Is WrPro safe?

Business

License

Is WRC1 A Scam?

Introduction

WRC1 is a relatively new player in the forex trading market, having been established in 2023 and headquartered in Mauritius. As a broker, it aims to provide a user-friendly platform for both novice and experienced traders, offering a range of financial instruments including forex pairs, commodities, and indices. However, the emergence of numerous online trading platforms has made it essential for traders to carefully evaluate the credibility and safety of these brokers before investing their hard-earned money. This article seeks to investigate whether WRC1 is a trustworthy broker or if it might be a scam.

To conduct this investigation, we have utilized a comprehensive approach that includes analyzing regulatory compliance, company background, trading conditions, customer experiences, and overall risk assessment. By synthesizing information from various sources, including reviews and regulatory data, we aim to provide a balanced view of WRC1's operational integrity.

Regulation and Legitimacy

The regulatory status of a forex broker is crucial in determining its legitimacy and safety for traders. WRC1 claims to be regulated by the Mauritius Financial Services Commission (FSC), which is a recognized regulatory body in the region. However, the effectiveness and credibility of this regulation have been questioned by several sources.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Mauritius FSC | GB22201139 | Mauritius | Verified |

While WRC1 holds a license from the FSC, the regulatory framework in Mauritius is often considered less stringent compared to other jurisdictions like the UK or Australia. This raises concerns about the level of investor protection offered. Many users have reported issues regarding withdrawals and transparency, which could indicate a lack of rigorous oversight. The absence of a robust regulatory environment may expose traders to higher risks, making it essential for potential clients to conduct thorough due diligence before engaging with WRC1.

Company Background Investigation

WRC1 is operated by GMBB Investment Ltd, a company that has not been thoroughly vetted in terms of its ownership structure and historical compliance. The company was registered in June 2023, and while it aims to present itself as a reputable broker, the lack of a substantial track record raises red flags.

The management team's backgrounds and professional experiences are also critical in assessing the company's credibility. However, detailed information about the management team is scarce, which can lead to questions regarding their expertise in the financial sector. Additionally, the company's transparency levels have been criticized, with many users expressing concerns about the clarity of information provided regarding trading conditions and fees. The lack of accessible, verifiable information about the company's operations and leadership can be a significant deterrent for potential clients.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for traders looking to maximize their investment potential. WRC1 presents a mixed bag of trading costs, including spreads, commissions, and overnight fees.

| Fee Type | WRC1 | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | 1.0 - 2.0 pips |

| Commission Model | TBD | Varies |

| Overnight Interest Range | TBD | Varies |

While WRC1 advertises competitive spreads and various account types, numerous user reports suggest hidden fees and unclear commission structures. Some users have experienced unexpected charges, which could indicate a lack of transparency in the fee structure. This can be particularly concerning for traders who rely on clear cost structures to make informed decisions.

Additionally, the absence of a free demo account may deter potential traders from testing the platform before committing real funds. The overall fee structure should be carefully scrutinized by traders to avoid surprises that could impact their profitability.

Client Fund Security

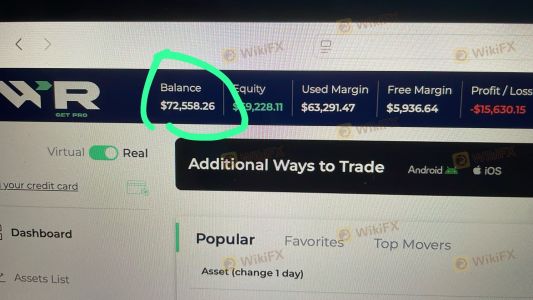

The safety of client funds is paramount in the forex trading industry. WRC1 claims to implement several security measures, including segregated accounts for client funds and adherence to anti-money laundering (AML) policies. However, the effectiveness of these measures remains in question, as several users have reported difficulties in withdrawing funds.

The companys policies regarding investor protection and negative balance protection are also critical factors. Users have expressed concerns about the lack of clarity around these policies, which could leave traders vulnerable in volatile market conditions. Historical incidents involving fund security issues further exacerbate these concerns, leading to skepticism about the broker's commitment to safeguarding client assets.

Customer Experience and Complaints

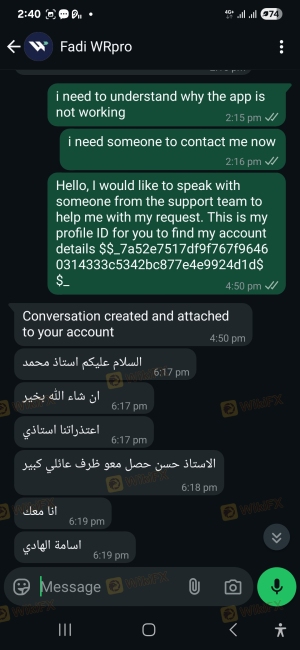

Customer feedback is an essential aspect of evaluating a broker's reliability. WRC1 has received mixed reviews, with some users praising its user-friendly platform and customer support, while others have reported significant issues regarding withdrawals and transparency.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Average |

| Customer Support Delays | Medium | Average |

Common complaints include difficulties in processing withdrawal requests and vague communication from customer support. In some cases, users have reported that their accounts were zeroed out after withdrawal requests, raising concerns about potential fraudulent behavior. These patterns of complaints indicate a troubling trend that potential clients should consider seriously.

Platform and Trade Execution

The performance of a trading platform directly impacts the trading experience. WRC1 utilizes a proprietary trading platform, which has received mixed reviews regarding its stability and execution quality. Users have reported instances of slippage and rejected orders, which can significantly affect trading outcomes.

The quality of order execution is critical for traders, especially in fast-moving markets. If a broker's platform frequently experiences technical issues, it may lead to missed trading opportunities and financial losses. Additionally, any signs of platform manipulation could further erode trust in the broker's integrity.

Risk Assessment

Engaging with WRC1 presents several risks that potential traders should be aware of. The overall risk profile can be summarized as follows:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Weak regulatory oversight in Mauritius. |

| Financial Risk | Medium | Potential hidden fees and withdrawal issues. |

| Operational Risk | High | Platform stability and execution issues. |

To mitigate these risks, traders should consider starting with a small investment, thoroughly reviewing all terms and conditions, and keeping abreast of any changes in the broker's policies.

Conclusion and Recommendations

In summary, while WRC1 presents itself as a legitimate forex broker, several concerning factors suggest that traders should exercise caution. The broker's regulatory status, mixed customer feedback, and reports of withdrawal issues raise red flags that cannot be ignored.

For traders seeking to engage with WRC1, it is advisable to conduct thorough research, consider starting with minimal investments, and remain vigilant regarding any unusual activity. Additionally, traders may want to explore more established and reputable alternatives in the forex market that offer stronger regulatory protections and a proven track record of customer satisfaction. Some recommended alternatives include brokers with robust regulatory oversight, transparent fee structures, and positive user experiences.

Is WrPro a scam, or is it legit?

The latest exposure and evaluation content of WrPro brokers.

WrPro Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

WrPro latest industry rating score is 1.41, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.41 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.