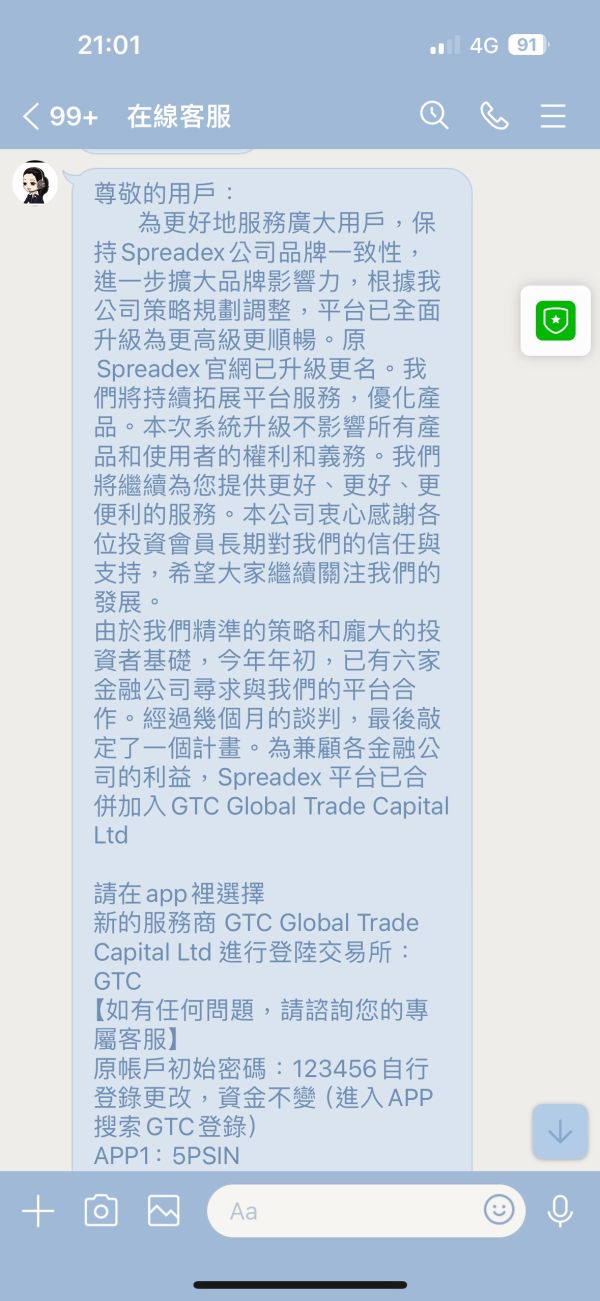

GTC Limited 2025 Review: Everything You Need to Know

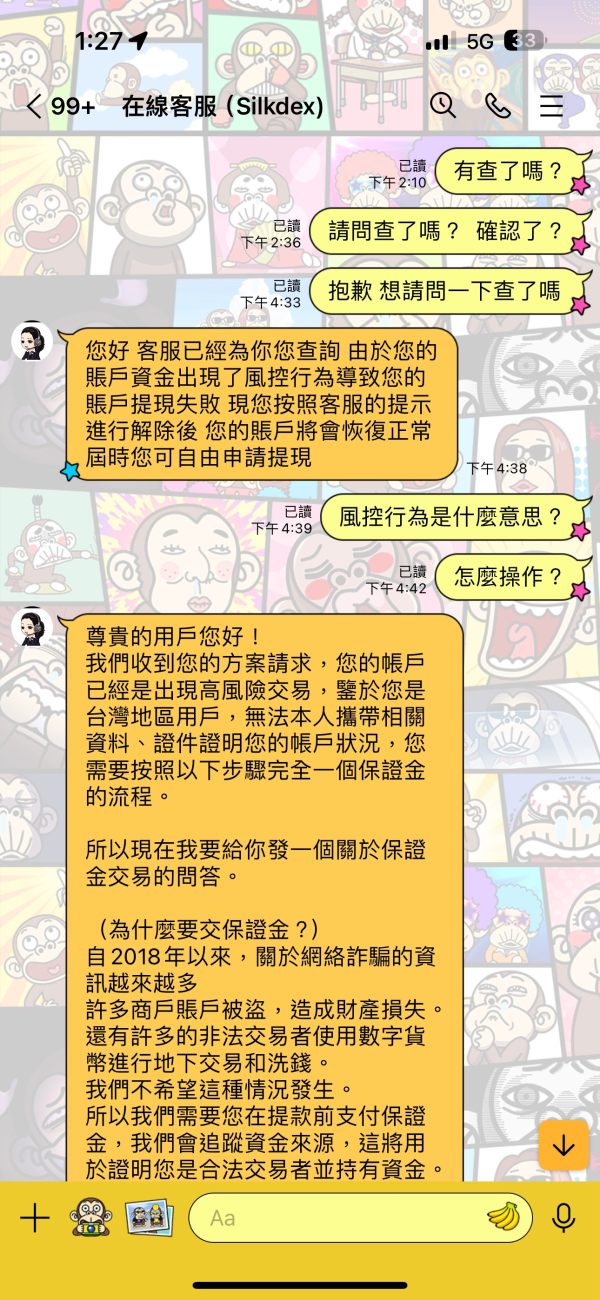

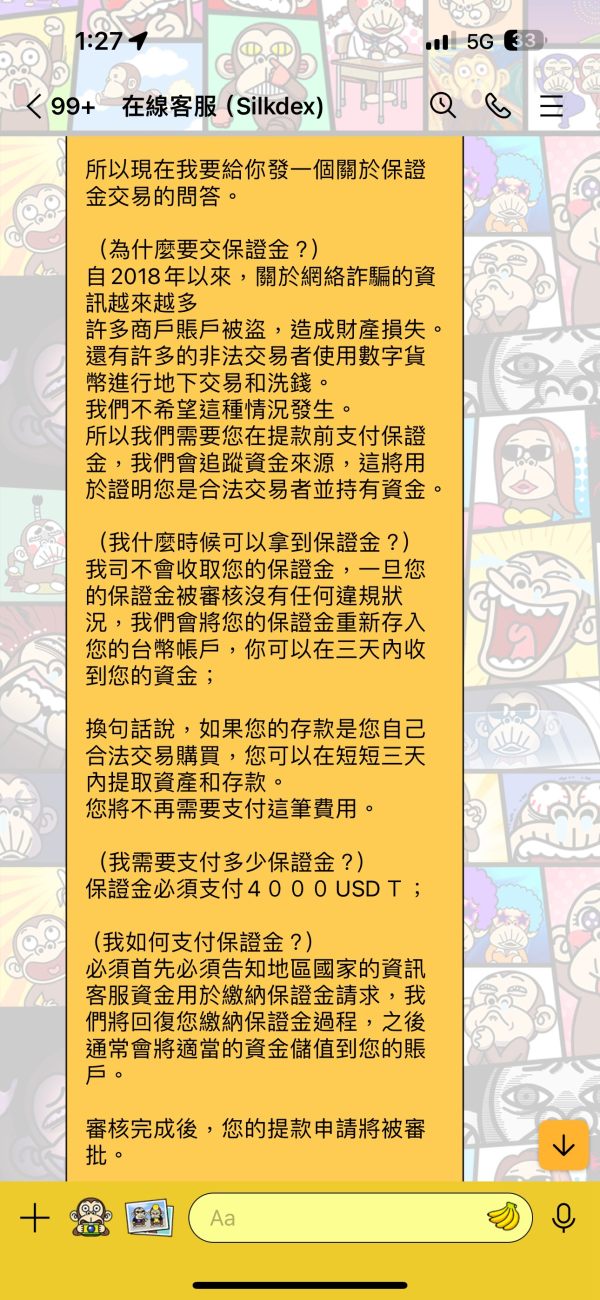

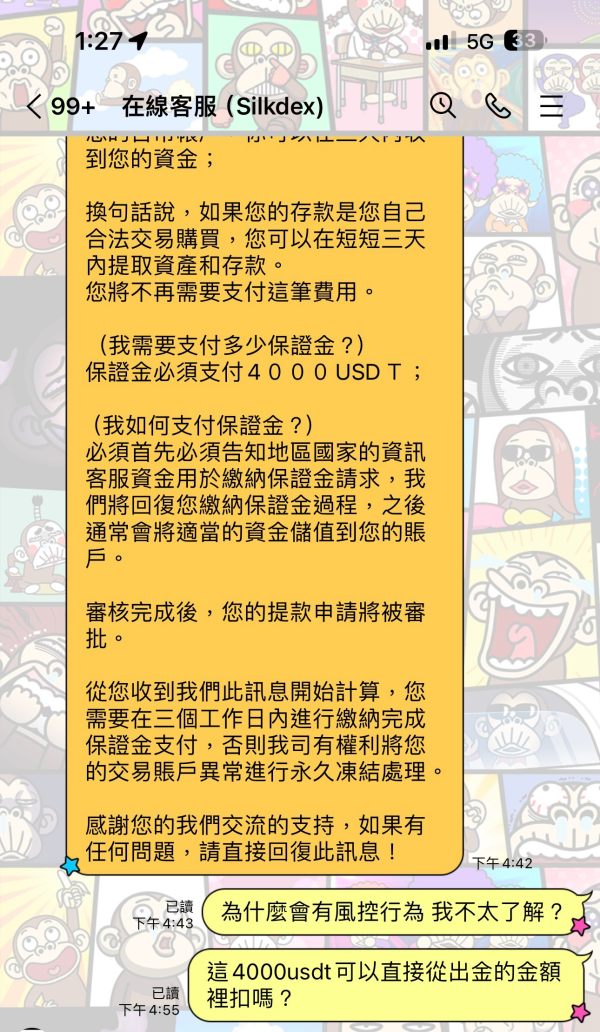

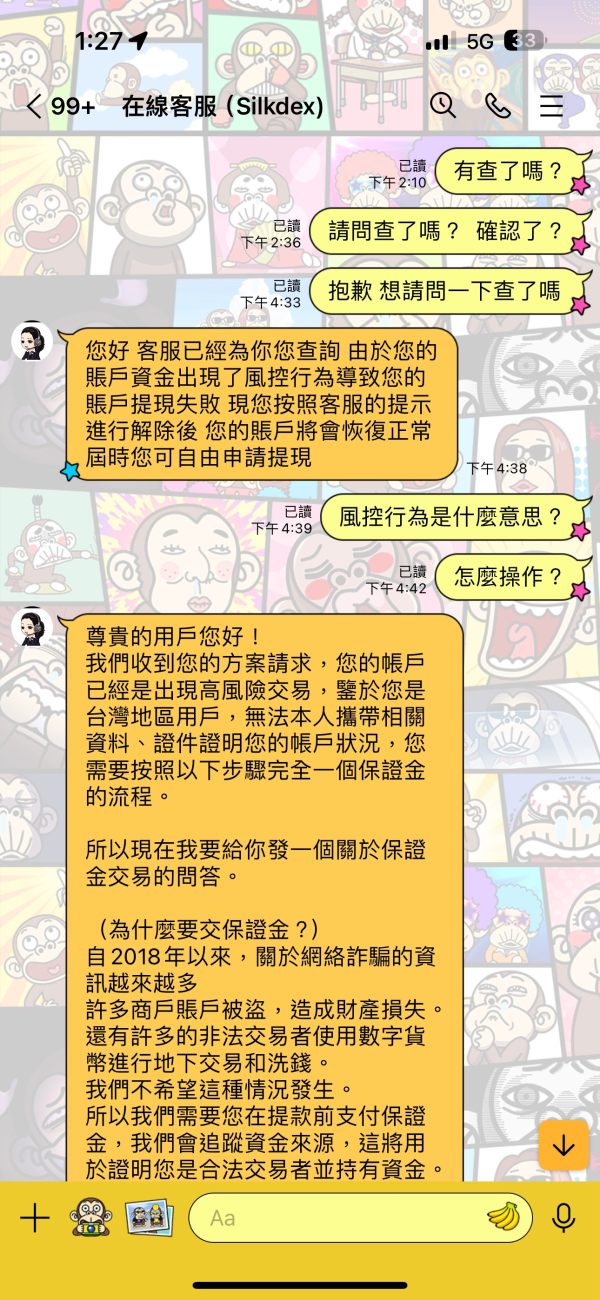

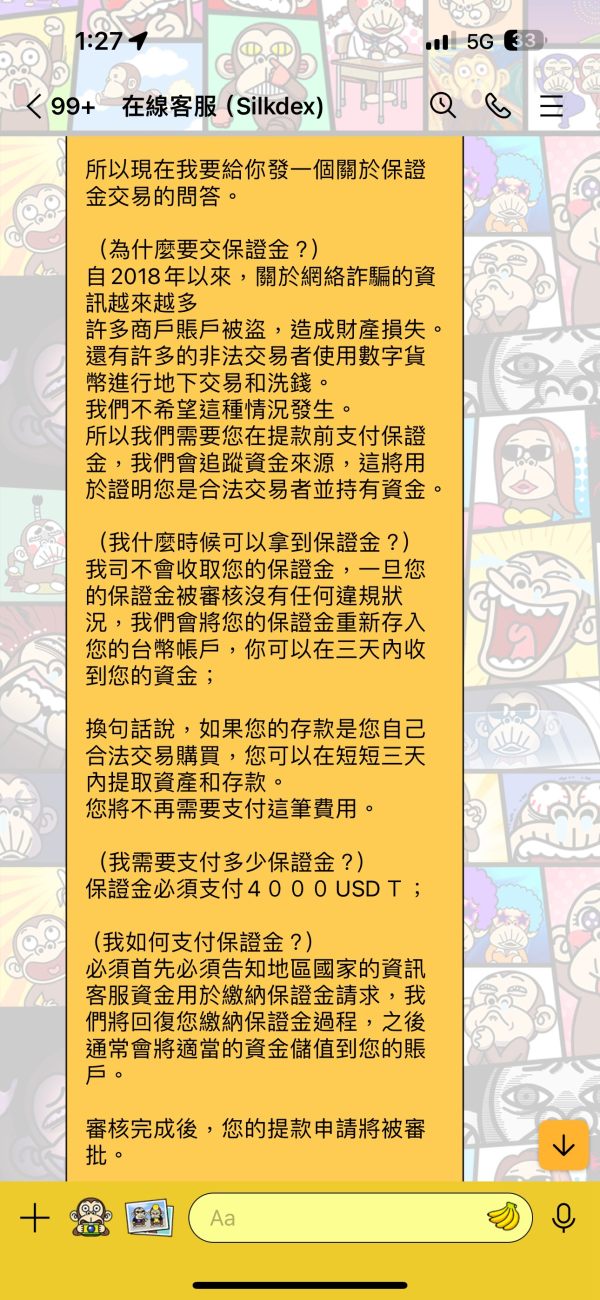

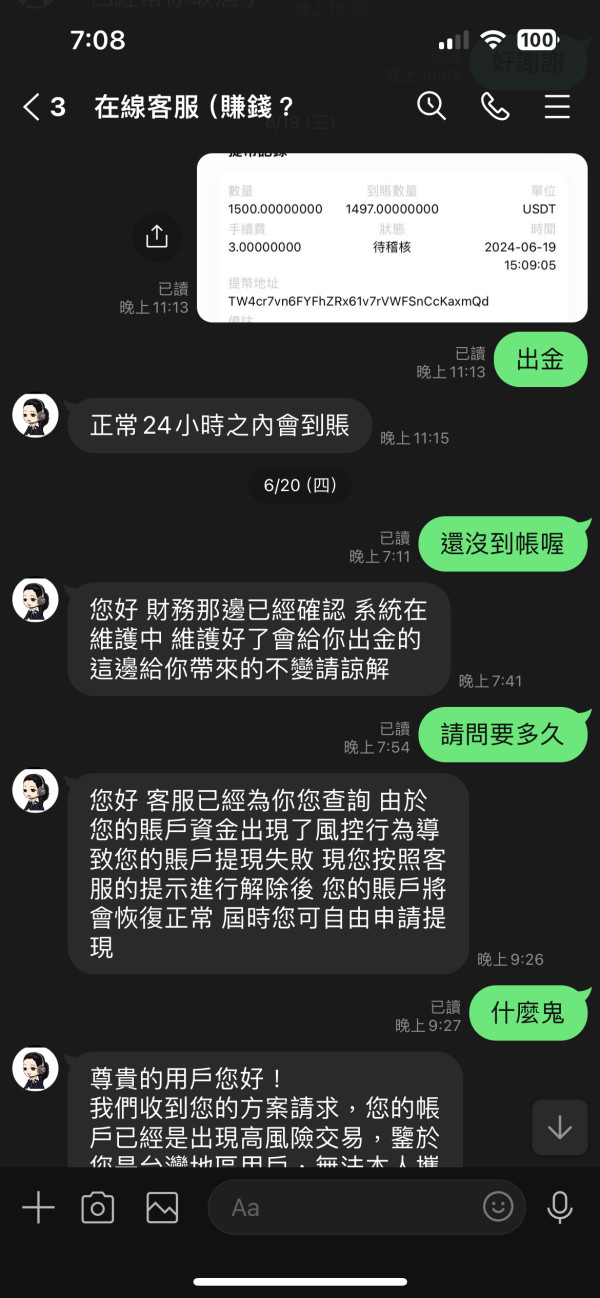

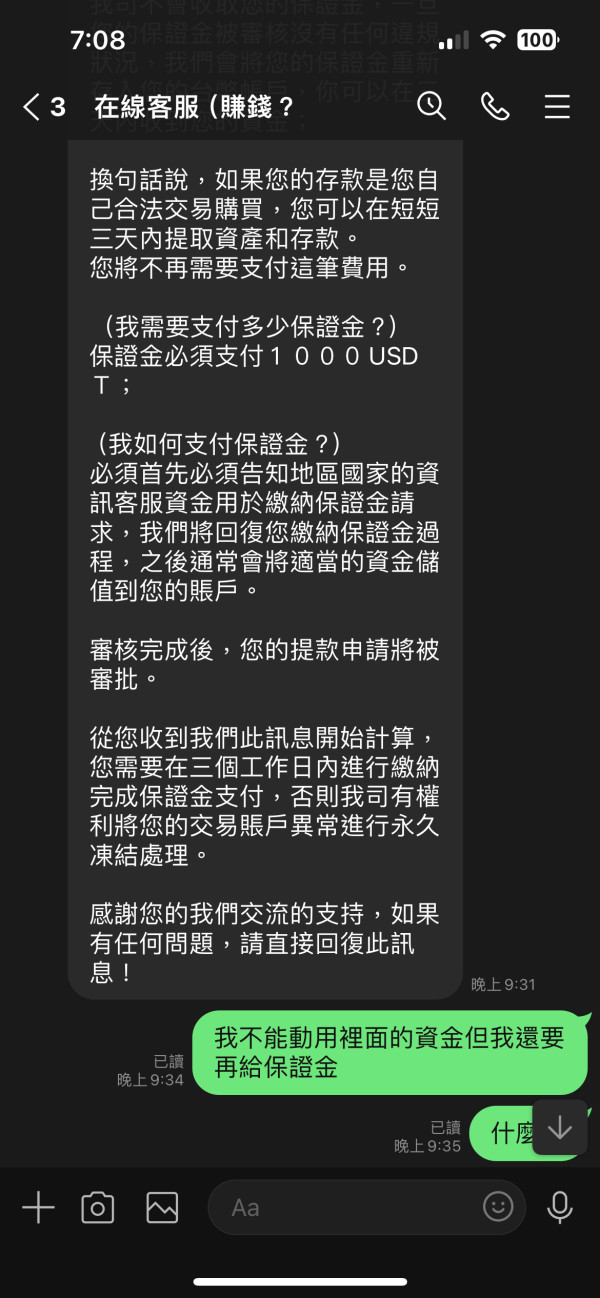

GTC Limited has garnered mixed reviews from various sources, with significant concerns raised regarding its legitimacy and regulatory status. While it offers a variety of trading options, the lack of transparency and regulatory oversight raises red flags for potential investors.

Note: It is essential to consider that GTC Limited operates under different entities across various regions, which may affect its regulatory compliance and user experience. Therefore, thorough research is advised before engaging with this broker.

Rating Summary

We evaluate brokers based on user feedback, expert opinions, and factual data from various sources.

Broker Overview

Founded in 2012, GTC Limited is a brokerage firm that claims to provide a range of trading services, including forex, CFDs, and commodities. The broker predominantly operates on the MetaTrader 4 and MetaTrader 5 platforms, which are well-regarded in the trading community for their robust features and user-friendly interfaces. However, GTC Limited's regulatory status remains ambiguous, with claims of oversight by various authorities, including the Vanuatu Financial Services Commission (VFSC) and the Securities and Commodities Authority (SCA) of the UAE.

Detailed Breakdown

Regulatory Regions

GTC Limited operates in multiple regions, including the UK and the UAE, but lacks robust regulatory oversight. The absence of tier-1 regulation raises concerns about the safety of client funds and the overall reliability of the broker. Reports indicate that GTC Limited has faced scrutiny for its operational practices, leading to warnings from various financial watchdogs.

Deposit/Withdrawal Currencies

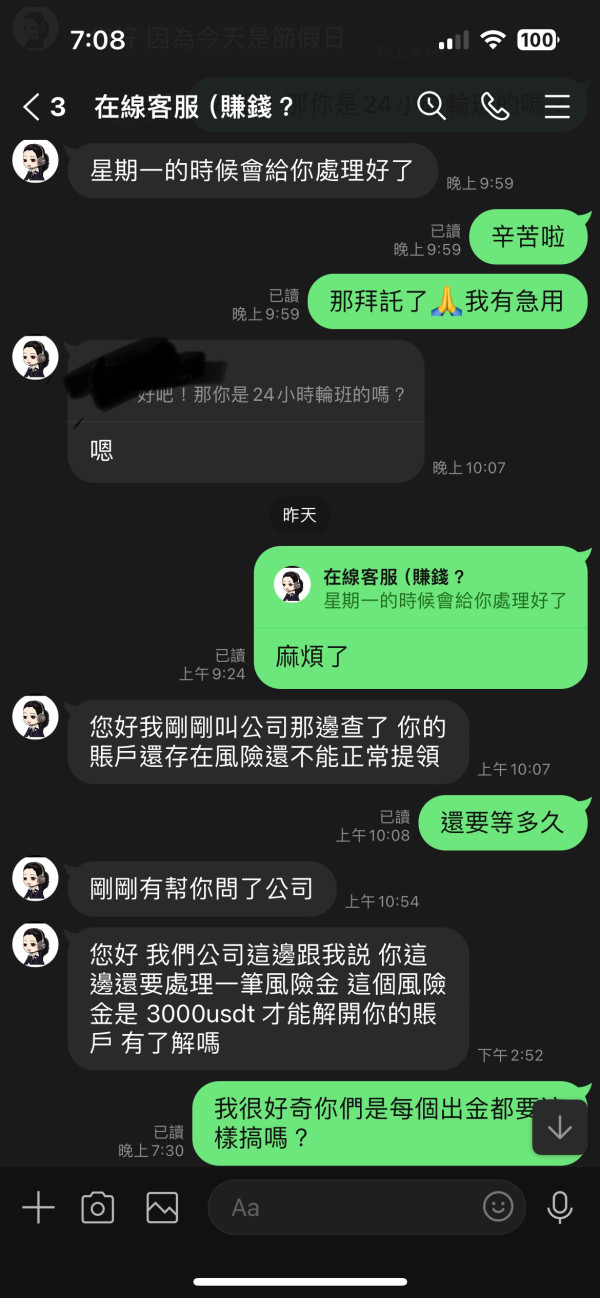

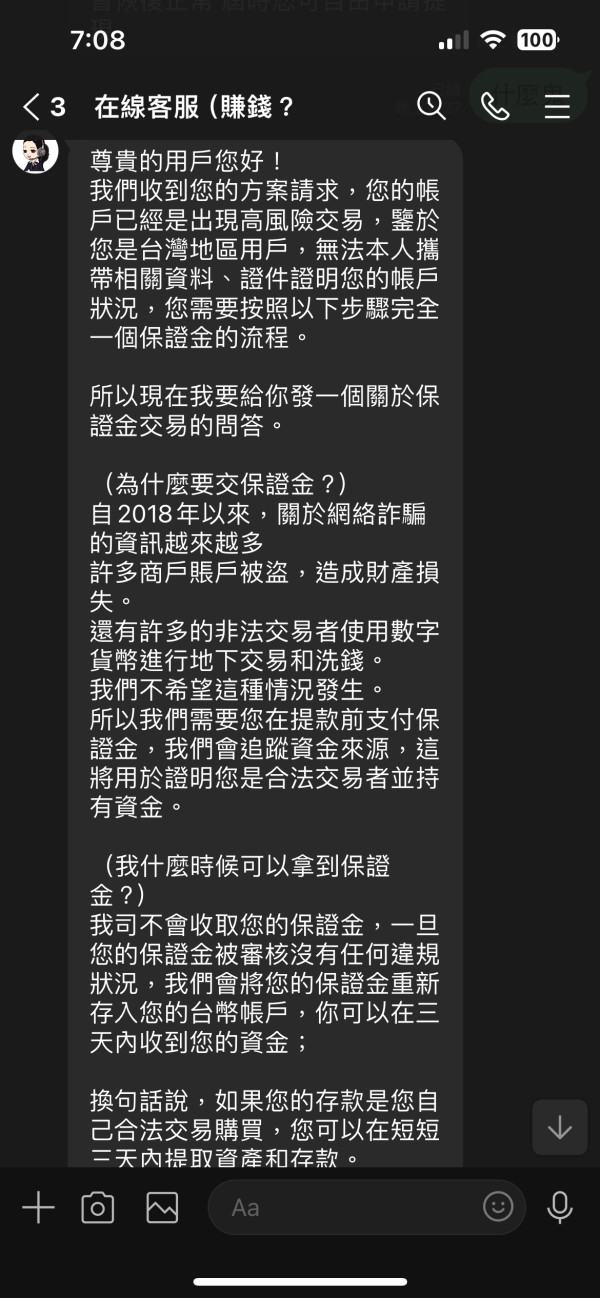

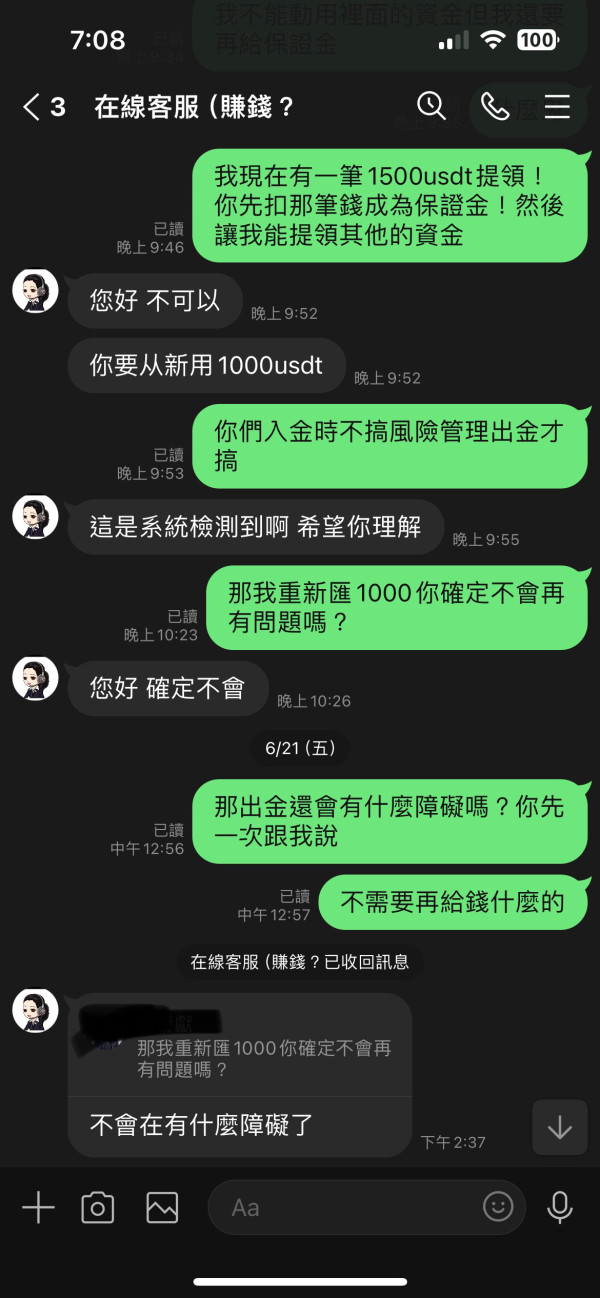

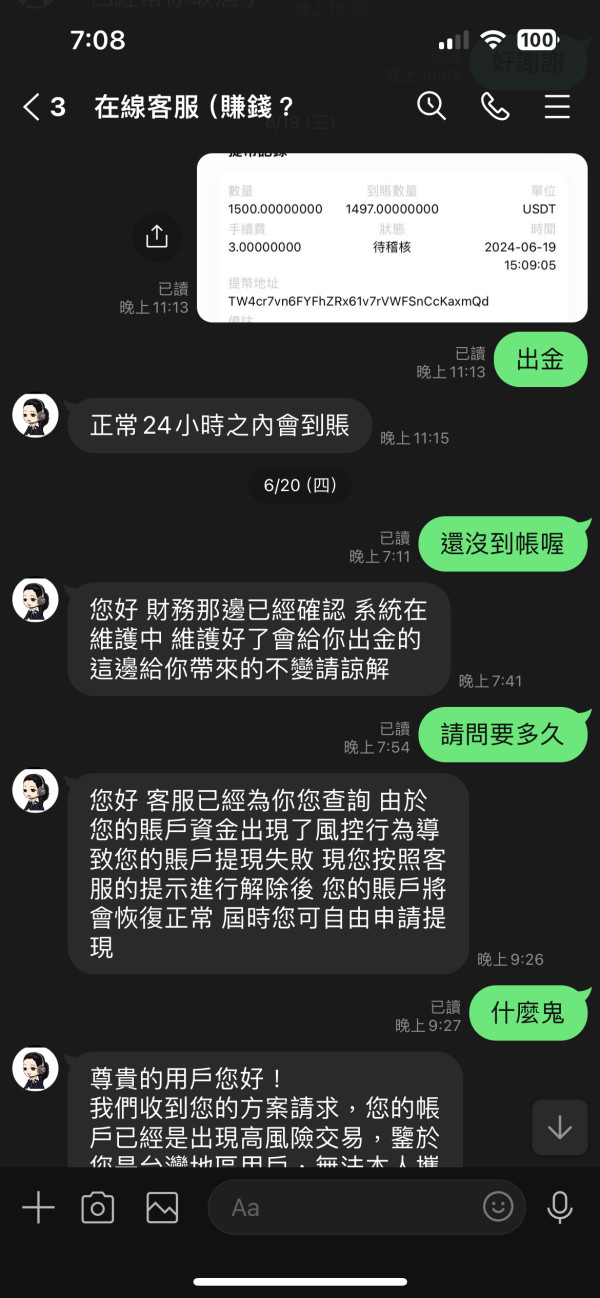

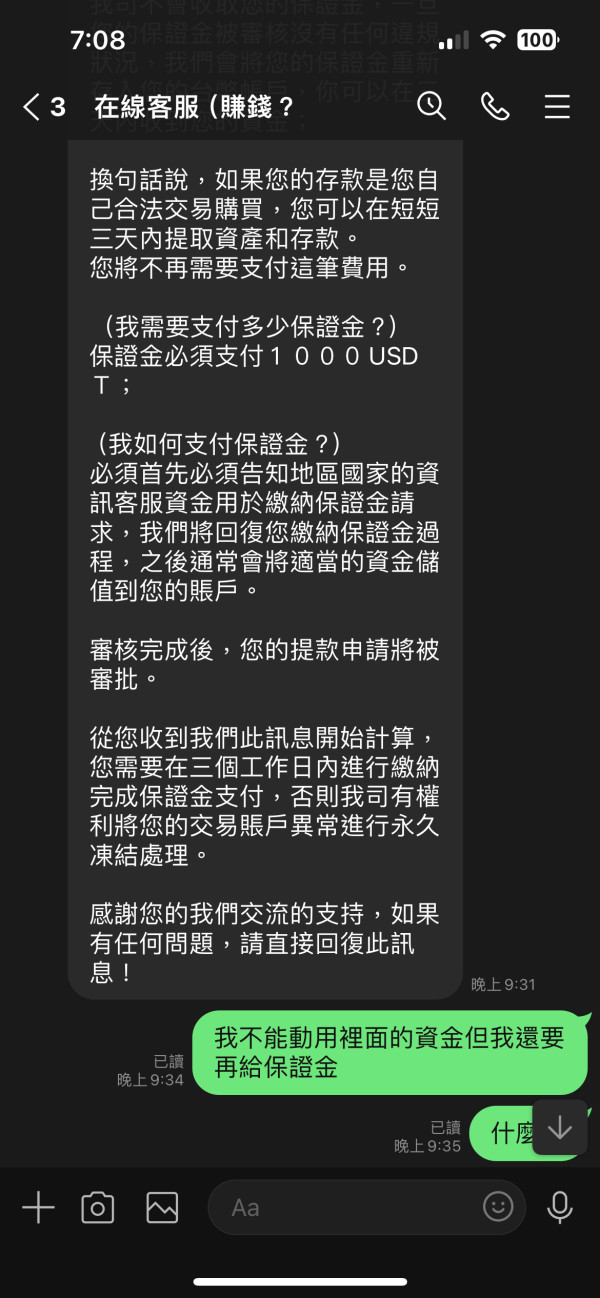

GTC Limited supports multiple currencies for deposits and withdrawals, including USD, EUR, and various cryptocurrencies. However, the specific details regarding transaction fees and processing times are often vague, leading to potential confusion for traders.

Minimum Deposit

The minimum deposit required to open an account with GTC Limited is reported to be around $30 for standard accounts. However, professional accounts require a significantly higher initial deposit, typically starting at $3,000. This tiered structure may deter novice traders who wish to start with smaller amounts.

While GTC Limited does offer various promotions, including welcome bonuses, the terms associated with these bonuses can be restrictive, often leading to complications during the withdrawal process. Traders are advised to read the fine print carefully to avoid unexpected fees or conditions.

Tradable Asset Classes

GTC Limited provides access to a variety of trading instruments, including forex pairs, commodities, and CFDs on stocks and indices. However, the range of assets may be limited compared to other brokers, potentially restricting traders' options for diversification.

Costs (Spreads, Fees, Commissions)

The broker's cost structure includes spreads that can start from 0.3 pips for standard accounts, with additional commissions applicable for professional accounts. However, user reviews suggest that hidden fees may be present, particularly concerning withdrawal processes, which can lead to dissatisfaction among clients.

Leverage

GTC Limited offers leverage up to 1:1000, which is appealing for traders looking to maximize their potential returns. However, such high leverage also comes with increased risk, making it crucial for traders to implement effective risk management strategies.

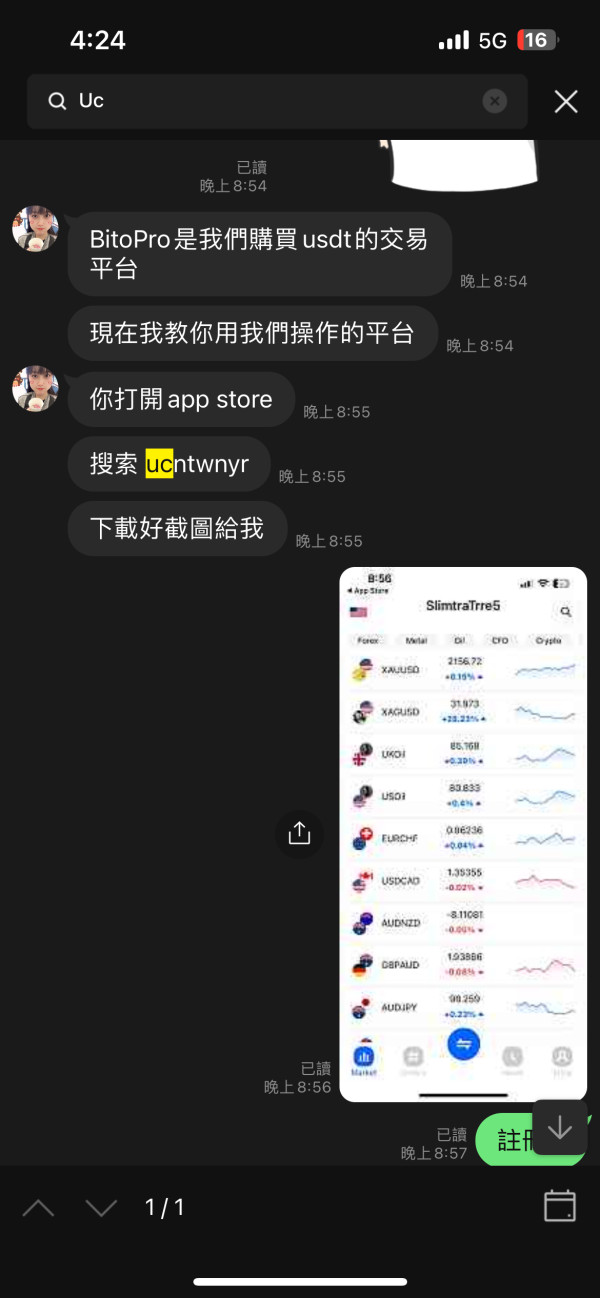

Traders at GTC Limited can utilize popular platforms such as MetaTrader 4 and MetaTrader 5, along with cTrader. These platforms provide advanced charting tools and are widely accepted in the trading community, enhancing the overall trading experience.

Restricted Regions

GTC Limited does not provide services in several countries, including the USA, Canada, and certain EU nations. This restriction may limit access for traders in these regions, necessitating alternative broker options.

Available Customer Service Languages

GTC Limited offers customer support in multiple languages, including English and Arabic, ensuring that traders can receive assistance in their preferred language. However, reviews indicate that response times can be slow, particularly via email.

Rating Summary (Revisited)

Detailed Analysis

Account Conditions

The account conditions at GTC Limited are relatively standard, with a low minimum deposit that makes it accessible for new traders. However, the lack of transparency regarding account types and the fees associated with withdrawals can lead to confusion.

While GTC Limited provides access to popular trading platforms, the educational resources available to traders are limited. Many users have expressed a desire for more comprehensive training materials and support.

Customer Service & Support

Customer service reviews are mixed, with some users praising the availability of support while others criticize the slow response times. This inconsistency can be frustrating for traders seeking immediate assistance.

Trading Experience

The trading experience is generally satisfactory, with users reporting decent execution speeds. However, concerns about hidden fees and withdrawal difficulties have marred the overall experience for some traders.

Trustworthiness

The trustworthiness of GTC Limited is a significant concern, primarily due to its lack of regulatory oversight and mixed reviews from users. Potential investors are advised to exercise caution and conduct thorough research before engaging with this broker.

User Experience

User experiences vary widely, with some traders appreciating the low entry costs and the availability of popular trading platforms, while others have reported issues with withdrawals and customer service.

In conclusion, while GTC Limited offers some appealing features, the significant concerns regarding its regulatory status and user experiences warrant caution. Prospective traders should carefully weigh the risks and consider alternative brokers with stronger regulatory oversight and better user reviews.