GX 2025 Review: Everything You Need to Know

Executive Summary

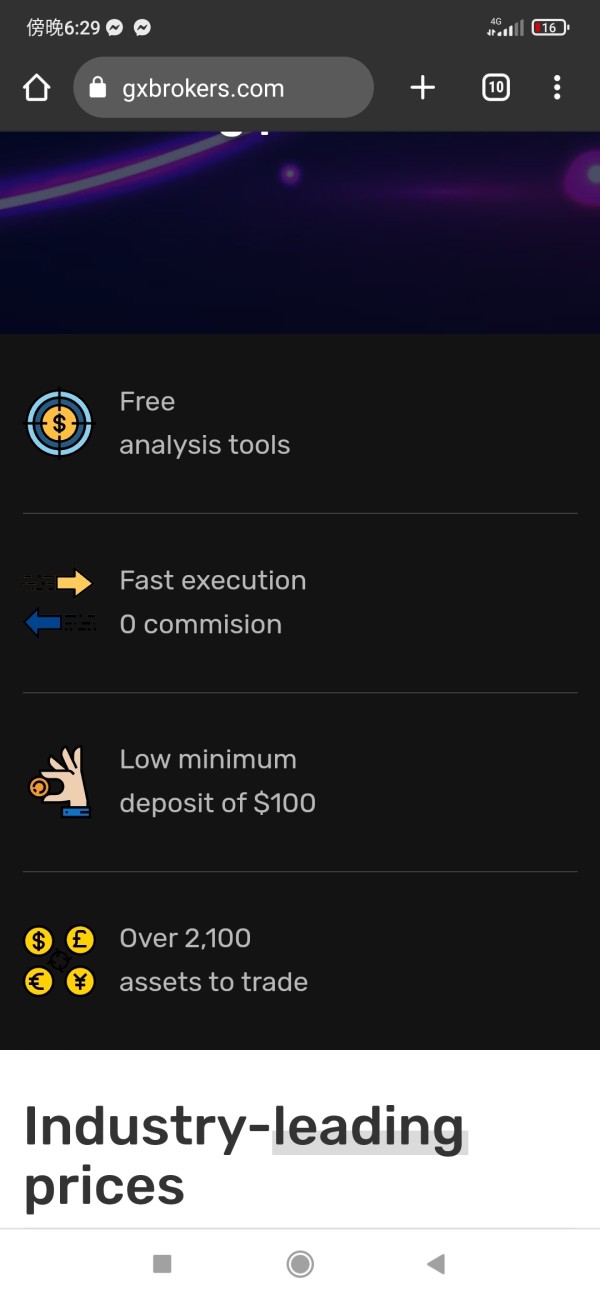

GX Markets has become a noteworthy player in the forex trading industry. The company offers competitive spreads and lightning-fast execution speeds that appeal to serious traders. This comprehensive gx review examines the broker's capabilities across multiple dimensions to provide traders with essential insights for their decision-making process.

GX Markets positions itself as a reliable forex broker with robust analytical tools designed to empower clients in making informed trading decisions. The platform emphasizes efficiency and market opportunity capitalization. It is backed by 24/7 customer support to ensure seamless trading experiences. With competitive spreads and advanced execution technology, GX Markets primarily targets forex traders seeking professional-grade trading conditions.

The broker's commitment to providing lightning-fast execution and comprehensive market analysis tools makes it particularly attractive to active traders. These traders require reliable performance during volatile market conditions. However, as with any broker evaluation, traders should consider multiple factors including regulatory compliance, account conditions, and overall trading costs when making their selection.

Important Disclaimers

This review is based on publicly available information and market research conducted as of 2025. Trading conditions, regulatory status, and service offerings may vary by geographic region and are subject to change. Potential clients should verify all information directly with GX Markets and ensure compliance with local regulations before opening trading accounts.

The evaluation methodology incorporates user feedback, market analysis, and publicly available company information. Individual trading experiences may differ based on account type, trading strategy, and regional variations in service delivery. All trading involves risk, and past performance does not guarantee future results.

Rating Framework

Broker Overview

GX Markets operates as an online trading platform with a primary focus on forex market opportunities. While the exact establishment date is not specified in available materials, the company has positioned itself as a technology-driven broker emphasizing execution speed and competitive trading conditions. The platform's business model centers on providing efficient market access through advanced trading infrastructure and comprehensive analytical tools.

The broker's approach emphasizes empowering clients through informed decision-making capabilities. This is supported by robust market analysis resources. GX Markets maintains a 24/7 customer support structure, indicating a commitment to serving traders across different time zones and trading sessions. This round-the-clock availability particularly benefits forex traders who operate in global markets with varying session hours.

GX Markets specializes primarily in forex trading, offering competitive spreads that appeal to both retail and potentially institutional clients. The platform's emphasis on lightning-fast execution suggests implementation of advanced order routing technology designed to minimize slippage and optimize trade execution. This gx review finds that the broker's technological focus aligns well with current market demands for speed and efficiency in trade execution.

Regulatory Status: Specific regulatory information for GX Markets is not clearly detailed in available public materials. This represents a significant information gap for potential clients seeking regulatory certainty.

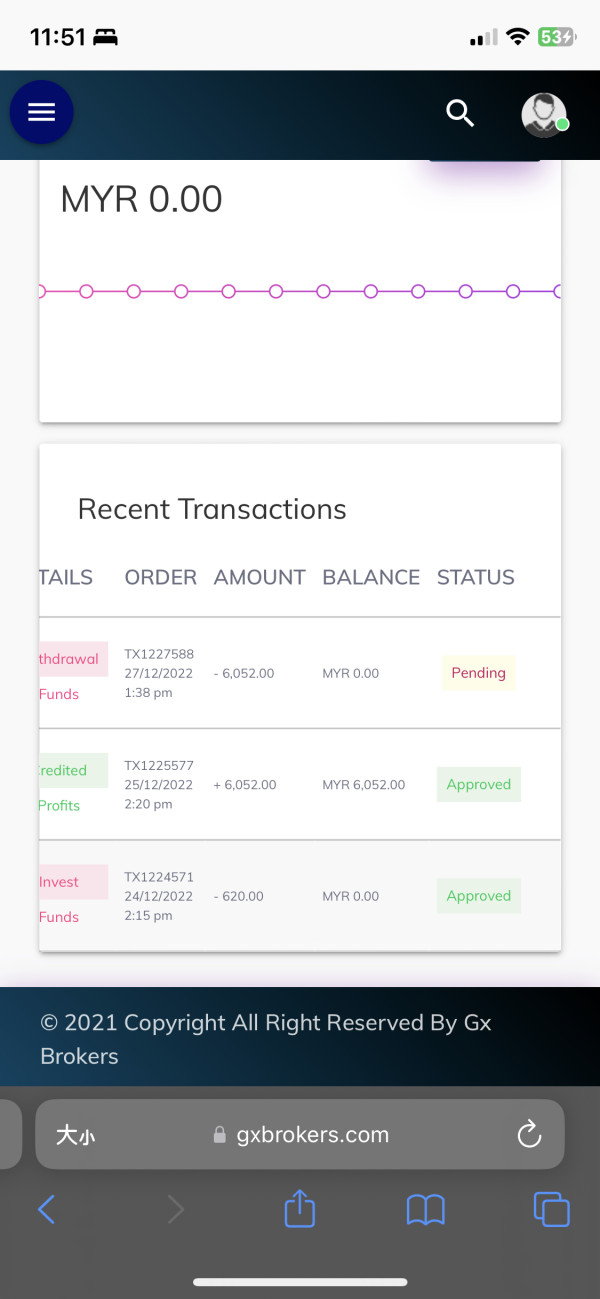

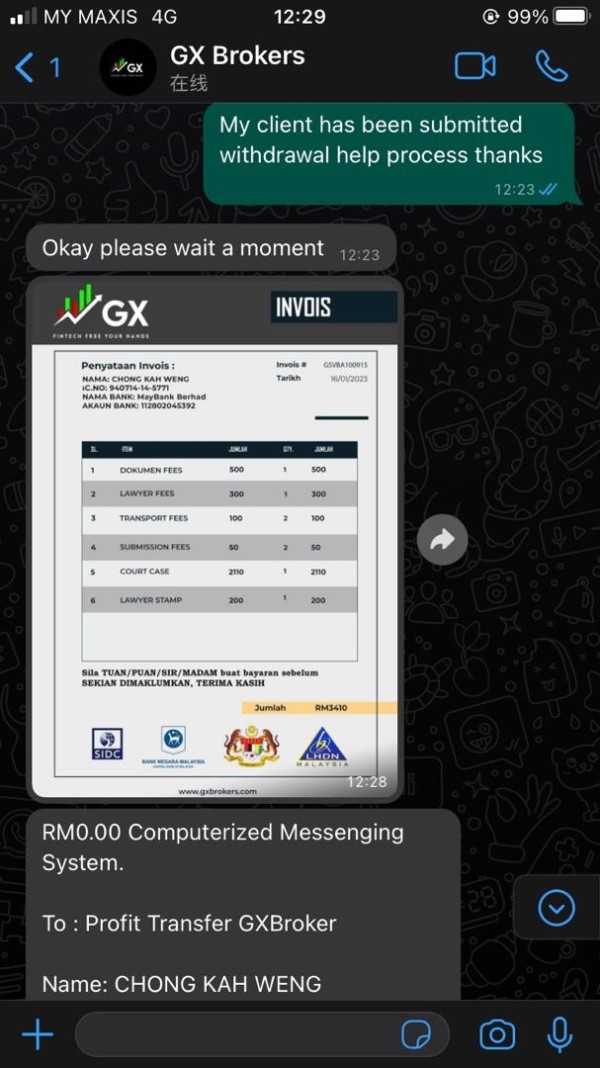

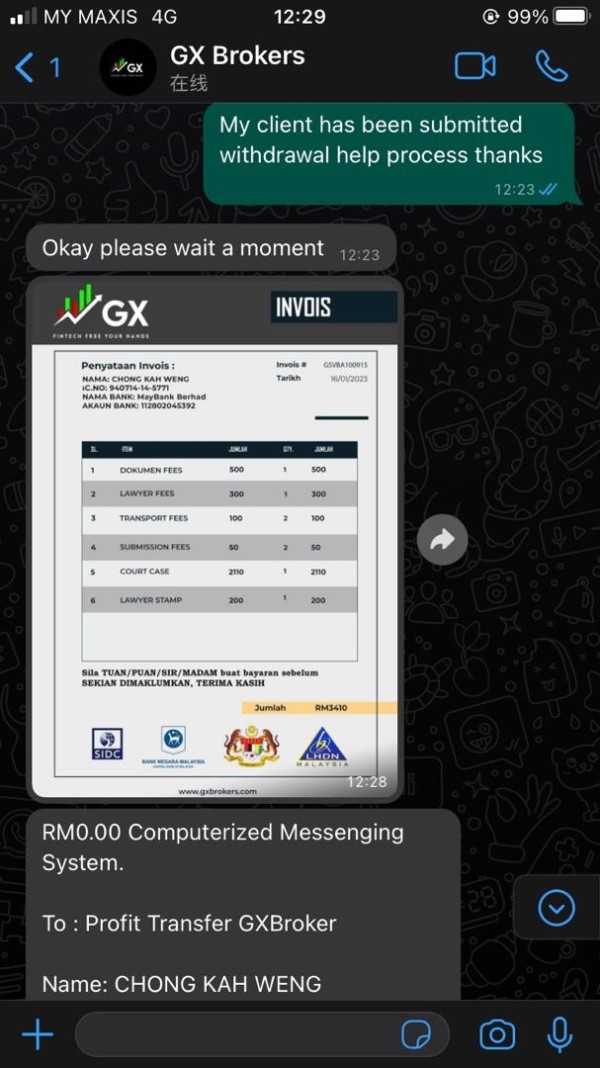

Account Funding: Deposit and withdrawal methods are not specifically outlined in available documentation. This requires direct inquiry with the broker for comprehensive funding information.

Minimum Deposit Requirements: Specific minimum deposit amounts are not disclosed in publicly available materials. This suggests potential variation based on account type or geographic location.

Promotional Offerings: Current bonus or promotional structures are not detailed in available information. This indicates either absence of such programs or limited public disclosure.

Tradable Assets: The platform focuses primarily on forex trading. However, the complete range of available currency pairs and additional instruments requires further clarification from the broker directly.

Cost Structure: While competitive spreads are mentioned, specific spread ranges, commission structures, and overnight financing rates are not detailed in available materials.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in publicly accessible information. This represents another area requiring direct broker consultation.

Platform Technology: GX Markets operates its proprietary platform. However, detailed technical specifications and feature sets are not comprehensively outlined in available materials.

Geographic Restrictions: Service availability by region is not clearly specified. This requires verification for specific jurisdictions.

Language Support: While 24/7 support is mentioned, specific language availability is not detailed in current information sources.

This gx review identifies several information gaps that potential clients should address through direct broker communication before account opening.

Account Conditions Analysis

The account conditions offered by GX Markets require further clarification as specific details regarding account types, minimum deposit requirements, and tier-based benefits are not comprehensively detailed in available public information. This represents a significant consideration for potential clients who need clear understanding of account structures before committing to a trading relationship.

While the broker emphasizes competitive trading conditions, the absence of detailed account specifications makes it challenging to assess the suitability for different trader profiles. Professional traders typically require transparent information about account minimums, spread structures, and any volume-based incentives that might be available.

The lack of specific information about specialized accounts, such as Islamic accounts for clients requiring Sharia-compliant trading conditions, represents another area where direct broker consultation becomes necessary. This gx review recommends that interested traders contact GX Markets directly to obtain comprehensive account condition details before making trading decisions.

Account opening procedures and verification requirements are not detailed in available materials. However, the emphasis on 24/7 customer support suggests that account setup assistance is readily available. The verification timeline and required documentation should be confirmed directly with the broker to ensure smooth account activation processes.

GX Markets emphasizes the provision of robust analytical tools designed to support informed trading decisions. However, specific details about these tools are not comprehensively outlined in available public information. The mention of analytical capabilities suggests the broker recognizes the importance of market research and analysis in successful trading outcomes.

The platform's focus on empowering clients through market analysis tools indicates potential availability of technical analysis features. However, the specific scope and sophistication of these tools require direct verification. Professional traders often require advanced charting capabilities, economic calendar access, and market sentiment indicators for comprehensive market analysis.

Educational resources and research materials are not specifically detailed in available information. This represents a potential area for improvement or simply limited public disclosure. Many successful brokers provide extensive educational content, market commentary, and trading guides to support client development and success.

Automated trading support and third-party platform integration capabilities are not specified in current materials. However, the emphasis on technological advancement suggests potential compatibility with popular trading systems. This aspect requires direct inquiry for traders who depend on algorithmic trading strategies or expert advisor implementations.

Customer Service and Support Analysis

GX Markets demonstrates a strong commitment to customer support through its 24/7 availability. This indicates recognition of the global nature of forex trading and the need for continuous assistance across different time zones. This round-the-clock support structure represents a significant advantage for active traders who may encounter issues or require assistance during various market sessions.

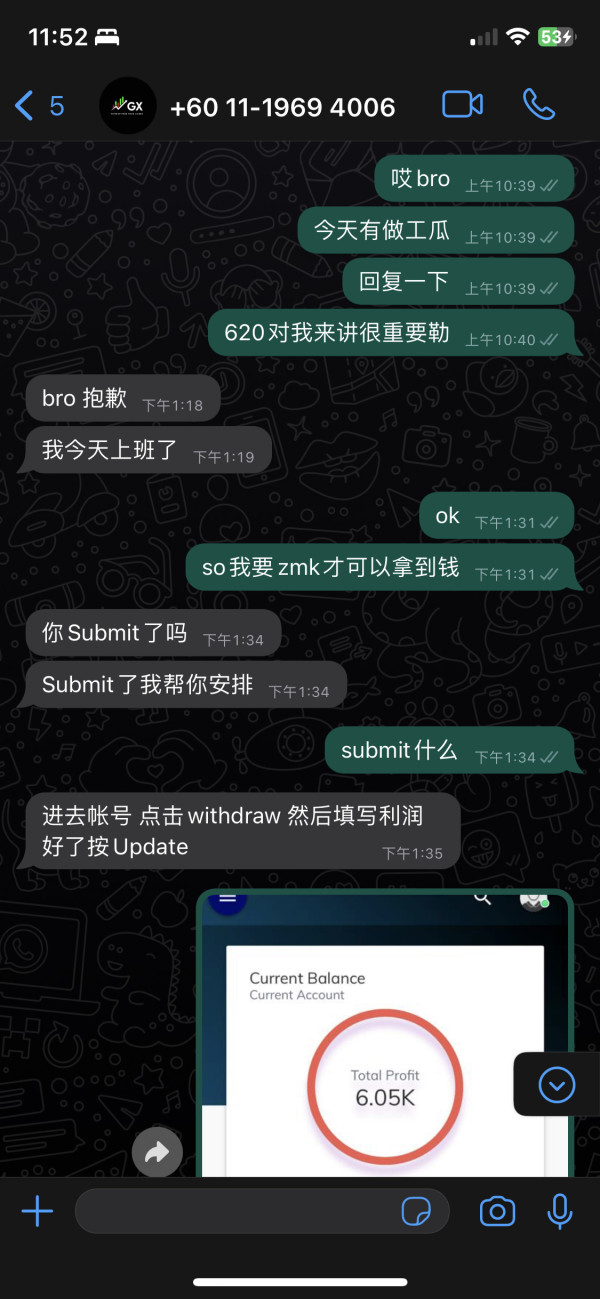

The quality and responsiveness of customer service, while not specifically detailed in available materials, can be inferred to be a priority given the broker's emphasis on ensuring seamless trading experiences. However, specific response time guarantees, available communication channels, and escalation procedures are not outlined in current public information.

Multi-language support capabilities are not specifically mentioned. However, the global nature of forex trading and 24/7 support structure suggest potential multilingual assistance. Traders should verify language availability for their specific requirements, particularly for complex technical or account-related issues that require clear communication.

The absence of specific customer service case studies or resolution examples in available materials means that service quality assessment relies primarily on the broker's stated commitment to seamless trading experiences. Direct testing of support responsiveness and competency becomes essential for potential clients evaluating service quality.

Trading Experience Analysis

The trading experience offered by GX Markets appears to be a primary strength, with specific emphasis on competitive spreads and lightning-fast execution speeds that directly impact trading profitability and efficiency. These fundamental execution characteristics represent critical factors for serious forex traders who require reliable performance during market volatility.

Platform stability and execution quality are highlighted through the broker's emphasis on lightning-fast execution. This suggests investment in robust technological infrastructure designed to minimize latency and optimize order processing. However, specific performance metrics, server locations, and redundancy measures are not detailed in available public information.

The competitive spread environment mentioned by GX Markets indicates potentially favorable trading costs. However, specific spread ranges for major, minor, and exotic currency pairs require direct verification. Trading cost transparency becomes essential for traders conducting cost-benefit analysis across multiple broker options.

Mobile trading capabilities and cross-platform synchronization are not specifically addressed in available materials. However, modern broker expectations typically include comprehensive mobile access. This gx review suggests verifying mobile platform availability and functionality for traders requiring flexible access to their trading accounts.

Order execution methodology, including handling of market orders during high volatility periods and slippage management, represents critical factors not detailed in current public information but essential for professional trading evaluation.

Trust and Regulation Analysis

The regulatory framework governing GX Markets operations is not clearly specified in available public materials. This represents a significant consideration for traders prioritizing regulatory oversight and client protection measures. Regulatory compliance serves as a fundamental trust indicator in broker evaluation processes.

Client fund segregation practices, deposit insurance coverage, and financial reporting transparency are not detailed in current information sources. However, these factors represent essential trust components for serious traders. The absence of specific regulatory information makes it difficult to assess the level of client protection available.

Company transparency regarding ownership structure, financial backing, and operational history is not comprehensively available in public materials. This requires direct inquiry for traders conducting thorough due diligence. Established regulatory frameworks typically require such disclosures for licensed brokers.

Third-party auditing, financial reporting standards, and dispute resolution mechanisms are not specified in available information. However, these elements contribute significantly to overall broker trustworthiness and client confidence in operational integrity.

User Experience Analysis

Overall user satisfaction with GX Markets appears positive based on the characterization as a reliable and trustworthy forex broker. However, detailed user testimonials and specific experience feedback are not comprehensively available in current public materials. The general positive perception suggests satisfactory service delivery across key operational areas.

Interface design, platform usability, and navigation efficiency are not specifically detailed in available information. However, the emphasis on seamless trading experiences suggests attention to user interface development. Modern trading platforms require intuitive design and efficient functionality for optimal user experience.

Account registration and verification processes are not outlined in current materials. However, the 24/7 support availability suggests assistance is available throughout onboarding procedures. Streamlined account opening and verification typically contribute significantly to positive initial user experiences.

The target user profile appears to focus on forex traders seeking competitive trading conditions and reliable execution. However, specific accommodation for different experience levels or trading styles is not detailed in available information. User experience optimization often requires tailored approaches for diverse trader requirements and preferences.

Conclusion

This comprehensive gx review reveals GX Markets as a forex broker with notable strengths in execution speed and competitive spreads. The broker is supported by 24/7 customer service availability. The broker's emphasis on technological efficiency and market opportunity capitalization aligns well with the needs of active forex traders seeking reliable trading conditions.

However, several information gaps regarding regulatory status, detailed account conditions, and comprehensive service specifications require direct broker consultation before account opening. While the general market perception appears positive, the limited availability of detailed public information necessitates thorough due diligence by potential clients.

GX Markets appears most suitable for forex traders who prioritize execution speed and competitive spreads. However, the absence of detailed regulatory information may concern traders requiring comprehensive regulatory oversight. The broker's strengths in execution efficiency and customer support availability represent significant advantages, while information transparency remains an area for potential improvement.