ONE FX Review 2

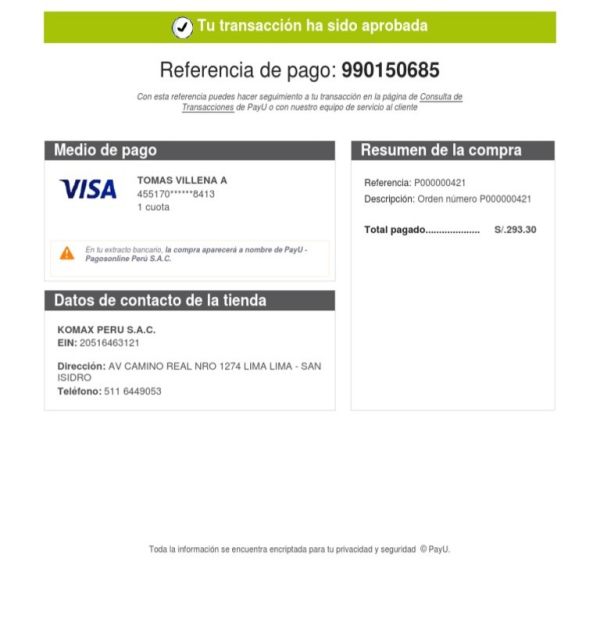

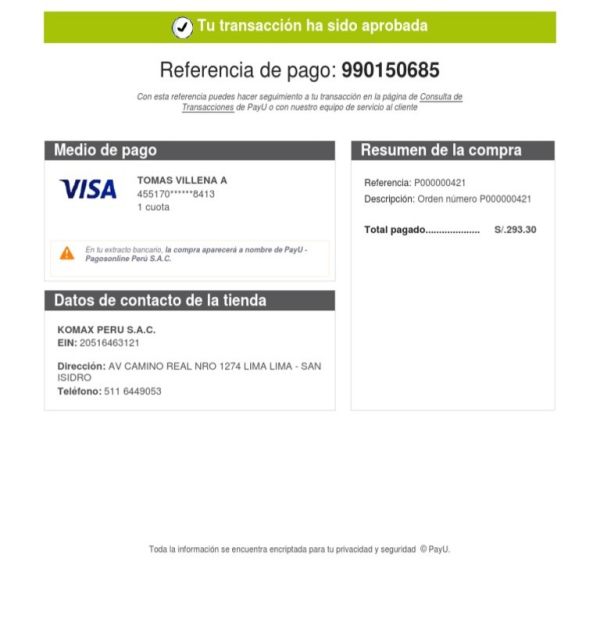

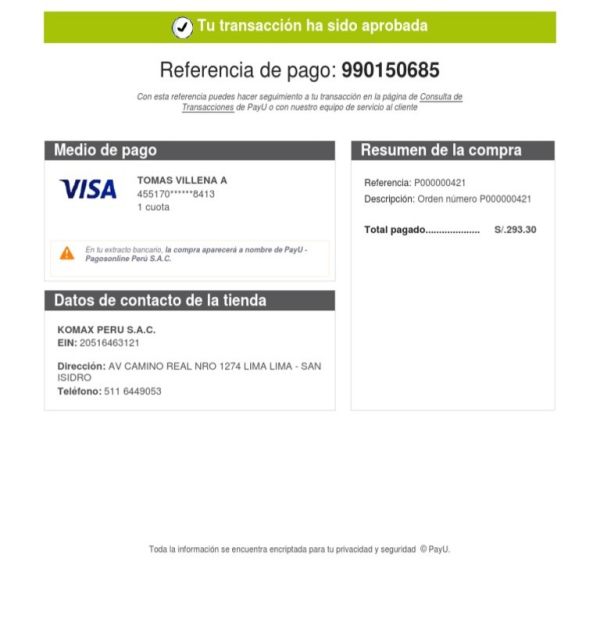

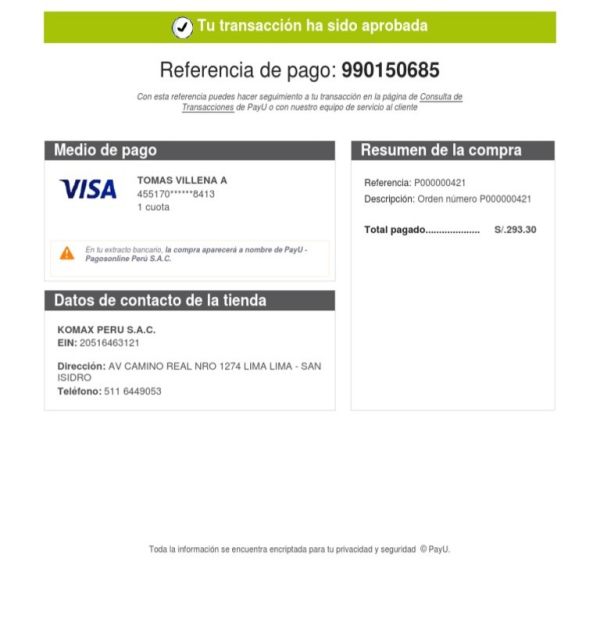

I lost $100 and they did not return $400 to me due to operation.

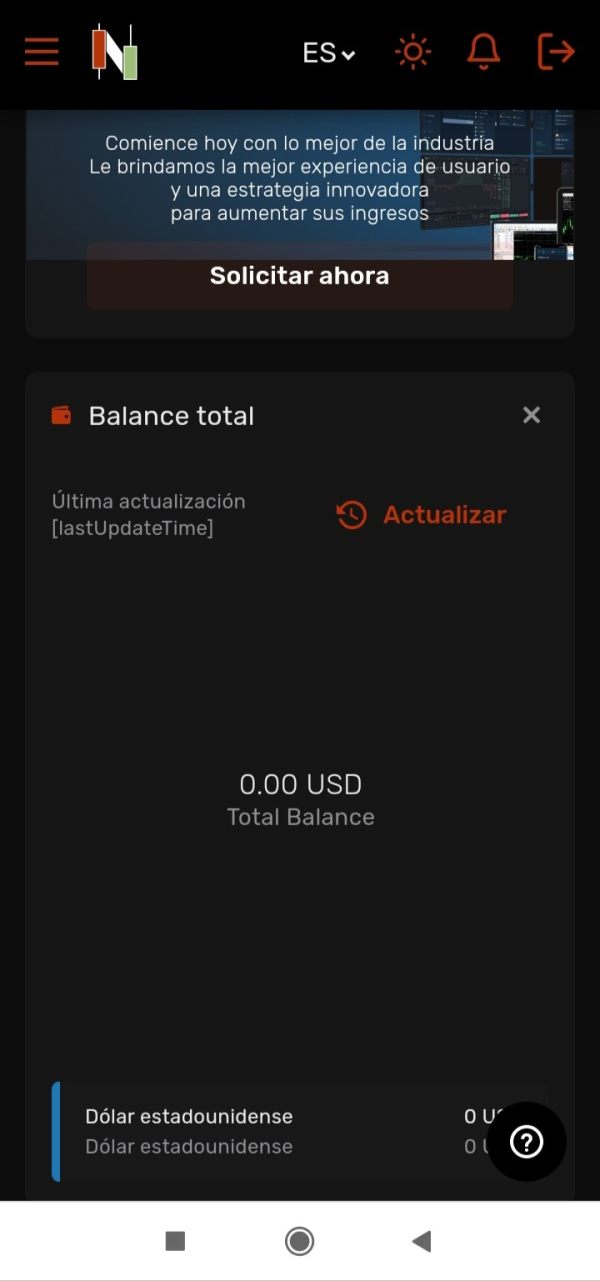

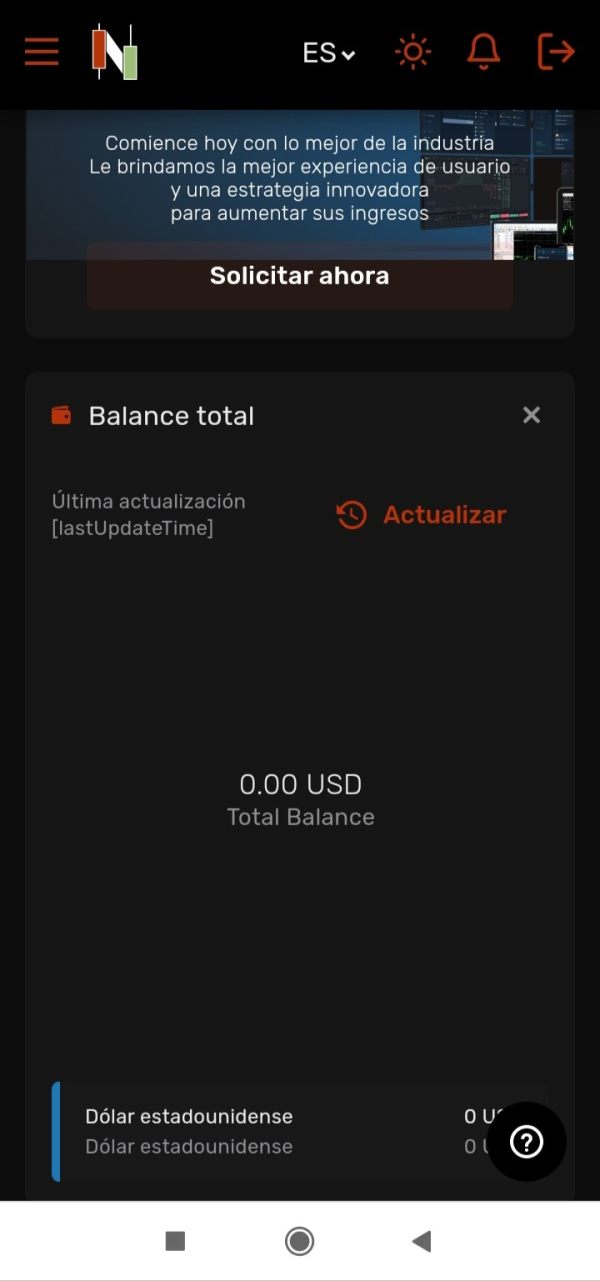

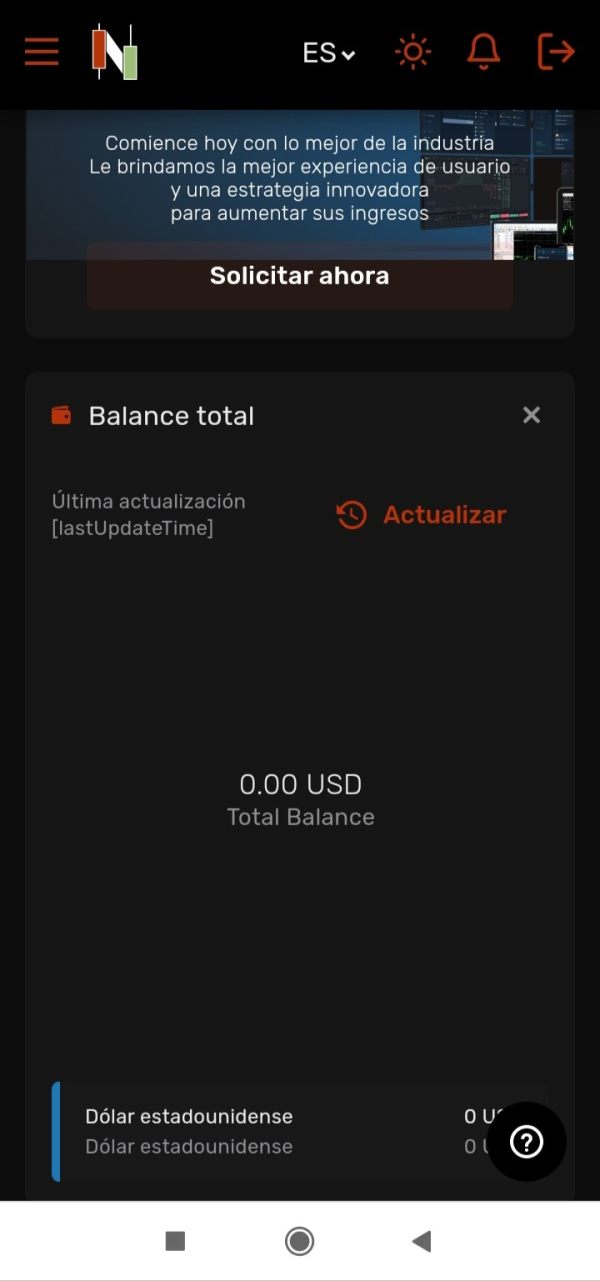

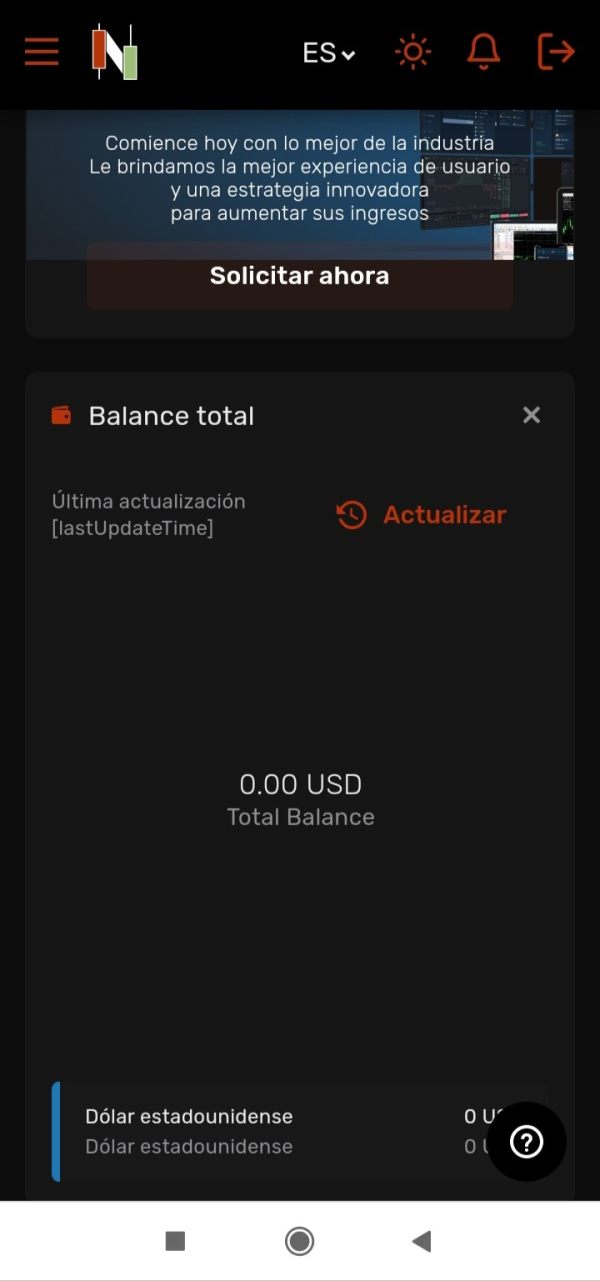

Unable to withdraw. My balance was zeroed by them.

ONE FX Forex Broker provides real users with * positive reviews, * neutral reviews and 2 exposure review!

I lost $100 and they did not return $400 to me due to operation.

Unable to withdraw. My balance was zeroed by them.

This detailed one fx review shows major concerns about this online forex broker. Potential traders should think carefully before opening an account with them. One FX says it follows rules from the UK Financial Conduct Authority and HM Revenue and Customs. However, our research found no matching records with these groups, which means we must call it a "SCAM" operation.

Even with these serious rule-breaking concerns, One FX offers some features that might attract new traders at first. These include a low minimum deposit of just $10 and access to both MT4 and MT5 trading platforms. The broker says it provides over 50 currency pairs plus indices, commodities, gold, silver, and oil trading across four account types. These account types are Micro, Mini, Standard, and VIP accounts.

User feedback shows a troubling picture with an average rating of 2.2 stars from 62 reviews. This rating shows that most customers are not happy with the service. The main target seems to be beginners and traders with little money who like the small deposit requirements. But the lack of proper oversight makes this broker wrong for serious trading.

One FX operates from Australia despite claiming UK regulation, according to available information. This creates more concerns about honesty and following rules properly. This one fx review strongly tells potential clients to be very careful when thinking about this broker.

Traders should know that One FX shows major rule differences that raise serious concerns about whether it's real. The broker claims to work under UK FCA and HMRC regulation, but our checking process found no matching records with these authorities. The actual business base seems to be in Australia. This creates a worrying mismatch between claimed and actual regulatory control.

This review uses publicly available information, user feedback from various trading communities, and regulatory database searches. The lack of checkable regulatory credentials and mostly negative user experiences form the base of our assessment. Potential clients should do their own research and think carefully about these findings before making any investment decisions.

| Criteria | Score | Rating Basis |

|---|---|---|

| Account Conditions | 4/10 | Low minimum deposit of $10, but lack of transparency in other trading conditions |

| Tools and Resources | 6/10 | Offers MT4 and MT5 platforms with multiple asset classes |

| Customer Service and Support | 3/10 | Predominantly negative user feedback regarding service quality |

| Trading Experience | 4/10 | User reports of poor platform stability and execution issues |

| Trust and Regulation | 2/10 | No verified regulatory status despite claims of UK regulation |

| User Experience | 3/10 | 2.2-star average rating indicating low overall satisfaction |

One FX presents itself as an online forex broker that offers multiple trading account types. These accounts are designed to fit traders with different experience levels and money requirements. The broker operates from Australia while claiming regulation under UK authorities. This creates immediate honesty concerns for potential clients.

According to available information, One FX provides four distinct account categories: Micro, Mini, Standard, and VIP accounts. Each account presumably offers different features and trading conditions, though specific details about account differences remain unclear in available documentation. The broker's business model centers around providing access to forex markets alongside other financial instruments.

One FX targets mainly new traders and those with limited starting money through its advertised $10 minimum deposit requirement. The broker tries to appeal to a broad user base by offering popular trading platforms and a diverse range of tradeable assets. It positions itself as an easy entry point for new traders entering the forex market.

From a technology standpoint, One FX provides both MetaTrader 4 and MetaTrader 5 platforms. These are industry-standard trading environments that most forex traders know well. The broker claims to offer access to over 50 foreign exchange currency pairs, along with trading opportunities in indices, commodities, precious metals including gold and silver, and energy products such as oil.

This diverse asset selection suggests an attempt to provide complete trading opportunities beyond traditional forex pairs. However, the quality of execution and pricing competitiveness across these instruments remains questionable given the regulatory concerns surrounding the broker's operations.

Regulatory Status: One FX claims regulation under the UK Financial Conduct Authority and HM Revenue and Customs. Verification attempts found no matching registration records, resulting in its classification as "SCAM" by regulatory verification services.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not detailed in available documentation. This raises additional transparency concerns for potential clients.

Minimum Deposit Requirements: The broker advertises a minimum deposit of $10. This makes it accessible to traders with limited starting capital.

Bonus and Promotional Offers: Available documentation does not specify any current bonus programs or promotional offers provided by the broker.

Available Trading Assets: One FX offers access to over 50 forex currency pairs, various market indices, commodities trading, precious metals including gold and silver, and energy products such as oil. This provides a diverse range of trading opportunities.

Cost Structure: Specific information regarding spreads, commissions, overnight fees, and other trading costs is not detailed in available sources. This is concerning for cost-conscious traders.

Leverage Ratios: Maximum leverage ratios and margin requirements are not specified in available documentation.

Platform Options: The broker provides both MetaTrader 4 and MetaTrader 5 trading platforms. These support various trading strategies and automated trading capabilities.

Geographic Restrictions: Information about specific country restrictions or availability limitations is not provided in available sources.

Customer Support Languages: Available customer service languages are not specified in the documentation reviewed.

This one fx review highlights significant information gaps that potential clients should consider when evaluating this broker's suitability for their trading needs.

One FX offers four distinct account types - Micro, Mini, Standard, and VIP - designed to fit traders with different experience levels and money availability. The most notable feature is the very low minimum deposit requirement of $10. This positions the broker as accessible to new traders and those with limited starting capital.

This low barrier to entry can be attractive for beginners who want to test live trading conditions without significant financial commitment. However, the lack of detailed information about specific account features, trading conditions, and benefits associated with each account tier raises transparency concerns. Available documentation does not clearly outline differences between account types.

This leaves potential clients uncertain about what they can expect from their chosen account category. The absence of information about account opening procedures, verification requirements, and upgrade pathways between account levels further complicates the evaluation process. User feedback suggests that while the low minimum deposit initially attracts traders, the actual account conditions and trading environment may not meet expectations.

The lack of clarity regarding account-specific features such as spread differences, commission structures, or exclusive tools for higher-tier accounts indicates poor communication and potentially misleading marketing practices. Compared to established brokers in the industry, the $10 minimum deposit is competitive, but the absence of transparent account condition details significantly undermines the value proposition. This one fx review finds that while the low entry barrier may appeal to beginners, the lack of clear account information poses risks for traders seeking reliable and transparent trading conditions.

One FX provides access to both MetaTrader 4 and MetaTrader 5 platforms. These are industry-standard trading environments offering complete charting tools, technical indicators, and automated trading capabilities. These platforms support various trading strategies including scalping, day trading, and long-term position holding.

This provides flexibility for different trading approaches. The availability of both MT4 and MT5 suggests an attempt to cater to traders with different platform preferences and technical requirements. The broker claims to offer trading across multiple asset classes including over 50 forex pairs, indices, commodities, and energy products.

This provides diversification opportunities for traders seeking exposure beyond traditional currency markets. However, the quality and depth of additional trading tools, research resources, and educational materials remain unclear from available documentation. User feedback indicates mixed experiences with the platform offerings.

Some traders acknowledge the familiarity and functionality of the MetaTrader platforms while expressing concerns about execution quality and platform stability. The absence of proprietary tools, advanced research capabilities, or complete educational resources suggests a basic service offering that may not meet the needs of more sophisticated traders. Compared to established brokers, the platform selection is adequate but not exceptional.

The lack of detailed information about additional tools, market analysis resources, or educational support materials indicates limited value beyond basic trading platform access. This may disappoint traders seeking complete trading support and development resources.

Customer service represents one of the most significant weaknesses in One FX's offering. This is based on available user feedback and review analysis. The broker's customer support capabilities appear inadequate, with users frequently reporting difficulties in reaching support representatives and unsatisfactory resolution of trading-related issues.

Response times are consistently described as lengthy. This creates frustration for traders requiring timely assistance with account or trading problems. The quality of support interactions, when available, receives poor ratings from users who describe unhelpful responses and lack of expertise among support staff.

Many traders report feeling abandoned when facing account issues, withdrawal problems, or technical difficulties with the trading platform. The absence of clear information about available support channels, operating hours, or multilingual capabilities further compounds these service deficiencies. User feedback consistently highlights customer service as a major pain point.

Many traders express regret about choosing this broker primarily due to poor support experiences. The lack of professional, knowledgeable, and responsive customer service creates significant risks for traders who may need urgent assistance during critical trading situations or account emergencies. Problem resolution appears to be particularly challenging, with users reporting extended delays in addressing account issues, withdrawal requests, and technical problems.

The overall customer service experience falls well below industry standards and represents a significant risk factor for potential clients considering this broker for their trading activities.

The trading experience with One FX receives consistently poor reviews from users. There are significant concerns about platform stability, execution quality, and overall trading environment reliability. Traders report frequent technical issues including platform freezes, connection problems, and delayed order execution that can severely impact trading performance and profitability.

These technical problems appear to occur regularly rather than as isolated incidents. This suggests systemic infrastructure issues. Order execution quality represents another major concern, with users reporting instances of slippage, requotes, and delayed fills that can negatively impact trading results.

The lack of transparent information about execution methods, liquidity providers, and order processing procedures raises questions about the broker's commitment to fair and efficient trade execution. These execution issues are particularly problematic for traders employing time-sensitive strategies such as scalping or news trading. Platform functionality, while based on the familiar MetaTrader environment, appears to be compromised by technical instabilities and connectivity issues that disrupt normal trading activities.

Users describe frustrating experiences with platform crashes during important market movements and inability to close positions when needed. This creates significant trading risks. The overall trading environment lacks the reliability and professionalism expected from a legitimate forex broker.

Poor execution quality, technical instabilities, and inadequate infrastructure create an unsuitable environment for serious trading activities. This one fx review strongly indicates that the trading experience falls well below industry standards and poses significant risks to trader capital and success.

Trust and regulatory compliance represent the most serious concerns in this one fx review. There are fundamental issues that should alarm any potential client. One FX claims regulation under the UK Financial Conduct Authority and HM Revenue and Customs, but verification efforts through official regulatory databases found no corresponding registration records.

This discrepancy between claimed and actual regulatory status is a major red flag indicating potential fraudulent operations. The absence of verifiable regulatory credentials means that client funds lack the protection typically provided by legitimate regulatory frameworks. Without proper oversight, traders have no recourse through regulatory channels if disputes arise or if the broker fails to meet its obligations.

This regulatory vacuum creates extreme risks for client fund safety and operational transparency. Company transparency is severely lacking, with limited verifiable information about corporate structure, ownership, management, or operational procedures. The mismatch between claimed UK regulation and apparent Australian operations further undermines credibility and raises questions about the broker's true identity and intentions.

These transparency issues make it impossible for potential clients to conduct proper due diligence. The broker's industry reputation is severely damaged by its classification as "SCAM" by regulatory verification services and consistently negative user feedback. The combination of false regulatory claims, lack of transparency, and poor operational practices creates a profile consistent with fraudulent operations rather than legitimate brokerage services.

These trust and regulatory issues make One FX unsuitable for any serious trading activities.

User experience with One FX is overwhelmingly negative. This is evidenced by the 2.2-star average rating from 62 reviews, indicating widespread dissatisfaction among actual clients. The low satisfaction scores reflect systemic problems across multiple aspects of the broker's service delivery, from account opening through ongoing trading support and fund management.

This poor rating pattern suggests consistent service failures rather than isolated incidents. Interface design and platform usability receive criticism from users who report difficulties navigating account management features and trading platform interfaces. While the underlying MetaTrader platforms are familiar to most traders, users describe implementation issues and customization limitations that impact the overall trading experience.

The lack of user-friendly account management tools and clear information presentation creates additional frustration for clients. Registration and account verification processes appear problematic based on user feedback, with reports of lengthy delays, unclear requirements, and poor communication during onboarding. These initial experience problems often set negative expectations that persist throughout the client relationship.

The absence of streamlined, professional onboarding procedures reflects the broker's overall operational deficiencies. Common user complaints center around fund safety concerns, poor customer service, technical platform issues, and difficulties with account management. The consistency of these complaints across multiple review sources indicates systematic operational problems rather than individual service failures.

The user experience profile strongly suggests that One FX fails to meet basic standards for professional brokerage services. This makes it unsuitable for traders seeking reliable and professional trading support.

This complete one fx review reveals significant concerns that make One FX unsuitable for serious trading activities. The broker's fundamental lack of verifiable regulatory credentials, combined with consistently poor user experiences and operational deficiencies, creates unacceptable risks for potential clients. While the low $10 minimum deposit may initially appeal to new traders, the absence of proper oversight and protection makes this broker inappropriate for any trading capital.

The analysis indicates that One FX fails to meet basic industry standards across multiple critical areas including regulatory compliance, customer service, trading execution, and operational transparency. The 2.2-star user rating and classification as "SCAM" by regulatory verification services provide clear warnings that potential clients should heed. For traders seeking legitimate forex brokerage services, this review strongly recommends avoiding One FX and instead choosing properly regulated brokers with verified credentials, transparent operations, and positive user feedback.

The risks associated with unregulated brokers far outweigh any perceived benefits from low deposit requirements or accessible account options.

FX Broker Capital Trading Markets Review