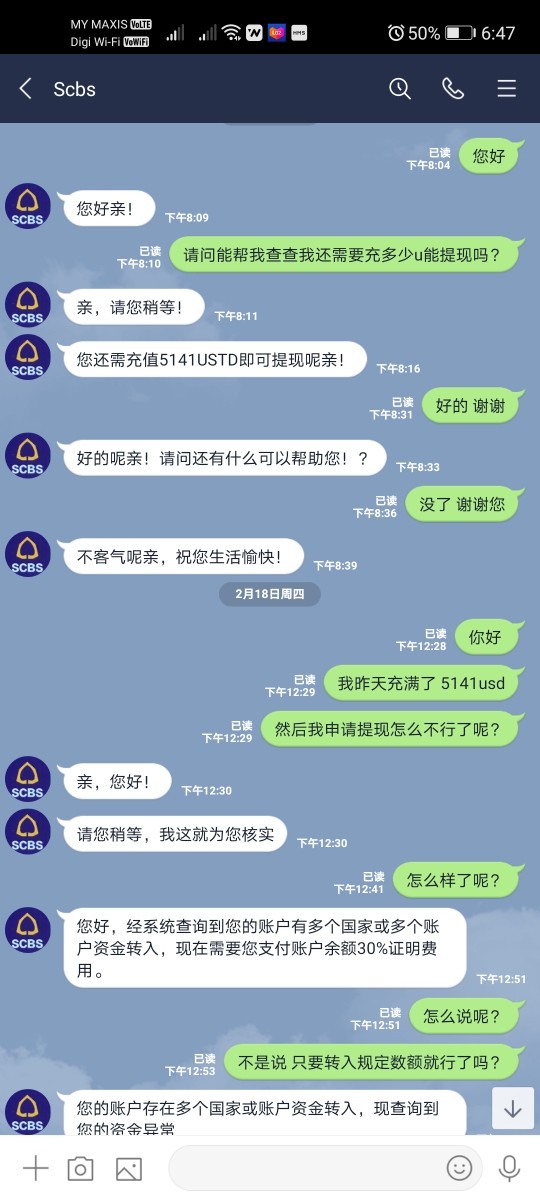

Scbs 2025 Review: Everything You Need to Know

Executive Summary

This Scbs review looks at a broker with limited public presence in forex trading. SCBS operates as a limited liability company with registered business activities in Tucson, Arizona, based on information from review platforms like Angie's List and ResellerRatings. The company's specific focus on forex trading services remains unclear from publicly available sources.

The broker has some online presence that suggests business operations. User review platforms acknowledge its existence and provide channels for customer feedback. SCBS, LLC appears on local business directories, indicating legitimate business registration. However, detailed information about trading services, regulatory compliance, and operational specifics are not readily available through standard industry channels.

Potential clients should exercise caution and conduct thorough research before considering this broker for forex trading activities. The absence of detailed regulatory information, trading platform specifications, and clear service offerings raises questions about the broker's positioning within the competitive forex market landscape.

Important Notice

This review uses publicly available information from business directories and review platforms. Due to limited data about SCBS's specific forex trading operations, regulatory status, and service offerings, this evaluation may not reflect the complete picture of the broker's capabilities and compliance status.

The information presented here comes from general business listings and user review platforms rather than comprehensive regulatory filings or detailed broker documentation. Potential clients should independently verify all trading conditions, regulatory compliance, and service terms directly with the broker before making any investment decisions.

Rating Framework

Broker Overview

SCBS, LLC operates as a registered business entity with documentation available through various business directory platforms. According to Glassdoor listings, the company maintains corporate information including potential employment data, salary information, and office details. This suggests an established business structure. However, the specific nature of their forex trading services and market positioning remains unclear from publicly accessible information.

The broker's presence on platforms like Angie's List indicates some level of customer interaction and service provision. The scope and quality of these services in relation to forex trading are not explicitly detailed. The company appears to maintain operations in the Tucson, Arizona area. Business registration suggests legitimate corporate status within the United States jurisdiction.

Specific information about MetaTrader platform availability, supported currency pairs, CFD options, or other trading instruments is not detailed in available sources. Information about primary regulatory oversight, licensing jurisdictions, and compliance frameworks is not clearly documented in the accessible business information. This represents a significant gap for potential trading clients seeking regulatory assurance.

Regulatory Jurisdiction: Specific regulatory information is not detailed in available sources, though the company operates as a registered LLC in Arizona.

Deposit and Withdrawal Methods: Payment processing options and banking methods are not specified in public information.

Minimum Deposit Requirements: Entry-level funding requirements are not documented in accessible sources.

Promotional Offers: Current bonus structures and promotional campaigns are not detailed in available information.

Tradeable Assets: Specific information about forex pairs, CFDs, commodities, or other trading instruments is not provided in public sources.

Cost Structure: Details regarding spreads, commission structures, overnight fees, and other trading costs are not available in the reviewed sources.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in accessible documentation.

Platform Selection: Information about trading platform options, including MetaTrader availability or proprietary platforms, is not detailed.

Geographic Restrictions: Specific country limitations or service availability restrictions are not documented.

Customer Support Languages: Available support languages are not specified in the reviewed information.

This Scbs review highlights the significant information gaps that potential clients would encounter when evaluating this broker option.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of SCBS's account conditions faces significant limitations due to the absence of detailed information in publicly available sources. Standard account types remain unspecified, whether the broker offers retail, professional, or institutional account categories. The lack of transparency regarding minimum deposit requirements makes it impossible to assess the broker's accessibility for different trader segments. This affects everyone from beginners to high-volume professionals.

Account opening procedures, verification requirements, and documentation processes are not detailed in available sources. This creates uncertainty for potential clients about onboarding experiences. Special account features that are standard in the industry are not mentioned in the accessible information. These include Islamic accounts for Sharia-compliant trading, demo account availability, or managed account options.

The absence of clear account condition details represents a significant transparency gap. This distinguishes SCBS from established brokers who typically provide comprehensive account information. The lack of detail makes it challenging for traders to make informed decisions about account suitability for their trading strategies and capital requirements. Without specific information about account tiers, benefits, or restrictions, potential clients cannot adequately compare SCBS's offerings against industry standards.

This Scbs review emphasizes that comprehensive account condition information should be a priority for any serious broker evaluation.

Assessment of SCBS's trading tools and analytical resources is severely limited by the lack of detailed information in available sources. Standard trading tools such as technical analysis indicators, charting packages, economic calendars, and market research resources are not documented in accessible materials. The absence of information about proprietary trading tools or third-party integrations makes it impossible to evaluate the broker's technological capabilities.

Educational resources are crucial for trader development, but these are not detailed in the available information. Whether SCBS provides webinars, trading guides, market analysis, or educational content remains unclear. Research capabilities are not specified in public sources. This includes fundamental analysis, technical analysis tools, and market commentary.

Automated trading support is not mentioned in the reviewed materials. This includes Expert Advisor compatibility, algorithmic trading options, or API access for advanced traders. The lack of information about mobile trading applications, platform customization options, or advanced order types further limits the ability to assess the broker's technological offerings.

Professional traders typically require sophisticated tools for market analysis and trade execution. SCBS's capabilities in this area cannot be determined from available sources. This information gap significantly impacts the ability to recommend the broker for different trading styles and experience levels.

Customer Service and Support Analysis

Evaluation of SCBS's customer service capabilities is constrained by limited information in publicly available sources. Standard customer support channels are not detailed in accessible materials. These include live chat, telephone support, email assistance, and response time commitments. The quality and availability of customer service represent crucial factors for trader satisfaction. Yet specific information about SCBS's support infrastructure remains unclear.

Multi-language support capabilities are essential for brokers serving international clients, but these are not documented in the available sources. Support hours, weekend availability, and timezone coverage are not specified. This makes it difficult for potential clients to understand when assistance would be available for their trading activities.

Problem resolution procedures, escalation processes, and customer service quality metrics are not detailed in the reviewed information. User feedback specifically related to customer service experiences is not available in the accessible sources. This prevents assessment of real-world support quality and effectiveness.

The absence of dedicated account manager services cannot be confirmed from available information. Priority support for different account tiers and specialized technical support options also cannot be verified. This lack of customer service transparency represents a significant concern for traders who value reliable support infrastructure as part of their broker selection criteria.

Trading Experience Analysis

Assessment of the trading experience with SCBS faces substantial limitations due to insufficient information in available sources. Platform stability, execution speed, and order processing quality are fundamental aspects of trading experience. Yet specific details about these performance metrics are not documented in accessible materials. The absence of information about slippage rates, re-quotes frequency, and execution reliability makes it impossible to evaluate the broker's trading environment quality.

Platform functionality is not detailed in the reviewed sources. This includes order types availability, one-click trading options, and advanced trading features. Mobile trading capabilities are essential for modern traders, but these are not specified. This leaves questions about iOS and Android application quality and functionality unanswered.

Market depth information, real-time pricing accuracy, and spread consistency during different market conditions are not documented in available sources. The trading environment during high-impact news events cannot be assessed based on accessible information. Market volatility periods and session overlaps also cannot be evaluated.

User feedback specifically related to trading experience, platform performance, and execution quality is not available in the reviewed sources. Without access to trader testimonials or performance data, it becomes challenging to provide meaningful insights about the practical aspects of trading with SCBS.

This Scbs review underscores the importance of comprehensive trading experience information for broker evaluation.

Trust and Security Analysis

Evaluation of SCBS's trustworthiness and security measures is significantly hampered by the lack of detailed regulatory and compliance information in available sources. Regulatory licensing forms the foundation of broker credibility, but this is not clearly documented in accessible materials. The absence of specific regulatory authority oversight, compliance frameworks, and licensing jurisdictions raises important questions about investor protection and operational standards.

Fund security measures are not detailed in the reviewed sources. These include segregated account policies, client fund protection schemes, and deposit insurance coverage. These security measures are crucial for trader confidence. Yet SCBS's specific policies and protections remain unclear from publicly available information.

Company transparency cannot be adequately assessed based on available sources. This includes ownership structure, financial reporting, and operational disclosure. Industry reputation, peer recognition, and regulatory standing are not documented in accessible materials. This limits the ability to evaluate the broker's position within the forex trading industry.

Third-party audits, compliance certifications, and security protocols are not specified in the available information. The handling of negative events, dispute resolution procedures, and regulatory compliance history cannot be determined from the reviewed sources. This represents significant transparency gaps that affect trust assessment.

User Experience Analysis

Comprehensive evaluation of user experience with SCBS is limited by the scarcity of detailed user feedback and interface information in available sources. Overall user satisfaction levels typically reflect the cumulative experience of trading with a broker. These cannot be accurately assessed due to insufficient user review data in accessible materials.

Interface design quality, platform navigation ease, and user-friendly features are not detailed in the reviewed sources. Registration and account verification processes significantly impact first-time user experience. These are not documented in available information, making it impossible to assess onboarding efficiency and user-friendliness.

Funding and withdrawal experience are not specified in accessible sources. This includes processing times, fee structures, and transaction convenience. Common user complaints, recurring issues, and positive feedback patterns cannot be identified from the limited information available.

User demographic analysis cannot be determined from available sources. This includes the types of traders who find SCBS suitable for their needs. The balance between positive and negative user experiences, areas for improvement, and user retention factors are not documented in the reviewed materials.

Without comprehensive user feedback and experience data, it becomes challenging to provide meaningful recommendations about user experience quality and satisfaction levels with SCBS's services.

Conclusion

This Scbs review reveals significant information limitations that impact the ability to provide a comprehensive broker evaluation. Based on available sources from business directories and review platforms, SCBS operates as a registered business entity. However, specific details about forex trading services, regulatory compliance, and operational capabilities remain unclear. The lack of transparency regarding trading conditions, platform offerings, and regulatory oversight represents substantial gaps for potential clients seeking a reliable forex broker.

The absence of detailed information across all major evaluation criteria suggests that traders should exercise considerable caution when considering SCBS for their trading activities. Without clear regulatory status, trading condition details, and user experience data, it becomes difficult to recommend this broker for any specific trader category or trading strategy.

Potential clients are strongly advised to seek comprehensive information directly from SCBS and verify all regulatory, operational, and service details before making any trading decisions. The limited public information available emphasizes the importance of thorough research in broker selection processes.