Wrich 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Wrich is a brokerage that presents an appealing opportunity for risk-tolerant investors, particularly seasoned traders who seek high-risk, high-reward trading environments. However, a deeper examination reveals significant red flags, primarily relating to its suspicious regulatory history and a troubling pattern of customer complaints. With a lack of trustworthiness, accompanied by unresolved issues ranging from excessive fees to questionable investment recommendations, potential investors must tread carefully. While seasoned traders might find allure in the high-risk strategy that Wrich offers, the risks could easily steepen into a precarious endeavor. Thus, the trade-off between potential lucrative rewards and the inherent risks becomes a crucial consideration for any investor.

⚠️ Important Risk Advisory & Verification Steps

Warning: Engaging with unregulated brokers such as Wrich carries significant financial risks.

- Potential Harms:

- Loss of investment due to unregulated and potentially fraudulent practices.

- Difficulty in recovering funds because of lack of regulatory oversight.

- Emotional stress from possible financial losses and unresolved complaints.

Self-Verification Steps:

- Check Wrich's regulatory status on official sites like the Financial Industry Regulatory Authority (FINRA).

- Read user reviews and feedback on forums dedicated to trading.

- Consult the Securities Investor Protection Corporation (SIPC) to determine if the broker is a member.

- Verify claims of regulations by checking with credible financial authorities.

Thoroughly assess any broker's legitimacy before making any trading decisions—taking these precautions may protect your financial future.

Rating Framework

Broker Overview

Company Background and Positioning

Wrich, founded in 1986, operates as a trading brokerage primarily based in Hong Kong. Its persistent engagement in the forex market primarily revolves around offering high-reward trading strategies directly appealing to seasoned investors. However, the companys reputation is heavily tarnished by regulatory issues, including a revoked license which raises questions about its operational legitimacy. With warnings from several financial oversight groups, many advisory sources caution against their services.

Core Business Overview

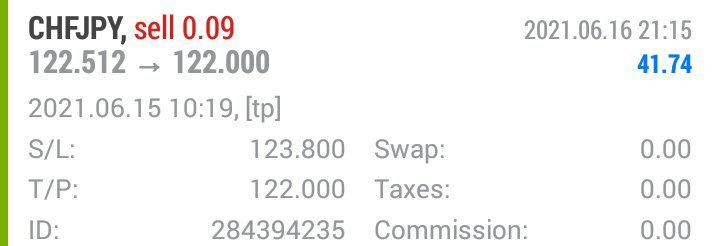

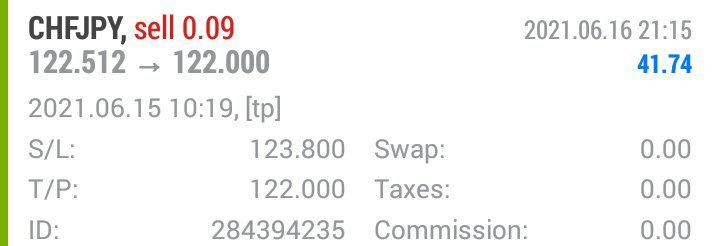

Operating under the pseudonym “Always Rich,” Wrich engages in financial services related to forex, CFDs, and commodities trading. The brokerage claims to offer trading on platforms like MetaTrader 4 and 5, providing access to a diverse range of asset classes. Crucially, Wrich lacks substantial regulatory backing; its previously sanctioned regulatory license, now revoked, puts it at a higher risk level for potential clients.

Quick-Look Details

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Teaching users to manage uncertainty

Wrich's trustworthiness is under significant scrutiny primarily due to its dubious regulatory status. Their previous operating license was revoked, which compromises investor safety and indicates potential illegitimacy. Furthermore, claims of regulation are not substantiated by credible regulatory bodies.

- Analysis of Regulatory Information Conflicts

The absence of verifiable regulatory oversight creates a dangerous environment for investors. Multiple online sources have flagged Wrich as a broker to avoid, highlighting their dubious history:

"Low score, please stay away!" - WikiFX.

User Self-Verification Guide

To self-validate Wrich's legitimacy as a broker, follow these steps:

Visit the FINRA BrokerCheck tool.

Input "Wrich" or its known aliases.

Review the licensing status and background information.

Consult regulated financial authorities databases for any disciplinary records.

Industry Reputation and Summary

Overall, customer feedback points to serious concerns about fund safety and customer service:

"I had a hard time withdrawing my money." - Anonymous user feedback.

Trading Costs Analysis

The double-edged sword effect

While Wrich markets itself with competitive commission structures, hidden costs often undermine perceived advantages.

Advantages in Commissions

Their low commission rates may initially seem beneficial. For example, fees for forex trades are touted as low, attracting beginner and intermediate investors looking for value in a commission structure. However, this appearance can be deceptive.

The "Traps" of Non-Trading Fees

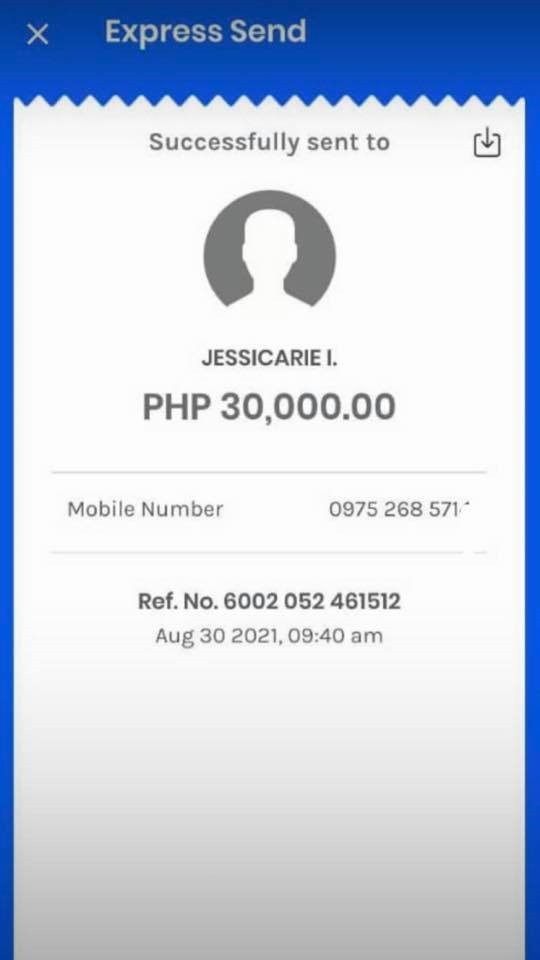

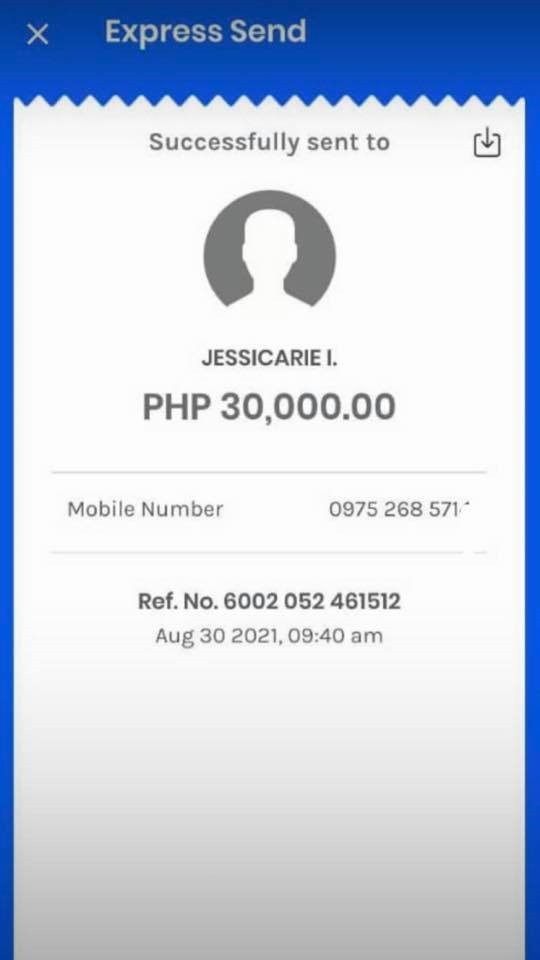

Several complaints detail exorbitant withdrawal fees and hidden charges:

"I was shocked to see a withdrawal fee of $30!" - User review.

Despite attractive initial rates, maintaining an account may lead to unexpected costs that erode potential profits.

- Cost Structure Summary

For high-frequency traders, the low commission may offset certain fees; however, novice traders might be better served by established, regulated alternatives that typically offer more transparency and reliability.

Professional depth vs. beginner-friendliness

Wrich provides trading platforms such as MetaTrader 4/5 but lacks deeper analytical tools essential for professional trading.

Platform Diversity

Although MetaTrader platforms are generally well-regarded in trading circles, Wrich's platform offerings lack customization and advanced analytical options that many investors seek. This can deter users looking for robust tools to enhance their trading strategies.

Quality of Tools and Resources

User feedback has often criticized the quality and availability of educational materials as insufficient. New traders might find the lack of resources concerning as they seek to learn the nuances of trading strategies.

Platform Experience Summary

User experiences highlight how educational resources need improvement:

"Theres hardly any useful training provided." - User review.

User Experience Analysis

Navigating a mixed-traffic environment

Navigating the Wrich platform raises challenges due to underlying issues with functionality and customer service.

User Onboarding Process

Navigation difficulties highlighted in user reports reveal a lack of streamlined onboarding. Potential clients should ensure they feel comfortable with the platform's usability before engaging.

Overall Experience Summary

Customer reviews express frustration with fund withdrawals and account management, pointing toward increasing concerns about user experience:

"I can't recommend them due to withdrawal problems." - User feedback.

Customer Support Analysis

Assessing responsiveness and reliability

Wrich's customer service records are notably mixed.

Available Support Channels

Although a support system exists, users report lengthy response times, leaving many inquiries unresolved and customers dissatisfied.

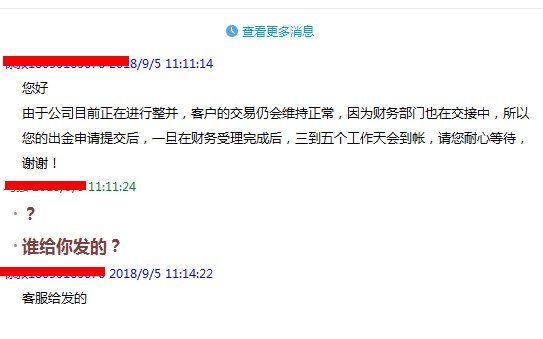

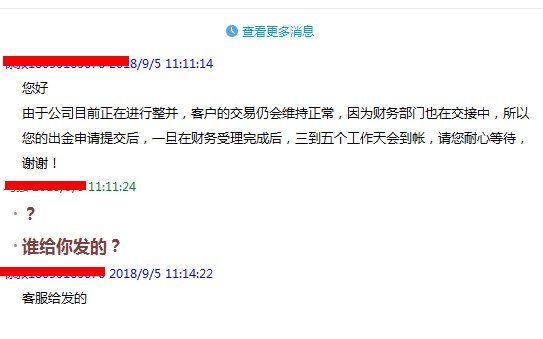

Feedback from Users

Users have documented their experiences with the support team, noting:

"I waited over a week for my account issue to be addressed." - Customer review.

Account Conditions Analysis

Reviewing accessibility and terms

Wrich's account conditions appear attractive but may not be suitable for all investors.

Minimum Deposit Requirements

Although $500 may be manageable for many, in comparison with regulated brokers, the overall level of service draws scrutiny, especially when unregulated platforms typically have lower barriers.

Withdrawal Policies

Several users highlighted excessive withdrawal delays and associated costs that could deter potential clients:

"It took weeks to get my money back." - Anonymous feedback.

Conclusion

Wrich offers a high-risk trading landscape that may attract experienced investors. However, with a dubious regulatory background, history of customer complaints, and subpar support capabilities, it presents substantial risks that more cautious investors should consider before engaging. Those navigating the forex and CFD markets should carefully evaluate whether the potential rewards outweigh the apparent traps set by this broker, as the stakes may exceed their comfort levels. Aspiring traders should heed the multiple risk signals present and explore fully regulated alternatives that support safer investing practices.