first option fx 2025 Review: Everything You Need To Know

─────────────────────────────

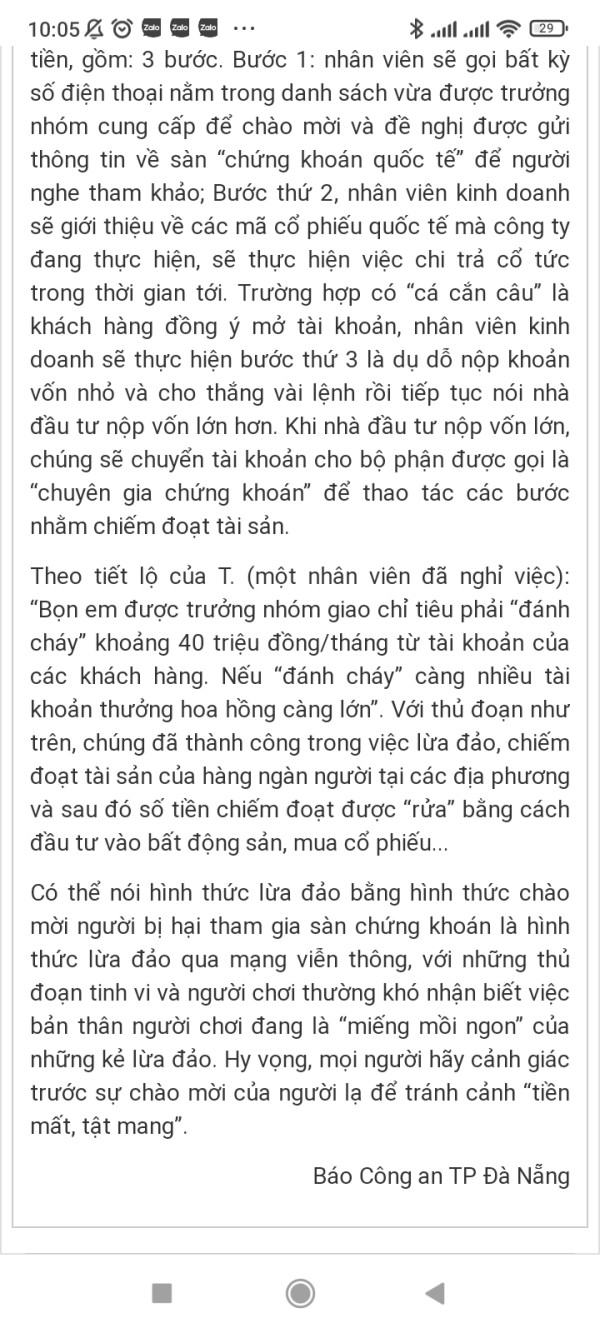

1. Abstract

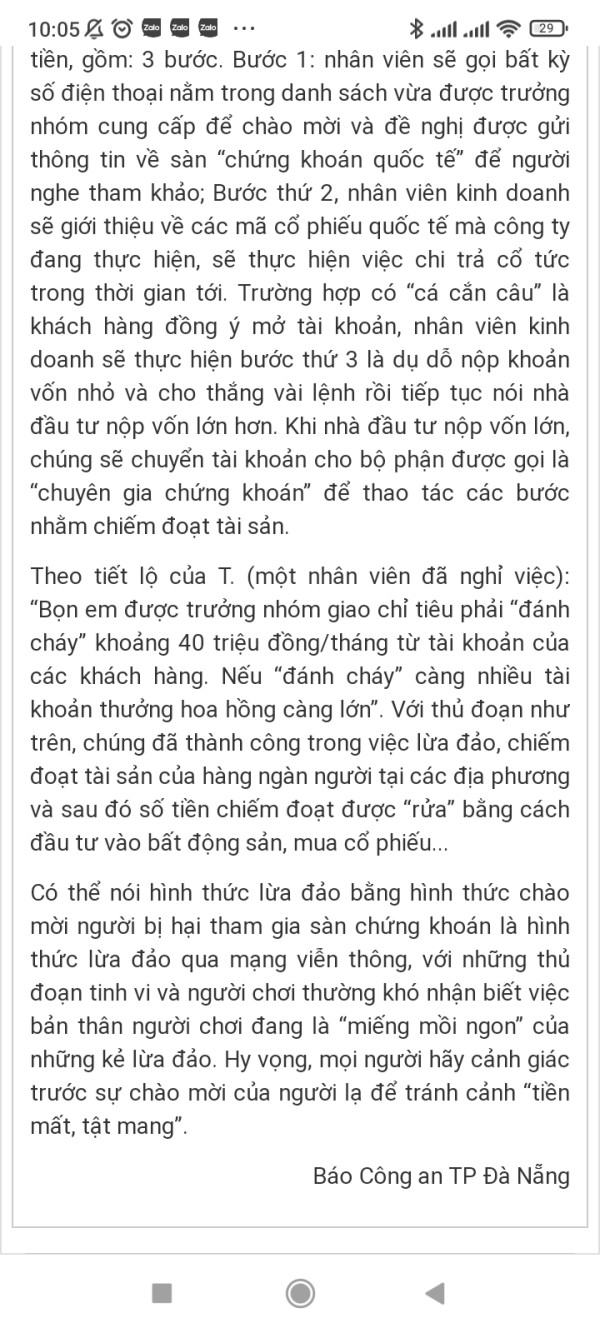

This first option fx review gives you a detailed look at a broker that has caused big concerns in the forex community. First Option FX gets heavy criticism for having no rules watching over it and asking for very high minimum deposits. This review shows the clear risks of using a broker that works outside recognized rule-making groups, as proven by warnings from the UK's Financial Conduct Authority and many user stories calling it a possible scam. The broker's business plan focuses on forex trading and CFD tools, which brings in high-risk traders who might like its wide range of assets even with all the warning signs.

However, the missing verified rule-making licenses and bad user experiences really hurt its reputation. With ongoing user complaints about poor service and questionable trading conditions, this review aims to give future traders a complete understanding of First Option FX's working environment and operational problems.

─────────────────────────────

2. Notice

First Option FX works as an unregulated company in all areas. No major rule-making body has given it approval or watches over it, including the FCA, which has publicly warned people about how it operates. This review comes from gathering user feedback, documented warnings from rule-making authorities, and information available to the public. The review method compares reported user experiences with official rule-making statements, making sure we get a clear picture of the broker's operational risks.

─────────────────────────────

3. Scoring Framework

─────────────────────────────

4. Broker Overview

First Option FX claims it has a good background with its stated headquarters in the United Kingdom, but it works without any regulatory license, as recent reviews confirm. The broker mainly deals in forex and CFD trading and presents itself with an international look despite having no verification by regulatory agencies. The review points out that while the branding might look sophisticated to attract high-risk traders, the internal operational structure stays unclear with incomplete details on account features, spreads, commissions, or any additional trading tools.

According to various sources, user reviews have mostly identified First Option FX as lacking transparency and financial reliability. Also, potential clients must know that the broker's high minimum deposit requirements create an unusually steep entry barrier, made worse by limited verified data on safe fund handling practices.

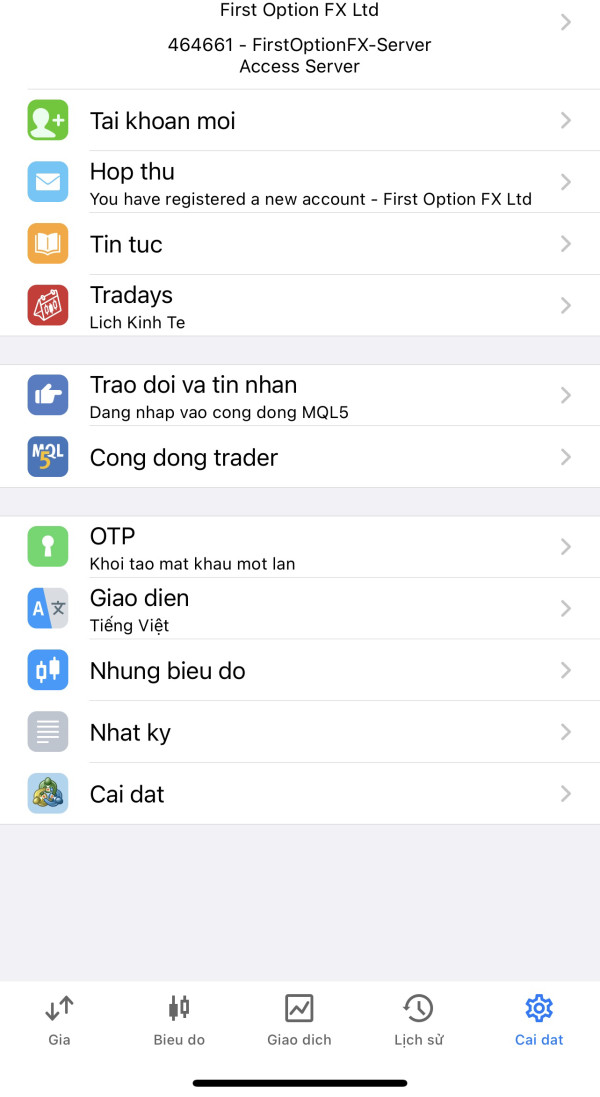

In a second part of the overview, First Option FX claims to offer several asset classes including forex pairs, CFDs on stocks, indices, and commodities. However, concrete information about the specific trading platforms is not given, leaving users to rely on vague claims of advanced technology and diverse asset offerings. The absence of any regulatory approval – very different from industry standards – further reduces investor confidence.

The broker's primary business model, as detailed in multiple first option fx review reports, seems to attract attention only from traders with a high appetite for risk. The little information on actual trading conditions, combined with the regulatory red flags, requires significant caution and thorough due diligence before engaging with this broker.

─────────────────────────────

• Regulatory Regions :

First Option FX operates without any official regulatory oversight. According to multiple reports and warnings by authorities such as the FCA, there is no evidence of regulatory licenses in any region. This lack of regulation is a primary concern frequently mentioned in first option fx review articles. It underscores the risk and absence of investor protection measures.

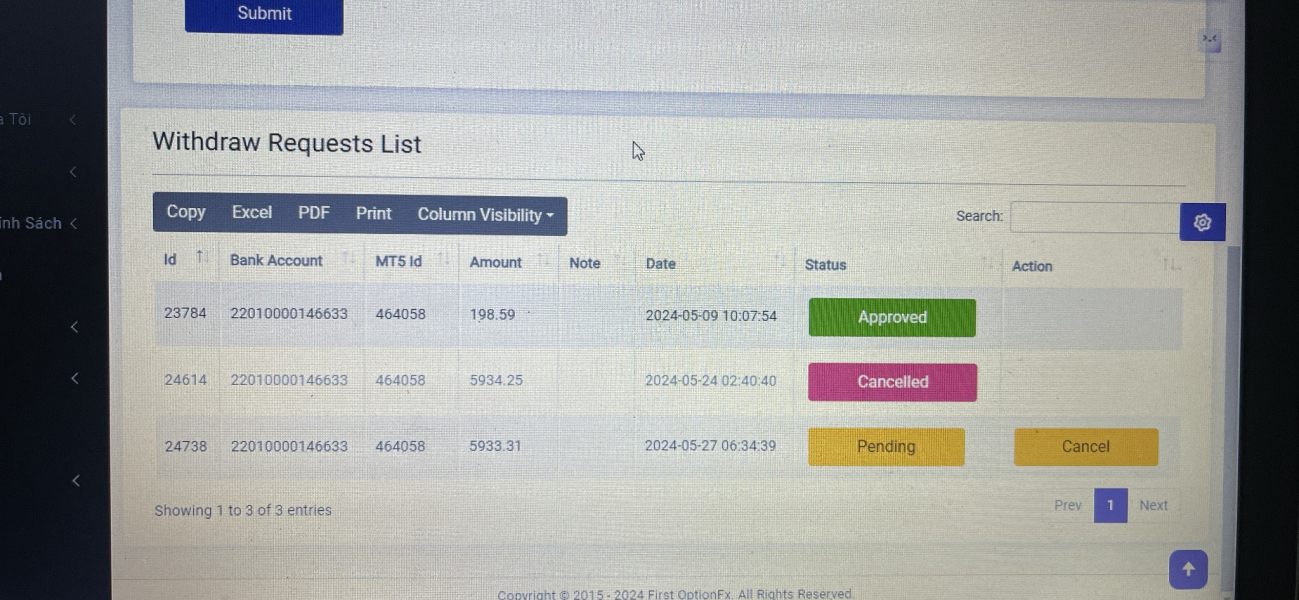

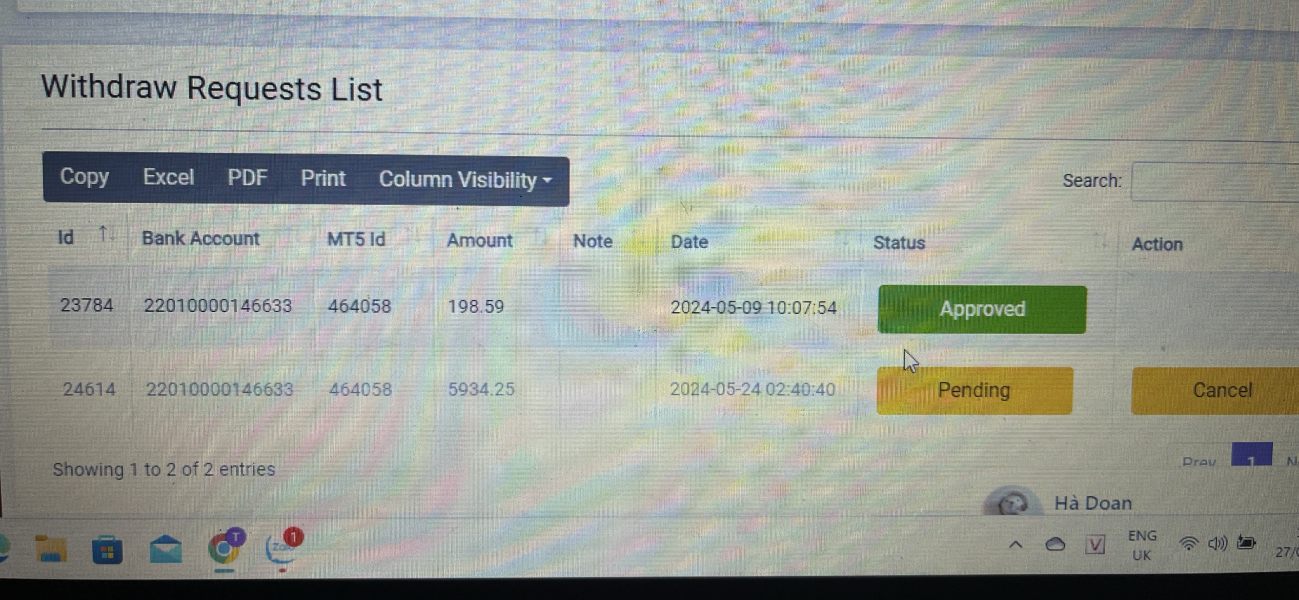

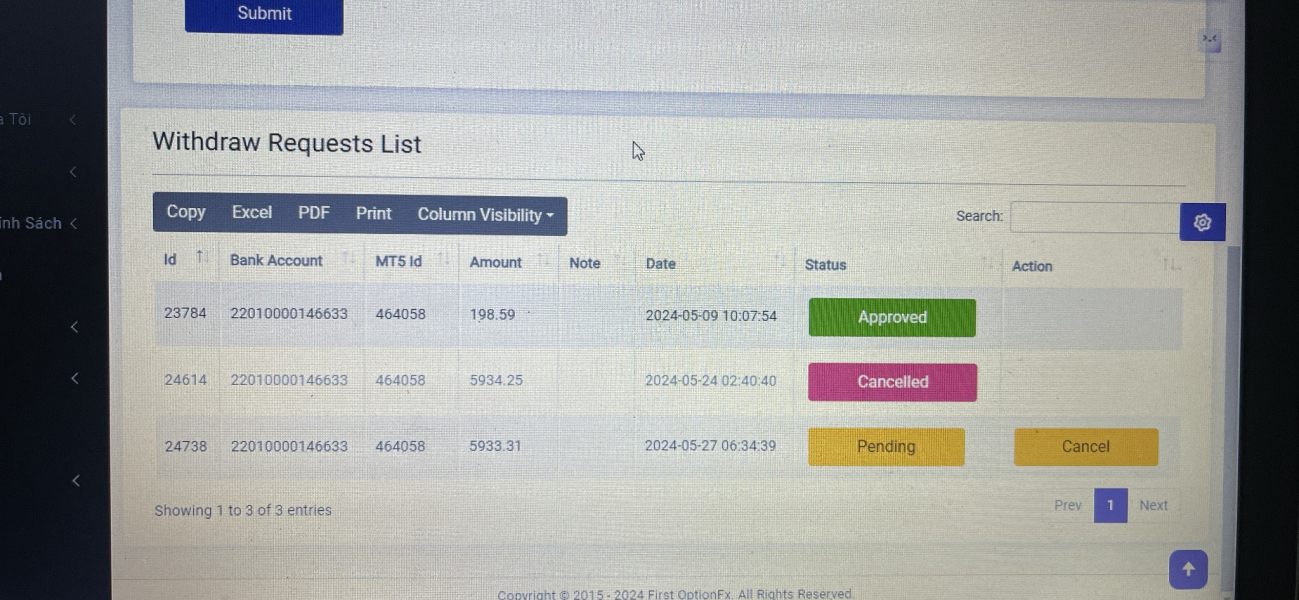

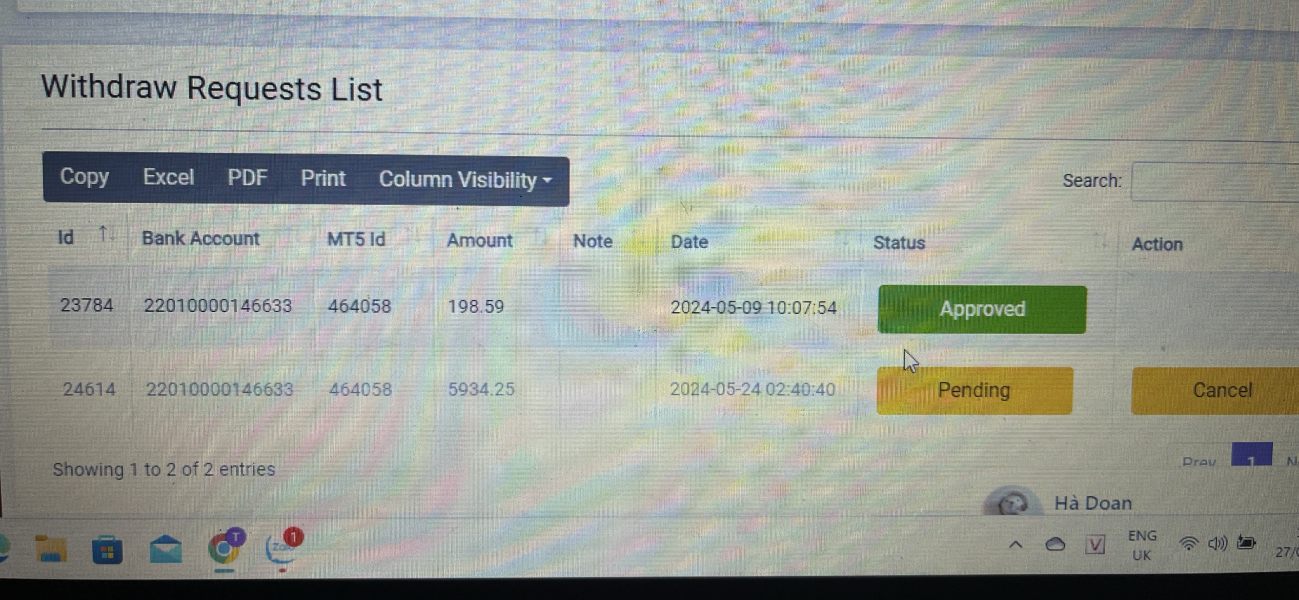

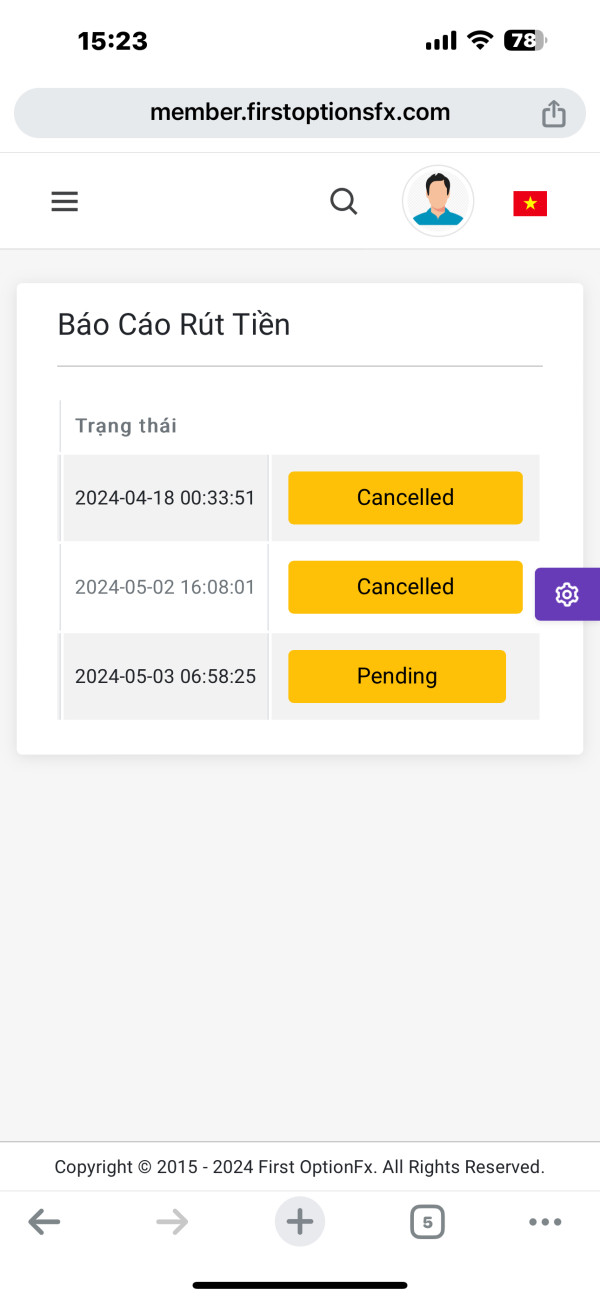

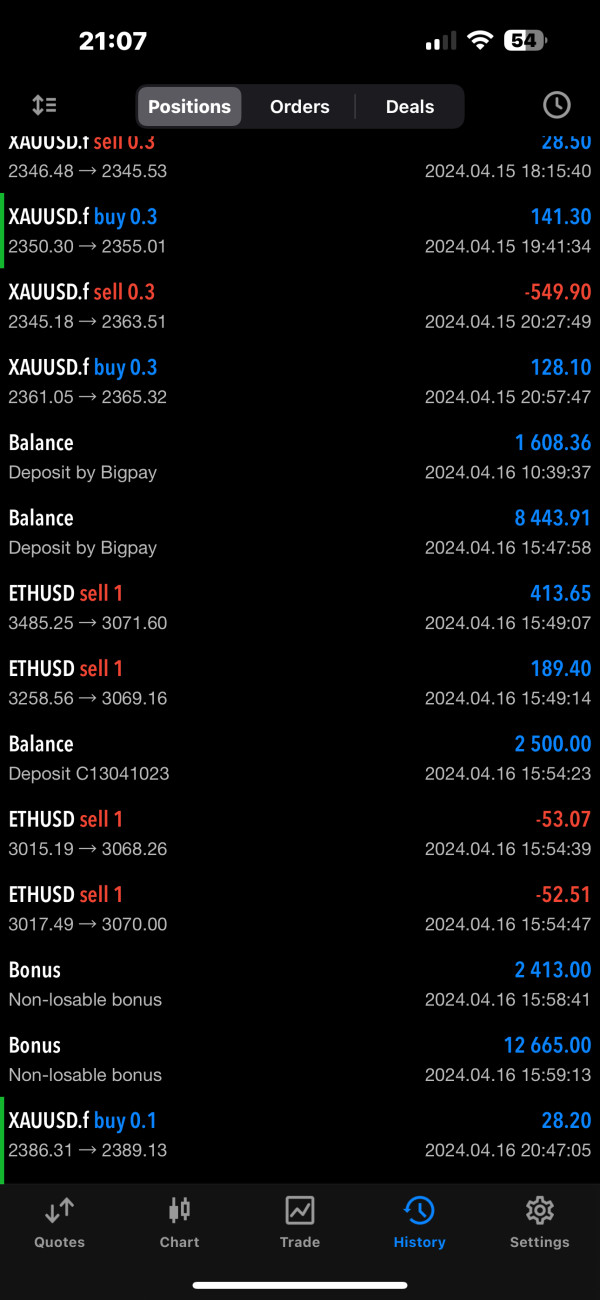

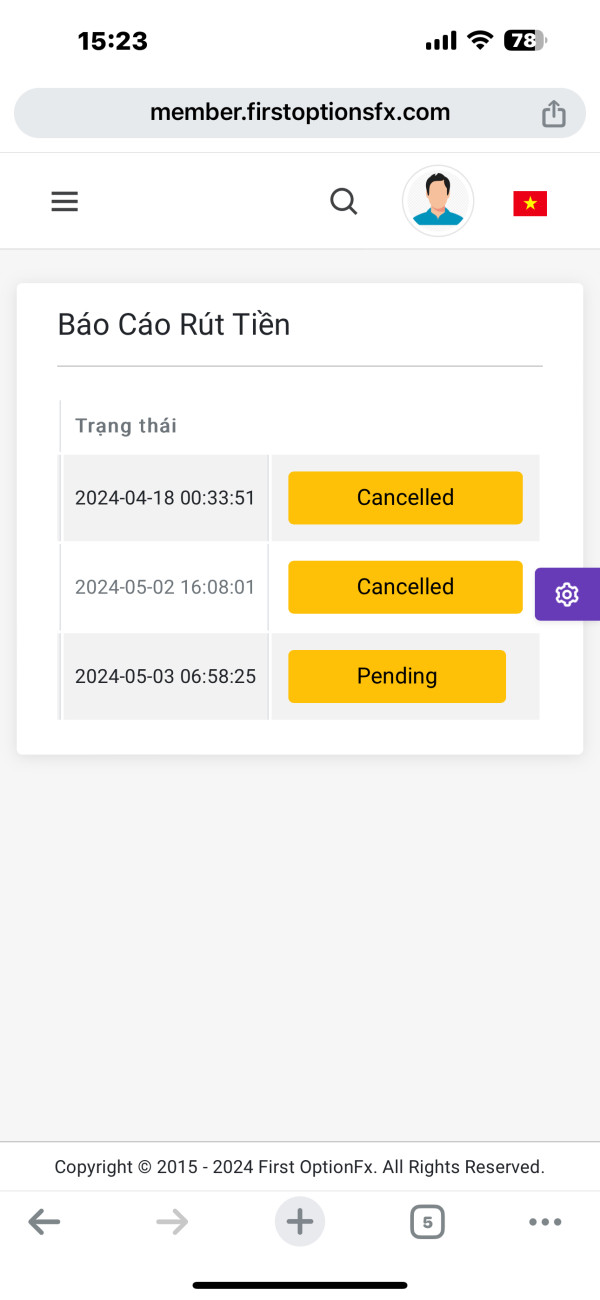

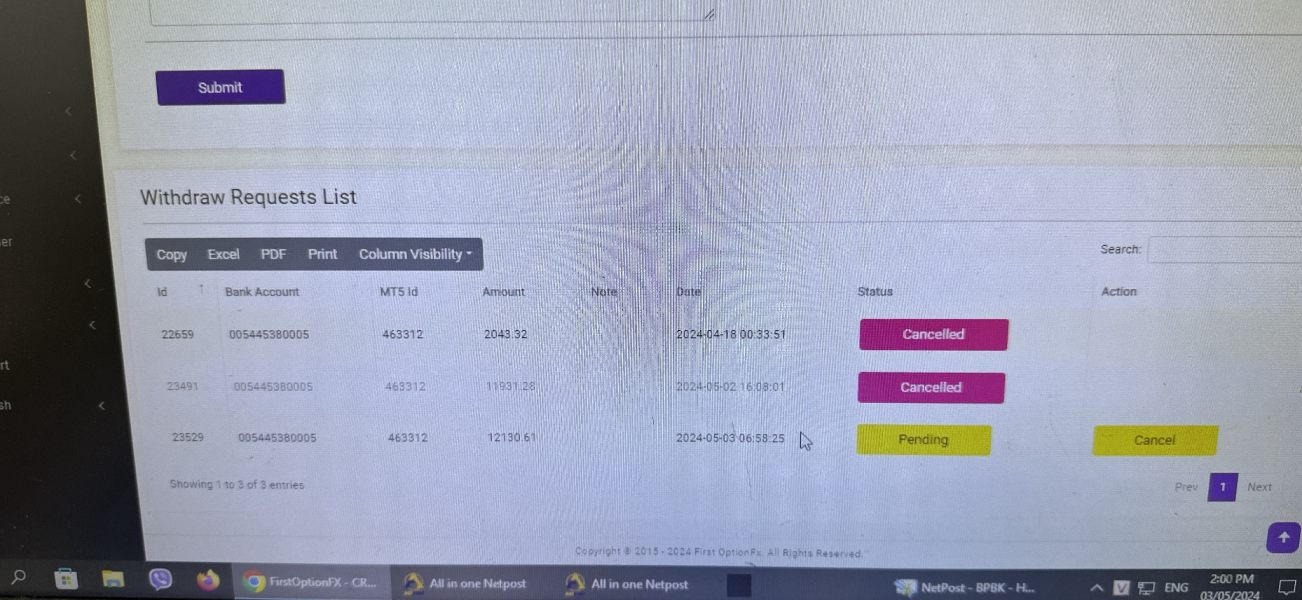

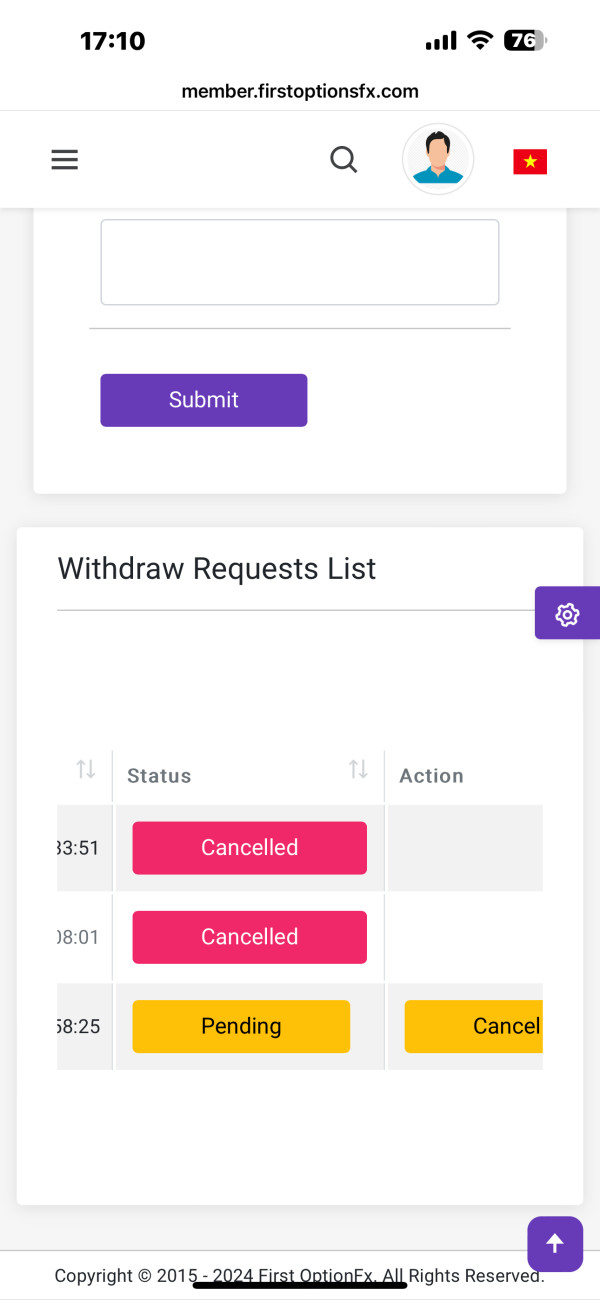

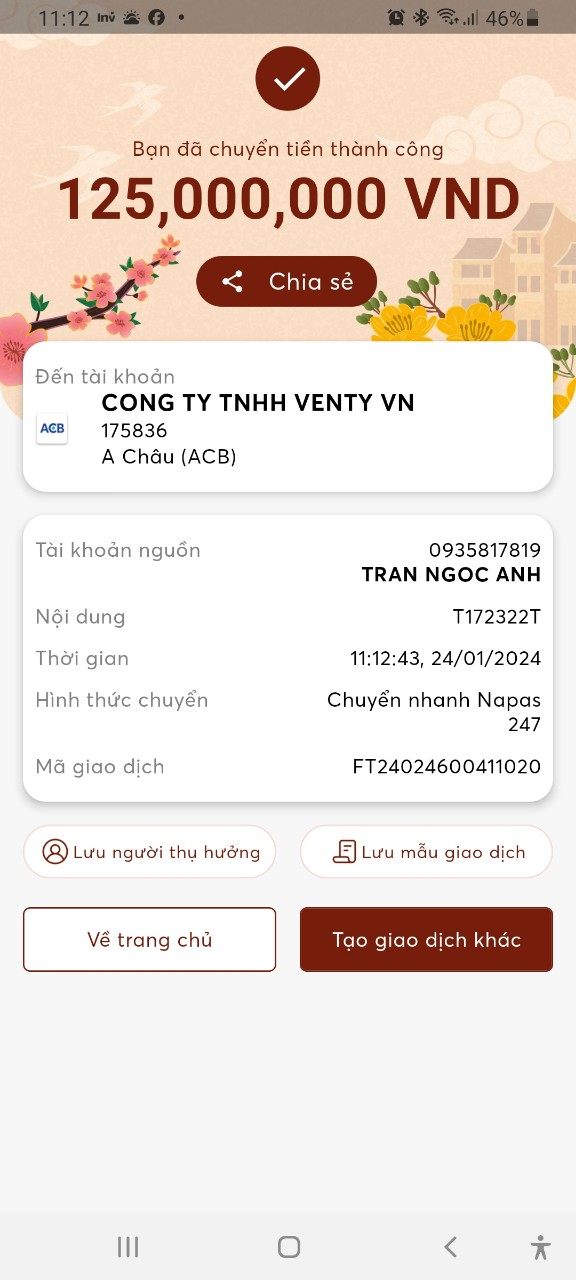

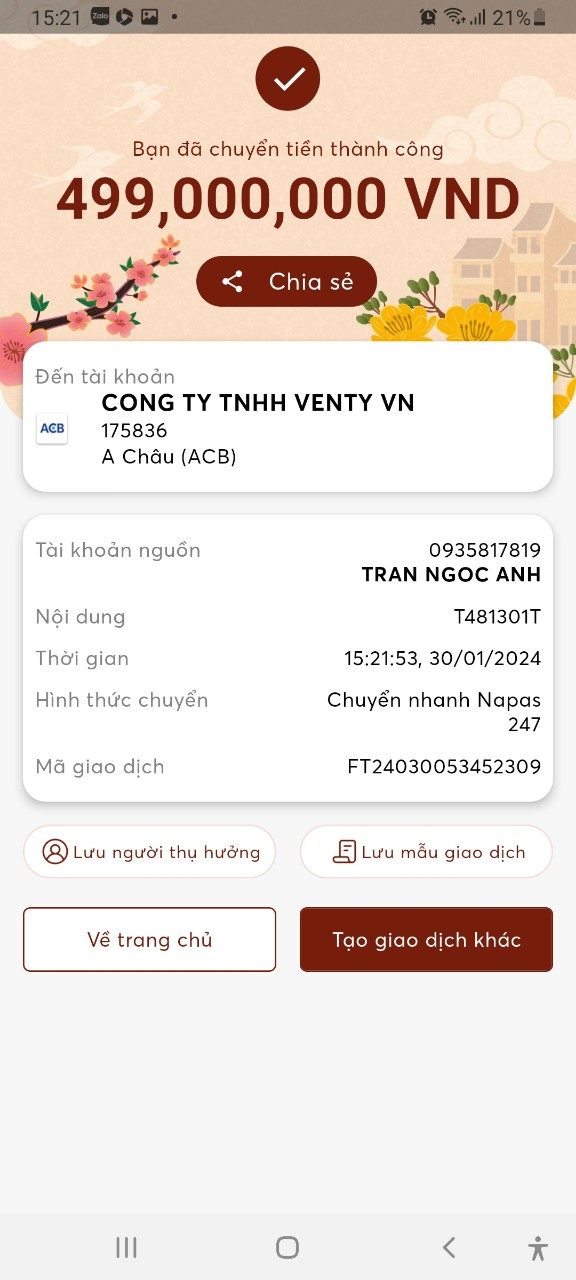

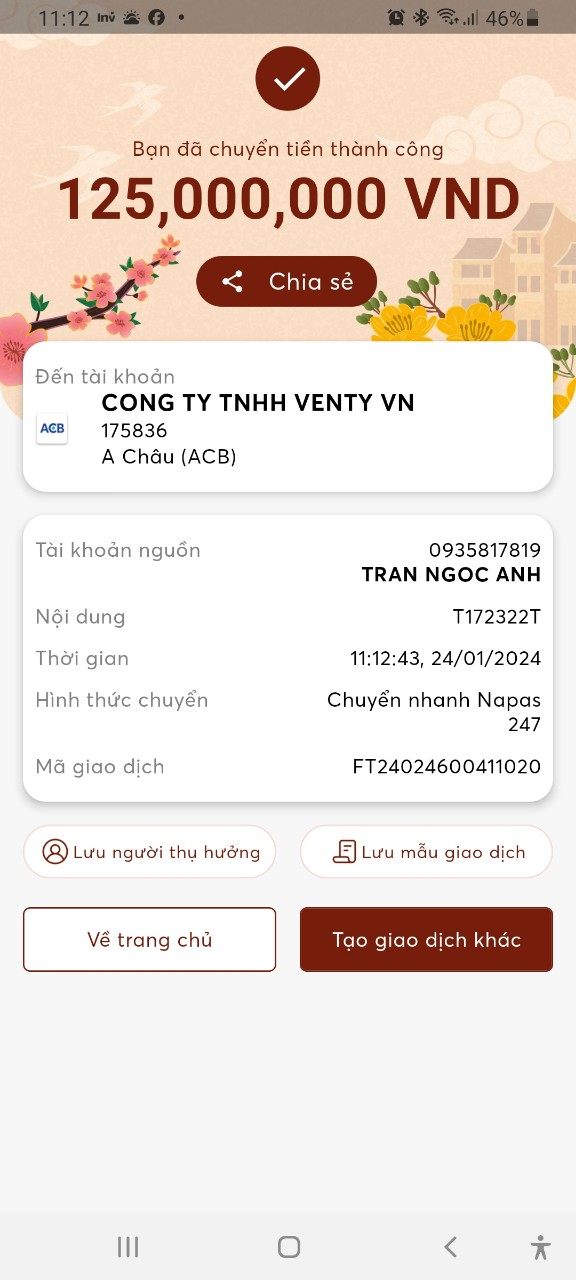

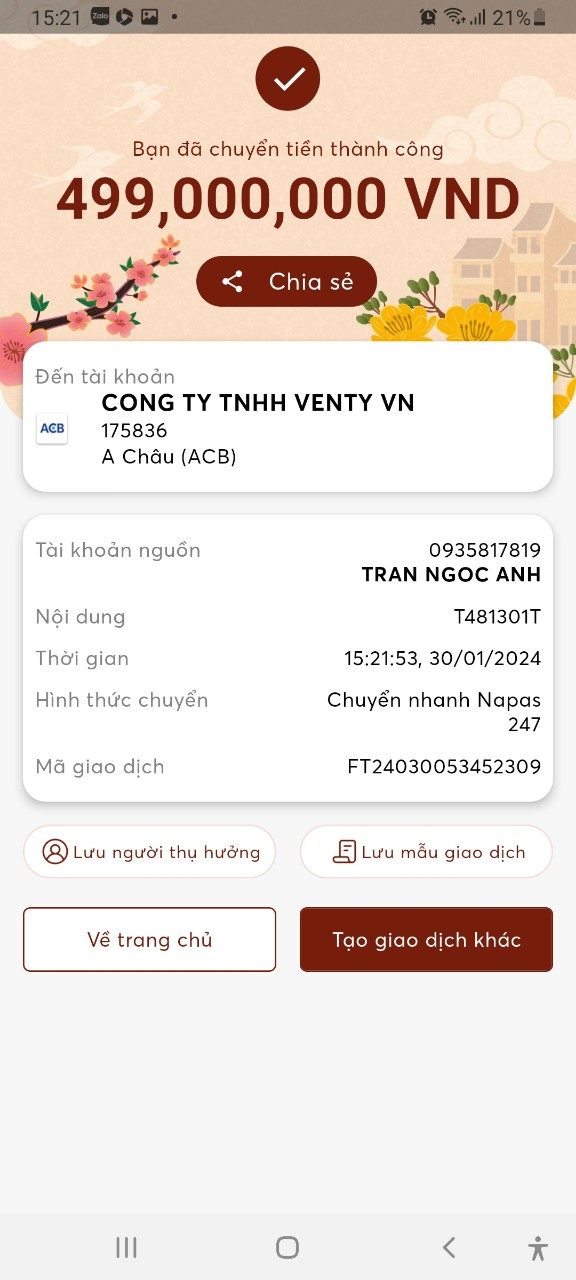

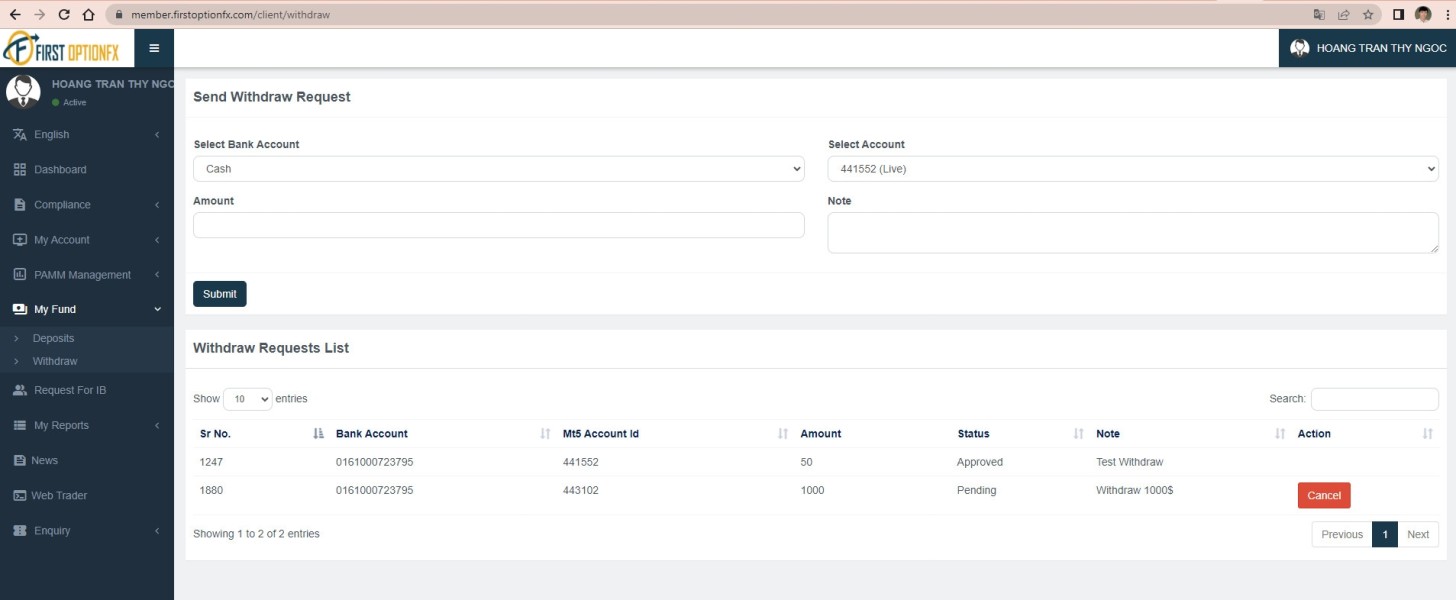

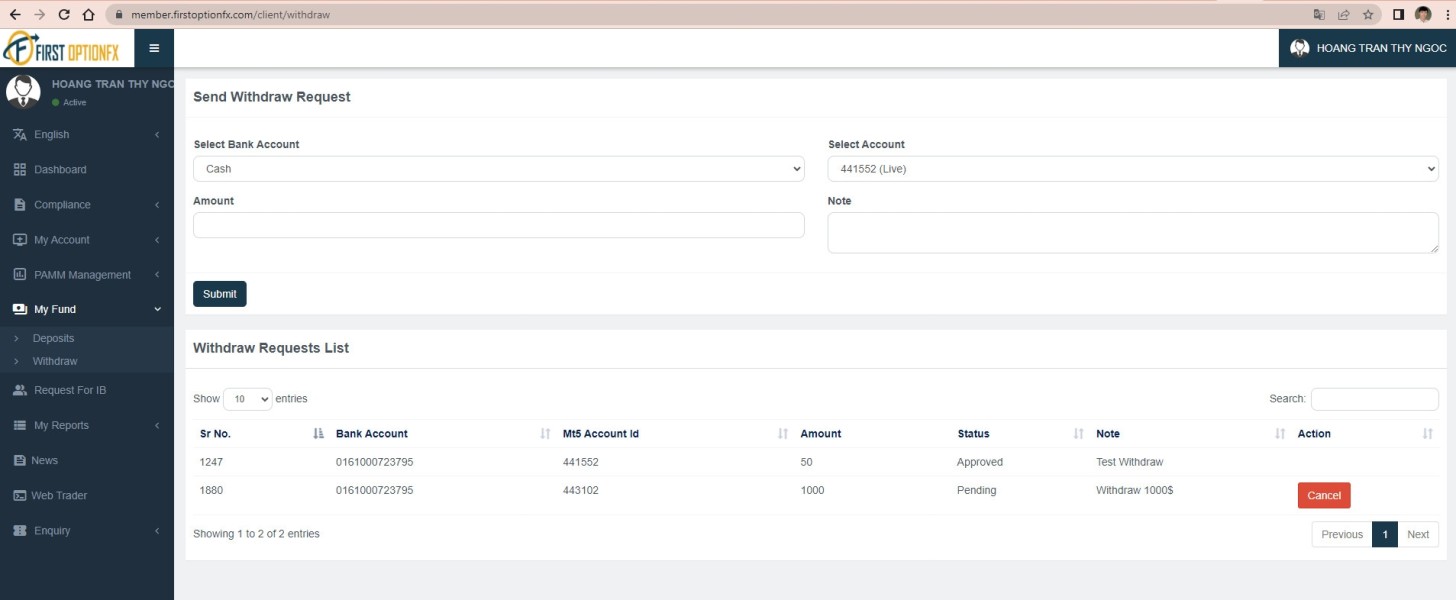

• Deposit and Withdrawal Methods :

Specific deposit and withdrawal methods for First Option FX are not clearly detailed in the available information. Users have noted a lack of clarity and transparency regarding the processing times and fees associated with these transactions. No official guidelines are provided in the documentation.

• Minimum Deposit Requirement :

Multiple user testimonials highlight that First Option FX enforces a high minimum deposit requirement. This can be prohibitive for many retail traders. This condition is a persistent point of criticism found in various first option fx review sources.

• Bonuses and Promotions :

No concrete information regarding bonuses or promotional offers has been disclosed by First Option FX. The absence of clear promotional strategies or bonus structures in the public literature increases suspicion. It reduces its appeal to most prospective traders.

• Tradable Assets :

The broker claims to provide a range of tradable assets including forex pairs and CFDs on a variety of instruments such as indices and commodities. However, details remain sparse, making it difficult for traders to gauge the comprehensiveness of the asset offering. This issue has been a recurring topic in numerous first option fx review analyses.

• Cost Structure :

The cost structure for trading with First Option FX remains ambiguous. There is limited information on specific spreads, commission levels, or additional fees. Users consistently report that, aside from the high minimum deposit, there are hidden costs and a lack of clear, published pricing details.

This vague disclosure of fees leads to further uncertainty and has been a major contributor to the negative sentiment expressed in several first option fx review reports.

• Leverage Ratios :

Details regarding the leverage options provided by First Option FX have not been explicitly mentioned in any of the available materials. Such lack of clarity regarding leverage ratios creates additional risk for traders. It raises further concerns about the broker's transparency.

• Platform Options :

There is no definitive information on the specific trading platforms used by First Option FX. The broker claims advanced trading tools, but without concrete details or platform names, users are left to rely on vague promotional statements. They cannot access verified platform performance reviews observed in multiple first option fx review sources.

• Regional Restrictions :

The available information does not indicate any explicit regional restrictions. Though the overall lack of regulatory licensing suggests that the broker's operations could be subject to limitations in many controlled markets.

• Customer Service Languages :

No detailed information is provided regarding the languages supported by First Option FX customer service. This absence of multilingual support adds to the overall operational ambiguity.

─────────────────────────────

6. Detailed Rating Analysis

6.1 Account Conditions Analysis

First Option FX's account conditions reflect several underlying issues that have raised alarms in the forex community. In terms of account types, the available documentation provides no clear differentiation between account variants such as standard, premium, or Islamic accounts. Most notably, the minimum deposit requirement is substantially higher compared to industry standards, a factor repeatedly underscored by negative user reviews.

The absence of specific details about spreads, commissions, and any potential benefits associated with different account types further complicates matters. Additionally, there is no indication of an efficient and streamlined account opening process, as potential clients often encounter vague instructions and limited transparency. This lack of clarity in account conditions significantly diminishes the trustworthiness of the broker, as revealed in numerous first option fx review analyses.

Moreover, user testimonials frequently cite the high deposit requirement as a barrier that offers little value in return for the risks associated with an unregulated trading environment.

Regarding trading tools and resources, First Option FX provides general claims of offering a variety of instruments and analytical resources. However, specifics regarding the trading tools, charting packages, automated trading systems, or even educational materials are scarcely detailed in any official documentation. Many users have commented that while the broker promises a comprehensive toolset, the actual performance and reliability of these tools remain questionable.

There is a noticeable absence of in-depth research and analysis resources that many other regulated brokers provide. Furthermore, there is no reliable evidence of effective automated trading support, and no dedicated educational platform or resource center has been confirmed through user experience reports. The overall lack of detailed information regarding these resources not only raises doubts about their efficacy but also highlights a broader pattern of opacity.

This sentiment is consistently echoed in several first option fx review pieces, where the provided resources are viewed as insufficient for serious traders who prioritize robust analytical and educational support.

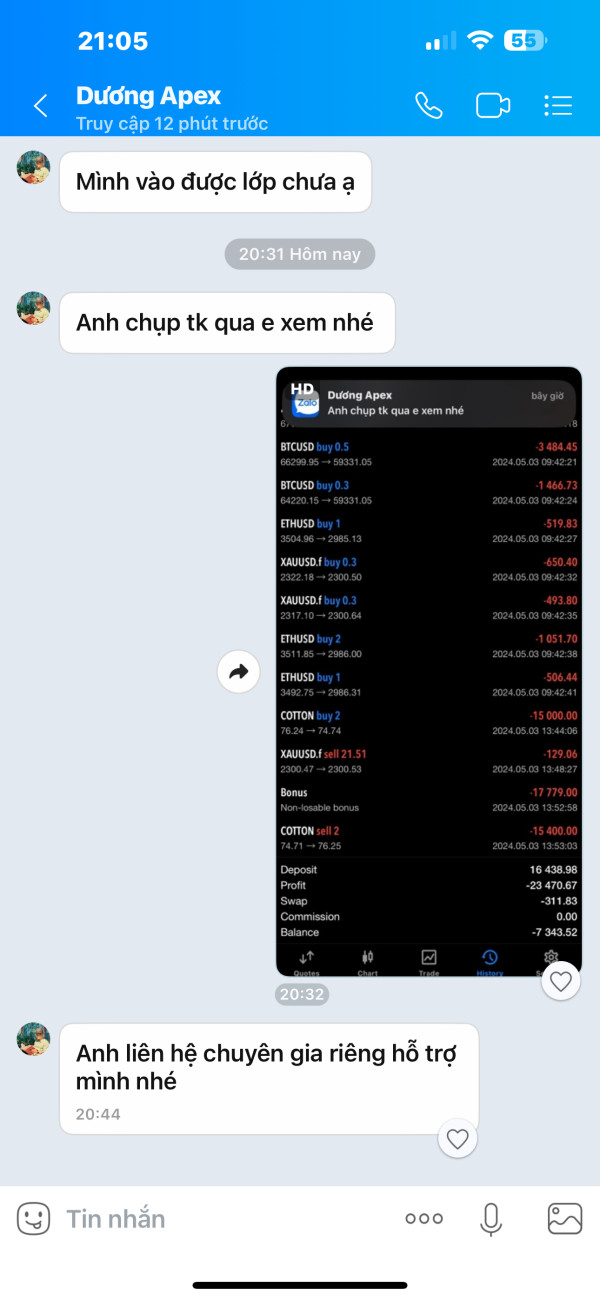

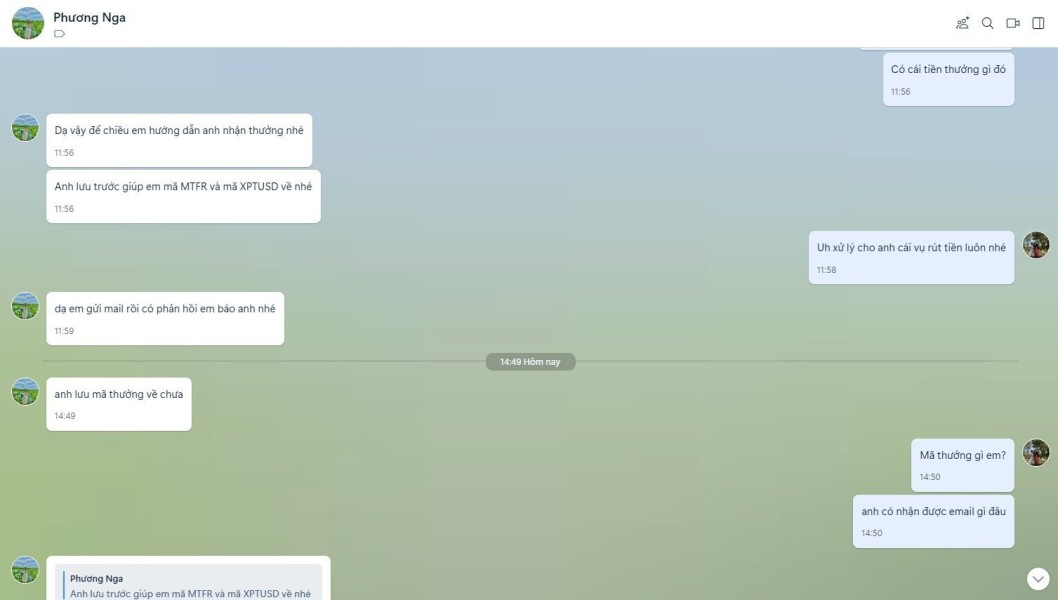

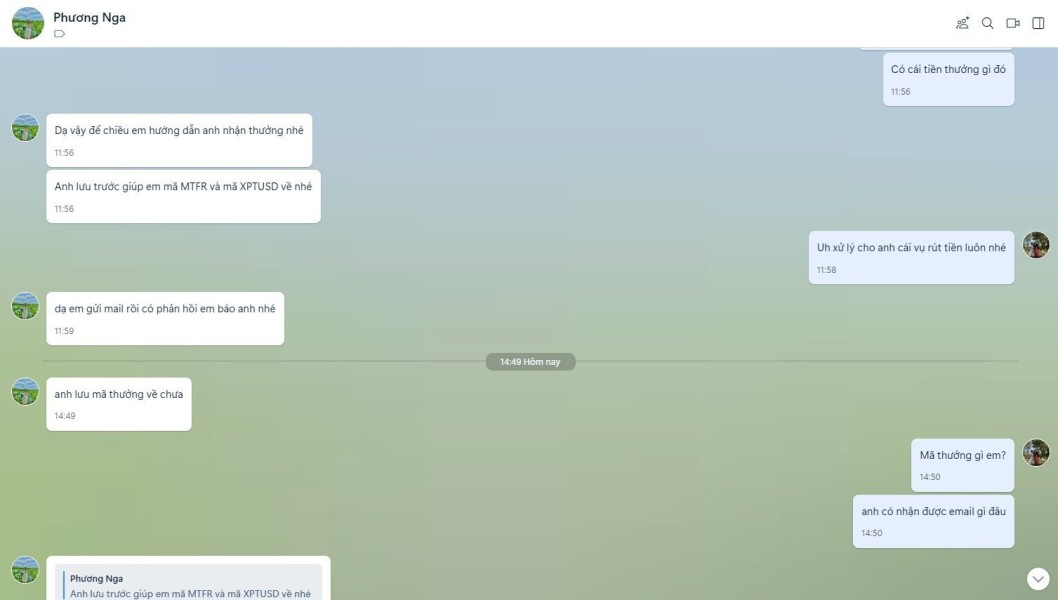

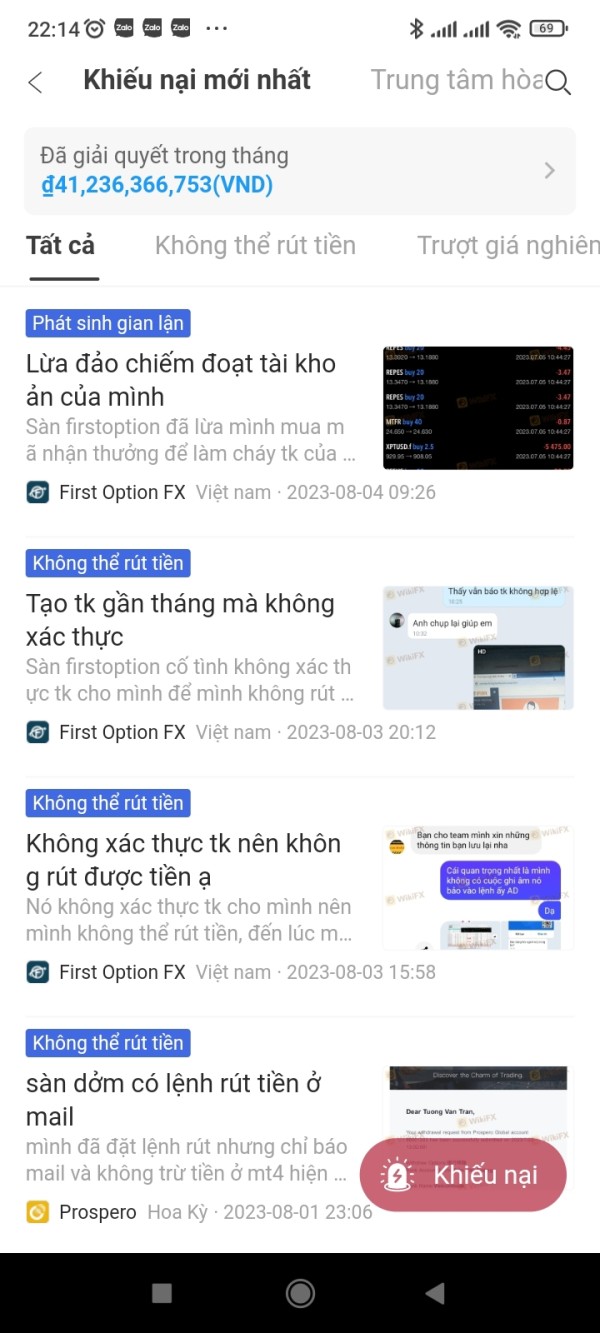

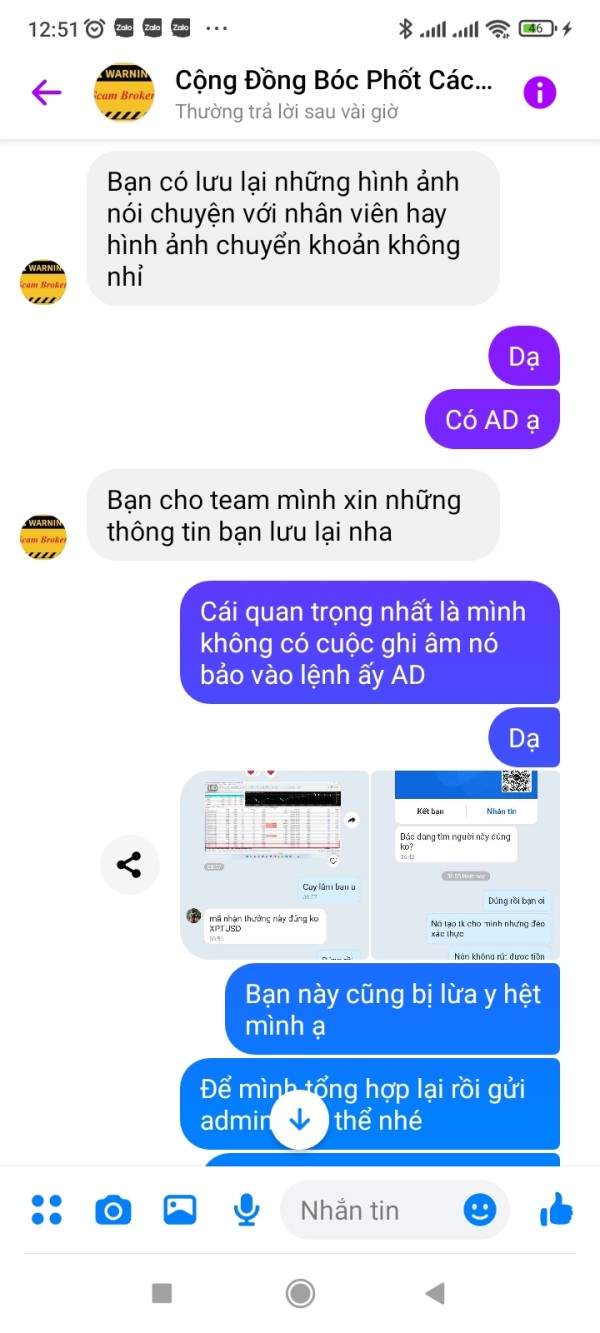

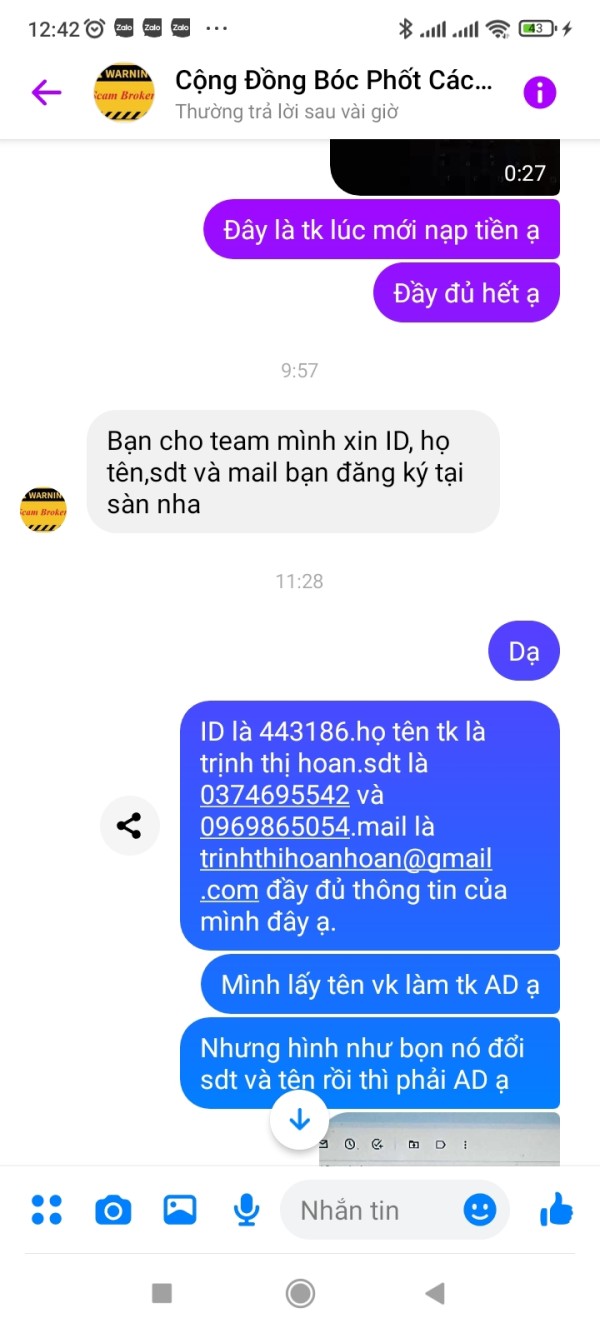

6.3 Customer Service and Support Analysis

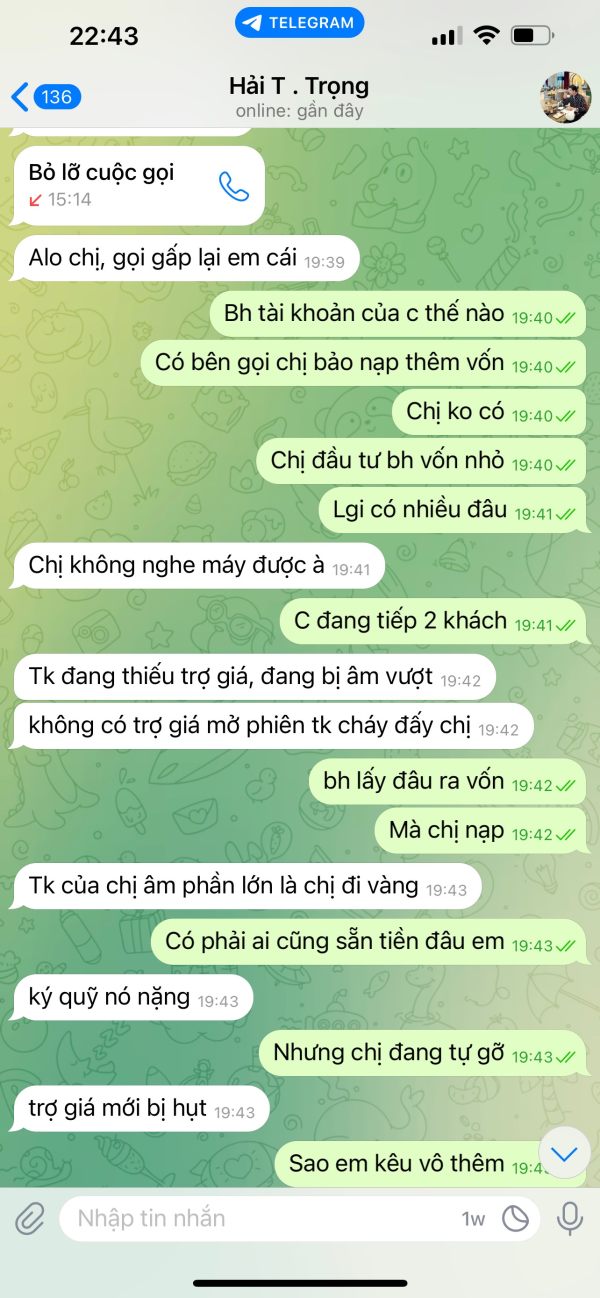

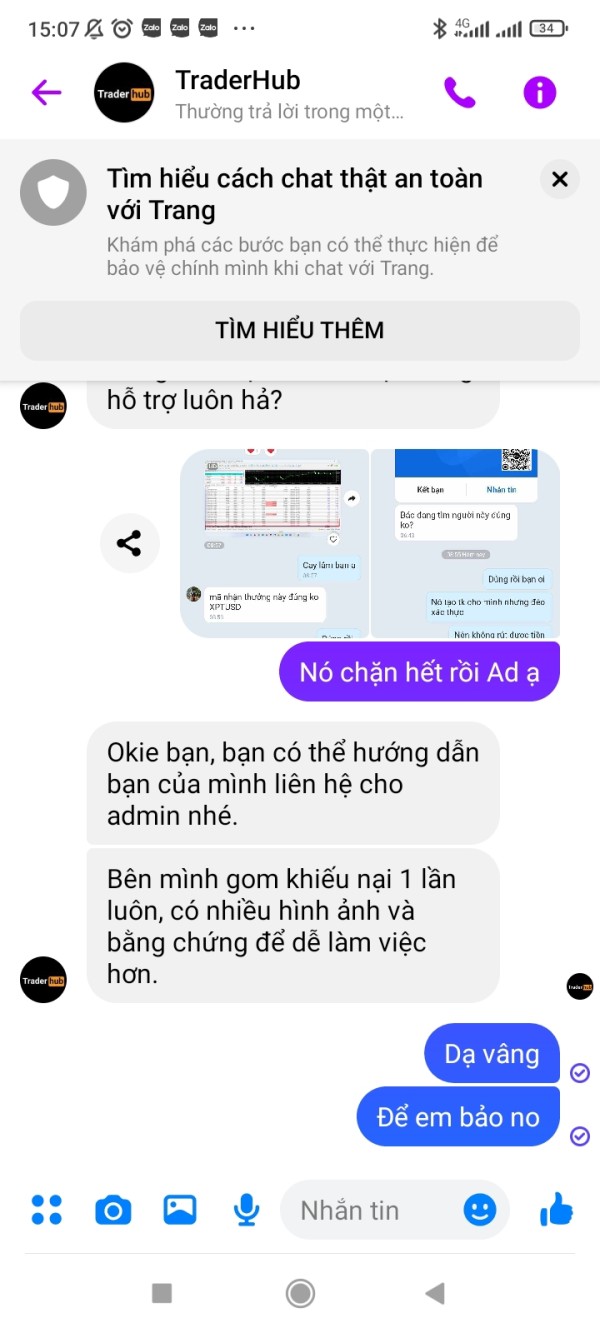

Customer service is a critical aspect of any brokerage, and unfortunately, First Option FX does not seem to excel in this area. Reports from numerous users indicate that the responsiveness of the support team is notably poor, with extended waiting times and unsatisfactory resolutions to inquiries. Specific details regarding the available communication channels, such as live chat, telephone support, or email correspondence, remain largely unspecified.

There is also no evidence of a multilingual support system that caters to a diverse investor base. In many first option fx review analyses, customers have recounted negative interactions, citing unhelpful responses and a general lack of professionalism in addressing their concerns. The deficiency in customer service is further compounded by the broker's overall opacity and lack of official communication protocols.

This directly impacts the overall trading environment, as users are left without the critical support needed in volatile market conditions. Given the risks associated with unregulated brokers, the lack of robust customer service mechanisms is particularly concerning for traders who might require immediate assistance with urgent issues.

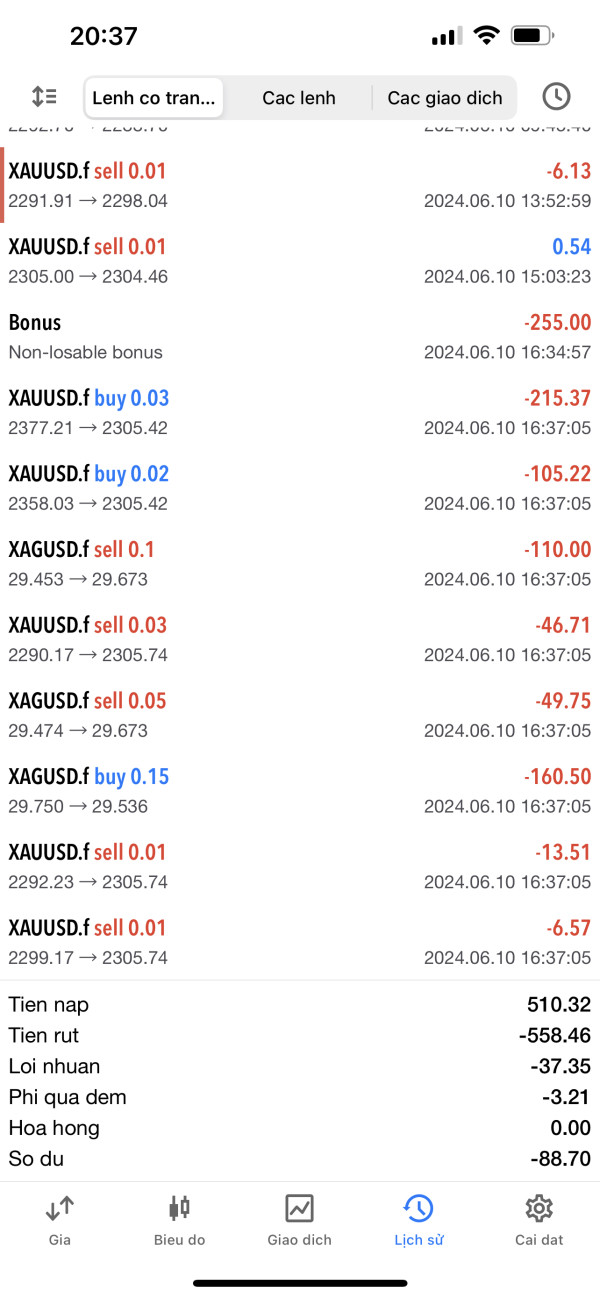

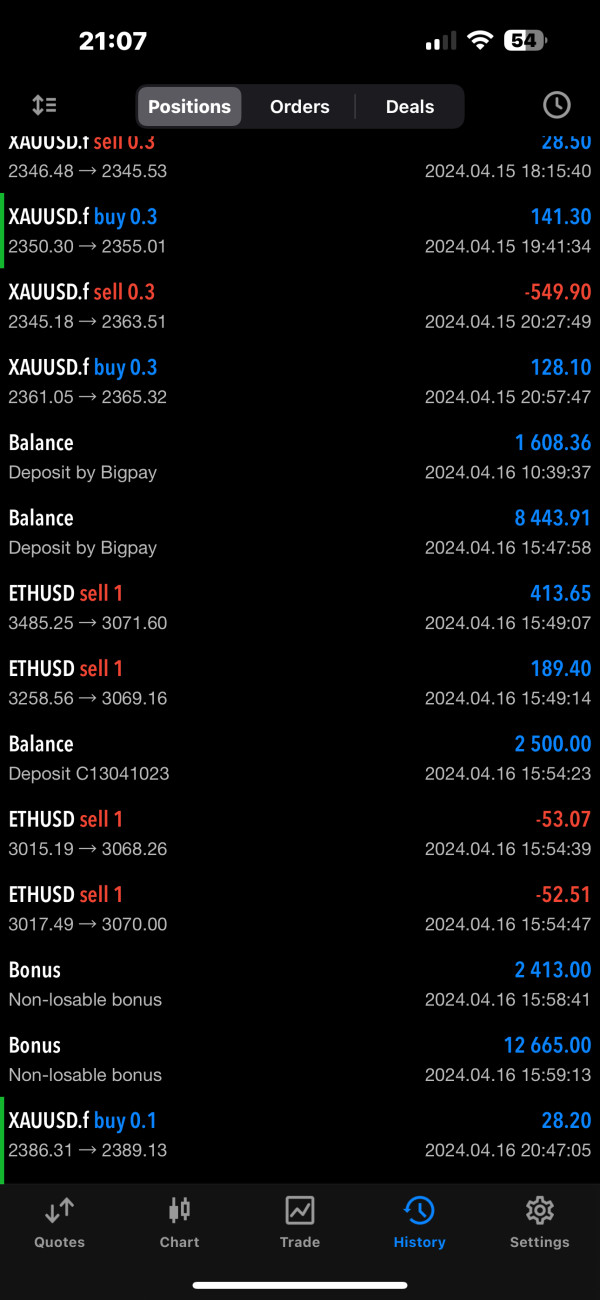

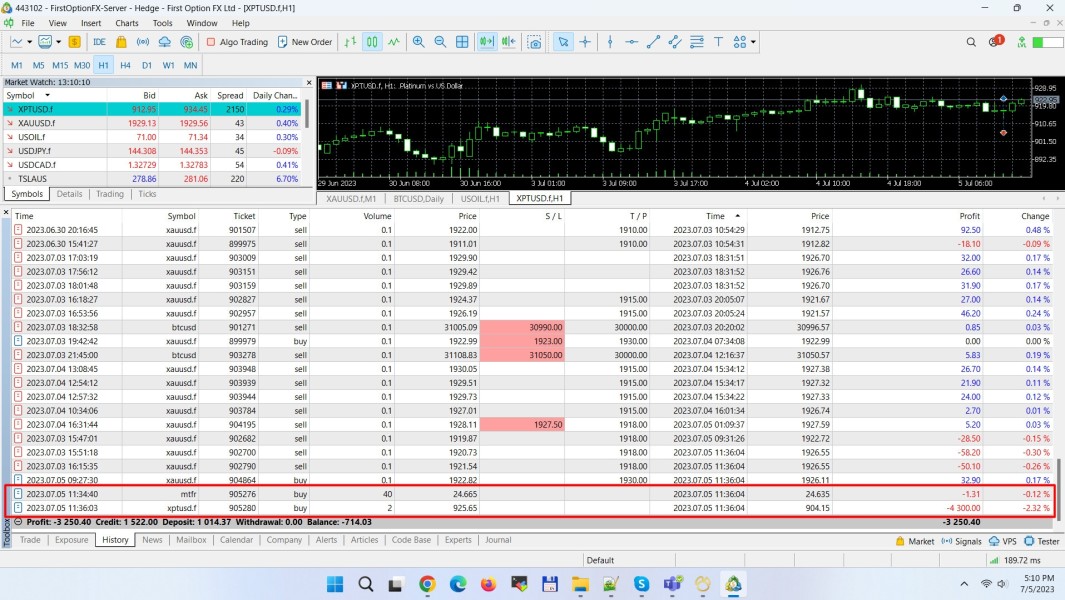

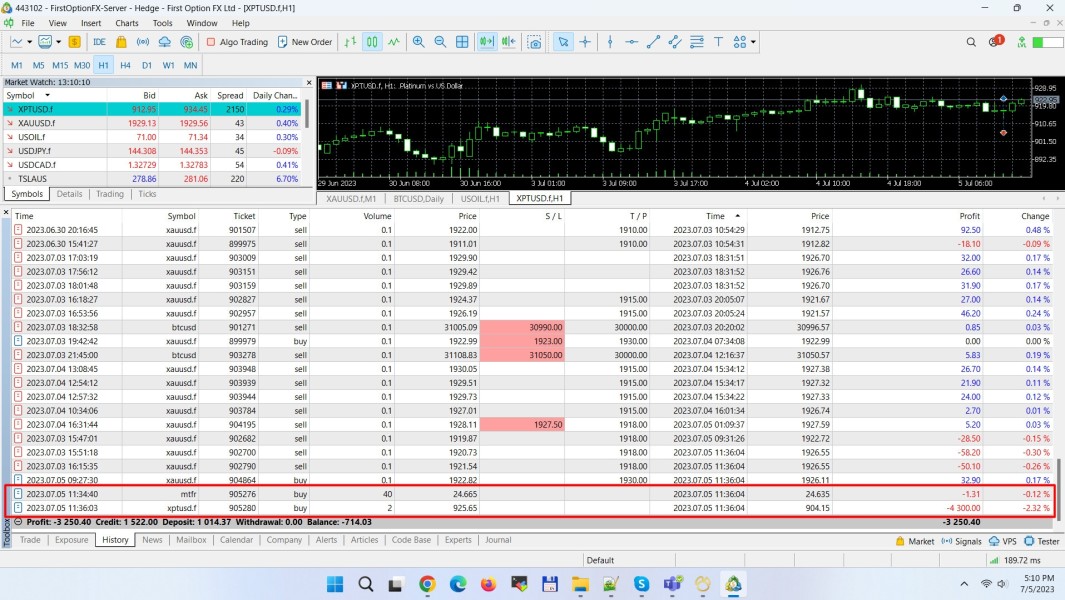

6.4 Trading Experience Analysis

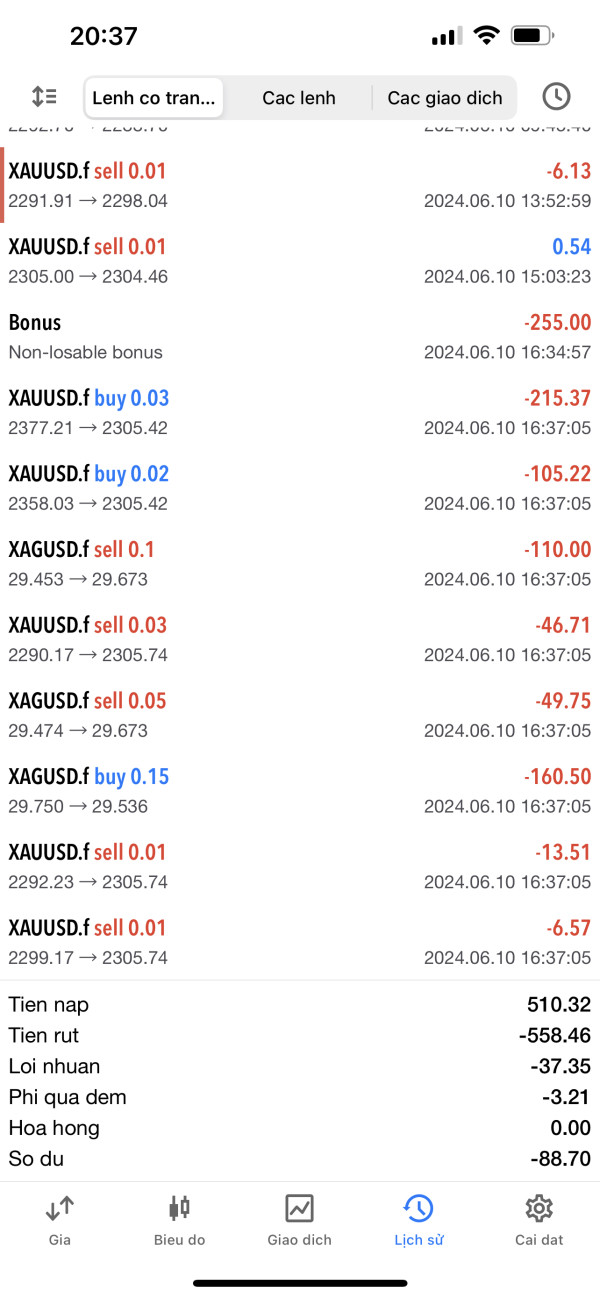

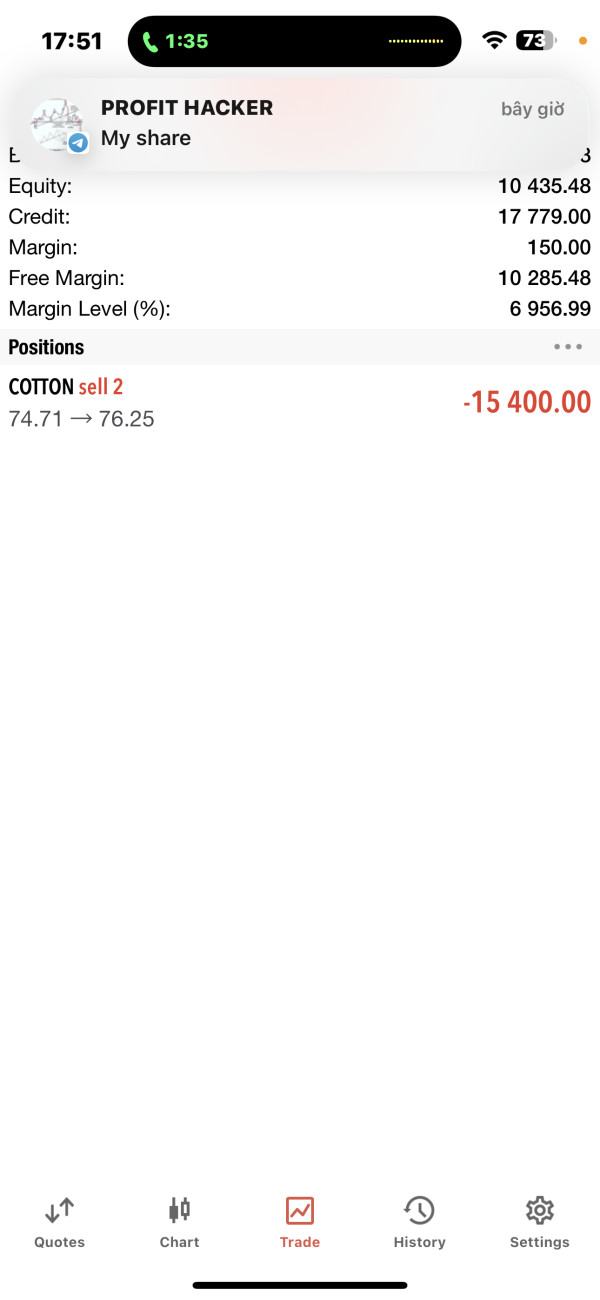

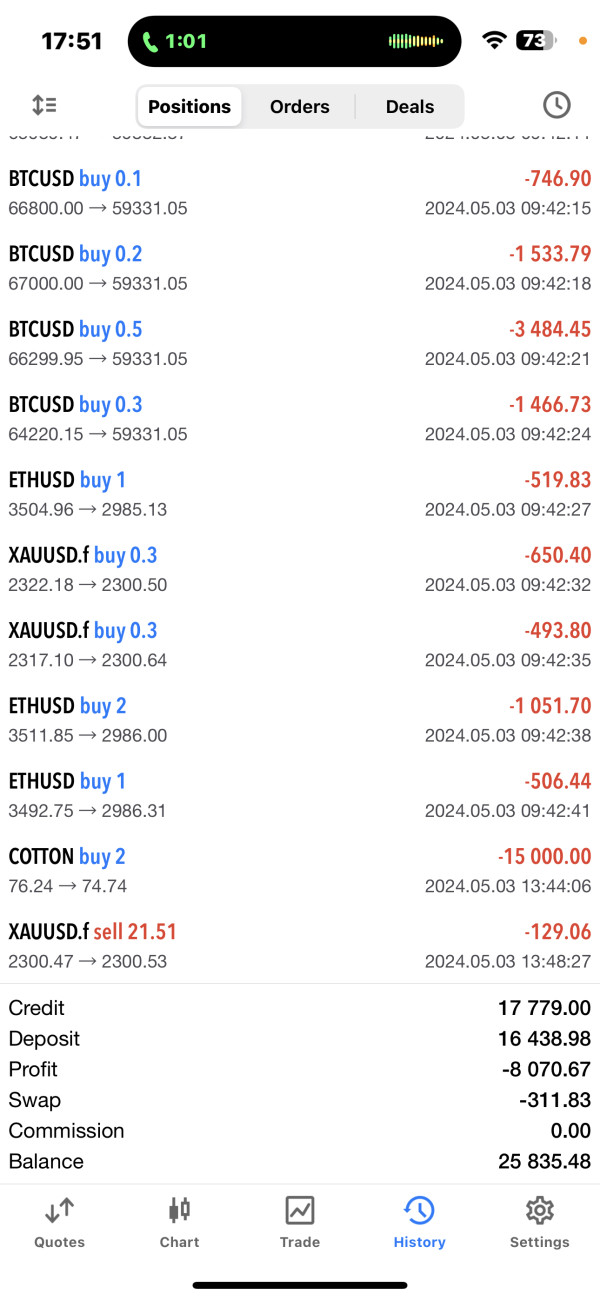

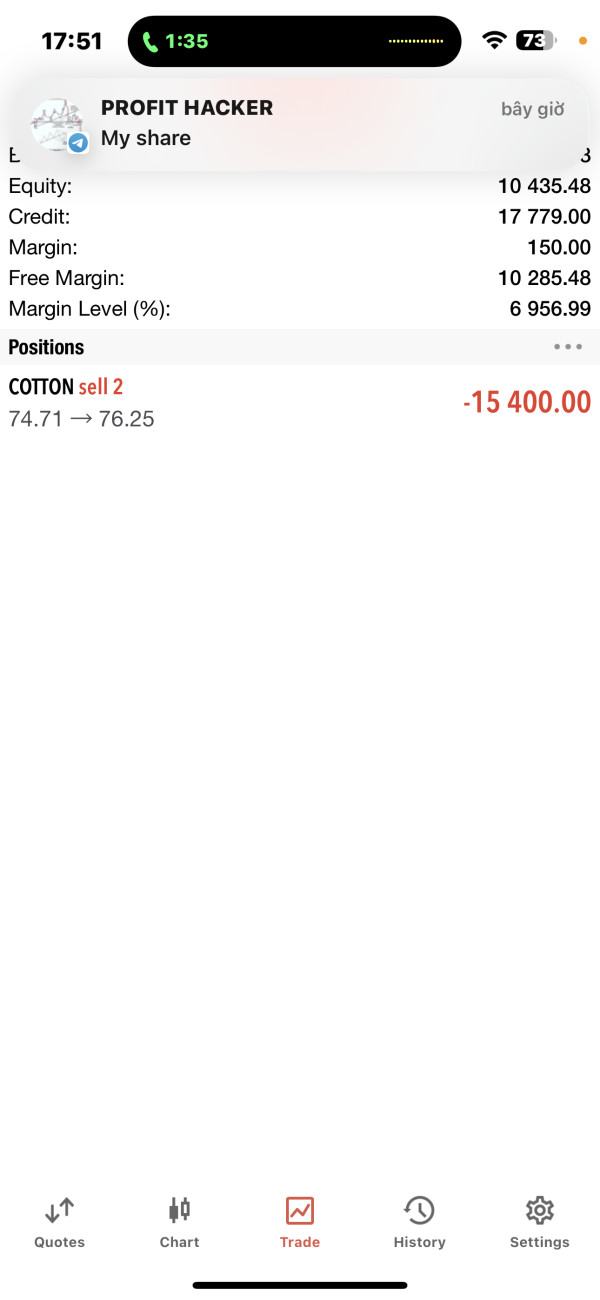

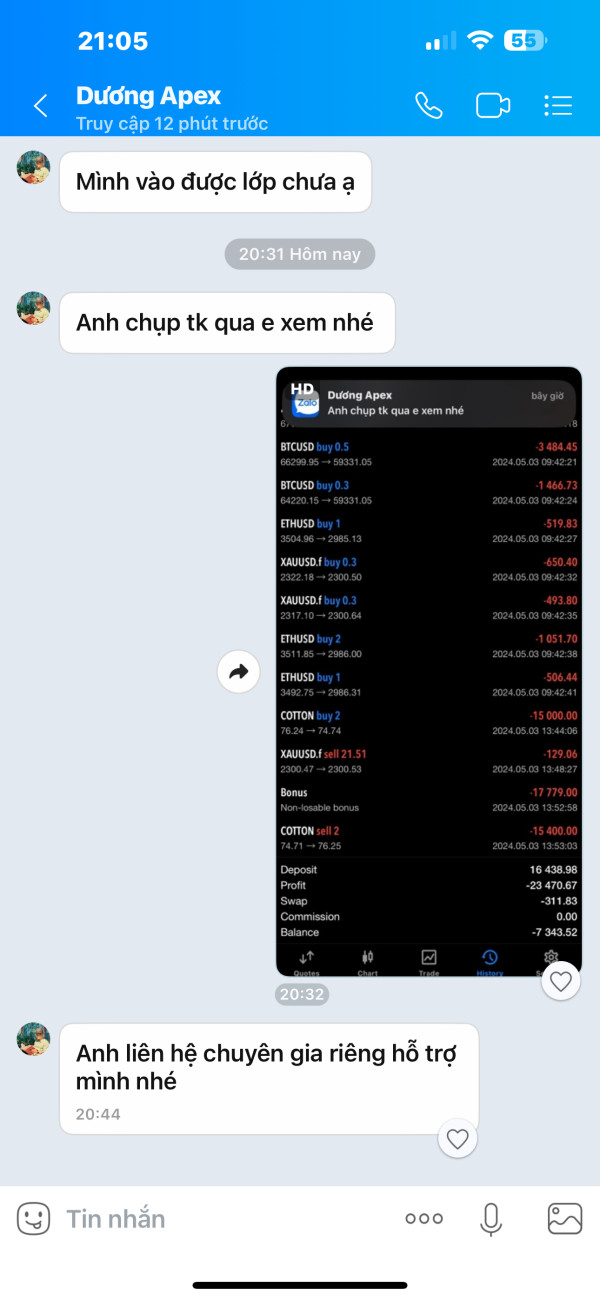

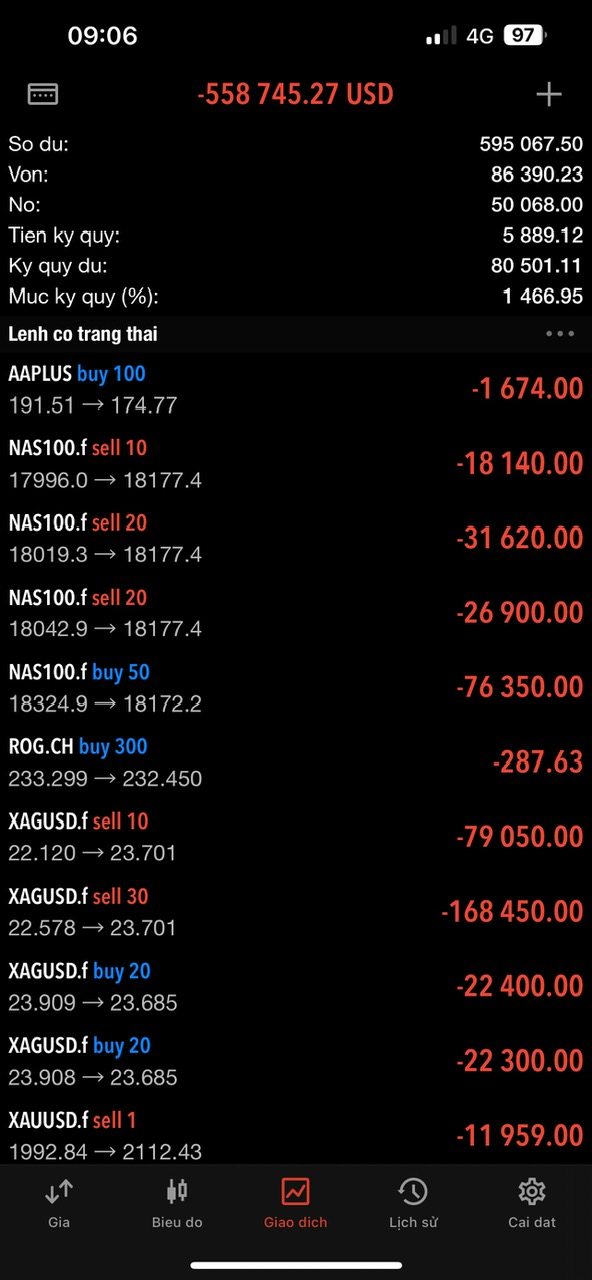

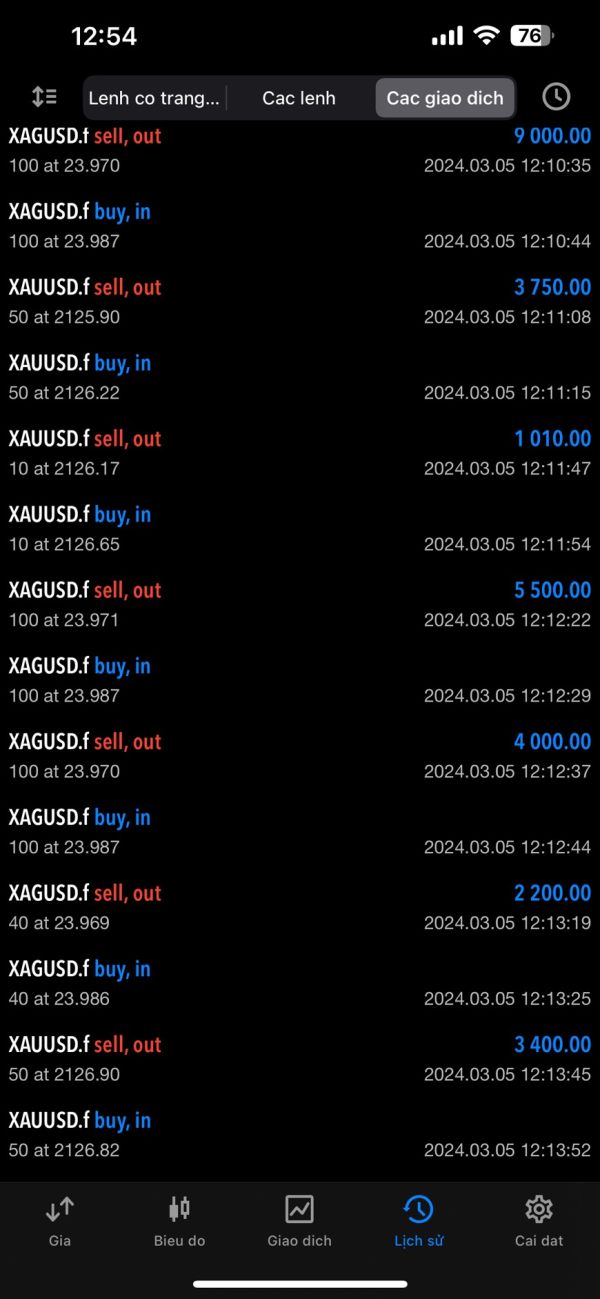

The trading experience with First Option FX has been subject to numerous criticisms, largely due to the platform's unreliable performance and questionable execution quality. Many traders have reported issues such as slippage and re-quotes, which are detrimental in fast-paced markets. Furthermore, there is a pervasive sense of uncertainty regarding the overall stability and speed of the trading platform, with several users citing frequent technical glitches and operational delays.

The absence of detailed information on the platform's features, including mobile trading options or advanced order types, further detracts from its appeal. Additionally, liquidity issues have been noted, contributing to an inconsistent and often frustrating trading experience. Such consistent negative feedback is a recurring theme in multiple first option fx review reports, where technical shortcomings and poor order execution quality have been highlighted as major deficiencies that compromise the trader's ability to conduct timely and effective market transactions.

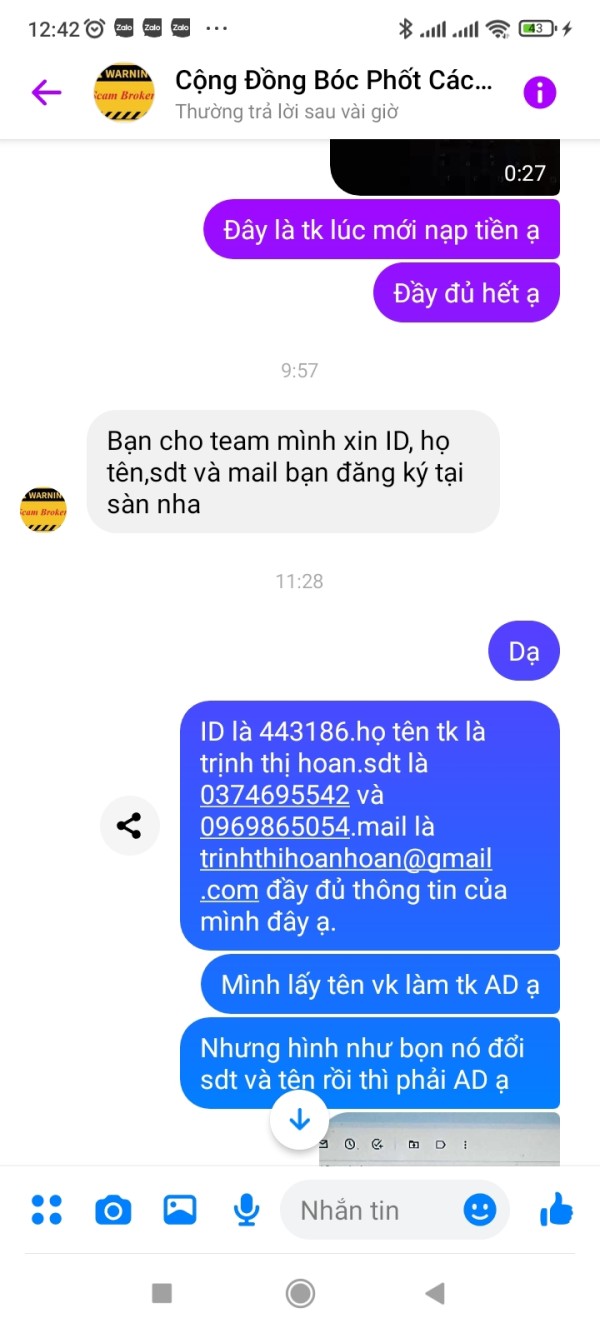

6.5 Trust Analysis

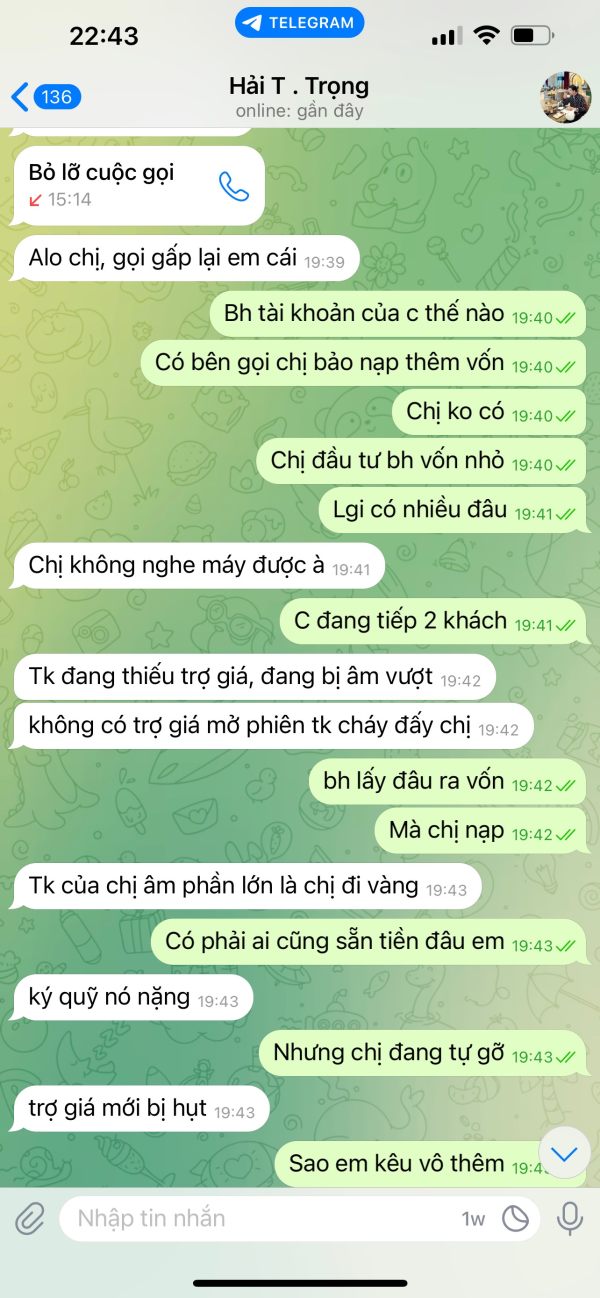

Trust is the cornerstone of any reliable broker, and unfortunately, First Option FX falls significantly short in this domain. A primary red flag is the broker's blatant lack of regulation; it has not secured approvals from any recognized regulatory body, and the FCA has explicitly issued warnings about its operations. This absence of regulatory oversight leaves investors vulnerable, with little to no safeguard for their funds.

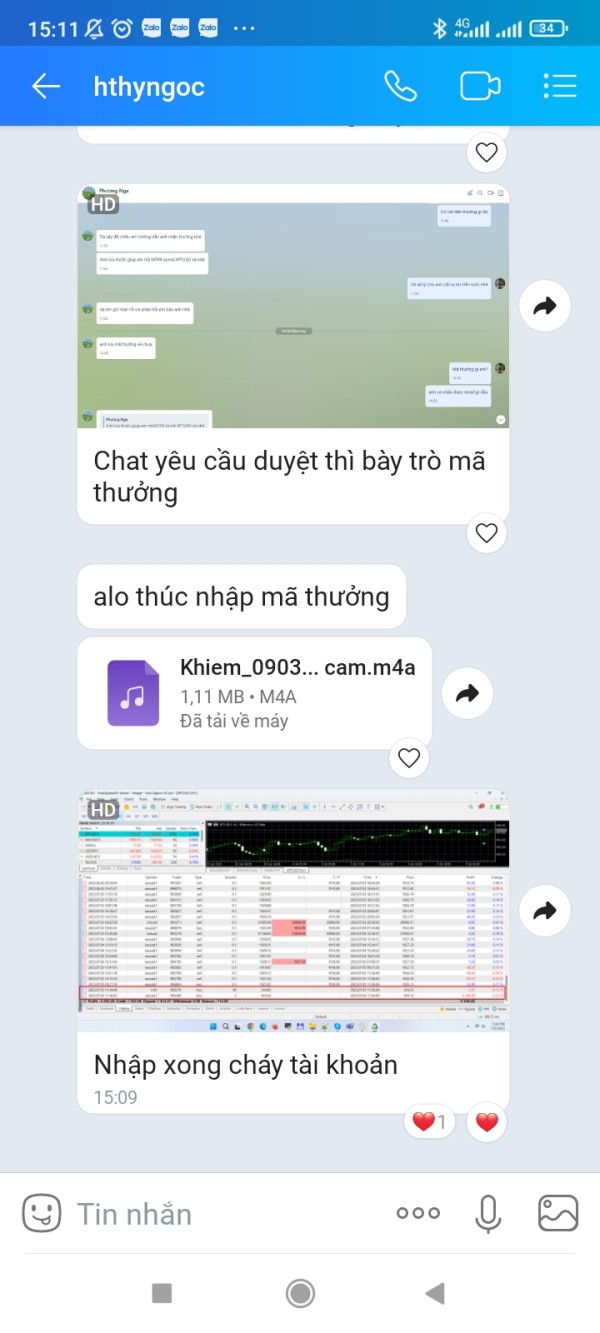

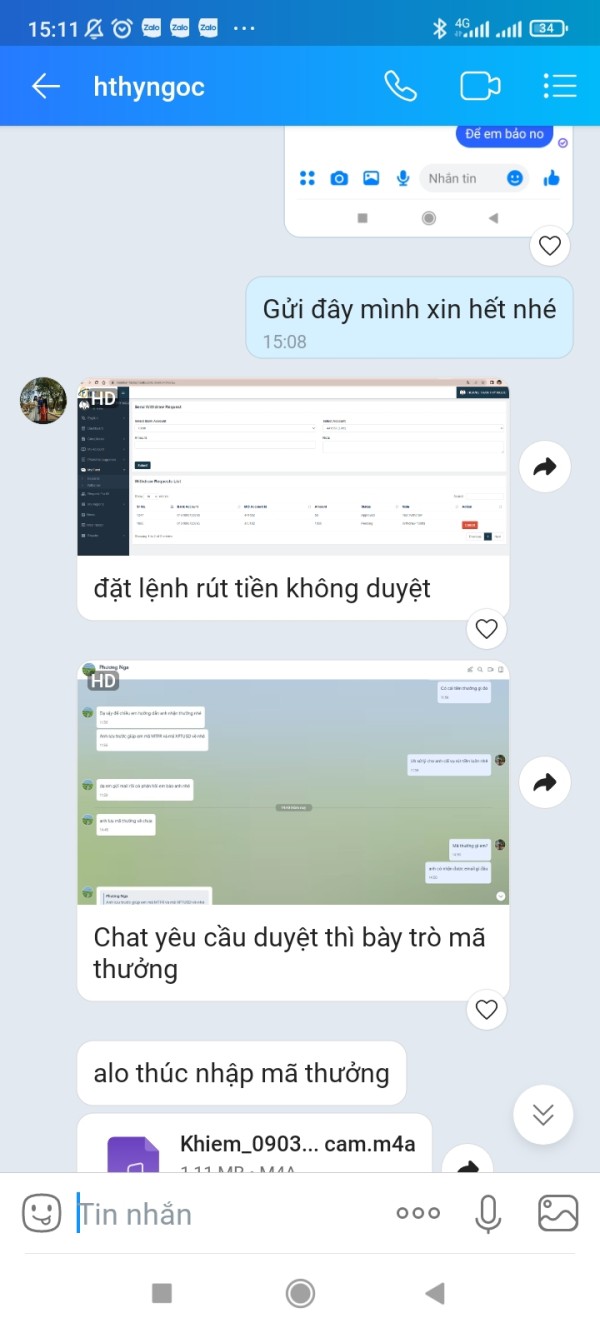

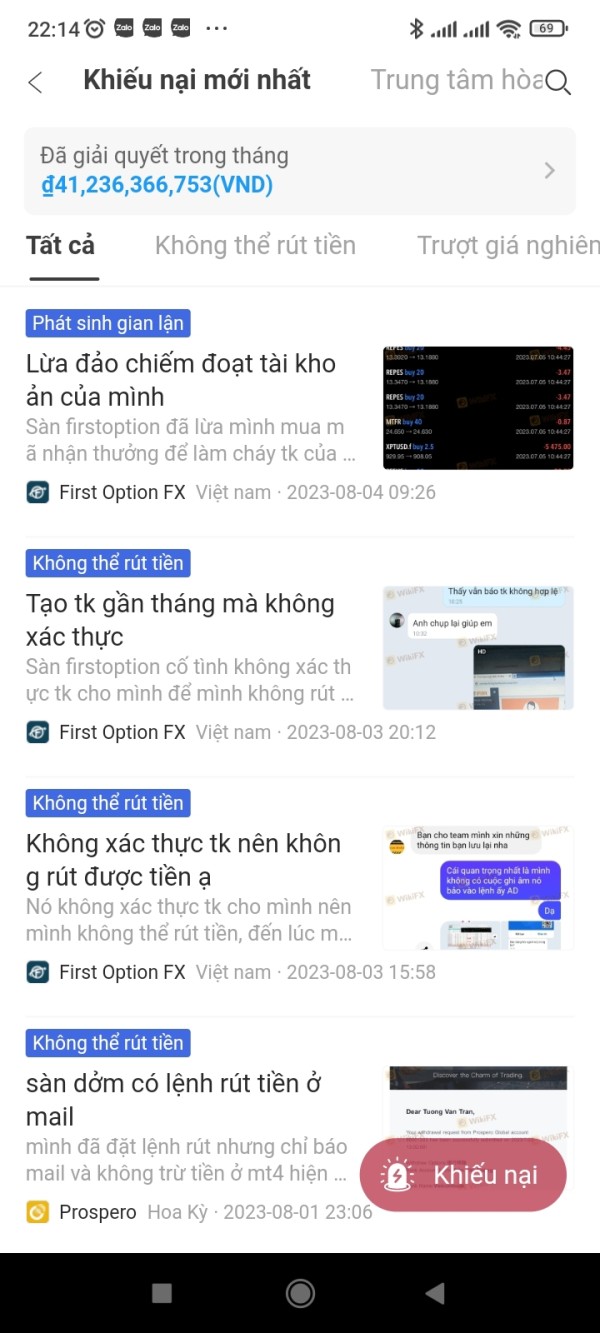

Additionally, the company demonstrates a high degree of opacity in its operations, failing to provide essential information related to fund segregation and client asset protection. Multiple reports and user testimonials consistently describe First Option FX as operating in a manner akin to a scam, severely undermining its credibility. The cumulative effect of these issues is a pervasive lack of confidence among traders, as reflected in various first option fx review analyses.

Given the absence of transparency in critical operational areas and the multitude of negative reports, the trust score for First Option FX remains perilously low, indicating that potential users should exercise extreme caution.

6.6 User Experience Analysis

User experience with First Option FX has been overwhelmingly negative, as evidenced by consistent reports from traders who have engaged with the platform. Users commonly cite a variety of issues, including a clunky interface, unclear navigation, and cumbersome registration and verification processes. The ambiguity surrounding the platform's functionality compounds the frustration, especially when users are left uncertain about the status of their orders and fund management options.

Many reviews point to significant concerns regarding the overall safety of funds, with frequent complaints about the broker's lack of transparency and accountability. Additionally, given the high minimum deposit requirement and the unclear cost structure, users feel that the risk-reward balance is severely skewed. The combination of technical deficiencies, unreliable customer service, and an overall questionable regulatory status has led to a predominantly negative perception among the trading community.

This critical consensus, frequent in first option fx review publications, reinforces the recommendation that only traders with an exceptionally high risk tolerance might consider engaging with this broker.

─────────────────────────────

7. Conclusion

In summary, First Option FX suffers from multiple operational deficiencies including the absence of regulatory oversight, high minimum deposit requirements, and consistently negative user experiences. The collective evidence from various first option fx review reports strongly indicates that this broker is unsuitable for the majority of traders, particularly those seeking safety and transparency in their trading activities. Prospective clients should exercise extreme caution, as the risks involved far outweigh any potentially attractive asset offerings.

Given these significant drawbacks, it is recommended that both novice and experienced investors seek regulated alternatives to ensure proper investor protection and a more reliable trading environment.