hedgecent 2025 Review: Everything You Need to Know

1. Abstract

In this hedgecent review, we examine a high-risk forex trading platform that has created major debate among traders. Hedgecent offers very high leverage of up to 1:2000 and supports many different asset classes including forex, commodities, and cryptocurrencies. However, its unregulated status and the lack of clear licensing details have raised serious legal and safety concerns among users. The platform targets traders with a high risk appetite, welcoming those who are willing to gamble on aggressive positions amid a complex user experience. While the promise of high returns attracts some, the legitimacy and transparency of hedgecent remain subjects of major skepticism. Users have reported different experiences in terms of platform usability and customer service, with some even questioning whether the broker might be operating as a scam. Overall, this assessment provides a balanced overview based on available user feedback and factual details. It is important to note that many critical aspects, such as deposit procedures, minimum deposit requirements, and specific trading tools, are not clearly detailed in the available information, leaving potential investors to exercise heightened caution.

2. Notice

This review highlights that hedgecent operates as an unregulated trading platform. Its legal status may vary significantly across different regions. Evaluators and potential investors should note that hedgecent's legitimacy is in question because no clear regulatory authority has been confirmed. The analysis presented here is based on a combination of user feedback, available online information, and third-party assessments, acknowledging that several significant details are not fully disclosed. Readers must understand that the review relies on the current state of publicly available data and that different sources sometimes offer conflicting reports. Therefore, prospective users are advised to perform additional due diligence before engaging with the platform. The following detailed evaluation attempts to address these gaps and presents an unbiased perspective while stressing that regional differences may impact the overall safety and functionality of the platform.

3. Score Framework

4. Broker Overview

The origins of hedgecent trace back to 2021, when the company was established with its headquarters located in Bulgaria. In its brief period of operation, the broker has marketed itself as a provider of elite forex trading solutions, boasting the ability to offer a highly leveraged trading environment with leverage levels of up to 1:2000. Despite its ambitious promise of facilitating access to multiple asset classes including forex, commodities, precious metals, stocks, indices, and cryptocurrencies, hedgecent remains unregulated. Its unregulated status has been a focal point of criticism, with numerous industry observers and users questioning the platform's adherence to standard regulatory protocols essential for ensuring investor protection and service transparency.

The trading model of hedgecent is primarily based on an unregulated exchange system that appeals to a niche market of high-risk traders. As evident in this hedgecent review, the broker provides various account types such as Cent, ECN, Elite, and Standard accounts, designed to cater to traders with different strategies and capital levels. However, even as hedgecent attempts to position itself as a multi-asset trading hub, details regarding its trading platform technology, whether it supports automated trading or mobile functionality, remain scarce. Furthermore, clear information on regulatory oversight and other critical operational parameters is notably absent from the available data, leaving potential investors with important unanswered questions about overall reliability.

While hedgecent presents itself as a one-stop solution for trading various financial instruments, several key details remain undiscussed or unclear in the available information.

Regulatory Regions:

There is no specific mention of any regulatory oversight, and information regarding regional licensing and compliance is notably absent. This lack of regulation means that depending on jurisdiction, the platform's legal standing could be subject to varying interpretations.

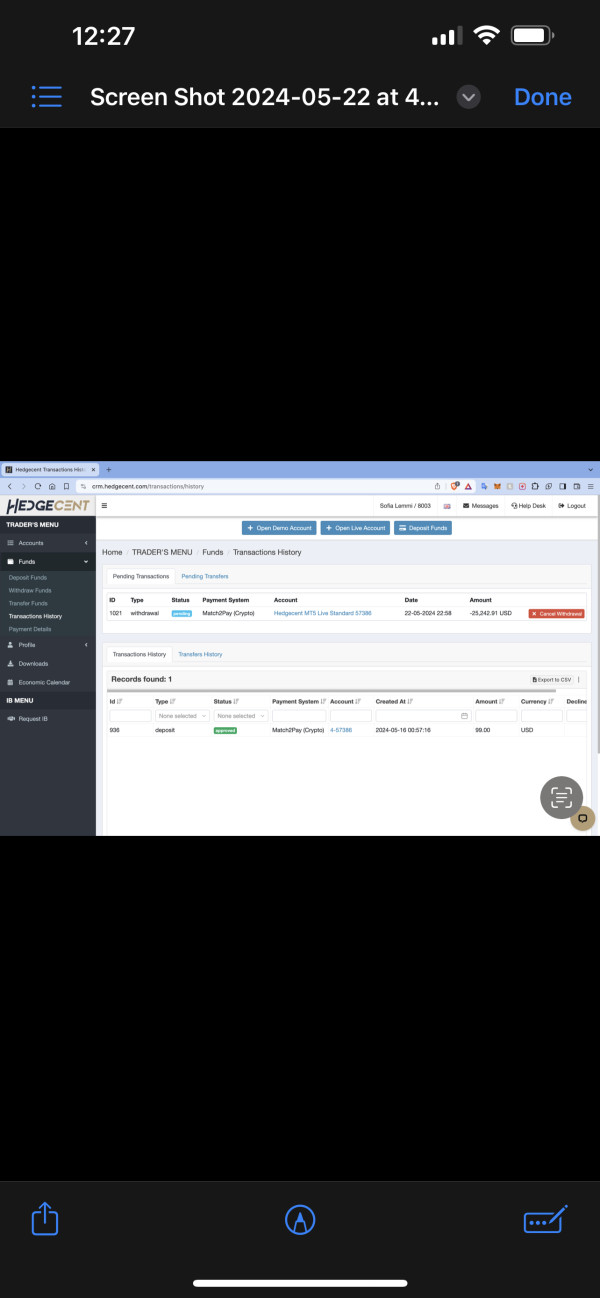

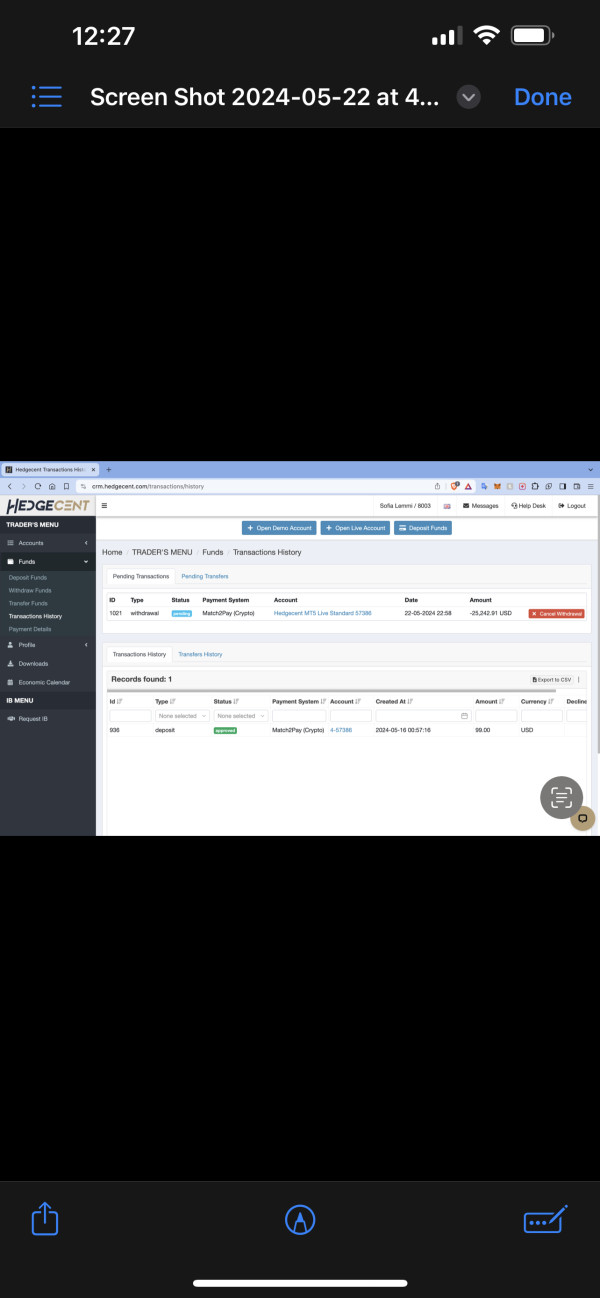

Deposit and Withdrawal Methods:

Available reports do not provide clear details on the deposit and withdrawal options. As such, potential users have limited guidance on the reliability and speed of the platform's transaction processes, leaving room for uncertainty regarding fund accessibility.

Minimum Deposit Requirements:

The minimum deposit required to open an account is not specified in the available sources. This missing detail could prove challenging for prospective traders assessing their initial capital allocation.

Bonuses and Promotions:

There is no detailed disclosure of any bonus schemes or promotions, which is a common feature among regulated brokers. The lack of transparency in this area leads to difficulties in comparing hedgecent with other market players offering clearer incentives.

Tradable Assets:

Hedgecent allows trading in a diverse array of assets, including forex, commodities, precious metals, stocks, indices, and cryptocurrencies. This breadth may appeal to traders looking to diversify their portfolios, but without solid platform tools, the execution quality remains unverified.

Cost Structure:

Details regarding spreads, commissions, and other transactional fees are not clearly defined in the available information. The absence of such cost structure details makes it challenging for traders to fully assess the true cost of trading on the platform, and no reliable data on typical spreads or fee schedules has been provided.

Leverage Ratio:

A significant feature that is well-documented is the broker's offering of leverage up to 1:2000. While this extreme leverage can potentially amplify profits, it equally magnifies losses and contributes to the overall high-risk profile.

Platform Selection:

There is no clear mention of the exact trading platforms used by hedgecent. Information regarding whether the platform supports desktop, web-based, or mobile trading is not provided, which leaves a gap in understanding the overall usability of the trading environment.

Regional Restrictions:

The review does not mention any specific regional restrictions, and the information regarding geographic limitations is not detailed in the available sources.

Customer Service Languages:

Finally, details on the languages supported by the customer service team are missing, which could be critical for a platform operating on a global scale in ensuring effective communication with traders from various regions.

This comprehensive breakdown highlights significant gaps in information while attempting to provide a balanced view of hedgecent's operations based on available data.

6. Detailed Rating Analysis

6.1 Account Conditions Analysis

Hedgecent offers several account types including Cent, ECN, Elite, and Standard, which is designed to appeal to a variety of trading strategies and experience levels. This diversity provides potential flexibility; however, there is a significant lack of transparency regarding essential details such as minimum deposit requirements, commission structures, and specific account features. The absence of these critical factors makes it challenging for traders to compare hedgecent with more transparent, regulated brokers. Additionally, user feedback frequently cites confusion during the account setup process, highlighting issues with the clarity of information provided by the platform. Compared to other brokers that provide comprehensive details at the onboarding stage, hedgecent's account opening process appears less transparent, which has raised concerns among users. Furthermore, while the existence of multiple account types represents a potential benefit, the underlying deficiencies in disclosure undermine the overall attractiveness of the offerings. This hedgecent review underscores the necessity for complete and clear account condition details to guarantee that traders fully understand the associated costs and requirements before committing funds.

In assessing the tools and resources offered by hedgecent, the initial appeal lies in its broad range of tradable asset categories, including not only forex and commodities but also precious metals, stocks, indices, and cryptocurrencies. Nevertheless, despite the diversity in asset classes, there is little evidence of strong trading tools or educational resources that are crucial for informed trading decisions. The available information does not specify details such as charting software, automated trading support, or research materials, which are typically critical components in a trader's toolkit. Educational resources and market analysis capabilities are notably absent, leaving beginners and even experienced traders with limited guidance to navigate the high-risk and potentially volatile market environment. In contrast to platforms that invest heavily in research reports, live market updates, and technical indicators, hedgecent's offering remains superficial. The perspective commonly expressed in this hedgecent review is that while asset diversity is a plus, the deficiency in tangible trading support tools may hinder traders from efficiently capitalizing on market opportunities. Overall, without substantial investment in advanced technology and comprehensive educational support, the platform falls short compared to its more established counterparts.

6.3 Customer Service and Support Analysis

Customer service and support form a critical element in any trading experience and thus deserve focused examination. Hedgecent's support structure appears to be troubled, based mostly on scattered user reviews indicating negative experiences. Specific details such as the range of communication channels , response times, and the availability of multilingual support are not provided in the available information. Several users have expressed frustration with slow and unresponsive customer service, which has contributed to a decline in trader confidence. The lack of substantial and easily accessible support documentation further worsens the problem. Moreover, the limited information regarding operational hours or after-hours support raises additional concerns, especially for traders operating across different time zones. This analysis, consistent with feedback highlighted in our data sources, shows that while hedgecent attempts to offer support, the actual quality of the service remains questionable. Poor and inconsistent customer service could ultimately impair resolution times, leaving users in potentially dangerous positions during market volatility.

6.4 Trading Experience Analysis

The trading experience on hedgecent is a point of significant disagreement among users, with feedback ranging from moderate satisfaction to outright discontent. Critical to any trading platform are elements such as order execution speed, platform stability, and the overall reliability of the trading environment. Unfortunately, the specifics on these technical aspects are not clearly outlined in the available information. Users have reported varying experiences regarding the stability of trading operations, with some encountering delays or technical glitches during periods of market volatility. The platform's overall functionality, including its mobile and desktop interfaces, remains unclear in the absence of detailed descriptions or comparisons with industry benchmarks. Additionally, while the availability of a high leverage ratio is often promoted as a benefit, it can worsen the effects of any deficiencies in execution quality. During periods when rapid market movements occur, even slight delays in order processing could translate into significant losses, further intensifying the inherent risk. The inconsistent feedback provided by users, combined with a lack of transparent performance data, complicates an objective evaluation of the trading experience. As noted in this hedgecent review, these issues collectively contribute to an environment where potential traders must exercise significant caution and conduct further due diligence.

6.5 Trustworthiness Analysis

Trust plays a crucial role in the relationship between brokers and their clients, and hedgecent presents significant challenges on this front. The platform operates without clear regulatory oversight, and there is no confirmed affiliation with any reputable financial authority—a major red flag common among critical reviews. Several users have raised questions regarding the security of their funds and the legitimacy of the broker, with some even alleging scam-like behavior based on their own experiences. The absence of clear information on safeguarding measures, such as segregated accounts or strong cybersecurity protocols, further worsens these concerns. Transparency issues are also evident, with the company providing limited operational history and few details about its internal processes. In comparison to brokers that adhere to established regulatory regimes and industry standards, hedgecent's approach appears markedly unclear. This opacity has led to widespread user wariness, which is particularly concerning given the high-risk nature of the trading environment it promotes. The overall consensus emerging from multiple sources is that without proper regulatory backing and clear safety protocols, hedgecent struggles to earn the trust and confidence that are critical to fostering long-term client relationships.

6.6 User Experience Analysis

The overall user experience with hedgecent is marked by mixed reviews that reflect significant differences in trader satisfaction. For some, the broad selection of assets and the promise of high leverage represent attractive features; for others, the lack of transparency and reported difficulties in navigation have created a frustrating environment. Users have highlighted issues ranging from the registration and verification process to problems with depositing or withdrawing funds, though precise details on these processes remain unclear. Interface design and overall usability are not well documented in the available materials, making it challenging for potential clients to gauge the ease-of-use of hedgecent's platforms. Moreover, a number of traders have voiced concerns that the platform's overall design does little to inspire confidence, with some even going as far as to label it as scam-like in their reviews. The stark differences in user experience suggest that while some traders may find niche opportunities within its high-risk framework, the prevailing sentiment is one of caution. This final component of our hedgecent review underscores the need for significant improvements in user interface design, clearer communication during the registration process, and a more robust explanation of operational processes to enhance overall customer satisfaction.

7. Conclusion

In summary, hedgecent emerges as a high-risk platform that offers an array of asset classes and promising high leverage but is burdened by glaring issues of transparency and legitimacy. While its diverse account types and the potential for significant gains might appeal to high-risk traders, the absence of clear regulatory information, incomplete disclosure on costs, and recurring negative user experiences make it a questionable option for most investors. This review underscores that prospective users should proceed with extreme caution and conduct extensive due diligence before jumping in. Hedgecent may have some appealing features, yet the inherent risks and unresolved concerns ultimately overshadow its potential benefits.