WRC1 2025 Review: Everything You Need to Know

Executive Summary

WRC1 (WorldCapital1) is a forex broker that needs careful attention from potential investors. This company started in 2023 and registered under the Mauritius Financial Services Commission (FSC), making it a relatively new trading platform that has received mostly negative user feedback and shows major red flags. Review platforms show that WRC1 has an extremely low trust score of about 4%, with users reporting serious problems including potential identity theft risks and poor service quality. This wrc1 review shows that while the broker claims to follow regulations in Mauritius, the overwhelming negative user feedback and lack of clear trading conditions make it wrong for most traders, especially newcomers to forex trading. The platform seems to target new traders and low-risk investors, but our analysis suggests these very groups should be most careful when thinking about WRC1 as their trading partner.

Important Notice

Regional Entity Differences: WRC1 claims registration under the Mauritius Financial Services Commission. However, users should know about potential identity misrepresentation risks that have been highlighted in various user reports. The broker's legitimacy and actual operational compliance with stated regulatory frameworks remain questionable based on available user feedback.

Review Methodology: This complete evaluation is based on user feedback from multiple review platforms including Trustpilot and Scamdoc, regulatory information from public databases, and third-party analysis reports. Due to limited official information available from the broker itself, this review heavily relies on user experiences and independent assessments.

Rating Framework

Broker Overview

WRC1 (WorldCapital1) entered the forex trading market in 2023 as a new player based in Mauritius. The company presents itself as an online trading platform that focuses on providing various investment opportunities through forex and possibly other financial instruments. However, despite its recent start, the broker has quickly attracted attention for worrying reasons rather than positive innovations. The company's business model seems to focus on attracting new traders through online marketing, though specific details about their trading approach and client onboarding processes remain largely hidden in public materials.

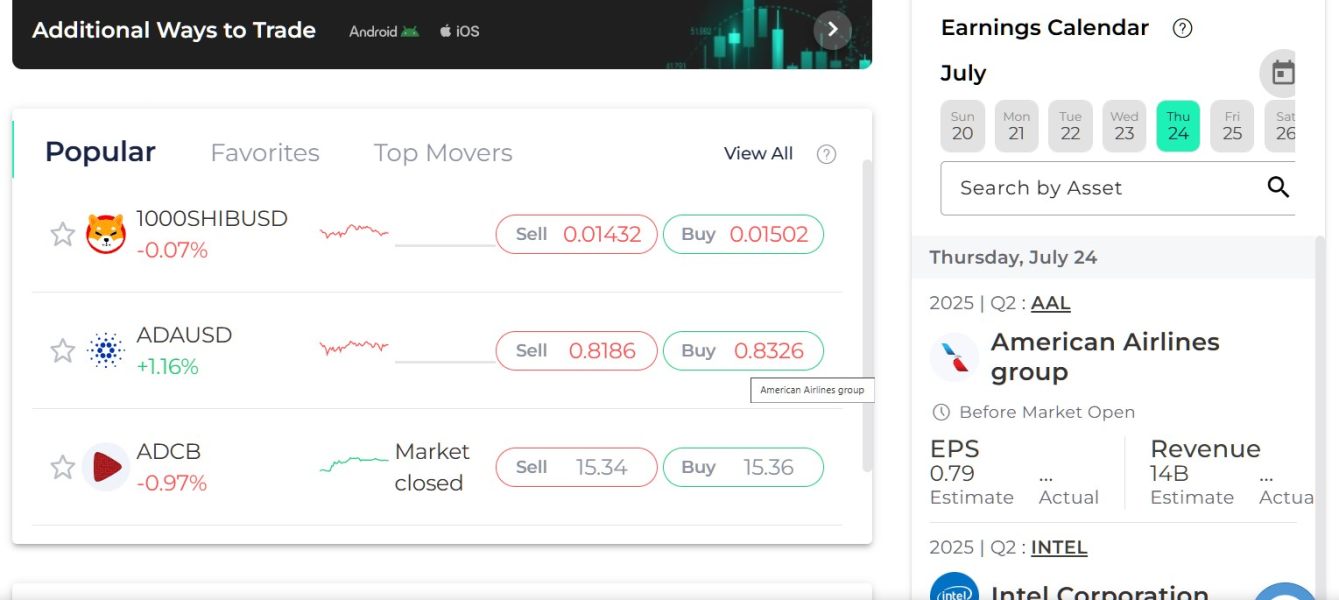

The broker operates under the regulatory framework of the Mauritius Financial Services Commission (FSC), a jurisdiction known for its relatively flexible regulatory environment. However, the specific trading platforms offered by WRC1, such as whether they provide MetaTrader 4, MetaTrader 5, or their own platforms, remain unclear from available sources. Similarly, the range of tradeable assets, including major forex pairs, commodities, indices, or cryptocurrencies, has not been fully detailed in accessible materials. This wrc1 review highlights the worrying lack of transparency that potential clients face when trying to evaluate the broker's offerings and capabilities.

Regulatory Jurisdiction: WRC1 operates under the Mauritius Financial Services Commission (FSC). The specific license number and compliance details are not easily available in public documentation.

Deposit and Withdrawal Methods: Specific information about accepted payment methods, processing times, and fees for deposits and withdrawals is not detailed in available sources.

Minimum Deposit Requirements: The broker has not clearly disclosed minimum deposit amounts for different account types in accessible materials.

Bonuses and Promotions: No specific information about welcome bonuses, trading promotions, or loyalty programs is available in current documentation.

Tradeable Assets: While WRC1 markets itself as a forex broker, the specific currency pairs, commodities, indices, or other instruments available for trading remain unspecified.

Cost Structure: Details about spreads, commissions, overnight fees, and other trading costs are not clearly disclosed in available materials.

Leverage Ratios: Maximum leverage ratios and their variations across different account types or asset classes are not specified.

Platform Options: The specific trading platforms offered, including mobile applications and web-based solutions, lack detailed description.

Regional Restrictions: Information about geographical limitations or restricted countries is not available.

Customer Service Languages: Supported languages for customer service interactions are not specified in available documentation. This wrc1 review emphasizes the worrying lack of basic operational transparency.

Detailed Rating Analysis

Account Conditions Analysis (3/10)

WRC1's account conditions receive a poor rating due to the major lack of transparency in their account offerings. The broker fails to provide clear information about different account types, their features, or the specific benefits each level might offer to traders. Without detailed disclosure of minimum deposit requirements, account maintenance fees, or special features like Islamic accounts for Muslim traders, potential clients cannot make informed decisions about which account structure suits their needs.

The account opening process remains largely undocumented in public materials. This raises questions about the verification procedures, required documentation, and timeframes for account activation. This opacity is particularly worrying for new traders who need clear guidance on how to begin their trading journey. The absence of detailed account specifications also makes it impossible to compare WRC1's offerings with industry standards or competitor brokers.

Furthermore, user feedback suggests difficulties with account management and unclear terms of service. This contributes to the overall negative perception of the broker's account conditions. The lack of educational resources about account features and the absence of demo account information further diminish the appeal for traders seeking to test the platform before committing real funds. This wrc1 review cannot recommend the broker's account conditions due to these transparency and clarity issues.

The tools and resources offered by WRC1 receive a below-average rating mainly due to insufficient information about their trading infrastructure and educational materials. The broker has not clearly outlined what trading tools, analytical resources, or market research materials are available to clients. This lack of transparency makes it difficult for traders to assess whether the platform can support their analytical needs and trading strategies.

Market analysis resources, including economic calendars, news feeds, technical analysis tools, and fundamental analysis reports, appear to be either limited or not prominently featured in the broker's public materials. For forex traders who rely heavily on timely market information and sophisticated analytical tools, this represents a major disadvantage compared to established brokers who provide comprehensive research departments and third-party analysis integrations.

Educational resources, which are crucial for new traders, seem to be minimal or non-existent based on available information. The absence of trading guides, webinars, tutorials, or market education materials suggests that WRC1 may not prioritize client development and success. Automated trading support, including expert advisors (EAs) and algorithmic trading capabilities, remains unspecified, limiting options for traders who prefer systematic trading approaches.

Customer Service and Support Analysis (2/10)

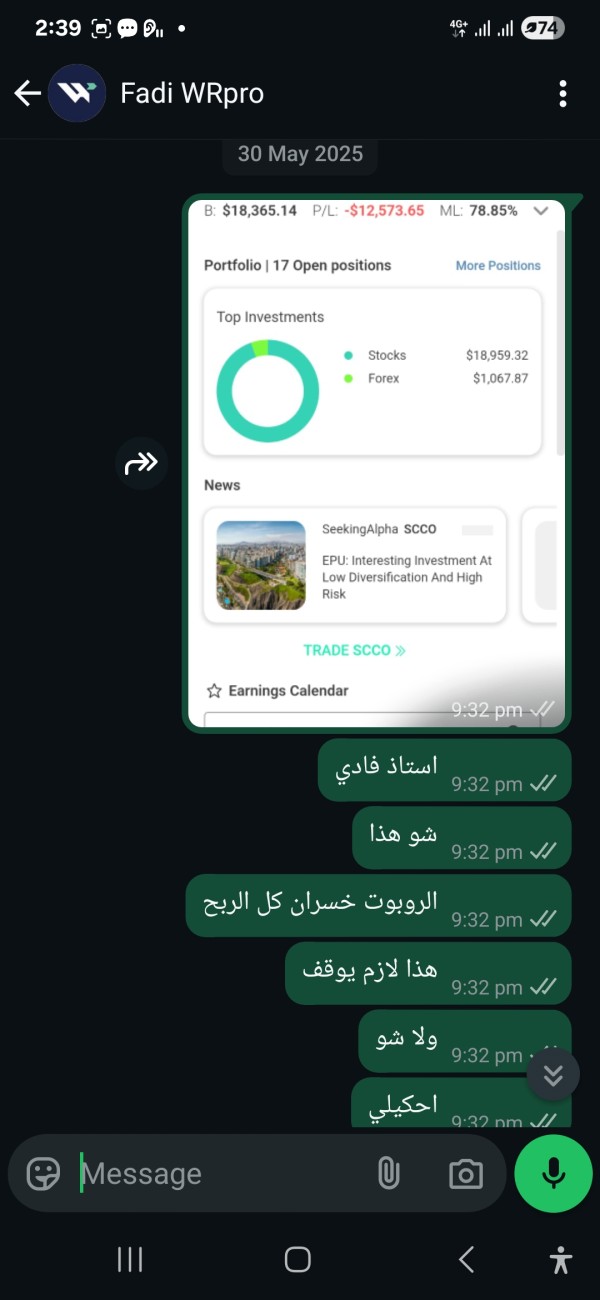

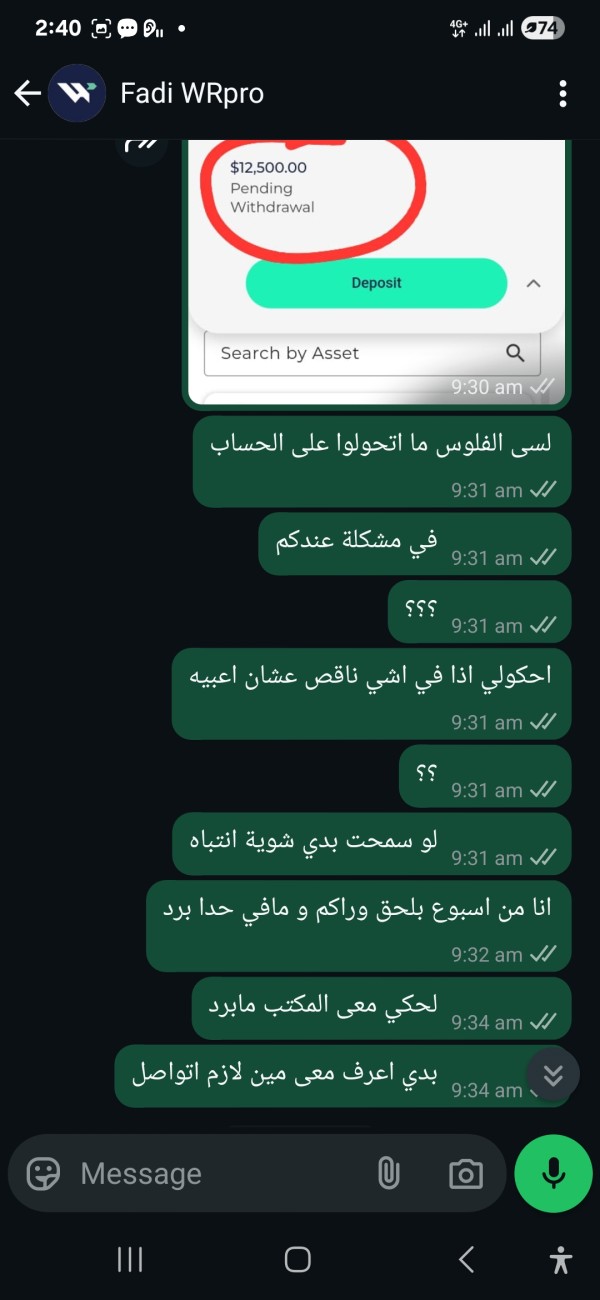

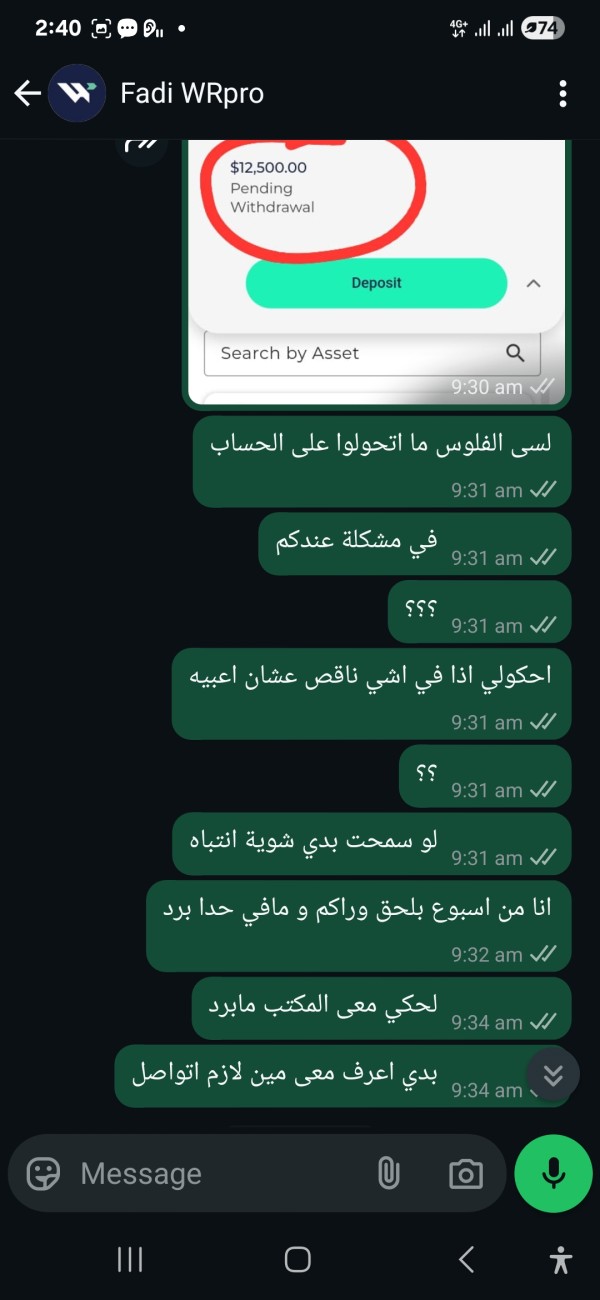

WRC1's customer service receives a very poor rating based on consistently negative user feedback and apparent lack of responsive support infrastructure. User reports suggest major difficulties in reaching customer service representatives, with extended response times and inadequate resolution of client concerns. This poor service quality is particularly problematic in forex trading, where timely support can be crucial for resolving urgent trading issues or account problems.

The availability of customer service channels, including phone support, email assistance, live chat, or ticket systems, remains unclear from public information. Without clear communication channels and published service hours, clients face uncertainty about when and how they can receive assistance. The lack of multilingual support options may further limit accessibility for international clients who prefer assistance in their native languages.

User feedback shows frustration with the quality of responses received from customer service. This suggests that representatives may lack the technical knowledge or authority to resolve complex trading or account-related issues effectively. The absence of comprehensive FAQ sections or self-service resources forces clients to rely entirely on direct support, which appears to be inadequate based on user experiences.

Trading Experience Analysis (3/10)

The trading experience with WRC1 receives a poor rating due to limited information about platform stability, execution quality, and overall trading conditions. Without clear details about the trading platforms offered, users cannot assess whether the broker provides reliable, fast, and user-friendly trading environments that meet modern standards. Platform stability and uptime are crucial factors in forex trading, where market volatility can create time-sensitive trading opportunities.

Order execution quality, including execution speeds, slippage rates, and requote frequency, remains undocumented in available materials. These factors greatly impact trading profitability and user satisfaction, making their absence in promotional materials worrying. The lack of transparency about trading conditions makes it difficult for traders to develop realistic expectations about their trading experience.

Mobile trading capabilities, which are essential for modern traders who need to monitor and manage positions while away from their computers, are not clearly described. The absence of detailed platform feature lists, including available order types, charting capabilities, and technical indicators, further limits traders' ability to assess whether the platform can support their trading strategies effectively. This wrc1 review cannot provide confidence in the trading experience due to these information gaps.

Trustworthiness Analysis (1/10)

WRC1 receives an extremely poor trustworthiness rating based on its remarkably low trust score of about 4% from user review platforms and multiple red flags identified in independent assessments. While the broker claims registration under the Mauritius Financial Services Commission, the effectiveness of this regulatory oversight and the broker's actual compliance with regulatory standards remain questionable based on user experiences.

The absence of transparent information about client fund segregation, insurance coverage, or other investor protection measures raises serious concerns about fund safety. Established brokers typically provide clear details about how client funds are protected, including segregated accounts with tier-1 banks and participation in compensation schemes. WRC1's failure to prominently display such information is a major red flag.

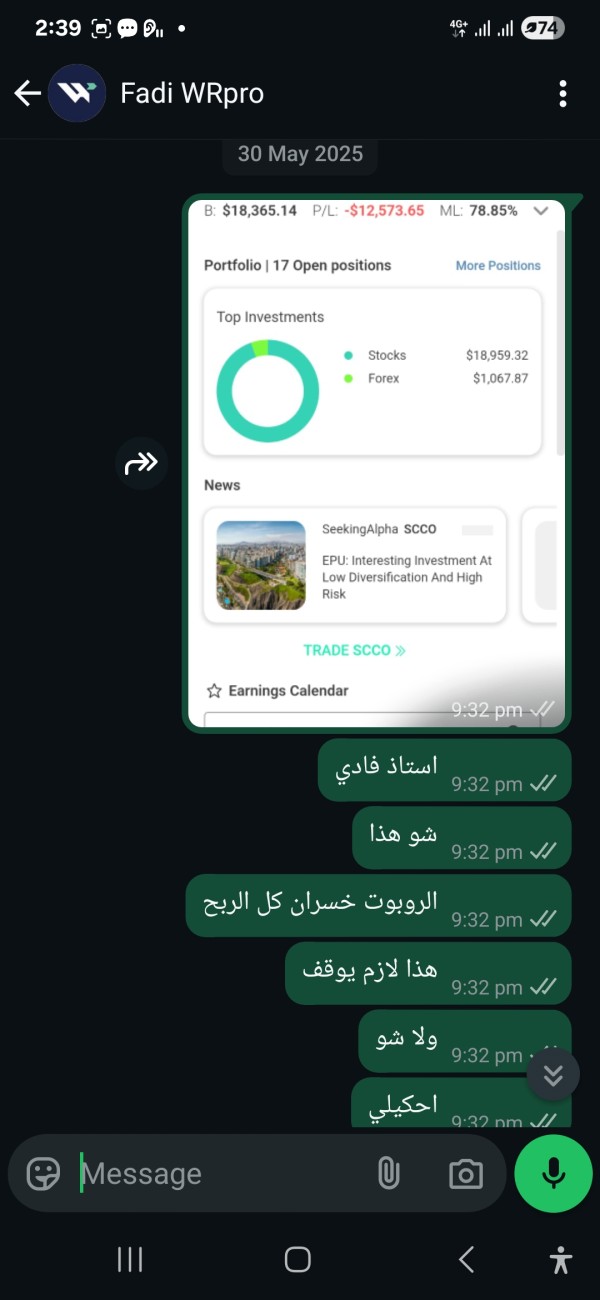

User reports suggest potential risks including identity theft concerns and difficulties with fund withdrawals. These are among the most serious issues that can affect forex traders. The broker's limited operational history, combined with mostly negative user feedback, creates a risk profile that is unacceptable for most traders. Independent review platforms consistently warn against engaging with WRC1, citing multiple risk factors that potential clients should consider seriously.

User Experience Analysis (2/10)

The overall user experience with WRC1 receives a very poor rating based on consistently negative feedback across multiple review platforms and user testimonials. Users report frustration with various aspects of their interaction with the broker, from initial registration difficulties to ongoing account management problems. The lack of intuitive website design and clear information architecture makes it challenging for users to find essential information about trading conditions and services.

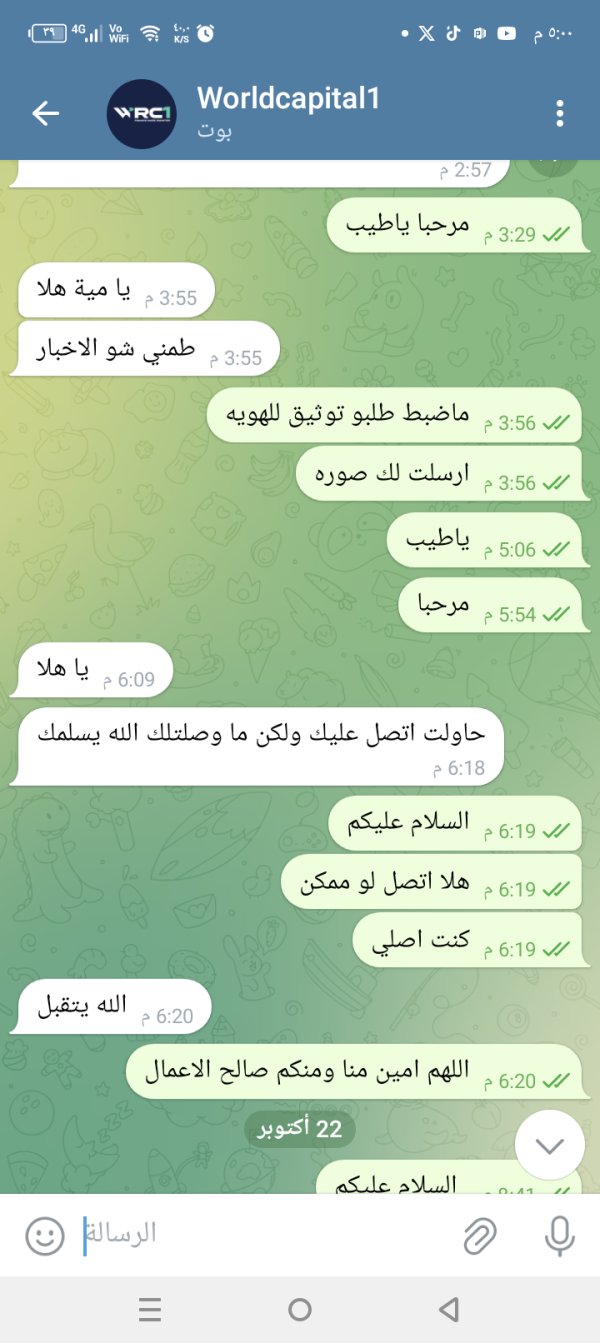

The registration and verification process appears to be problematic based on user feedback. Users report lengthy delays and unclear requirements. This creates immediate friction for new users and sets a negative tone for the entire client relationship. Account verification procedures, which are standard in the industry for regulatory compliance, seem to be handled poorly, causing unnecessary stress and delays for legitimate users.

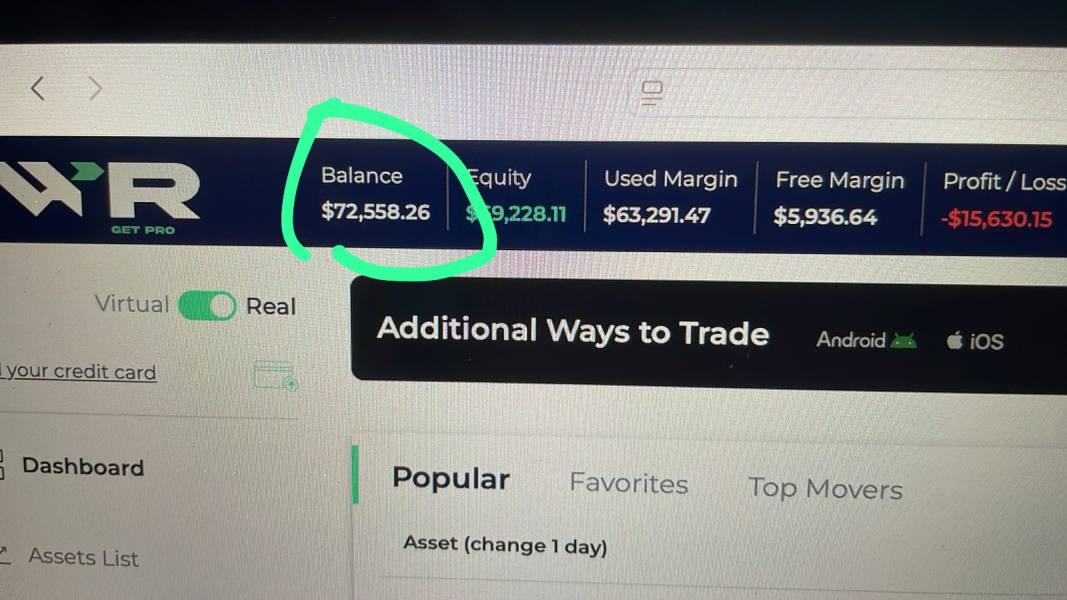

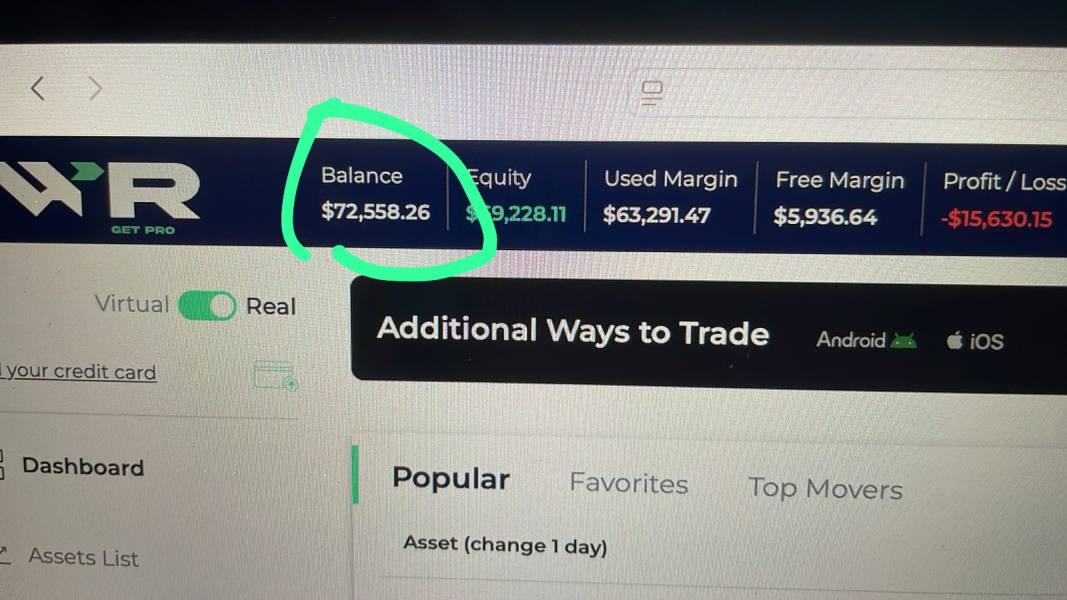

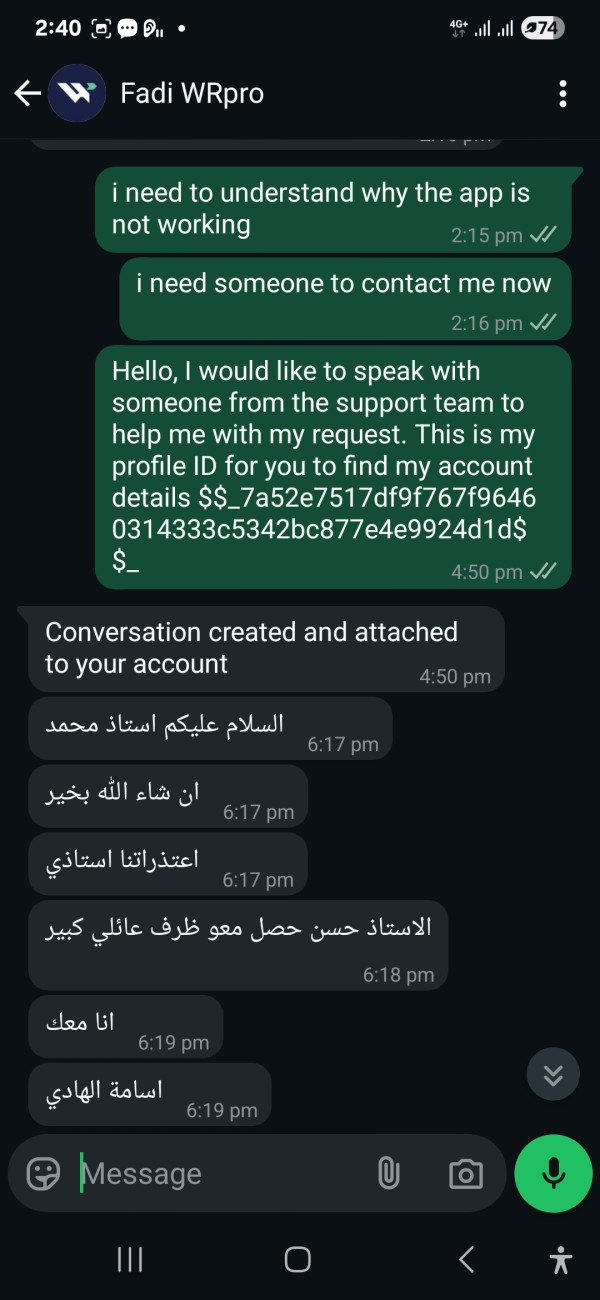

Fund management experiences, including deposit and withdrawal processes, generate major user complaints based on available feedback. Users report difficulties with transaction processing and unclear fee structures that result in unexpected charges. The absence of clear communication about account management procedures and transaction timelines contributes to user frustration and distrust. Common complaints include poor platform performance, unresponsive customer service, and concerns about fund security, creating an overall user experience that falls well below industry standards.

Conclusion

This comprehensive wrc1 review reveals a forex broker that presents major risks and should be approached with extreme caution by potential traders. WRC1's extremely low trust score of 4%, combined with mostly negative user feedback and lack of transparency in basic operational areas, makes it unsuitable for most trading scenarios. The broker's poor performance across all evaluated dimensions, particularly in trustworthiness and customer service, suggests fundamental operational deficiencies that could negatively impact client experiences and financial security.

WRC1 is not recommended for new traders who require reliable support, transparent conditions, and educational resources to develop their trading skills safely. Similarly, experienced traders and risk-averse investors should consider more established brokers with proven track records and comprehensive regulatory oversight. The broker's main disadvantages include extremely poor user feedback, lack of transparency in trading conditions, inadequate customer service, and potential security risks that outweigh any possible benefits of choosing this platform for forex trading activities.