Is New Zealand Visions safe?

Business

License

Is New Zealand Visions A Scam?

Introduction

New Zealand Visions is a forex broker that has emerged in the trading landscape, claiming to offer various trading opportunities in the foreign exchange market. As traders navigate the complexities of forex trading, it is crucial to evaluate the credibility and reliability of their chosen brokers. The forex market is rife with potential scams and dishonest practices, making thorough research essential before committing funds. This article aims to provide an objective assessment of New Zealand Visions, analyzing its regulatory status, company background, trading conditions, client feedback, and overall safety. Our evaluation draws from various sources, including user reviews, regulatory databases, and financial news articles, to form a comprehensive picture of the broker's legitimacy.

Regulation and Legitimacy

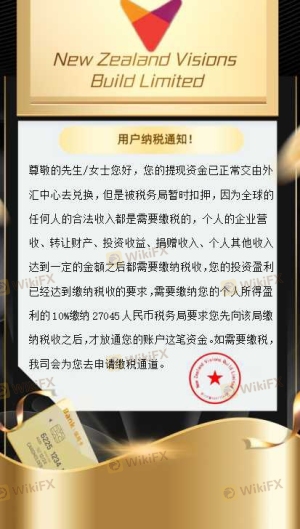

The regulatory status of a forex broker serves as a critical indicator of its legitimacy. New Zealand Visions claims to operate under the oversight of the National Futures Association (NFA) in the United States. However, numerous reports indicate that this claim is dubious, with suspicions of the broker being a clone of a legitimate entity. The absence of valid regulatory oversight raises significant concerns regarding the safety of client funds and the broker's operational practices.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0550787 | United States | Suspicious Clone |

The lack of a recognized regulatory body overseeing New Zealand Visions means that traders have little recourse in case of disputes or financial mishaps. The importance of regulatory compliance cannot be overstated; it ensures that brokers adhere to strict operational standards, protecting traders from fraud and mismanagement. Given the dubious claims of regulatory oversight, potential investors should exercise extreme caution when considering whether New Zealand Visions is safe.

Company Background Investigation

New Zealand Visions is relatively new to the forex trading arena, having been established within the last 1-2 years. The company is registered in the United Kingdom, but its operational transparency is questionable. There is limited information available about the ownership structure and management team, which raises red flags regarding accountability and trustworthiness.

The management teams background is a crucial factor in assessing a broker's reliability. Unfortunately, there is scant information available about the individuals behind New Zealand Visions. The lack of transparency surrounding the company's leadership can lead to concerns about the broker's operational integrity and reliability. In a sector where trust is paramount, the absence of accessible information about the company's history and leadership significantly undermines confidence in the broker.

Furthermore, the company's website has been reported as inaccessible, which suggests potential operational issues or even the possibility of the broker absconding with client funds. This lack of transparency and the inability to verify the broker's claims further complicate the question of whether New Zealand Visions is safe.

Trading Conditions Analysis

The trading conditions offered by New Zealand Visions are another critical factor to consider. Understanding the fee structure and any potential hidden costs is essential for any trader. Reports indicate that the broker has a complex fee structure that may not be clearly communicated to clients, which is a common tactic used by less scrupulous brokers.

| Fee Type | New Zealand Visions | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | 0.5 - 1.0 pips |

| Commission Model | N/A | $3 per lot |

| Overnight Interest Range | N/A | Varies |

The absence of specific information regarding spreads, commissions, and overnight interest rates raises concerns about transparency. Traders have reported facing difficulties when attempting to withdraw funds, suggesting that the broker may impose unreasonable fees or conditions that hinder access to their own money. Such practices are often indicative of a broker operating with less than ethical standards, leading to the conclusion that New Zealand Visions may not be safe.

Client Funds Security

The safety of client funds is paramount in forex trading. New Zealand Visions claims to implement various measures to protect client funds, but the lack of regulatory oversight significantly diminishes the credibility of these claims. Reports of clients being unable to withdraw funds from their accounts raise serious concerns about the broker's financial practices.

Traders should look for brokers that offer segregated accounts, ensuring that client funds are kept separate from the broker's operational funds. Additionally, features such as negative balance protection are essential to safeguard traders from losing more than their initial investment. Unfortunately, New Zealand Visions has not provided clear information regarding these safety measures, leading to further skepticism about whether New Zealand Visions is safe.

Customer Experience and Complaints

Customer feedback is a vital component of assessing a broker's reliability. A review of various online platforms reveals a concerning pattern of complaints against New Zealand Visions. Many clients have reported difficulties in withdrawing their funds, with some describing their experiences as a "nightmare."

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Slow |

| Transparency Concerns | High | Non-existent |

The predominant complaints revolve around withdrawal issues and unresponsive customer service. For instance, one trader reported being unable to withdraw funds for several months, citing a lack of communication from the broker. Such issues are alarming and suggest a lack of accountability on the part of New Zealand Visions, reinforcing the notion that New Zealand Visions is not safe for traders.

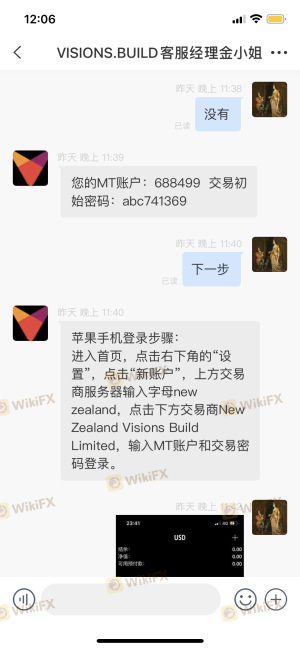

Platform and Execution

The trading platform and execution quality are crucial for any trader. Reports indicate that New Zealand Visions offers a standard trading platform, but there are concerns about its reliability and execution speed. Traders have raised issues regarding slippage and order rejections, which can significantly impact trading performance.

The platform's performance is vital for traders, as delays or failures in order execution can lead to substantial financial losses. Given the reported issues, potential investors should be wary of the platform's reliability, further questioning whether New Zealand Visions is safe.

Risk Assessment

Assessing the risks associated with trading with New Zealand Visions is essential for any potential investor. The lack of regulation, transparency, and numerous complaints collectively indicate a high-risk environment for traders.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | No valid regulatory oversight |

| Fund Security | High | Reports of withdrawal issues |

| Customer Service | Medium | Poor responsiveness to complaints |

To mitigate these risks, traders are advised to conduct thorough research, consider using well-regulated brokers, and avoid investing large sums of money until they can verify the broker's legitimacy.

Conclusion and Recommendations

In conclusion, the evidence suggests that New Zealand Visions operates in a high-risk environment, with numerous red flags indicating potential fraudulent practices. The lack of valid regulatory oversight, combined with a pattern of withdrawal issues and poor customer service, raises significant concerns about the safety of trading with this broker.

For traders seeking reliable forex trading options, it is advisable to consider well-regulated alternatives such as Black Bull Markets or TMG, which are recognized for their compliance and customer service. In light of the findings, it is prudent for potential investors to approach New Zealand Visions with caution and to remain vigilant about the risks associated with trading on unregulated platforms.

Is New Zealand Visions a scam, or is it legit?

The latest exposure and evaluation content of New Zealand Visions brokers.

New Zealand Visions Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

New Zealand Visions latest industry rating score is 1.43, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.43 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.