MOL Review 1

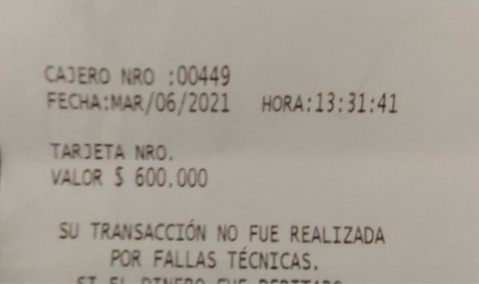

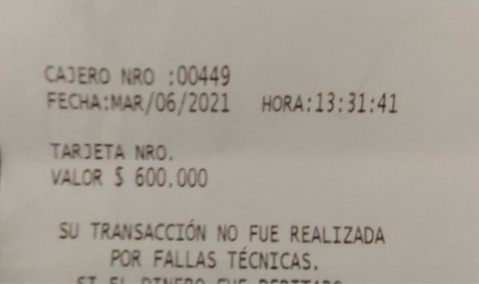

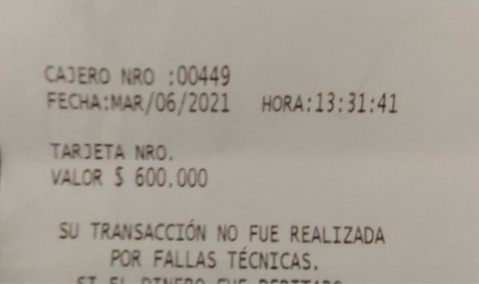

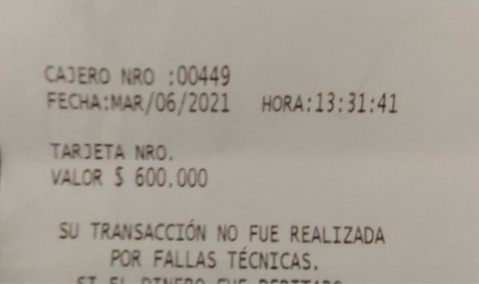

They said they would guide me about investment. But after I deposited $600, the platform disappeared.

MOL Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

They said they would guide me about investment. But after I deposited $600, the platform disappeared.

This comprehensive mol review presents a mixed picture of MOL's performance in the financial services sector. According to available data from Trustpilot, MOL maintains a 2-star rating. This rating indicates significant user dissatisfaction and negative feedback from clients. However, contrasting this external perception, internal employee satisfaction tells a different story that shows promise for the company's future development.

Glassdoor data reveals that MOL employees rate the company at 3.8 out of 5 stars. An impressive 82% of employees are willing to recommend MOL as a workplace. This suggests strong internal management and supportive company culture that creates positive working conditions for staff members.

The difference between external client experience and internal employee satisfaction highlights MOL's complex market position. While the company appears to excel in employee relations and internal operations, client-facing services seem to require substantial improvement that could benefit from strategic planning. MOL Learn operates as a training provider specializing in qualifications across HR, Learning and Development, Management and Leadership, and Property sectors.

Additionally, MOL Logistics functions as a global logistics service provider. This indicates the company's diversified business approach that spans multiple industries and service areas. The primary target audience for MOL includes investors seeking forex market participation, particularly those requiring educational support and comprehensive guidance.

Despite the challenging user experience reflected in external ratings, the company's strong internal foundation suggests potential for improvement and growth in service delivery.

Regional Entity Differences: The available information summary does not provide specific regulatory details or jurisdictional compliance information. Users should exercise caution and conduct independent verification of MOL's regulatory status across different regions before engaging in any trading activities that could affect their financial standing.

Review Methodology: This evaluation is based on available user feedback and company background information. The assessment lacks comprehensive data regarding specific trading conditions, detailed regulatory oversight, and complete service offerings that would provide a fuller picture. Potential clients should seek additional information directly from MOL to make fully informed decisions.

| Evaluation Criteria | Score | Rating Basis |

|---|---|---|

| Account Conditions | N/A | Specific account condition details not mentioned in available information |

| Tools and Resources | N/A | Trading tools and resources not detailed in information summary |

| Customer Service and Support | 7/10 | Indeed reviews indicate positive employee experience with supportive management |

| Trading Experience | N/A | Specific trading experience details not mentioned in available information |

| Trustworthiness | N/A | Specific regulatory information not mentioned in available information |

| User Experience | 5/10 | Trustpilot 2-star rating indicates poor user experience |

MOL operates as a multifaceted organization with distinct business divisions serving different market segments. The company's establishment date and founding details are not specified in the available information summary. However, the organization has developed a notable presence across multiple sectors that demonstrates its commitment to diverse business operations.

MOL Learn functions as the educational arm, specializing in professional qualifications and training programs across Human Resources, Learning and Development, Management and Leadership, and Property sectors. This educational focus suggests the company's commitment to knowledge transfer and professional development that benefits both individuals and organizations. Simultaneously, MOL Logistics operates as a global logistics service provider, indicating the company's diversified business model and international reach.

This dual approach combining education and logistics services creates a unique market position. However, the connection to forex trading services requires further clarification from company representatives. The company's business model appears centered on providing educational and training services, supporting both individual professional development and enterprise-level organizational growth.

The mol review data suggests that while the company maintains strong internal operations and employee satisfaction, external client experience requires significant attention and improvement.

Regulatory Regions: The information summary does not mention specific regulatory authorities or jurisdictional oversight. Potential clients should independently verify MOL's regulatory status in their respective regions before engaging in trading activities that could impact their financial security.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal options is not detailed in the available information summary.

Minimum Deposit Requirements: The information summary does not provide details about minimum deposit requirements for account opening.

Bonus and Promotions: No specific information about promotional offers or bonus structures is mentioned in the available data.

Tradeable Assets: The information summary does not specify the range of tradeable assets or financial instruments available through MOL's platform.

Cost Structure: Detailed information about spreads, commissions, and fee structures is not provided in the available information summary.

Leverage Ratios: Specific leverage options and ratios are not mentioned in the available data.

Platform Options: The information summary does not detail the trading platforms offered by MOL.

Regional Restrictions: Specific geographic limitations or restrictions are not mentioned in the available information.

Customer Service Languages: The information summary does not specify the languages supported by MOL's customer service team.

This mol review highlights the significant information gaps that potential clients should address through direct communication with MOL representatives.

The evaluation of MOL's account conditions faces significant limitations due to insufficient information in the available data sources. The information summary does not provide details about account types, their specific features, or the variety of options available to different client segments that would help potential users make informed decisions. Without access to information about minimum deposit requirements, account opening procedures, or special account features such as Islamic accounts, it becomes challenging to provide a comprehensive assessment of MOL's account offerings.

The absence of detailed account condition information represents a significant gap in this mol review. Potential clients seeking to understand account structures, fee arrangements, or special features must obtain this information directly from MOL representatives who can provide current and accurate details. The lack of readily available account information may itself indicate areas where MOL could improve transparency and client communication.

Industry standards typically require clear disclosure of account conditions, minimum requirements, and associated fees. The limited availability of such information in public sources suggests that MOL may need to enhance its public information disclosure practices to meet client expectations and industry standards that promote transparency.

The assessment of MOL's trading tools and resources is constrained by the absence of specific information in the available data sources. The information summary does not detail the variety or quality of trading tools offered, research and analysis resources available to clients, educational materials provided, or automated trading support capabilities that modern traders typically expect.

Educational resources appear to be a focus area for MOL Learn, given its specialization in professional qualifications and training programs. However, the connection between these educational services and forex trading resources requires clarification from company representatives who can explain how these services integrate. The company's expertise in Learning and Development suggests potential strength in client education, though specific forex-related educational offerings are not detailed in available materials.

The lack of information about research tools, market analysis resources, and trading automation support represents significant gaps in this evaluation. Modern forex trading requires comprehensive tool suites, and the absence of detailed information about MOL's offerings may concern potential clients seeking advanced trading capabilities that can enhance their market performance.

Customer service and support evaluation reveals mixed signals based on available feedback from multiple sources. Indeed reviews indicate that employees enjoy working at MOL, with management described as supportive and encouraging in ways that create positive workplace environments. This positive internal environment suggests that the company maintains good employee relations and supportive management structures, which often translate into better customer service delivery.

However, the contrast between positive employee feedback and the 2-star Trustpilot rating creates questions about service delivery effectiveness. While employees report positive experiences with supportive management, client experiences appear significantly less favorable in ways that suggest systematic issues. This disconnect suggests potential issues in service delivery processes or client expectation management that require attention from company leadership.

The information summary does not provide details about customer service channels, availability hours, response times, or multilingual support capabilities. Without specific information about service quality metrics, resolution procedures, or communication channels, clients cannot fully assess MOL's customer support capabilities before engagement with the company's services.

The evaluation of MOL's trading experience faces substantial limitations due to insufficient information in the available data sources. The information summary does not provide details about platform stability, execution speed, order processing quality, mobile trading capabilities, or overall trading environment characteristics that traders need to evaluate. Platform performance represents a critical factor in forex trading success, yet specific information about MOL's trading infrastructure, technology capabilities, and execution quality is not available in the current data sources.

The absence of user feedback specifically related to trading experience makes it impossible to assess platform reliability, execution speed, or technical performance. Mobile trading capabilities, platform functionality, and trading environment quality are essential considerations for modern forex traders who need reliable and efficient systems. The lack of detailed information about these aspects in this mol review highlights the need for potential clients to conduct thorough platform testing and evaluation before committing to MOL's services.

Trustworthiness assessment encounters significant challenges due to the absence of specific regulatory information in the available data sources. The information summary does not mention regulatory qualifications, oversight authorities, compliance frameworks, or fund safety measures implemented by MOL to protect client interests. Regulatory oversight represents a fundamental aspect of broker trustworthiness, yet the current information lacks details about MOL's regulatory status, licensing authorities, or compliance measures.

Without verification of regulatory standing, potential clients cannot adequately assess the safety and security of their funds or the legal protections available. Industry reputation and transparency measures are also not detailed in the available information that would help clients make informed decisions. The absence of information about negative event handling, dispute resolution procedures, or third-party validations further complicates trustworthiness evaluation.

Potential clients must independently verify MOL's regulatory status and safety measures before engagement.

User experience analysis reveals concerning trends based on available feedback data from multiple review platforms. Trustpilot's 2-star rating indicates significant user dissatisfaction and poor overall experience with MOL's services that affects client retention. This low rating suggests widespread issues with service delivery, platform functionality, or client expectation management that require immediate attention.

The contrast between poor external user ratings and positive internal employee feedback creates an interesting dynamic. While employees report satisfaction with management and workplace conditions, clients experience significant dissatisfaction with services received in ways that suggest disconnection between internal operations and external service delivery. This disconnect suggests potential issues in client-facing operations or service delivery processes.

The information summary does not provide details about interface design, platform usability, registration procedures, verification processes, or fund operation experiences. Without specific user feedback about these operational aspects, it becomes difficult to identify particular areas requiring improvement that could enhance overall client satisfaction. The general negative sentiment reflected in Trustpilot ratings suggests comprehensive service review and enhancement may be necessary.

This comprehensive mol review presents a complex picture of an organization with strong internal foundations but significant external service challenges. While MOL demonstrates excellence in employee relations and internal management, as evidenced by positive Glassdoor ratings and high employee recommendation rates, the stark contrast with poor client experience ratings indicates substantial room for improvement in service delivery that could transform the company's market position.

The company appears well-suited for investors seeking educational support and comprehensive guidance in forex market participation, given its background in Learning and Development. However, potential clients should exercise caution and conduct thorough due diligence, particularly regarding regulatory compliance and service quality expectations that align with their trading needs. The primary advantages include strong internal company culture and supportive management structures, while significant disadvantages center on poor user experience and limited transparency in service offerings.

Potential clients should seek detailed information directly from MOL representatives to address the numerous information gaps identified in this evaluation.

FX Broker Capital Trading Markets Review