Is FOGEE safe?

Business

License

Is Fogee Safe or a Scam?

Introduction

Fogee is an online forex and CFD broker that has recently garnered attention in the trading community. Positioned as a global trading platform, it claims to offer a wide range of financial instruments, including forex, cryptocurrencies, and commodities. However, the rise of online trading has also led to an influx of unregulated and potentially fraudulent brokers, making it crucial for traders to conduct thorough evaluations before committing their funds. This article aims to investigate the legitimacy of Fogee, assessing its regulatory compliance, company background, trading conditions, and customer experiences to determine whether Fogee is safe for traders.

Our investigation is based on a comprehensive analysis of multiple sources, including user reviews, regulatory filings, and expert opinions. We will utilize a structured framework to evaluate Fogees credibility, focusing on key areas such as regulation, company background, trading conditions, and customer feedback.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its safety. A regulated broker is required to adhere to stringent standards that protect traders and ensure fair practices. In the case of Fogee, there are significant concerns regarding its regulatory compliance.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

Fogee claims to be registered in the UK and has purportedly obtained a license from the US NFA (National Futures Association). However, upon verification, it has been found that the claimed NFA ID does not exist in their database, raising serious doubts about the broker's legitimacy. The absence of a valid regulatory license is a major red flag, as it indicates that Fogee operates without oversight, which can lead to a lack of accountability and potential fraud. Furthermore, the broker has not provided any information about its regulatory history, leaving potential clients in the dark about its compliance track record.

Company Background Investigation

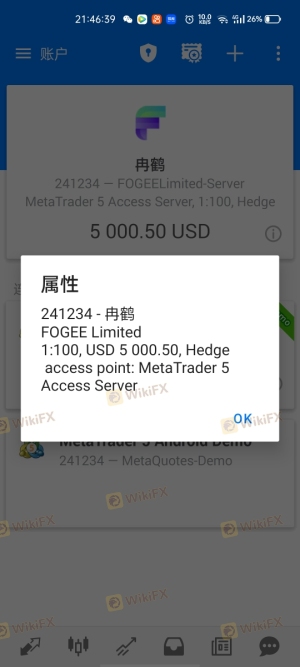

To further understand whether Fogee is safe, it is essential to investigate the company‘s background. Fogee Limited appears to have a vague operational history, with minimal information available regarding its inception, ownership, and management structure. The lack of transparency concerning the company’s founders and their qualifications raises concerns about its credibility.

Moreover, there is no verifiable information about the companys physical address or its operational history, which is often a sign of a broker attempting to obscure its true identity. Transparency is a fundamental aspect of trust in the financial industry, and Fogee's failure to disclose essential information about its operations significantly undermines its reliability.

Trading Conditions Analysis

Examining the trading conditions provided by Fogee is crucial in determining its overall safety. A broker's fee structure, including spreads and commissions, can significantly impact a trader's profitability.

| Fee Type | Fogee | Industry Average |

|---|---|---|

| Spread for Major Pairs | Unknown | 1.0 - 2.0 pips |

| Commission Model | Unknown | Varies |

| Overnight Interest Range | Unknown | Varies |

Unfortunately, Fogee does not provide clear information on its trading fees, which is concerning. The absence of transparency in fee structures often leads to hidden costs that can erode traders' profits. Furthermore, the lack of details about commissions and overnight interest rates suggests that traders may face unexpected charges, which is a common tactic employed by less reputable brokers to maximize their profits at the expense of traders.

Customer Fund Safety

The safety of customer funds is paramount in evaluating any broker. Fogee's approach to fund security, including measures for fund segregation and investor protection, remains unclear. There is no indication that client funds are held in segregated accounts, which is a standard practice among regulated brokers to ensure that traders' money is protected in case of insolvency.

Additionally, there is no information available regarding negative balance protection policies, which can safeguard traders from incurring debts beyond their initial deposits. The absence of such protections raises alarms about the potential risks associated with trading with Fogee.

Customer Experience and Complaints

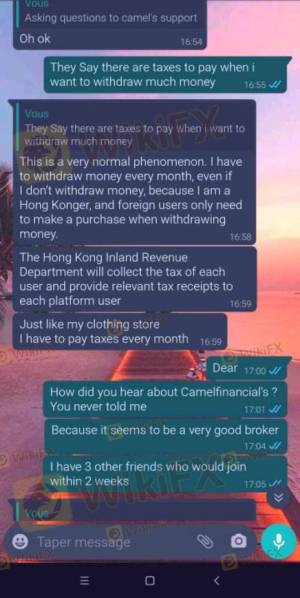

Customer feedback is a valuable indicator of a broker's reliability. Reviews of Fogee reveal a pattern of negative experiences from users, with many reporting issues related to withdrawal difficulties and poor customer service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Poor |

Many users have expressed frustration over their inability to withdraw funds, a common issue associated with fraudulent brokers. In some cases, clients have reported being pressured to deposit additional funds before being allowed to access their existing balances. Such practices are indicative of a scam, suggesting that Fogee is not safe for traders looking to manage their investments responsibly.

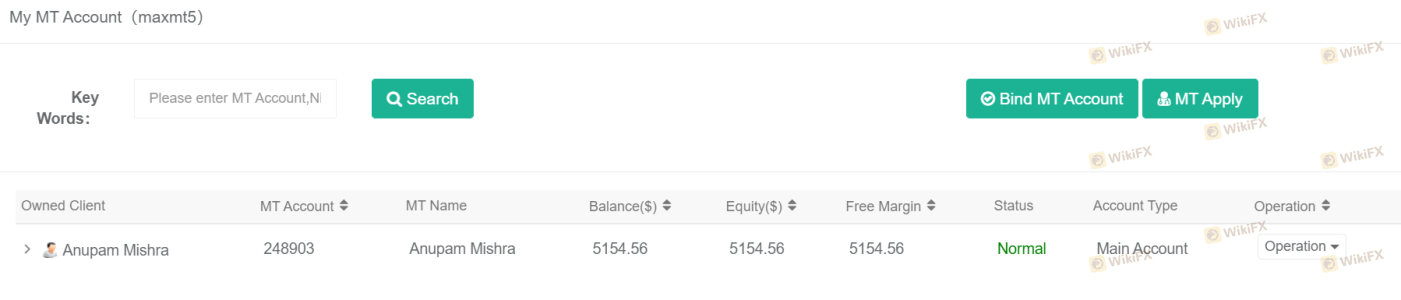

Platform and Execution

The trading platform offered by a broker is another critical factor in assessing its reliability. Fogee claims to utilize the MetaTrader 5 (MT5) platform, which is known for its robust features and user-friendly interface. However, user experiences indicate that the platform may suffer from stability issues, including slippage and execution delays.

The lack of a demo account further complicates matters, as it prevents potential clients from testing the platform's functionality before committing real funds. This absence of testing opportunities raises questions about whether Fogee is safe, as traders are left to navigate the platform without prior experience.

Risk Assessment

Considering all the information gathered, the risks associated with trading through Fogee are significant.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory license |

| Financial Risk | High | Lack of fund protection |

| Operational Risk | Medium | Poor platform reliability |

| Customer Service Risk | High | Negative feedback on support |

The combination of regulatory non-compliance, unclear trading conditions, and negative customer experiences indicates a high-risk environment for traders. It is essential for potential clients to consider these risks seriously before engaging with Fogee.

Conclusion and Recommendations

Based on the comprehensive analysis presented, it is evident that Fogee is not safe. The broker's lack of regulation, transparency, and poor customer feedback all point to significant risks that could jeopardize traders' investments.

For those considering trading in the forex market, it is advisable to seek out regulated brokers with a proven track record of reliability and customer support. Some trustworthy alternatives include brokers like IG, OANDA, and Forex.com, which offer robust regulatory oversight and transparent trading conditions.

In summary, prospective traders should exercise extreme caution and conduct thorough due diligence before engaging with Fogee, as the evidence strongly suggests that it operates in a manner consistent with scam practices.

Is FOGEE a scam, or is it legit?

The latest exposure and evaluation content of FOGEE brokers.

FOGEE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FOGEE latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.