Is Gomax safe?

Pros

Cons

Is Gomax Safe or a Scam?

Introduction

Gomax is a forex broker that has emerged in the trading landscape, positioning itself as a platform for traders looking to engage in foreign exchange and other financial instruments. Given the rapid growth of online trading, it is imperative for traders to exercise caution when selecting a broker. The forex market is rife with opportunities but also fraught with risks, including the potential for scams. Therefore, evaluating a broker's credibility, regulatory compliance, and overall trustworthiness is essential for safeguarding one's investments.

This article investigates the legitimacy of Gomax by analyzing its regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and associated risks. The information is derived from various credible sources to provide a comprehensive overview of whether Gomax is indeed a safe trading option or a potential scam.

Regulation and Legitimacy

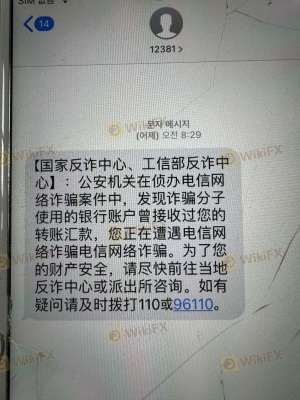

Regulation is crucial in the forex trading industry as it serves as a safeguard for traders, ensuring that brokers adhere to certain standards and practices. Gomax claims to be regulated by the Financial Crimes Enforcement Network (FinCEN), but this assertion is misleading. FinCEN does not oversee forex trading; it focuses on preventing financial crimes such as money laundering. Furthermore, Gomax does not appear to be registered with any reputable regulatory bodies, raising significant concerns about its legitimacy.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| FinCEN | 31000251361096 | USA | Not Applicable |

The absence of genuine regulatory oversight indicates that Gomax operates without the necessary legal framework, which is a red flag for potential investors. Traders must be aware that without proper regulation, their funds may not be protected, and they may have limited recourse in case of disputes. Therefore, it is essential to approach Gomax with caution, as the lack of regulatory legitimacy suggests it may not be a safe trading environment.

Company Background Investigation

Gomax was reportedly established in 2015, but its online presence and credibility have come under scrutiny. The company's ownership structure and management team are not well-documented, which raises questions about transparency and accountability. A lack of information regarding the individuals behind the broker can be a significant concern for potential clients, as it is difficult to ascertain their qualifications and experience in the financial sector.

The company's website does not provide comprehensive details about its operational history, which further diminishes its credibility. Transparency in business practices is vital for building trust, and Gomax's failure to disclose essential information is a cause for concern. Investors should be wary of engaging with a broker that lacks a clear and verifiable background, as this could indicate potential fraudulent behavior.

Trading Conditions Analysis

When evaluating whether Gomax is safe, it is essential to consider its trading conditions, including fees and spreads. Gomax offers competitive spreads starting from 0.0 pips, which may initially seem attractive. However, the absence of a demo account limits traders' ability to test the waters before committing real funds.

| Fee Type | Gomax | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Moderate |

The fee structure may have hidden costs or unusual policies that could impact traders' profitability. For instance, while Gomax advertises low spreads, the lack of transparency regarding commissions and overnight fees could lead to unexpected charges. Therefore, potential traders should scrutinize the fee model carefully to avoid unwelcome surprises.

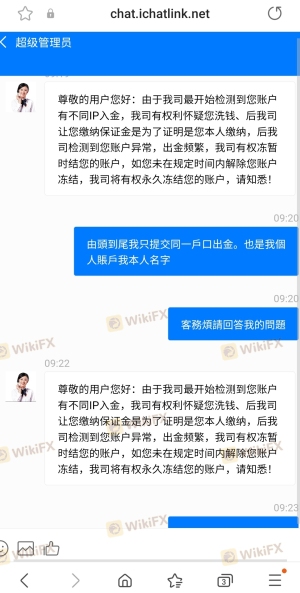

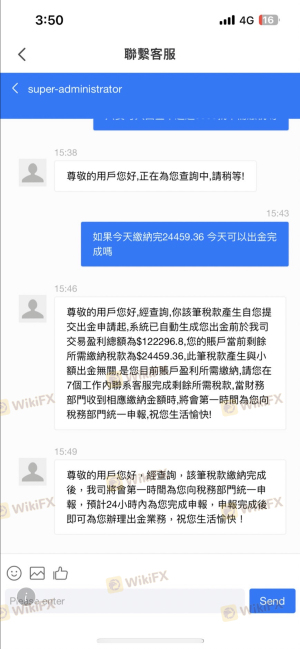

Client Fund Security

The safety of client funds is paramount when assessing whether Gomax is safe. The broker claims to implement several security measures, but the specifics are vague. Notably, there is no information available regarding fund segregation or investor protection schemes. Without these fundamental safeguards, clients' investments could be at risk, especially if the broker faces financial difficulties.

Additionally, there have been no documented incidents of fund security breaches with Gomax, but the absence of a regulatory framework means that there is no oversight to ensure that client funds are handled responsibly. Traders should be cautious about entrusting their capital to a broker that does not provide clear assurances regarding fund safety.

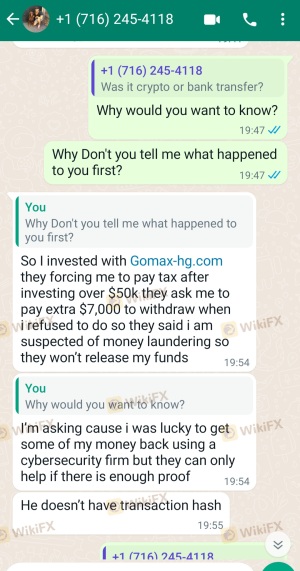

Customer Experience and Complaints

Analyzing customer feedback is crucial in determining whether Gomax is a safe broker. Numerous reviews indicate a pattern of complaints, primarily focusing on withdrawal issues and customer service responsiveness. Many users have reported difficulties in accessing their funds and receiving timely support, which raises significant concerns about the broker's reliability.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Service | Medium | Limited Availability |

For instance, one user detailed their experience of waiting weeks for a withdrawal request to be processed, only to receive vague responses from customer service. Such experiences highlight the potential risks associated with trading through Gomax, as a lack of effective customer support can exacerbate issues for traders.

Platform and Trade Execution

Assessing the trading platform's performance is another critical factor in determining whether Gomax is safe. Users have reported mixed experiences regarding platform stability and order execution quality. Some traders noted instances of slippage and rejected orders, which can significantly impact trading outcomes.

Moreover, the platform does not offer industry-standard tools like MetaTrader 4 or MetaTrader 5, which are widely regarded for their reliability and user-friendly interfaces. Instead, Gomax utilizes proprietary software, which may lack the robustness and features that experienced traders expect.

Risk Assessment

Using Gomax poses several risks that traders should carefully consider. The lack of regulation, combined with a history of complaints and questionable trading conditions, creates a high-risk environment for investors.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No legitimate oversight |

| Fund Security Risk | High | Lack of fund protection |

| Customer Service Risk | Medium | Poor response times |

To mitigate these risks, traders should conduct thorough due diligence before engaging with Gomax. Seeking out regulated alternatives with a proven track record of reliability and transparency is highly advisable.

Conclusion and Recommendations

In summary, the evidence suggests that Gomax may not be a safe trading option for investors. The broker's lack of genuine regulatory oversight, combined with a history of customer complaints and ambiguous trading conditions, raises significant red flags.

Traders are strongly encouraged to exercise caution and consider alternative brokers that are fully regulated and have a proven reputation for customer service and fund security. Some reputable alternatives include brokers regulated by the Financial Conduct Authority (FCA) or the Commodity Futures Trading Commission (CFTC), which offer a safer trading environment.

In conclusion, while Gomax may present itself as a viable option, the associated risks and lack of transparency warrant a careful reevaluation of its credibility. Always prioritize safety and due diligence when selecting a broker in the forex market.

Is Gomax a scam, or is it legit?

The latest exposure and evaluation content of Gomax brokers.

Gomax Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Gomax latest industry rating score is 1.38, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.38 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.