Hengda 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Hengda review examines a broker that presents significant challenges for potential traders seeking reliable forex services. Based on available public information, Hengda demonstrates concerning gaps in regulatory transparency and standardized trading conditions that raise red flags for serious traders. According to Trustpilot data, Hengda maintains a notably low brand rating of 23.8 out of 100, indicating substantial user dissatisfaction across various service areas.

The entity appears to operate across multiple business sectors, including jewelry manufacturing through Shenzhen Hengda Xin Jewelry Co., Ltd., insurance brokerage, and potentially forex services. However, the lack of clear regulatory information and transparent trading conditions raises serious concerns about the safety and reliability of their financial services that cannot be ignored. ReviewMeta indicates over 25,987 product reviews across 337 different products, suggesting a diverse but fragmented business model that may lack focus on core forex trading services.

This review is particularly relevant for traders considering alternative brokers, as it highlights the importance of regulatory compliance and transparency in broker selection. The mixed business portfolio and limited regulatory clarity make Hengda suitable primarily for users seeking diversified products, though significant caution regarding safety and reliability is strongly advised for anyone considering their services.

Important Notice

Cross-Regional Entity Clarification: Hengda operates across multiple business sectors including jewelry manufacturing, real estate assessment, insurance brokerage, and potentially forex services. This review focuses specifically on the forex trading aspects, though clear delineation between these business units remains unclear in available documentation that we could access. Traders should verify they are engaging with the appropriate entity for forex services.

Review Methodology: This evaluation is based exclusively on publicly available information, regulatory databases, and user feedback from verified sources. Individual trading experiences may vary significantly, and this assessment does not constitute personalized investment advice that should guide your final decision. Due to limited transparent information available about Hengda's forex operations, some standard evaluation criteria could not be thoroughly assessed.

Rating Framework

Broker Overview

Hengda presents a complex business structure that spans multiple industries, making it challenging to assess as a dedicated forex broker. The company operates through various entities, including Shenzhen Hengda Xin Jewelry Co., Ltd., which focuses on jewelry manufacturing and has received a modest rating of 5 on Made-in-china.com that reflects limited user confidence. Additionally, Hengda Insurance Brokerage Co. operates in the financial services sector, though specific details about forex trading operations remain unclear in available documentation.

The multi-sector approach raises questions about the company's core competencies and dedication to forex trading services. According to Tracxn company profiles, Hengda maintains various business interests, but the lack of focused forex trading information suggests either limited operations in this sector or insufficient transparency in their service offerings that makes evaluation difficult. This Hengda review reveals that potential traders face significant uncertainty about the actual scope and quality of forex services provided.

The trading platform type, specific asset classes offered, and primary regulatory oversight remain unspecified in available public information. This lack of transparency contrasts sharply with established forex brokers who typically provide comprehensive details about their trading infrastructure, regulatory compliance, and service offerings in clear, accessible formats. The absence of clear regulatory authority oversight represents a significant concern for traders prioritizing safety and compliance in their broker selection process.

Regulatory Status: Available information does not specify clear regulatory oversight from recognized financial authorities such as FCA, ASIC, or CySEC. This represents a significant gap in standard broker credentials and raises concerns about client protection and regulatory compliance that every trader should consider.

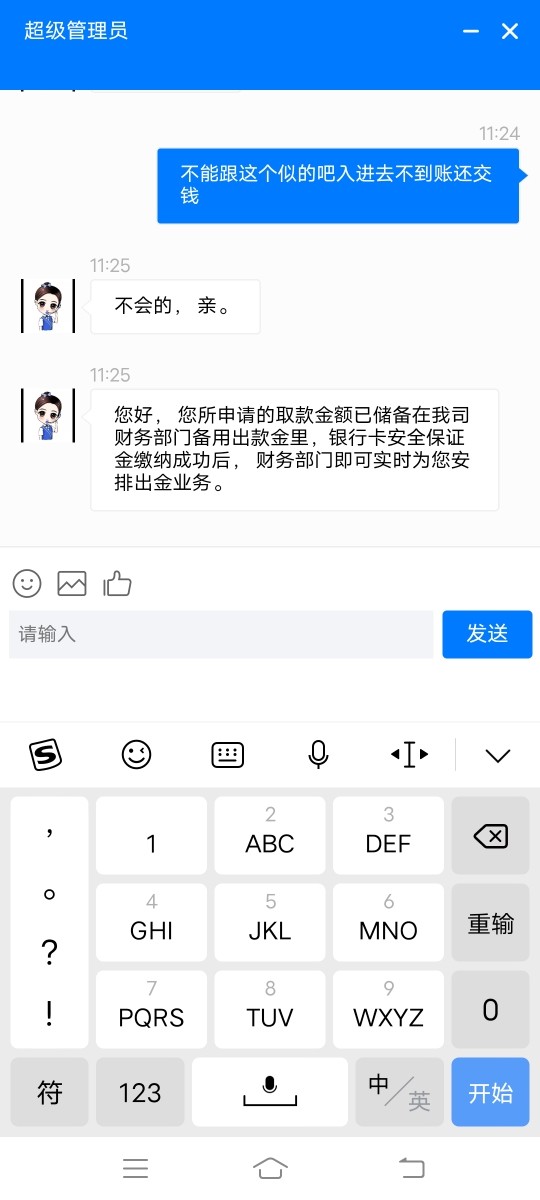

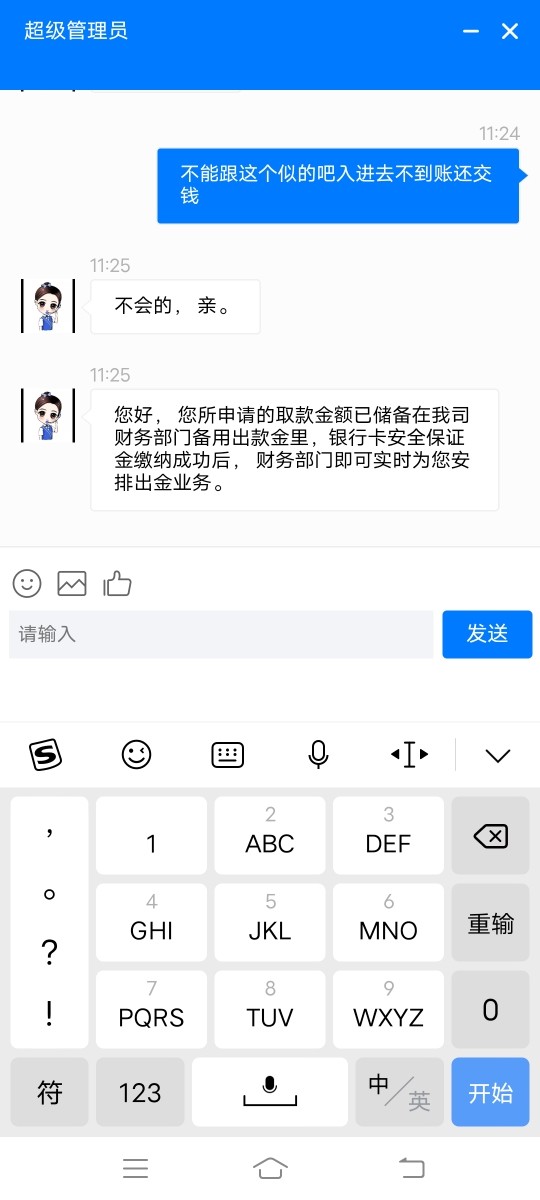

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees is not detailed in available sources. Standard banking and electronic payment options are presumed but not confirmed through official documentation.

Minimum Deposit Requirements: Exact minimum deposit amounts for different account types are not specified in available documentation, making it difficult for potential clients to assess accessibility and entry requirements. This lack of clarity creates uncertainty for new traders planning their initial investment.

Bonuses and Promotions: No clear information about welcome bonuses, loyalty programs, or promotional offers is available in current sources, suggesting either absence of such programs or limited marketing transparency. Most established brokers clearly outline their promotional offerings.

Tradable Assets: The range of available trading instruments, including forex pairs, commodities, indices, and cryptocurrencies, is not clearly specified in accessible documentation. This Hengda review cannot provide definitive information about asset diversity that traders typically expect.

Cost Structure: Details about spreads, commissions, overnight fees, and other trading costs are not transparently provided in available sources. This lack of pricing transparency makes cost comparison with other brokers impossible for potential clients.

Leverage Options: Maximum leverage ratios for different account types and trading instruments are not specified in current documentation. Most brokers clearly state their leverage offerings for trader planning purposes.

Platform Selection: Information about available trading platforms, including MetaTrader support or proprietary platform features, is not detailed in accessible sources. Platform choice significantly impacts trading experience and strategy implementation.

Geographic Restrictions: Specific information about restricted countries or regional limitations is not provided in available documentation. International traders need this information for compliance purposes.

Customer Support Languages: Available languages for customer service are not specified in current sources. Multilingual support is essential for international forex operations.

Detailed Rating Analysis

Account Conditions Analysis (3/10)

The account conditions for Hengda present significant transparency issues that substantially impact the overall trading proposition. Available documentation fails to provide clear information about account types, minimum deposit requirements, or specific features that distinguish different account tiers that traders need to make informed decisions. This lack of transparency makes it extremely difficult for potential traders to make informed decisions about account selection and suitability.

Standard industry practices typically include detailed descriptions of account types ranging from basic to premium tiers, each with specific minimum deposits, spread conditions, and additional features. However, this Hengda review reveals a concerning absence of such standardized information that most brokers provide as basic service transparency. The lack of clear account opening procedures, verification requirements, and timeline expectations further compounds these concerns.

Special account features commonly offered by established brokers, such as Islamic accounts for Sharia-compliant trading, VIP accounts with enhanced conditions, or demo accounts for practice trading, are not clearly documented. This absence suggests either limited account options or insufficient communication about available features that could benefit different trader types. The overall account conditions framework appears underdeveloped compared to industry standards, contributing to the low rating in this category.

The trading tools and educational resources available through Hengda demonstrate significant deficiencies when compared to industry standards. Available information does not indicate the presence of professional-grade trading tools, market analysis resources, or comprehensive educational materials that modern traders expect from reputable brokers who prioritize client success. Standard trading tools such as economic calendars, market sentiment indicators, technical analysis software, and real-time news feeds appear to be either absent or inadequately documented.

The lack of research and analysis resources limits traders' ability to make informed decisions and develop effective trading strategies. Educational resources, including webinars, tutorials, trading guides, and market analysis, are not clearly available based on current documentation that we could access through standard channels. Automated trading support, including Expert Advisor compatibility, algorithmic trading platforms, and API access for advanced users, is not mentioned in available sources.

This represents a significant limitation for traders seeking sophisticated trading solutions and automated strategies. The overall tools and resources offering appears substantially below industry standards, warranting the low rating assigned to this category that reflects the inadequate support for trader development.

Customer Service and Support Analysis (3/10)

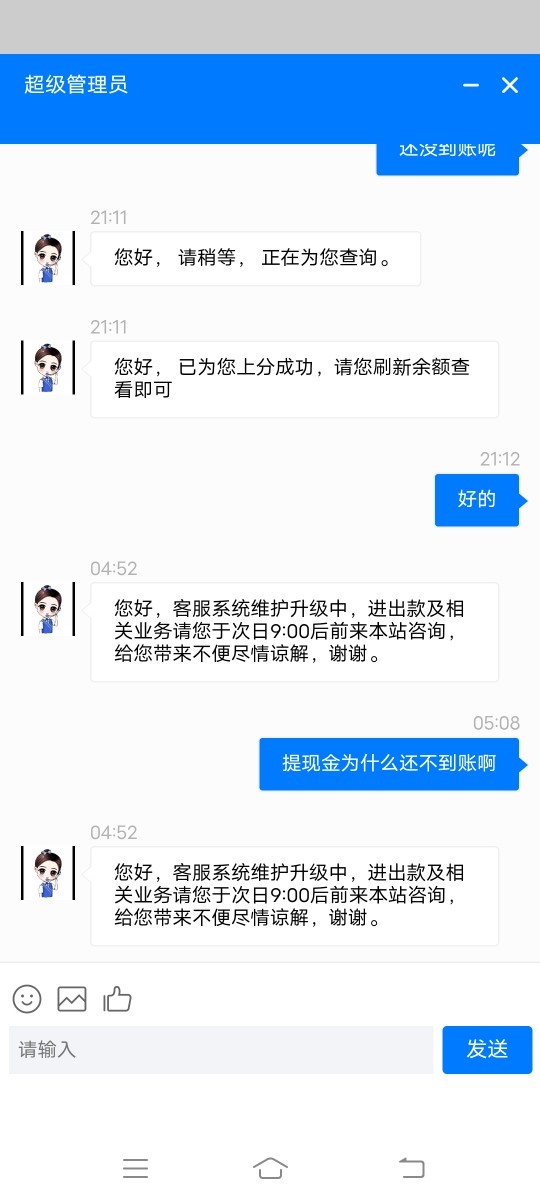

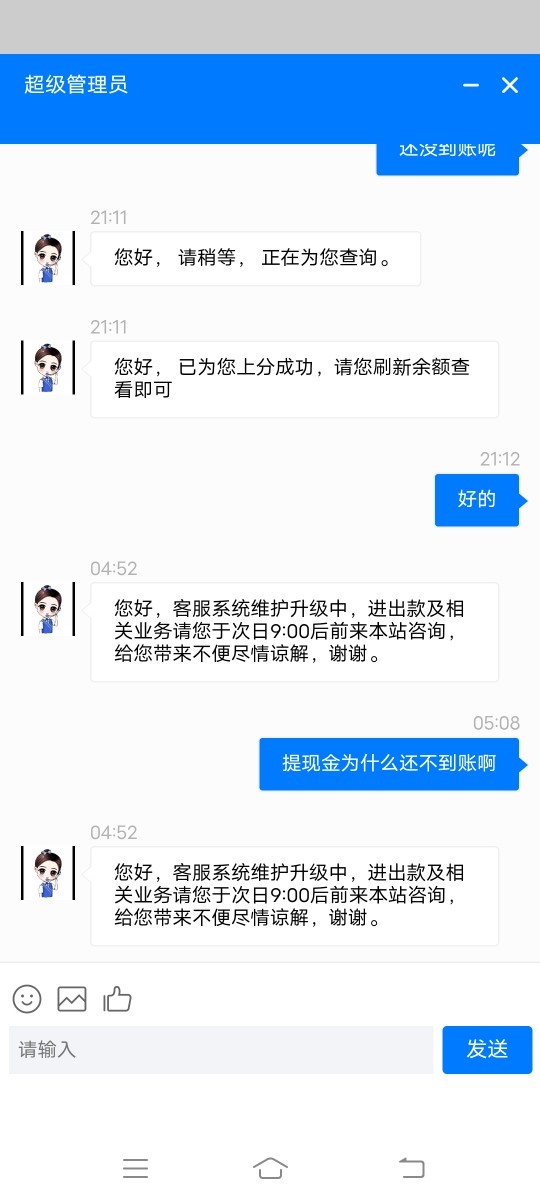

Customer service quality represents a critical concern based on available feedback and rating information. The Trustpilot rating of 23.8 indicates widespread customer dissatisfaction, though this rating may encompass multiple business sectors rather than focusing specifically on forex trading services that we are evaluating. Available information does not specify customer service channels, availability hours, or response time commitments.

Standard support options such as live chat, telephone support, email assistance, and comprehensive FAQ sections are not clearly documented. The absence of clear communication about support availability and service standards raises concerns about the overall customer experience that traders can expect when issues arise. Multilingual support capabilities, which are essential for international forex brokers, are not specified in current documentation.

This limitation could significantly impact non-English speaking traders' ability to receive adequate support. The lack of transparent customer service information, combined with the low overall rating, suggests substantial room for improvement in this critical area that affects daily trading operations.

Trading Experience Analysis (2/10)

The trading experience offered by Hengda presents significant concerns due to limited information about platform stability, execution quality, and overall trading infrastructure. Available documentation does not provide details about trading platform options, execution speeds, or system reliability measures that are crucial for effective forex trading and successful trade management. Order execution quality, including fill rates, slippage statistics, and execution speed benchmarks, is not documented in available sources.

This Hengda review cannot provide specific information about trading environment quality, which is essential for traders to assess potential performance and reliability. Platform functionality, including charting capabilities, order types, and risk management tools, remains unclear from available documentation that we could access. Mobile trading experience, which is increasingly important for modern traders, is not detailed in current documentation.

The absence of information about mobile app features, compatibility, and functionality represents a significant gap in service transparency. Overall trading environment assessment is hampered by the lack of comprehensive platform information and performance data that traders need for informed decisions.

Trust and Safety Analysis (2/10)

Trust and safety represent the most concerning aspects of Hengda's forex operations based on available information. The absence of clear regulatory licensing from recognized financial authorities raises fundamental questions about client protection, fund safety, and operational oversight that cannot be overlooked by serious traders. Established forex brokers typically maintain licenses from respected regulatory bodies such as the Financial Conduct Authority, Australian Securities and Investments Commission, or Cyprus Securities and Exchange Commission.

The lack of such regulatory credentials in available documentation represents a significant red flag for potential traders prioritizing safety and compliance. Fund safety measures, including client money segregation, deposit protection schemes, and operational risk management, are not clearly documented in accessible sources. Company transparency regarding ownership structure, financial reporting, and operational procedures appears limited based on available sources.

The overall trust and safety framework falls substantially below industry standards, necessitating the low rating assigned to this critical category. Traders should carefully consider these safety concerns before committing funds.

User Experience Analysis (3/10)

User experience assessment reveals mixed signals across different business sectors, though forex-specific feedback remains limited. The overall Trustpilot rating of 23.8 suggests widespread user dissatisfaction, though this may reflect experiences across various Hengda business units rather than focusing specifically on forex trading services that we are reviewing. Interface design and platform usability information is not available in current documentation, making it impossible to assess the quality of user interaction with trading systems.

Registration and account verification processes are not clearly documented, potentially creating uncertainty for new users about onboarding procedures and requirements. Fund management experience, including deposit and withdrawal processes, processing times, and associated fees, lacks transparency in available sources that traders typically consult. Common user complaints and satisfaction patterns cannot be clearly identified due to limited forex-specific feedback.

The mixed business model may contribute to user confusion about service expectations and delivery standards, impacting overall user experience quality. Clear service boundaries and expectations are essential for positive user experiences.

Conclusion

This comprehensive Hengda review reveals significant concerns about the broker's suitability for serious forex trading. The absence of clear regulatory oversight, transparent trading conditions, and comprehensive service documentation raises fundamental questions about safety and reliability that cannot be ignored by prudent traders. The low Trustpilot rating of 23.8 further reinforces concerns about overall service quality and customer satisfaction.

While Hengda may appeal to users seeking diversified financial services across multiple sectors, the lack of focused forex trading expertise and regulatory transparency makes it unsuitable for traders prioritizing safety and professional trading conditions. The primary advantages appear limited to potential product diversity, while significant disadvantages include regulatory uncertainty, limited transparency, and unclear service standards that create substantial risks. Potential traders are strongly advised to consider established, well-regulated alternatives that provide clear regulatory credentials, transparent trading conditions, and comprehensive customer protection measures.

The current state of available information about Hengda's forex operations suggests substantial risks that outweigh any potential benefits for serious forex trading activities.