Fogee 2025 Review: Everything You Need to Know

Summary

Fogee is a new broker in the forex market. The company works under FCF Group Holdings and connects with Fogoil Capital Services to provide trading services. This Fogee review shows a broker that focuses on using technology to help traders have better experiences in financial markets.

The broker uses both its own technology and outside tech companies to make trading better for clients. FCF Group Holdings thinks technology is the most important part of financial markets today, so they always check their tech tools and trading processes to make them better. They offer good rates and low fees to both regular traders and big investment companies who want technology-focused trading solutions.

Fogee offers many different financial services like investments, loans, working capital, venture capital, and business finance help. But we don't have much detailed information about their trading rules, who watches over them, or how they operate, which makes it hard to give a complete review.

Important Notice

This review uses information that is available to the public about Fogee's business. Readers should know that we don't have detailed information about regulations, specific trading conditions, and all the services they offer because this information isn't easy to find. The review you're reading is based on information we could access when we wrote this and hasn't been checked through actual trading experience with their platform.

Different parts of Fogee in different countries might follow different rules, so potential users should check the specific regulations in their area before using the broker's services.

Rating Framework

Broker Overview

Fogee is a financial services company managed by FCF Group Holdings. Fogoil Capital Services helps them deliver services to clients. The company focuses on financial technology and tries to combine advanced tech solutions with traditional financial market work.

According to company information, FCG Group Holdings believes that technology is what drives modern financial markets, which affects how they develop services and work with clients. The company offers more than just forex trading and provides many different financial solutions including investment services, loan help, working capital, venture capital activities, and business finance brokerage services. This wide range of services suggests they want to be a complete financial partner rather than just a simple trading platform.

Their business philosophy focuses on always checking technology and making trade processes better. The broker says they provide both their own technology solutions and use outside technology companies to make client trading experiences better, but specific details about these tech innovations, platform features, and how they implement strategies are not explained in available documents. This Fogee review finds that while their focus on technology is clear, we don't have concrete information about what their platform can actually do.

Regulatory Jurisdiction: We don't have specific regulatory information in available sources, making it hard to know who oversees Fogee's operations or what compliance rules they follow.

Deposit and Withdrawal Methods: Available sources don't tell us about payment methods, how long processing takes, or fee structures for funding and withdrawal processes.

Minimum Deposit Requirements: We don't have documented information about specific minimum deposit amounts for different account types.

Bonus and Promotions: Details about welcome bonuses, ongoing promotions, or reward programs are not provided in available materials.

Tradeable Assets: The range of financial tools, currency pairs, commodities, indices, or other assets available for trading is not listed in source documents.

Cost Structure: We don't have specific information about spreads, commissions, overnight fees, and other trading costs, though the broker mentions offering competitive rates and fees for their services.

Leverage Ratios: Maximum leverage offerings and margin requirements are not listed in available information.

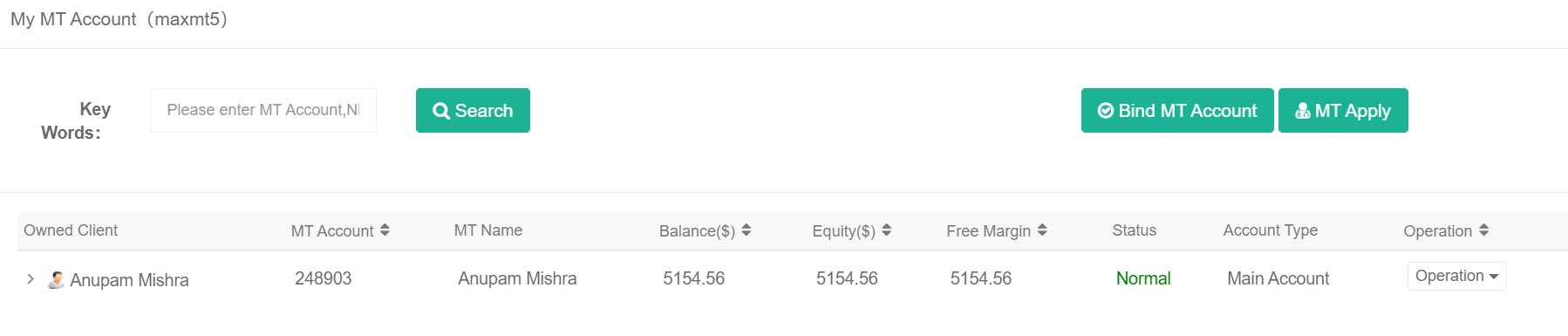

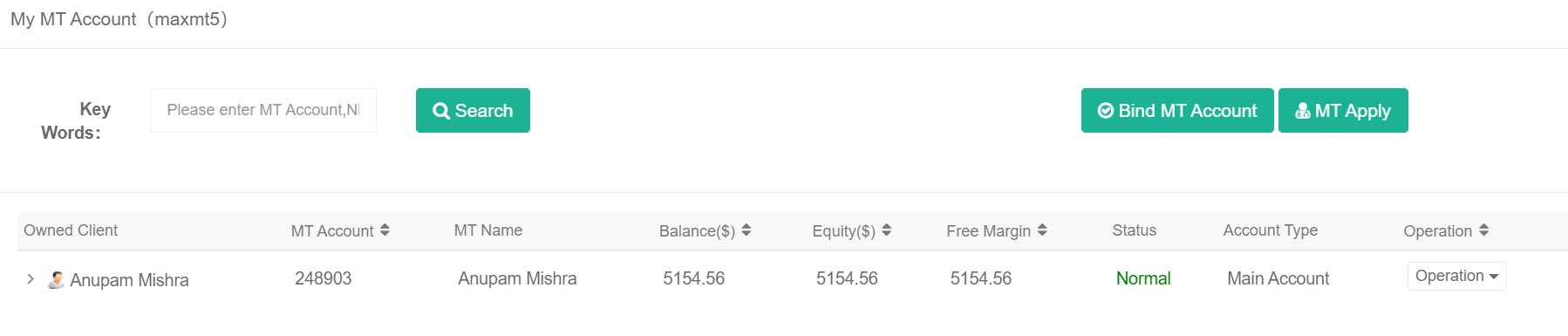

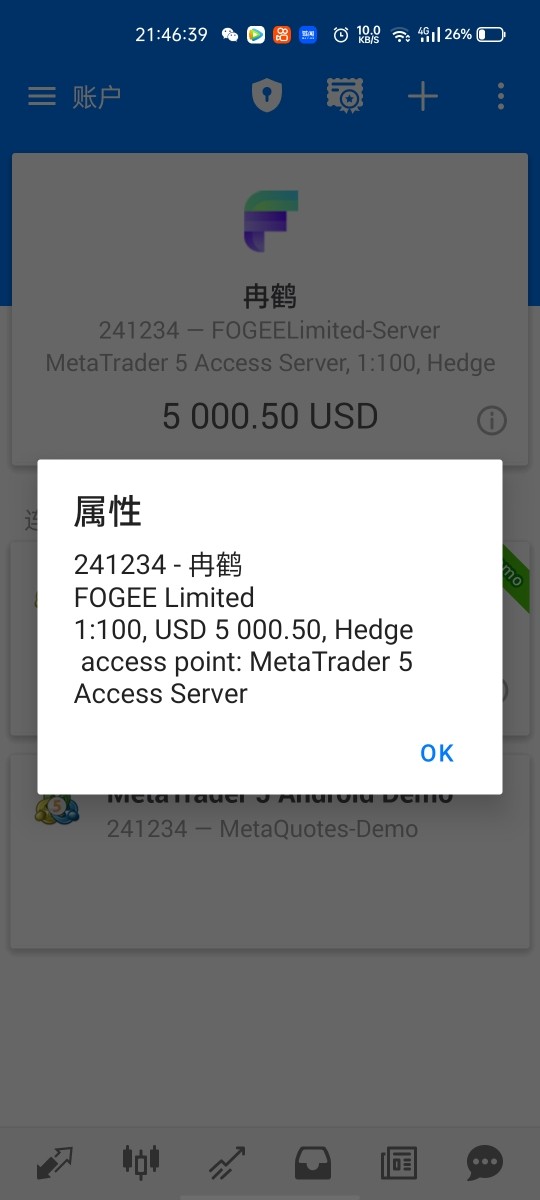

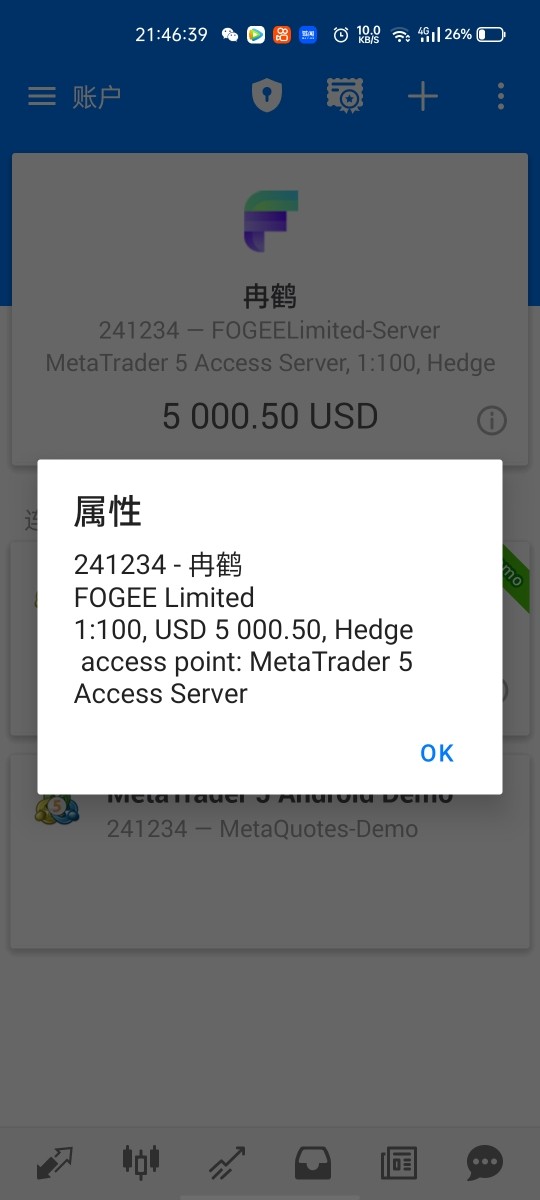

Platform Options: Details about trading platform types, software providers, or platform-specific features are not documented in accessible sources.

Geographic Restrictions: Information about restricted countries or regional limitations is not provided in available materials.

Customer Support Languages: Supported languages for customer service are not listed in source documents.

This Fogee review shows significant information gaps that would typically be essential for trader evaluation and decision-making processes.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Fogee's account conditions has big limitations because we don't have specific information in available sources. Normal account condition checks would typically look at account type varieties, minimum deposit requirements, account features, and special offerings such as Islamic accounts or professional trader categories.

Without access to detailed account information, it's impossible to know if Fogee offers different account levels, what benefits different account types might provide, or how their account conditions compare to industry standards. The lack of information about minimum deposit requirements prevents us from knowing if the platform is accessible for different trader types, from retail beginners to big institutional clients.

Account opening procedures, verification requirements, and documentation needs are not detailed in available sources. This absence of information makes it difficult for potential clients to understand the sign-up process or prepare necessary documents for account setup.

The Fogee review process shows that while the broker emphasizes competitive rates and fees, specific account-related costs, maintenance fees, or inactivity charges are not documented. This information gap significantly impacts our ability to provide a complete account conditions evaluation.

Assessment of Fogee's trading tools and resources has similar information limitations. Available sources do not detail the specific trading tools, analytical resources, or educational materials that the broker provides to its clients.

Modern forex brokers typically offer economic calendars, market analysis, trading signals, technical analysis tools, and educational resources ranging from webinars to complete trading courses. The absence of detailed information about Fogee's offerings in these areas makes it challenging to evaluate their commitment to trader development and support.

Research capabilities, market commentary, and analytical resources are not listed in available documentation. Similarly, information about automated trading support, API access, or third-party tool integration is not provided.

The broker's emphasis on technology suggests potential strength in this area, but without specific details about tool offerings, platform capabilities, or resource availability, a complete evaluation cannot be finished based on available information.

Customer Service and Support Analysis

Customer service evaluation for Fogee faces significant constraints due to limited information availability. Essential customer support elements such as contact methods, availability hours, response times, and service quality indicators are not detailed in accessible sources.

Modern forex brokers typically provide multiple contact channels including live chat, email support, phone assistance, and sometimes social media engagement. The languages supported, regional availability, and specialized support for different client segments are important factors that remain unspecified for Fogee.

Response time expectations, problem resolution procedures, and escalation processes are not documented in available materials. The quality of customer service often significantly impacts trader satisfaction and platform usability, making this information gap particularly relevant for potential clients.

Without access to customer feedback, service quality metrics, or support capability details, this aspect of the Fogee evaluation remains incomplete based on currently available information.

Trading Experience Analysis

The trading experience assessment for Fogee encounters substantial information limitations. Critical factors such as platform stability, execution speed, order processing quality, and overall trading environment characteristics are not detailed in available sources.

Platform performance metrics, including uptime statistics, execution speeds, slippage rates, and requote frequencies, are essential for evaluating trading experience quality. These technical performance indicators are not provided in accessible documentation.

Mobile trading capabilities, platform functionality, order types supported, and trading interface design details are not specified. The broker's technology emphasis suggests potential strengths in platform development, but specific capabilities and user experience features remain undocumented.

Trading conditions such as execution models, liquidity provision, and market access details are not clarified in available information. This Fogee review finds that while technological focus is evident, concrete trading experience details are insufficient for comprehensive evaluation.

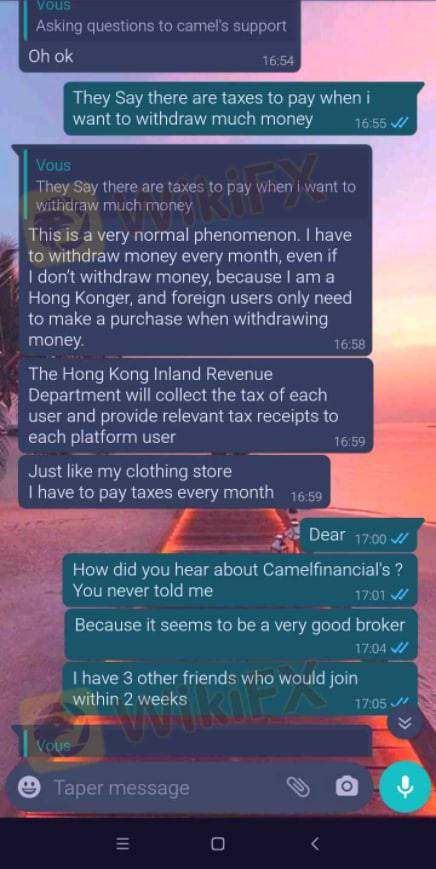

Trust Factor Analysis

Trust factor evaluation for Fogee faces significant challenges due to limited regulatory and transparency information. Regulatory compliance, licensing details, and oversight mechanisms are not comprehensively documented in available sources.

Fund security measures, segregation policies, and client protection protocols are not specified. These elements are crucial for establishing broker trustworthiness and ensuring client fund safety.

Company transparency regarding ownership structure, financial stability, and operational history is limited in accessible information. Industry reputation, regulatory standing, and any historical compliance issues are not detailed.

The absence of specific regulatory information makes it difficult to verify the broker's compliance with industry standards and client protection requirements. This information gap significantly impacts the ability to assess Fogee's trustworthiness and regulatory standing.

User Experience Analysis

User experience evaluation for Fogee is constrained by limited information about client satisfaction, interface design, and operational procedures. Overall user satisfaction metrics, feedback summaries, and experience quality indicators are not provided in available sources.

Registration and verification processes, account setup procedures, and user onboarding experiences are not detailed. These factors significantly impact initial user impressions and platform accessibility.

Interface design quality, platform usability, and navigation efficiency details are not specified. Fund management procedures, deposit and withdrawal experiences, and account management capabilities are not documented in accessible materials.

Common user concerns, feedback patterns, and satisfaction levels remain unknown based on available information. This limits the ability to provide comprehensive user experience guidance for potential Fogee clients.

Conclusion

This Fogee review reveals a broker that positions itself within the technology-focused segment of the financial services industry. The company emphasizes the integration of advanced technological solutions with financial market operations. While FCF Group Holdings' commitment to technology-driven trading experiences and competitive fee structures presents potentially attractive features, the significant lack of detailed information about trading conditions, regulatory compliance, and operational specifics creates substantial evaluation challenges.

The broker may appeal to traders seeking technology-enhanced trading experiences, particularly those interested in comprehensive financial services beyond traditional forex trading. However, the absence of crucial details regarding regulatory oversight, specific trading conditions, and platform capabilities makes it difficult to recommend Fogee without additional information verification.

Potential clients should conduct thorough research, seek additional information directly from the broker, and verify regulatory compliance in their jurisdiction before committing to Fogee's services. The information gaps identified in this review highlight the importance of comprehensive broker transparency for informed trading decisions.