Is Glen Markets safe?

Business

License

Is Glen Markets Safe or Scam?

Introduction

Glen Markets, formerly known as Glenmore Investments, is a forex and CFD broker that launched in January 2018. The broker has positioned itself as a provider of diverse trading options, including over 100 forex pairs, commodities, and cryptocurrencies. However, the forex market is riddled with brokers that may not always have the best interests of their clients at heart. Therefore, traders need to exercise caution when evaluating the legitimacy and safety of any forex broker. This article aims to provide a comprehensive analysis of Glen Markets, focusing on its regulatory status, company background, trading conditions, client fund safety, customer experiences, and overall risk assessment. Our investigation is based on various online sources, including reviews and regulatory information, to ensure an objective evaluation of whether Glen Markets is safe or a potential scam.

Regulation and Legitimacy

When assessing the safety of any forex broker, regulatory compliance is paramount. A regulated broker is subject to oversight by a financial authority, which helps protect clients' interests and ensures fair trading practices. Unfortunately, Glen Markets is not a licensed or regulated broker. It operates under the auspices of Magna Technologies Ltd, located in the Commonwealth of Dominica. This offshore registration raises significant concerns about the broker's legitimacy and the protection of client funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulatory oversight means that Glen Markets is not required to adhere to strict financial guidelines, such as maintaining a certain level of capital reserves or providing investor protection schemes. Consequently, traders may find themselves exposed to higher risks, including the potential loss of their investment without any recourse. Historical compliance issues, lack of transparency, and offshore operations further contribute to the skepticism surrounding Glen Markets. Therefore, it is crucial to question: Is Glen Markets safe? The answer leans towards caution, given its unregulated status.

Company Background Investigation

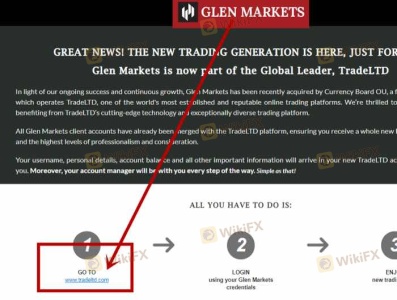

Glen Markets has a relatively brief history in the forex trading arena, having been established in 2018. The company has undergone several ownership changes, which may contribute to its lack of stability and transparency. Initially operating under Glenmore Investments, it merged with TradeLTD, further complicating its ownership structure. The current operator, Magna Technologies Ltd, is based in Dominica, a jurisdiction known for its lenient regulatory framework.

The management team behind Glen Markets lacks publicly available information, raising concerns about their qualifications and experience in the financial sector. Transparency is crucial for building trust with clients, and the absence of detailed information about the management team can lead to skepticism regarding the broker's reliability. Additionally, the broker's website does not provide adequate information about its operations, further questioning its transparency and commitment to client safety.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value. Glen Markets claims to offer competitive trading fees, but a closer examination reveals potential red flags. The broker provides various account types, with the minimum deposit for a mini account starting at $250. However, the spreads for major currency pairs range from 0.8 pips to 1.3 pips, which may not be competitive compared to industry standards.

| Fee Type | Glen Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.8 - 1.3 pips | 0.5 - 1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of clarity regarding commission structures and overnight interest rates raises concerns about potential hidden fees. Traders should be wary of brokers that do not provide transparent information about their fee structures, as this can lead to unexpected costs that diminish profitability. Overall, the trading conditions at Glen Markets warrant careful consideration, leading to the question of whether Glen Markets is safe for traders looking for a reliable and transparent trading environment.

Client Fund Safety

Client fund safety is a critical aspect of any trading operation. Glen Markets claims to implement various security measures to protect client funds; however, the lack of regulation means that these measures may not be robust. The broker does not provide clear information about whether client funds are held in segregated accounts or whether there are any investor protection schemes in place.

Additionally, there have been no documented instances of fund security issues or disputes, but the absence of regulatory oversight raises concerns about the broker's accountability. Traders should be cautious when dealing with unregulated brokers, as they may not have the same protections in place as regulated firms. This leads to the important question: Is Glen Markets safe in terms of client fund protection? Given its unregulated status and lack of transparent policies, the answer is likely no.

Customer Experience and Complaints

Customer feedback is an essential component of evaluating a broker's reliability. Reviews of Glen Markets indicate a mix of experiences, with some traders expressing dissatisfaction with the broker's customer service and withdrawal processes. Common complaints include delays in processing withdrawals, lack of responsive customer support, and issues with account verification.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Support Issues | Medium | Poor |

| Account Verification Problems | High | Poor |

For instance, several users have reported difficulties in withdrawing their funds, often citing that their requests were met with vague excuses or delayed responses. This pattern of complaints raises serious concerns about the broker's operational integrity and its commitment to customer service. Therefore, potential clients should carefully consider these factors before deciding to engage with Glen Markets, leading to the question of whether Glen Markets is safe for trading.

Platform and Trade Execution

The performance of a trading platform is crucial for a trader's success. Glen Markets offers a web-based trading platform, as well as access to the popular MetaTrader 4 (MT4) software. However, user reviews indicate that the platform may experience stability issues, leading to concerns about order execution quality and the potential for slippage or rejections.

The lack of detailed information about order execution metrics further complicates the assessment of the broker's reliability. Traders need assurance that their orders will be executed promptly and accurately, without undue delays or manipulation. Given the mixed reviews regarding platform performance and execution quality, potential clients must weigh these factors carefully. This raises the question: Is Glen Markets safe in terms of trading execution? The answer remains uncertain, as the broker's platform may not meet the expectations of all traders.

Risk Assessment

Engaging with any broker carries inherent risks, and Glen Markets is no exception. The combination of its unregulated status, lack of transparency, and mixed customer feedback presents a concerning risk profile for potential clients.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Safety Risk | High | Lack of information on fund protection measures. |

| Customer Service Risk | Medium | Mixed reviews regarding support and withdrawal processes. |

To mitigate these risks, potential clients should thoroughly research the broker, consider using only funds they can afford to lose, and explore alternative, regulated brokers that offer better security and transparency. The question remains: Is Glen Markets safe for trading? The risks associated with this broker suggest that caution is warranted.

Conclusion and Recommendations

In conclusion, the evidence gathered regarding Glen Markets raises significant concerns about its safety and legitimacy. The absence of regulation, mixed customer experiences, and a lack of transparency all contribute to a risk-laden trading environment. Therefore, it is essential for potential clients to exercise caution and thoroughly evaluate their options before engaging with this broker.

For traders seeking a safer alternative, it is advisable to consider regulated brokers that offer robust investor protections and transparent trading conditions. Ultimately, it is crucial to prioritize safety and reliability in the forex market, leading to the overarching question: Is Glen Markets safe? The analysis suggests that it is not a safe option for traders looking to protect their investments.

Is Glen Markets a scam, or is it legit?

The latest exposure and evaluation content of Glen Markets brokers.

Glen Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Glen Markets latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.