Go Futures 2025 Review: Everything You Need to Know

Executive Summary

Go Futures is an established discount online futures and commodities brokerage firm. The company has over 16 years of operational experience in the financial markets. This comprehensive go futures review examines the company's offerings, services, and overall market position for traders seeking professional commodity brokerage services. The firm is headquartered in Chicago, Illinois. Go Futures has built its reputation on providing specialized futures and commodities trading services to retail and institutional clients.

The company's primary strength lies in its extensive experience spanning several decades in the commodities sector. Go Futures positions itself as a discount broker focused specifically on futures markets. The company has maintained visibility through customer review platforms including the Better Business Bureau and Investimonials. These platforms allow clients to share their trading experiences and evaluate the broker's services.

This brokerage primarily targets traders who seek cost-effective access to futures and commodities markets through a discount brokerage model. The firm's Chicago location places it at the heart of American commodity trading. This location potentially offers advantages in terms of market access and execution speeds for futures contracts.

Important Disclaimer

This review is compiled based on publicly available information and user feedback accessible through various financial review platforms. Traders should note that regulatory requirements and service availability may vary significantly across different jurisdictions. Prospective clients are strongly advised to verify applicable regulations and compliance requirements in their specific region before engaging with Go Futures.

The evaluation methodology employed in this go futures review relies on company-provided information, third-party review platforms, and industry standard assessment criteria. Some aspects of the broker's services require direct verification with the company due to limited detailed information available in public sources.

Rating Framework

Broker Overview

Go Futures operates as a specialized discount brokerage firm. The company has a foundation built over more than 16 years of continuous service in the futures and commodities trading sector. The company's establishment in Chicago, Illinois, strategically positions it within one of the world's most significant commodity trading hubs. Chicago is home to major exchanges including the Chicago Mercantile Exchange and Chicago Board of Trade.

The firm's business model centers on providing cost-effective access to futures and commodities markets. Go Futures distinguishes itself from full-service brokers by focusing on competitive pricing structures typical of discount brokerage operations. This approach appeals particularly to experienced traders who require reliable execution services without extensive hand-holding or comprehensive research packages that often accompany higher-cost brokerage services.

According to available information, Go Futures leverages decades of combined experience in commodity brokerage services. This suggests the firm's leadership and operational team possess substantial industry knowledge. The company maintains a presence on customer review platforms, indicating a commitment to transparency and client feedback. However, specific details about trading platforms, asset coverage, and regulatory oversight remain limited in publicly accessible sources.

The brokerage's focus on futures and commodities markets suggests specialization rather than diversification into other asset classes commonly offered by multi-asset brokers. This go futures review notes that such specialization can benefit traders seeking deep expertise in specific market segments. However, it may limit options for those requiring broader investment opportunities.

Regulatory Status

Available information does not specify the regulatory authorities overseeing Go Futures operations. Prospective clients should directly verify the firm's regulatory status and compliance requirements applicable to their jurisdiction before opening accounts.

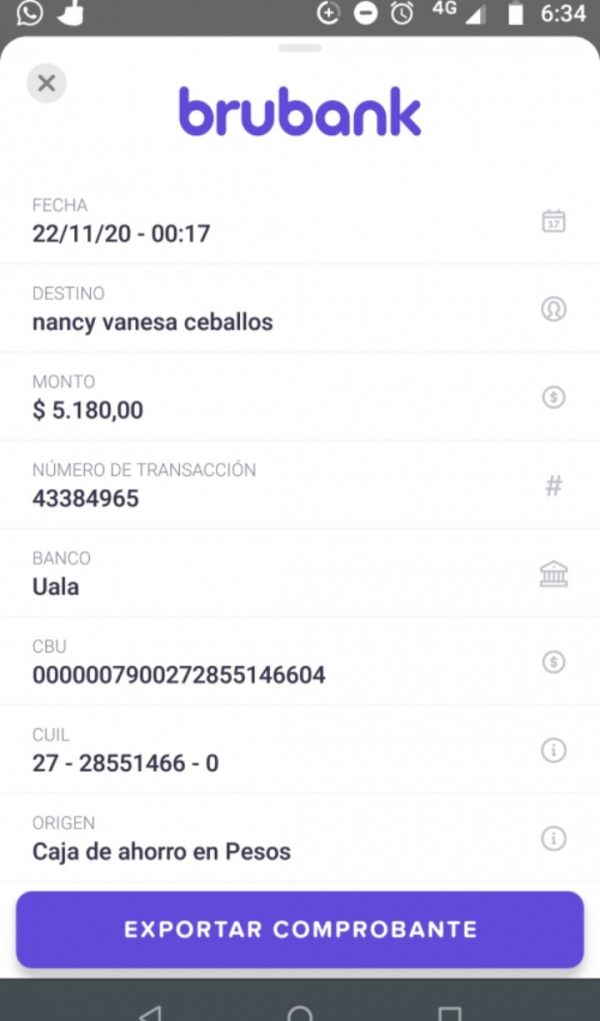

Deposit and Withdrawal Methods

Current sources do not detail the available funding methods, processing times, or associated fees for deposits and withdrawals. This information requires direct inquiry with the brokerage.

Minimum Deposit Requirements

Specific minimum deposit amounts for different account types are not disclosed in available public information. Traders should contact Go Futures directly for current account opening requirements.

No information regarding welcome bonuses, promotional offers, or incentive programs is available in current sources. The firm's discount brokerage model may prioritize low costs over promotional incentives.

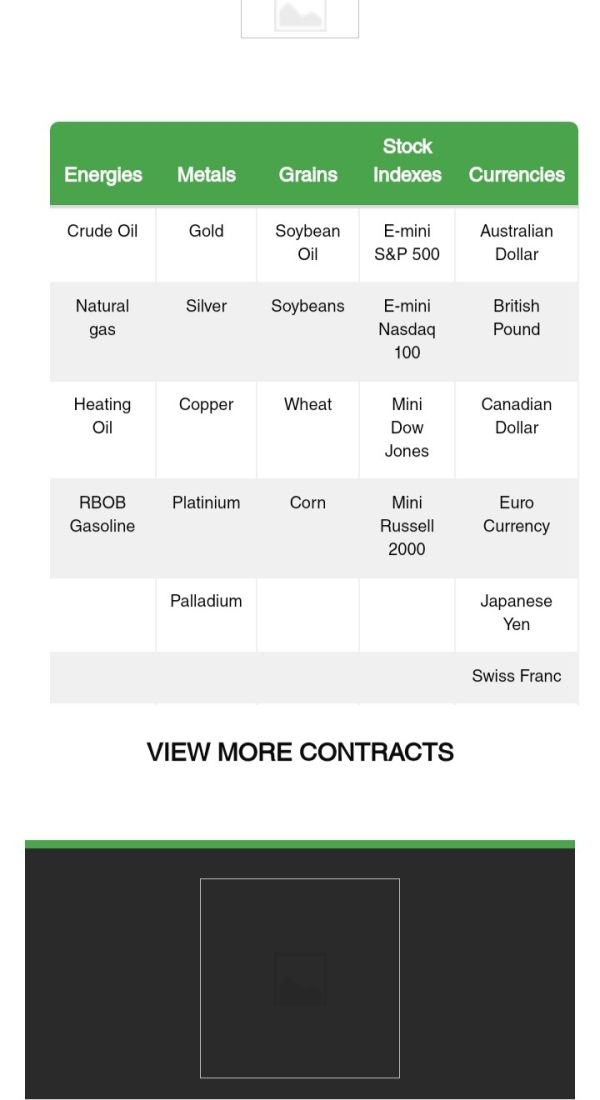

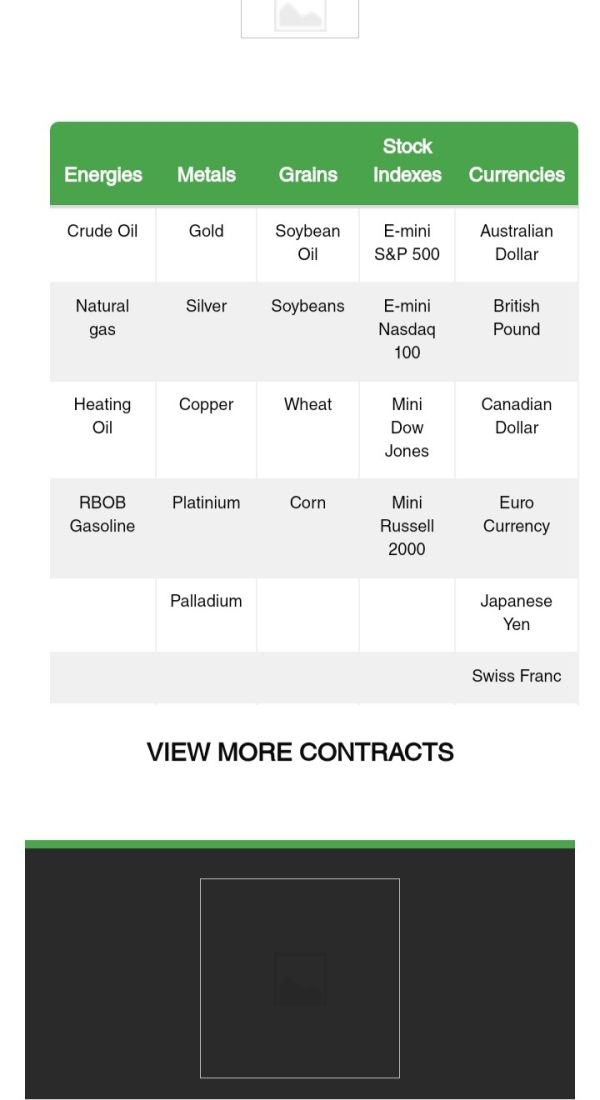

Tradeable Assets

The company specializes in futures and commodities. However, specific contracts, markets, and instruments available for trading are not detailed in accessible sources. This go futures review recommends direct verification of available markets.

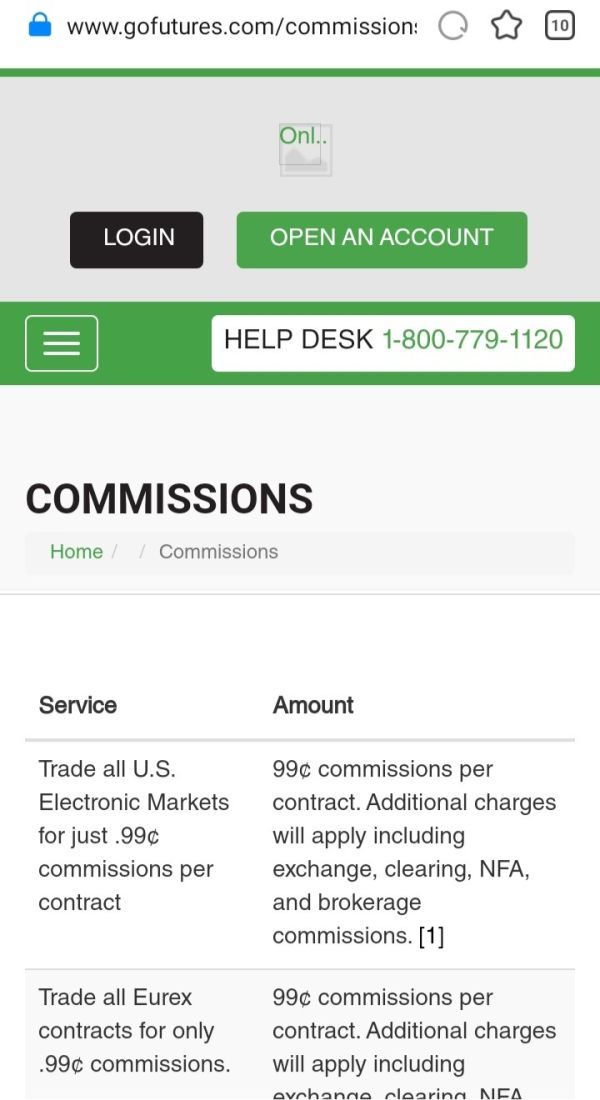

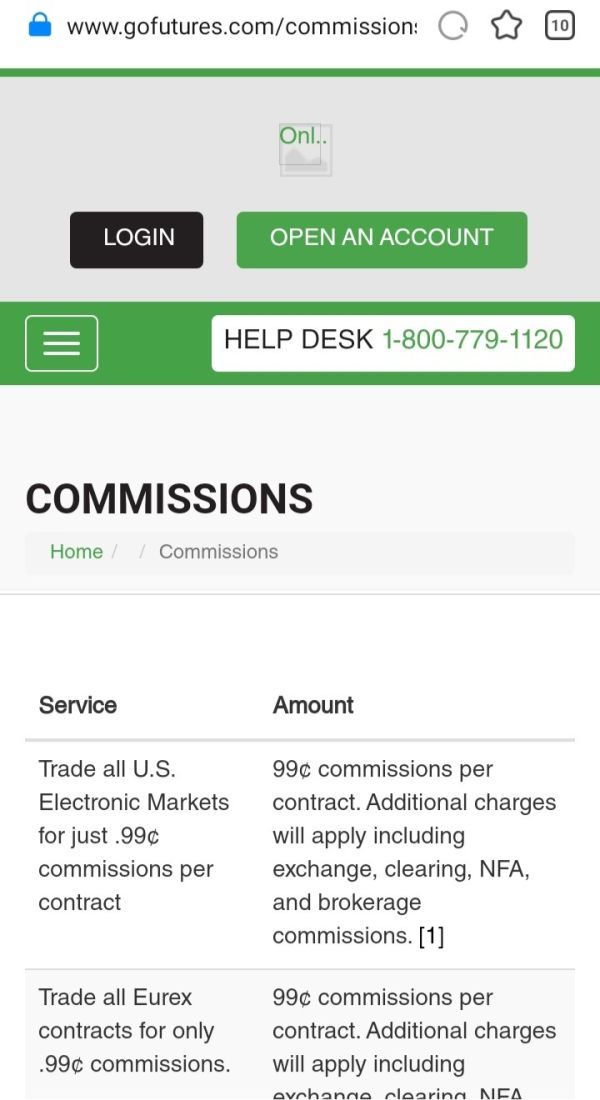

Cost Structure

Detailed information about commission rates, spreads, overnight financing charges, and other trading costs is not available in current sources. As a discount broker, the firm likely emphasizes competitive pricing. However, specific rates require direct inquiry.

Leverage Ratios

Leverage offerings and margin requirements for different instruments are not specified in available information.

The trading platforms supported by Go Futures are not detailed in current sources. This requires direct verification of available technology solutions.

Geographic Restrictions

Information regarding service availability in different countries or jurisdictions is not provided in accessible sources.

Customer Support Languages

Available customer service languages are not specified in current information.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Go Futures' account conditions faces significant limitations due to insufficient publicly available information regarding account types, minimum deposits, and specific terms of service. This go futures review cannot provide a comprehensive assessment of account opening requirements, maintenance fees, or special account features without access to detailed broker documentation.

Typically, futures brokers offer different account structures for retail traders, professional clients, and institutional investors. Each account type has varying minimum deposit requirements and service levels. However, Go Futures has not made such information readily accessible through standard review channels. This may indicate either a preference for direct client consultation or limited online presence regarding account specifications.

The absence of detailed account condition information presents challenges for potential clients seeking to compare Go Futures with other brokerage options. Traders typically require clear understanding of minimum funding requirements, account maintenance costs, and any special conditions before committing to a brokerage relationship.

Without specific data on account types such as individual, joint, corporate, or retirement accounts, potential clients cannot adequately assess whether Go Futures meets their particular account structure needs. The firm's specialization in futures and commodities suggests account offerings likely focus on these markets specifically.

Assessment of Go Futures' trading tools and educational resources proves challenging due to limited information availability in current sources. Modern futures trading typically requires sophisticated analytical tools, real-time market data, charting capabilities, and risk management features. However, specific details about Go Futures' technological offerings remain unclear.

Professional futures trading often demands access to advanced order types, algorithmic trading capabilities, and comprehensive market analysis tools. The firm's position as a discount broker may influence the scope and sophistication of provided tools. This potentially focuses on essential trading functions rather than comprehensive research packages.

Educational resources represent a crucial component for many traders, particularly those new to futures markets or specific commodity sectors. However, current information does not detail whether Go Futures provides market analysis, educational webinars, trading guides, or other learning materials to support client development.

The absence of detailed tool and resource information may reflect the firm's target market of experienced traders who rely on third-party analysis or possess sufficient market knowledge to operate independently. Alternatively, it may indicate limited investment in comprehensive online resource development.

Customer Service and Support Analysis

Evaluation of Go Futures' customer service quality encounters limitations due to insufficient specific information about support channels, response times, and service quality metrics. The company's presence on review platforms suggests some level of customer feedback collection. However, detailed service quality data is not readily available.

Professional futures trading often requires rapid support response, particularly during volatile market conditions when technical issues or account problems can result in significant financial impact. The quality and availability of customer support becomes crucial for traders operating in fast-moving commodity markets.

Effective brokerage support typically encompasses multiple communication channels including phone, email, live chat, and potentially dedicated account management for larger accounts. However, specific details about Go Futures' support infrastructure, operating hours, and response time commitments are not detailed in available sources.

The firm's Chicago location may provide advantages for clients operating during US market hours. However, support availability for international clients or outside standard business hours remains unclear without additional information.

Trading Experience Analysis

Assessment of the trading experience provided by Go Futures faces significant constraints due to limited information about platform performance, execution quality, and user interface design. This go futures review cannot provide comprehensive evaluation of order execution speeds, platform stability, or trading environment quality without access to detailed performance data.

Futures trading demands robust platform performance, particularly given the leverage involved and rapid price movements common in commodity markets. Execution quality, including fill rates and slippage minimization, represents critical factors for trader success, especially in volatile market conditions.

The technological infrastructure supporting futures trading must handle high-frequency order flow and provide real-time market data with minimal latency. However, specific information about Go Futures' technological capabilities, platform reliability, and execution quality metrics is not available in current sources.

Mobile trading capabilities have become increasingly important for active traders who require market access beyond traditional desktop environments. The availability and functionality of mobile trading solutions from Go Futures remain unclear without detailed platform information.

Trust and Reliability Analysis

Evaluating Go Futures' trustworthiness and reliability proves challenging due to limited available information regarding regulatory oversight, financial safeguards, and transparency measures. The firm's 16-year operational history suggests some level of market stability. However, specific regulatory compliance and client protection details require verification.

Regulatory oversight provides crucial protection for traders, including segregation of client funds, compliance with capital requirements, and adherence to fair trading practices. However, current sources do not specify the regulatory authorities overseeing Go Futures operations or the specific protections available to clients.

Financial transparency, including disclosure of company financial health, ownership structure, and operational procedures, contributes significantly to broker trustworthiness. The limited publicly available information about Go Futures' corporate structure and financial standing may concern traders seeking comprehensive due diligence.

Industry reputation and peer recognition often indicate broker reliability. However, specific awards, industry certifications, or professional acknowledgments for Go Futures are not detailed in current sources. The firm's presence on review platforms provides some transparency mechanism, though comprehensive reputation assessment requires additional information.

User Experience Analysis

Comprehensive evaluation of user experience with Go Futures encounters limitations due to insufficient detailed feedback and interface information in available sources. User satisfaction typically encompasses ease of account opening, platform usability, customer service quality, and overall trading environment effectiveness.

The account opening and verification process significantly impacts initial user experience. However, specific details about Go Futures' onboarding procedures, documentation requirements, and approval timeframes are not available in current sources. Streamlined account opening processes benefit traders seeking rapid market access.

Platform usability, including interface design, navigation efficiency, and feature accessibility, directly affects daily trading experience. However, without specific platform information, assessment of Go Futures' user interface quality and ease of use remains incomplete.

Overall user satisfaction often reflects the cumulative experience across all broker touchpoints, from initial contact through ongoing trading activities. The limited specific user feedback available in current sources constrains comprehensive satisfaction assessment for this go futures review.

Conclusion

Go Futures presents as an established futures and commodities brokerage with over 16 years of operational experience. The firm positions itself within the discount brokerage segment of the market. However, this review encounters significant limitations due to insufficient publicly available information about key aspects of the firm's services, regulatory status, and trading conditions.

The firm appears most suitable for experienced futures traders seeking cost-effective market access through a specialized commodity broker. The Chicago location provides strategic positioning within major commodity trading centers. This potentially offers execution advantages for futures contracts.

Primary advantages include the firm's extensive industry experience and specialized focus on futures and commodities markets. However, significant disadvantages include limited transparency regarding trading conditions, regulatory oversight, platform capabilities, and detailed service offerings. Prospective clients should conduct thorough due diligence and direct verification of all trading terms before engaging with Go Futures.