Is GMI safe?

Business

License

Is GMI Safe or Scam?

Introduction

GMI, or Global Market Index, is a forex broker that has positioned itself as a significant player in the online trading landscape since its inception in 2009. With its headquarters in Shanghai and a presence in multiple financial hubs, GMI offers a range of trading services, including forex, CFDs, and commodities. However, as the trading environment becomes increasingly saturated, the importance of evaluating the credibility and reliability of brokers like GMI cannot be overstated. Traders must exercise caution and thoroughly research any broker before committing their funds to ensure they are making informed decisions. This article aims to provide an objective analysis of whether GMI is a safe trading platform or if it raises any red flags, using a combination of qualitative assessments and quantitative data.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. GMI is regulated by the Financial Conduct Authority (FCA) in the UK and the Financial Services Commission (FSC) in Mauritius. The FCA is known for its stringent regulatory requirements, which adds a layer of security for traders. Below is a summary of GMI's regulatory information:

| Regulatory Authority | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| FCA | 677530 | UK | Verified |

| FSC | C118023454 | Mauritius | Verified |

The presence of FCA regulation is a strong indicator of GMI's commitment to maintaining high operational standards. However, it is essential to note that the FSC operates under an offshore regulatory framework, which may not provide the same level of oversight as tier-one regulators like the FCA. This dual-regulation model can be a double-edged sword; while it allows GMI to cater to a broader client base, it also raises questions about the regulatory rigor applied to its operations.

Company Background Investigation

GMI was established in 2009 and has since expanded its operations internationally, opening representative offices in various locations, including Auckland and London. The company is owned by Global Market Index Limited, which operates multiple entities under different jurisdictions. The management team comprises experienced professionals from the finance and trading sectors, contributing to the broker's reputation as a technology-driven brokerage solution.

Despite GMI's claims of transparency, there are concerns regarding the level of information disclosed to clients. While the broker provides basic details about its services, a lack of comprehensive information about its ownership structure and management team can lead to skepticism among potential traders. Furthermore, traders should be cautious about the brokers offshore entities, as they are often associated with reduced accountability and transparency.

Trading Conditions Analysis

GMI offers a competitive trading environment with various account types, including standard, cent, and ECN accounts. The overall fee structure appears to be favorable, but traders must be aware of any unusual or hidden fees that may apply. Below is a comparison of GMI's core trading costs:

| Fee Type | GMI | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1 pip | 1.2 pips |

| Commission Model | $4 per lot (ECN) | $5 per lot |

| Overnight Interest Range | Varies | Varies |

GMI's spreads are competitive, especially for ECN accounts, which offer spreads starting from 0 pips but come with a commission. However, the commission structure may deter some traders, particularly those with lower trading volumes. Additionally, the broker's policy on dormant accounts, which incurs a monthly fee after 90 days of inactivity, could be a concern for less active traders.

Client Fund Security

The safety of client funds is paramount when assessing a broker's reliability. GMI employs several measures to protect client funds, including segregated accounts held at leading banks and investor compensation schemes. This means that in the event of insolvency, client funds are protected, which is a positive aspect of GMI's operational framework. Furthermore, GMI claims to offer negative balance protection, ensuring that traders cannot lose more than their deposited amount.

However, it is crucial to examine GMI's historical performance regarding fund security. There have been no significant reported incidents of fund mismanagement or disputes related to client withdrawals, which bodes well for the broker's reputation. Nevertheless, the offshore nature of some of its operations may raise concerns about the level of investor protection compared to brokers regulated by more stringent authorities.

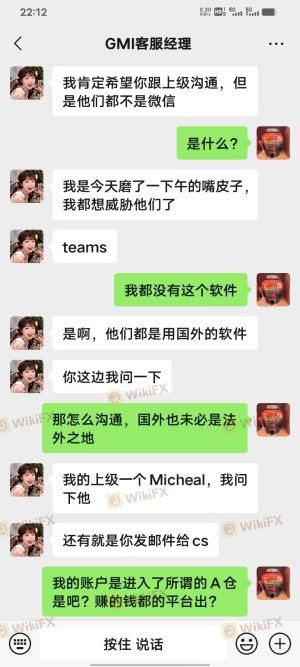

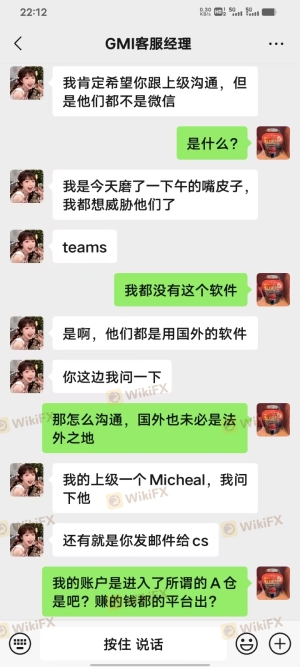

Customer Experience and Complaints

Customer feedback can provide valuable insights into a broker's reliability. GMI has received a mix of reviews from users, with some praising its competitive trading conditions and responsive customer support, while others have raised concerns about withdrawal processes and the quality of educational resources. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Slow response |

| Lack of Educational Resources | High | No improvement |

For instance, some users have reported delays in processing withdrawals, which can be frustrating, especially for traders who expect timely access to their funds. Additionally, the absence of comprehensive educational materials has been a common point of criticism, particularly among novice traders seeking guidance.

Platform and Execution

GMI provides access to popular trading platforms such as MetaTrader 4 (MT4) and its proprietary GMI Edge platform. The performance of these platforms is generally stable, with users reporting satisfactory execution speeds and minimal slippage. However, there have been isolated instances of lag during high volatility periods, which could impact trading outcomes.

The quality of order execution is crucial for traders, and GMI's average execution time is reported to be within acceptable limits. Nonetheless, potential users should remain vigilant for any signs of platform manipulation or issues that could affect their trading experience.

Risk Assessment

While GMI presents several advantages, potential traders should be aware of the risks involved in using this broker. Below is a risk assessment summary:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Offshore regulation may lack oversight. |

| Withdrawal Risk | High | Complaints about withdrawal delays. |

| Educational Resource Risk | Medium | Limited educational support for beginners. |

To mitigate these risks, traders should conduct thorough research, utilize demo accounts for practice, and maintain a diversified trading strategy to minimize exposure.

Conclusion and Recommendations

In conclusion, GMI is a broker that offers a range of competitive trading conditions and regulatory oversight from reputable authorities like the FCA. However, the presence of offshore entities raises questions regarding the overall safety and transparency of the broker. While there are no clear indications of fraud, potential traders should exercise caution and remain vigilant about the risks involved.

For traders seeking reliable alternatives, consider brokers that offer a broader range of trading instruments, comprehensive educational resources, and robust customer support. Overall, GMI may be a suitable choice for experienced traders who prioritize competitive spreads and advanced trading tools, but beginners may want to explore other options that provide more extensive support and resources.

In summary, is GMI safe? The evidence suggests that while GMI operates legitimately, potential clients should be aware of its limitations and approach with due diligence.

Is GMI a scam, or is it legit?

The latest exposure and evaluation content of GMI brokers.

GMI Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GMI latest industry rating score is 1.40, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.40 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.