FXem 2025 Review: Everything You Need to Know

Executive Summary

FXem presents itself as a global online forex broker targeting both retail investors and institutional partners. This fxem review reveals significant concerns about the platform's credibility. User feedback consistently points to negative experiences, with many traders questioning the broker's legitimacy and labeling it as an unreliable platform. Despite claims of offering competitive trading conditions including low spreads, fast execution speeds, and flexible ECN accounts, the overwhelming user sentiment suggests caution.

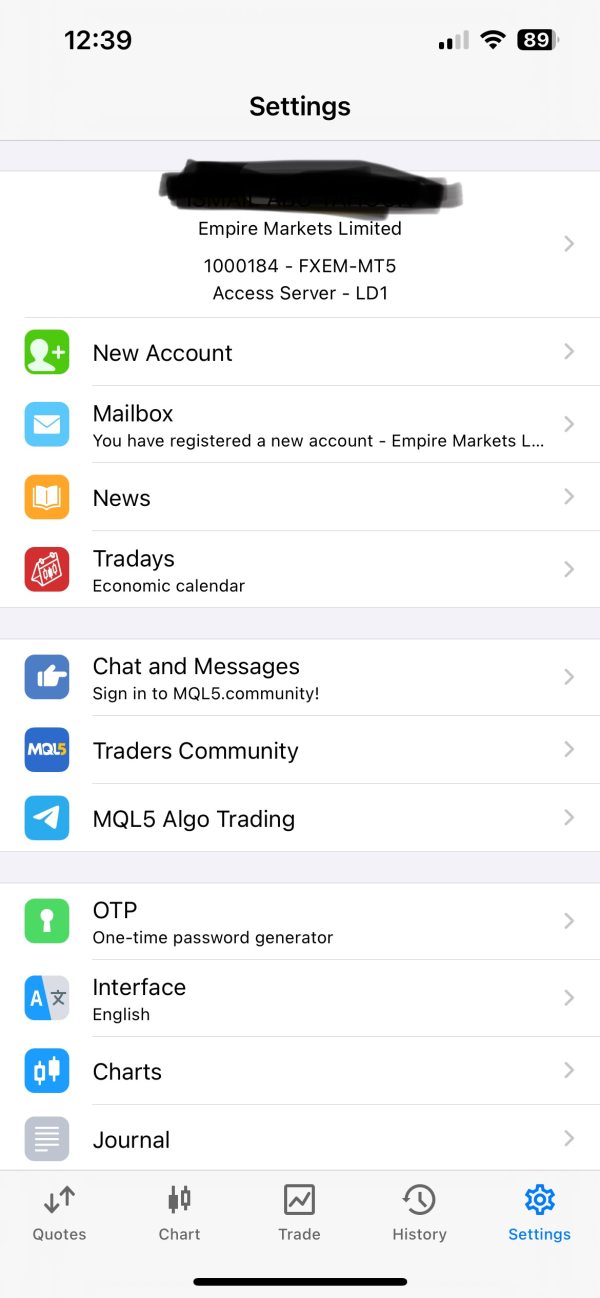

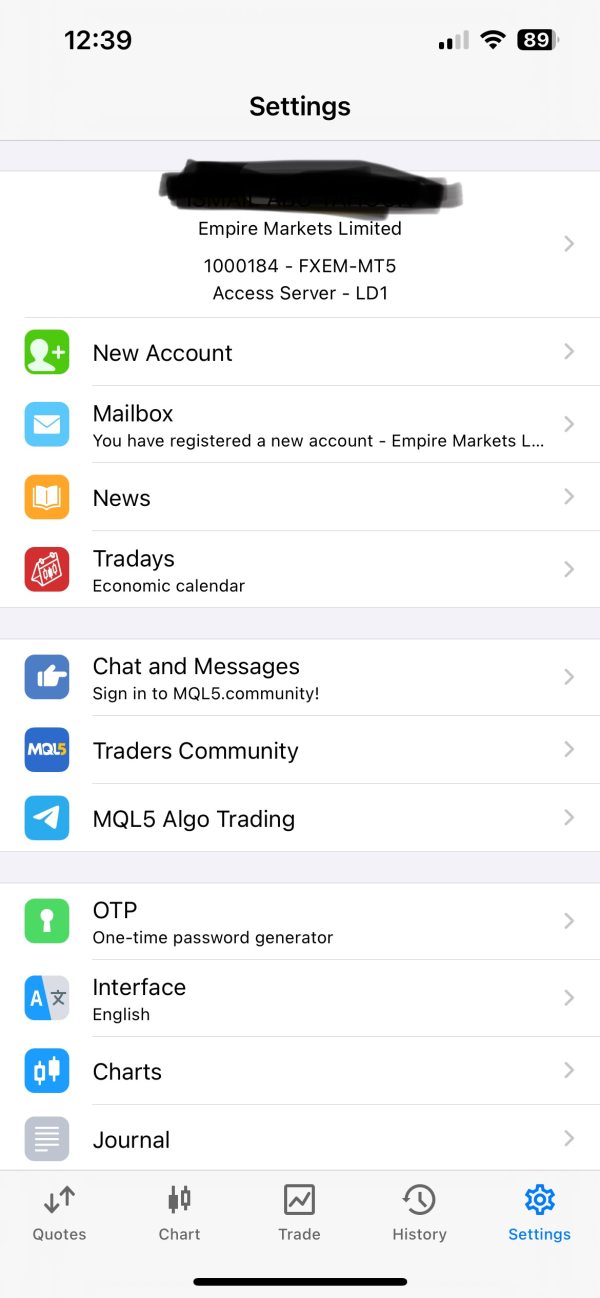

The broker positions itself in the retail forex market with over 60 currency pairs and CFD instruments covering major indices, energy, and metals. However, the lack of transparent regulatory information and predominantly negative user reviews raise serious red flags about the platform's trustworthiness. Established in 2015, FXem operates through multiple entities including Empire Markets LLC, though specific regulatory oversight remains unclear. While the platform offers MT4 trading capabilities and claims to provide institutional-grade execution, potential clients should carefully consider the substantial reputational concerns before engaging with this broker.

Important Notice

FXem operates as a shared brand across multiple entities, including Empire Markets LLC. Specific regulatory information and jurisdictional oversight details are not clearly disclosed in available documentation. This fxem review is based on comprehensive analysis of user feedback, available market data, and publicly accessible information about the broker's services and offerings.

Readers should note that regulatory frameworks and service availability may vary significantly across different regions. The lack of clear regulatory disclosure presents additional considerations for potential clients. Our evaluation methodology incorporates direct user experiences, platform testing data where available, and comparative analysis with industry standards.

Rating Framework

Broker Overview

FXem entered the forex market in 2015. The company positions itself as a comprehensive online trading platform serving both individual retail investors and institutional clients worldwide. The company operates through a network of entities, with Empire Markets LLC being one of the identified corporate structures. The complete organizational framework and regulatory oversight remain insufficiently documented in publicly available materials.

The broker's business model centers on providing forex and CFD trading services through electronic execution. FXem targets traders seeking direct market access and competitive pricing structures. FXem emphasizes its technological infrastructure and claims to offer institutional-grade execution speeds, though user experiences vary significantly regarding platform reliability and service quality.

The primary trading platform offered is MetaTrader 4. This provides access to over 60 currency pairs alongside CFD instruments covering major global indices, energy commodities, and precious metals. However, the scope of available instruments and specific trading conditions lack detailed transparency in official documentation. This fxem review finds that while the broker presents competitive trading features on paper, the implementation and user satisfaction levels raise substantial concerns. The platform's overall reliability and trustworthiness in practical trading scenarios remain questionable.

Regulatory Status: Available information does not specify concrete regulatory oversight or licensing details. This represents a significant transparency gap for potential clients seeking regulated trading environments.

Deposit and Withdrawal Methods: Specific funding options and withdrawal procedures are not detailed in accessible documentation. This limits transparency about financial transaction processes.

Minimum Deposit Requirements: The broker has not clearly disclosed minimum deposit thresholds for different account types. This makes it difficult for traders to assess entry barriers.

Bonus and Promotional Offers: No specific information about welcome bonuses, promotional campaigns, or trading incentives is available in current documentation.

Trading Instruments: The platform provides access to over 60 currency pairs covering major, minor, and exotic combinations. Plus CFD instruments including major global indices, energy commodities like crude oil and natural gas, and precious metals including gold and silver.

Cost Structure: The broker claims to offer low spreads and competitive pricing. However, detailed commission structures, overnight financing rates, and additional fees are not comprehensively disclosed in available materials.

Leverage Options: Multiple leverage ratios are mentioned as available. Specific maximum leverage limits and their application across different instrument types lack detailed specification.

Platform Selection: MetaTrader 4 serves as the primary trading platform. It offers standard charting tools, technical indicators, and automated trading capabilities through Expert Advisors.

Geographic Restrictions: Specific country restrictions and regional service limitations are not clearly outlined in accessible documentation.

Customer Support Languages: The range of supported languages for customer service communications is not specified in available information sources. This comprehensive fxem review highlights the need for greater transparency across multiple operational aspects.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

FXem's account structure emphasizes flexibility through its ECN account offerings. The lack of transparent information about account types significantly impacts the overall evaluation. The broker claims to provide competitive spreads and direct market access, which appeals to cost-conscious traders seeking institutional-style execution. However, the absence of clearly defined minimum deposit requirements creates uncertainty for potential clients planning their initial investment.

User feedback suggests that while some traders appreciate the claimed low-cost trading environment, the overall account opening experience lacks the transparency expected from reputable brokers. The platform's failure to provide detailed account specifications, including specific spread ranges, commission structures, and account tier benefits, limits traders' ability to make informed decisions.

Compared to established industry players, FXem's account conditions appear competitively positioned in terms of claimed costs. They fall short in transparency and documentation quality. The lack of specialized account types such as Islamic accounts or demo account details further restricts the platform's appeal to diverse trading communities. This fxem review emphasizes that account flexibility means little without proper disclosure and user confidence in the platform's reliability.

The trading instrument selection at FXem covers essential market categories with over 60 currency pairs spanning major, minor, and exotic combinations. This provides reasonable diversity for forex-focused strategies. The CFD offerings include major global indices, energy commodities, and precious metals, creating opportunities for portfolio diversification across different asset classes.

However, the platform significantly lacks comprehensive research and analytical resources that modern traders expect from competitive brokers. No information is available about market analysis reports, economic calendars, trading signals, or expert commentary that could support informed trading decisions. The absence of educational resources such as webinars, tutorials, trading guides, or market insights represents a substantial gap in value-added services.

Automated trading support through MetaTrader 4 provides basic EA functionality. The platform lacks advanced algorithmic trading tools or signal services that institutional clients often require. User feedback indicates that while the instrument variety meets basic trading needs, the lack of supporting analytical tools forces traders to seek third-party resources for market research and education. This reduces the platform's overall value proposition compared to full-service competitors.

Customer Service and Support Analysis (3/10)

Customer service represents one of FXem's most significant weaknesses based on extensive user feedback indicating widespread dissatisfaction with support quality and responsiveness. Multiple user reports suggest that communication channels are limited and response times are inadequately long for urgent trading-related issues.

The absence of detailed information about available support channels, operating hours, or multilingual capabilities indicates poor service infrastructure planning. Users consistently report difficulties reaching qualified support representatives and receiving satisfactory resolutions to account or trading-related problems.

Service quality complaints focus primarily on unresponsive communication, lack of technical expertise among support staff, and inadequate problem resolution procedures. The absence of comprehensive FAQ sections, knowledge bases, or self-service options forces users to rely entirely on direct support channels that appear insufficient for the platform's user base. These systemic customer service issues contribute significantly to the overall negative user sentiment and trust concerns surrounding the platform.

Trading Experience Analysis (7/10)

FXem's trading execution capabilities receive mixed feedback, with some users acknowledging fast order processing speeds and competitive spread environments during optimal market conditions. The MetaTrader 4 platform provides familiar functionality for experienced forex traders, including standard charting tools, technical indicators, and automated trading capabilities.

Platform stability appears adequate during normal market conditions. Comprehensive stress testing data during high volatility periods is not available. The claimed fast execution speeds align with some user experiences, particularly for standard currency pairs during liquid market sessions, though slippage and requote frequency data lacks detailed documentation.

Mobile trading functionality through MT4 mobile applications provides basic trading capabilities. Advanced features and platform optimization for mobile devices receive limited user feedback. The overall trading environment benefits from MT4's established infrastructure and familiar interface, though the lack of proprietary platform innovations or advanced trading tools limits differentiation from competitors.

However, the underlying trust issues and customer service problems significantly impact the practical trading experience. Users report concerns about platform reliability during critical trading moments. This fxem review notes that technical execution capabilities alone cannot compensate for fundamental trust and service quality deficiencies.

Trust and Reliability Analysis (2/10)

Trust represents FXem's most critical vulnerability, with widespread user feedback characterizing the platform as unreliable and potentially fraudulent. The absence of clear regulatory oversight and licensing information creates fundamental concerns about legal compliance and client protection standards.

Multiple user reports describe FXem as a "scam platform," indicating serious issues with fund security, withdrawal processing, or trading practices that have damaged user confidence. The lack of transparent corporate information, regulatory registration details, and third-party audit reports prevents independent verification of the platform's legitimacy and operational standards.

Industry reputation analysis reveals predominantly negative sentiment from trading communities and review platforms. Few positive endorsements come from credible sources. The broker's failure to address transparency concerns or provide verifiable regulatory credentials suggests inadequate commitment to industry standards and client protection protocols.

Fund safety measures, segregated account policies, and deposit insurance protections are not documented in available materials. This leaves clients without clear understanding of financial security arrangements. The combination of negative user experiences and regulatory opacity creates substantial risk factors that override any potential trading advantages the platform might offer.

User Experience Analysis (4/10)

Overall user satisfaction with FXem remains significantly below industry standards, with negative feedback substantially outweighing positive experiences across multiple evaluation criteria. The platform's interface design and navigation functionality receive mixed reviews, with some users finding the MT4 environment familiar while others report technical difficulties and platform limitations.

Registration and account verification processes lack streamlined efficiency. Users report extended waiting periods and documentation requirements that exceed industry norms. The absence of clear onboarding procedures and account setup guidance creates unnecessary friction for new clients seeking to begin trading activities.

Funding operations represent a particular concern, with limited information about deposit and withdrawal methods creating uncertainty about financial transaction processes. User feedback suggests that money movement procedures lack the transparency and efficiency expected from professional trading platforms. This contributes to overall dissatisfaction with the service experience.

Common user complaints center on poor customer service responsiveness, platform trust issues, and inadequate transparency about trading conditions and corporate policies. The platform would benefit significantly from improved communication protocols, enhanced transparency measures, and comprehensive service quality improvements to address fundamental user experience deficiencies.

Conclusion

This comprehensive fxem review reveals a platform that presents competitive trading conditions on paper but fails to deliver the transparency, reliability, and service quality that modern traders require. While FXem offers potentially attractive features such as low spreads, fast execution, and flexible ECN accounts, these advantages are overshadowed by significant trust and service concerns.

The broker appears most suitable for experienced traders who prioritize low trading costs and can navigate the platform's limitations. Even this narrow user segment should exercise extreme caution given the substantial reputational risks. The lack of regulatory transparency and widespread negative user feedback make FXem unsuitable for most retail traders seeking reliable, regulated trading environments.

The platform's primary advantages include competitive trading costs and MT4 platform familiarity, while major disadvantages encompass poor customer service, trust issues, regulatory opacity, and negative user sentiment. Potential clients should carefully consider these substantial risks before engaging with FXem and may find better value and security with established, regulated alternatives in the competitive forex broker marketplace.