Investment One Review 1

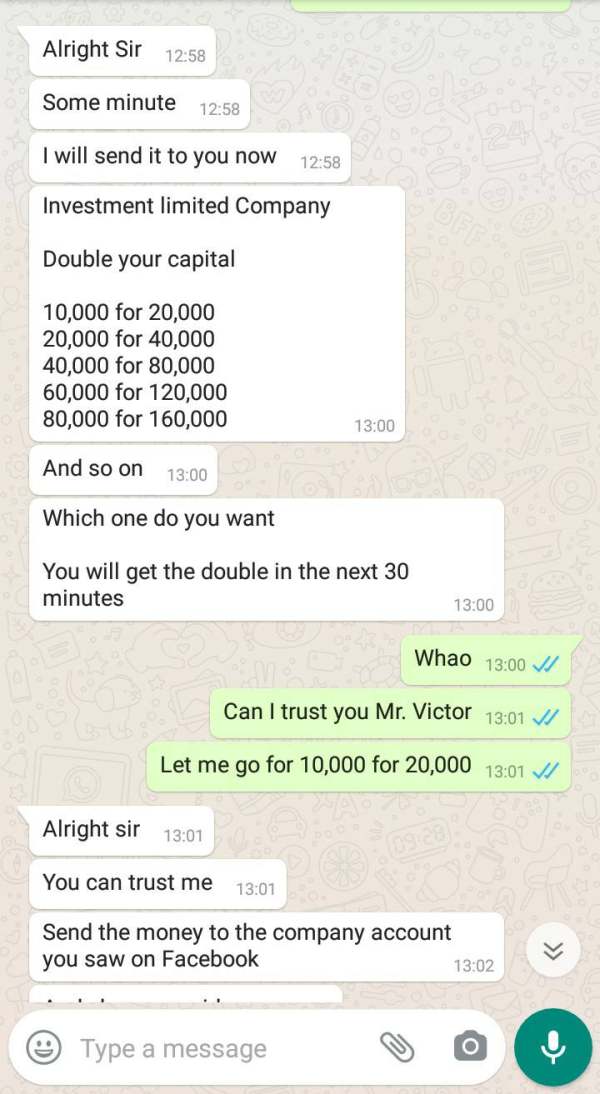

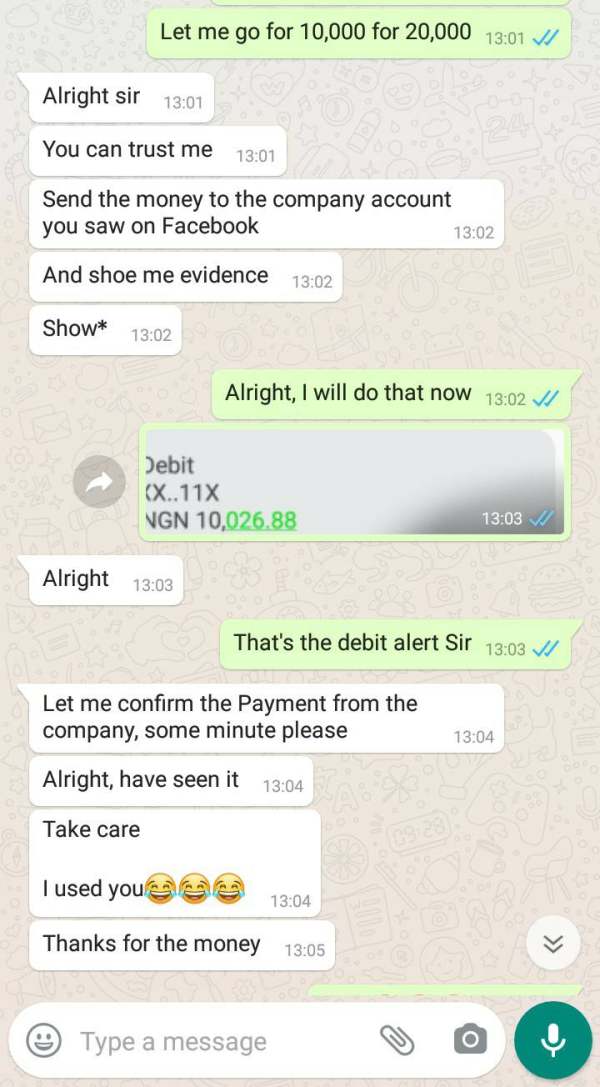

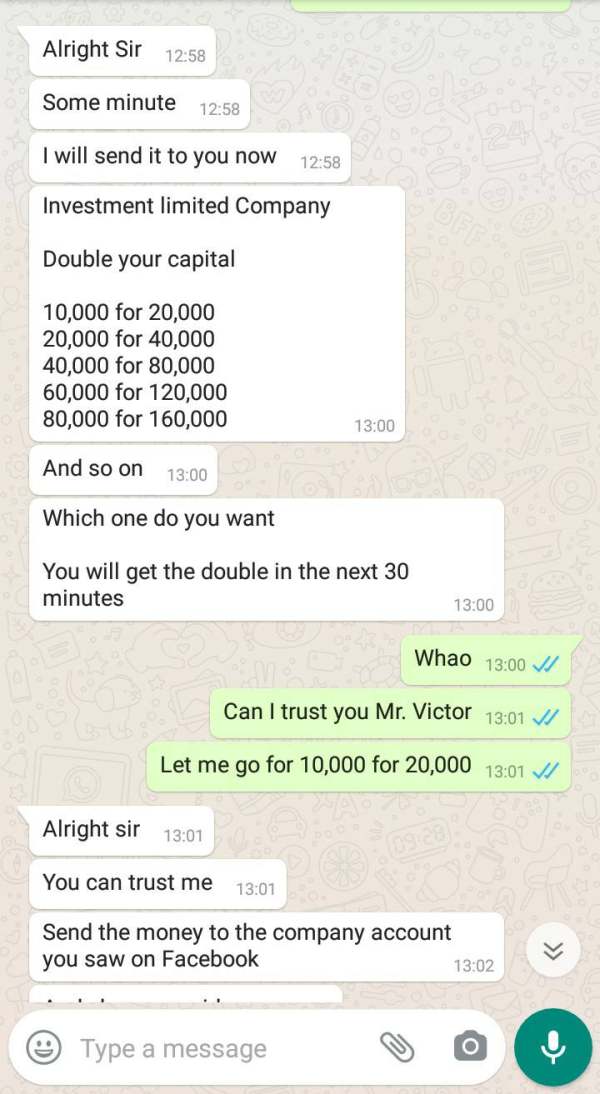

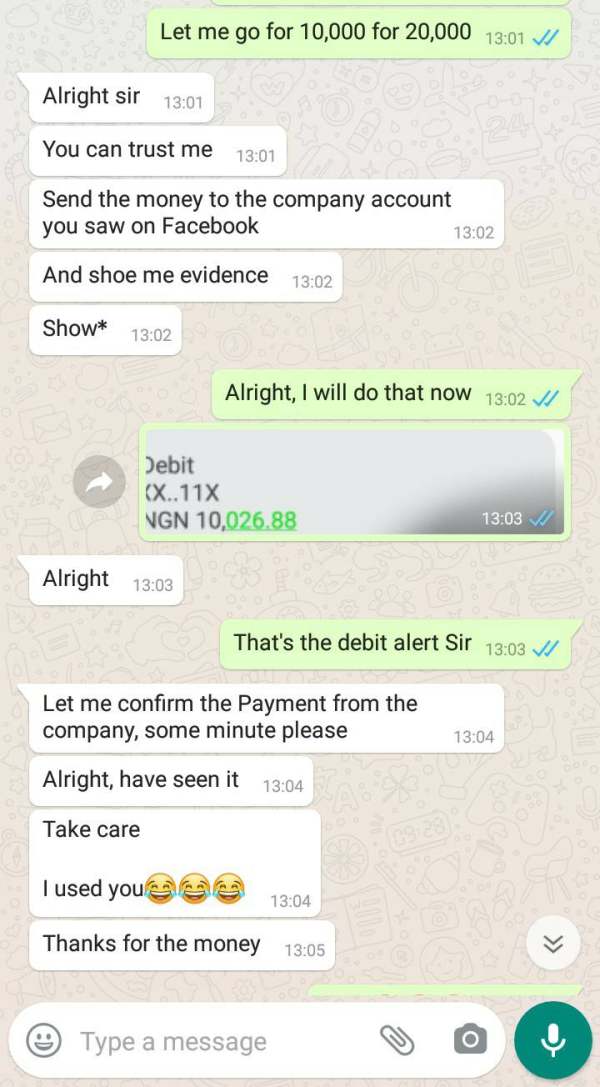

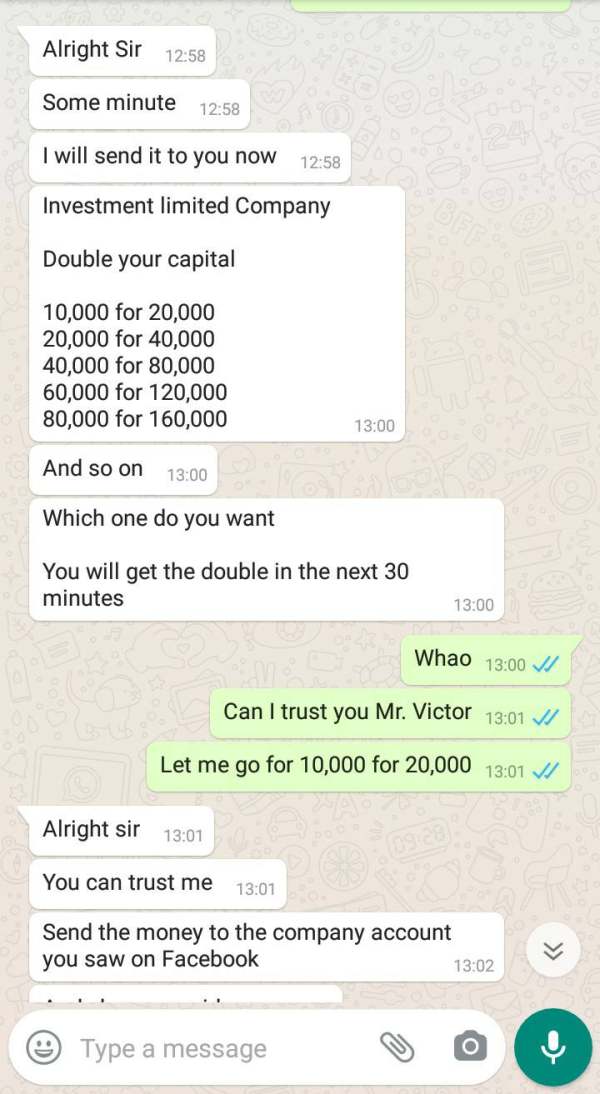

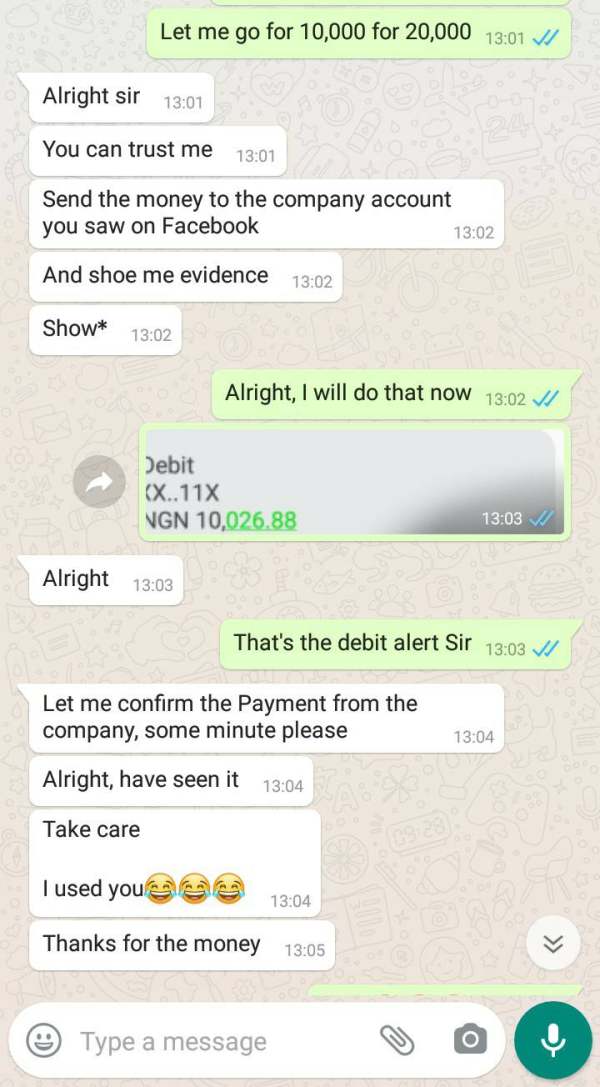

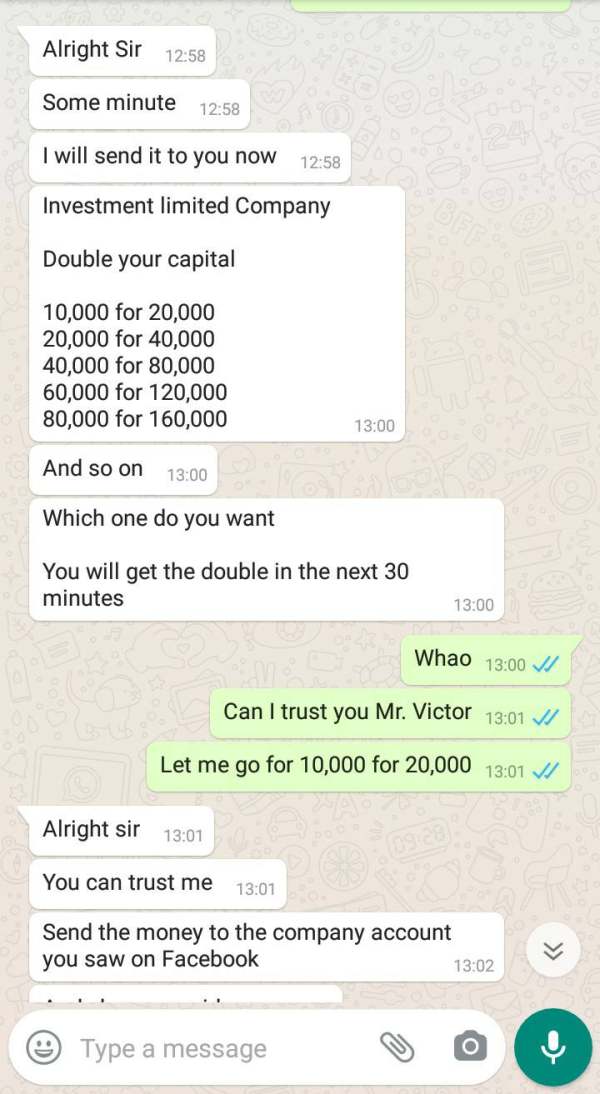

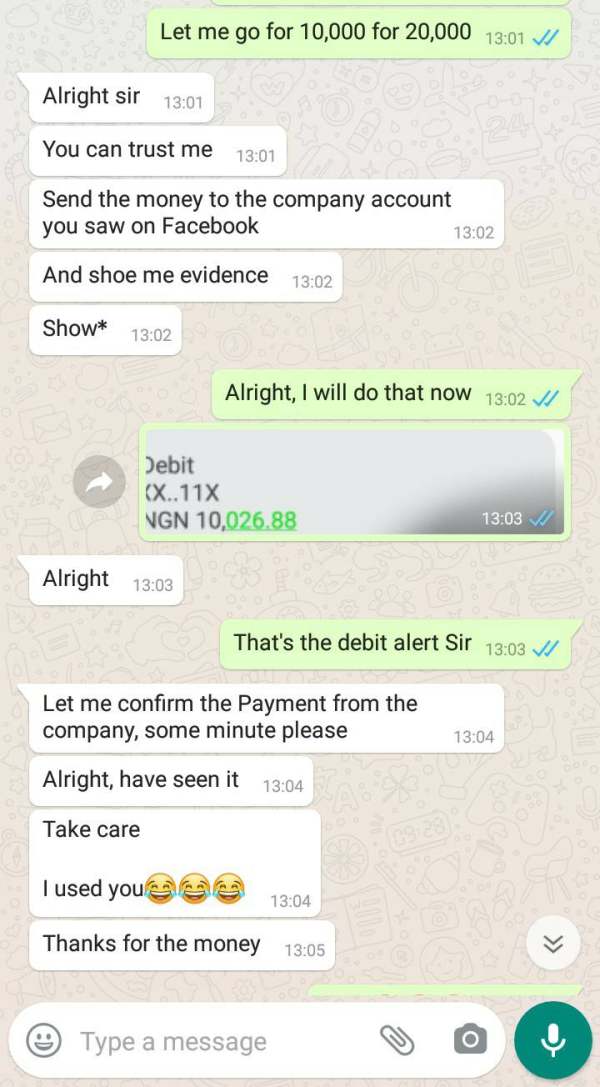

I was scammed of 10,000NGN, not even up to 5 minute, please beware of this trick... I was used by Mr Victor

Investment One Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

I was scammed of 10,000NGN, not even up to 5 minute, please beware of this trick... I was used by Mr Victor

This Investment One review looks at a licensed broker that works in Nigeria. The company operates under the watch of Nigeria's Securities and Exchange Commission and the Nigerian Stock Exchange. Investment One focuses on managing assets, trading securities, and lending for investment properties, with special attention to fixed-income markets.

The company gives real-time financial information through its own mobile app. This app helps investors make smart financial choices. User feedback about Investment One shows both good and bad experiences from clients.

The platform mainly serves investors who want fixed-income securities, stocks, bonds, and investment property loans. The regulatory framework gives the company legitimacy, but user experiences differ a lot. This means people should think carefully before using their services. The broker works hard to provide new real-time financial data, which makes it different from other Nigerian brokers.

Investment One works mainly in the Nigerian financial market under local regulatory watch. Clients should know that regulatory rules and market conditions can be very different across regions.

This Investment One review uses publicly available information and user feedback from various sources, including app store reviews and regulatory filings. The analysis here tries to give an objective look at Investment One's services. However, future users should do their own research and think about their specific investment needs and risk tolerance before making decisions.

| Dimension | Score | Rating Basis |

|---|---|---|

| Account Conditions | 6/10 | Limited public information available on specific account terms |

| Tools and Resources | 8/10 | Strong real-time financial information capabilities |

| Customer Service | 6/10 | Mixed user feedback regarding support quality |

| Trading Experience | 7/10 | Mobile app functionality with room for improvement |

| Trust and Safety | 7/10 | Regulatory oversight by SEC and NSE provides credibility |

| User Experience | 6/10 | Balanced mix of positive and negative user reviews |

Investment One works as a licensed securities broker and dealer in Nigeria's financial markets. The company provides complete asset management and brokerage services. Investment One has become a specialist in fixed-income markets, giving clients access to stocks, bonds, and investment property lending opportunities.

According to regulatory filings, Investment One keeps proper licensing through Nigeria's Securities and Exchange Commission and works with the Nigerian Stock Exchange. This ensures they follow local financial regulations. The broker's business model focuses on providing different investment options while keeping a strong focus on fixed-income securities.

This specialization lets Investment One offer targeted expertise in bond markets and related investment vehicles. The company has developed its own technology solutions, including a mobile application that delivers real-time financial information to help clients make informed investment decisions. Investment One's approach emphasizes transparency and accessibility, though specific details about account structures and trading conditions remain limited in publicly available sources.

Regulatory Jurisdiction: Investment One operates under the regulatory framework of Nigeria's Securities and Exchange Commission and maintains membership with the Nigerian Stock Exchange. This ensures compliance with local financial market regulations.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not detailed in available public sources. As a licensed Nigerian broker, standard local banking methods are likely supported.

Minimum Deposit Requirements: The minimum deposit requirements for opening an account with Investment One are not specified in available documentation.

Bonus and Promotions: No specific information about promotional offers or bonus programs is mentioned in current available sources.

Tradeable Assets: Investment One provides access to stocks, bonds, and investment property loans. The company has a particular specialization in fixed-income securities and related investment vehicles.

Cost Structure: Detailed information about spreads, commissions, and fee structures is not publicly available in current sources. This requires direct contact with the broker for specific pricing details.

Leverage Ratios: Leverage information is not specified in available public documentation.

Platform Options: Investment One offers its own mobile application designed to provide real-time financial information and trading capabilities.

Geographic Restrictions: Specific geographic limitations are not detailed in available sources.

Customer Service Languages: The languages supported by customer service are not specified in current documentation.

Investment One's account conditions present a mixed picture because of limited publicly available information about specific account types and requirements. While the broker operates under proper regulatory oversight from Nigeria's SEC and NSE, detailed account specifications such as minimum deposit requirements, account tiers, and specific features are not easily accessible in public documentation.

This lack of transparency about account conditions represents a significant information gap for potential clients. The account opening process appears to be conducted through the company's mobile application, though specific verification requirements and timeframes are not detailed in available sources. Without clear information about different account types or special features such as Islamic accounts, potential clients must rely on direct communication with the broker to understand available options.

This opacity in account condition disclosure impacts the overall assessment, as transparency in account terms is crucial for informed decision-making. The regulatory framework provided by Nigerian authorities does offer some protection for account holders, but the absence of detailed public information about account structures limits the ability to fully evaluate the competitiveness of Investment One's offerings compared to other brokers in the market.

Investment One shows strong capabilities in providing real-time financial information through its own mobile application. According to app store descriptions, the platform is designed to give users control over their finances with new real-time data that supports sound financial decision-making.

This technological focus represents one of the broker's key strengths, particularly for investors who value immediate access to market information. The broker's specialization in fixed-income markets suggests access to relevant research and analysis tools specific to bond and debt securities, though detailed information about research resources is not extensively documented in available sources. The emphasis on real-time information delivery indicates a commitment to providing timely market data, which is essential for active investors and those seeking to capitalize on market movements.

However, specific details about educational resources, automated trading support, or advanced analytical tools are not clearly outlined in current documentation. The mobile-first approach to platform delivery suggests a focus on accessibility and convenience, though the depth of available tools and resources would require direct evaluation of the application to fully assess.

Customer service information for Investment One is limited in publicly available sources. This makes it challenging to provide a complete assessment of support quality and availability.

User reviews show mixed experiences, with some clients expressing satisfaction while others have reported concerns, indicating variability in service delivery. The broker's mobile application serves as a primary interface for client interaction, suggesting that digital support channels may be emphasized over traditional phone or email support. However, specific information about response times, available support channels, multilingual capabilities, or operating hours is not detailed in current documentation.

The regulatory oversight by Nigerian authorities provides some framework for complaint resolution and client protection, but the specific mechanisms Investment One has in place for addressing client concerns are not clearly outlined. The mixed user feedback suggests that while some clients receive satisfactory support, others may experience challenges in getting timely or effective assistance.

Investment One's trading experience centers around its mobile application platform, which is designed to provide real-time financial information and trading capabilities. The mobile-first approach suggests an emphasis on accessibility and convenience for users who prefer to manage their investments on mobile devices.

However, detailed information about platform stability, execution speed, and technical performance is not extensively documented in available sources. The broker's focus on fixed-income markets and securities trading suggests a more traditional approach to order execution, though specific details about slippage, requotes, or execution quality are not publicly available. The absence of detailed technical specifications makes it difficult to assess the platform's performance under various market conditions.

User reviews indicate mixed experiences with the trading platform, suggesting that while some clients find the interface satisfactory, others may encounter limitations or technical issues. The lack of detailed information about available technical indicators, charting tools, or advanced trading features limits the ability to fully evaluate the platform's suitability for different types of traders.

Investment One's trust and safety profile is anchored by its regulatory status with Nigeria's Securities and Exchange Commission and membership in the Nigerian Stock Exchange. This regulatory framework provides a foundation of legitimacy and ensures compliance with local financial market regulations, which is crucial for client protection and operational transparency.

The broker's focus on licensed securities activities and asset management suggests adherence to established financial industry standards within the Nigerian market. However, specific information about fund safety measures, segregation of client funds, or additional security protocols is not detailed in publicly available documentation. While no significant negative events or regulatory actions are mentioned in available sources, the limited transparency regarding specific safety measures and fund protection policies impacts the overall trust assessment.

The regulatory oversight provides some assurance, but potential clients would benefit from more detailed information about how their investments and personal data are protected.

User experience with Investment One shows a balanced mix of positive and negative feedback based on available reviews. Some users appreciate the real-time financial information capabilities and find the mobile application useful for managing their investments.

However, other users have expressed concerns, indicating that the overall user experience may vary significantly depending on individual needs and expectations. The mobile application interface appears to be the primary user touchpoint, with design focused on providing financial control and real-time information access. However, specific details about user interface design, navigation ease, or feature accessibility are not extensively documented in available sources.

The registration and verification process, fund operation procedures, and overall platform usability would require direct experience or more detailed user feedback to fully assess. The mixed nature of user reviews suggests that while some clients find the platform meets their needs, others may encounter limitations or challenges that impact their overall satisfaction with the service.

Investment One presents a regulated brokerage option for investors interested in Nigerian securities markets, particularly those focused on fixed-income investments and asset management services. The broker's regulatory standing with Nigeria's SEC and NSE provides legitimacy, while its emphasis on real-time financial information delivery through mobile technology represents a modern approach to investment services.

However, the limited transparency regarding account conditions, fee structures, and detailed service specifications presents challenges for potential clients seeking complete information before making decisions. The mixed user feedback suggests that while some investors find value in Investment One's services, others may encounter limitations or service quality issues. Investment One appears most suitable for investors who prioritize regulatory compliance, are interested in Nigerian securities markets, and value mobile-accessible real-time financial information.

However, potential clients should conduct thorough due diligence and direct communication with the broker to understand specific terms, conditions, and service capabilities before committing to their platform.

FX Broker Capital Trading Markets Review