Is Fxtrading safe?

Business

License

Is Fxtrading Safe or a Scam?

Introduction

Fxtrading.com is an online forex and CFD broker headquartered in Sydney, Australia. Established in 2014, it aims to provide a comprehensive trading platform for both novice and experienced traders, offering a wide range of financial instruments, including forex, commodities, indices, and cryptocurrencies. As the forex market continues to grow, the number of brokers has increased, making it essential for traders to conduct thorough evaluations before committing their funds. This article aims to analyze the safety and legitimacy of Fxtrading by examining its regulatory status, company background, trading conditions, customer fund security, user experiences, and overall risk profile. The investigation is based on data gathered from various reputable sources, including regulatory bodies, user reviews, and financial analysis websites.

Regulation and Legitimacy

Regulation is a crucial factor in determining the legitimacy of a broker. Fxtrading is regulated by two key authorities: the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC). Regulatory oversight plays a significant role in ensuring that brokers adhere to strict guidelines designed to protect traders' interests.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 337985 | Australia | Verified |

| VFSC | 40256 | Vanuatu | Verified |

ASIC is recognized as a tier-1 regulatory authority, imposing stringent standards on financial institutions operating within its jurisdiction. This includes requirements for capital adequacy, transparency, and compliance with anti-fraud measures. On the other hand, while the VFSC provides a regulatory framework, its standards are generally considered less rigorous compared to ASIC. Therefore, while Fxtrading is regulated, the quality of oversight varies, and traders should be aware of the implications.

Company Background Investigation

Fxtrading.com operates under Gleneagle Securities Pty Ltd, a company with a history that includes a rebranding from Rubix FX. The management team consists of professionals with extensive experience in finance and trading, which adds to the broker's credibility. The company's commitment to transparency is evident through its clear communication regarding fees, trading conditions, and customer support.

The broker's website provides detailed information about its operations, including its regulatory status, trading platforms, and available financial instruments. However, some users have reported a lack of responsiveness in customer service, which raises questions about the company's overall transparency and reliability.

Trading Conditions Analysis

The trading conditions offered by Fxtrading are competitive, but it's essential to examine the fee structure closely. The broker provides two primary account types: the Standard account, which features no commissions but higher spreads, and the Pro account, which offers lower spreads but charges a commission per trade.

| Fee Type | Fxtrading | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.0 pips | From 0.1 pips |

| Commission Model | $2 per lot (Pro) | $5 per lot |

| Overnight Interest Range | Variable | Variable |

While the spreads are competitive, traders should be cautious of any hidden fees or unusual charges that may arise, particularly regarding withdrawal fees or inactivity fees, which could affect overall profitability.

Customer Fund Security

The safety of customer funds is paramount in the forex trading environment. Fxtrading implements several measures to ensure the security of its clients' funds. Client funds are kept in segregated accounts, meaning that they are separated from the broker's operational funds. This segregation is crucial in the event of insolvency, as it protects traders' funds.

Additionally, Fxtrading offers negative balance protection, ensuring that clients cannot lose more than their initial deposit. This feature is particularly important for traders who utilize high leverage, as it minimizes the risk of incurring significant losses. However, there have been no major historical issues reported regarding fund security, which is a positive sign.

Customer Experience and Complaints

User feedback is a valuable source of information when assessing a broker's reliability. Reviews of Fxtrading are mixed, with some users praising its competitive spreads and user-friendly platform, while others highlight issues with customer support and withdrawal processes.

| Complaint Type | Severity | Company Response |

|---|---|---|

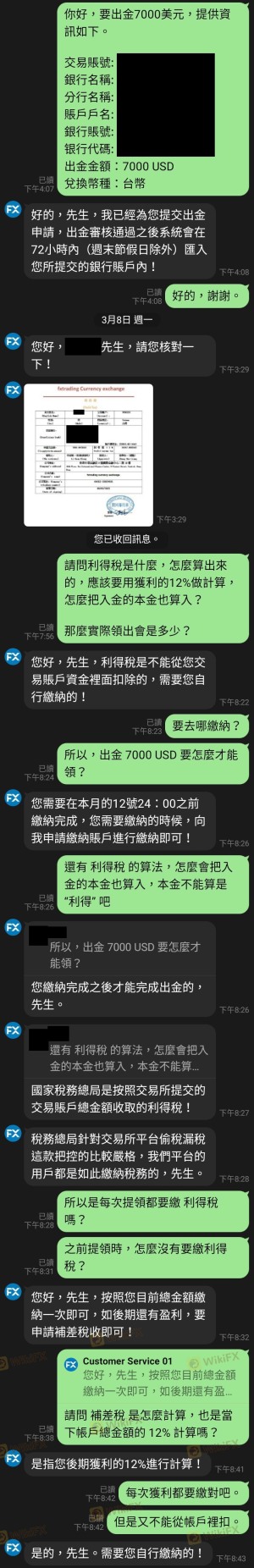

| Withdrawal Delays | High | Slow response |

| Customer Support Issues | Medium | Variable response |

| Lack of Transparency | Medium | Needs improvement |

For instance, some users have reported delays in withdrawing funds, which can be a significant concern for traders who require quick access to their capital. Additionally, the quality of customer support has been criticized, with some users experiencing long wait times for responses.

Platform and Trade Execution

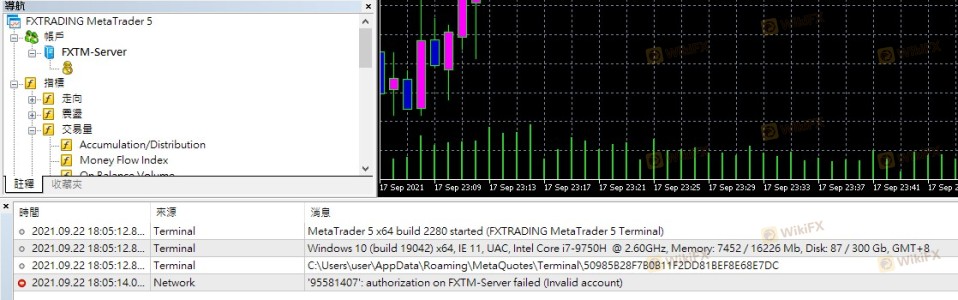

The trading platform provided by Fxtrading is based on the widely-used MetaTrader 4 and MetaTrader 5, known for their robust features and reliability. However, the performance of the platform can vary based on market conditions. Users have reported that the execution speed is generally satisfactory, but there have been instances of slippage during volatile market periods.

Risk Assessment

Using Fxtrading presents several risks that traders should consider. While the broker is regulated, the dual oversight from ASIC and VFSC means that the level of protection can vary significantly. Additionally, the lack of a comprehensive investor protection scheme may expose traders to higher risks.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Varying regulatory standards |

| Operational Risk | Medium | Potential for withdrawal delays |

| Market Risk | High | High volatility in forex trading |

To mitigate these risks, traders should conduct thorough research, utilize demo accounts to practice trading strategies, and maintain a diversified portfolio to spread risk.

Conclusion and Recommendations

In conclusion, while Fxtrading is a regulated broker with several positive attributes, potential traders should exercise caution. The presence of dual regulation does provide a level of security, but the varying quality of oversight and mixed user feedback warrant careful consideration. Traders should be particularly vigilant regarding withdrawal processes and customer support.

For those seeking alternative options, brokers like Pepperstone and IC Markets offer similar services with robust regulatory frameworks and positive user experiences. Ultimately, it is crucial for traders to assess their individual needs and risk tolerance before selecting a broker.

In summary, while Fxtrading may not be a scam, it is essential for traders to remain aware of the potential risks and challenges associated with this broker.

Is Fxtrading a scam, or is it legit?

The latest exposure and evaluation content of Fxtrading brokers.

Fxtrading Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Fxtrading latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.