features if accurately implemented.

The positive rating in this category is primarily based on user feedback about the platform's functionality and the apparent investment in trading technology. However, the score is limited by the inability to independently verify the broker's claims about performance. There is also a lack of detailed information about educational resources, market analysis tools, and research capabilities that are typically expected from comprehensive trading platforms.

Customer Service and Support Analysis (Score: 4/10)

SafeCap's customer service receives a below-average rating due to mixed user feedback and concerning reports about the broker's reliability. While some users have reported positive experiences with responsive support, these positive reviews are overshadowed by more serious concerns. These include fraudulent behavior and the broker's overall trustworthiness. The presence of scam allegations in user feedback significantly undermines confidence in the broker's customer service capabilities.

The lack of detailed information about customer support channels, availability hours, and multilingual support options further contributes to the poor rating. Legitimate brokers typically provide comprehensive customer support information. This includes multiple contact methods, support hours across different time zones, and language options to serve their international client base. SafeCap's failure to provide such details raises questions about their commitment to customer service excellence.

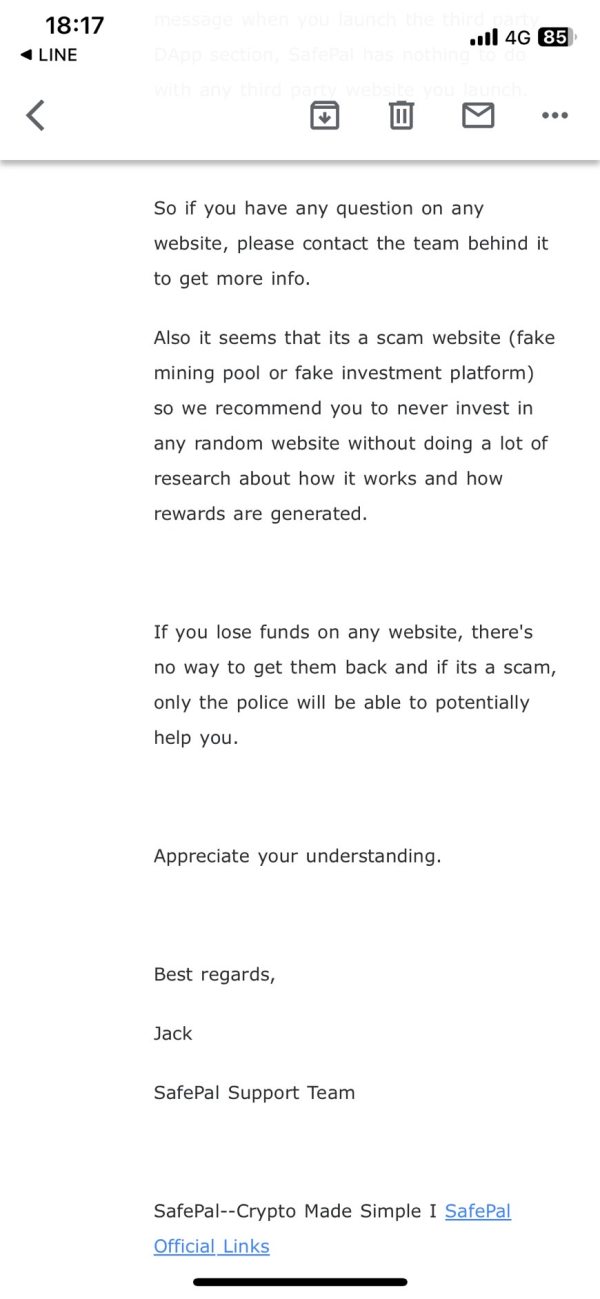

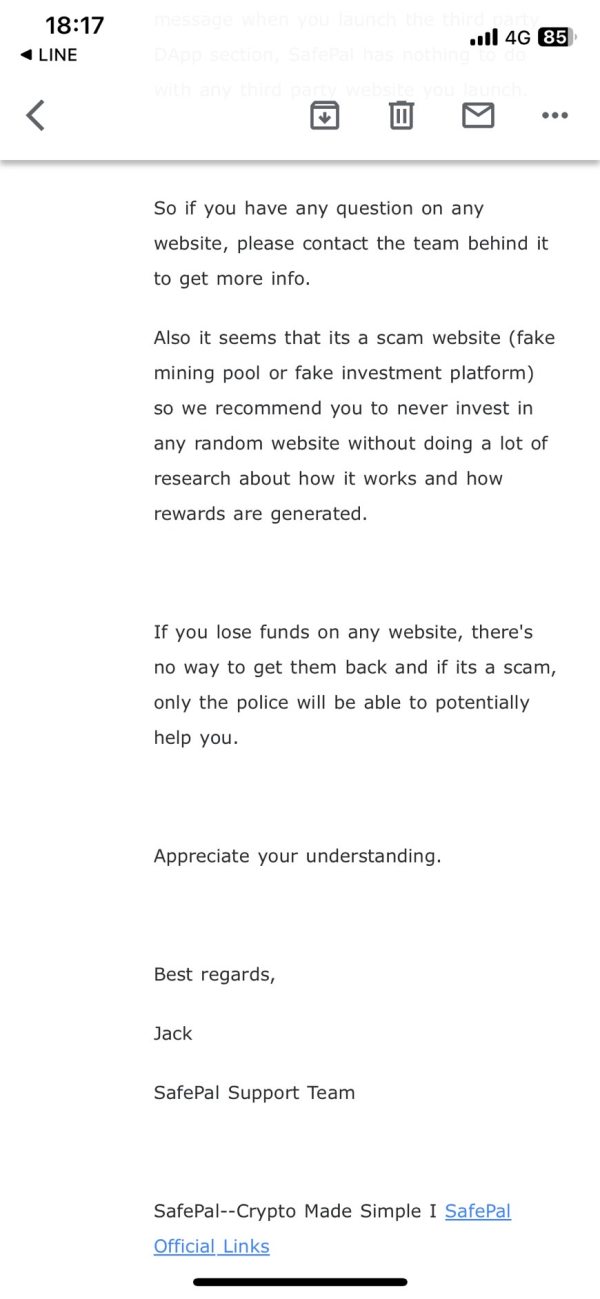

User reports suggesting fraudulent activities and the FCA's warning about SafeCap being a clone company create serious concerns about how customer issues are handled and resolved. The below-average rating reflects not only the mixed user feedback but also the fundamental trust issues. These arise from engaging with an unregulated broker that has been flagged by regulatory authorities.

Trading Experience Analysis (Score: 5/10)

The trading experience with SafeCap receives an average rating based on the limited available information about platform performance and user feedback. While users have described the Webtrader platform as intuitive and user-friendly, the lack of detailed information about trading conditions makes comprehensive assessment difficult. This includes execution quality and platform stability.

The broker's claims about ultra-fast execution speeds and advanced trading technology suggest potential for a good trading experience. However, these claims cannot be verified independently. User feedback indicates that the platform interface is straightforward and accessible, which could benefit traders who prioritize ease of use over advanced features. However, the SafeCap review reveals that the absence of detailed trading condition information significantly impacts the overall trading experience assessment.

The average rating reflects the balance between positive user interface feedback and significant concerns about transparency and regulatory compliance. While the platform may offer functional trading capabilities, the lack of regulatory oversight and detailed performance data limits confidence in the overall trading experience. Traders seeking reliable and transparent trading conditions may find SafeCap's offering insufficient for their needs.

Trust and Reliability Analysis (Score: 1/10)

SafeCap receives the lowest possible rating for trust and reliability due to fundamental issues with regulatory compliance and legitimacy. The FCA's explicit warning that SafeCap is a clone company attempting to impersonate legitimate regulated entities represents a critical red flag. This cannot be overlooked. This regulatory warning indicates that SafeCap lacks proper authorization to provide financial services, making it an unsuitable choice for traders seeking secure and compliant trading environments.

The absence of proper regulatory oversight means that traders have no recourse through official regulatory channels if issues arise with their accounts or funds. Legitimate forex brokers typically hold licenses from respected regulatory authorities. They provide clear information about their regulatory status, client fund protection measures, and compliance procedures. SafeCap's failure to meet these basic requirements for legitimacy severely undermines any trust potential clients might place in the broker.

User reports of fraudulent behavior and scam allegations further reinforce the poor trust rating. The combination of regulatory warnings and negative user experiences creates a pattern of concern that responsible traders should not ignore. The very poor rating in this category reflects the fundamental risks associated with engaging with an unregulated broker that has been specifically warned against by regulatory authorities.

User Experience Analysis (Score: 6/10)

SafeCap's user experience receives an above-average rating primarily based on positive feedback about the platform's interface design and usability. Users have generally praised the Webtrader platform for its intuitive layout and accessibility. This suggests that the broker has invested effort in creating a user-friendly trading environment. The platform appears to accommodate both novice traders who need straightforward functionality and experienced traders who require more advanced features.

The positive aspects of user experience include the platform's visual design and navigation structure. Users have described these as straightforward and easy to understand. This accessibility factor is particularly important for new traders who may be intimidated by overly complex trading platforms. The broker's focus on creating an intuitive user interface appears to have resonated positively with at least some of its user base.

However, the user experience rating is significantly limited by serious concerns about safety and reliability. While the platform interface may be well-designed, the underlying issues with regulatory compliance and fraud allegations create a negative overall user experience. This extends beyond interface design. The above-average rating reflects the positive interface feedback while acknowledging that user experience encompasses much more than just platform usability, including trust, safety, and overall service reliability.

Conclusion

This comprehensive SafeCap review reveals a broker that presents significant risks and concerns for potential traders. While SafeCap offers some positive elements, including an intuitive Webtrader platform and user-friendly interface design, these benefits are completely overshadowed by fundamental issues. These include regulatory compliance and legitimacy problems. The FCA's explicit warning that SafeCap is a clone company represents a critical red flag that responsible traders cannot ignore.

SafeCap may initially appear suitable for both novice and experienced traders seeking an accessible trading platform. However, the lack of proper regulatory authorization makes it an inappropriate choice for any trader prioritizing safety and compliance. The absence of detailed information about trading conditions, costs, and account features further undermines the broker's credibility and transparency.

The main advantages of SafeCap include its reportedly user-friendly platform interface and positive user feedback about platform functionality. However, these limited benefits are far outweighed by significant disadvantages. These include the lack of regulatory oversight, FCA warnings about clone company status, user reports of fraudulent behavior, and the absence of transparent business information. Traders seeking reliable and secure forex trading services should consider properly regulated alternatives that provide the necessary protections and transparency expected in professional trading environments.