Fxtrading 2025 Review: Everything You Need to Know

Summary

This Fxtrading review looks at a broker with mixed results in forex trading. We studied user feedback carefully and found Fxtrading has a moderate reputation with 6 out of 10 stars from 235 user reviews, but only 14% of users recommend it. The broker says it is trustworthy in the forex market and offers good trading fees plus special forex signal services. Users often complain about poor service quality, slow response times, and promises the company doesn't keep. This review helps traders who already know forex and want quality trading signals, but they should know about possible service problems. Fxtrading has good fees and signals, but the low recommendation rate and service complaints mean you should think carefully before opening an account.

Important Notice

Regional Entity Differences: We could not find regulatory information for Fxtrading in available materials, which might mean different rules apply in different places. You should check local rules before signing up for an account.

Review Methodology: We based this review on user feedback and market research. Since we lack detailed regulatory information, this review might not apply to all users in different locations, and your experience might be very different depending on where you live and what type of account you have.

Rating Framework

Broker Overview

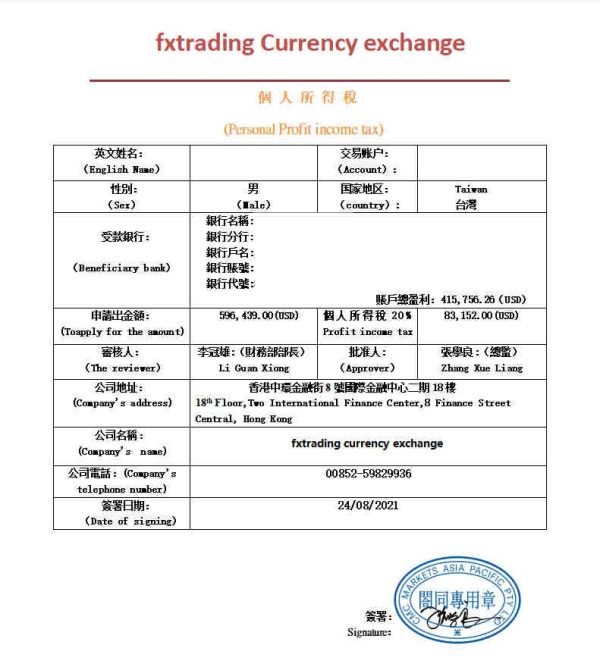

Fxtrading works as a forex trading service provider, but we don't have details about when it started. The company has built a place in the forex market as what users call a "trustworthy broker," focusing mainly on foreign exchange trading with special attention to forex signals. User feedback shows the broker keeps trading fees competitive, which seems to be its main advantage in the busy forex brokerage market.

The business focuses on forex trading services with special attention to creating and sharing signals. User reviews suggest the company's signal services show quality, but the overall service has big problems. The broker seems to target traders who know forex basics and want better trading signals to help make decisions, but customer service has issues according to user reports.

Regulatory Jurisdictions: We found no specific regulatory information in available materials, creating questions about oversight and compliance.

Deposit and Withdrawal Methods: Available materials did not list the payment methods Fxtrading supports for funding accounts or withdrawing money.

Minimum Deposit Requirements: We found no details about minimum deposit amounts in the source materials.

Bonus and Promotional Offers: The reviewed materials contained no information about promotional offers or bonus programs.

Tradeable Assets: The broker focuses on forex signals, but we found no details about specific asset classes beyond foreign exchange.

Cost Structure: User feedback shows competitive trading fees, making Fxtrading look good for cost efficiency, but we found no specific spread and commission details.

Leverage Ratios: Available materials did not specify leverage information.

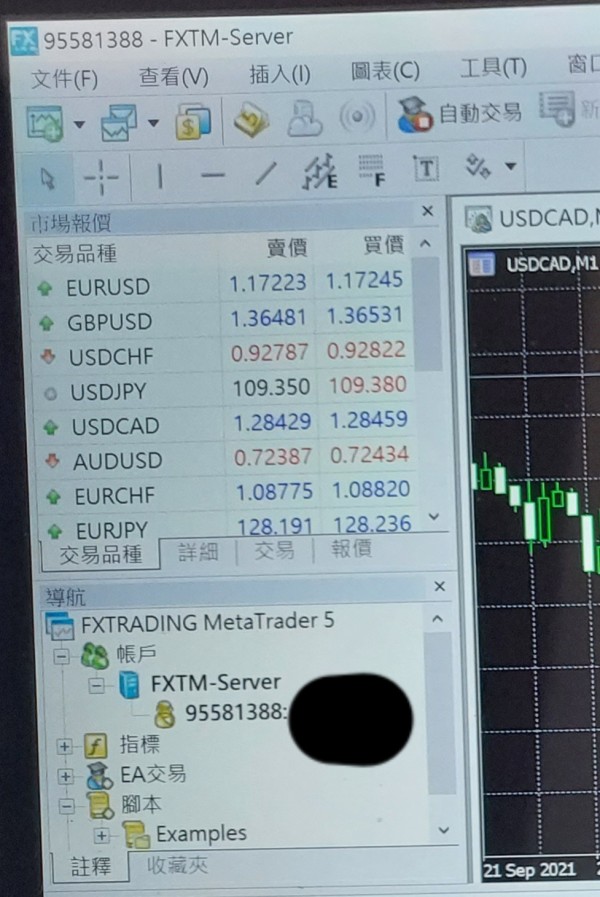

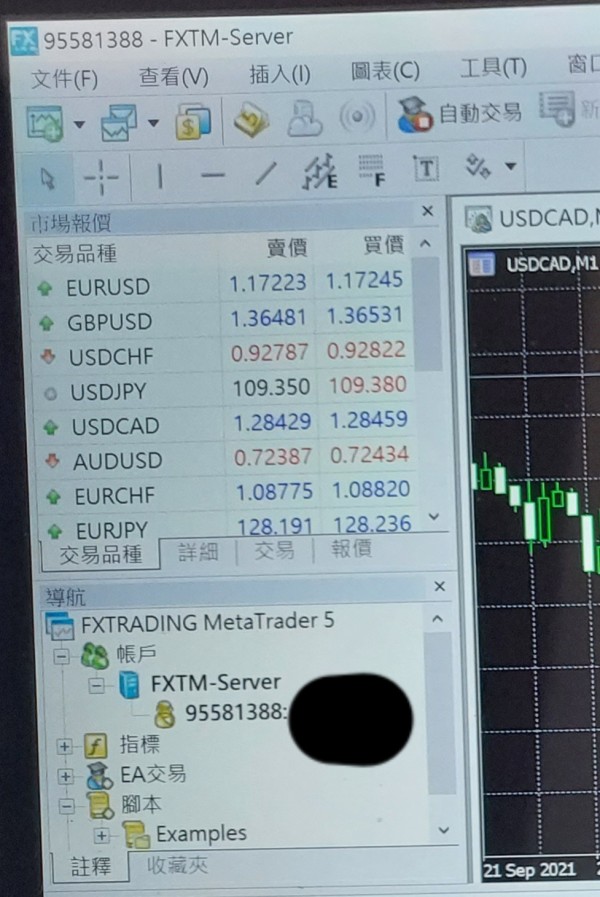

Platform Options: Source materials did not mention specific trading platform types and software options.

Geographic Restrictions: Available information did not detail regional limitations.

Customer Service Languages: The reviewed materials did not specify supported languages for customer service.

This Fxtrading review shows big information gaps that potential clients should address by contacting the broker directly before making trading decisions.

Detailed Rating Analysis

Account Conditions Analysis

We cannot properly evaluate Fxtrading's account conditions because of missing information in available materials. The materials did not detail specific account types and their special features, making it hard to judge the broker's offerings completely. We found no minimum deposit information, so potential clients cannot understand how much money they need to start trading. Account opening steps and how complex they are remain unclear, which could greatly affect user experience.

The source materials also did not mention special account features like Islamic accounts, professional trading accounts, or other religious or regulatory compliance options. This missing information is a big concern for traders who need specific account setups. The lack of detailed account information suggests that potential clients must talk directly with Fxtrading representatives to understand available options, which may add to the slow response times mentioned in user complaints.

Without clear account structure information, this Fxtrading review cannot give solid guidance on account suitability for different trader types, showing the need for direct broker consultation.

We face big information limits when evaluating trading tools and resources at Fxtrading. Available materials did not detail specific trading tool types and their quality, preventing us from fully analyzing the broker's technology offerings. Research and analytical resources, which are crucial for modern forex trading support, lack documentation in the reviewed materials.

Educational resources, increasingly important for trader development and keeping customers, were not specified in available information. The missing educational content details might mean limited support for trader skill development, but we cannot confirm this without more information. Automated trading support capabilities, including expert advisor compatibility and algorithmic trading features, remain unspecified.

The lack of detailed tool and resource information creates a big gap in this evaluation. Modern forex traders usually need comprehensive analytical tools, market research access, and educational support systems. Without specific information about these offerings, potential clients cannot judge whether Fxtrading's technology infrastructure meets modern trading requirements. This missing information may contribute to the mixed user feedback and low recommendation rates we see in user reviews.

Customer Service and Support Analysis

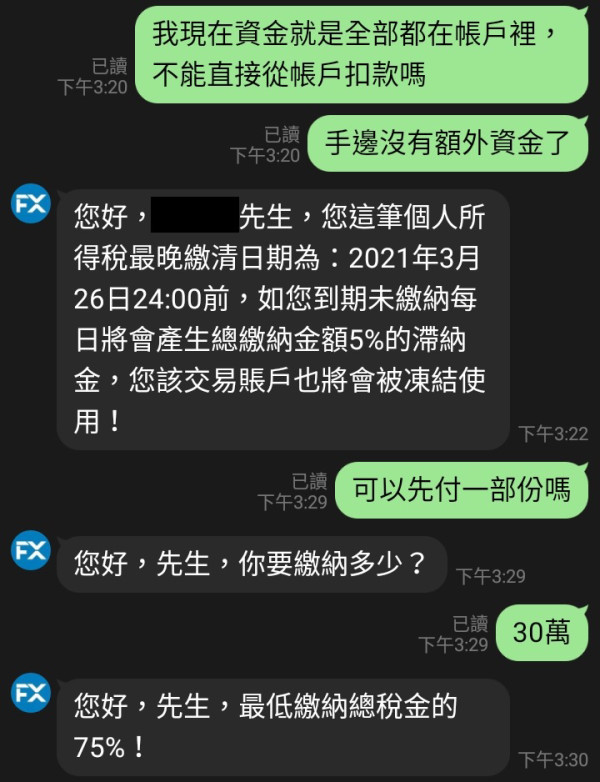

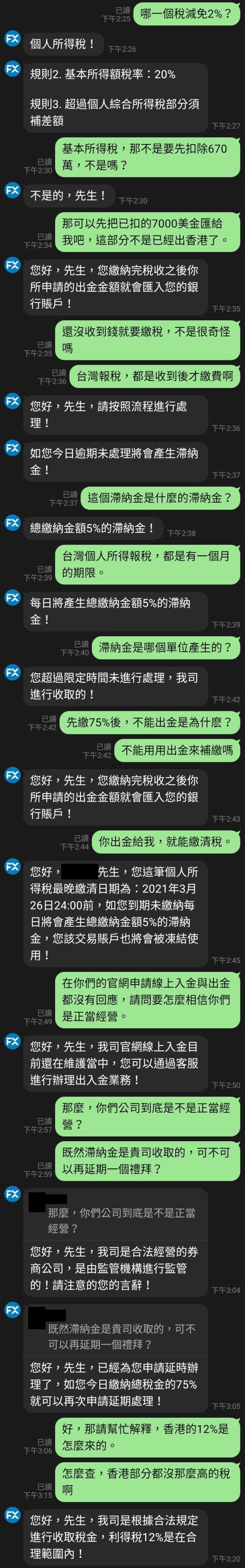

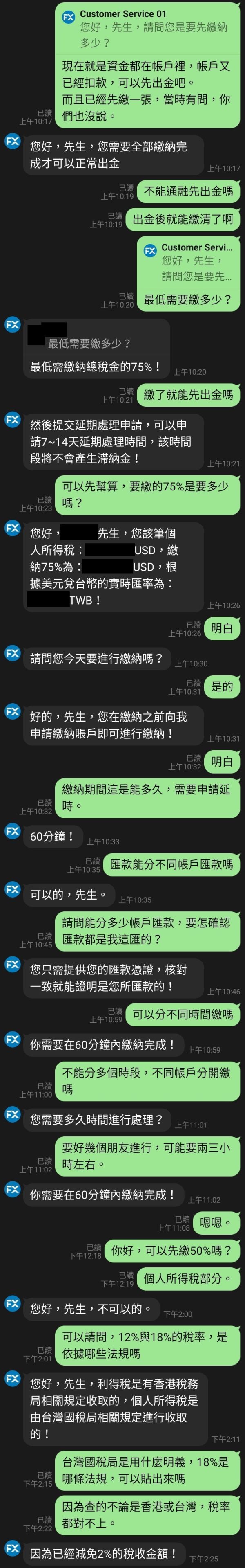

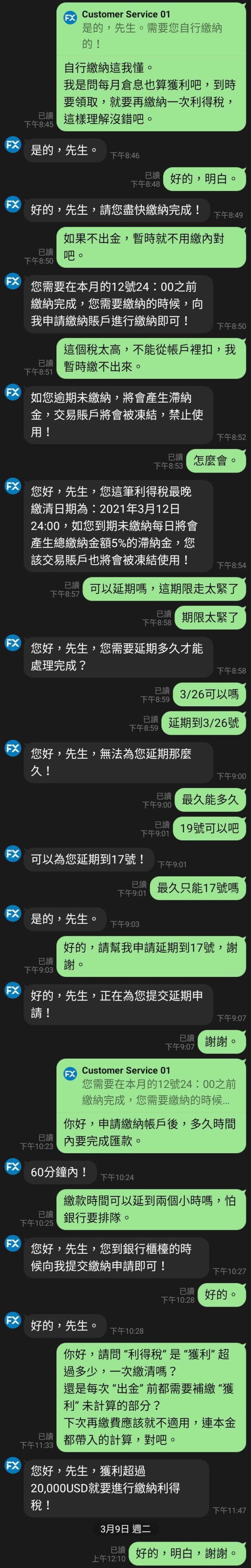

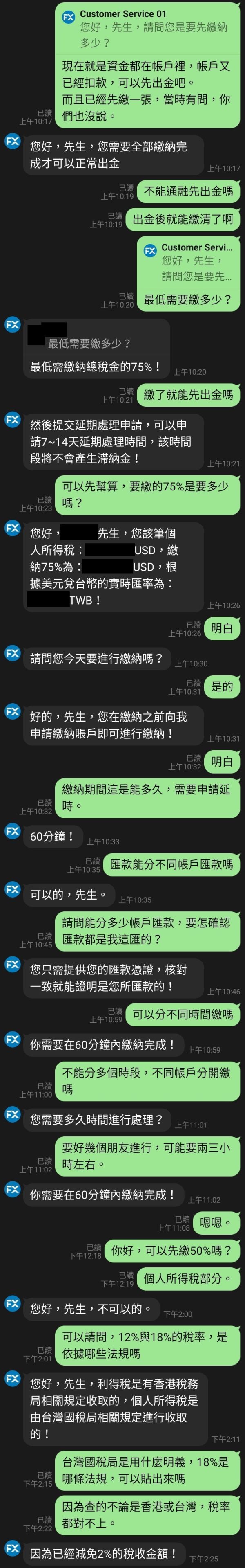

Customer service is a critical weak area for Fxtrading based on available user feedback. Many user reviews specifically point out "poor service quality" and "extended response times" as ongoing issues that affect the trading experience. These service quality problems seem to be system-wide rather than isolated incidents, given how prominent they are in user feedback patterns.

Available materials did not detail the specific customer service channels and their availability, but the response time issues suggest possible understaffing or inefficient support systems. User feedback shows that the broker fails to meet promised achievements, which could relate to both service delivery timelines and trading-related commitments. This pattern of unmet expectations contributes significantly to the low 14% recommendation rate among users.

We found no information about multilingual support capabilities, potentially limiting access for international clients. Customer service operating hours also lack documentation, which may contribute to response delays if coverage is insufficient for global trading schedules. The consistent negative feedback about service quality represents a big concern for potential clients, especially those who need responsive support for time-sensitive trading decisions.

According to user reviews, "service quality is poor, response times are long," showing systematic customer service challenges that significantly hurt user satisfaction.

Trading Experience Analysis

We face big information limits when evaluating the trading experience for Fxtrading, with specific platform stability and execution speed data not available in source materials. Order execution quality, a critical factor for forex trading success, lacks detailed documentation, preventing us from fully assessing the broker's technical performance capabilities.

Source materials did not specify platform functionality completeness and feature sets, though the emphasis on forex signals suggests some specialized tools may be available. Mobile trading experience details, increasingly important for modern forex traders, remain undocumented in the reviewed information. The overall trading environment characteristics, including market access and execution models, lack sufficient detail for thorough evaluation.

The absence of specific trading experience descriptions in user feedback may mean either satisfactory performance in this area or limited user engagement with advanced trading features. However, without concrete performance data or detailed user reviews about trading execution, this Fxtrading review cannot provide solid guidance on trading experience quality. The information gap represents a big limitation for traders seeking detailed performance assessments before broker selection.

We found no technical performance data, including latency measurements and execution statistics, in the reviewed materials, preventing objective trading experience evaluation.

Trustworthiness Analysis

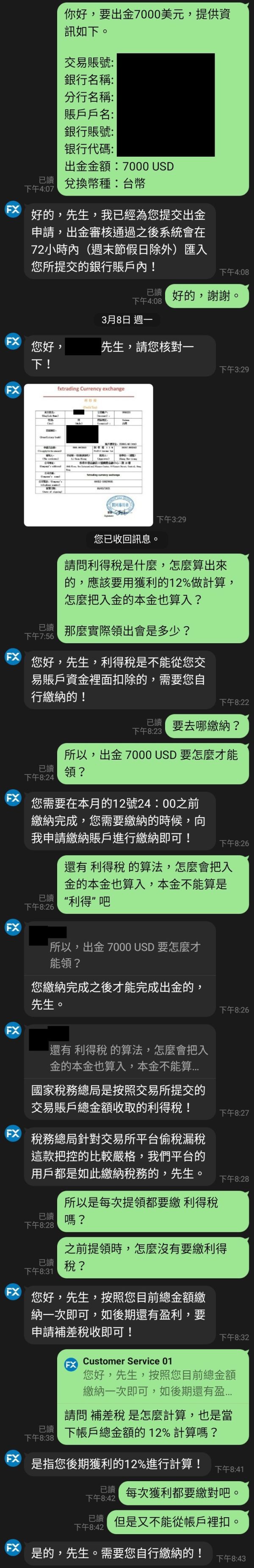

Fxtrading's trustworthiness assessment shows a complex picture with both positive and concerning elements. User feedback shows that the broker is "considered a trustworthy broker," suggesting some level of market confidence and reliability in basic operations. However, this positive view is significantly undermined by the absence of specific regulatory information in available materials.

The lack of detailed regulatory oversight information creates uncertainty about fund security measures and compliance frameworks. Regulatory authorization details, which typically provide crucial investor protection insights, were not specified in the reviewed materials. This regulatory information gap represents a big concern for traders who prioritize fund security and legal recourse options.

Company transparency levels appear limited given the sparse information available about operational details, regulatory compliance, and corporate structure. Industry reputation assessment faces challenges due to mixed user feedback, with trustworthiness recognition offset by service quality complaints. The handling of negative events or disputes lacks documentation, preventing assessment of the broker's crisis management capabilities.

We found no third-party evaluations beyond user reviews in the source materials, limiting independent verification of trustworthiness claims. While users indicate trust in the broker's basic integrity, the regulatory uncertainty and service quality issues create a complex trustworthiness profile requiring careful consideration.

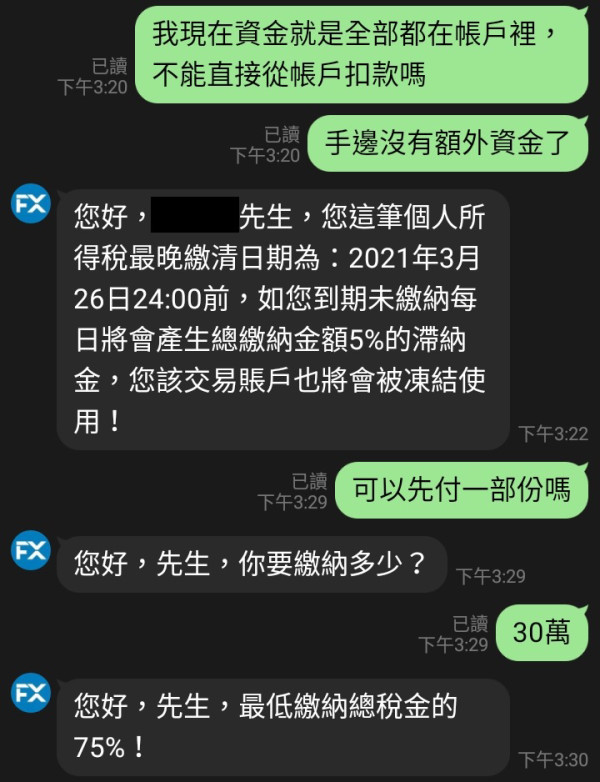

User Experience Analysis

User experience analysis reveals big satisfaction challenges for Fxtrading, with the overall user rating of 6/10 showing mediocre performance across user touchpoints. The particularly concerning 14% recommendation rate suggests that while some users find the service acceptable, the vast majority would not endorse the broker to others, showing substantial experience deficiencies.

Available materials did not specify interface design and usability details, though the focus on forex signals suggests some specialized functionality may enhance certain user interactions. Registration and verification process experiences lack documentation, potentially contributing to user frustration if these procedures are complex or time-consuming.

Fund operation experiences, including deposit and withdrawal processes, were not detailed in available feedback, though the general service quality complaints may extend to these critical functions. Common user complaints center on service quality deficiencies and response time issues, creating negative experience patterns that likely contribute to the low recommendation rate.

The user profile analysis suggests suitability for traders with existing forex knowledge who specifically value signal services, though broader service expectations may not be met. User feedback balance shows positive recognition for signal service quality offset by significant negative experiences with customer service and responsiveness. Improvement recommendations focus on enhancing customer service response speeds and overall service quality standards to address the primary user satisfaction barriers.

Conclusion

This comprehensive Fxtrading review reveals a broker with a complex profile that requires careful consideration before selection. While Fxtrading maintains recognition as a trustworthy broker with competitive trading fees and quality forex signal services, significant service quality issues substantially impact the overall user experience. The 6/10 user rating combined with only 14% recommendation rate shows systematic challenges that potential clients should carefully evaluate.

The broker appears most suitable for experienced forex traders who specifically value high-quality trading signals and can tolerate potential service delivery limitations. However, traders requiring responsive customer support or comprehensive service experiences may find Fxtrading inadequate for their needs. The primary advantages include competitive cost structures and specialized signal services, while the main disadvantages center on poor service responsiveness and unmet user expectations. Prospective clients should conduct thorough research and consider alternative options given the mixed user feedback and service quality concerns highlighted in this evaluation.