OBFX 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

OBFX is an unregulated forex broker based in the United Kingdom that operates under questionable circumstances. Established in 2021, its lack of regulatory oversight, compounded by multiple user complaints regarding withdrawal issues and lack of transparency, presents significant risks for traders. The broker specifically targets experienced traders who seek high leverage opportunities without the patience for regulations or risk management concerns. However, novice traders should avoid engaging with OBFX due to its unsafe trading environment, where potential users might struggle to fully comprehend the implications of trading with an unregulated broker.

In this review, we will meticulously explore OBFXs operations, assessing its core business, operational risks, and the challenges confronting potential clients.

⚠️ Important Risk Advisory & Verification Steps

When considering trading with OBFX, it is critical to understand the inherent risks involved:

- Lack of Regulation: OBFX is not regulated by any recognized financial authority, exposing traders to high levels of risk.

- Withdrawal Issues: Multiple reports from users indicate persistent problems with fund withdrawals, which is a major red flag for any broker.

- Dysfunctional Website: The current state of OBFX's official website is often reported as non-functional, making it difficult for potential traders to verify the legitimacy of the platform.

Self-Verification Steps:

- Check Regulatory Status: Visit official regulatory websites such as the FCA or NFA for verification of the broker's claims.

- Read User Reviews: Engage with community feedback on forums and review sites to gain insights about trader experiences and challenges.

- Test Customer Support: Attempt to contact customer support to evaluate responsiveness and reliability before investing.

Rating Framework

Broker Overview

Company Background and Positioning

OBFX, officially known as OB FX Global Technology Limited, is ostensibly located in the United Kingdom. The broker has been operational for about two years, during which it has faced scrutiny for not procuring legitimate regulatory status. The absence of valid regulatory frameworks raises immediate concerns regarding the safety of traders funds and overall operational integrity.

Core Business Overview

OBFX positions itself as a forex and CFD trading platform that provides access to various financial instruments. However, despite claiming multiple asset offerings, including forex pair trading, the broker does not have a robust platform with industry-standard tools. Reported experiences indicate that traders may face difficulties accessing critical information, including trading conditions and withdrawal processes, thereby obstructing informed decision-making.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Analysis of Regulatory Information Conflicts:

The primary concern with OBFX is its lack of regulation. Despite the claims of licensing, the broker has no affiliation with any major regulatory bodies like the FCA or ASIC. The NFA license number presented by OBFX is suspected to be fictitious, leading to substantial risks for traders looking to invest without adequate protections.

User Self-Verification Guide:

- Visit the FCA website and look for the broker's registration number.

- Cross-reference licenses with known regulatory bodies to verify legitimacy.

- Consult user reviews on reputable trading forums to gauge the broker's reputation.

"We have received messages from clients who mention not being able to withdraw their capital, which adds to the very negative characteristic of the company." - (Source Material)

Industry Reputation and Summary:

Overall, OBFX has cultivated a poor reputation within the trading community. Given the lack of transparency and numerous complaints about fund safety, potential customers should perform diligent due diligence before engaging with this platform.

Trading Costs Analysis

Advantages in Commissions:

OBFX markets itself as a low-cost trading option, citing competitive commission structures. However, deeper examination reveals that while the commission might be low, hidden fees related to withdrawals and inactivity pose a risk to traders.

The "Traps" of Non-Trading Fees:

Reportedly, OBFX imposes hefty withdrawal fees. For instance, users have disclosed issues accessing their funds, with certain fees as high as $30 for processing requests. Such unexpected charges are common warning signals seen with unregulated brokers.

"I received a transaction review email asking me to upload a video for verification when I attempted to withdraw $23,000, but there was no response for many days after the video was posted." - (Source Material)

Cost Structure Summary:

Given the outlined costs, the overall proposition may not be worthwhile for most traders. Special attention should be paid to the high non-trading fees that can erase the perceived benefits of lower commissions.

Platform Diversity:

OBFX employs the MT5 platform but fails to offer comprehensive support or useful resources which could assist traders in effectively utilizing this platform.

Quality of Tools and Resources:

While there are mentions of analytical and educational tools, users report inadequate training materials and limited functionality. The brokers platform often lacks user-friendly features, which can hinder trading execution.

Platform Experience Summary:

User feedback commonly indicates dissatisfaction with the platforms overall functionality and reliability.

"The only thing it really does successfully is throw off peoples attention and not let them concentrate on the actual details." - (Source Material)

User Experience Analysis

Overall User Engagement:

With a reputation marred by complaints and difficulties experienced during trading, OBFX lacks the essential aspects of a user-friendly platform.

Interface and Navigation:

Most users find the interface clunky and challenging to navigate due to ongoing website issues, which affect user experience significantly.

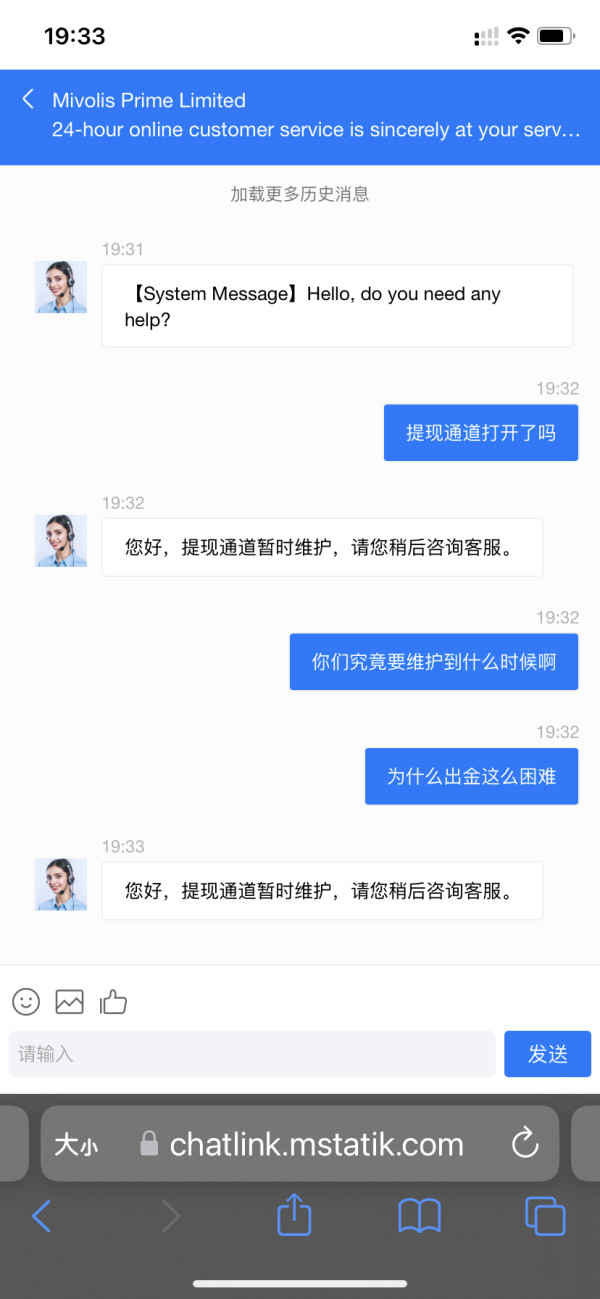

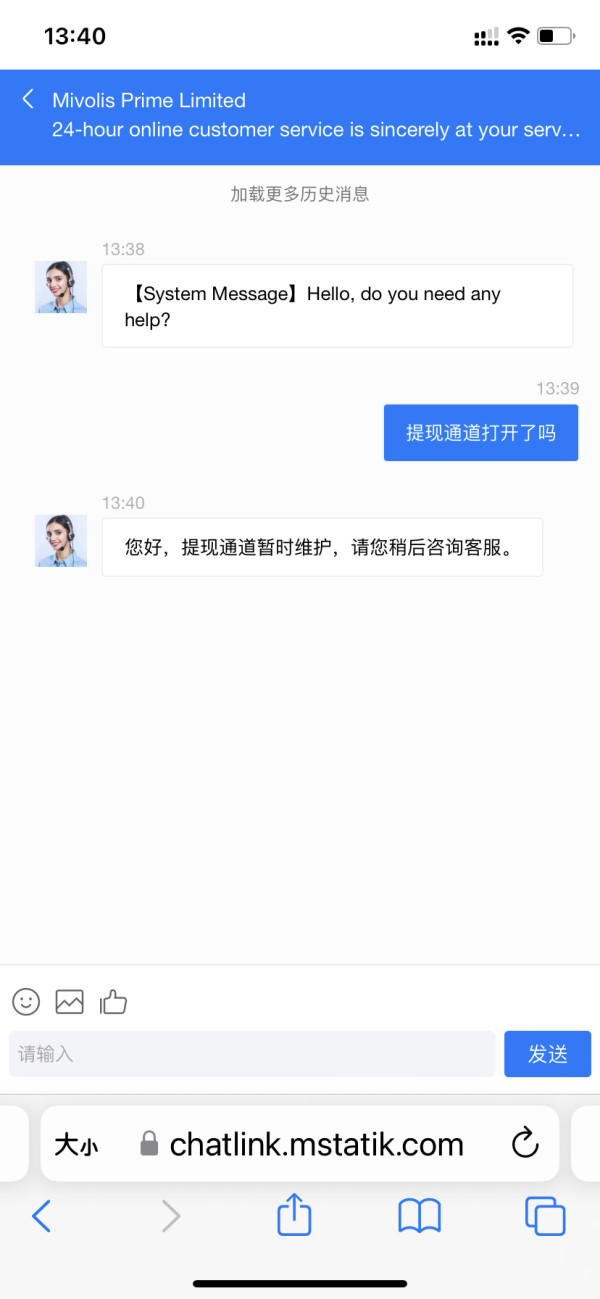

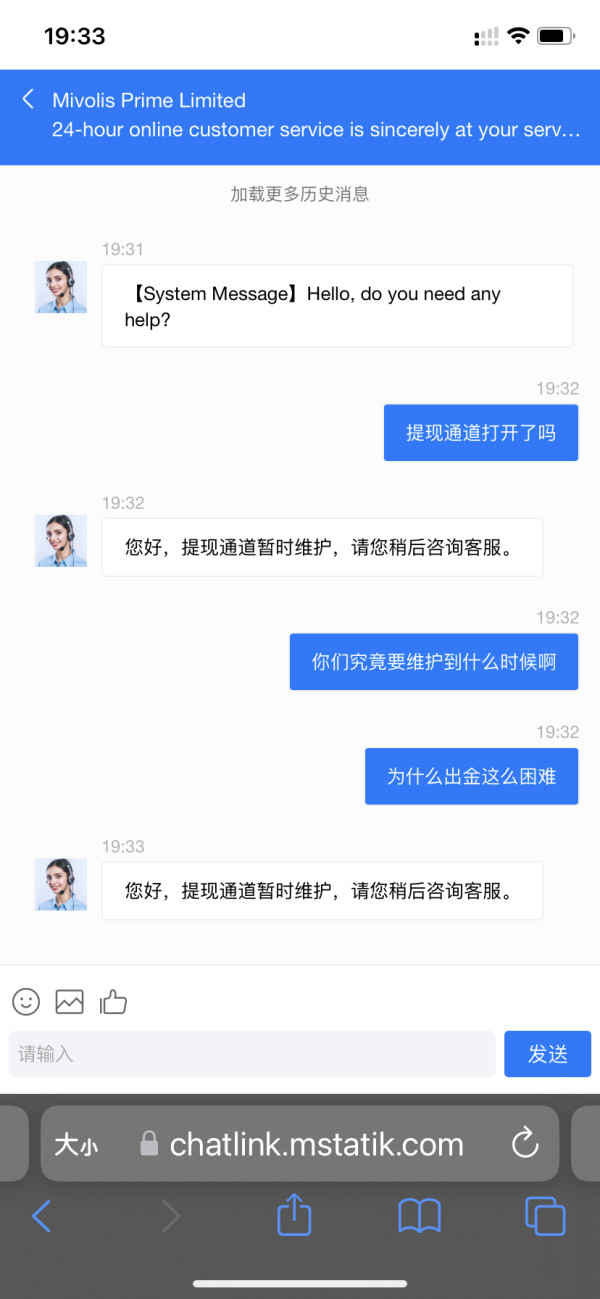

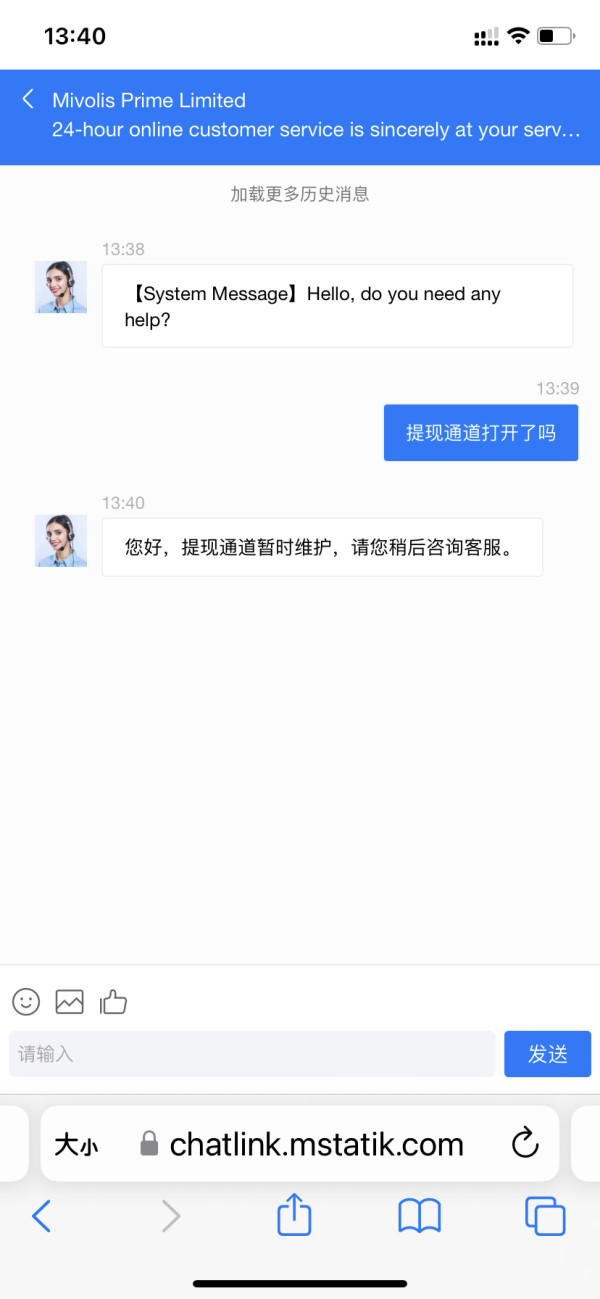

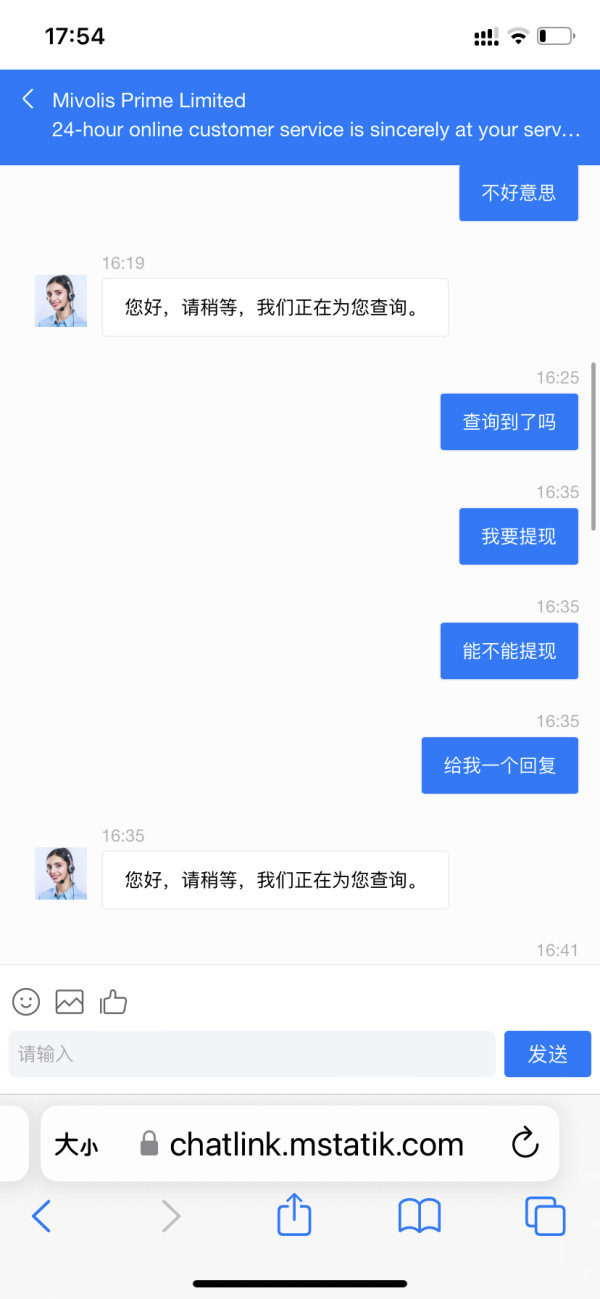

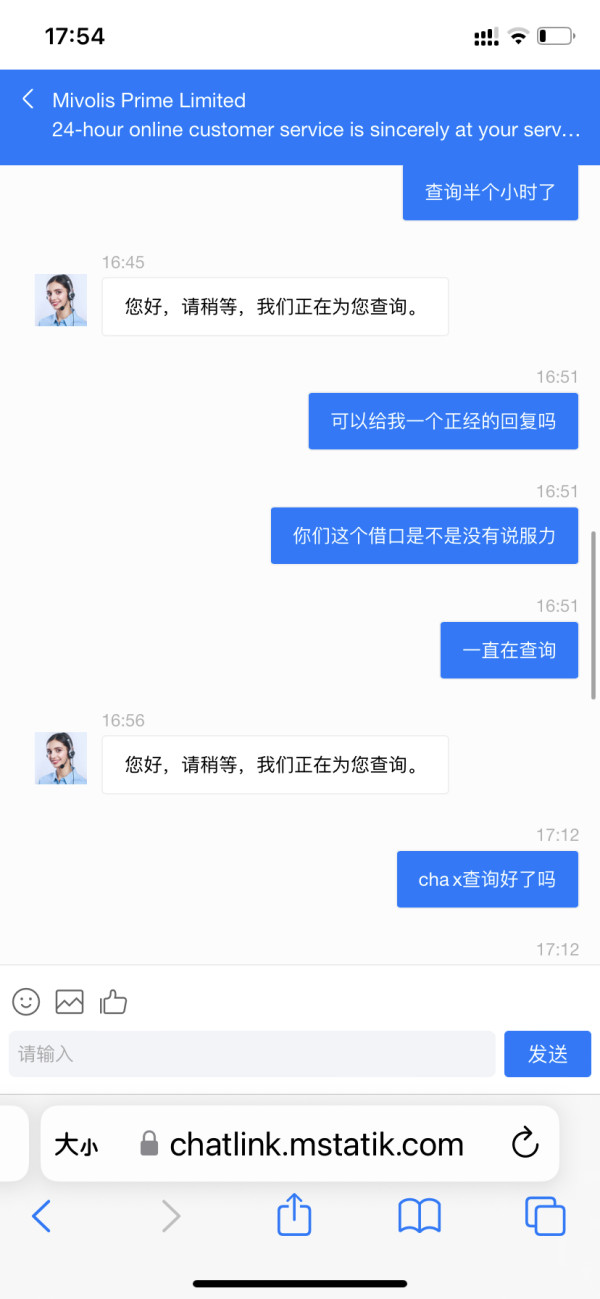

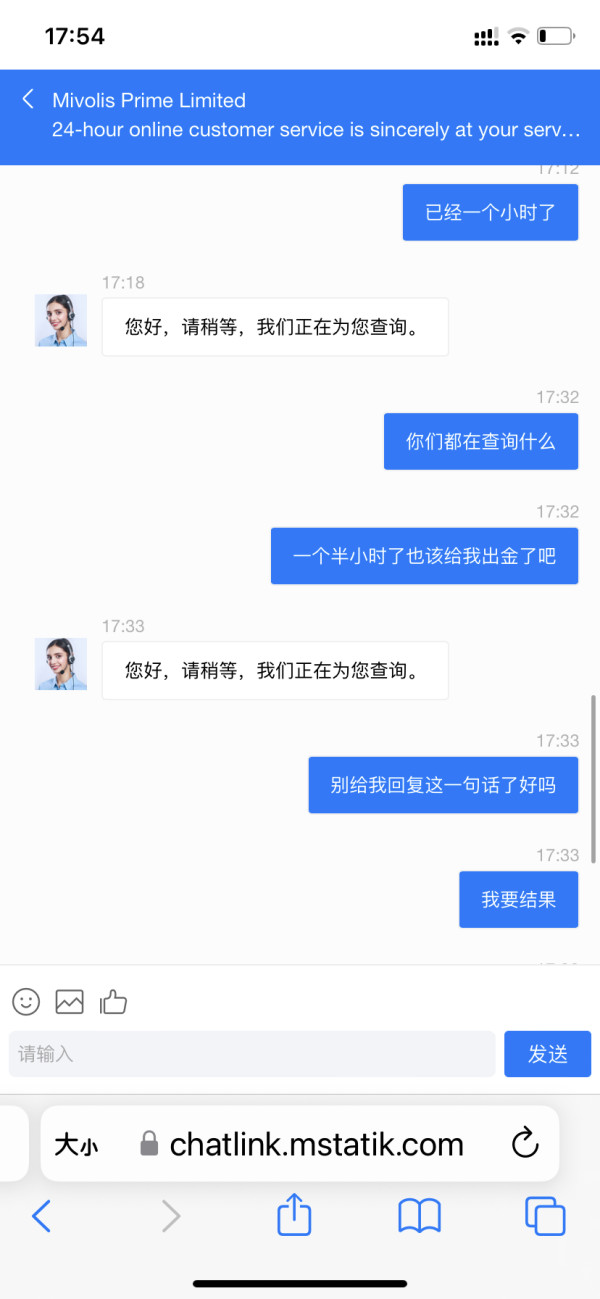

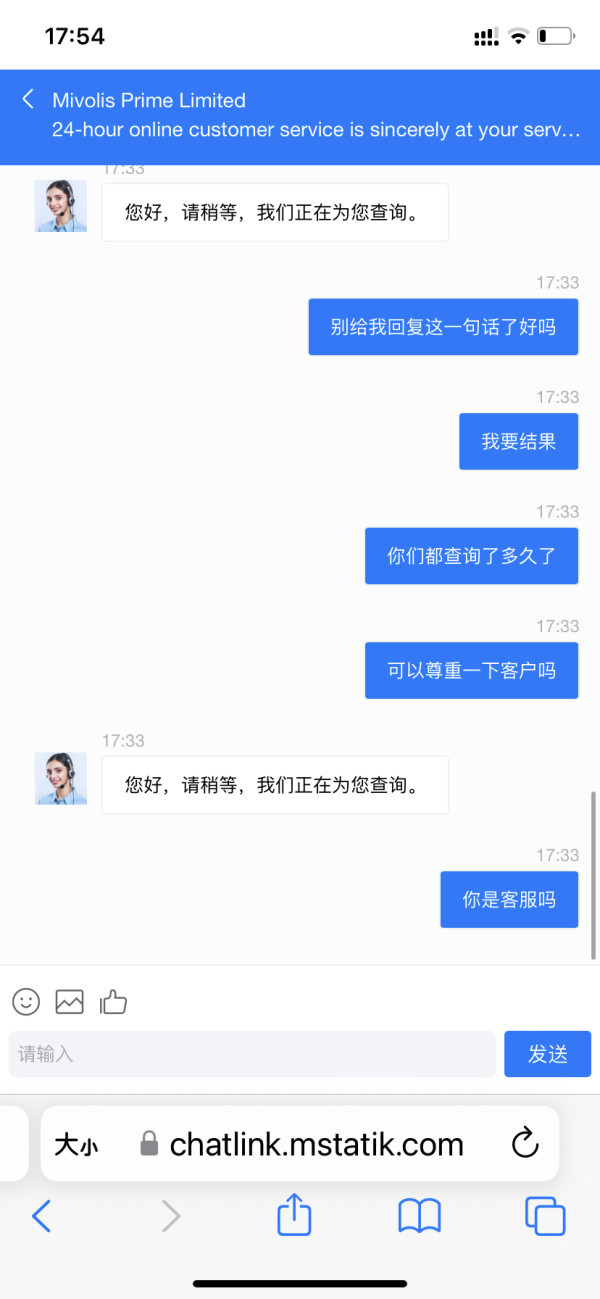

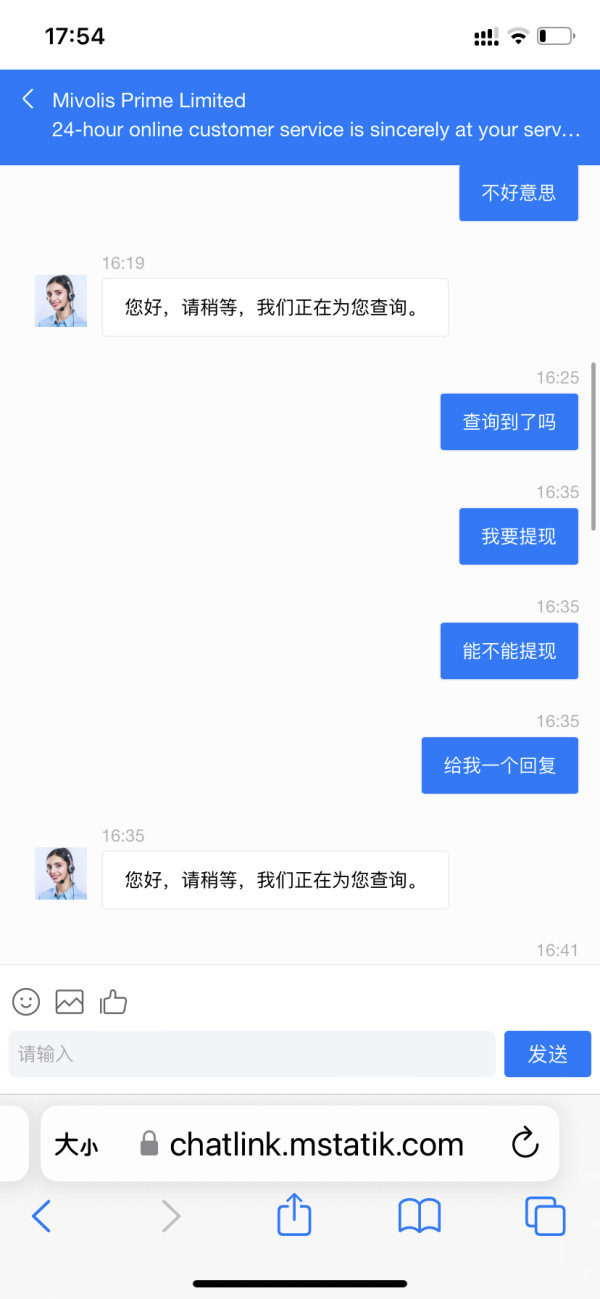

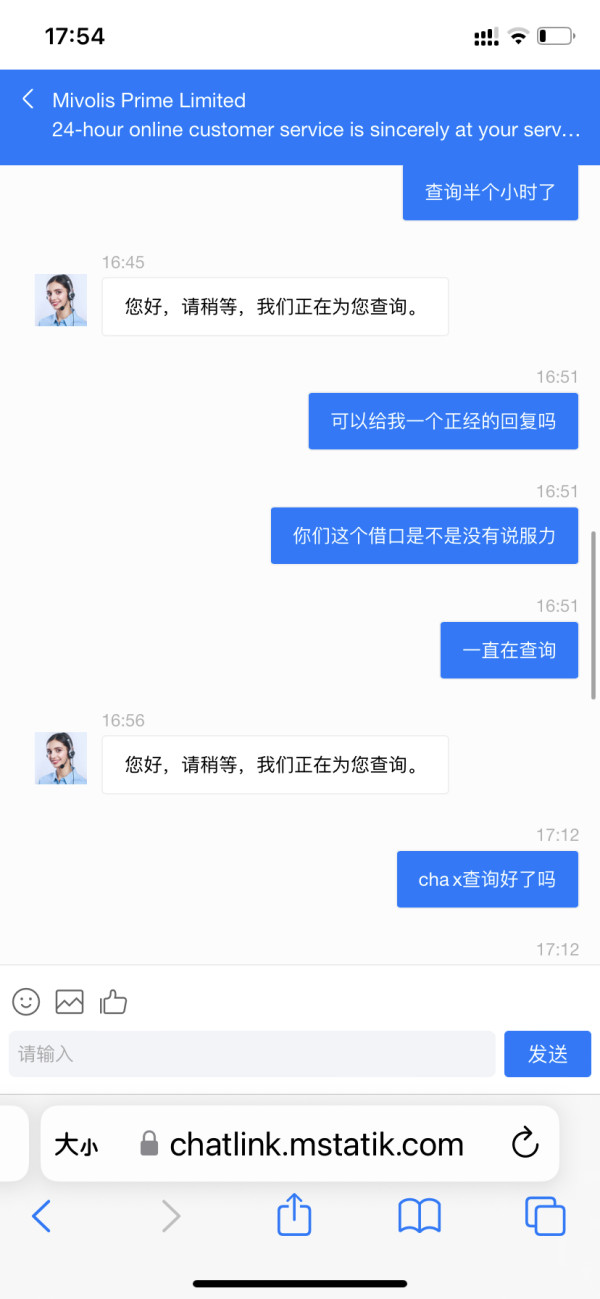

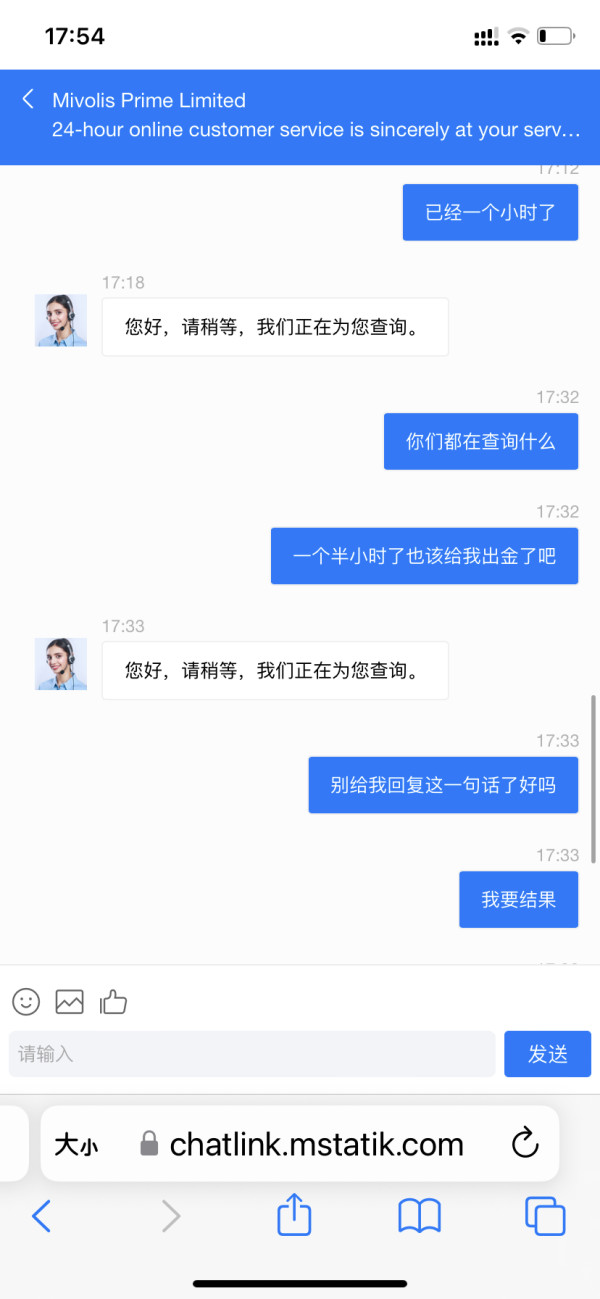

Customer Support Analysis

Support Channels Evaluated:

OBFX offers limited support exclusively through email, resulting in delayed and inefficient responses to user inquiries.

Evaluating Responsiveness:

Reported experiences reflect frustrations with delayed replies, particularly during critical fund withdrawal requests, underscoring a lack of adequate support.

Account Conditions Analysis

Account Options:

OBFX has two types of accounts, but the specifics surrounding the advantages of higher-tier accounts remain unclear.

Restrictions on Accounts:

Generally, the presence of high deposit requirements alongside unclear trading conditions raises skepticism regarding the overall accessibility for new or less experienced traders.

In conclusion, while OBFX markets numerous advantages to attract savvy traders, the lack of regulation, poor user experiences, and significant withdrawal obstacles present severe risks. Engaging with OBFX is fraught with risk; thus, comprehensive due diligence is highly recommended for any potential trader.

Before proceeding, potential clients should assess safer options and ensure thorough verification of any broker before commitment.