DIFX 2025 Review: Everything You Need to Know

Executive Summary

This difx review provides a comprehensive analysis of DIFX. DIFX stands for Digital Financial Exchange, which is a cross-asset trading platform that launched in September 2021. Based in Croatia, DIFX positions itself as a revolutionary exchange. The platform bridges the gap between traditional and cryptocurrency trading through its fully insured trading services. The platform supports multiple asset classes including digital assets such as cryptocurrencies, tokens, and DeFi products. It also offers traditional assets like stocks, commodities, indices, and futures.

According to available information, DIFX has gained attention for its unique ecosystem. This ecosystem allows users to trade across various asset classes under one platform. The exchange reportedly received a grade A security rating. It also climbed the ranks among top exchanges within two weeks of its CMC listing. However, user concerns regarding safety and legitimacy have emerged. These concerns exist particularly due to limited regulatory transparency. This review aims to provide potential traders with essential information about DIFX's features, reliability, and overall trading experience. The goal is to help make informed decisions about whether this platform suits their trading needs.

Important Notice

This difx review is based on publicly available information and user feedback as of 2025. Due to the limited regulatory information provided by DIFX, users should exercise caution. They should also conduct their own due diligence before engaging with the platform. Different jurisdictions may have varying legal and tax implications. These implications apply to trading on unregulated or insufficiently regulated platforms.

The evaluation presented in this review may contain information gaps. These gaps exist due to the platform's limited transparency regarding certain operational aspects. Traders are advised to verify all information independently. They should also consider the regulatory environment in their respective regions before making any trading decisions.

Rating Framework

Broker Overview

DIFX, officially known as Digital Financial Exchange, was established in September 2021. The company is headquartered in Croatia. The company has positioned itself as an innovative cross-asset trading platform. This platform is designed to bridge the traditional gap between conventional financial markets and the emerging cryptocurrency ecosystem. According to reports, DIFX operates as a fully insured trading platform. This represents one of its key selling points in an industry where security concerns are paramount.

The platform's business model centers around providing a unified trading environment. In this environment, users can access multiple asset classes without the need to maintain accounts across different specialized platforms. This approach aims to simplify the trading experience for both institutional and retail investors. These investors seek exposure to diverse financial instruments.

DIFX operates through its proprietary Digital Financial Exchange platform. It supports an extensive range of asset classes that span both digital and traditional markets. The digital assets category includes cryptocurrencies, various tokens, and DeFi products. The traditional assets encompass stocks, commodities, indices, and futures contracts. This comprehensive approach to asset coverage distinguishes DIFX from many competitors. Many competitors typically specialize in either traditional or digital assets exclusively. However, specific regulatory oversight information remains limited in available documentation. This has contributed to user concerns about the platform's legitimacy and operational framework.

Regulatory Status: Available information does not specify particular regulatory jurisdictions or oversight bodies governing DIFX operations. This has contributed to user concerns about legitimacy and safety.

Deposit and Withdrawal Methods: Specific information about supported deposit and withdrawal methods is not detailed in available source materials.

Minimum Deposit Requirements: The minimum deposit amount required to open and maintain an account with DIFX is not specified in reviewed documentation.

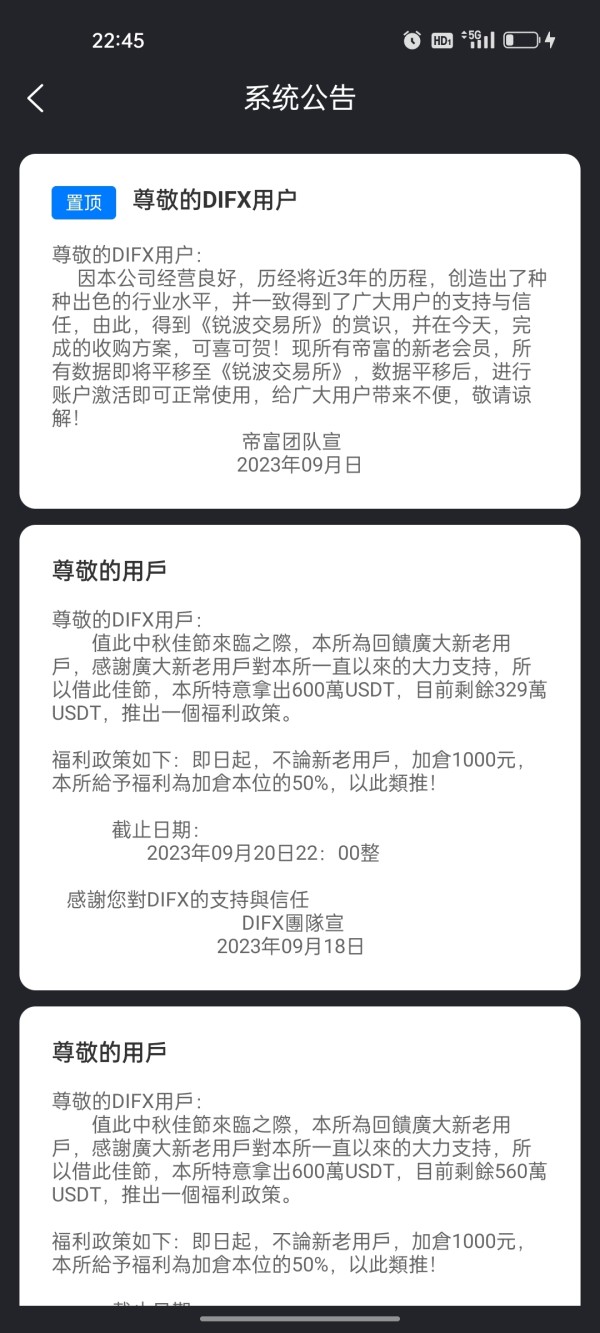

Bonuses and Promotions: Current promotional offers, welcome bonuses, or ongoing incentive programs are not detailed in available information.

Tradeable Assets: DIFX supports a comprehensive range of tradeable assets. These include digital assets such as cryptocurrencies, tokens, and DeFi products. The platform also offers traditional financial instruments including stocks, commodities, indices, and futures contracts.

Cost Structure: Specific information regarding spreads, commissions, overnight fees, and other trading costs is not provided in available source materials. This makes it difficult to assess the platform's competitiveness in terms of pricing.

Leverage Ratios: Maximum leverage ratios offered across different asset classes are not specified in reviewed documentation.

Platform Options: The primary trading platform is the proprietary DIFX system. Details about additional platform options or third-party integrations are not available.

Geographic Restrictions: Specific information about regional limitations or restricted jurisdictions is not detailed in available materials.

Customer Support Languages: The range of languages supported by customer service teams is not specified in reviewed documentation.

This difx review notes that the limited availability of detailed operational information represents a significant concern. Potential users seeking comprehensive platform evaluation face this challenge.

Detailed Rating Analysis

Account Conditions Analysis

The specific details regarding DIFX account conditions remain largely undisclosed in available documentation. This makes it challenging to provide a comprehensive assessment of this crucial aspect. Without clear information about account types, minimum deposit requirements, or account opening procedures, potential users face uncertainty. They experience this uncertainty when considering the platform.

The absence of detailed account condition information represents a significant transparency gap. This gap affects user confidence. Most established brokers provide comprehensive details about their account structures. These details include different tier options, associated benefits, and qualification requirements. The lack of such information in DIFX's case raises questions. These questions concern the platform's commitment to transparency.

Account opening procedures, verification requirements, and ongoing account maintenance conditions are essential factors. Traders consider these factors when selecting a broker. Without access to this information, users cannot make informed comparisons with other platforms. They also cannot assess whether DIFX meets their specific trading needs and preferences.

The platform's failure to provide clear account condition details in readily available materials suggests several possibilities. These include either inadequate marketing communication or potential concerns about competitive positioning. This difx review emphasizes the importance of obtaining detailed account information directly from the platform. Users should do this before making any commitment to trade.

Available source materials do not provide specific information about the trading tools and analytical resources offered by DIFX. This creates a significant information gap for potential users evaluating the platform's capabilities. Modern traders typically expect access to comprehensive charting tools, technical indicators, market analysis, and educational resources. These resources support their trading decisions.

The absence of detailed information about research and analysis resources makes assessment difficult. Users cannot determine whether DIFX provides the analytical depth required by serious traders. Most competitive platforms offer market commentary, economic calendars, technical analysis tools, and educational materials. These offerings help users improve their trading skills and market understanding.

Educational resources represent a particularly important aspect for newer traders. These traders require guidance on market dynamics, trading strategies, and risk management techniques. Without information about DIFX's educational offerings, potential users cannot determine whether the platform provides adequate support. This support would be for skill development.

Automated trading capabilities, API access, and third-party tool integrations are increasingly important features. Traders seek these features in modern platforms. The lack of information about these capabilities in available documentation suggests either limited offerings or insufficient communication. The communication would be about available features.

Customer Service and Support Analysis

Customer service and support information for DIFX is notably absent from available documentation. This creates concerns about the platform's commitment to user assistance and problem resolution. Effective customer support represents a critical component of any trading platform. This is particularly true for users who may encounter technical issues or require assistance with account management.

The availability of multiple communication channels typically indicates a broker's dedication to customer service excellence. These channels include live chat, email support, and telephone assistance. Without information about DIFX's support channels, users cannot assess the accessibility of assistance. They cannot determine this when assistance is needed.

Response times and service quality metrics are essential factors. These factors distinguish superior brokers from those offering basic support services. The absence of such information makes it impossible to evaluate DIFX's performance in this crucial area. Additionally, multilingual support capabilities are important for international users. However, no information is available regarding language options.

Operating hours for customer support services significantly impact user experience. This is particularly true for traders operating across different time zones. The lack of information about support availability raises questions. These questions concern the platform's ability to provide timely assistance to its global user base.

Trading Experience Analysis

The trading experience offered by DIFX cannot be thoroughly evaluated based on available information. Specific details about platform performance, execution quality, and user interface design are not provided in source materials. Platform stability and execution speed represent fundamental requirements for effective trading. This is particularly true in volatile markets where timing is crucial.

Order execution quality directly impacts trading profitability but remains unspecified in available documentation. This quality includes fill rates, slippage characteristics, and execution speed. Without this information, traders cannot assess whether DIFX meets professional execution standards. These standards are expected in modern trading environments.

The platform's functionality completeness represents another critical evaluation area. This includes advanced order types, risk management tools, and portfolio management features. However, available materials do not provide sufficient detail about these capabilities. This makes comprehensive assessment impossible.

Mobile trading capabilities have become essential for modern traders. These traders require market access while away from desktop computers. The absence of information about DIFX's mobile offerings represents another significant information gap. This gap affects user decision-making. This difx review emphasizes the importance of understanding platform capabilities. Users should understand these before committing to any trading relationship.

Trust and Reliability Analysis

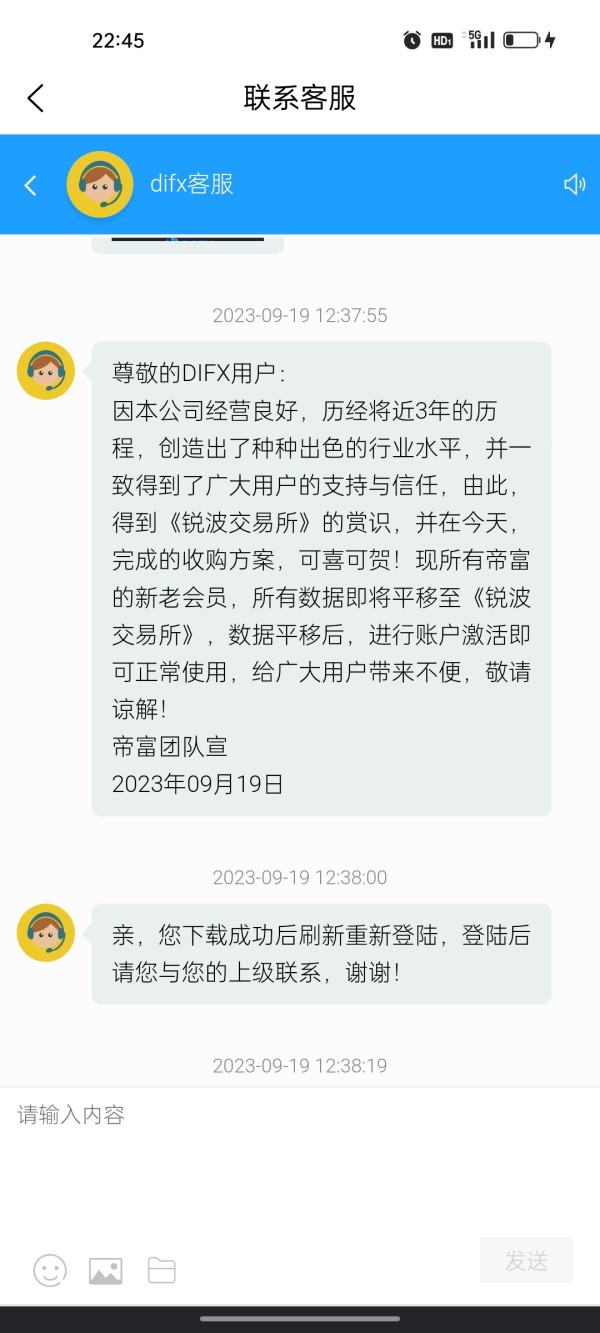

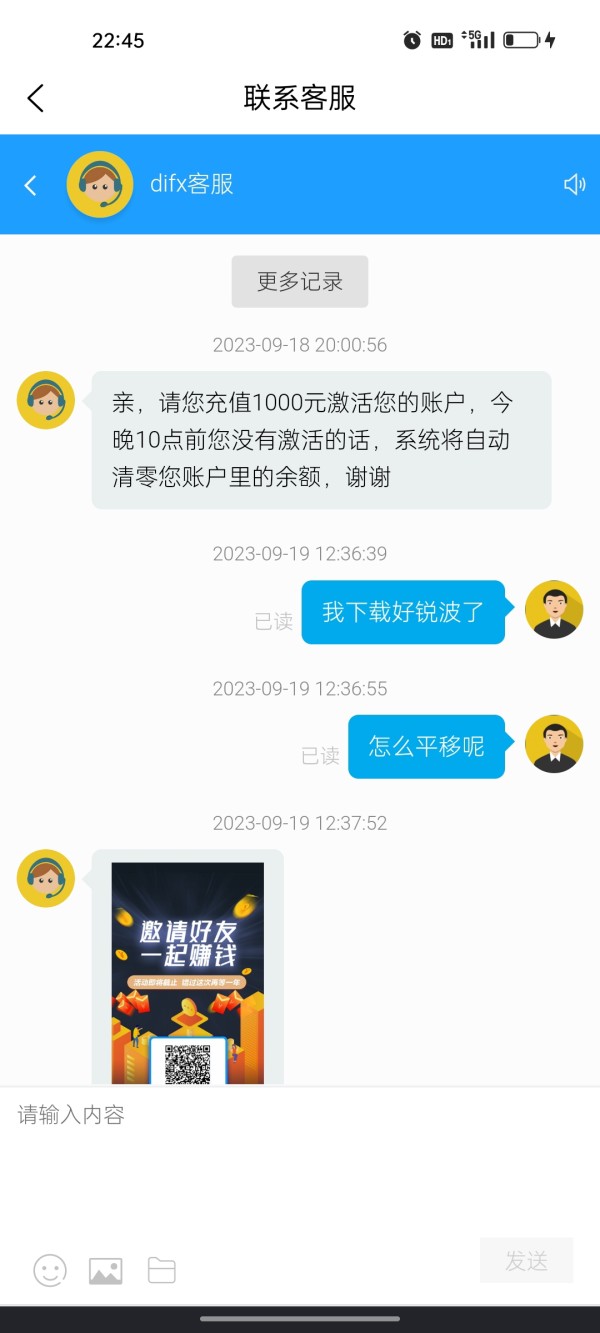

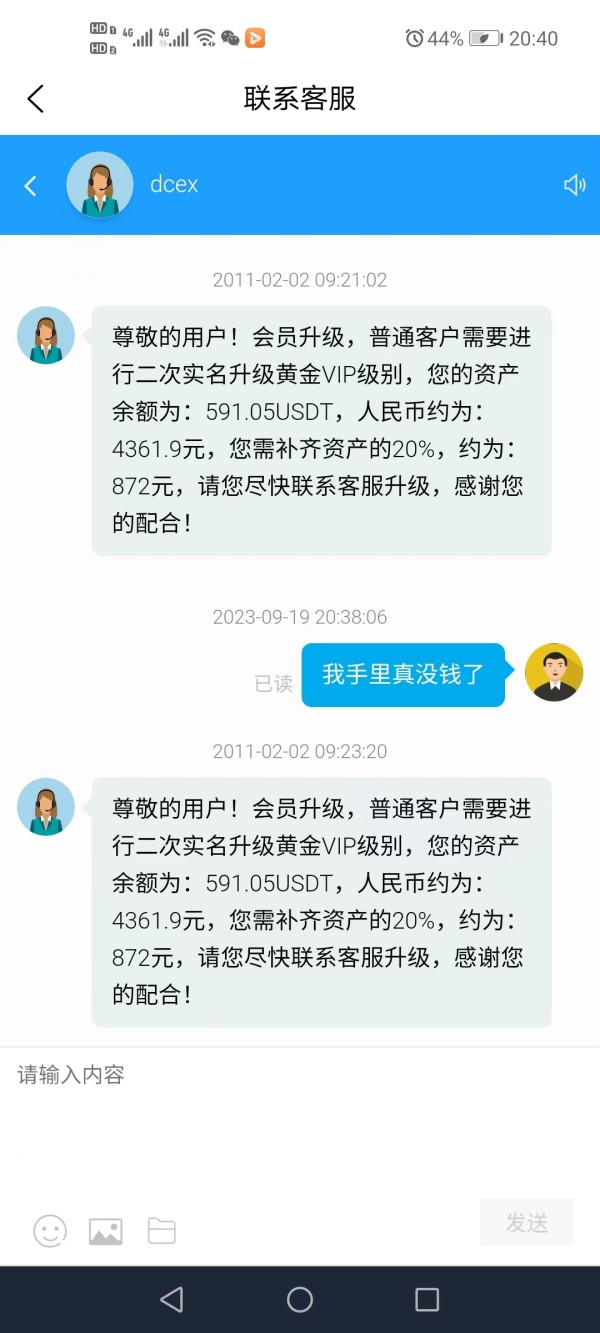

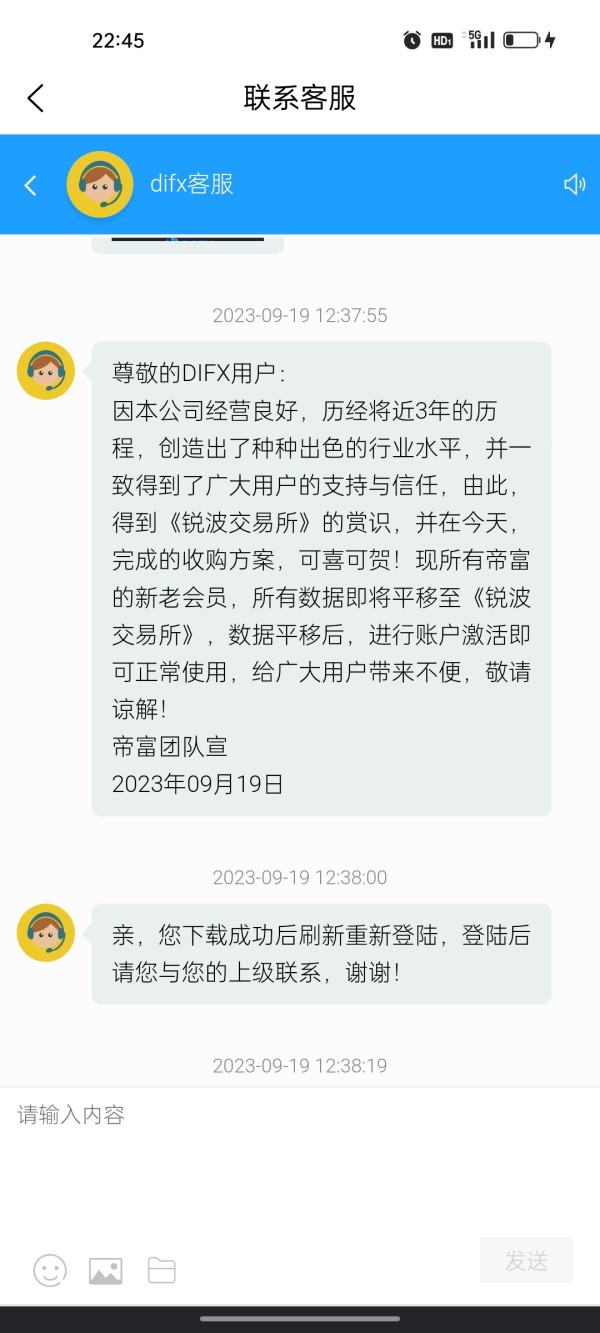

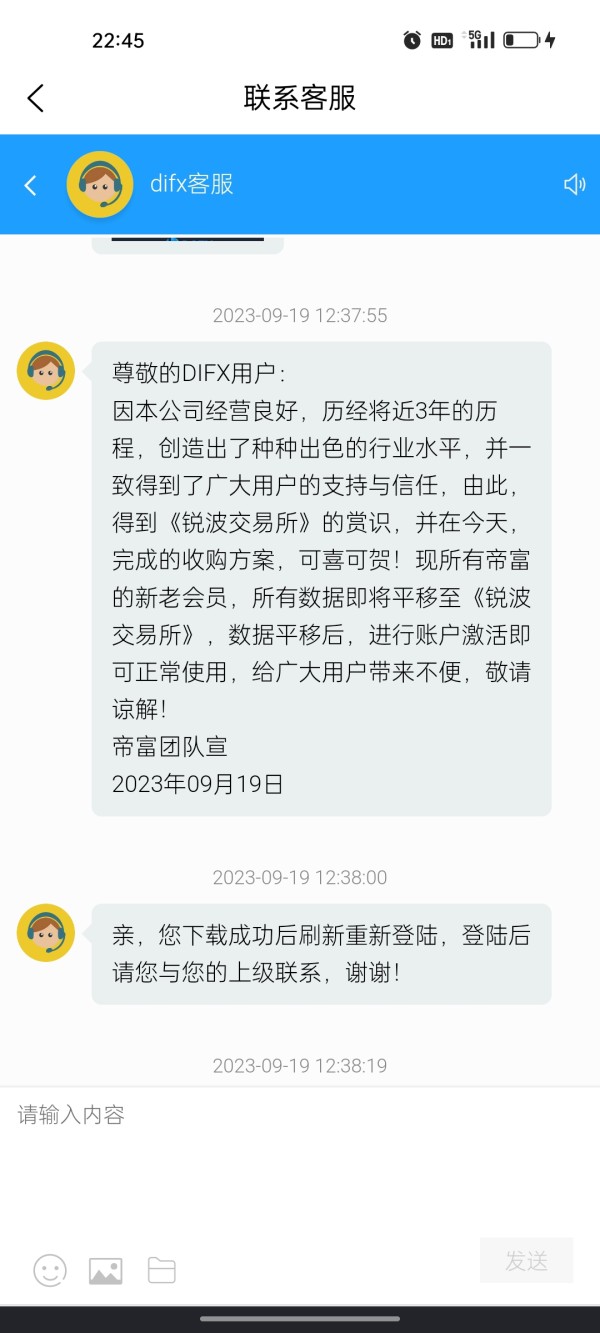

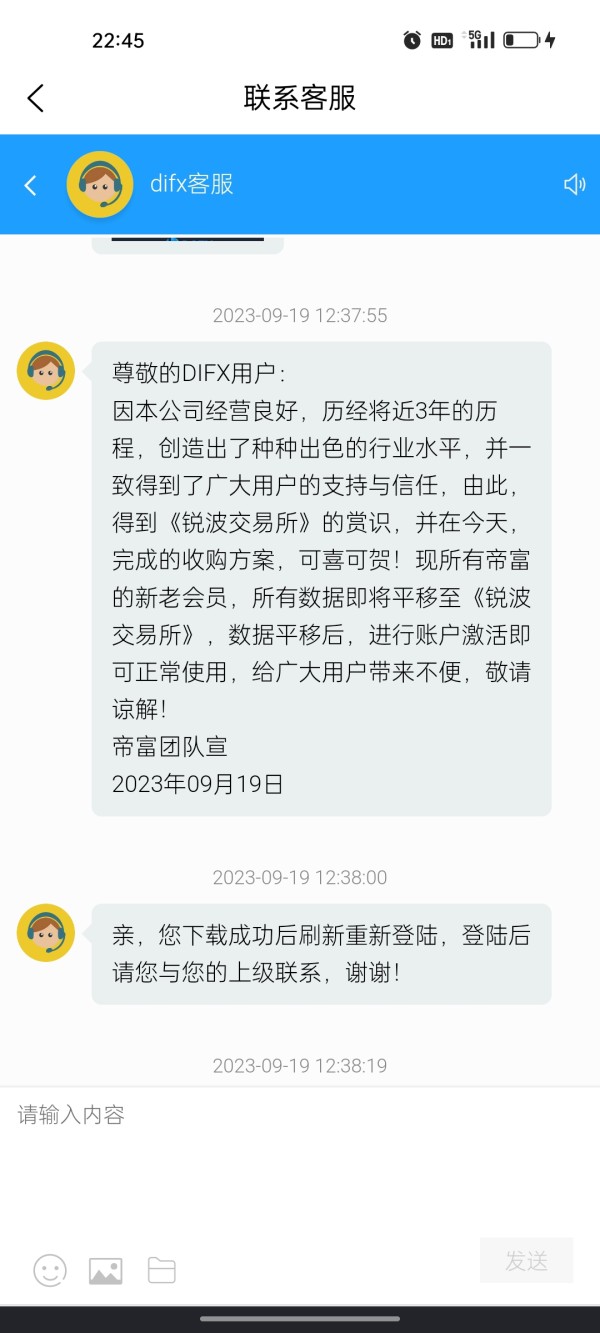

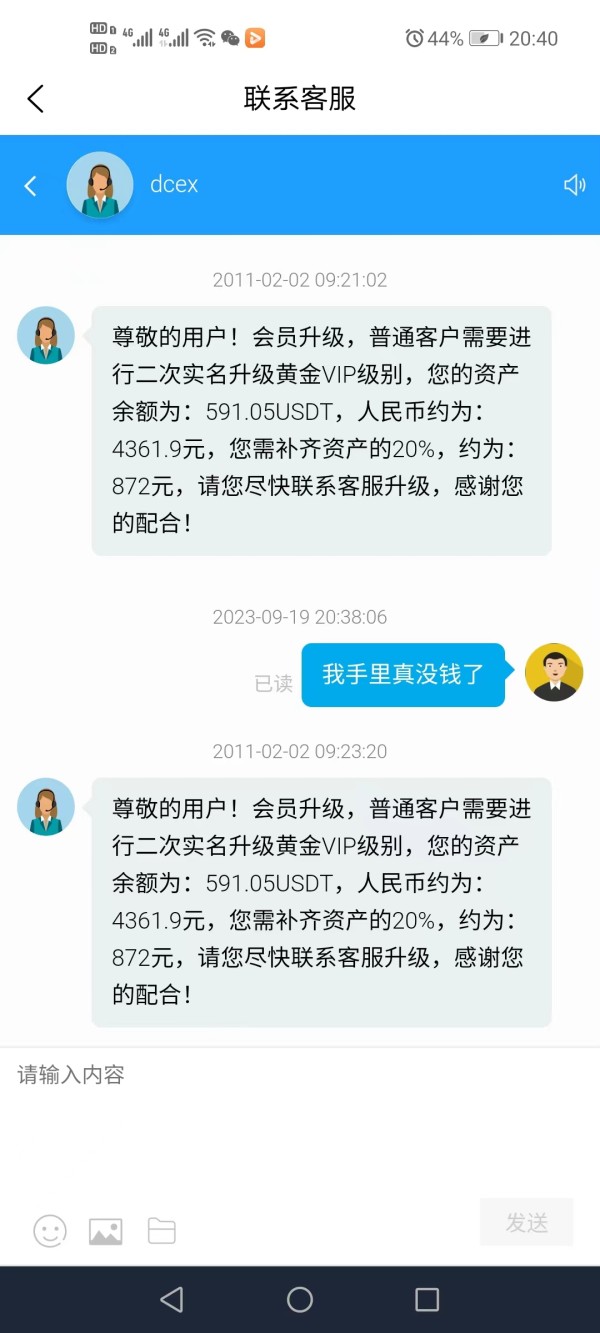

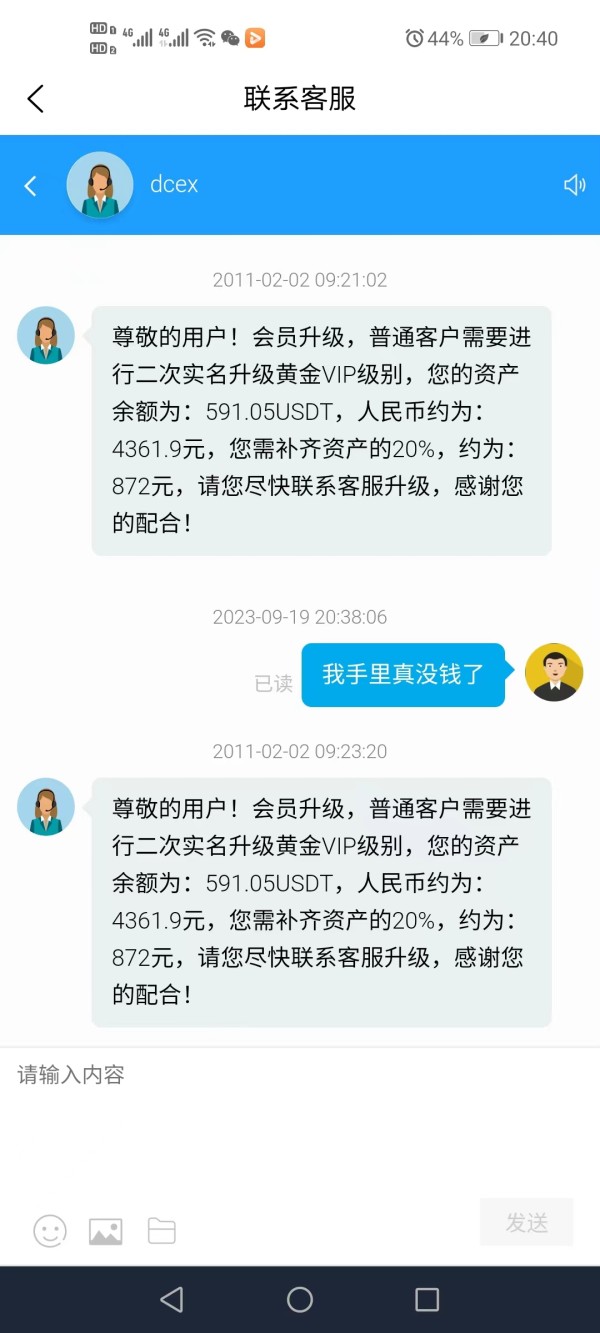

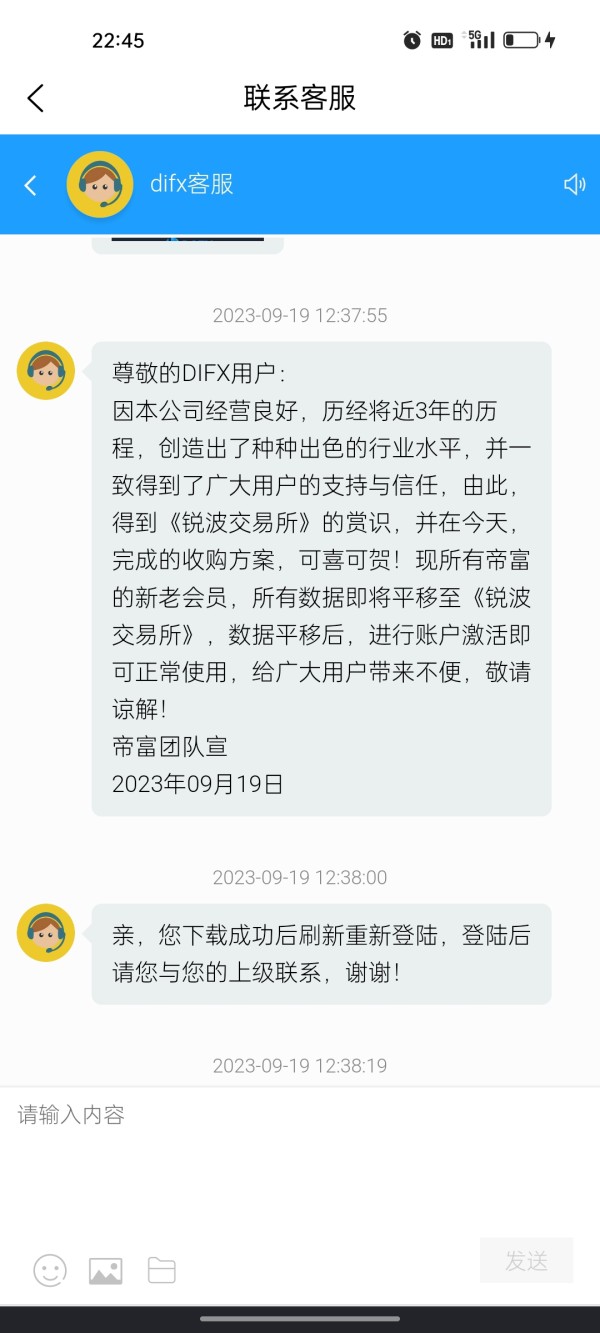

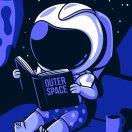

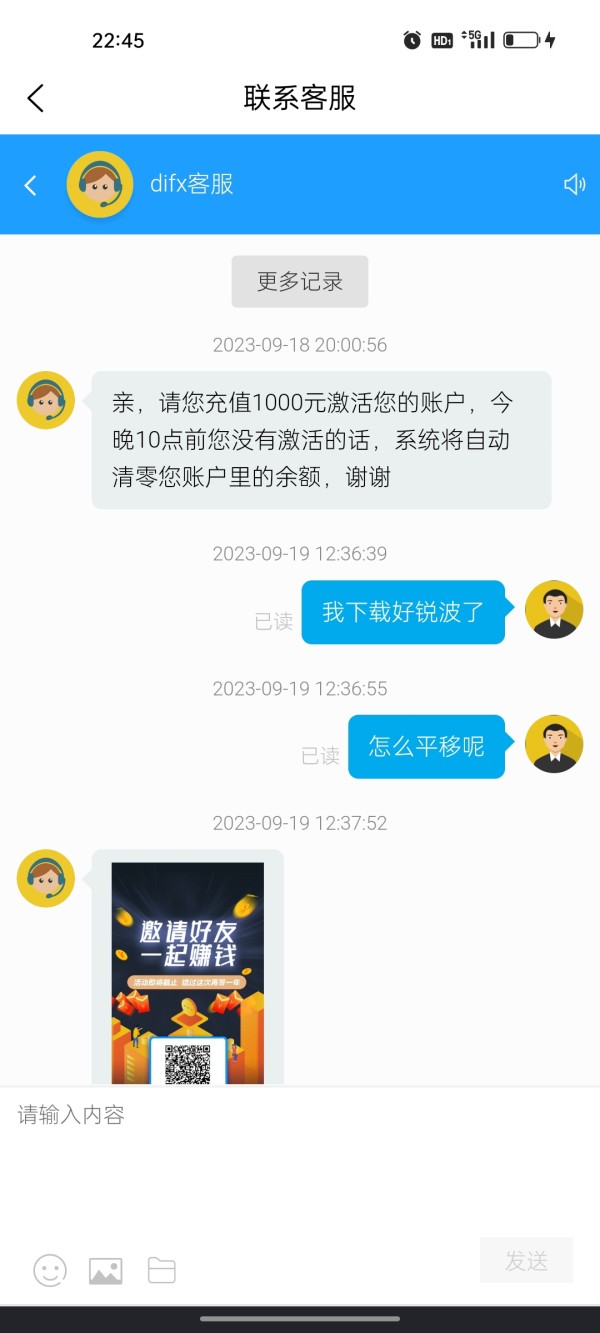

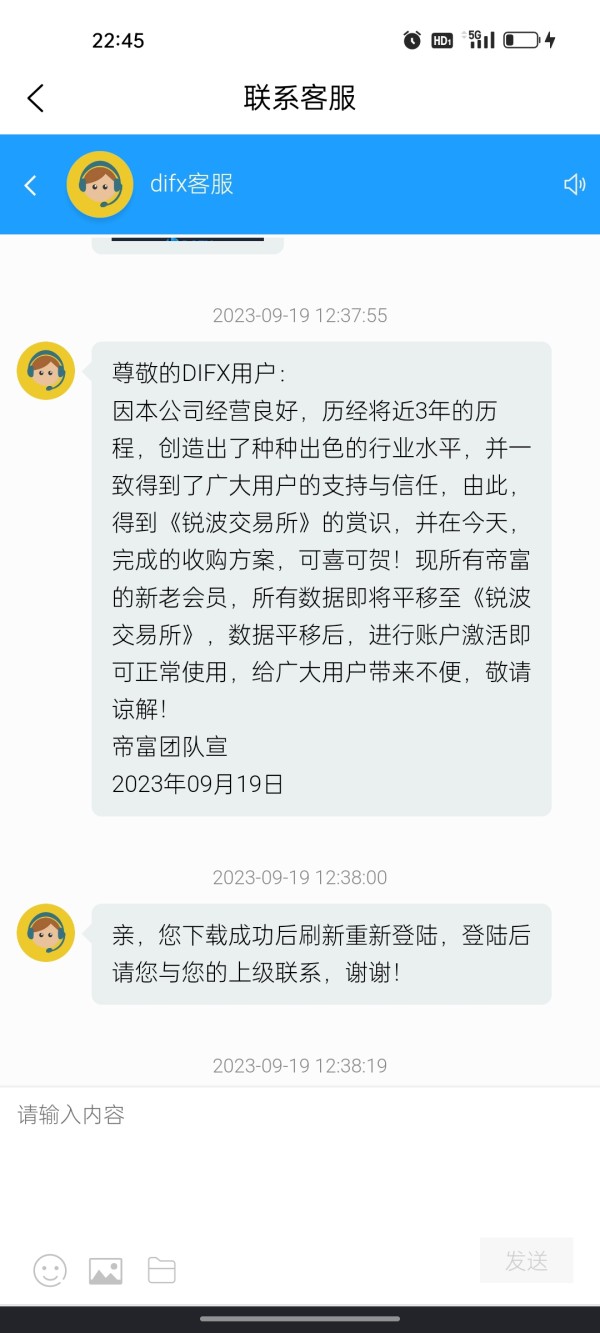

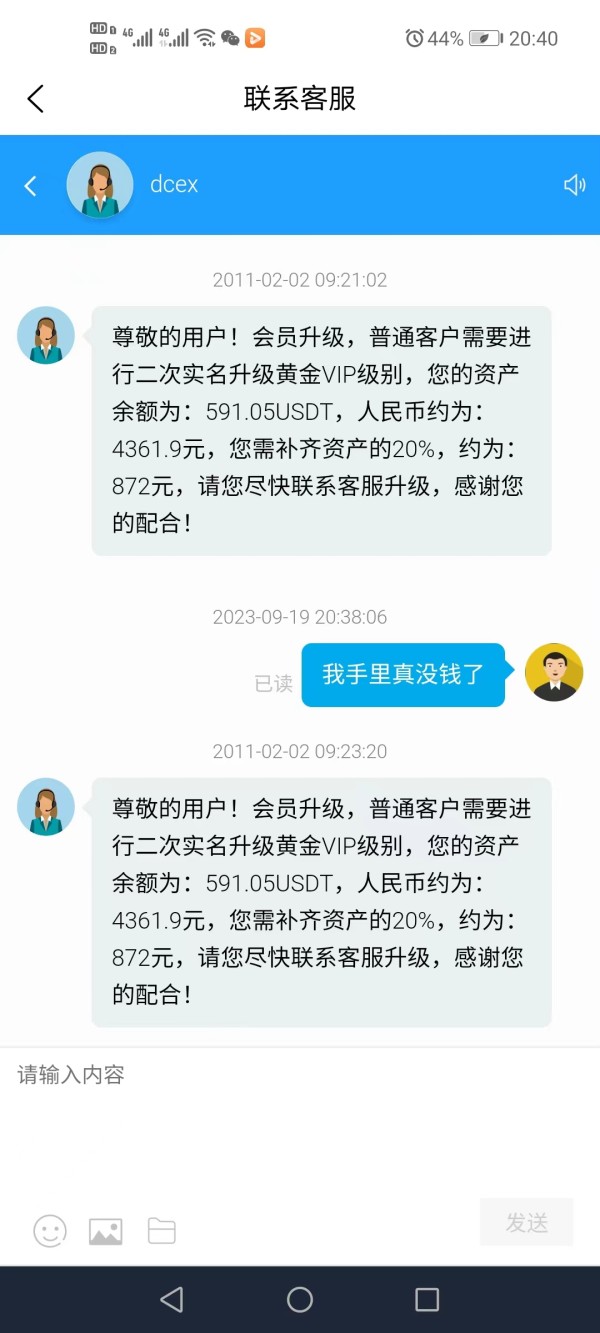

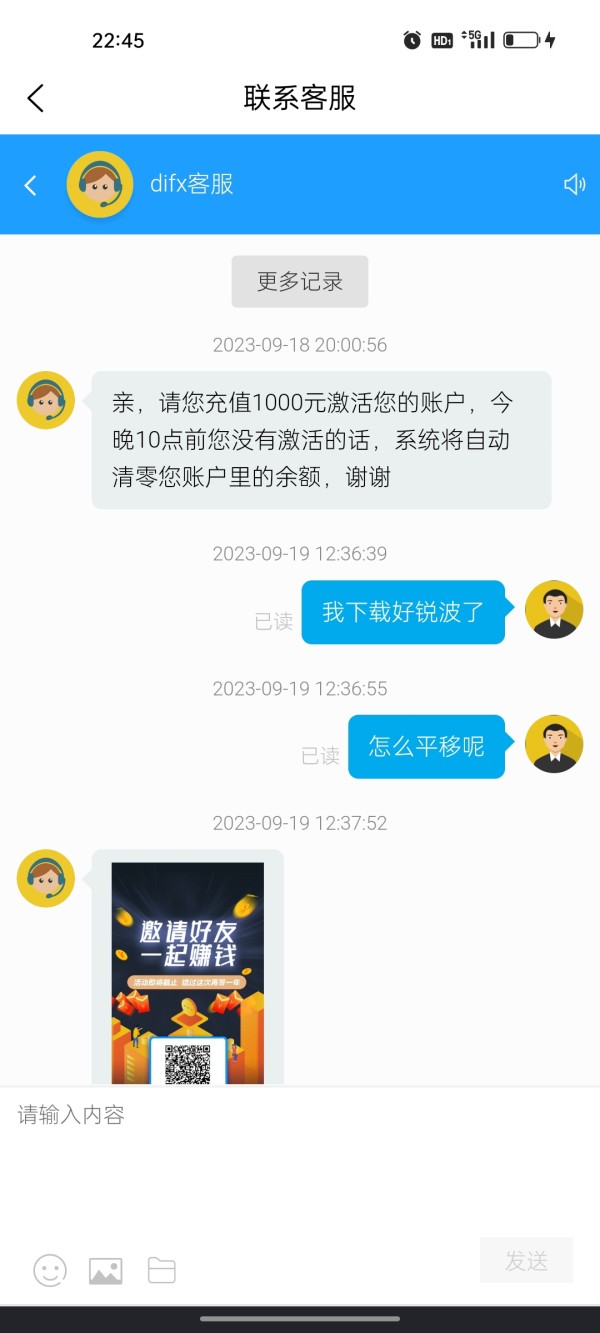

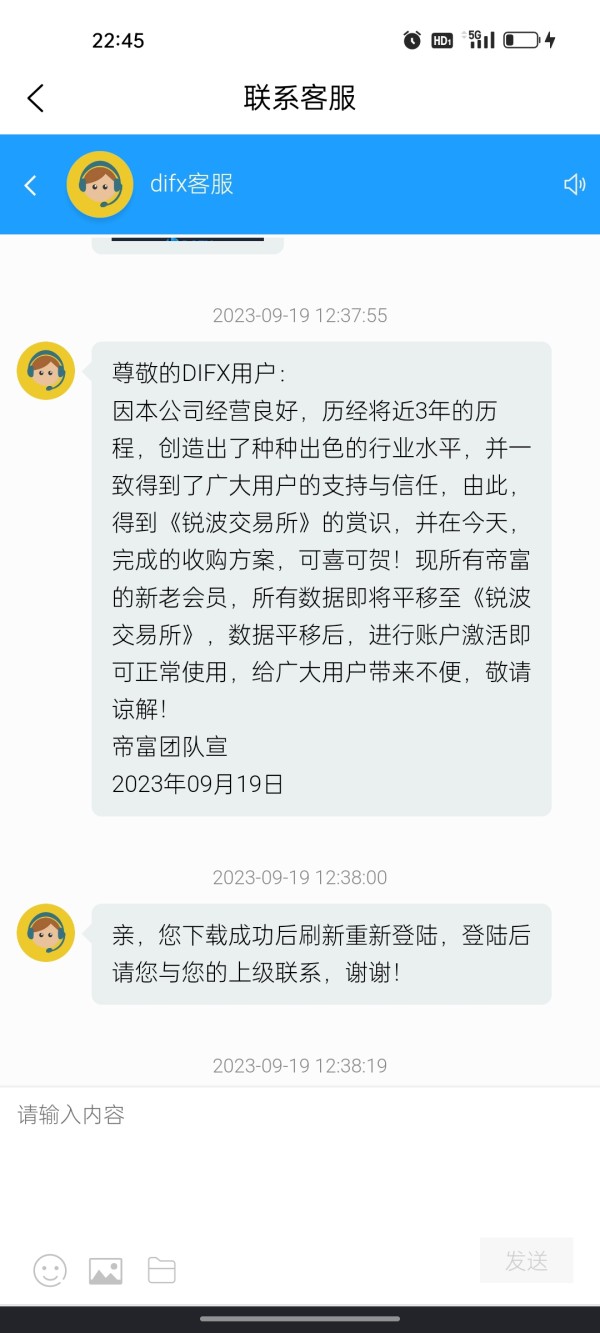

Trust and reliability concerns represent the most significant challenges facing DIFX. These concerns are based on available information and user feedback. The platform's limited regulatory transparency has generated user concerns about safety and legitimacy. This directly impacts its credibility in the competitive trading industry.

Regulatory oversight provides essential protection for traders. It also serves as a key indicator of platform reliability. The absence of clear regulatory information in available documentation raises questions. These questions concern DIFX's compliance with international financial standards and user protection measures. Established brokers typically prominently display their regulatory credentials. They do this to build user confidence.

Fund safety measures represent critical trust factors that remain unspecified in available materials. These measures include segregated client accounts, deposit insurance, and compensation schemes. Without clear information about how client funds are protected, users face uncertainty. This uncertainty concerns the security of their investments.

Company transparency regarding ownership, management, and operational procedures contributes significantly to trust building. The limited availability of such information about DIFX creates additional concerns. These concerns affect potential users seeking assurance about the platform's stability and long-term viability. User feedback indicating concerns about safety and legitimacy further compounds these trust-related challenges.

User Experience Analysis

Comprehensive user experience evaluation for DIFX is limited by the absence of detailed user feedback and interface information. This information is missing from available source materials. Overall user satisfaction typically depends on factors including platform ease of use, registration efficiency, and operational reliability. None of these factors are adequately documented.

Interface design and usability represent crucial factors. These factors determine whether traders can effectively navigate the platform and execute their strategies. Without specific information about DIFX's user interface design or usability features, potential users cannot assess whether the platform meets their operational preferences. They also cannot determine if it meets their requirements.

Registration and verification processes significantly impact initial user experience. However, specific details about DIFX's onboarding procedures are not available in reviewed materials. Efficient account setup and verification procedures typically indicate professional platform management. They also indicate user-focused design.

The existence of user concerns about safety and legitimacy suggests that some aspects of the user experience may be problematic. This is noted in available information. However, without comprehensive user feedback data, it remains difficult to identify specific areas of concern. It is also difficult to identify areas of excellence in DIFX's user experience delivery.

Conclusion

This difx review reveals a platform with ambitious goals but significant transparency challenges. These challenges impact user confidence and evaluation capabilities. DIFX presents itself as an innovative cross-asset trading platform offering access to both digital and traditional financial instruments under a unified ecosystem. This represents an attractive proposition for diversified traders.

However, the platform's limited regulatory transparency and the absence of detailed operational information create substantial concerns for potential users. The lack of specific details about account conditions, trading costs, customer support, and regulatory oversight makes comprehensive evaluation difficult. It also raises questions about the platform's commitment to transparency.

DIFX may appeal to traders interested in accessing both cryptocurrency and traditional asset markets through a single platform. This is particularly true for those attracted to its claimed insurance protections. However, the user concerns about safety and legitimacy, combined with limited regulatory information, suggest that potential users should exercise significant caution. They should also conduct thorough due diligence before engaging with the platform.